Question: Castlegar Ltd. had the following investment

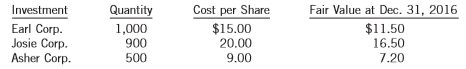

Castlegar Ltd. had the following investment portfolio at January 1, 2017:

During 2017, the following transactions took place:

1. On March 1, Josie Corp. paid a $2 per share dividend.

2. On April 30, Castlegar sold 300 shares of Asher Corp. for $10 per share.

3. On May 15, Castlegar purchased 200 more Earl Corp. shares at $16 per share.

4. At December 31, 2017, the shares had the following market prices per share: Earl Corp. $17; Josie Corp. $19; and Asher Corp. $8. During 2018, the following transactions took place:

5. On February 1, Castlegar sold the remaining Asher Corp. shares for $7 per share.

6. On March 1, Josie Corp. paid a $2 per share dividend.

7. On December 21, Earl Corp. declared a cash dividend of $3 per share to be paid in the next month.

8. At December 31, 2018, the shares had the following market prices per share: Earl Corp. $19 and Josie Corp. $21.

Instructions:

(a) Assuming that Castlegar Ltd. is a publicly accountable enterprise that applies IFRS 9 and accounts for its investment portfolio at FV-OCI (with no recycling), prepare journal entries to record all of the 2017 and 2018 transactions and year-end events.

(b) Prepare the relevant parts of Castlegar Ltd.’s 2018 and 2017 comparative statements of financial position, statements of comprehensive income, and statements of changes in shareholders’ equity (accumulated other comprehensive income portion), where applicable, to show how the investments and related accounts are reported.

(c) Assume that Castlegar Ltd. is a private enterprise that applies ASPE and accounts for its investment portfolio at cost (that is, the securities do not have actively traded market prices). Determine the amount by which the company’s 2017 net income and 2018 net income would differ from the amounts reported under the assumptions in parts (a) and (b). Explain your results.

(d) Refer to your answers to parts (b) and (c). From an investor’s perspective, what additional relevant information, if any, is provided in the financial statements under part (b) that would not be available in financial statements prepared under the method used in part (c)?

Transcribed Image Text:

Investment Quantity Cost per Share Fair Value at Dec. 31, 2016 Earl Corp. Josie Corp. Asher Corp. 1,000 900 500 $15.00 20.00 $11.50 16.50 7.20 9.00

> Nevine Corporation owns and manages a small 10-store shopping centre and classifies the shopping centre as an investment property. Nevine has a May 31 year end and initially recognized the property at its acquisition cost of $10.8 million on June 2, 2016

> Plaza Holdings Inc., a publicly listed company in Canada, ventured into construction of a mega–shopping mall in Edmonton, which is rated as the largest shopping mall in North America. The company’s board of directors, after much market research, decided

> On March 1 2017, Russell Winery Ltd. purchased a five-hectare commercial vineyard for $1,050,000. The total purchase price was based on appraised market values of the building, grapevines, and equipment ($580,000, $260,000, and $210,000, respectively). R

> Light stone Equipment Ltd. wanted to expand into New Brunswick and was impressed by the provincial government’s grant program for new industry. Once it was sure that it would qualify for the grant program, it purchased property in downtown Saint John on

> Jamil Jonas is an accountant in public practice. Not long ago, Jamil struck a deal with his neighbor Ralph to prepare Ralph’s business income tax and GST returns for 2017 in exchange for Ralph’s services as a landscaper. Ralph provided labour and used hi

> Wen Corp., a public company located in Manitoba, both purchases and constructs various pieces of machinery and equipment that it uses in its operations. The following items are for machinery that was purchased and a piece of equipment that was constructe

> Carver Inc. recently replaced a piece of automatic equipment at a net price of $4,000, f.o.b. factory. The replacement was necessary because one of Carver’s employees had accidentally backed his truck into Carver’s original equipment and made it inoperab

> Stacey Limited exchanged equipment that it uses in its manufacturing operations for similar equipment that is used in the operations of Chokar Limited. Stacey also paid Chokar $3,000 in cash. The following information pertains to the exchange: Instruct

> In 2002, the Sarbanes-Oxley Act (SOX) was passed in the United States to strengthen the capital marketplace. In the following year, there were many debates in Canada about whether the securities commissions here should adopt the same regulations. In the

> Cannon Ltd. purchased an electric wax melter on April 30, 2017, by trading in its old gas model and paying the balance in cash. The following data relate to the purchase: List price of new melter…………………………………………………………$15,800 Cash paid…………………………………………………

> On September 1, 2017, Rupert Ltd. purchased equipment for $30,000 by signing a two-year note payable with a face value of $30,000 due on September 1, 2019. The going rate of interest for this level of risk was 8%. The company has a December 31 year end.

> Native Inc. decided to purchase equipment from Central Ontario Industries on January 2, 2017, to expand its production capacity to meet customers’ demand for its product. Native issued a $900,000, five-year, non–interest-bearing note to Central Ontario f

> Geddes Engineering Corporation purchased conveyor equipment with a list price of $50,000. Three independent cases that are related to the equipment follow. Assume that the equipment purchases are recorded gross. 1. Geddes paid cash for the equipment 25 d

> Plant acquisitions for selected companies are as follows: 1. Bella Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump-sum price of $700,000. At the time of purchase, Torres’s assets h

> Wu Inc. operates a retail computer store. To improve its delivery services to customers, the company purchased four new trucks on April 1, 2017. The terms of acquisition for each truck were as follows: 1. Truck #1 had a list price of $27,000 and was acqu

> Copper Products Limited leases property on which copper has been discovered. The lease provides for an immediate payment of $472,000 to the lessor before drilling has begun and an annual rental of $55,000. In addition, the lessee is responsible for clean

> Activet Corporation, a Canadian-based international company that follows IFRS 9, has the following securities in its portfolio of investments acquired for trading purposes and accounted for using the FV-NI method on December 31, 2016: In 2017, Activet

> NB Corp. purchased a $100,000 face-value bond of Myers Corp. on August 31, 2016, for $104,490 plus accrued interest. The bond pays interest annually each November 1 at a rate of 9%. On November 1, 2016, NB Corp. received the annual interest. On December

> On December 31, 2016, Zurich Corp. provided you with the following pre adjustment information regarding its portfolio of investments held for short-term profit-taking: During 2017, the Bilby Corp. shares were sold for $9,500. The fair values of the sec

> (www.ccgg.ca) was formed in 2002 and represents a signifi cant number of institutional investors in Canada. Instructions: (a) What is the purpose of the CCGG? (b) How does an institutional investor differ from other investors? (c) In your opinion, what

> The following information relates to the debt investments of Wildcat Inc. during a recent year: 1. On February 1, the company purchased Gibbons Corp. 10% bonds with a face value of $300,000 at 100 plus accrued interest. Interest is payable on April 1 and

> Refer to the information in E9-3, except assume that Mustafa hopes to make a gain on the bonds as interest rates are expected to fall. Mustafa accounts for the bonds at fair value with changes in value taken to net income, and separately recognizes and r

> On January 1, 2017, Phantom Corp. acquires $300,000 of Spider Products, Inc. 9% bonds at a price of $278,384. The interest is payable each December 31, and the bonds mature on December 31, 2019. The investment will provide Phantom Corp. with a 12% yield.

> The elements that are most directly related to measuring an enterprise’s performance and financial status follow: Instructions: (a) Indicate which element is being described below. For any item that is an asset or liability, consider

> The qualitative characteristics that make accounting information useful include: Instructions: Identify the appropriate qualitative characteristic(s) to be used given the information provided below. (a) The qualitative characteristic being employed whe

> The trial balance of Mis-Match Inc. on June 30, 2017 is as follows: The following transactions took place in July 2017: 1. Payments received from customers on account amounted to $1,320. 2. A computer printer was purchased on account for $500. 3. Servi

> On January 1, 2017, Mustafa Limited paid $537,907.40 for 12% bonds with a maturity value of $500,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2017, and mature on January 1, 2022, with interest receivable on December

> The adjusted trial balance of North Bay Corporation is provided in the following work sheet for the year ended December 31, 2017. Instructions: The note payable is due in four months. Complete the work sheet and prepare a statement of financial positio

> The trial balance of Airbourne Travel Inc. on March 31, 2017, is as follows: Additional information: 1. A physical count reveals only $520 of supplies on hand. 2. Equipment is depreciated at a rate of $100 per month. 3. Unearned ticket revenue amounted

> On April 30, 2017, Oceanarium Corporation ordered a new passenger ship, which was delivered to the designated cruise port and available for use as of June 30, 2017. Overall, the cost of the ship was $97 million, with an estimated useful life of 12 years

> Locate the audited annual financial statements (including the accompanying notes) of Maple Leaf Foods Inc. (Maple Leaf) for its year ended December 31, 2014 (www.sedar.com). Instructions: Refer to the statements and notes to answer the following questi

> Linda Monkland established Monkland Ltd. in mid-2016 as the sole shareholder. The accounts on June 30, 2017, the company’s year end, just prior to preparing the required adjusting entries, were as follows: All the capital assets were

> Soon after December 31, 2017, the auditor of Morino Manufacturing Corp. asked the company to prepare a depreciation schedule for semi trucks that showed the additions, retirements, depreciation, and other data that affected the company’s income in the fo

> The following data relate to the Plant Assets account of Keller Inc. at December 31, 2016: The following transactions occurred during 2017: 1. On May 5, Asset A was sold for $16,500 cash. The company’s bookkeeper recorded this retirem

> P11-5 On January 1, 2015, Dayan Corporation, a small manufacturer of machine tools, acquired new industrial equipment for $1.1 million. The new equipment had a useful life of five years and the residual value was estimated to be $50,000. Dayan estimates

> Comco Tool Corp. records depreciation annually at the end of the year. Its policy is to take a full year’s depreciation on all assets that are used throughout the year and depreciation for half a year on all machines that are acquired o

> On June 15, 2014, a second-hand machine was purchased for $77,000. Before being put into service, the equipment was overhauled at a cost of $5,200, and additional costs of $400 for direct material and $800 for direct labour were paid in fi ne-tuning the

> Alladin Company purchased a large piece of equipment on October 1, 2017. The following information relating to the equipment was gathered at the end of October: Price…………………………………………………………………………………….$60,000 Credit terms………………………………………………………………………2/10, n

> Roland Corporation uses special strapping equipment in its packaging business. The equipment was purchased in January 2016 for $10 million and had an estimated useful life of eight years with no residual value. In early April 2017, a part costing $875,00

> Donovan Resources Group has been in its plant facility for 15 years. Although the plant is quite functional, numerous repair costs are incurred to keep it in good working order. The book value of the company’s plant is currently $800,000, calculated as f

> Conan Logging and Lumber Company, a small private company that follows ASPE, owns 3,000 hectares of timberland on the north side of Mount Leno, which was purchased in 2005 at a cost of $550 per hectare. In 2017, Conan began selectively logging this timbe

> In the IASB standard-setting conceptual framework, the word “reliability” has been replaced with “faithful representation.” This has caused much discussion among preparers of financial information. The change has led to other implications related to subs

> Khamsah Mining Ltd. is a small private company that purchased a tract of land for $720,000. After incurring exploration costs of $83,000, the company estimated that the tract would yield 120,000 tonnes of ore with enough mineral content to make mining an

> On January 1, 2016, Locke Company, a small machine-tool manufacturer, acquired a piece of new industrial equipment for $1,260,000. The new equipment had a useful life of five years, and the salvage value was estimated to be $60,000. Locke estimates that

> Phoenix Corp. purchased Machine no. 201 on May 1, 2017. The following information relating to Machine no. 201 was gathered at the end of May: Price…………………………………………………………………………………$85,000 Credit terms…………………………………………………………………..2/10, n/30 Freight-in costs…

> During the current year, Garrison Construction Ltd. traded in two relatively new small cranes (cranes no. 6RT and S79) for a larger crane that Garrison expects will be more useful for the particular contracts that the company has to fulfill over the next

> The production manager of Chesley Corporation wants to acquire a different brand of machine by exchanging the machine that it currently uses in operations for the brand of equipment that others in the industry are using. The brand being used by other com

> Vidi Corporation, a private enterprise, made the following purchases related to its property, plant, and equipment during its fiscal year ended December 31, 2017. The company uses the straight-line method of depreciation for all its capital assets. 1. In

> In June 28, 2017, in relocating to a new town, Kerr Corp. purchased a property consisting of two hectares of land and an unused building for $225,000 plus property taxes in arrears of $4,500. The company paid a real estate broker a fee of $12,000 for fin

> Webb Corporation prepares financial statements in accordance with IFRS. Selected accounts included in the property, plant, and equipment section of the company’s statement of financial position at December 31, 2016, had the following balances: Land……………

> P10-3 At December 31, 2016, certain accounts included in the property, plant, and equipment section of Golden Corporation’s statement of financial position had the following balances: Land…………………………………………………..$310,000 Buildings—Structure ……………………………883

> Obtain the 2014 financial statements of Teck Resources Limited from SEDAR (www.sedar. com). Instructions: (a) Using the notes to the consolidated financial statements, determine the company’s revenue recognition policy. Comment on whether the company us

> Adamski Corporation manufactures ballet shoes and is experiencing a period of sustained growth. In an effort to expand its production capacity to meet the increased demand for its product, the company recently made several acquisitions of plant and equip

> The unadjusted trial balance of Imagine Ltd. at December 31, 2017 is as follows: Additional information: 1. On November 1, 2017, Imagine received $10,200 rent from its lessee for a 12-month lease beginning on that date. This was credited to Rent Revenu

> Dr. Emma Armstrong, M.D., maintains the accounting records of the Blood Sugar Clinic on a cash basis. During 2017, Dr. Armstrong collected $146,000 in revenues and paid $55,470 in expenses. At January 1, 2017, and December 31, 2017, she had accounts rece

> Information follows for Quartz Industries Ltd.: Additional information: - One June 26 transaction was for bank service charges. - One June 30 transaction was a bank debit memo for $1,050.00 for a customer’s cheque returned and marke

> Information related to Bonzai Books Ltd. is as follows: balance per books at October 31, $41,847.85; November receipts, $173,528.91; November disbursements, $166,193.54; balance per bank statement at November 30, $56,270.20. The following cheques were ou

> Wordcrafters Inc. is a book distributor that had been operating in its original facility since 1988. The increase in certification programs and continuing education requirements in several professions has contributed to an annual growth rate of 15% for W

> Inglewood Landscaping Corp. began constructing a new plant on December 1, 2017. On this date, the company purchased a parcel of land for $184,000 cash. In addition, it paid $2,000 in surveying costs and $4,000 for title transfer fees. An old dwelling on

> On March 1, 2017, Jessi Corp. acquired a 10-unit residential complex for $1,275,000, paid in cash. An independent appraiser determined that 75% of the total purchase price should be allocated to buildings, with the remainder allocated to land. On the dat

> Camco Manufacturers Inc., a publicly listed company, has two machines that are accounted for under the revaluation model. Technology in Camco’s industry is fast-changing, causing the fair value of each machine to change significantly ap

> On July 1, 2017, Lucas Ltd., a publicly listed company, acquired assets from Jared Ltd. On the transaction date, a reliable, independent valuator assessed the fair values of these assets as follows: Manufacturing plant (building #1)……………………………..$400,000

> Companies normally issue their annual financial statements within weeks of year end. Instructions: (a) Identify the top five Canadian companies (by revenue) in the following industries. 1. Banking 2. Insurance 3. Real estate 4. Gas and electrical utilit

> December 31, 2014 Consolidated Statement of Financial Position lists property and equipment at $6 billion and total assets of $10.6 billion. Air Canada’s Note 4 to the financial statements titled Property and Equipment provides a schedule of the transact

> The following information relates to the debt securities investments of Wild Company: 1. On February 1, the company purchases 10% bonds of Gibbons Co. having a par value of $300,000 at 100 plus accrued interest. Interest is payable April 1 and October 1.

> Astro Languet established Languet Products Co. as a sole proprietorship on January 5, 2017. At the company’s year end of December 31, 2017, the accounts had the following balances (in thousands): Current assets, excluding inventory…………………………….$ 10 Other

> The summary financial statements of Langford Landscaping Ltd. on December 31, 2017, are as follows: LANDFORD LANDSCAPING LTD. Balance Sheet, December 31, 2017 Assets Cash………………………………………………………………………………..$ 5,000 Accounts and notes receivable……………………………………

> On December 31, 2016, Nodd Corp. acquired an investment in GT Ltd. bonds with a nominal interest rate of 10% (received each December 31), and the controller produced the following bond amortization schedule based on an effective rate of approximately 15%

> Pascale Corp. has the following securities (all purchased in 2017) in its investment portfolio on December 31, 2017: 2,500 Anderson Corp. common shares, which cost $48,750; 10,000 Munter Ltd. common shares, which cost $580,000; and 6,000 King Corp. prefe

> The following amortization schedule is for Flagg Ltd.’s investment in Spangler Corp.’s $100,000, five-year bonds with a 7% interest rate and a 5% yield, which were purchased on December 31, 2016, for $108,660: The fo

> The following information relates to the 2017 debt and equity investment transactions of Wildcat Ltd., a publicly accountable Canadian corporation. All of the investments were acquired for trading purposes and accounted for using the FV-NI model, with al

> On December 31, 2016, Acker Ltd. reported the following statement of financial position. The accumulated other comprehensive income was related only to the company’s non-traded equity investments. Some of these were sold in 2017 for c

> On January 1, 2017, Melbourne Corporation, a public company, acquired 15,000 of the 50,000 outstanding common shares of Noah Corp. for $25 per share. The statement of financial position of Noah reported the following information at the date of the acquis

> The financial statements of Brookfield Asset Management Inc. are presented at the end of the book. Complete the following instructions by referring to these financial statements and the accompanying notes. Instructions: (a) What were the company’s total

> Access the annual report for British Airways plc (BA) for the year ended December 31, 2014, from its parent company’s website (www. iagshares.com). British Airways is now a part of the International Airlines Group. Use the amounts in and notes to BA’s gr

> Randy’s, a family-owned restaurant chain operating in Alabama, has grown to the point that expansion throughout the entire Southeast is feasible. The proposed expansion would require the firm to raise about $18.3 million in new capital. Because Randy’s c

> Assuming that FASB Statement 13 and ASU 2016-02 are working as they are supposed to work, should traditional leasing arrangements enable a firm to use more financial leverage than it otherwise could? How did synthetic leases alter the situation? How do F

> Hasting Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vanell’s free cash flows to be $2.5 million, $2.9 million, $3.4 million, and $3.57 million at Years 1 through 4, respectively, after which the free cash flows wi

> What is the cash conversion cycle (CCC)? Why is it better, other things held constant, to have a shorter rather than a longer CCC? Suppose you know a company’s annual sales, average inventories, average accounts receivable, average accounts payable, and

> Differentiate between an operating lease, a capital (or financial) lease, and a sale and leaseback arrangement. How would the past accounting treatment of leases mislead investors and what rules have been put in place to mitigate this problem?

> A company has the following information: Earnings before interest and taxes……………………….$100.00 Interest expense……………………………………………………$ 10.00 Tax rate……………………………………………………………………..40% Net change in debt…………………………………………………$ 12.00 Investment in total capital…………

> Kendra Brown is analyzing the capital requirements for Reynold Corporation for next year. Kendra forecasts that Reynold will need $15 million to fund all of its positive-NPV projects and her job is to determine how to raise the money. Reynold’s net incom

> Hasting Corporation is interested in acquiring Vandell Corporation. Vandell has 1 million shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.4 (given its target capital structure). Vandell has $10.82 million in debt t

> Hatfield Medical Supply’s stock price had been lagging its industry averages, so its board of directors brought in a new CEO, Jaiden Lee. Lee had brought in Ashley Novak, a finance MBA who had been working for a consulting company, to r

> Thress Industries just paid a dividend of $1.50 a share (i.e., D0 5 $1.50). The dividend is expected to grow 5% a year for the next 3 years and then 10% a year thereafter. What is the expected dividend per share for each of the next 5 years?

> Winston Watch’s stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock ou

> The first part of the case, presented in Chapter 6, discussed the situation of Computron Industries after an expansion program. A large loss occurred in 2018 rather than the expected profit. As a result, its managers, directors, and investors are concern

> Jenny Cochran, a graduate of the University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previ

> AA Corporation’s stock has a beta of 0.8. The risk-free rate is 4%, and the expected return on the market is 12%. What is the required rate of return on AA’s stock?

> Using Rhodes Corporation’s financial statements (shown after part f), answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2018? b. What are the amounts of net operating working capital for both ye

> You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: a. Calculate the average rate of return for each stock during the 5-

> Assume that you recently graduated and have just reported to work as an investment advisor at the brokerage firm of Balik and Kiefer, Inc. One of the firm’s clients is Michelle DellaTorre, a professional tennis player who has just come to the United Stat

> Absalom Energy’s 14% coupon rate, semiannual payment, $1,000 par value bonds that mature in 30 years are callable 5 years from now at a price of $1,050. The bonds sell at a price of $1,353.54, and the yield curve is flat. Assuming that interest rates in

> Indicate by a (1), (2), or (0) whether each of the following events would probably cause average annual inventory holdings to rise, fall, or be affected in an indeterminate manner: a. Our suppliers change from delivering by train to air freight. ________

> You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. a. What are the betas of Stocks X and Y? b. What are the required rates of return on Stocks X and Y? c. What is the required rate

> The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of $6.56. What is the value of a put option written on the stock with the same exercis

> How could (accurate) balance sheet and in come statement information be used, along with other information, to make a statement of cash flows? What is the primary purpose of this statement?

> The Bookbinder Company has made $150,000 before taxes during each of the last 15 years, and it expects to make $150,000 a year before taxes in the future. However, in 2018, the firm incurred a loss of $650,000. The firm will claim a tax credit at the tim

> Corporate bonds issued by Johnson Corporation currently yield 8%. Municipal bonds of equal risk currently yield 6%. At what tax rate would an investor be indifferent between these two bonds?

> The Talley Corporation had taxable operating income of $365,000 (i.e., earnings from operating revenues minus all operating costs). Talley also had (1) interest charges of $50,000, (2) dividends received of $15,000, (3) dividends paid of $25,000, and (4)