Question: Button Company has the following two temporary

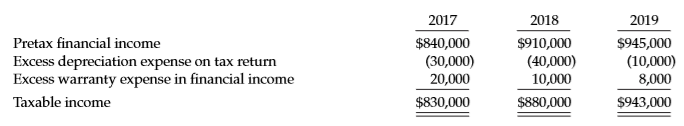

Button Company has the following two temporary differences between its income tax expense and income taxes payable.

The income tax rate for all years is 40%.

Instructions

a. Assuming there were no temporary differences prior to 2017, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019.

b. Indicate how deferred taxes will be reported on the 2019 balance sheet. Button’s product warranty is for 12 months.

c. Prepare the income tax expense section of the income statement for 2019, beginning with the line “Pretax financial income.â€

Transcribed Image Text:

2017 2018 2019 Pretax financial income Excess depreciation expense on tax return Excess warranty expense in financial income $840,000 (30,000) 20,000 $910,000 (40,000) 10,000 $945,000 (10,000) 8,000 Taxable income $830,000 $880,000 $943,000

> Mancuso Corporation amended its pension plan on January 1, 2017, and granted $160,000 of prior service costs to its employees. The employees are expected to provide 2,000 service years in the future, with 350 service years in 2017. Compute prior service

> Campbell Soup Company reported pension expense of $73 million and contributed $71 million to the pension fund. Prepare Campbell Soup Company’s journal entry to record pension expense and funding, assuming Campbell has no OCI amounts.

> For 2017, Sampsell Inc. computed its annual postretirement expense as $240,900. Sampsell’s contribution to the plan during 2017 was $180,000. Prepare Sampsell’s 2017 entry to record postretirement expense, assuming Sampsell has no OCI amounts.

> Manno Corporation has the following information available concerning its postretirement benefit plan for 2017. Service cost………………………………………………………$40,000 Interest cost……………………………………………………….47,400 Actual and expected return on plan assets…………..26,900 Compu

> AMR Corporation (parent company of American Airlines) reported the following (in millions). Service cost…………………………….$366 Interest on P.B.O………………………737 Return on plan assets………………..593 Amortization of prior service cost….13 Amortization of net loss……………..

> At December 31, 2017, Appaloosa Corporation had a deferred tax liability of $25,000. At December 31, 2018, the deferred tax liability is $42,000. The corporation’s 2018 current tax expense is $48,000. What amount should Appaloosa report as total 2018 inc

> Shetland Inc. had pretax financial income of $154,000 in 2017. Included in the computation of that amount is insurance expense of $4,000 which is not deductible for tax purposes. In addition, depreciation for tax purposes exceeds accounting depreciation

> Mitchell Corporation had income before income taxes of $195,000 in 2017. Mitchell’s current income tax expense is $48,000, and deferred income tax expense is $30,000. Prepare Mitchell’s 2017 income statement, beginning with Income before income taxes.

> At December 31, 2017, Hillyard Corporation has a deferred tax asset of $200,000. After a careful review of all available evidence, it is determined that it is more likely than not that $60,000 of this deferred tax asset will not be realized. Prepare the

> At December 31, 2017, Percheron Inc. had a deferred tax asset of $30,000. At December 31, 2018, the deferred tax asset is $59,000. The corporation’s 2018 current tax expense is $61,000. What amount should Percheron report as total 2018 income tax expense

> Using the information from BE19-2, assume this is the only difference between Oxford’s pretax financial income and taxable income. Prepare the journal entry to record the income tax expense, deferred income taxes, and income taxes payable, and show how t

> Oxford Corporation began operations in 2017 and reported pretax financial income of $225,000 for the year. Oxford’s tax depreciation exceeded its book depreciation by $40,000. Oxford’s tax rate for 2017 and years thereafter is 30%. In its December 31, 20

> Youngman Corporation has temporary differences at December 31, 2017, that result in the following deferred taxes. Deferred tax liability related to depreciation difference…………$38,000 Deferred tax asset related to warranty liability………………………..62,000 Defer

> Use the information for Rode Inc. given in BE19-13. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2017. From BE19-13:

> Rode Inc. incurred a net operating loss of $500,000 in 2017. Combined income for 2015 and 2016 was $350,000. The tax rate for all years is 40%. Rode elects the carryback option. Prepare the journal entries to record the benefits of the loss carryback and

> Conlin Corporation had the following tax information. In 2018, Conlin suffered a net operating loss of $480,000, which it elected to carry back. The 2018 enacted tax rate is 29%. Prepare Conlin’s entry to record the effect of the loss

> Carow Corporation purchased on January 1, 2017, as a held-to-maturity investment, $60,000 of the 8%, 5-year bonds of Harrison, Inc. for $65,118, which provides a 6% return. The bonds pay interest semiannually. Prepare Carow’s journal entries for a. the

> At December 31, 2017, Fell Corporation had a deferred tax liability of $680,000, resulting from future taxable amounts of $2,000,000 and an enacted tax rate of 34%. In May 2018, a new income tax act is signed into law that raises the tax rate to 40% for

> Clydesdale Corporation has a cumulative temporary difference related to depreciation of $580,000 at December 31, 2017. This difference will reverse as follows: 2018, $42,000; 2019, $244,000; and 2020, $294,000. Enacted tax rates are 34% for 2018 and 2019

> In 2017, Amirante Corporation had pretax financial income of $168,000 and taxable income of $120,000. The difference is due to the use of different depreciation methods for tax and accounting purposes. The effective tax rate is 40%. Compute the amount to

> On January 2, 2017, Adani Inc. sells goods to Geo Company in exchange for a zero-interest-bearing note with face value of $11,000, with payment due in 12 months. The fair value of the goods at the date of sale is $10,000 (cost $6,000). Prepare the journa

> Archer Construction Company began work on a $420,000 construction contract in 2017. During 2017, Archer incurred costs of $278,000, billed its customer for $215,000, and collected $175,000. At December 31, 2017, the estimated additional costs to complete

> Guillen, Inc. began work on a $7,000,000 contract in 2017 to construct an office building. Guillen uses the completed-contract method. At December 31, 2017, the balances in certain accounts were Construction in Process $1,715,000, Accounts Receivable $24

> Travel Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Carmel Company employees. The total cruise package price to Carmel Company employees is $70,000. Travel Inc. receives a commission of 6% of the total price. Travel Inc. therefor

> Manual Company sells goods to Nolan Company during 2017. It offers Nolan the following rebates based on total sales to Nolan. If total sales to Nolan are 10,000 units, it will grant a rebate of 2%. If it sells up to 20,000 units, it will grant a rebate o

> Telephone Sellers Inc. sells prepaid telephone cards to customers. Telephone Sellers then pays the telecommunications company, TeleExpress, for the actual use of its telephone lines related to the prepaid telephone cards. Assume that Telephone Sellers se

> Petrenko Corporation has outstanding 2,000 $1,000 bonds, each convertible into 50 shares of $10 par value common stock. The bonds are converted on December 31, 2017, when the unamortized discount is $30,000 and the market price of the stock is $21 per sh

> The following information relates to Moran Co. for the year ended December 31, 2017: net income $1,245.7 million; unrealized holding loss of $10.9 million related to available-for-sale debt securities during the year; accumulated other comprehensive inco

> Use the information from BE17-5 but assume the stock is nonmarketable. Prepare Fairbanks’ journal entries to record a. the purchase of the investment, b. the dividends received, and c. the fair value adjustment, if any. From BE17-5: Fairbanks Corpora

> Presented below are two independent cases related to available-for-sale debt investments. For each case, determine the amount of impairment loss, if any.

> Ferraro, Inc. established a stock-appreciation rights (SARs) program on January 1, 2017, which entitles executives to receive cash at the date of exercise for the difference between the market price of the stock and the pre-established price of $20 on 5,

> Bedard Corporation reported net income of $300,000 in 2017 and had 200,000 shares of common stock outstanding throughout the year. Also outstanding all year were 45,000 options to purchase common stock at $10 per share. The average market price of the st

> DiCenta Corporation reported net income of $270,000 in 2017 and had 50,000 shares of common stock outstanding throughout the year. Also outstanding all year were 5,000 shares of cumulative preferred stock, each convertible into 2 shares of common. The pr

> Rockland Corporation earned net income of $300,000 in 2017 and had 100,000 shares of common stock outstanding throughout the year. Also outstanding all year was $800,000 of 9% bonds, which are convertible into 16,000 shares of common. Rockland’s tax rate

> The 2017 income statement of Wasmeier Corporation showed net income of $480,000 and a loss from discontinued operations of $120,000. Wasmeier had 100,000 shares of common stock outstanding all year. Prepare Wasmeier’s income statement presentation of ear

> Tomba Corporation had 300,000 shares of common stock outstanding on January 1, 2017. On May 1, Tomba issued 30,000 shares. a. Compute the weighted-average number of shares outstanding if the 30,000 shares were issued for cash. b. Compute the weighted-a

> Douglas Corporation had 120,000 shares of stock outstanding on January 1, 2017. On May 1, 2017, Douglas issued 60,000 shares. On July 1, Douglas purchased 10,000 treasury shares, which were reissued on October 1. Compute Douglas’s weighted-average number

> Garfield Company purchased, on January 1, 2017, as a held-to-maturity investment, $80,000 of the 9%, 5-year bonds of Chester Corporation for $74,086, which provides an 11% return. Prepare Garfield’s journal entries for a. the purchase of the investment,

> The accounting staff of Holder Inc. has prepared the following postretirement benefit worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the ac

> Using the information in E20-19, prepare a worksheet inserting January 1, 2017, balances, and showing December 31, 2017, balances. Prepare the journal entry recording postretirement benefit expense. From E20-19: Kreter Co. provides the following informa

> The accounting staff of Usher Inc. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks r

> Keeton Company sponsors a defined benefit pension plan for its 600 employees. The company’s actuary provided the following information about the plan. The average remaining service life per employee is 10.5 years. The service cost com

> The actuary for the pension plan of Gustafson Inc. calculated the following net gains and losses. Incurred during the Year…………….(Gain) or Loss 2017â

> Latoya Company provides the following selected information related to its defined benefit pension plan for 2017. Pension asset/liability (January 1)……………………………………..$ 25,000 Cr. Accumulated benefit obligation (December 31)…………………………400,000 Actual and exp

> Using the information in E20-13 about Erickson Company’s defined benefit pension plan, prepare a 2017 pension worksheet with supplementary schedules of computations. Prepare the journal entries at December 31, 2017, to record pension ex

> Erickson Company sponsors a defined benefit pension plan. The corporation’s actuary provides the following information about the plan. Instructions a. Compute the actual return on the plan assets in 2017. b. Compute the amount of th

> Ferreri Company received the following selected information from its pension plan trustee concerning the operation of the company’s defined benefit pension plan for the year ended December 31, 2017. The service cost component of pensi

> Henning Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2017 in which no benefits were paid. 1. The actuarial present value of future benefits earned by employees for

> Ismail Construction enters into a contract to design and build a hospital. Ismail is responsible for the overall management of the project and identifies various goods and services to be provided, including engineering, site clearance, foundation, procur

> The following facts relate to Krung Thep Corporation. 1. Deferred tax liability, January 1, 2017, $40,000. 2. Deferred tax asset, January 1, 2017, $0. 3. Taxable income for 2017, $95,000. 4. Pretax financial income for 2017, $200,000. 5. Cumulative

> Zurich Company reports pretax financial income of $70,000 for 2017. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by $16,000.

> Meyer reported the following pretax financial income (loss) for the years 2015–2019. 2015……………$240,000 2016……………..350,000 2017…………….120,000 2018…………(570,000) 2019……………180,000 Pretax financial income (loss) and taxable income (loss) were the same for all

> Beilman Inc. reports the following pretax income (loss) for both book and tax purposes. (Assume the carryback provision is used where possible for a net operating loss.) The tax rates listed were all enacted by the beginning of 2015. Instructions a.

> Spamela Hamderson Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. (Assume the carryback provision is used for a net operating loss.) The tax rates listed were all enacted by the beginning of 2015.

> Felicia Rashad Corporation has pretax financial income (or loss) equal to taxable income (or loss) from 2009 through 2017 as follows. Pretax financial income (loss) and taxable income (loss) were the same for all years since Rashad has been in business

> The pretax financial income (or loss) figures for Jenny Spangler Company are as follows. 2012………..$160,000 2013…………250,000 2014………….80,000 2015……….(160,000) 2016………(380,000) 2017…………120,000 2018…………100,000 Pretax financial income (or loss) and taxable in

> The differences between the book basis and tax basis of the assets and liabilities of Castle Corporation at the end of 2016 are presented below. It is estimated that the litigation liability will be settled in 2017. The difference in accounts receivabl

> The following information is available for Wenger Corporation for 2016 (its first year of operations). 1. Excess of tax depreciation over book depreciation, $40,000. This $40,000 difference will reverse equally over the years 2017–2020. 2. Deferral, fo

> On May 10, 2017, Cosmo Co. enters into a contract to deliver a product to Greig Inc. on June 15, 2017. Greig agrees to pay the full contract price of $2,000 on July 15, 2017. The cost of the goods is $1,300. Cosmo delivers the product to Greig on June 15

> Nadal Inc. has two temporary differences at the end of 2016. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Nadal’s accounting department has developed a schedule of

> Teri Hatcher Inc., in its first year of operations, has the following differences between the book basis and tax basis of its assets and liabilities at the end of 2016. It is estimated that the warranty liability will be settled in 2017. The difference

> Andy McDowell Co. establishes a $100 million liability at the end of 2017 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2018. Also, at the end of 2017

> During 2017, Kate Holmes Co.’s first year of operations, the company reports pretax financial income at $250,000. Holmes’s enacted tax rate is 45% for 2017 and 40% for all later years. Holmes expects to have taxable in

> Taxable income and pretax financial income would be identical for Huber Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. The tax rates in effect

> Novotna Inc.’s only temporary difference at the beginning and end of 2016 is caused by a $3 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current ass

> Assume the same information as E19-12, except that at the end of 2016, Jennifer Capriati Corp. had a valuation account related to its deferred tax asset of $45,000. Instructions a. Record income tax expense, deferred income taxes, and income taxes pay

> Jennifer Capriati Corp. has a deferred tax asset account with a balance of $150,000 at the end of 2016 due to a single cumulative temporary difference of $375,000. At the end of 2017, this same temporary difference has increased to a cumulative amount of

> At the end of 2016, Lucretia McEvil Company has $180,000 of cumulative temporary differences that will result in reporting the following future taxable amounts. 2017………….$ 60,000 2018…………….50,000 2019…………...40,000 2020………..…30,000 $

> The following facts relate to Duncan Corporation. 1. Deferred tax liability, January 1, 2017, $60,000. 2. Deferred tax asset, January 1, 2017, $20,000. 3. Taxable income for 2017, $105,000. 4. Cumulative temporary difference at December 31, 2017, giv

> Employees at your company disagree about the accounting for sales returns. The sales manager believes that granting more generous return provisions can give the company a competitive edge and increase sales revenue. The controller cautions that, dependin

> Taylor Marina has 300 available slips that rent for $800 per season. Payments must be made in full by the start of the boating season, April 1, 2018. The boating season ends October 31, and the marina has a December 31 year-end. Slips for future seasons

> Aaron’s Agency sells an insurance policy offered by Capital Insurance Company for a commission of $100 on January 2, 2017. In addition, Aaron will receive an additional commission of $10 each year for as long as the policyholder does not cancel the polic

> Blair Biotech enters into a licensing agreement with Pang Pharmaceutical for a drug under development. Blair will receive a payment of $10,000,000 if the drug receives regulatory approval. Based on prior experience in the drug-approval process, Blair det

> Bill Amends, owner of Real Estate Inc., buys and sells commercial properties. Recently, he sold land for $3,000,000 to the Blackhawk Group, a developer that plans to build a new shopping mall. In addition to the $3,000,000 sales price, Blackhawk Group ag

> Jeff Heun, president of Concrete Always, agrees to construct a concrete cart path at Dakota Golf Club. Concrete Always enters into a contract with Dakota to construct the path for $200,000. In addition, as part of the contract, a performance bonus of $40

> Jupiter Company sells goods to Danone Inc. by accepting a note receivable on January 2, 2017. The goods have a sales price of $610,000 (cost of $500,000). The terms are net 30. If Danone pays within 5 days, however, it receives a cash discount of $10,000

> On January 1, 2017, Lesley Benjamin signed an agreement, covering 5 years, to operate as a franchisee of Campbell Inc. for an initial franchise fee of $50,000. The amount of $10,000 was paid when the agreement was signed, and the balance is payable in fi

> Pacific Crossburgers Inc. charges an initial franchise fee of $70,000. Upon the signing of the agreement (which covers 3 years), a payment of $28,000 is due. Thereafter, three annual payments of $14,000 are required. The credit rating of the franchisee i

> Yanmei Construction Company began operations on January 1, 2017. During the year, Yanmei Construction entered into a contract with Lundquist Corp. to construct a manufacturing facility. At that time, Yanmei estimated that it would take 5 years to complet

> Hamilton Construction Company uses the percentage-of-completion method of accounting. In 2017, Hamilton began work under contract #E2-D2, which provided for a contract price of $2,200,000. Other details follow: Instructions a. What portion of the tota

> Monat Company has grown rapidly since its founding in 2004. To instill loyalty in its employees, Monat is contemplating establishment of a defined benefit plan. Monat knows that lenders and potential investors will pay close attention to the impact of th

> During 2017, Nilsen Company started a construction job with a contract price of $1,600,000. The job was completed in 2019. The following information is available. Instructions a. Compute the amount of gross profit to be recognized each year, assuming

> Refer to the information in E18-31. Instructions a. Does the accounting for capitalized costs change if the contract is for 1 year rather than 3 years? Explain. b. Dan’s Demolition is a startup company; as a result, there is more than insignificant un

> Rex’s Reclaimers entered into a contract with Dan’s Demolition to manage the processing of recycled materials on Dan’s various demolition projects. Services for the 3-year contract include collecting, sorting, and transporting reclaimed materials to recy

> Tyler Financial Services performs bookkeeping and tax-reporting services to startup companies in the Oconomowoc area. On January 1, 2017, Tyler entered into a 3-year service contract with Walleye Tech. Walleye promises to pay $10,000 at the beginning of

> In September 2017, Gaertner Corp. commits to selling 150 of its iPhone-compatible docking stations to Better Buy Co. for $15,000 ($100 per product). The stations are delivered to Better Buy over the next 6 months. After 90 stations are delivered, the con

> On January 1, 2017, Gordon Co. enters into a contract to sell a customer a wiring base and shelving unit that sits on the base in exchange for $3,000. The contract requires delivery of the base first but states that payment for the base will not be made

> Celic Inc. manufactures and sells computers that include an assurance-type warranty for the first 90 days. Celic offers an optional extended coverage plan under which it will repair or replace any defective part for 3 years from the expiration of the ass

> On January 2, 2017, Grando Company sells production equipment to Fargo Inc. for $50,000. Grando includes a 2-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on January 2, 2017. During 2

> On May 3, 2017, Eisler Company consigned 80 freezers, costing $500 each, to Remmers Company. The cost of shipping the freezers amounted to $840 and was paid by Eisler Company. On December 30, 2017, a report was received from the consignee, indicating tha

> Wood-Mode Company is involved in the design, manufacture, and installation of various types of wood products for large construction projects. Wood-Mode recently completed a large contract for Stadium Inc., which consisted of building 35 different types o

> Kleckner Company started operations in 2013. Although it has grown steadily, the company reported accumulated operating losses of $450,000 in its first four years in business. In the most recent year (2017), Kleckner appears to have turned the corner and

> Zagat Inc. enters into an agreement on March 1, 2017, to sell Werner Metal Company aluminum ingots. As part of the agreement, Zagat also agrees to repurchase the ingots on May 1, 2017, at the original sales price of $200,000 plus 2%. Instructions a. P

> Cramer Corp. sells idle machinery to Enyart Company on July 1, 2017, for $40,000. Cramer agrees to repurchase this equipment from Enyart on June 30, 2018, for a price of $42,400 (an imputed interest rate of 6%). Instructions a. Prepare the journal ent

> Uddin Publishing Co. publishes college textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms f.o.b. shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30%

> Organic Growth Company is presently testing a number of new agricultural seeds that it has recently harvested. To stimulate interest, it has decided to grant to five of its largest customers the unconditional right of return to these products if not full

> On July 1, 2017, Selig Company purchased for cash 30% of the outstanding common stock of Spoor Corporation. Both Selig and Spoor have a December 31 year-end. Spoor Corporation, whose common stock is actively traded on the NASDAQ exchange, paid a cash div

> On July 1, 2018, Fontaine Company purchased for cash 40% of the outstanding common stock of Knoblett Company. Both Fontaine Company and Knoblett Company have a December 31 yearend. Knoblett Company, whose common stock is actively traded in the over-the-c

> Revenue is usually recognized at the point of sale (a point in time). Under special circumstances, however, bases other than the point of sale are used for the timing of revenue recognition. Instructions a. Why is the point of sale usually used as the

> Lexington Co. has the following securities outstanding on December 31, 2017 (its first year of operations). During 2018, Summerset Company stock was sold for $9,200, the difference between the $9,200 and the “fair valueâ€&#