Question: Campus Theater adjusts its accounts every month.

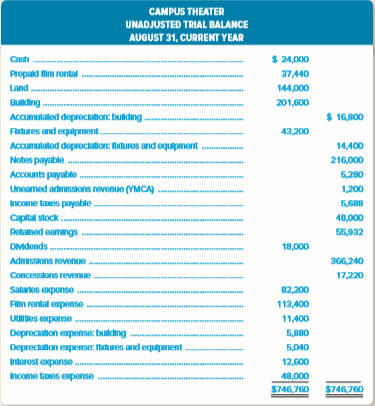

Campus Theater adjusts its accounts every month. The company’s unadjusted trial balance dated August 31, current year, appears as follows. Additional information is provided for use in preparing the company’s adjusting entries for the month of August. (Bear in mind that adjusting entries have already been made for the first seven months of current year, but not for August.)

Other Data:

1. Film rental expense for the month is $18,240. However, the film rental expense for several months has been paid in advance.

2. The building is being depreciated over a period of 20 years (240 months).

3. The fixtures and equipment are being depreciated over a period of five years (60 months).

4. On the first of each month, the theater pays the interest that accrued in the prior month on its note payable. At August 31, accrued interest payable on this note amounts to $1,800.

5. The theater allows the local YMCA to bring children attending summer camp to the movies on any weekday afternoon for a fixed fee of $600 per month. On June 28, the YMCA made a $1,800 advance payment covering the months of July, August, and September.

6. The theater receives a percentage of the revenue earned by Tastie Corporation, the concessionaire operating the snack bar. For snack bar sales in August, Tastie owes Campus Theater $2,700, payable on September 10. No entry has yet been made to record this revenue. (Credit Concessions Revenue.)

7. Salaries earned by employees, but not recorded or paid as of August 31, amount to $2,040. No entry has yet been made to record this liability and expense.

8. Income taxes expense for August is estimated at $5,040. This amount will be paid in the

September 15 installment payment.

9. Utilities expense is recorded as monthly bills are received. No adjusting entries for utilities expense are made at month-end.

Instructions:

a. For each of the numbered paragraphs, prepare the necessary adjusting entry (including an explanation).

b. Refer to the balances shown in the unadjusted trial balance at August 31. How many months of expense are included in each of the following account balances? (Remember, Campus Theater adjusts its accounts monthly. Thus, the accounts shown were last adjusted on July 31, current year.)

1. Utilities Expense

2. Depreciation Expense

3. Accumulated Depreciation: Building

c. Assume the theater has been operating profitably all year. Although the August 31 trial balance shows substantial income taxes expense, income taxes payable is a much smaller amount. This relationship is quite normal throughout much of the year. Explain.

Transcribed Image Text:

CAMPUS THEATER UNADJUSTED TRIAL BALANCE AUGUST 31, CURRENT YEAR Cash $ 24,000 Prepaid fim rental Land Bulkding . Accumutatod depreciabon: bulding Rdures and equilpment. 37440 144,000 201,600 $ 16,800 43,200 Accumulated deprociation: bduros and equipment 14,400 Notes payable . Accounts payable . Uneamed admisions revenue (YMCA) Income tes payable Capital stock . Retamed eamngs 216,000 5,280 1,200 5,688 48,000 55,932 DIMidends . 18,000 Admissions revonue 366,240 Concessions revenue 17,220 Salarlos axpense 82,200 Flm rental expense 113,400 Ues expense 11,400 Deprectaltion expense: building Deprecialion expense: cures and equipment 5,880 5,040 Intorost oxpense. 12,600 Income taxes epense 48,000 $746,760 * $746,760

> On November 1, Girtz Corporation purchased a six-month insurance policy from The Tomptee Agency for $4,500. a. Prepare the necessary adjusting entry for Girtz Corporation on November 30, assuming it recorded the November 1 expenditure as Unexpired Insur

> Listed as follows are nine technical accounting terms used in this chapter. Unrecorded revenue Adjusting entries Accrued expenses Book value Matching principle Accumulated depreciation Unearned revenue Materiality Prepaid expenses Each of the following s

> How is deferred revenue reported in the balance sheet?

> Four types of adjusting entries were identified in this chapter Type I Converting Assets to Expenses Type II Converting Liabilities to Revenue Type III Accruing Unpaid Expenses Type IV Accruing Uncollected Revenue Complete the following table by indic

> The Freemont Flyers, a professional soccer team, prepares financial statements on a monthly basis. The soccer season begins in May, but in April the team engaged in the following transactions. 1. Paid $1,500,000 to the municipal stadium as advance rent

> Ted’s Tax Service had earned—but not yet recorded—the following client service revenue at the end of the current accounting period. Prepare the necessary adjusting entry to record Tedâ€&#

> On March 1, Phonic Corporation had office supplies on hand of $1,000. During the month, Phonic purchased additional supplies costing $500. Approximately $200 of unused office supplies remain on hand at the end of the month. Prepare the necessary adjustin

> On February 1, Watson Storage agreed to rent Hillbourne Manufacturing warehouse space for $300 per month. Hillbourne Manufacturing paid the first three months’ rent in advance. a. Prepare the necessary adjusting entry for Hillbourne Manufacturing on Feb

> Hunter’s unadjusted trial balance dated December 31, year 1, reports Income Taxes Expense of $70,000, and Income Taxes Payable of $20,000. The company’s accountant estimates that income taxes expense for the entire year ended December 31, year 1, is $85,

> Jump Corporation borrowed $60,000 on December 1, year 1, by issuing a 2-month, 4 percent note payable to Service One Credit Union. The entire amount of the loan, plus interest, is due February 1, year 2. a. Prepare the necessary adjusting entry for inte

> Milford Corporation pays its employees on the 15th of each month. Accrued, but unpaid, salaries on December 31, year 1, totaled $210,000. Salaries earned by Milford’s employees from January 1 through January 15, year 2, totaled $216,000. a. Prepare the

> Jasper’s unadjusted trial balance reports Unearned Client Revenue of $4,000 and Client Revenue Earned of $30,000. An examination of client records reveals that $2,500 of previously unearned revenue has now been earned. a. Prepare the necessary adjusting

> Jesse Company adjusts its accounts monthly and closes its accounts on December 31. On October 31, year 1, Jesse Company signed a note payable and borrowed $150,000 from a bank for a period of six months at an annual interest rate of 6 percent. a. How mu

> List various accounts in the balance sheet that represent deferred expenses

> Sweeney & Allen, a large marketing firm, adjusts its accounts at the end of each month. The following information is available for the year ending December 31. 1. A bank loan had been obtained on December 1. Accrued interest on the loan at December 31 a

> When Delta Airlines sells tickets for future flights, it debits Cash and credits an account entitled Air Traffic Liability (as opposed to crediting Passenger Revenue Earned). This account, reported recently at approximately $4.5 billion, is among the lar

> The geological consulting firm of Gilbert, Marsh, & Kester prepares adjusting entries on a monthly basis. Among the items requiring adjustment on December 31, year 2, are the following. 1. The company has outstanding a $50,000, 9 percent, 2-year note pa

> Carnival Corporation & PLC is one of the world’s largest cruise line companies. Its printing costs for brochures are initially recorded as Prepaid Advertising and are later charged to Advertising Expense when they are mailed. Passenger deposits for upcom

> Security Service Company adjusts its accounts at the end of the month. On November 30, adjusting entries are prepared to record the following. a. Depreciation expense for November. b. Interest expense that has accrued during November. c. Revenue earne

> The financial statements of Home Depot, Inc., appear in Appendix A at the end of this textbook. Examine the company’s consolidated balance sheet and identify specific accounts that may have required adjusting entries at the end of the year.

> For each of the following situations described, indicate the underlying accounting principle that is being violated. Choose from the following principles. Matching Materiality Cost Realization

> The unadjusted and adjusted trial balances for Tinker Corporation on December 31, current year are shown as follows Journalize the nine adjusting entries that the company made on December 31, current year. TINKER CORPORATION TRIAL BALANCES DECEMBER

> Listed are seven corporations that receive cash from customers prior to earning revenue. Delta Air Lines, Inc. (airline) The New York Times Company (newspaper) Royal Caribbean (Cruise Company) DeVry Education Group (for-profit technical college)

> The following information was reported in a recent balance sheet issued by Microsoft Corporation. 1. The book value of property and equipment is listed at $14.7 billion (net of depreciation). Related notes to the financial statements reveal that accumul

> Would a $1,000 expenditure be considered material to all businesses? Explain.

> Among the ledger accounts used by Rapid Speedway are the following: Prepaid Rent, Rent Expense, Unearned Admissions Revenue, Admissions Revenue, Prepaid Printing, Printing Expense, Concessions Receivable, and Concessions Revenue. For each of the followin

> Why does the recording of adjusting entries require a better understanding of the concepts of accrual accounting than does the recording of routine revenue and expense transactions occurring throughout the period?

> Do adjusting entries affect income statement accounts, balance sheet accounts, or both? Explain.

> What is the purpose of making adjusting entries? Your answer should relate adjusting entries to the goals of accrual accounting.

> What is meant by the term unearned revenue?Where should an unearned revenue account appear in the financial statements? As the work is done, what happens to the balance of an unearned revenue account?

> If services have been rendered to customers during the current accounting period but no revenue has been recorded and no bill has been sent to the customers, why is an adjusting entry needed? What types of accounts should be debited and credited by this

> Why does the purchase of a one-year insurance policy four months ago give rise to insurance expense in the current month?

> The concept of materiality is an underlying principle of financial reporting. a. Briefly explain the concept of materiality. b. Is $2,500 a material dollar amount? Explain. c. Describe two ways in which the concept of materiality may save accountants’

> Discuss the matching principle and how it is applied in the recognition of expenses. Does the payment of cash necessarily coincide with the recognition of an expense? Explain.

> Stephen Corporation recently hired Tom Waters as its new bookkeeper. Waters is very inexperienced and has made seven recording errors during the last accounting period. The nature of each error is described in the following table. Instructions: Indicat

> Explain how Carnival Corporation accounts for customer deposits as passengers purchase cruise tickets in advance.

> Coyne Corporation recently hired Elaine Herrold as its new bookkeeper. Herrold was not very experienced and made seven recording errors during the last accounting period. The nature of each error is described in the following table. Instructions: Indi

> Discuss the realization principle and how it is applied in the recognition of revenue. Does the receipt of cash for customers necessarily coincide with the recognition of revenue? Explain.

> Clint Stillmore operates a private investigating agency called Stillmore Investigations. Some clients pay in advance for services; others are billed after services have been performed. Advance payments are credited to an account entitled Unearned Retaine

> Ken Hensley Enterprises, Inc., is a small recording studio in St. Louis. Rock bands use the studio to mix high-quality demo recordings distributed to talent agents. New clients are required to pay in advance for studio services. Bands with established cr

> Briefly explain the concept of materiality. If an item is not material, how is the item treated for financial reporting purposes?

> Mate Ease is an Internet dating service. All members pay in advance to be listed in the database. Advance payments are credited to an account entitled Unearned Member Dues. Adjusting entries are performed on a monthly basis. An unadjusted trial balance d

> Alpine Expeditions operates a mountain climbing school in Colorado. Some clients pay in advance for services; others are billed after services have been performed. Advance payments are credited to an account entitled Unearned Client Revenue. Adjusting en

> Property Management Professionals provides building management services to owners of office buildings and shopping centers. The company closes its accounts at the end of the calendar year. The manner in which the company has recorded several transactions

> Marvelous Music provides music lessons to student musicians. Some students pay in advance for lessons; others are billed after lessons have been provided. Advance payments are credited to an account entitled Unearned Lesson Revenue. Adjusting entries are

> Terrific Temps fills temporary employment positions for local businesses. Some businesses pay in advance for services; others are billed after services have been performed. Advance payments are credited to an account entitled Unearned Fees. Adjusting ent

> How does accrued but uncollected revenue affect the balance sheet?

> Visit Hershey’s home page at: www.hersheys.com From Hershey’s home page, access its most recent annual report (follow “Corporate Information” to the “Investors” link). Examine the company’s balance sheet and identify the accounts most likely to have been

> The Off-Campus Playhouse adjusts its accounts every month. The following is the company’s unadjusted trial balance dated September 30, current year. Additional information is provided for use in preparing the company’s

> On January 2, year 1, Hagen Corporation purchased equipment costing $172,800. Hagen performs adjusting entries monthly. a. Record this equipment’s depreciation expense on December 31, year 6, assuming its estimated life was eight years on January 2, yea

> River Rat, Inc., operates a ferry that takes travelers across the Wild River. The company adjusts its accounts at the end of each month. Selected account balances appearing in the April 30 adjusted trial balance are as follows. Other Data: 1. The fer

> Gunflint Adventures operates an airplane service that takes fishing parties to a remote lake resort in northern Manitoba, Canada. Individuals must purchase their tickets at least one month in advance during the busy summer season. The company adjusts its

> Slippery Slope, Inc., is a downhill ski area in northern New England. In an attempt to attract more ski enthusiasts, Slippery Slope’s management recently engaged in an aggressive preseason advertising campaign in which it spent $9,000 to distribute broch

> Big Oaks, a large campground in Vermont, adjusts its accounts monthly and closes its accounts annually on December 31. Most guests of the campground pay at the time they check out, and the amounts collected are credited to Camper Revenue. The following i

> Enchanted Forest, a large campground in South Carolina, adjusts its accounts monthly. Most guests of the campground pay at the time they check out, and the amounts collected are credited to Camper Revenue. The following information is available as a sour

> The concept of materiality is one of the most basic principles underlying financial accounting. a. Answer the following questions. 1. Why is the materiality of a transaction or an event a matter of professional judgment? 2. What criteria should account

> How do accrued but unpaid expenses affect the balance sheet?

> High Tech Monopoly Co. has plenty of cash to fund any conceivable positive NPV project. Can you describe a situation in which capital rationing could still occur?

> Facebook does not pay dividends. How can it have a positive stock price?

> The modified IRR (MIRR) alleviates two concerns with using the IRR method for evaluating capital investments. What are they?

> You are currently thinking about investing in a stock valued at $25.00 per share. The stock recently paid a dividend of $2.25 and its dividend is expected to grow at a rate of 5 percent for the foreseeable future. You normally require a return of 14 perc

> Why is stock valuation more difficult than bond valuation?

> Explain why preferred stock is considered to be a hybrid of equity and debt securities?

> Ted McKay has just bought the common stock of Ryland Corp. The company expects to grow at the following rates for the next three years: 30 percent, 25 percent, and 15 percent. Last year the company paid a dividend of $2.50. Assume a required rate of retu

> You want to estimate the value of a local advertising firm. The earnings of the firm are expected to be $2 million next year. Based on expected earnings next year, the average price-to-earnings ratio of similar firms in the same industry is 48. Therefore

> You are valuing a company using the WACC approach and have estimated that the free cash flows from the firm (FCFF) in the next five years will be $36.7, $42.6, $45.1, $46.3, and $46.6 million, respectively. Beginning in year 6, you expect the cash flows

> How do the cash flows that are discounted when the WACC approach (FCFF approach) is used to value a business differ from those that are discounted when the free cash flow to equity (FCFE) approach is used to value the equity in a business?

> How is a preferred stock with a fixed maturity valued?

> You have the following information for a company you are valuing and for a comparable company: Comparable company: ………….……………………………… Company you are valuing: Stock price = $23.45 ………………… ………………………………………. Value of debt = $3.68 million Number of shares out

> Your sister wants to open a store that sells antique-style jewelry and accessories. She has $15,000 of savings to invest, but opening the store will require an initial investment of $20,000. Net cash inflows will be −$2,000, −$1,000, and $0 in the first

> Two publicly traded companies in the same industry are similar in all respects except one. Whereas Publicks has issued debt in the public markets, Privicks has never borrowed from any public source. In fact, it always uses private bank debt for its borro

> You believe that the average investor is subject to a 20 percent tax rate on dividend payments. If a firm is going to pay a $0.30 dividend, by what amount would you expect the stock price to drop on the ex-dividend date?

> You would like to own a common stock that has a record date of Friday, September 8, 2017. What is the last date that you can purchase the stock and still receive the dividend?

> You are analyzing a firm that is financed with 60 percent debt and 40 percent equity. The current cost of debt financing is 10 percent, but due to a recent downgrade by the rating agencies, the firm’s cost of debt is expected to increase to 12 percent im

> Mike’s T-Shirts, Inc., has debt claims of $400 (market value) and equity claims of $600 (market value). If the after-tax cost of debt financing is 11 percent and the cost of equity is 17 percent, then what is Mike’s weighted average cost of capital?

> Belt Bottoms, Inc. is considering a five-year project with an initial investment of $20,000. What annual free cash flow (FCF) would be required for this project to have an NPV of $0 if the opportunity cost capital is 11 percent?

> You are considering investing in a business that has monthly fixed costs of $5,500 and sells a single product that costs $35 per unit to make. This product sells for $90 per unit. What is the annual pretax operating cash flow break-even point for this bu

> The Vinyl CD Co. is going to take on a project that is expected to increase its EBIT by $90,000, its fixed cost cash expenditures by $100,000, and its depreciation and amortization by $80,000 next year. If the project yields an additional 10 percent in r

> Why can skipping payment of a preferred dividend be a bad signal?

> Hydrogen Batteries sells its specialty automobile batteries for $85 each, while its current variable cost per unit is $65. Total fixed costs (including depreciation and amortization expense) are $150,000 per year. Management expects to sell 10,000 batter

> The Yellow Shelf Company sells all of its shelves for $100 per shelf, and incurs $50 in variable costs to produce each. If the fixed costs for the firm are $2,000,000 per year, what will the EBIT for the firm be if it produces and sells 45,000 shelves ne

> Sprigg Lane Manufacturing, Inc., needs to purchase a new central air-conditioning system for a plant. There are two choices. The first system costs $50,000 and is expected to last 10 years, and the second system costs $72,000 and is expected to last 15 y

> In calculating the NPV of a project, should we use all of the after-tax cash flows associated with the project, or incremental after-tax cash flows from the project? Why?

> Explain why the announcement of a new investment is usually accompanied by a change in the firm’s stock price?

> You are considering a project that has an initial outlay of $1 million. The profitability index of the project is 2.24. What is the NPV of the project?

> Refer to Problem 10.1. Compute the IRR for each of the two systems. Is the investment decision different from the one determined by NPV? Refer to Problem 10.1: The Management of Premium Manufacturing Company is evaluating two forklift systems to use in

> Terrell Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the follow

> Perryman Crafts Corp. management is evaluating two independent capital projects that will each cost the company $250,000. The two projects will provide the following cash flows: Which project will be chosen if the company’s payback cri

> The Management of Premium Manufacturing Company is evaluating two forklift systems to use in its plant that produces the towers for a windmill power farm. The costs and the cash flows from these systems are shown below. If the company uses a 12 percent d

> Explain why the growth rate g must always be less than the rate of return R for the constant-growth rate model?

> You are interested in buying the preferred stock of a bank that pays a dividend of $1.80 every quarter. If you discount such cash flows at 8 percent, what is the value of this stock?

> Barrymore Infotech is a fast-growing communications company. The company did not pay a dividend last year and is not expected to do so for the next two years. Last year the company’s growth accelerated, and management expects to grow the business at a ra

> Clarion Corp. has been selling electrical supplies for the past 20 years. The company’s product line has changed very little in the past five years, and the company’s management does not expect to add any new items for the foreseeable future. Last year,

> Merriweather Manufacturing Company has been growing at a rate of 6 percent for the past two years, and the CEO expects the company to continue to grow at this rate for the next several years. The company paid a dividend of $1.20 last year. If your requir

> How might financial statements for private companies differ from those for public companies?

> What is a key person?

> Why is marketability an important issue in business valuation?

> What is the difference between investment value and fair market value?

> Why is it important to specify a valuation date when you value a business?

> What is the difference between FCFE and dividends?