Question: Binding Machines Ltd sells wire-loop binding

Binding Machines Ltd sells wire-loop binding machines to printing units. The company has three separate departments:

Department A: sells new machines

Department B: sells second-hand machines

Department C: repairs machines for external customers and overhauls machines at the request of Departments A and B.

Each department is regarded as a responsibility center and a profit center.

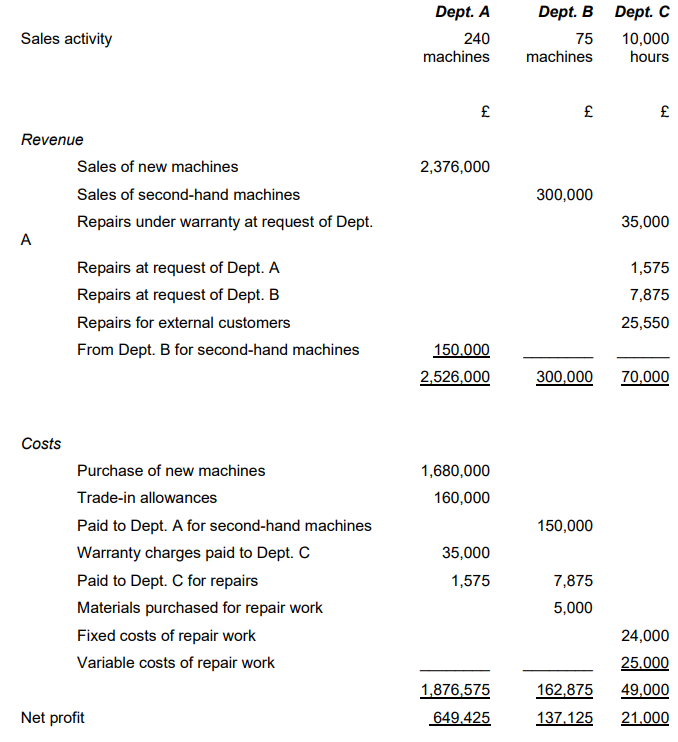

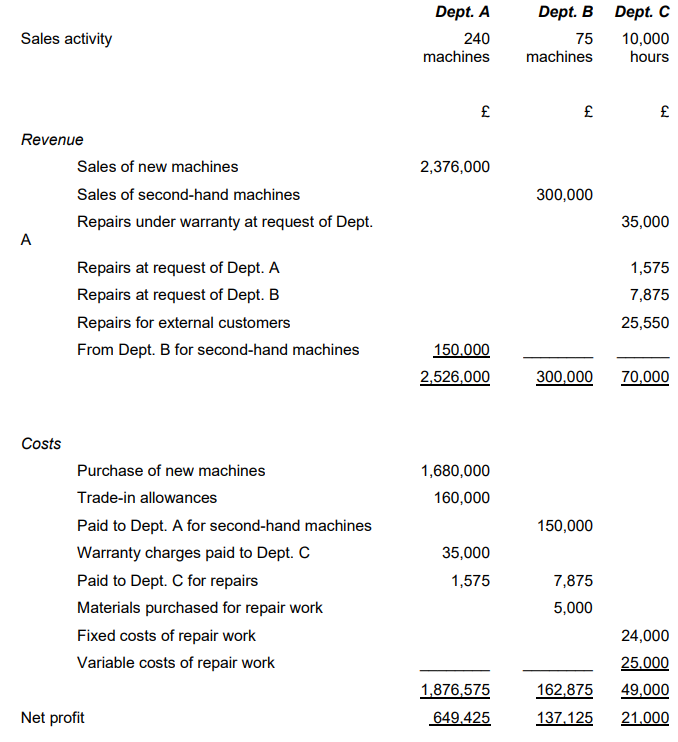

The following information relates to the year ended 31 December Year 8:

Further information:

Department A sold 240 new machines during the year. Each machine had a selling price of £9,900 and cost £7,000 to purchase from the manufacturer. Department A took 80 old machines in part exchange at an average allowance of £2,000 per machine. Of these, five were scrapped and the rest were passed to Department C for repair, before being returned to Department B for sale. These second-hand machines were sold at an average price of £4,000 each.

Repair work was carried out by Department C. The repair of each machine was estimated in advance to require an average of 15 hours labor in Department C. In fact, the work required an average of 18 hours per machine. Department C claimed the extra hours were due to lack of care by Department A in scrutinizing machines taken in part-exchange.

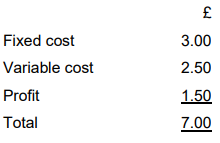

Department C applied a charge-out rate for labor hours of £7 per hour calculated as follows:

Costs of materials required for repair were charged directly to customers and therefore do not appear in the statement of costs and revenues. Materials for repairs of second-hand machines taken by Department A were charged to Department B at a cost of £5,000.

Fixed workshop cost in Department C is based on an annual budget of 8,000 hours. The actual hours worked were 10,000. Actual fixed costs incurred were equal to budgeted expenditure Through an agreement with the manufacturer, Binding Machines Ltd will undertake repairs free of charge where any machine fails during a period of 12 months from the date of purchase. The manufacturer’s charge of £7,000 to Department A for the cost of a new machine is stated after making an allowance of £200 per machine to cover repairs under warranty. Any such repair costs incurred in excess of this allowance must be borne by Binding Machines Ltd. Department A claims that an outside repair shop would carry out all the work of Department C at a cost of £6 per labor hour. No stocks of new or second-hand machines were held at the start or end of the year.

Required:

Explain the problems of applying the concepts of profit centers and responsibility centers in practice, illustrating your answer by reference to the information provided.

> 28. Which of the following is a correct statement about the strategic report? (a) A forward-looking aspect is not permitted. (b) A forward-looking aspect is encouraged. (c) The content of the strategic report is prescribed by an international financia

> On 1 September Year 1, a company paid £1,800 as an insurance premium to give accident cover for the 12 months ahead. The accounting year-end is 31 December. Required: Prepare an accounting equation spreadsheet to show the effect of the prepayment in th

> 9. Which of the following is the most accurate definition of return on shareholders’ equity? (a) Profit after tax as a percentage of share capital (b) Profit after tax as a percentage of share capital and reserves (c) Sales (revenue)

> 13. Which of the following items is/are likely to be found in a company’s statement of changes in equity? (i) Dividends paid (ii) Surplus on revaluation of non-current (fixed) assets (iii) Premium on the issue of shares Is it (a) (

> 10. Which of the following will not normally be found under the heading ‘Liabilities due after 1 year’? (a) Deferred taxation (b) Unsecured loan (c) Bank overdraft (d) Provision for reorganization costs 11. Which of the following most accurately des

> 12. Which of the following is/are normally treated as a contingent liability? (i) The corporation tax liability for the reporting period (ii) Claim for damages by a customer, where the reporting company believes the customer will be unsuccessful (iii)

> 24. On 1 April Year 1, a company paid £2,800 in advance for 1 year’s fire insurance. On the financial statement date of 31 December, what is the correct accounting treatment for this information? (a) Insurance expense of £700: current liability of £2,10

> 14. Which of the following would be included in a statement of financial position (balance sheet) under the heading ‘inventory’ (‘stock’)? (i) Raw materials (ii) Bank deposits (ii

> 28. The following is a list of non-current (fixed) assets: (i) Plant and equipment (ii) Patents (iii) Shares in subsidiary companies (iv) Trade marks Which of the above are classed as intangible assets? (a) (i) and (ii) (b) (ii) and (iii) (c) (ii

> 18. JK Builders Co purchases a new excavator costing £40,000. Its expected useful life is 10 years, at which point it is anticipated that the excavator will have a residual value of £6,000. If the straight-line method of depreciation is used, what is the

> 20. Which of the following is the best description of convergence of accounting in Europe? (a) From 2005, all accounting standards in the European Union are prepared by the European Commission. (b) From 2005, all listed companies in the European Union

> 16. A manufacturing company has carried out the following business transactions: • 500 kg of raw materials has been purchased for cash at a price of £3 per kg. • 300 kg of the raw materials has been put into production process. • 1 kg of raw material

> On 1 January Year 1, Company A purchased a bus costing £70,000. It was estimated to have a useful life of three years and a residual value of £4,000. It was sold for £8,000 on the last day of Year 3. On 1 January Year 1, Company B purchased a bus also co

> 6. Which of the following reflects the effect of the delivery of finished goods to customers on the accounting equation? (a) Assets decrease: ownership interest decreases (b) Assets decrease: ownership interest increases (c) Assets increase: ownership

> 6. Which of the following reflects the effects of a payment to creditors on the accounting equation? (a) Assets decrease: ownership interest decreases. (b) Assets decrease: ownership interest increases. (c) Assets increase: liabilities decrease. (d)

> 17. Which of the following statement is/are correct? (a) All pages of the annual report of a typical public company are heavily regulated by the company law. (b) The auditors are responsible for preparing a company’s annual financial statements. (c) T

> J Sainsbury plc: annual report of a service business We want to be a place where people love to work and shop. That means harnessing the talent, creativity and diversity of our colleagues to ensure that customers receive great service every time they sho

> Scope and quality of audits needs reform, say City chiefs Auditors have had their “heads in the sand” and must provide a far more rounded view of companies’ health than the current statutory “truth and fairness” opinions if they are to win back public tr

> Whitbread plc: main points from financial statements Extracts from the Annual Report Whitbread is the UK’s leading hospitality company We have built two of the UK’s most successful hospitality brands, Premier Inn and C

> The Financial Reporting Council (FRC) in the UK has set out an accounting standard for micro entities, which are the very smallest companies. Typically they have fewer than 10 employees. One permitted outline for a statement of financial position (balanc

> Oxfam Great Britain’s purpose is to help create lasting solutions to the injustice of poverty. As stated in its Memorandum of Association, the objects for which Oxfam is established for the public benefit are: • to prevent and relieve poverty and to prot

> Associated British Foods is a diversified international food, ingredients and retail group with sales of £13.4 billion, 130,000 employees and operations in 50 countries across Europe, southern Africa, the Americas, Asia and Australia. Business strategies

> The Bristol Port Company was formed in 1991 when entrepreneurs Terence Mordaunt and David Ord purchased the Port of Bristol from Bristol City Council. Since privatisation over £475 million has been invested to create a modern, thriving business offering

> Explain how the accounting equation spreadsheet of your answer to question B8.4 would alter if the building had been sold for £250,000. Data from Question B8.4: Angela’s Employment Agency sells the building for £285,000 on the final day of December Year

> More than half a million students have lived with us during our 25-year history and we continue to grow. In 2016, we opened five new properties which means we have the privilege of housing our largest ever number of students, 49,000. As the UKâ

> At our core, we are a successful branded soft drinks business, building a diverse and differentiated portfolio of great tasting brands that people love. We make it our business to understand what our consumers want. Whether it’s our iconic IRN-BRU, launc

> The case study shows a typical announcement of budget plans where management accounting is helpful but must be read in conjunction with short-term requirements and longer term strategic plans. Read the case now but only attempt the discussion points afte

> Plymouth-based super yacht company Princess Yachts has almost doubled its order book this year as it embarks on a £100m investment program. The company said that orders following the Cannes Yachting Festival reached a record £640m – 85pc higher than at t

> How much should I charge for my cakes? I have read that a good way to price cakes is to charge for the cost of ingredients times 2 (or 3). We firmly believe that the ‘ingredients times 2 or 3’ method of pricing is arbitrary and not rooted in any kind of

> Whirlpool said Monday it swung to a profit in the fourth quarter driven by higher prices and sales in North America, though the appliance maker’s 2019 outlook disappointed investors. Stronger prices for its products and fixed cost reduction boosted Whirl

> The purpose as ever of this annual road haulage cost movement report is to assist members and their customers to understand trends in the industry. It reflects cost movements, reasons for changes, and makes predictions. Every firm has different costs and

> Chartered Institute of Management Accounting (CIMA) What is management accounting? Management accounting is the sourcing, analysis, communication and use of decision-relevant financial and non-financial information to generate and preserve value for orga

> Unless it can reduce inventory and working capital, dividends may be at risk Everyone likes a bargain, particularly investors. Hennes & Mauritz, Sweden’s purveyor of Scandi fashions worldwide, offers value on the high street. Unfortunately, fears of “pea

> Our business model is designed to generate long-term sustainable value. We focus on mission-critical and highly engineered equipment with intensive aftermarket care and comprehensive global support. This model creates positive outcomes for our customers

> Angela’s Employment Agency sells the building for £285,000 on the final day of December Year 3. Record the transactions and events of Year 3 in an accounting equation spreadsheet. Assume depreciation is calculated in full for Year 3.

> The following extracts show the different ways in which three companies report their operating profit margins (operating profit as a percentage of sales). This ratio is an indicator of the performance of the business, or segments of the business. It prov

> Thames Water is one of ten regional licensed and regulated companies providing water and wastewater services in England and Wales. With 15 million customers we serve about 25% of the population of England and Wales. Dividends The Companyâ€

> We are a global energy company with wide reach across the world’s energy system. We have operations in Europe, North and South America, Australasia, Asia and Africa. Decommissioning Liabilities for decommissioning costs are recognized when the group has

> We use our cost advantage and number one and number two network positions in strong markets to deliver low fares and operational efficiency on point-to-point routes, with our people making the difference by offering friendly service for our customers. S

> Ocado Group plc: reporting inventory Established in 2000 and listed on the London Stock Exchange in July 2010, Ocado is the world’s largest dedicated online grocery retailer, with over 580,000 active customers. Our objective is to provi

> Investment by UK companies has fallen for three consecutive quarters, in a decline that highlights how uncertainty about Brexit is prompting consumers and businesses to tighten their belts. Business investment was 2.2 per cent lower in the third quarter

> Domino’s Pizza International Franchising Inc. (‘DPIF’) is the owner of the Domino’s brand across the globe. We have two Master Franchise Agreements in place with DPIF, which gives us exclusive rights to the markets in the UK, the Republic of Ireland, Swi

> Mulberry is a vertically integrated luxury brand which was founded in 1971 in Somerset. The Group designs, develops, manufactures, markets and sells products under the Mulberry brand name. The Group has over 1,400 employees (full time equivalents), the m

> The following information has been gathered from the accounting records of Jonathan’s Hair Stylists. Using the accounting equation, calculate (a) the amount of ownership interest at 30 September Year 8; (b) the amount of net profit fo

> Read the dialogue between David and Leona. What errors can occur in reporting the amount of ‘inventories’ (stocks) in financial statements?

> Assume that fee income and costs are the same in Year 2 as in Year 1. Record the transactions and events of Year 2 in an accounting equation spreadsheet. Prepare the statement of financial position (balance sheet) at the end of Year 2 and the income stat

> Weston plc produced the following draft statement of financial position (balance sheet) as on 1 May Year 4. During June, the following transactions and events occurred: 1. The company bought stock costing £66,000 from its suppliers on 2 mon

> You are the recently appointed financial controller of Motorway Catering Supplies Ltd (MCS) that has successfully operated motorway service stations for many years. It has been given the opportunity by the Transport Construction Group (TCG), the builders

> The board of directors of Kirkside Glassware Ltd is considering the following proposed investment projects: It is estimated that each product will provide benefits in terms of reduced cash outflows, measured over the coming five years. The outlays and ca

> You are the management accountant at the head office of a company which owns retail shoe shops throughout the country. The shops are grouped into areas, each having an area manager. Goods for sale are bought through a central purchasing scheme administer

> Write an essay of approximately 500 to 750 words on the topic: ‘It is questionable whether variance reporting is a useful tool of management’.

> As a further development of that answer, it is possible to link the cash flow to the gross profit using the changes in working capital. Attempt now to set out a calculation that links cash flow to gross profit in this way. In the world of business, it is

> Holyrood Products Ltd makes cassette recorders. The management accountant has produced the following summary of the company’s trading in the year ended 30 June Year 3: The following additional information is available: (a) Works and adm

> Woollens Ltd manufactures high-quality sweaters. At present, the company sells direct to retail stores, but sales through those outlets have been declining due to overseas competition − the profit last year was only £160,00

> Super toys Ltd is the sole manufacturer in Scotland of the Super-robot toy. The current level of production and sales is 40,000 toys per annum. The selling price of each Super robot is £20. The contribution from each toy is 20 per cent of the selling pri

> Which components are currently covered by an audit report of the type illustrated? Discuss the problems and potential benefits of having an audit opinion covering all categories of financial information.

> A company is able to sell four products and is planning its production mix for the next period. Estimated costs, sales and production data are as follows: Required (a) Based on the foregoing information, show the most profitable production mix under each

> A small business manufactures two products. Product A is a high-volume product of relatively low sales value and Product B is a low-volume product of relatively high sales value. Product A results from an automated process where the labour input is from

> An independent bus company on an island operates 15 routes and has 50 buses. Two routes take one hour for a journey round the island each; the remaining routes take 30 minutes for a return journey to various villages from a central hub in the main town.

> Florence Ltd is a manufacturing company with a financial year ending on 31 December Year 1. The company manufactures wooden storage units for schools and colleges, each job being planned to meet a customer’s specific order. A predetermined overhead rate

> Oldham Ltd is a small manufacturing company producing a variety of pumps for the oil industry. It operates from one factory that is geographically separated from its head office. The components for the pumps are assembled in the assembling department; th

> Timberchair Company produces custom-made chairs to suit individual customer requirements. The company’s main material is timber. It also uses glue and nails. The company has a small buying department that purchases timber from around the world. It also h

> You have been asked for advice by the owner of a small business who has previously estimated overhead costs as a percentage of direct labor cost. This method has produced quite reasonable results because the products have all been of similar sales value

> In a general engineering works the following routine has been followed for several years to arrive at an estimate of the price for a contract. The process of estimating is started by referring to a job cost card for some previous similar job and evaluat

> In a school, the head of the history unit is responsible for cost control. The finance office has produced the following statement of costs for the history unit cost centre. State which of them are controllable and which of them are non-controllable cost

> Complete the following table of cost classification for a shop selling bicycles:

> Explain why users require all the information and not merely the primary financial statements with notes to the accounts.

> Tots Ltd manufactures babies’ play suits for sale to retail stores. All play suits are of the same design. There are two departments: the cutting department and the machining department. You are asked to classify the costs listed below under the headings

> Supermarket checkout operators are paid a weekly wage plus overtime at an hourly rate. One operator has recently resigned from work. The supermarket manager has been asked whether the direct costs of the supermarket operation could be maintained within t

> The following information has been extracted from the financial statements of Casings Ltd. Income statement (profit and loss account) extract for the year to 31 December Year 2 Statement of changes in equity Equity holders’ funds at sta

> Consider the following: Statements of financial position (balance sheets) at 31 December Further information 1. The dividend paid during Year 2 was £25m. The retained earnings increased by £77m profit of the period and decreased

> Carry out a trend analysis on Safe and Sure plc, using the historical summary set out in Appendix I. Write a short report on the key features emerging from the trends.

> Prepare a full ratio analysis and commentary for Craigielaw. Assume that a share price of 160 pence is applicable at both year-end dates. Industry average ratios for both Year 7 and Year 6 are as follows:

> The summarised version of the Year 7 accounts of Worldchem plc is shown below along with comparative figures for the previous year. Most of the notes in the accounts, which give further details about nearly every item, are omitted here. Required: (a) C

> Carry out a ratio analysis of Safe and Sure plc, using the financial statements set out in Appendix I (at the end of this book) and applying the method of analysis set out in section 13.6. Making a comparison of Year 7 with Year 6, write a short commenta

> The following table sets out business transactions and events for Chris Brown Ltd. Required: (a) Using the accounting equation spreadsheet provided, record the effect of each transaction and events of Chris Brown Ltd for its first year of trading. (b)

> The following is a list of assets, liabilities and ownership interest of D. James Ltd on 1 January Year 5 when the company began to trade. The company has an issued share capital of 100,000 £1 ordinary shares. The following transactions were

> The following list of transactions relates to the business of Electrical Retailers during the month of November. Required: (a) Make entries in a spreadsheet for the above transactions. (b) Using the information you have entered in the spreadsheet, prepa

> Suggest six non-financial performance measures for a company which offers contract gardening services to companies which have landscaped sites surrounding their offices. Give reasons for your choice.

> As a result of organizational cost-cutting, new-hire orientation is cut short to a few days. Describe how this will affect retention.

> Organizations use different selection devices to recruit new employees. Are all methods equally good for all jobs?

> In Malaysia, certain industries like IT and customer services, are increasingly dependent on specialist human resource providers as a common source of trained manpower. Companies like the US-based ManpowerGroup provide professional HRM services to client

> Can a labor union help prevent employees from being unfairly terminated?

> What are the main challenges facing organizational designs today?

> How could a job-sharing arrangement be made effective? What would a job sharer need to do to make the arrangement work?

> There is evidence that an organization’s size will affect its structure. The larger the number of employees, the more mechanistic the organization will tend to become. Can this problem be overcome?

> In terms of organizational designs, what is a simple structure?

> Why is structure important? Why does an organization need a clear structure? Are there any other reasons for organizational structures beyond the formal arrangement of jobs, roles, and responsibilities?

> Discuss why you think an organization might be keen to increase its managers’ span of control.

> Internet sales comprise about 20 percent of all retail sales in the UK, with a record of £1.9 billion in online sales in December 2018. And for advancements in online sales, December 7, 2016, is a special delivery day for the country. On this day, one Am

> Contrast mechanistic and organic organizations.

> Organizational design has traditionally had a chain of command. How does a chain of command work?

> Do you think a person can be taught to be an entrepreneur? Why or why not?

> Why do you think many entrepreneurs find it hard to step aside and let others manage their business?

> Would a good manager be a good entrepreneur? Discuss.

> How many options are there for a new entrepreneur to start up their business venture?

> What do you think would be the hardest thing about being an entrepreneur? What do you think would be the most fun?

> Are there any disadvantages to be a first-mover? Provide examples.

> Creating a competitive advantage over rivals is advantageous, but it’s only a matter of time before they catch up, or changes in the industry nullifies the advantage. How does an organization sustain its competitive advantage?

> Describe the role of competitive advantage and how Porter’s competitive strategies help an organization develop competitive advantage.