Question: Beverly and Ken Hair have been married

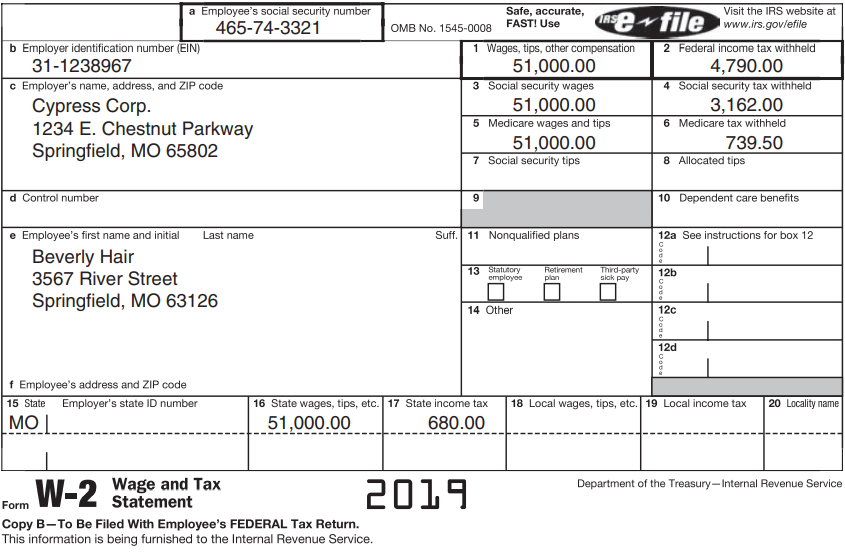

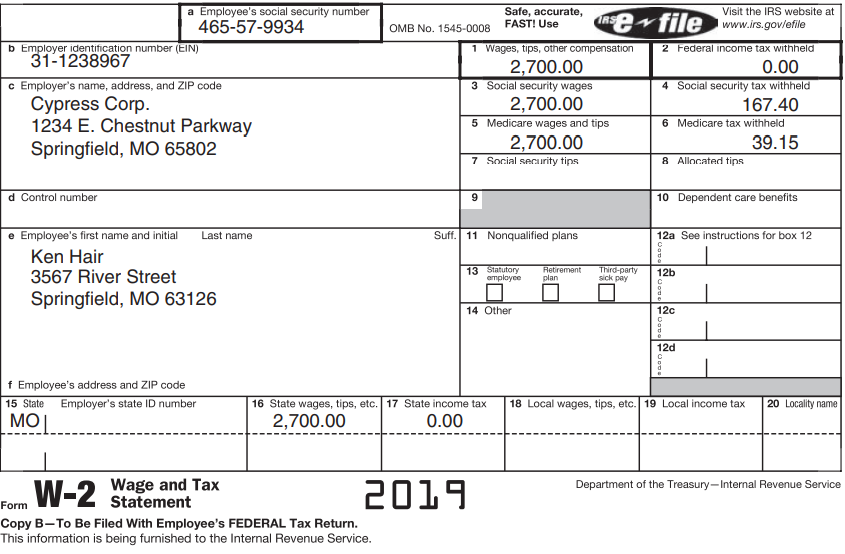

Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Ken’s birthdate is January 12, 1993 and Beverly’s birthdate is November 4, 1995. Bev and Ken’s earnings and income tax withholdings are reported on the following Form W-2s:

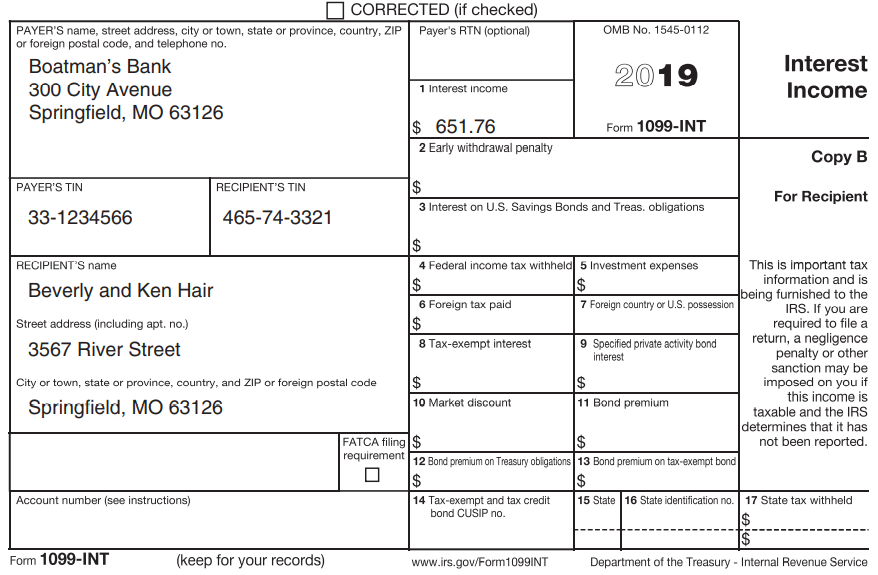

The Hairs have interest income of $1,000 on City of St. Louis bonds. Beverly and Ken also received the following Form 1099-INT and 1099-DIV:

Ken is an excellent student at SMSU. He was given a $1,750 scholarship by the

university to help pay educational expenses. The scholarship funds were used by Ken

for tuition and books.

Last year, Beverly was laid off from her former job and was unemployed during January 2019. She was paid $1,825 of unemployment compensation until she started work with her current employer, Cypress Corporation. Ken has a 4-year-old son, Robert R. Hair, from a prior marriage that ended in divorce in 2014. During 2019, he paid his ex-wife $300 per month in child support. Robert is claimed as a dependent by Ken’s ex-wife. During 2019, Ken’s aunt died. The aunt, in her will, left Ken $15,000 in cash. Ken deposited this money in the Boatman’s Bank savings account.

Required: Complete the Hairs’ federal tax return for 2019 on Form 1040, Schedule 1, and the Qualified Dividends and Capital Gain Tax Worksheet.

> Thuy worked as the assistant manager at Burger Crown through August 2019 and received wages of $79,000. Thuy then worked at Up and Down Burger starting in September of 2019 and received wages of $61,500. Calculate the amount of Thuy’s overpayment of Soci

> Fiduciary Investments paid its employee, Yolanda, wages of $139,000 in 2019. Calculate the FICA tax: Withheld from Yolanda’s wages: Social Security? Medicare? Paid by Fiduciary: Social Security? Medicare? Total FICA Tax?

> Lamden Company paid its employee, Trudy, wages of $52,000 in 2019. Calculate the FICA tax: Withheld from Trudy’s wages: Social Security? Medicare? Paid by Lamden: Social Security? Medicare?

> Kana is a single wage earner with no dependents and taxable income of $205,000 in 2019. Her 2018 taxable income was $155,000 and tax liability were $31,490. Calculate the following: Kana’s 2019 income tax liability? Kana’s minimum required 2019 annual pa

> In 2019, Professor Patricia (Patty) Pâté retired from the Palm Springs Culinary Arts Academy (PSCAA). She is a single taxpayer and is 62 years old. Patty lives at 98 Colander Street, Apt. 206D, Henderson, NV 89052. Professor P&A

> Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2019. She estimates her required annual estimated tax payment for 2019 to be $8,468. She had a $417 overpayment of last year

> Sophie is a single taxpayer. For the first payroll period in July 2019, she is paid wages of $2,200 monthly. Sophie claims one allowance on her Form W-4. a. Use the percentage method to calculate the amount of Sophie’s withholding for a monthly pay peri

> Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph earns a total of $98,000 and estimates their itemized deductions to be $29,500 for the year. Kathy is not employed. Use Form W-4 on Pages 9-35 and 9-36 to determine the number o

> Telly, age 38, has a $140,000 IRA with Blue Mutual Fund. He has read good things about the management of Green Mutual Fund, so he opens a Green Fund IRA. Telly asked for a distribution rollover and received his balance from the Blue Fund on May 1, 2019.

> Thomas is an employer with two employees, Patty and Selma. Patty’s wages are $12,450 and Selma’s wages are $1,310. The state unemployment tax rate is 5.4 percent. Calculate the following amounts for Thomas: a. FUTA tax before the state tax credit b. Stat

> Philcon Corporation created the following 2019 employee payroll report for one of its employees. a. Complete the following Form W-2 for Louise Chugach from Philcon Corporation. b. Philcon Corporation also paid $1,100 to Ralph Kincaid for presenting a man

> Drew Freeman operates a small business and his payroll records for the first quarter f 2019 reflect the following: Drew’s employee identification number is 34-4321321 and his business is located at 732 Nob Hill Blvd. in Yakima, WA 98902

> Phan Mai is single with two dependent children under age 17. Phan estimates her wages for the year will be $42,000 and her itemized deductions will be $14,000. In the previous year, Phan had a small tax liability. Assuming Phan files as head of household

> On February 2, 2019, Alexandra purchases a personal computer. The computer cost $1,800. Alexandra uses the computer 85 percent of the time in her accounting business, and the remaining 15 percent of the time for various personal uses. Calculate Alexandra

> During 2019, William purchases the following capital assets for use in his catering business: Assume that William decides to use the election to expense on the baking equipment (and has adequate taxable income to cover the deduction) but not on the autom

> Christopher Crosphit (birthdate April 28, 1977) owns and operates a health club called “Catawba Fitness.” The business is located at 4321 New Cut Road, Spartanburg, SC 29303. The principal business code is 812190 and t

> Calculate the following: a. The first year of depreciation on a residential rental building costing $250,000 purchased June 2, 2019. b. The second year (2020) of depreciation on a computer costing $5,000 purchased in May 2019, using the half-year conven

> On March 8, 2019, Holly purchased a residential apartment building. The cost basis assigned to the building is $700,000. Holly also owns another residential apartment building that she purchased on October 15, 2019, with a cost basis of $400,000. a. Cal

> Mike purchases a new heavy-duty truck (5-year class recovery property) for his delivery service on March 30, 2019. No other assets were purchased during the year. The truck is not considered a passenger automobile for purposes of the listed property and

> Carey exchanges land for other land in a qualifying like-kind exchange. Carey’s basis in the land given up is $115,000, and the property has a fair market value of $150,000. In exchange for her property, Carey receives land with a fair market value of $1

> William sold Section 1245 property for $25,000 in 2019. The property cost $38,500 when it was purchased 5 years ago. The depreciation claimed on the property was $19,200. a. Calculate the adjusted basis of the property. b. Calculate the recomputed basis

> Steve Drake sells a rental house on January 1, 2019, and receives $100,000 cash and a note for $50,000 at 7 percent interest. The purchaser also assumes the mortgage on the property of $25,000. Steve’s original cost for the house was $1

> Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $20,000 when purchased on July 1, 2017. Nadia has claimed $3,100 in depreciation and sells the asset for $13,500 with no selling costs. Sale of l

> Derek purchases a small business from Art on June 30, 2019. He paid the following amounts for the business: a. How much of the $250,000 purchase price is for Section 197 intangible assets? b. What amount can Derek deduct on his 2019 tax return as Section

> Tom has a successful business with $100,000 of taxable income before the election to expense in 2019. He purchases one new asset in 2019, a new machine which is 7-year MACRS property and costs $25,000. If you are Tom’s tax advisor, how would you advise T

> Go to the IRS website (www.irs.gov) and assuming bonus depreciation is used, redo Problem 11, using the most recent interactive Form 4562, Depreciation and Amortization. Data from Problem 11: During 2019, Pepe Guardio purchases the following property fo

> Carl Conch and Mary Duval are married and file a joint return. Carl works for the Key Lime Pie Company and Mary is a homemaker after losing her job in 2018. Carl’s birthdate is June 14, 1974 and Mary’s is October 2, 19

> During 2019, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Pepe uses the accelerated depreciation method under MACRS, if available, and does not make the election to expense or take bonus depreciat

> On September 14, 2019, Jay purchased a passenger automobile that is used 75 percent in his accounting business. The automobile has a basis for depreciation purposes of $40,000, and Jay uses the accelerated method under MACRS. Jay does not elect to expens

> Calculate the amount of the child and dependent care credit allowed before any tax liability limitations or other credits for 2019 in each of the following cases, assuming the taxpayers had no income other than the stated amounts. a. William and Carla f

> Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2019, Diane’s wages are $18,900 and she receives dividend income of $900. Calculate Diane’s earned income credit us

> George and Amal file a joint return in 2019 and have AGI of $39,800. They each make a $1,600 contribution to their respective IRAs. Assuming that they are not eligible for any other credits, what is the amount of their Saver’s Credit?

> In 2019, Jeff spends $6,000 on solar panels to heat water for his main home. What is Jeff’s credit for his 2019 purchases?

> Mike bought a solar electric pump to heat his pool at a cost of $2,500 in 2019. What is Mike’s credit?

> Carl and Jenny adopt a Korean orphan. The adoption takes 2 years and two trips to Korea and is finalized in 2019. They pay $7,000 in 2018 and $7,500 in 2019 for qualified adoption expenses. In 2019, Carl and Jenny have AGI of $150,000. a. What is the ad

> Martha and Lew are married taxpayers with $400 of foreign tax withholding from dividends in a mutual fund. They have enough foreign income from the mutual fund to claim the full $400 as a foreign tax credit. Their tax bracket is 24 percent and they itemi

> Janie graduates from high school in 2019 and enrolls in college in the fall. Her parents pay $4,000 for her tuition and fees. a. Assuming Janie’s parents have AGI of $170,000, what is the American Opportunity tax credit they can claim for Janie? b. Assu

> Hardy and Dora Knox are married and file a joint return for 2019. Hardy’s Social Security number is 466-47-3311 and her birthdate is January 4, 1975. Dora’s Social Security number is 467-74-4451 and her birthday is Jul

> Using the information in the previous question, assume that the Collins’ Form 1095-A also indicated that the total advance payment of the premium tax credit was $9,200. Calculate the excess advance premium tax credit and the repayment amount for 2019.

> Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2019, Susan’s income is $41,214 and Stan’s is $12,000 and both are self-employed. They also have $500 in interest income from tax

> Go to the IRS website (www.irs.gov) and redo Problem 10 above using the most recent Form 2441, Child and Dependent Care Expenses. Print out the completed Form 2441. Do not calculate the earned income credit here. Data from Problem 10: Clarita is a singl

> Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in qualified child care expenses during the year. If her adjusted gross income (all from wages) for the year is $19,600 and she takes the standard deduction, ca

> Refer to the previous problem 8. If Stan’s parents elected to report Stan’s income on his parents’ return, what would the tax on Stan’s income be? Data from Problem 8: Brian and Kim have a 12-year-old child, Stan. For 2019, Brian and Kim have taxable in

> Brian and Kim have a 12-year-old child, Stan. For 2019, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No election is made to include Stan’s income on Brian and Kim’s return. a. For purposes of the tax on a child’s

> Amy is a calendar-year taxpayer reporting on the cash basis. Please indicate how she should treat the following items for 2019: a. She makes a deductible contribution to an IRA on April 15, 2020. b. She has made an election to accrue the increase in val

> Married taxpayers Otto and Ruth are both self-employed. Otto earns $352,000 of self-employment income and Ruth has a self-employment loss of $13,500. How much 0.9 percent Medicare tax for high-income taxpayers will Otto and Ruth have to pay with their 20

> Yolanda is a cash basis taxpayer with the following transactions during the year: Calculate Yolanda’s income from her business for this calendar year. Sales income? Expenses: Other than rent and interest? Rent? Interest? Net income?

> Ann hires a nanny to watch her two children while she works at a local hospital. She pays the 19-year-old nanny $170 per week for 42 weeks during the current year. a. What is the employer’s portion of Social Security and Medicare tax for the nanny that

> Steve Jackson (birthdate December 13, 1966) is a single taxpayer living at 3215 Pacific Dr., Apt. B, Pacific Beach, CA 92109. His Social Security number is 465-88-9415. In 2019, Steve’s earnings and income tax withholding as laundry att

> The following information has been extracted from the books of a trader at 1 July 20X8: Required Write up the sales ledger control account and the purchases ledger control account for the year ended 30 June 20X9.

> The balance of the purchases ledger control account in the general ledger of A. Brook and Co. at 1 September is £1,984.50, the details being as follows: Note: See questions 11.9 and 12.9 – you should already have prepared

> The following particulars relating to the year ended 31 March 20X9 have been extracted from the books of Heel and Toe, footwear wholesalers. All sales have been recorded in personal accounts in the sales ledger, and the sales ledger control account is pa

> Prepare the sales ledger control account and the individual credit customer’s accounts for the month of November 20X9 from the details provided below. (Note: see questions 11.8 and 12.8 – you should already have prepar

> Fox & Co. maintains control accounts, in respect of both the sales ledger and purchases ledger, within their nominal ledger. On 31 December 20X9 the net total of the balances extracted from the sales ledger amounted to £9,870, which did not agree with th

> The following figures relating to the year ended 31 March 20X9 have been extracted from the books of a manufacturer: The balances on the control accounts, as shown above, have been included in the trial balance and in this trial balance the total of th

> The bank statement for G. Graduate for the period ended 30 June 20X9 was received. On investigation it emerged that the balance per the statement was different to the balance per the cash book. The cash book showed a debit balance of £5,944. On examinati

> The statement of financial position and statement of performance of Faults Ltd show the following two items: However, the balance as shown on the bank statement does not agree with the balance as shown in the cash book. Your investigation of this matte

> A young and inexperienced bookkeeper is having great difficulty in producing a bank reconciliation statement at 31 December. He gives you his attempt to produce a summarized cash book, and also the bank statement received for the month of December. These

> The following is a summary from the cash book of Hozy Co. Ltd for October 20X9: On investigation you discover that: 1. Bank charges of £35 shown on the bank statement have not been entered in the cash book. 2. A direct debit payment for &A

> Who do you think the stakeholders (users) of financial statement might be?

> The following is the cash book of T. Trading for the month of September 20X9: The following is the bank statement received for T. Trading for the month of September 20X9: Required Prepare the bank reconciliation as at 30 September 20X9.

> David Greene, the bookkeeper for Botanic, a wholesale distributor of garden equipment, prepares accounts without the aid of a computerized accounting system. He carries out a bank reconciliation on a monthly basis. The details of the cash book for Decemb

> The following is an extract of the cash book for J. Robin: The bank statement of J. Robin in the account with the Bank of ABC is as follows: Required a. Complete the cash book and prepare the bank reconciliation as at 31 July 20X9.

> Catherine Big has a cash balance of £52,900 on 1 June 20X9. She opens a current account on that date, with Belfast Bank, depositing £50,000. Her transactions during the next three days included the following: 1 June â€

> F. Harrison is in business as a trader. A trial balance taken out as at 31 January 20X9 was as follows: The following information is to be taken into account: 1. Included in sales are goods on sale or return that cost £240 and which have b

> S. Trader carries on a merchandising business. The following balances have been extracted from his books on 30 September 20X9: The following further information is to be taken into account: 1. Inventories on hand on 30 September 20X9 were valued at &Ac

> The following trial balance has been extracted from the ledger of Andrea Howell, a sole trader, as at 31 May 20X9, the end of her most recent financial year. The following additional information as at 31 May 20X9 is available: 1. Inventories as at the

> The following trial balance has been prepared from the books and records of Sulphur Products as at 30 September 20X9. We are also told that the figures have to be amended to take into account further adjustments (see below). Additional information 1. A

> The balances extracted from the books of Cara Van at 31 December 20X9 are given below: Required a. Prepare the trial balance. b. What is the missing account? Additional information At 31 December 20X9: 1. Inventories are valued at £33,990

> B. Good drew up the following trial balance as at 31 March 20X9. Closing information included the following: 1. Inventories at the year-end were valued at £35,650. 2. An accrual for wages of £400 has still to be posted. 3. The

> What do you think is the objective of financial statements?

> The trial balance extracted from the books of Mary, a sole trader, as at 31 December 20X9 was as follows: Additional information 1. Inventory on hand on 31 December 20X9 is £94,280. 2. Rates paid in advance at 31 December 20X9 are Â&

> The trial balance for Jock at 31 December 20X8 is as follows: Additional information 1. Closing inventory value is £500. 2. The rates in the trial balance cover the 15 months to 31 March 20X9. 3. The motor car is depreciated using 20 per c

> After stocktaking for the year ended 31 May 20X9 had taken place, the closing inventory of Cobden Ltd was aggregated to a figure of £87,612. During the course of the audit that followed, the under-noted facts were discovered: 1. Some goods stored outside

> On 1 April 20X8 Modern Dwellings Ltd commenced business as builders and contractors. It spent £14,000 on the purchase of six acres of land with the intention of dividing the land into plots and building 72 houses thereon. During the year end

> S. Bullock, a farmer, makes up his financial statements to 31 March each year. The trial balance extracted from his books as at 31 March 20X9 was as follows: Included in the above-mentioned figure of £50 is £15 for rent and t

> Your company sells, for £275 each unit, a product that it purchases from several different manufacturers, all charging different prices. The manufacturers deliver at the beginning of each week throughout each month. The following details rel

> Brian Ltd starts selling footballs in 20X8. Although each ball looks the same, the unit cost of manufacture (which is done in batches) has fluctuated during the period. Details of the costs are as follows: Details of sales are as follows: The closing

> John Ltd starts selling mobile phones in 20X9. Details of purchases in the year are as follows: Details of sales in the year are as follows: Required a. Calculate the cost of sales for the year ended 31 December 20X9 and detail the value of the closi

> Anna started a picture framing business on 1 July 20X9. The following transactions occurred in the six months ended 31 December 20X9: Additional information 1. On 1 July 20X9 Anna started the business by putting £10,000 into the bank accou

> The balances on certain accounts of Foster Hardware Co. as at 1 April 20X8 were: Required Post and balance the appropriate accounts for the year ended 31 March 20X9, deriving the transfer entries to the statement of performance where applicable.

> Why are financial statements prepared by companies?

> The company’s year-end is 31 December 20X9. Prepare ledger accounts for the following accounts showing the adjustments that are necessary for the year-end accruals and prepayments and the balances that would appear in the financial statements. a. The ope

> a. Stationery: During the year to 31 December 20X9 £1,300 was paid in respect of stationery. The amount owing at 31 December 20X8 was £140 and the amount owing at 31 December 20X9 was £200. b. Rent: Kristal received rent of £3,000 during the year ended 3

> a. Commission: received in advance at the start of the current year £50; received in the current year £5,600; receivable at the current year end £250. b. Rates: paid in the current year £950; prepaid at the start of the current year £220; prepaid at the

> Munch Catering Ltd, whose financial year runs from 1 December to the following 30 November, maintains a ‘Building occupancy costs’ account in its general ledger. This account is used to record all payments in respect o

> Oriel Ltd, whose financial year runs from 1 June to the following 31 May, maintains a combined rent and rates account in its ledger. Rent is fixed on a calendar year basis and is payable quarterly in advance. Rent was £2,400 for the year end

> Bush, a sole trader, commenced trading on 1 January 20X9. a. Telephone expense details The quarterly rental payable in advance on 1 January, 1 April, 1 July and 1 October is £30. Telephone calls are payable in arrears: January to March 20X9

> The trial balance of Snodgrass, a sole trader, at 1 January 20X9 is as follows: The following information is given for the year: At 31 December 20X9 the following balances are given: Required Prepare a statement of performance for the year, and a s

> The financial statements for the year ended 30 November 20X8 of Springboard Ltd included an allowance for irrecoverable debts at that date of £900. During the year ended 30 November 20X9, the company received £500 from Peter Lyo

> YEAR 1 1. The balance on trade receivables at the year-end is £110,000. 2. Two of the balances in the sales ledger have to be written off. One is £4,500, the other is £5,500. 3. The company is to provide 5 per cent for an allowance for irrecoverable debt

> Because of the doubtful nature of some debts, P. Rudent instructed his accountants to make a specific allowance in the financial statements for the year ended 30 June 20X8 against the following debts: He also instructed that a general allowance of 5 pe

> Enter the following transactions in the books of ‘Seamus McKee’ for November (use T accounts). 1 Nov Started business with £10,000 in the bank 2 Nov Paid for advertising by debit card: £130 3 Nov Paid for stationery by debit card: £50 5 Nov Bought goods

> The statement of financial position as at 31 December 20X8 of Zoom Products Ltd included: The financial statements for the year ended 31 December 20X8 included an allowance for irrecoverable debts at 31 December 20X8 of 3 per cent of the balance outsta

> The following transactions are to be recorded. At the beginning of year 1 an allowance for irrecoverable debts account is to be opened. It should show an allowance of 2 per cent against trade receivables of £50,000. During the year irrecoverable debts of

> The statement of financial position of Beta Ltd as at 30 June 20X8 shows motor vehicles as follows: Vehicles are depreciated on the straight line basis over a five-year life. Depreciation is charged pro rata to time in the year of acquisition but no ch

> Makers and Co. is a partnership with a small factory on the outskirts of London. They decide to erect an extension to their factory. The following items appear in the trial balance of the firm, as at 31 December 20X9: In the course of your examination

> Pusher commenced business on 1 January 20X7 with two lorries – A and B. A cost £1,000 and B cost £1,600. On 3 March 20X8, A was written off in an accident and Pusher received £750 from the insurance company. This vehicle was replaced on 10 March 20X8 by

> An item of plant and machinery was sold within the year for £5,000. The asset cost the company £10,000 over two years ago. The balances on the cost account and accumulated depreciation account were £118,000 and £18,000. It is company policy to provide fo

> Plant was purchased in the year for £10,000. It has been decided to provide for depreciation on a reducing balance basis (25 per cent). A full year’s depreciation is charged in the year of purchase. Required a. Show the entries in the ledgers for the fi