Question: Calculate the answers for the missing data: /

> On January 1, Prescott Corp. issues 6 percent, 15-year bonds payable with a maturity value of $120,000. The bonds sell at 94 and pay interest on January 1 and July 1. Prescott Corp. amortizes any bond discount or premium using the straight-line method.

> On March 31, Cunnington Corporation issued 5 percent, 20-year bonds payable with a maturity value of $480,000. The bonds were issued at par and pay interest on March 31 and September 30. Requirements 1. Record the issuance of the bonds on March 31. 2. R

> Orbit Corp. issued a $410,000, 9 percent mortgage on January 1, 2018, to purchase warehouses. Requirements 1. Complete the amortization schedule for Orbit Corp., assuming payments are made semiannually. Round amounts to the nearest dollar. 2. Record th

> The accounting records of Prestige Auto Repair showed a balance of $6,700 in Estimated Warranty Payable at December 31, 2017. In the past, Prestige Auto Repair’s warranty expense has been 2 percent of sales. During 2018, Prestige Auto Repair made sales o

> Adirondack Publishing Company completed the following transactions during 2018: Requirements 1. Journalize these transactions. Explanations are not required. 2. What amounts would Adirondack Publishing Company report on the balance sheet at December 31

> Record the following note payable transactions of Cranmore Corp. in the company’s journal. Round intermediate interest calculations to the nearest cent and final amounts to the nearest dollar. Explanations are not required.

> Make journal entries to record the following transactions. Explanations are not required. November 30 Recorded cash sales of $62,000 for the month, plus sales tax of 6% collected for the state of Mississippi. Ignore cost of goods sold. December 5 Sent

> Appleway Supply had the following balances as of December 31, 2018: Total Current Assets............................................................................................. $ 122,000 Total Long-Term Assets.......................................

> At December 31, 2018, Christianson Cabinets owes $5,700 on accounts payable, plus salaries payable of $3,200 and income tax payable of $7,000. Christianson Cabinets also has $280,000 of notes payable that require payment of a $20,000 installment in 2019

> Let’s think about Dick’s Sporting Goods (Dick’s) again. Think about accountants reporting what Dick’s has, where it got its money, and what it has been doing to create value. Is Dick’s earning net income or loss? What resources did Dick’s need to operate

> Seattle Physicians Group borrowed $300,000 on July 1, 2018, by issuing a 6 percent long-term note payable that must be paid in three equal annual installments, plus interest, each July 1 for the next three years. Requirement 1. Insert the appropriate am

> Barret, Inc., issued $270,000 of 6-year, 8 percent bonds payable on January 1. Barret, Inc., pays interest each January 1 and July 1, and amortizes any discount or premium using the straight-line method. Barret, Inc., can issue its bonds payable under va

> On January 1, Dogwood Industries issues 9 percent, 10-year bonds payable with a maturity value of $130,000. The bonds sell at 96 and pay interest on January 1 and July 1. Dogwood Industries amortizes any bond discount or premium using the straight-line m

> Hart Corporation issued 4 percent, 20-year bonds payable with a maturity value of $330,000 on January 31. The bonds were issued at par and pay interest on January 31 and July 31. Requirement 1. Record (a) issuance of the bonds on January 31, (b) payment

> Solar Corp. issued a $460,000, 8 percent mortgage on January 1, 2018, to purchase warehouses. Requirements 1. Complete the amortization schedule for Solar Corp., assuming payments are made semiannually. Round amounts to the nearest dollar. 2. Record th

> The accounting records of Miller Upholstery showed a balance of $2,300 in Estimated Warranty Payable at December 31, 2017. In the past, Miller Upholstery’s warranty expense has been 2.5 percent of sales. During 2018, Miller Upholstery made sales of $312,

> Horizon Publishing Company completed the following transactions during 2018: Requirements 1. Journalize these transactions. Explanations are not required. 2. What amounts would Horizon Publishing Company report on the balance sheet at December 31, 2018

> Record the following note payable transactions of Concilio Corp. in the company’s journal. Round intermediate interest calculations to the nearest cent and final amounts to the nearest dollar. Explanations are not required.

> Make journal entries to record the following transactions. Explanations are not required.

> The following are selected data for Nelson Equipment, Inc., for the current year: Requirement 1. Calculate the return on assets (ROA) and the fixed asset turnover ratio for Nelson Equipment for the current year. Round your answers to two decimal places

> Let’s think about Dick’s Sporting Goods (Dick’s) again. Think about accountants reporting what Dick’s has, where Dick’s got its money, and what Dick’s has been doing to create value. Is Dick’s earning net income or loss? What resources did Dick’s need to

> At the end of 2018, Zepher Corp. had total assets of $331,500 and total liabilities of $164,300. Included in the assets were property, plant, and equipment with a cost of $237,600, and accumulated depreciation of $114,800. Also included in the assets wer

> Mesa Transport is a large trucking company. Mesa Transport uses the units of production (UOP) method to depreciate its trucks. In 2015, Mesa Transport acquired a Mack truck costing $330,000, with a useful life of 10 years or 900,000 miles. Estimated resi

> Assume that Branson Corporation’s comparative balance sheet reported these amounts: Requirement 1. Assume that on January 1, 2018, Branson sold one-eighth of its plant and equipment for $60,500 cash. Journalize this transaction for Br

> On January 2, 2018, Trendz Lighting purchased showroom fixtures for $20,000 cash, expecting the fixtures to remain in service for four years. Trendz Lighting has depreciated the fixtures on a straight-line basis, with zero residual value. On March 31, 20

> Cool Rays Tanning Salon bought three tanning beds in a $15,000 lump-sum purchase. An independent appraiser valued the tanning beds: Tanning Bed ………………………… Appraised Value 1 …………………………………………………….. $ 3,900 2 ………………………………………………………… 5,400 3 …………………………………………

> Rodriguez Transfer manufactures conveyor belts. Early in the month of July, Rodriguez Transfer constructed its own building at a cost of $980,000 (for materials, labor, and overhead). Rodriguez Transfer paid cash for the construction costs. Rodriguez Tra

> The following are selected data for Simpson Equipment, Inc., for the current year: Sales ............................................................................ $782,000 Net income …..................................................................

> At the end of 2018, Crawford Corp. had total assets of $321,800 and total liabilities of $183,400. Included in the assets were property, plant, and equipment, with a cost of $242,000, and accumulated depreciation of $116,000. Also included in the assets

> Rabito Corp. aggressively acquires other companies. Assume that Rabito Corp. purchased Loring, Inc., for $1,500,000 cash. The market value of Loring’s assets is $2,200,000, and it has liabilities with a market value of $825,000. Requirements 1. Compute

> Part 1. Morris Printing manufactures high-speed printers. Morris Printing recently paid $300,000 for a patent on a new laser printer. Although it gives legal protection for 20 years, the patent is expected to provide a competitive advantage for only eigh

> Let’s look at Dick’s Sporting Goods (Dick’s), the largest retailer of sporting goods in the United States. Think about Dick’s, all its stakeholders, what products it sells, and how and where it sells its products. Think about all the employees who work f

> Assume that Hart Corporation’s comparative balance sheet reported these amounts: Requirement 1. Assume that on January 1, 2018, Hart sold one-tenth of its plant and equipment for $56,000 cash. Journalize this transaction for Hart.

> On January 2, 2018, Evergreen Lighting purchased showroom fixtures for $18,000 cash, expecting the fixtures to remain in service for 5 years. Evergreen Lighting has depreciated the fixtures on a straight-line basis, with zero residual value. On August 2,

> Westwood Tanning Salon bought three tanning beds in a $19,000 lump-sum purchase. An independent appraiser valued the tanning beds as follows: Tanning Bed ………………… Appraised Value 1 …………………………………………….… $6,300 2 …..………………………………………….… 5,250 3 …..……………………………

> Whelan Transfer manufactures conveyor belts. Early in August 2018, Whelan Transfer constructed its own building at a cost of $910,000 (for materials, labor, and overhead). Whelan Transfer paid cash for the construction costs. Whelan Transfer also paid $7

> Mackay Industries, Inc., purchased land, paying $80,000 cash as a down payment and signing a $160,000 note payable for the balance. In addition, Mackay Industries, Inc., paid delinquent property tax of $4,300, title insurance costing $3,100, and a $7,800

> Tri-State Equipment reported the following items on July 31, 2018 (last year’s amounts are also given as needed): Requirements 1. Compute Tri-State Equipment’s (a) quick ratio, (b) current ratio, and (c) accounts rec

> Consider the following data: Requirements 1. Calculate the quick assets and the quick ratio for each company. 2. Calculate the current ratio for each company. 3. Which company should be concerned about its liquidity?

> Jitterz Coffee Supply, Inc., sells on account. When a customer account becomes four months old, Jitterz Coffee Supply, Inc., converts the account to a note receivable. During 2018, Jitterz Coffee Supply completed these transactions: Requirement 1. Reco

> Journalize the following transactions of Cramer Art Supply, Inc., which ends its accounting year on September 30:

> On July 31, 2018, Virginia State Bank loaned $175,000 to Swanson Paint, Inc., on a one-year, 7 percent note. Requirements 1. Compute the interest on the note for the years ended December 31, 2018, and December 31, 2019. Round interest calculations to th

> Let’s examine Dick’s Sporting Goods (Dick’s) again. Think about Dick’s. What liabilities might Dick’s need to finance its operations? Return to Dick’s Annual Report and look at the financial statements (see the Continuing Financial Statement Analysis Pro

> Inland Paving, Inc., uses the allowance method to account for uncollectible accounts. On December 31, 2018, Allowance for Uncollectible Accounts has a $725 credit balance. Journalize the year-end adjusting entry for uncollectible accounts assuming the fo

> On March 31, 2018, the Accounts Receivable balance of Dunham Manufacturing, Inc., is $173,000. The Allowance for Uncollectible Accounts has a $1,650 credit balance. Dunham Manufacturing, Inc., prepares the following aging schedule for its accounts recei

> Beckett Appliance Repair, Inc., ended December 2017 with Accounts Receivable of $2,400 and a debit balance of $175 in Allowance for Uncollectible Accounts. During January 2018, Beckett Appliance Repair, Inc., completed the following transactions: Requi

> Advantage Electronics, Inc., uses the direct write-off method to account for bad debts. Record the following transactions that occurred during the year:

> Information from Grey’s Photography, Inc., Cash account as well as the July bank statement are presented next. Check 210 was written for $500 to pay salaries expense. Requirements 1. Prepare the bank reconciliation on July 31. 2. Pr

> Casey’s Construction, Inc.’s checkbook lists the following: Casey’s Construction, Inc.’s September bank statement shows the following: Requirements 1. Prepare Caseyâ€&

> Lakota Equipment reported the following items on December 31, 2018 (last year’s amounts are also given as needed): Requirements 1. Compute Lakota Equipment’s (a) quick ratio, (b) current ratio, and (c) accounts recei

> Consider the following data: Requirements 1. Calculate the quick assets and the quick ratio for each company (round your final answers to two decimal places). 2. Calculate the current ratio for each company (round your final answers to two decimal plac

> Valley Hardware Supply, Inc., sells on account. When a customer account becomes four months old, Valley Hardware Supply converts the account to a note receivable. During 2018, Valley Hardware Supply completed these transactions: Requirement 1. Record t

> Let’s look at Dick’s Sporting Goods (Dick’s) some more. Think about Dick’s. What assets did Dick’s need to operate? Return to Dick’s Annual Report (see the Continuing Financial Statement Analysis Problem in Chapter 2 for instructions on how to access the

> Journalize the following transactions of Lawn Pro, Inc., which ends its accounting year on September 30:

> On April 30, 2018, Seattle First National Bank loaned $100,000 to Pugliese Produce, Inc., on a one-year, 8 percent note. Requirements 1. Compute the interest on the note for the years ended December 31, 2018, and December 31, 2019. Round interest calcul

> River City Supply, Inc., uses the allowance method to account for uncollectible accounts. On December 31, 2018, Allowance for Uncollectible Accounts has a $375 credit balance. Journalize the year-end adjusting entry for uncollectible accounts, assuming t

> On December 31, 2018, the Accounts Receivable balance of TDS Distribution, Inc., is $194,000. The Allowance for Uncollectible Accounts has a $1,200 credit balance. TDS Distribution, Inc., prepares the following aging schedule for its accounts receivable:

> DJ’s Auto Repair, Inc., ended December 2017 with Accounts Receivable of $8,500 and a credit balance of $275 in Allowance for Uncollectible Accounts. During January 2018, DJ’s Auto Repair, Inc., completed the following

> Ellison Heating and Air Conditioning, Inc., uses the direct write-off method to account for bad debts. Record the following transactions that occurred during the year:

> Information from DT Photography’s Cash account as well as the January bank statement are presented next. Check 210 was written for $310 to pay salaries expense. Requirements 1. Prepare the bank reconciliation on January 31. 2. Prepa

> Cryer’s Produce, Inc.’s checkbook lists the following: Cryers’s Produce, Inc.’s November bank statement shows the following: Requirements 1. Prepare Cryer’s Pro

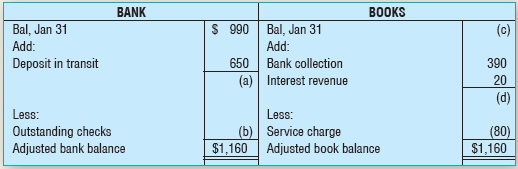

> Calculate the answers for the missing data:

> Julia’s Jungle, Inc., has the following information as of August 31, 2018: Requirements 1. Compute the rate of inventory turnover for Julia’s Jungle, Inc., for the year ended August 31, 2018. Round the result to two

> Let’s continue our examination of Dick’s Sporting Goods (Dick’s). Return to Dick’s Annual Report (see the Continuing Financial Statement Analysis Problem in Chapter 2 for instructions on how to access the Annual Report). Now answer the following question

> Tune Time, Inc., sells and installs audio equipment. Tune Time, Inc.’s entire inventory was destroyed during a recent fire that occurred at its warehouse. Tune Time, Inc.’s accounting records reflect the following information: Beginning Inventory ………………

> Jacob’s Upholstery, Inc., reported the following comparative income statements for the years ended September 30, 2018, and September 30, 2017. During 2018, Jacob’s Upholstery, Inc., discovered that the 2017 ending in

> Parts Plus, Inc., had the following FIFO perpetual inventory record for one of its inventory items at September 30, the end of the fiscal year. A physical count of the inventory performed at year’s end revealed $83.25 (nine items) of

> Eagle Resources, Inc., has the following account balances at October 31, 2018. The inventory balance was determined using FIFO. Eagle Resources, Inc., has determined that the replacement cost (current market value) of the October 31, 2018, ending inven

> Assume McCormack Tire, Inc., completed the following perpetual inventory transactions for a line of tires: Beginning Inventory …………………….. 27 tires @ $140 Purchase ……………………………….……. 39 tires @ $136 Sale …………………………………………… 42 tires @ $204 Requirements 1. C

> Refer to the data for The Bike Hub, Inc., in E5-31B. Requirements 1. Compute the cost of ending inventory under FIFO. 2. Compute the cost of ending inventory under LIFO. 3. Which method results in a higher cost of ending inventory? E5-31B: Assume The B

> Assume The Bike Hub, Inc., bought and sold a line of comfort bikes during July as follows: The Bike Hub, Inc., uses a perpetual inventory system. Requirements 1. Compute the cost of goods sold under FIFO. 2. Compute the cost of goods sold under LIFO.

> Refer to the data for E5-28B. However, instead of the FIFO method, assume Tee Time, Inc., uses the average cost method. Requirements 1. Prepare a perpetual inventory record for the putters on the average cost basis to determine the cost of ending invent

> Refer to the data for E5-28B. However, instead of the FIFO method, assume Tee Time, Inc., uses the LIFO method. Requirements 1. Prepare a perpetual inventory record for the putters on the LIFO basis to determine the cost of ending inventory and cost of

> Tee Time, Inc., carries a line of monogrammed putters. Tee Time uses the FIFO method and a perpetual inventory system. The sale price of each putter is $170. Company records indicate the following activity for putters for the month of January: Requirem

> Let’s resume our examination of Dick’s Sporting Goods (Dick’s). Return to Dick’s Annual Report (see the Continuing Financial Statement Analysis Problem in Chapter 2 for instructions on how to access the Annual Report). Now answer the following questions:

> Brava Landscaping, Inc., completed the following transactions during its first month of operations for January 2018: a. Gabrielle Brava invested $8,500 cash and a truck valued at $16,000 to start Brava Landscaping, Inc.; the business issued common stock

> The price of a car you want is $42,000 today. Its price is expected to increase by $1000 each year. You now have $25,000 in an investment account, which is earning 10% per year. How many years will it be before you have enough to buy the car without borr

> The PW of five independent projects have been calculated at an MARR of 12% per year. Select the best combination at a capital investment limit of (a) $25,000, (b) $49,000, and (c) unlimited.

> The chief engineer at Clean Water Engineering has established a capital investment limit of $710,000 for next year for projects related to concentrate management. (a) Select any or all of the following independent projects, using a MARR of 10% per year.

> Dwayne has four independent vendor proposals to contract the nationwide oil recycling services for the Ford Corporation manufacturing plants. All combinations are acceptable, except that vendors B and C cannot both be chosen. Revenue sharing of recycled

> A financial services consulting company bought an office building for $900,000. The company has 10 professional staff members. Monthly expenses for salaries, utilities, grounds maintenance, etc. are $1.1 million. The average billing rate per professional

> Feng Seawater Desalination Systems has established a capital investment limit of $800,000 for next year for projects that target improved recovery of highly brackish groundwater. All projects have a 4-year life and the MARR is 10% per year. (a) Select a

> Determine which of the following independent projects should be selected for investment if a maximum of $240,000 is available and the MARR is 10% per year. Use the PW method to evaluate mutually exclusive bundles to perform your analysis.

> If the market interest rate is 12% per year and the inflation rate is 5% per year, the number of future dollars in year 7 that will be equivalent to $2000 now is best represented by the equation: (a) Future dollar amount = 2000(1 + 0.198)7 (b) Future dol

> The cost of a well-equipped F-150 truck was $29,350 three years ago. If the cost increased only by the inflation rate and the price today is $33,015, the inflation rate over the 3-year period was closest to: (a) 3% (b) 4% (c) 5% (d) 6%

> When the market interest rate is less than the real interest rate, then: (a) The inflated interest rate is higher than the real interest rate (b) The real interest rate is zero (c) A deflationary condition exists (d) An inflationary condition exists

> At what electricity cost would the following alternatives just break even? (a) Alternatives 1 and 2, (b) alternatives 1 and 3, (c) alternatives 1 and 4.

> In order to convert inflated dollars into constant value dollars, it is necessary to: (a) Divide by (1 + if )n (b) Divide by (1 + f )n (c) Divide by (1 + i)n (d) Multiply by (1 + f )n

> When all future cash flows are expressed in then current dollars, the rate that should be used to find the present worth is the: (a) Real MARR (b) Inflation rate (c) Inflated interest rate (d) Real interest rate

> For a real interest rate of 12% per year and an inflation rate of 7% per year, the market interest rate per year is closest to: (a) 5.7% (b) 7% (c) 12% (d) 19.8%

> Assume you save $6000 each year starting this year until your planned retirement 40 years from now. The buying power of the money in terms of today’s dollars at the market interest rate of 10% per year and inflation rate of 5% per year is closest to: (a)

> An industrial robot with a controller, teach pendants, and job-specific peripherals has an initial cost of $85,000 now, and the future cost will increase exactly by the inflation rate. The cost of a similar robot 3 years from now at a market interest rat

> For a real interest rate of 1% per month and an inflation rate of 1% per month, the nominal inflated interest rate per year is closest to: (a) 1% (b) 2% (c) 24% (d) 24.12%

> You expect to receive an inheritance of $50,000 six years from now. Its present worth at a real interest rate of 4% per year and an inflation rate of 3% per year is closest to: (a) $27,600 (b) $29,800 (c) $33,100 (d) $50,000

> An investment of $1000 was made 25 years ago. The amount available 10 years from now at the market interest rate of 5% per year and an inflation rate of 2% per year is closest to: (a) $3085 (b) $5430 (c) $5515 (d) $35,000

> Two methods to control newly discovered poisonous weeds in bar-ditches on the sides of county roads in New Farmendale are under consideration. Method A involves use of a 20-year life lining at an initial cost of $14,000 and an annual maintenance cost of

> The cost of equipment to apply epoxy paint to a warehouse floor is $1400. Materials and supplies (masking tape, surface repair material, solvents, cleanup supplies, etc.) will cost $2.03 per ft2. Alternatively, a contractor can be hired annually to do th

> If the cost of electricity decreased to 8 ¢∕kWh, which alternative would be the most cost-effective?

> Ma Bryan sells homemade preserves. The profit relation for the following estimates at a quantity that is 10% above breakeven is closest to: Fixed cost = $500,000 per year Cost per 100 units = $200 Revenue per 100 units = $250 (a) Profit = 200(11,000) − 2

> A mixing process for laboratory-grade sodium phosphate has an estimated first cost of $320,000 with annual costs of $40,000. Income is expected to be $98,000 per year. At a MARR of 20% per year, the payback period is closest to: (a) 3 years (b) 15 years