Question: Blue Skies T-shirt Company operates a

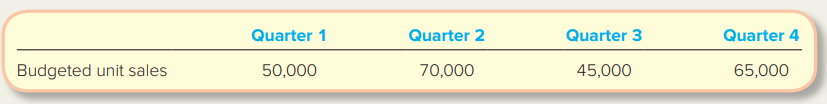

Blue Skies T-shirt Company operates a chain of T-shirt shops in the northeastern United States. The sales manager has provided a sales forecast for the coming year, along with the following information:

∙ Each T-shirt is expected to sell for $20.

∙ The purchasing manager buys the T-shirts for $8 each.

∙ The company needs to have enough T-shirts on hand at the end of each quarter to fill 30 percent of the next quarter’s sales demand.

∙ Selling and administrative expenses are budgeted at $60,000 per quarter plus 15 percent of total sales revenue.

Required:

Prepare the following operating budgets for quarters 1, 2, and 3. (You do not have enough information to complete quarter 4.)

1. Sales budget.

2. Merchandise purchases budget.

3. Cost of goods sold budget.

4. Selling and administrative expense budget.

5. Budgeted income statement.

> According to a recent Statement on Management Accounting (SMA), what are some of the potential benefits of a strong ethical business climate?

> How did the Sarbanes-Oxley Act attempt to reduce fraudulent reporting by addressing opportunity, incentives, and character?

> How did the Sarbanes-Oxley Act affect managers’ responsibility for creating and maintaining an ethical business and reporting environment?

> What events or factors led to the creation and enactment of the Sarbanes-Oxley Act of 2002?

> What are ethics and why is ethical behavior important to managers?

> How are the three basic management functions interrelated?

> What are the three basic functions of management?

> Consider the area within a 3-mile radius of your campus. What service companies, merchandising companies, and manufacturing firms are located within that area?

> Refer to the information for Oasis Company in E3-5. Required: 1. Reconcile the number of physical units to find the missing amounts. Determine the number of units started and completed each month. 2. Calculate the number of equivalent units for both mate

> Explain the difference between service companies, merchandising companies, and manufacturing companies.

> Why are traditional, GAAP-based financial statements not necessarily useful to managers and other internal parties?

> Your friend, Maria Cottonwood, has designed a new type of fire extinguisher that is very small and easy to use. It will target two groups of people: people who have trouble operating heavy, traditional extinguishers (e.g., the elderly or people with disa

> You have been asked to take part in an upcoming Young Professionals meeting in your area. The program planned for the evening focuses on today’s manufacturing environment. Specifically, you have been asked to explain how manufacturing firms determine h

> You have the opportunity to invest $10,000 in one of two companies from a single industry. The only information you have is shown here. The word high refers to the top third of the industry; average is the middle third; low is the bottom third. Required:

> The financial statements for Thor and Gunnar companies are summarized here: These two companies are in the same business and state but different cities. Each company has been in operation for about 10 years. Both companies received an unqualified audit o

> Mattel and Hasbro are the two biggest makers of games and toys in the world. Mattel sells over $5.6 billion of products each year while annual sales of Hasbro products exceed $5 billion. Compare the two companies as a potential investment based on the fo

> A condensed income statement for Southwest Airlines and a partially completed vertical analysis follow. Required: 1. Complete the vertical analysis by computing each line item (a)–(f) as a percentage of sales revenues. Round to the near

> A condensed balance sheet for Southwest Airlines and a partially completed vertical analysis are presented below. Required: 1. Complete the vertical analysis by computing each line item (a)–(c) as a percentage of total assets. Round to

> Use the data given in PB13–1 for Tiger Audio. Required: 1. Compute the gross profit percentage in the current and previous years. Are the current year results better, or worse, than those for the previous year? 2. Compute the net profit

> Oasis Company adds all materials at the beginning of its manufacturing process. Production information for selected months of the year follows: Required: 1. Reconcile the number of physical units to find the missing amounts. 2. Calculate the number of eq

> Tiger Audio declared and paid a cash dividend of $5,525 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information: Required: 1. Complete the two final columns shown beside each item

> Refer to PB12–4. Required: Complete requirements 1 and 2 using the direct method. Data from PB12-4: Dive In Company was started several years ago by two diving instructors. The company’s comparative balance sheets and

> Refer to the information in PB12–2. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the direct method. Data from PB12-2: The income statement and selected balance sheet informatio

> Dive In Company was started several years ago by two diving instructors. The company’s comparative balance sheets and income statement, as well as additional information, are presented below. Additional Data: a. Rent is paid in advance

> Audio City, Inc., is developing its annual financial statements at December 31. The statements are complete except for the statement of cash flows. The completed comparative balance sheets and income statement are summarized below: Additional Data: a. Bo

> The income statement and selected balance sheet information for Calendars Incorporated for the year ended December 31 are presented below. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the indirec

> For each of the following transactions, indicate whether operating (O), investing (I), or financing activities (F) are affected and whether the effect is a cash inflow (+) or outflow (−). Use (NE) if the transaction has no effect on cash. 1. Received dep

> Citco Company is considering investing up to $500,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects. ∙ Project A would redesign the production process to recycle raw material

> After incurring a serious injury caused by a manufacturing defect, your friend has sued the manufacturer for damages. The manufacturer made your friend three offers to settle the lawsuit: a. Receive an immediate cash payment of $100,000. b. Receive $10,0

> Montego Production Co. is considering an investment in new machinery for its factory. Various information about the proposed investment follows: Required: Help Montego evaluate this project by calculating each of the following: 1. Accounting rate of retu

> The following four companies use a process cost system: Required: Treating each case independently, find the missing amounts for letters a through h. You should do them in the order listed.

> Harmony Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and time horizon, Harmony’s management is finding it difficult to compare them. Project 1: Retooling Manufacturing Facility This pro

> Gondola Company is considering automating its production facility. The initial investment in automation would be $5,800,000 and the equipment has a useful life of eight years with a residual value of $400,000. The company will use straight-line depreciat

> The Best Cab Company (TBCC) is considering the purchase of four new taxicabs. Various information about the proposed investment follows: Required: Help TBCC evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payb

> The following table lists several metrics from the Global Reporting Initiatives’ (GRI) sustainability reporting standards and other industry sources. For each metric, classify it based on its impact on the triple bottom line (People, Pr

> Monona produces bottled water. The company recently purchased Cabot Co., a manufacturer of plastic bottles. In the past, Monona has purchased plastic bottles on the open market at $0.20 each. Financial information for the past year for Monona and Cabot f

> Quail Company produces outdoor gear. Salter is a division of Quail that manufactures unbreakable zippers used in Quail’s gear and sold to other manufacturers. Cost information per zipper follows: In addition, Salter’s

> Yummy Company has three divisions: Chips, Cookies, and Crackers. The company has a hurdle rate of 7 percent. Selected operating data for the three divisions follow: Yummy is considering an expansion project in the upcoming year that will cost $5,250,000

> The following is partial information for Tonopah Company’s most recent year of operation. Tonopah manufactures children’s shoes and categorizes its operations into two divisions: Girls and Boys. Required: 1. Without ma

> Escuda Company has the following information available for the past year: The company’s hurdle rate is 12 percent. 1. Determine Escuda’s return on investment (ROI) and residual income for each division for last year. 2

> Refer to the information in PB9–7 for First Trax. Required: Prepare the journal entries to record the following for First Trax: 1. Direct materials costs and related variances. 2. Direct labor and related variances. Data from PB9-7: Fi

> In 2008, Fetzer Vineyards redesigned its bottling process to use a more lightweight bottle by reducing the thickness of the glass and removing the “punt” or indentation at the base of the bottle. The result was to reduce the weight of each wine bottle f

> First Trax Company manufactures snowboards. Its standard cost information follows. First Trax has the following actual results for the month of June: Required: Calculate the following for First Trax: 1. Direct materials price, quantity, and spending vari

> Refer to the information in PB9–4 for Dolles Clay. Required: Prepare the journal entries to record the following for Dolles Clay: 1. Direct materials costs and related variances. Assume the company purchases direct materials as needed a

> Refer to the information for Dolles Clay in PB9–4. Required: Compute the following for Dolles Clay: 1. Fixed overhead spending variance 2. Fixed overhead volume variance. 3. Over- or underapplied fixed manufacturing overhead. Data from

> Dolles Clay, Inc., manufactures basic terra cotta planters. Its standard cost information for the past year follows: Dolles Clay has the following actual results for the past year: Required: Calculate the following for Dolles Clay: 1. Direct materials pr

> Refer to the information in PB9–1 for Sweetly Sent. Required: Prepare the journal entry to record the following for Sweetly Sent: 1. Direct materials costs and related variances. Assume the company purchases direct materials as needed a

> Refer to the information for Sweetly Sent in PB9–1. Required: Compute the following for Sweetly Sent: 1. Fixed overhead spending variance. 2. Fixed overhead volume variance. 3. Total over- or underapplied fixed manufacturing overhead.

> Sweetly Sent, Inc., manufactures scented pillar candles. Its standard cost information for the month of February follows: Sweetly Sent has the following actual results for the month of February: Required: Calculate the following for Sweetly Sent: 1. Dire

> Refer to the information presented in PB8–4 regarding Boscoe Power Tools. Required: Prepare the following for the first quarter: 1. Cost of goods sold budget. 2. Selling and administrative expense budget. 3. Budgeted income statement fo

> Boscoe Power Tools manufactures a wide variety of tools and accessories. One of its more popular craft-related items is the cord free glue gun. Each glue gun sells for $30. Boscoe expects the following unit sales: Boscoe’s ending finish

> Sereno Company makes piñatas for children’s birthday parties. Information for Sereno’s last six months of operation is listed as follows. Required: Prepare the journal entries to record each of the following transactions. (a) Purchased $15,600 of raw mat

> Beach Wind Company had $12,200 cash on hand on April 1. Of its sales, 60 percent is cash. Of the credit sales, 50 percent is collected during the month of the sale and 50 percent is collected during the month following the sale. Of direct materials purch

> Refer to the information in PB8–1. Required: Prepare Beach Wind’s budgeted income statement for quarter 2. Data from PB8-1: Beach Wind Company manufactures kites that sell for $20 each. Each kite requires 2 yards of l

> Beach Wind Company manufactures kites that sell for $20 each. Each kite requires 2 yards of lightweight canvas, which costs $0.60 per yard. Each kite takes approximately 30 minutes to build, and the labor rate averages $8 per hour. Beach Wind has the fol

> Gold Dust Co. manufactures tablet PCs. The company is currently operating at capacity and has received an offer from one of its suppliers to make the 20,000 glass screens it needs for $26 each. Gold Dust’s costs to make the glass screen are $10 in direct

> Shasta Co. manufactures designer pillows for college dorm rooms. Each line of pillow is endorsed by a high-profile sports star and designed with special elements selected by the sports star. During the most recent year, Shasta Co. had the following opera

> Golden Trophy Inc. manufactures trophies and other promotional awards. The company uses an extrusion process in which metals and plastic are molded into a metal base of different sizes and shapes. Managers can either sell the unfinished base to other tro

> Prospector Company makes three types of long-burning scented candles. The models vary in terms of size and type of materials (fragrance, decorations, etc.). Unit information for Prospector follows: Prospector has determined that it can sell a limited num

> Barb Bach recently graduated from Coral College’s accounting program. She has been hired as an analyst by Rainier Ski Co. and one of her first assigned tasks was to evaluate the Colorado division of Rainier Ski Co. This division has bee

> Greenview currently manufactures one model of a plain, unfinished oak bookcase. The company is considering changing this product by adding a long-wearing finish and more appealing trim. A summary of the expected costs and revenues for Greenviewâ

> Greenview Corp. is considering eliminating a product from its line of outdoor tables. Two products, the Sunrise and Noche tables, have impressive sales. However, sales for the Blanco model have been dismal. Information related to Greenviewâ€&#

> Mesa Company produces wooden rocking chairs. The company has two production departments, Cutting and Assembly. The wood is cut and sanded in Cutting and then transferred to Assembly to be assembled and painted. From Assembly, the chairs are transferred t

> Greenview Corp. is considering the possibility of outsourcing the production of the upholstered chair pads included with some of its wooden chairs. The company has received a bid from a company in China to produce 1,000 units per year for $9 each. Greenv

> Greenview Corp. makes several varieties of wooden furniture. It has been approached about producing a special order for Wilderness rocking chairs. A local senior citizens group would use the special-order chairs in a newly remodeled activity center. The

> Backpacks for Good manufactures and sells backpacks for educational and recreational uses. The company locates its manufacturing facilities in areas with high unemployment rates and provides on-site day care and education for its employeesâ€&#

> Sapphire Company produces two models of electric lawnmower. Information about Sapphire’s products is given below: Sapphire’s fixed costs total $104,625. Required: 1. Determine Sapphire’s weighted-aver

> Joan Company produces two backpack models. Information about its products follows Joan’s fixed costs total $51,700. Required: 1. Determine Joan’s weighted-average unit contribution margin and weighted-average contribut

> King Peak Company produces one security door model. A partially complete table of its costs follows: Required: 1. Complete the table. 2. King Peak sells its doors for $200 each. Prepare a contribution margin income statement for each of the three product

> Ivy Kay, Inc., makes one type of doggie sweater that it sells for $25 each. Its variable cost is $12.50 per sweater and its fixed costs total $8,600 per year. Ivy Kay currently has the capacity to produce up to 1,000 sweaters per year, so its relevant ra

> Regina Star delivers flowers for several local flower stores. She charges clients $0.85 per mile driven. Regina has determined that if she drives 1,200 miles in a month, her average operating cost is $0.80 per mile. If she drives 2,000 miles in a month,

> Franklin, Inc., produces one model of seat cover. Partial information for the company follows: Required: 1. Complete the table. 2. Calculate Franklin’s contribution margin ratio and its total contribution margin at each sales level indi

> Herb Garden manufactures garden planters for growing fresh herbs to use in cooking. Individuals as well as local restaurants purchase the planters. Recently, the company incurred the following costs: Herb Garden charges $17 for each planter that it sells

> Brite Toothbrushes has gathered the following information to complete its Production Report for the month of April. Required: Using the provided information, complete the report.

> Dirk Inc. produces and sells model cars. It incurs the costs listed in the following table. Required: Use an X to categorize each of the following costs. You may have more than one X for each item.

> Refer to the information for Vestibule in PB5–4. Additional information for Vestibule’s most recent year of operations follows: Required: 1. Without any calculations, explain whether Vestibule’s profi

> Vestibule produces one model of ski vest. Partial information for the company follows: Required: 1. Complete Vestibule’s cost data table. 2. Calculate Vestibule’s contribution margin ratio and its total contribution ma

> Refer to your solutions for Sigrid’s Custom Graphics in PB5–2. Required: 1. Consider the pattern of the company’s activity and costs throughout the year. Would you consider this to be a seasonal busin

> Sigrid’s Custom Graphics specializes in creating and painting store window advertisement displays. The majority of its business comes from local retailers and fast-food restaurants. A portion of Sigrid’s operating info

> Odie Company manufactures a popular brand of cat repellant known as Cat-B-Gone, which it sells in gallon-size bottles with a spray attachment. The majority of Odie’s business comes from orders placed by homeowners who are trying to keep

> In recent years, the managerial concepts of target costing, just-in-time inventory systems, and lean-manufacturing processes have received considerable attention from manufacturing companies. Increased competition in the marketplace and growing pressure

> Summit Company makes two models of snowboards, the Junior and the Expert. Its basic production information follows: Summit has monthly overhead of $484,746, which is divided into the following cost pools: The company has also compiled the following infor

> Berry Good Company makes two types of energy drinks, cherry and strawberry. Basic production information follows: Berry Good has monthly overhead of $159,670, which is divided into the following cost pools: The company has also compiled the following inf

> Paradiso Corp. is the manufacturer of food processors. It currently has two product lines, the Basic and the Industrial. Paradiso has $85,170 in total overhead. The company has identified the following information about its overhead activity cost pools a

> Homerun Corp., which manufactures baseball bats, currently has two product lines, the Traditional and the Acrylic, and $47,125 in total overhead. The company has identified the following information about its activity cost pools and the two product lines

> Fincher Farms uses process costing to account for the production of canned vegetables. Direct materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the process. Beginning work in process is 30 percent

> Refer to the information in PB3-5 for Ivy Glen Inc. Required: Complete all requirements for PB3-5 using the FIFO method. Data from PB3-5: Ivy Glen Inc. makes one model of lighted baby toy. All direct materials are added at the beginning of the manufactu

> Ivy Glen Inc. makes one model of lighted baby toy. All direct materials are added at the beginning of the manufacturing process. Information for the month of September follows: Required: 1. Using the weighted-average method of process costing, complete e

> Refer to the information in PB3-3 for Crismon Company. Required: Complete all requirements for PB3-3 using the FIFO method. Data from PB3-3: Crismon Company makes camping tents in a single production department. All direct materials are added at the beg

> Crismon Company makes camping tents in a single production department. All direct materials are added at the beginning of the manufacturing process. Information for the month of July follows: Required: 1. Using the weighted-average method of process cost

> Refer to the information about Mallory Inc. in PB3-1. Required: Complete all requirements for PB3-1 using the FIFO method. Data from PB3-1: Mallory Inc. produces a popular brand of energy drink. It adds all materials at the beginning of the manufacturin

> Mallory Inc. produces a popular brand of energy drink. It adds all materials at the beginning of the manufacturing process. The company has provided the following information: Required: 1. Using the weighted-average method of process costing, complete ea

> Refer to the information in PB2–3 for Knight Company. Required: 1. Prepare a journal entry showing the transfer of Job 102 into Finished Goods Inventory upon its completion. 2. Prepare the journal entries to recognize the sales revenue

> Knight Company uses a job order cost system with overhead applied to products on the basis of machine hours. For the upcoming year, Knight estimated its total manufacturing overhead cost at $450,000 and its total machine hours at 150,000. During the firs

> Refer to the information presented in PB2–1 for Coda Industries. Required: Prepare all of Coda’s necessary journal entries for the month of November. Data from PB2-1: Coda Industries uses a job order cost system. On N

> Coda Industries uses a job order cost system. On November 1, the company had the following balance in the accounts: The following transactions occurred during November: a. Purchased materials on account at a cost of $270,500. b. Requisitioned materials a

> Place the following steps required to prepare a process costing production report into their correct order. List separately any step that should not be included in the process. 1. Reconcile the total cost of work in process inventory. 2. Apply manufactur

> Carlton Manufacturing Company uses a job order cost system with manufacturing overhead applied to products on the basis of direct labor dollars. At the beginning of the most recent period, the company estimated its total direct labor cost to be $42,000 a

> Timberland Company is trying to decide on an allocation base to use to assign manufacturing overhead to jobs. The company has always used direct labor hours to assign manufacturing overhead to products, but it is trying to decide whether it should use a

> The following information was obtained from the records of Martinez Corporation during 2018. 1. Manufacturing overhead was applied at a rate of 175 percent of direct labor dollars. 2. Beginning value of inventory follows: a. Beginning Work in Process Inv