Question: Brooks Corp. is a medium-sized corporation

Brooks Corp. is a medium-sized corporation that specializes in quarrying stone for building construction. The company has long dominated the market, and at one time had 70% market penetration. During prosperous years, the company's profits and conservative dividend policy resulted in funds becoming available for outside investment. Over the years, Brooks has had a policy of investing idle cash in equity instruments of other companies. In particular, Brooks has made periodic investments in the company's main supplier, Norton Industries Limited. Although Brooks currently owns 18% of the outstanding common shares of Norton, it does not yet have significant influence over the operations of this investee company. Brooks accounts for its investment in Norton using FV-OCI without recycling through net income.

Yasmina Olynyk has recently joined Brooks as assistant controller, and her first assignment is to prepare the 2020 year-end adjusting entries. Olynyk has gathered the following information about Brooks's relevant investment accounts:

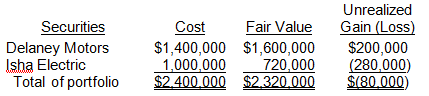

1. In 2020, Brooks acquired shares of Delaney Motors Corp. and Isha Electric Ltd. for short-term trading purposes. Brooks purchased 100,000 shares of Delaney Motors for $1.4 million, and the shares currently have a fair value of $1.6 million. Brooks's investment in Isha Electric has not been profitable: the company acquired 50,000 shares of Isha at $20 per share and they currently have a fair value of $720,000.

2. Before 2020, Brooks had invested $22.5 million in Norton Industries and, at December 31, 2019, the investment had a fair value of $21.5 million. While Brooks did not sell or purchase any Norton shares this year, Norton declared and paid a dividend totalling $2.4 million on all of its common shares, and reported 2020 net income of $13.8 million. Brooks's 18% ownership of Norton Industries has a December 31, 2020 fair value of $22,225,000.

Instructions

a. Prepare the appropriate adjusting entries for Brooks as at December 31, 2020.

b. For both categories of investments, describe how the results of the valuation adjustments made in part (a) would appear in the body of and/or notes to Brooks's 2020 financial statements. Ignore income taxes.

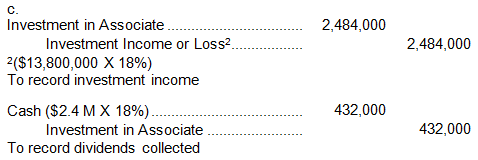

c. Prepare the dividend and adjusting entries for the Norton investment, assuming that Brooks's 18% interest results in significant influence over Norton's activities.

d. If Brooks Corp. were a private enterprise and followed ASPE, identify how your answers to parts (a), (b), and (c) would differ.

e. Could an 18% ownership interest actually result in Brooks having significant influence? Could Brooks have a 45% ownership interest and yet not have significant influence? Explain your answers.

Answer:

a. Investment in trading (FV-NI) securities:

Investment Income or Loss 80,000

FV-NI Investments 80,000

To record fair value adjustment

Calculations:

Investment in FV-OCI securities - Norton:

FV-OCI Investments……………………………………………………….725,000

Unrealized Gain or Loss – OCI…………………………………………………………725,000

To record fair value adjustment

Fair value of investment in Norton……………………………………………$22,225,000

Carrying amount of investment………………………………………………………… 21,500,000

Unrealized holding gain…………………………………………………………………….$ 725,000

b. Statement of Financial Position:

Current Assets

Trading securities, at fair value………………………………………………….$2,320,000

Long-term Investments

Investment in shares of Norton Industries,

at fair value with holding gains in OCI……………………………………$22,225,000

Shareholders’ Equity

Accumulated other comprehensive

Income (loss) ($22,500,000 - $22,225,000)………………………………….$(275,000)

Statement of Comprehensive Income:

Other Expenses and Losses (in net income)

Investment loss on securities at FV-NI………………………………………….$(80,000)

Other Comprehensive Income:

Item that will not be reclassified to net income-

Holding gain on FV-OCI securities………………………………………………………………..725,000

Included in comprehensive income…………………………………………………….$ 645,000

Statement of Changes in Shareholders’ Equity (Excerpt) –

Accumulated Other Comprehensive Income:

Accumulated other comprehensive income (loss),

January 1, 20201……………………………………………………………………$(1,000,000)

Other comprehensive income, 2020………………………………………………………. 725,000

Accumulated other comprehensive income (loss),

December 31, 2020……………………………………………………………….$(275,000)

1Norton: $21,500,000 opening FV – $22,500,000 invested

Brooks has significant influence and should apply the equity method. No fair value adjustments are recorded under the equity method.

d. Under parts a. and b., if Brooks Corp. was a private entity following ASPE, then the Norton Industries shares would have to be accounted for using fair value through net income (since ASPE does not have an FV-OCI option). However, if the Norton Industries shares were not actively traded and there was no active market price available for the shares, then Brooks could also account for the shares at cost. Under part c., ASPE permits the investor to account for shares in a significantly influenced company to be accounted for using the equity method or at cost. However, if the shares of Norton Industries were actively traded, then the cost method is not permitted and the FV-NI method is.

e. The 20%-50% holding is a guide only. It is up to the entity to determine if significant influence exists; specifically, does the entity have the power to participate in the financial and operating policy decisions of the entity whose shares it owns. If the other shares are widely held, for example, an 18% interest could result in very significant influence. On the other hand, if one other party owned the other 55% of the shares, a 45% interest might not enable the investor to have any influence at all.

> The "Internet of things" refers to physical devices such as phones, cars, cameras, fitness tracking devices, and other sensing devices that capture and track data through the Internet. Such devices collect a significant amount of data. For instance, most

> Obtain the 2017 annual report for Maple Leaf Foods Inc. from the company's website or from SEDAR (www.sedar.com). The company's note disclosure (Note 2) on "Basis of preparation" for (d) Use of Estimates and Judgments, for its biological assets is reprod

> The financial statements of the Hudson's Bay Company are presented at the end of the book. Complete the following instructions by referring to these financial statements and the accompanying notes. Instructions a. What is the company's basis of presenta

> In its 2017 financial statements (Note 3), Air Canada has disclosed its critical estimates and judgements used in preparing the financial statements. Instructions Access the 2017 audited annual financial statements for Air Canada for the year ended Dec

> Refer to the scenario in RA2.7 regarding Bancroft Corporation (BC). Jason has been reading lately about artificial intelligence and big data. He notes during a quick Internet search that a company called Blue J Legal has created a product that scans and

> Bancroft Corporation (BC) has just completed its analysis of the income taxes that it believes it will have to pay to the government either this year or in future years. Although he feels that the final estimate of income taxes payable is probably fine,

> Pascale Corp. has the following securities (all purchased in 2020) in its investment portfolio on December 31, 2020: 2,500 Anderson Corp. common shares, which cost $48,750; 10,000 Munter Ltd. common shares, which cost $580,000; and 6,000 King Corp. prefe

> The following amortization schedule is for Flagg Ltd.'s investment in Spangler Corp.'s $100,000, five-year bonds with a 7% interest rate and a 5% yield, which were purchased on December 31, 2019, for $108,660: The following schedule presents a comparison

> The following information relates to the 2020 debt and equity investment transactions of Wildcat Ltd., a publicly accountable Canadian corporation. All of the investments were acquired for trading purposes and accounted for using the FV-NI model, with al

> Use the information for Odyssey Ltd. in BEll.5. (a) Calculate the 2020 depreciation expense using the sum-of-the-years'-digits method. (b) Calculate the 2020 depreciation expense using the sum-of-the-years'-digits method, but assuming the machinery was p

> MacAskill Corp. has the following portfolio of securities acquired for trading purposes and accounted for using the FV-NI model at September 30, 2020, the end of the company's third quarter: On October 8, 2020, the Yuen shares were sold for $4.30 per sha

> Use the data provided in Pl2.8. Assume instead that Meridan Golf and Sports is a public company. The relevant information for the impairment test on December 31, 2022, is as follows: Instructions Provide the calculations for the impairment test and an

> Meridan Golf and Sports was formed on July 1, 2020, when Steve Powerdriver purchased Old Master Golf Corporation. Old Master provides video golf instruction at kiosks in shopping malls. Powerdriver's plan is to make the instruction business part of his

> In 2020, Aquaculture Incorporated applied for several commercial fishing licences for its commercial fishing vessels. The application was successful and on January 2, 2020, Aquaculture was granted 22 commercial fishing licences for a registration fee of

> During 2018, Medicine Hat Tools Ltd., a Canadian public company, purchased a building site for its product development laboratory at a cost of $61,000. Construction of the building started in 2018. The building was completed in late December 2019 at a co

> Fields Laboratories holds a valuable patent (No. 758-6002-lA) on a precipitator that prevents certain types of air pollution. Fields does not manufacture or sell the products and processes it develops. Instead, it conducts research and develops products

> Monsecours Corp., a public company incorporated on June 28, 2019, set up a single account for all of its intangible assets. The following summary discloses the debit entries that were recorded during 2019 and 2020 in that account: The new business starte

> Information for Naples Corporation's intangible assets follows: 1. On January 1, 2020, Naples signed an agreement to operate as a franchisee of Copy Service Inc., for an initial franchise fee of $75,000. Of this amount, $35,000 was paid when the agreeme

> On July 31, 2020, Mexico Company paid $3 million to acquire all of the common shares of Conchita Incorporated, which became a division of Mexico. Conchita reported the following statement of financial position at the time of the acquisition. It was dete

> The president of Plain Corp., Joyce Lima, is thinking of purchasing Balloon Bunch Corporation. She thinks that the offer sounds fair but she wants to consult a professional accountant to be sure. Balloon Bunch Corporation is asking for $85,000 in excess

> Use the information for Odyssey Ltd. in BEll.5. (a) Calculate the 2020 depreciation expense using the double-declining-balance method. (b) Calculate the 2021 depreciation expense using the double-declining-balance method, but assuming the machinery was p

> Macho Inc. has recently become interested in acquiring a South American plant to handle many of its production functions in that market. One possible candidate is De Fuentes SA, a closely held corporation, whose owners have decided to sell their business

> On September 1, 2020, Madonna Lisa Corporation, a public company, acquired Jaromil Enterprises for a cash payment of $763,000. At the time of purchase, Jaromil's statement of financial position showed assets of $850,000, liabilities of $430,000, and owne

> In late July 2020, Mona Ltd., a private company, paid $2 million to acquire all of the net assets of Lubello Corp., which then became a division of Mona. Lubello reported the following statement of financial position at the time of acquisition: It was

> Guiglano Inc. is a large, publicly held corporation. The following are six selected expenditures that were made by the company during the fiscal year ended April 30, 2020. The proper accounting treatment of these transactions must be determined in order

> On April 30, 2020, Oceanarium Corporation ordered a new passenger ship, which was delivered to the designated cruise port and available for use as of June 30, 2020. Overall, the cost of the ship was $97 million, with an estimated useful life of 12 years

> Linda Monkland established Monkland Ltd. in mid-2019 as the sole shareholder. The accounts on June 30, 2020, the company's year end, just prior to preparing the required adjusting entries, were as follows: All the capital assets were acquired and put in

> On January 1, 2018, Dayan Corporation, a small manufacturer of machine tools, acquired new industrial equipment for $1.1 million. The new equipment had a useful life of five years and the residual value was estimated to be $50,000. Dayan estimates that

> Comco Tool Corp. records depreciation annually at the end of the year. Its policy is to take a full year's depreciation on all assets that are used throughout the year and depreciation for half a year on all machines that are acquired or disposed of dur

> On June 15, 2017, a second-hand machine was purchased for $77,000. Before being put into service, the equipment was overhauled at a cost of $5,200, and additional costs of $400 for direct material and $800 for direct labour were paid in fine -tuning the

> Odyssey Ltd. purchased machinery on January 1, 2020, for $60,000. The machinery is estimated to have a residual value of $6,000 after a useful life of eight years. (a) Calculate the 2020 depreciation expense using the straight-line method. (b) Calculate

> Alladin Company purchased a large piece of equipment on October 1, 2020. The following information relating to the equipment was gathered at the end of October: It is expected that the equipment could be used for 12 years, after which the salvage value w

> Ducharme Corporation purchased electrical equipment at a cost of $12,400 on June 2, 2017. From 2017 through 2020, the equipment was depreciated on a straight-line basis, under the assumption that it would have a 10-year useful life and a $2,400 residual

> Sung Corporation, a manufacturer of steel products, began operations on October 1, 2019. Sung's accounting department has begun to prepare the capital asset and depreciation schedule that follows. You have been asked to assist in completing this schedule

> The following is a schedule of property dispositions for Shangari Corp.: The following additional information is available: Land On February 15, land that was being held mainly as an investment was expropriated by the city. On March 31, another parcel o

> Roland Corporation uses special strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10 million and had an estimated useful life of eight years with no residual value. In early April 2020, a part costing $875,00

> Darby Sporting Goods Inc. has been experiencing growth in the demand for its products over the last several years. The last two Olympic Games greatly increased the popularity of basketballaround the world. As a result, a European sports retailing consort

> Conan Logging and Lumber Company, a small private company that follows ASPE, owns 3,000 hectares of timberland on the north side of Mount Leno, which was purchased in 2008 at a cost of $550per hectare. In 2020, Conan began selectively logging this timbe

> On January 1, 2019, Locke Company, a small machine-tool manufacturer, acquired a piece of new industrial equipment for $1,260,000. The new equipment had a useful life of five years, and the salvage value was estimated to be $60,000. Locke estimates that

> Kitchigami Limited was attracted to the Town of Mornington by the town's municipal industry commission. Mornington donated a plant site to Kitchigami, and the provincial government provided $180,000 toward the cost of the new manufacturing facility. The

> Gilles Corp. purchased a piece of equipment on February l , 2020, for $100,000. The equipment has an estimated useful life of eight years, with a residual value of $25,000, and an estimatedphysical life of 10 years, with no salvage value. The equipment w

> Munro Limited reports the following information in its tax files covering the fiveyear period from 2018 to 2022. All assets are Class 10 with a 30% maximum CCA, and no capital assets had been acquired before 2018. Instructions: a. Prepare a capital cost

> Minute Corp., a Canadian public corporation that follows IFRS, reported the following on its December 31, 2019 statement of financial position: Additional information: 1. The bond amortization table used by Minute Corp. for this bond indicated the follow

> On December 31, 2019, Acker Ltd. reported the following statement of financial position: The accumulated other comprehensive income was related only to the company's non-traded equity investments. Some of these were sold in 2020 for cash, resulting in a

> On January 1, 2020, Melbourne Corporation, a public company following IFRS, acquired 15,000 of the 50,000 outstanding common shares of Noah Corp. for $25 per share. Noah's statement of financial position reported the following information at the date of

> Fellows Inc., a publicly traded manufacturing company in the technology industry, has a November 30 fiscal year end. The company grew rapidly in its first 10 years and made three public offerings over this period. During its rapid growth period, Fellows

> Harper Corporation had the following portfolio of investments at December 31, 2020, that qualified and were accounted for using the FV-OCI method: Early in 2021, Harper sold all the Frank Inc. shares for $17 per share, less a 1 % commission on the sale.

> Octavio Corp. prepares financial statements annually on December 31, its fiscal year end. The company follows IFRS. At December 31, 2020, the company has the account Investments in its general ledger, containing the following debits for investment purcha

> On July 1, 2020, Menard Concrete Ltd. purchased 5% bonds having a maturity value of $50,000 for $48,645.70. The bonds provide the bondholders with a 6% yield. The bonds mature July l, 2023, with interest receivable June 30 and December 31 of each year. M

> The following information relates to the debt securities investments of Wild Company: 1. On February 1, the company purchases 10% bonds of Gibbons Co. having a par value of $300,000 at 100 plus accrued interest. Interest is payable April 1 and October 1.

> Chong Corp. purchased a machine on July 1, 2020, for $30,000. Chong paid $200 in title fees and a legal fee of $100 related to the machine. In addition, Chong paid $500 in shipping charges for delivery, and $400 to a local contractor to build and wire a

> Presented below is information taken from a bond investment amortization schedule, with related fair values provided. These bonds are classified as FV-OCI. Instructions a. Were the bonds purchased at a discount or at a premium? b. Prepare the adjusting e

> On January 1, 2020, Novotna Company purchased $400,000 worth of 8% bonds of Aguirre Co. for $369,114. The bonds were purchased to yield 10% interest. Interest is payable semi-annually, on July 1 and January 1. The bonds mature on January 1, 2025. Novotna

> On December 31 , 2019, Nodd Corp. acquired an investment in GT Ltd. bonds with a nominal interest rate of 10% (received each December 31), and the controller produced the following bond amortization schedule based on an effective rate of approximately 15

> Castlegar Ltd. had the following investment portfolio at January l, 2020: During 2020, the following transactions took place: 1. On March 1, Josie Corp. paid a $2 per share dividend. 2. On April 30, Castlegar sold 300 shares of Asher Corp. for $10 per sh

> The following are the facts for the second question asked of prospective employees. Last year the company exchanged a piece of land for a non-interest-bearing note. The note is to be paid at the rate of $15,000 per year for nine years, beginning one year

> Langevin Ltd., which has a calendar year end, entered into an equipment lease on June 1, 2020, with GH Financing Limited. The lease term is two years and requires payments of $3,000 at the end of each month beginning September 30. The stated rate of inte

> James Halabi is a financial executive with McDowell Enterprises. Although James has not had any formal training in finance or accounting, he has a "good sense" for numbers and has helped the company grow from a very small company ($500,000 in sales) to a

> You are hired to review the accounting records of Sheridan Inc. (a public corporation) before it closes its revenue and expense accounts as at December 31, 2020, the end of its current fiscal year. The following information comes to your attention. 1. Du

> Fusters Inc. provides audited financial statements to its creditors and is required to maintain certain covenants based on its debt to equity ratio and return on assets. In addition, management of Fusters receives a bonus partially based on revenues for

> Cameo Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Cameo's industry is fast-changing, causing the fair value of each machine to change significantly about every two year

> On October 1, 2020, Ocean Airways Ltd. purchased a new commercial aircraft for a total cost of $100 million. Included in the total cost are the aircraft's two engines, at a cost of $10 million each, and the aircraft's body, which costs $80 million. The e

> On July 1, 2020, Lucas Ltd., a publicly listed company, acquired assets from Jared Ltd. On the transaction date, a reliable, independent valuator assessed the fair values of these assets as follows: The buildings are owned by the company, and the land

> Vidi Corporation, a private enterprise, made the following purchases related to its property, plant, and equipment during its fiscal year ended December 31, 2020. The company uses the straight-line method of depreciation for all its capital assets. 1. In

> On June 28, 2020, in relocating to a new town, Kerr Corp. purchased a property consisting of two hectares of land and an unused building for $225,000 plus property taxes in arrears of $4,500. The company paid a real estate broker a fee of $12,000 for fin

> Kiev Corp. was incorporated on January 2, 2020, but was unable to begin manufacturing activities until July 1, 2020, because new factory facilities were not completed until that date. The Land and Building account at December 31, 2020, contained the foll

> Webb Corporation prepares financial statements in accordance with IFRS. Selected accounts included in the property, plant, and equipment section of the company's statement of financial position at December 31, 2019, had the following balances: During 2

> At December 31, 2019, certain accounts included in the property, plant, and equipment section of Golden Corporation's statement of financial position had the following balances: During 2020, the following transactions occurred: 1. Land site No. 621 was

> Adamski Corporation manufactures ballet shoes and is in a period of sustained growth. In an effort to expand its production capacity to meet the increased demand for its products, the company recently made several acquisitions of plant and equipment. Tan

> Wordcrafters Inc. is a book distributor that had been operating in its original facility since 1991. The increase in certification programs and continuing education requirements in several professions has contributed to an annual growth rate of 15% for W

> Inglewood Landscaping Corp. began constructing a new plant on December l , 2020. On this date, the company purchased a parcel of land for $184,000 cash. In addition, it paid $2,000 in surveying costs and $4,000 for title transfer fees. An old dwelling on

> Donovan Resources Group has been in its plant facility for 15 years. Although the plant is quite functional, numerous repair costs are incurred to keep it in good working order. The book value of the company's plant is currently $800,000, calculated as f

> Fong Limited purchased an asset at a cost of $45,000 on March l, 2020. The asset has a useful life of seven years and an estimated residual value of $3,000. For tax purposes, the asset belongs in CCA Class 8, with a rate of 20%. Calculate the CCA for eac

> On March 1, 2020, Jessi Corp. acquired a 10-unit residential complex for $1,275,000, paid in cash. An independent appraiser determined that 75% of the total purchase price should be allocated to buildings, with the remainder allocated to land. On the dat

> December 31, 2017 consolidated statement of financial position lists property and equipment at $9 billion and total assets of $17.7 billion. Air Canada's Note 4 to the financial statements titled Property and Equipment provides a schedule of the transact

> Riverdale Farms Ltd. operates dairy farms. The following are selected transactions that occurred during the fiscal years ended December 31, 2020 and 2021, for one dairy cow and its calf. 1. A calf was born in March 2020. Its fair value less costs to sell

> Milford Company determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2018, 2019, and 2020, as follows: Instructions a. Prepare the journal entries that are required at December 31, 2019 and 2020, assumin

> Astro Languet established Languet Products Co. as a sole proprietorship on January 5, 2020. At the company's year end of December 31, 2020, the accounts had the following balances (in thousands): A count of ending inventory on December 31, 2020, showed

> The summary financial statements of Langford Landscaping Ltd. on December 31, 2020, are as follows: The following errors were made by the inexperienced accountant on December 31, 2019, and were not corrected. 1. The inventory was overstated by $13,000.

> Halm Skidoos Limited, a private company that began operations in 2017, always values its inventories at their current net realizable value. The company uses ASPE. Its annual inventory figure is arrived at by taking a physical count and then pricing each

> On February 1, 2020, Akeson Ltd. began selling electric scooters that it purchased exclusively from Ionone Motors Inc. Ionone Motors offers volume rebates based on the volume of annual sales to its customers and calculates and pays the rebates at its fis

> In its 2020 annual report, Winkler Limited reports beginning-of-the-year total assets of $1,923 million, end-of-the-year total assets of $2,487 million, total revenue of $2,687 million, and net income of $52 million. (a) Calculate Winkler's asset turnove

> The Eserine Wood Corporation manufactures desks. Most of the company's desks are standard models that are sold at catalogue prices. At December 31, 2020, the following finished desks appear in the company's inventory: The 2020 catalogue was in effect t

> Sier Specialty Corp., a division of FH Inc., manufactures three models of bicycle gearshift components that are sold to bicycle manufacturers, retailers, and catalogue outlets. Since beginning operations in 1969, Sier has used normal absorption costing a

> The following independent situations relate to inventory accounting: Primary Guidance Under IFRS 1. Sanderson Company's inventory of $1.1 million at December 31, 2020, was based on a physical count of goods priced at cost and before any year-end adjustme

> Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019: Transactions during 2020 and other information relating to Desrosiers' long-term receivables were as follows: 1. The $1.8-million note receivable is dated May

> On December 31, 2020, Zhang Ltd. rendered services to Beggy Corp. at an agreed price of $91,844.10. In payment, Zhang accepted $36,000 cash and agreed to receive the balance in four equal installments of $18,000 that are due each December 31. An interest

> On October 1, 2020, Healy Farm Equipment Corp. sold a harvesting machine to Homestead Industries. Instead of a cash payment, Homestead Industries gave Healy Farm Equipment a $150,000, two-year, 10% notes; 10% is a realistic rate for a note of this type.

> The SFP of Alice Inc. at December 31, 2019, includes the following: Transactions in 2020 include the following: 1. Accounts receivable of $146,000 was collected. 2. Customer accounts of $39,500 were written off during the year. 3. An additional $16,700

> The following information relates to Shea Inc.'s accounts receivable for the 2020 fiscal year: 1. An aging schedule of the accounts receivable as at December 31, 2020, is as follows: 2. The Accounts Receivable control account has a debit balance of $37

> Use the information presented for Volumetrics Corporation in BEll.19, but assume that the machinery is sold for $5,200 instead of $13,500. Prepare journal entries to (a) update depreciation for 2022 and (b) record the disposal.

> Gelato Corporation, a private entity reporting under ASPE, was incorporated on January 3, 2019. The corporation's financial statements for its first year of operations were not examined by a public accountant. You have been engaged to audit the financial

> Fortini Corporation had record sales in 2020. It began 2020 with an Accounts Receivable balance of $475,000 and an Allowance for Doubtful Accounts of $33,000. Fortini recognized credit sales during the year of $6,675,000 and made monthly adjusting entrie

> A series of unrelated situations follow for several companies that use ASPE: 1. Atlantic Inc.'s unadjusted trial balance at December 31, 2020, included the following accounts: 2. An analysis and aging of Central Corp.'s accounts receivable at December

> Information follows for Quartz Industries Ltd.: Additional information: 1. One June 26 transactions were for bank service charges. 2. One June 30 transactions was a bank debit memo for $1,050.00 for a customer's cheque returned and marked NSF (includ

> The cash account of Villa Corp. shows a ledger balance of $3,969.85 on June 30, 2020. The bank statement as at that date shows a balance of $4,150. When the statement was compared with the cash records, the following facts were determined: 1. There were

> Joseph Kiuvik is reviewing the cash accounting for Connolly Corporation, a local mailing service. Joseph's review will focus on the petty cash account and the bank reconciliation for the month ended May 31, 2020. Petty cash Joseph has collected the follo

> The Patchwork Corporation manufactures sweaters for sale to athletic-wear retailers. The following information was available on Patchwork for the years ended December 31, 2019 and 2020: During 2020, Patchwork had the following transactions: 1. On June

> The Cormier Corporation sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 day

> In 2020, Ibran Corp. required additional cash for its business. Management decided to use accounts receivable to raise the additional cash and has asked you to determine the income statement effects of the following transactions: 1. On July 1, 2020, Ibra