Question: Bunyan Lumber, LLC, harvests timber and delivers

Bunyan Lumber, LLC, harvests timber and delivers logs to timber mills for sale. The company was founded 70 years ago by Pete Bunyan. The current CEO is Paula Bunyan, the granddaughter of the founder. The company is currently evaluating a 5,000-acre forest it owns in Oregon. Paula has asked Steve Boles, the company’s finance officer, to evaluate the project. Paula’s concern is when the company should harvest the timber.

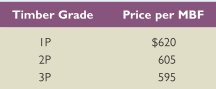

Lumber is sold by the company for its “pond value.†Pond value is the amount a mill will pay for a log delivered to the mill location. The price paid for logs delivered to a mill is quoted in dollars per thousands of board feet (MBF), and the price depends on the grade of the logs.

The forest Bunyan Lumber is evaluating was planted by the company 20 years ago and is made up entirely of Douglas fir trees. The table here shows the current price per MBF for the three grades of timber the company feels will come from the stand:

Steve believes that the pond value of lumber will increase at the inflation rate. The company is planning to thin the forest today, and it expects to realize a positive cash flow of $1,000 per acre from thinning. The thinning is done to increase the growth rate of the remaining trees, and it is always done 20 years following a planting.

The major decision the company faces is when to log the forest. When the company logs the forest, it will immediately replant saplings, which will allow for a future harvest. The longer the forest is allowed to grow, the larger the harvest becomes per acre. Additionally, an older forest has a higher grade of timber. Steve has compiled the following table with the expected harvest per acre in thousands of board feet, along with the breakdown of the timber grades:

The company expects to lose 5 percent of the timber it cuts due to defects and breakage.

The forest will be clear-cut when the company harvests the timber. This method of harvesting allows for faster growth of replanted trees. All of the harvesting, processing, replanting, and transportation are to be handled by subcontractors hired by Bunyan Lumber. The cost of the logging is expected to be $140 per MBF. A road system has to be constructed and is expected to cost $50 per MBF on average. Sales preparation and administrative costs, excluding office overhead costs, are expected to be $18 per MBF.

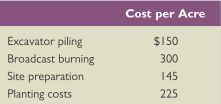

As soon as the harvesting is complete, the company will reforest the land. Reforesting costs include the following:

All costs are expected to increase at the inflation rate.

Assume all cash flows occur at the year of harvest. For example, if the company begins harvesting the timber 20 years from today, the cash flow from the harvest will be received 20 years from today. When the company logs the land, it will immediately replant the land with new saplings. The harvest period chosen will be repeated for the foreseeable future. The company’s nominal required return is 10 percent, and the inflation rate is expected to be 3.7 percent per year. Bunyan Lumber has a 35 percent tax rate.

Clear-cutting is a controversial method of forest management. To obtain the necessary permits, Bunyan Lumber has agreed to contribute to a conservation fund every time it harvests the lumber. If the company harvested the forest today, the required contribution would be $250,000. The company has agreed that the required contribution will grow by 3.2 percent per year. When should the company harvest the forest?

Transcribed Image Text:

Timber Grade Price per MBF IP $620 2P 605 3P 595 Years from Today Harvest (MBF) to Begin Harvest Timber Grade per Acre IP 2P ЗР 20 14.1 16% 36% 48% 25 16.4 20 40 40 30 17.3 22 43 35 35 18.1 24 45 31 Cost per Acre Excavator piling $150 Broadcast burning 300 145 Site preparation Planting costs 225

> Essence of Skunk Fragrances, Ltd., sells 5,450 units of its perfume collection each year at a price per unit of $480. All sales are on credit with terms of 1/10, net 40. The discount is taken by 35 percent of the customers. What is the total amount of th

> Cholern Electric Company (CEC) is a public utility that provides electricity to the central Colorado area. Recent events at its Mile-High Nuclear Station have been discouraging. Several shareholders have expressed concern over last year’

> Lewellen Products has projected the following sales for the coming year: Sales in the year following this one are projected to be 15 percent greater in each quarter. a. Calculate payments to suppliers assuming that the company places orders during each

> Submarine Manufacturing is investigating a lockbox system to reduce its collection time. It has determined the following: The total collection time will be reduced by three days if the lockbox system is adopted. a. What is the PV of adopting the system

> Are the following statements true or false? Explain why. a. If the general price index in Great Britain rises faster than that in the United States, we would expect the pound to appreciate relative to the dollar. b. Suppose you are a German machine tool

> If a firm is selling futures contracts on lumber as a hedging strategy, what must be true about the firm’s exposure to lumber prices?

> What are DIP loans? Where do DIP loans fall in the APR?

> What are the different inventory types? How do the types differ? Why are some types said to have dependent demand, whereas other types are said to have independent demand?

> In an ideal economy, net working capital is always zero. Why might net working capital be positive in a real economy?

> If a textile manufacturer wanted to hedge against adverse movements in cotton prices, it could buy cotton futures contracts or buy call options on cotton futures contracts. What would be the pros and cons of the two approaches?

> Which would a firm prefer: A net collection float or a net disbursement float? Why?

> What is the duration of a bond with three years to maturity and a coupon of 6.1 percent paid annually if the bond sells at par?

> A mail-order firm processes 5,450 checks per month. Of these, 70 percent are for $55 and 30 percent are for $80. The $55 checks are delayed two days on average; the $80 checks are delayed three days on average. a. What is the average daily collection flo

> Use Figure 31.1 to answer the following questions. Suppose interest rate parity holds, and the current six-month risk-free rate in the United States is 1.9 percent. What must the six-month risk-free rate be in Great Britain? In Japan? In Switzerland?

> Turnover Chen, Inc., has an average collection period of 34 days. Its average daily investment in receivables is $61,300. What are annual credit sales? What is the receivables turnover?

> The shareholders of Flannery Company have voted in favor of a buyout offer from Stultz Corporation. Information about each firm is given here: Flannery’s shareholders will receive one share of Stultz stock for every three shares they

> Suppose the exchange rate for the Swiss franc is quoted as SF 1.09 in the spot market and SF 1.11 in the 90-day forward market. a. Is the dollar selling at a premium or a discount relative to the franc? b. Does the financial market expect the franc to st

> Consider the following financial statement information for the Rivers Corporation: Calculate the operating and cash cycles. How do you interpret your answer? Item Beginning Ending Inventory $17,385 $19,108 Accounts receivable 13,182 13,973 Accounts

> Given that many multinationals based in many countries have much greater sales outside their domestic markets than within them, what is the particular relevance of their domestic currency?

> What is the absolute priority rule?

> Describe the advantages and disadvantages of a taxable merger as opposed to a tax-free exchange. What is the basic determinant of tax status in a merger? Would an LBO be taxable or nontaxable? Explain.

> In each of the following pairings, indicate which firm would probably have a longer credit period and explain your reasoning. a. Firm A sells a miracle cure for baldness; Firm B sells toupees. b. Firm A specializes in products for landlords; Firm B speci

> What are the costs of shortages? Describe them.

> A company produces an energy-intensive product and uses natural gas as the energy source. The competition primarily uses oil. Explain why this company is exposed to fluctuations in both oil and natural gas prices.

> Are poison pills good or bad for stockholders? How do you think acquiring firms are able to get around poison pills?

> Why is a preferred stock with a dividend tied to short-term interest rates an attractive short-term investment for corporations with excess cash?

> At one point, Duracell International confirmed that it was planning to open battery manufacturing plants in China and India. Manufacturing in these countries allows Duracell to avoid import duties of between 30 and 35 percent that have made alkaline batt

> Explain the purchase accounting method for mergers. What is the effect on cash flows? On EPS?

> What is the difference between liquidation and reorganization?

> You are short 25 gasoline futures contracts, established at an initial settle price of $1.36 per gallon, where each contract represents 42,000 gallons. Over the subsequent four trading days, gasoline settles at $1.33, $1.37, $1.39, and $1.44, respectivel

> Penn Corp. is analyzing the possible acquisition of Teller Company. Both firms have no debt. Penn believes the acquisition will increase its total aftertax annual cash flow by $1.3 million indefinitely. The current market value of Teller is $27 million,

> The Litzenberger Company has projected the following quarterly sales amounts for the coming year: a. Accounts receivable at the beginning of the year are $335. The company has a 45-day collection period. Calculate cash collections in each of the four qu

> Your firm has an average receipt size of $119. A bank has approached you concerning a lockbox service that will decrease your total collection time by two days. You typically receive 5,650 checks per day. The daily interest rate is .015 percent. If the b

> Suppose the Japanese yen exchange rate is ¥126 5 $1, and the British pound exchange rate is £1 5 $1.53. a. What is the cross-rate in terms of yen per pound? b. Suppose the cross-rate is ¥195.8 5 £1. Is there an arbitrage opportunity here? If there is, ex

> A firm offers terms of 1/10, net 30. What effective annual interest rate does the firm earn when a customer does not take the discount? Without doing any calculations, explain what will happen to this effective rate if: a. The discount is changed to 2 pe

> What are some of the factors that determine the length of the credit period? Why is the length of the buyer’s operating cycle often considered an upper bound on the length of the credit period?

> Is it possible for a firm’s cash cycle to be longer than its operating cycle? Explain why or why not.

> Bubbling Crude Corporation, a large Texas oil producer, would like to hedge against adverse movements in the price of oil because this is the firm’s primary source of revenue. What should the firm do? Provide at least two reasons why it probably will not

> Describe each of the following: a. Sight draft. b. Time draft. c. Banker’s acceptance. d. Promissory note. e. Trade acceptance.

> Grohl Manufacturing, Inc., has recently installed a just-in-time (JIT) inventory system. Describe the effect this is likely to have on the company’s carrying costs, shortage costs, and operating cycle.

> What is the difference between cash management and liquidity management?

> Are exchange rate changes necessarily good or bad for a particular company?

> Why doesn’t financial distress always cause firms to die?

> You are long 10 gold futures contracts, established at an initial settle price of $1,210 per ounce, where each contract represents 100 ounces. Over the subsequent four trading days, gold settles at $1,217, $1,213, $1,206, and $1,212, respectively. Comput

> Silver Enterprises has acquired All Gold Mining in a merger transaction. Construct the balance sheet for the new corporation if the merger is treated as a purchase for accounting purposes. The market value of All Gold Mining’

> Indicate the impact of the following on the cash and operating cycles, respectively. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change. a. The terms of cash discounts offered to customers are made less

> Delay Your neighbor goes to the post office once a month and picks up two checks, one for $9,700 and one for $2,600. The larger check takes four days to clear after it is deposited; the smaller one takes five days. a. What is the total float for the mont

> Suppose the spot exchange rate for the Canadian dollar is Can $1.13 and the six-month forward rate is Can$1.16. a. Which is worth more, a U.S. dollar or a Canadian dollar? b. Assuming absolute PPP holds, what is the cost in the United States of an Elkhea

> Tidwell, Inc., has weekly credit sales of $31,400, and the average collection period is 29 days. The cost of production is 75 percent of the selling price. What is the average accounts receivable figure?

> No matter how you look at it, Dow Chemical had busy years in 2014 and 2015. In 2014, Dow announced that it was planning to sell its subsidiaries Angus Chemical Company, Sodium Borohydride, and AgroFresh. Dow had also recently has completed the sale of a

> What are the five Cs of credit? Explain why each is important.

> What is the difference between a forward contract and a futures contract? Why do you think that futures contracts are much more common? Are there any circumstances under which you might prefer to use forwards instead of futures? Explain.

> What is prepackaged bankruptcy? What is the main benefit of prepackaged bankruptcy?

> Are stockholders and creditors likely to agree on how much cash a firm should keep on hand?

> What costs are associated with carrying receivables? What costs are associated with not granting credit? What do we call the sum of the costs for different levels of receivables?

> Suppose a financial manager buys call options on 50,000 barrels of oil with an exercise price of $65 per barrel. She simultaneously sells a put option on 50,000 barrels of oil with the same exercise price of $65 per barrel. Consider her gains and losses

> Kyoto Joe, Inc., sells earnings forecasts for Japanese securities. Its credit terms are 1/15, net 30. Based on experience, 70 percent of all customers will take the discount. a. What is the average collection period for the company? b. If the company sel

> Assume that the following balance sheets are stated at book value. Suppose that Jurion Co. purchases James, Inc. Then suppose the fair market value of James’s fixed assets is $23,000 versus the $13,300 book value shown. Jurion pays $30,

> Indicate the effect that the following will have on the operating cycle. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change. a. Receivables average goes up. b. Credit repayment times for customers are in

> Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold

> Purple Feet Wine, Inc., receives an average of $13,800 in checks per day. The delay in clearing is typically three days. The current interest rate is .018 percent per day. a. What is the company’s float? b. What is the most the company should be willing

> Use the information in Figure 31.1 to answer the following questions: a. What is the six-month forward rate for the Japanese yen in yen per U.S. dollar? Is the yen selling at a premium or a discount? Explain. b. What is the three-month forward rate for B

> Fair-to-Midland Manufacturing, Inc. (FMM), has applied for a loan at True Credit Bank. Jon Fulkerson, the credit analyst at the bank, has gathered the following information from the company’s financial statements: The stock price of F

> The exchange rate for the Australian dollar is currently A$1.40. This exchange rate is expected to rise by 10 percent over the next year. a. Is the Australian dollar expected to get stronger or weaker? b. What do you think about the relative inflation ra

> Explain why diversification per se is probably not a good reason for merger.

> For the year just ended, you have gathered the following information about the Holly Corporation: a. A $200 dividend was paid. b. Accounts payable increased by $500. c. Fixed asset purchases were $900. d. Inventories increased by $625. e. Long-term debt

> After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount

> What are some of the characteristics of a firm with a long cash cycle?

> What options are available to a firm if it believes it has too much cash? How about too little?

> Suppose the rate of inflation in Mexico will run about 3 percent higher than the U.S. inflation rate over the next several years. All other things being the same, what will happen to the Mexican peso versus dollar exchange rate? What relationship are you

> Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company’s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for

> In what form is trade credit most commonly offered? What is the credit instrument in this case?

> What are some benefits of financial distress?

> Refer to Table 25.2 in the text to answer this question. Suppose you sell five March 2015 silver futures contracts on January 8, 2015, at the last price of the day. What will your profit or loss be if silver prices turn out to be $16.61 per ounce at expi

> Consider the following premerger information about firm X and firm Y: Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $5 per share. Assuming that neither firm has any debt before or after the merg

> Blizzard Corp. has a book value of equity of $14,750. Long-term debt is $8,300. Net working capital, other than cash, is $1,950. Fixed assets are $20,730 and current liabilities are $1,930. How much cash does the company have? What are current assets?

> Each business day, on average, a company writes checks totaling $14,400 to pay its suppliers. The usual clearing time for the checks is four days. Meanwhile, the company is receiving payments from its customers each day, in the form of checks, totaling $

> Use the information in Figure 31.1 to answer the following questions: a. Which would you rather have, $100 or £100? Why? b. Which would you rather have, 100 Swiss francs (SF) or £100? Why? c. What is the cross-rate for Swiss francs in terms of British po

> The Paden Corporation has annual sales of $29.5 million. The average collection period is 27 days. What is the average investment in accounts receivable as shown on the balance sheet?

> If a firm is buying call options on pork belly futures as a hedging strategy, what must be true about the firm’s exposure to pork belly prices?

> Indicate whether you think the following claims regarding takeovers are true or false. In each case, provide a brief explanation for your answer. a. By merging competitors, takeovers have created monopolies that will raise product prices, reduce producti

> Ben Bates graduated from college six years ago with a finance undergraduate degree. Although he is satisfied with his current job, his goal is to become an investment banker. He feels that an MBA degree would allow him to achieve this goal. After examini

> In the previous problem, assume that the probability of default is 15 percent. Should the orders be filled now? Assume the number of repeat customers is affected by the defaults. In other words, 30 percent of the customers who do not default are expected

> Solar Engines manufactures solar engines for tractor-trailers. Given the fuel savings available, new orders for 125 units have been made by customers requesting credit. The variable cost is $11,400 per unit, and the credit price is $13,000 each. Credit i

> Warf Computers, Inc., was founded 15 years ago by Nick Warf, a computer programmer. The small initial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed

> Saché, Inc., expects to sell 700 of its designer suits every week. The store is open seven days a week and expects to sell the same number of suits every day. The company has an EOQ of 500 suits and a safety stock of 100 suits. Once an order is placed, i

> In Problem 15, what is the break-even price per unit under the new credit policy? Assume all other values remain the same.

> In Problem 14, what is the break-even price per unit that should be charged under the new credit policy? Assume that the sales figure under the new policy is 3,150 units and all other values remain the same.

> From our discussion of the Fisher effect in Chapter 8, we know that the actual relationship between a nominal rate, R, a real rate, r, and an inflation rate, h, can be written as follows: 1 + r = (1 + R)/(1 + h) This is the domestic Fisher effect. a. Wha

> In Problem 14, what is the break-even quantity for the new credit policy?

> In the previous problem, assume the equity increases by 1,750 solaris due to retained earnings. If the exchange rate at the end of the year is 1.24 solaris per dollar, what does the balance sheet look like?

> Kevin Nomura is a Japanese student who is planning a one-year stay in the United States. He expects to arrive in the United States in eight months. He is worried about depreciation of the yen relative to the dollar over the next eight months and wishes t

> Suppose there were call options and forward contracts available on coal, but no put options. Show how a financial engineer could synthesize a put option using the available contracts. What does your answer tell you about the general relationship between

> Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen solaris shows assets of 43,000 solaris, debt in the amount of 14,000 solaris, and equity of 29,000 solaris. a. If the current exchange ratio is 1.20 solaris

> The Chocolate Ice Cream Company and the Vanilla Ice Cream Company have agreed to merge and form Fudge Swirl Consolidated. Both companies are exactly alike except that they are located in different towns. The end-of-period value of each firm is determined

> What are some of the characteristics of a firm with a long operating cycle?

> The Silver Spokes Bicycle Shop has decided to offer credit to its customers during the spring selling season. Sales are expected to be 700 bicycles. The average cost to the shop of a bicycle is $650. The owner knows that only 96 percent of the customers

> William Santiago is interested in entering the import/export business. During a recent visit with his financial advisers, he said, “If we play the game right, this is the safest business in the world. By hedging all of our transactions in the foreign exc

> This morning you agreed to buy a one-year Treasury bond in six months. The bond has a face value of $1,000. Use the spot interest rates listed here to answer the following questions: a. What is the forward price of this contract? b. Suppose shortly aft

> You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would be SF 25 million. The cash flows from the project would be SF 6.9 million per year for the next five years. The dollar required retu