Question: Chadwick, Inc.: The Balanced Scorecard (Abridged)14

Chadwick, Inc.: The Balanced Scorecard (Abridged)14

The “Balanced Scorecardâ€15 article seemed to address the concerns of several division managers who felt that the company was over-emphasizing short-term financial results. But the process of getting agreement on what measures should be used proved a lot more difficult than I anticipated.

Bill Baron, Comptroller of Chadwick, Inc.

Company Background

Chadwick, Inc., was a diversified producer of personal consumer products and pharmaceuticals.

The Norwalk Division of Chadwick developed, manufactured, and sold ethical drugs for human and animal use. It was one of five or six sizable companies competing in these markets and, while it did not dominate the industry, the company was considered well managed and was respected for the high quality of its products. Norwalk did not compete by supplying a full range of products. It specialized in several niches and attempted to leverage its product line by continually searching for new applications for existing compounds.

Norwalk sold its products through several key distributors who supplied local markets, such as retail stores, hospitals and health service organizations, and veterinary practices. Norwalk depended on its excellent relations with the distributors who served to promote Norwalk’s products to end users and also received feedback from the end users about new products desired by their customers.

Chadwick knew that its long-term success depended on how much money distributors could make by promoting and selling Norwalk’s products. If the profit from selling Norwalk products was high, then these products were promoted heavily by the distributors and Norwalk received extensive communication back about future customer needs. Norwalk had historically provided many highly profitable products to the marketplace, but recent inroads by generic manufacturers had been eroding distributors’ sales and profit margins. Norwalk had been successful in the past because of its track record of generating a steady stream of attractive, popular products. During the second half of the 1980s, however, the approval process for new products had lengthened and fewer big winners had emerged from Norwalk’s R&D laboratories.

Research and Development

The development of ethical drugs was a lengthy, costly, and unpredictable process. Development cycles now averaged about 12 years. The process started by screening a large number of compounds for potential benefits and use. For every drug that finally emerged as approved for use, up to 30,000 compounds had to be tested at the beginning of a new product development cycle. The development and testing processes had many stages. The development cycle started with the discovery of compounds that possessed the desirable properties and ended many years later with extensive and tedious testing and documentation to demonstrate that the new drug could meet government regulations for promised benefits, reliability in production, and absence of deleterious side effects.

Approved and patented drugs could generate enormous revenues for Norwalk and its distributors. Norwalk’s profitability during the 1980s was sustained by one key drug that had been discovered in the late 1960s. No blockbuster drug had emerged during the 1980s, however, and the existing pipeline of compounds going through development, evaluation, and test was not as healthy as Norwalk management desired. Management was placing pressure on scientists in the R&D lab to increase the yield of promising new products and to reduce the time and costs of the product development cycle. Scientists were currently exploring new bioengineering techniques to create compounds that had the specific active properties desired rather than depending on an almost random search through thousands of possible compounds. The new techniques started with a detailed specification of the chemical properties that a new drug should have and then attempted to synthesize candidate compounds that could be tested for these properties. The bioengineering procedures were costly, requiring extensive investment in new equipment and computer-based analyses.

A less expensive approach to increase the financial yield from R&D investments was to identify new applications for existing compounds that had already been approved for use. While some validation still had to be submitted for government approval to demonstrate the effectiveness of the drug in the new applications, the cost of extending an existing product to a new application was much, much less expensive than developing and creating an entirely new compound. Several valuable suggestions for possible new applications from existing products had come from Norwalk salesmen in the field. The salesmen were now being trained not only to sell existing products for approved applications, but also to listen to end users who frequently had novel and interesting ideas about how Norwalk’s products could be used for new applications.

Manufacturing

Norwalk’s manufacturing processes were considered among the best in the industry. Management took pride in the ability of the manufacturing operation to quickly and efficiently ramp up to produce drugs once they had cleared governmental regulatory processes. Norwalk’s manufacturing capabilities also had to produce the small batches of new products that were required during testing and evaluation stages.

Performance Measurement

Chadwick allowed its several divisions to operate in a decentralized fashion. Division managers had almost complete discretion in managing all the critical processes: R&D, production, marketing and sales, and administrative functions such as finance, human resources, and legal. Chadwick set challenging financial targets for divisions to meet. The targets were usually expressed as return on capital employed (ROCE). As a diversified company, Chadwick wanted to be able to deploy the returns from the most profitable divisions to those divisions that held out the highest promise for profitable growth. Monthly financial summaries were submitted by each division to corporate headquarters. The Chadwick executive committee, consisting of the chief executive officer, the chief operating officer, two executive vice presidents, and the chief financial officer met monthly with each division manager to review ROCE performance and backup financial information for the preceding month.

The Balanced Scorecard Project

Bill Baron, comptroller of Chadwick, had been searching for improved methods for evaluating the performance of the various divisions. Division managers complained about the continual pressure to meet short-term financial objectives in businesses that required extensive investments in risky projects to yield long-term returns. The idea of a Balanced Scorecard appealed to him as a constructive way to balance short-run financial objectives with the long-term performance of the company.

Baron brought the article and concept to Dan Daniels, the president and chief operating officer of Chadwick. Daniels shared Baron’s enthusiasm for the concept, feeling that a Balanced Scorecard would allow Chadwick divisional managers more flexibility in how they measured and presented their results of operations to corporate management. He also liked the idea of holding managers accountable for improving the long-term performance of their division.

After several days of reflection, Daniels issued a memorandum to all Chadwick division managers. The memo had a simple and direct message: Read the Balanced Scorecard article, develop a scorecard for your division, and be prepared to come to corporate headquarters in 90 days to present and defend the divisional scorecard to Chadwick’s executive committee.

John Greenfield, the division manager at Norwalk, received Daniel’s memorandum with some concern and apprehension. In principle, Greenfield liked the idea of developing a scorecard that would be more responsive to his operations, but he was distrustful of how much freedom he had to develop and use such a scorecard. Greenfield recalled:

This seemed like just another way for corporate to claim that they have decentralized decision making and authority while still retaining ultimate control at headquarters.

Greenfield knew that he would have to develop a plan of action to meet corporate’s request but lacking a clear sense of how committed Chadwick was to the concept, he was not prepared to take much time from his or his subordinates’ existing responsibilities for the project.

The next day, at the weekly meeting of the Divisional Operating Committee, Greenfield distributed the Daniels memo and appointed a three-man committee, headed by the divisional controller, Wil Wagner, to facilitate the process for creating the Norwalk Balanced Scorecard.

Wagner approached Greenfield later that day:

I read the Balanced Scorecard article. Based on my understanding of the concept, we must start with a clearly defined business vision. I’m not sure I have a clear understanding of the vision and business strategy for Norwalk. How can I start to build the scorecard without this understanding?

Greenfield admitted: “That’s a valid point. Let me see what I can do to get you started.â€

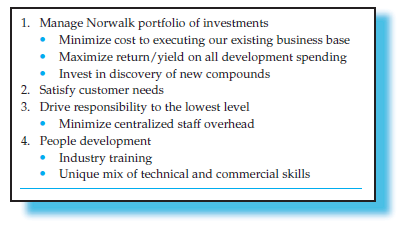

Greenfield picked up a pad of paper and started to write. Several minutes later he had produced a short business strategy statement for Norwalk (see Exhibit 2-22). Wagner and his group took Greenfield’s strategy statement and started to formulate scorecard measures for the division.

Required

(a) How does the Balanced Scorecard approach differ from traditional approaches to performance measurement? What, if anything, distinguishes the Balanced Scorecard approach from a “measure everything, and you might get what you want†philosophy?

(b) Develop the Balanced Scorecard for the Norwalk Pharmaceutical Division of Chadwick, Inc.

What parts of the business strategy that John Greenfield sketched out should be included?

Are there any parts that should be excluded or cannot be made operational? What scorecard measures would you use to implement your scorecard in the Norwalk Pharmaceutical Division? What new measures need to be developed, and how would you go about developing them?

(c) How would a Balanced Scorecard for Chadwick, Inc., differ from ones developed in its divisions, such as the Norwalk Pharmaceutical Division? Do you anticipate that there might be major conflicts between divisional scorecards and those of the corporation? If so, should those conflicts be resolved, and, if so, how should they be resolved?

Transcribed Image Text:

1. Manage Norwalk portfolio of investments • Minimize cost to executing our existing business base • Maximize return/yield on all development spending • Invest in discovery of new compounds 2. Satisfy customer needs 3. Drive responsibility to the lowest level • Minimize centralized staff overhead 4. People development Industry training Unique mix of technical and commercial skills

> What is a cash bonus?

> What type of organization is best suited to incentive compensation? Why?

> What is incentive compensation?

> What is an extrinsic reward?

> What is an intrinsic reward?

> Refer to the University of Leeds’ strategy map at http://www.leeds.ac.uk/downloads/Strategy_map_aw.pdf Required (a) What is the strategy for the university? (b) What will make it distinctive or unique? (c) What are its advantages and scope? (d) What

> What is budget slack?

> What is a stretch target?

> What is the most motivating type of budget with respect to targets?

> What are two essential elements in employee empowerment in MACS design?

> What is the single most important factor in making major changes to an organization?

> What is data falsification?

> What is meant by gaming a performance indicator?

> List three qualitative measures of performance.

> List three quantitative nonfinancial measures of performance in a manufacturing organization of your choice.

> What are some choices that individuals can make when ethical conflicts arise?

> Either by visiting a website or from a description in a published article, find a description of the implementation of a Balanced Scorecard. Required (a) Document in detail the elements (objectives, measures, and targets) of the Balanced Scorecard. (b)

> What is the human resources model view of motivation?

> What is the human relations movement view of motivation?

> What is the scientific management view of motivation?

> What are the four major behavioral considerations in MACS design?

> What four components should MACS designers consider when addressing the relevance of the system’s information?

> What are the four stages involved in keeping an organization in control?

> What are the six attributes of effective performance measurement systems?

> What are the three most common methods of setting a budget?

> What are the two interrelated behavioral issues in budgeting?

> What is an example of earnings management or smoothing?

> In the mid-1990s, Mobil Corporation’s Marketing and Refining (M&R) division underwent a major reorganization and developed new strategic directions. In conjunction with these changes, M&R developed a Balanced Scorecard around fo

> List three quantitative nonfinancial measures of performance in a service organization of your choice.

> List and explain the two categories in task control.

> How does task control differ from results control?

> How do diagnostic control systems differ from interactive control systems?

> What is an ethical control system, and what are its key elements?

> Megan Espanoza, manager of the Wells Division of Mars, Inc., a large credit card company, recently received a memorandum describing the company’s new budgeting process for the coming year. The new process requires Megan and the other division managers to

> Explain how participating in decision making and being educated to understand information received in an organization contribute toward employee empowerment in MACS design.

> Suppose that you are the manager of a production facility in a business that makes plastic items that organizations use for advertising. The customer chooses the color and quantity of the item and specifies what is to be imprinted on the item. Your job i

> Under what circumstances should both quantitative and qualitative performance measures be used to evaluate employee, work group, and divisional performance? Provide examples to support your answer.

> Cite two settings or jobs where each of the following approaches to control would be appropriately applied. Identify what you feel is the definitive characteristic of the setting that indicates the appropriateness of the approach to control that you have

> Domestic Auto Parts (DAP), a $1 billion subsidiary of a U.S. auto parts manufacturing company, manufactured and marketed original and after-market parts for automobile producers in the United States. It distributed products directly to original equipment

> You are a management accountant working in the controller’s office. Rick Koch, a very powerful executive, approaches you in the parking lot and asks you to do him a favor. The favor involves falsifying some of his division’s records on the main computer.

> During data collection for the transition from an old management accounting system to a new activity-based cost management system, you see a manager’s reported time allotments. You know that the data supplied by the manager are completely false. You conf

> Suppose you are the chief executive officer of a manufacturing firm that is bidding on a government contract. In this situation, the firm with the lowest bid will win the contract. Your firm has completed developing its bid and is ready to submit it to t

> Refer to “Does Cheating at Golf Lead to Cheating in Business?” in the In Practice box on page 347. Discuss reasons why individuals might feel justified in cheating at golf and whether individuals who cheat at golf are likely also to cheat in business.

> List the four key behavioral considerations in MACS design and explain the importance or benefits of each.

> Explain why an understanding of human motivation is essential to MACS design.

> Four broad approaches to distributing the proceeds of a bonus pool in a profit-sharing plan are listed here: 1. Each person’s share is based on salary. 2. Each person receives an equal share. 3. Each person’s share is based on position in the organizatio

> Marie Johnston, the manager of a government unemployment insurance office, is paid a salary that reflects the number of people she supervises and the number of hours that her subordinates work. Required (a) What do you think of this compensation scheme?

> Belleville Fashions sells high-quality women’s, men’s, and children’s clothing. The store employs a sales staff of 11 full-time employees and 12 part-time employees. Until recently, all sales staff were paid a flat salary and participated in a profit-sha

> Beau Monde, Inc., a manufacturer and distributor of health and beauty products, made the following disclosure about its compensation program: Our compensation philosophy is based on two simple principles: (1) We pay for performance and (2) management ca

> Denver Jack’s is a large toy manufacturer. The company has 100 highly trained and skilled employees who are involved with six major product lines, including the production of toy soldiers, dolls, and so on. Each product line is manufactured in a differen

> During the late 1970s, Harley-Davidson, the motorcycle manufacturer, was losing money and was very close to bankruptcy. Management believed that one of the problems was low productivity and, as a result, asked middle managers to speed up production. The

> Knox Company manufactures consumer products such as cleansers, air fresheners, and detergents. During a recent quarter, the value of the products made was $50 million, and the labor costs were $3 million. The company has decided to use a Scanlon plan wit

> Sakura Snack Company manufactures a line of snack foods, such as cheese crackers, granola bars, and cookies. The production workers are part of a gain-sharing program that works as follows: A target level of labor costs is set that is based on the achiev

> Peterborough Medical Devices makes devices and equipment that it sells to hospitals. The organization has a profit-sharing plan that is worded as follows: The company will make available a profit-sharing pool that will be the lower of the following two

> Hoechst Celanese, a pharmaceutical manufacturer, has used a profit-sharing plan, the Hoechst Celanese Performance Sharing Plan, to motivate employees. To operationalize the plan, the Hoechst Celanese executive committee set a target earnings from operati

> DMT Biotech is a biotechnology research and development company that designs products for the needs of life science researchers. The company consists of an administrative unit, a research laboratory, and a facility used to develop prototypes of and produ

> Suppose that you are the owner/manager of a house-cleaning business. You have 30 employees who work in teams of three. Teams are dispatched to the homes of customers where they are directed by the customer to undertake specific cleaning tasks that vary w

> Answer the following two questions about the organization units listed below: • What behavior should be rewarded? • What is an appropriate incentive compensation system? a. A symphony orchestra b. A government welfare office c. An airline complaint desk

> What are some pros and cons of tying an individual’s pay to performance?

> Wells Fargo’s web page (https://www .wellsfargo.com/pdf/invest_relations/VisionandValues04.pdf) states that the company’s vision is “to satisfy all our customers’ financial needs and help them succeed financially.” The brochure also describes the follow

> Mike Shields was having dinner with one of his friends at a restaurant in Memphis. His friend, Woody Brooks, a local manager of an express mail service, told Mike that he consistently overstated the amount of resources needed in his budget requests for h

> Manoil Electronics manufactures and sells electronic components to electronics stores. The controller is preparing her annual budget and has asked the sales group to prepare sales estimates. All members of the sales force have been asked to estimate sale

> Budgets are usually set through one of three methods: participation, authority, or consultation. Required Write an essay stating the circumstances under which each method is most appropriate. If you disagree with a particular method, justify your answer

> Why is it important that people understand what performance is measured, how performance is measured, and how employee rewards relate to measured performance?

> When should an organization use profit sharing?

> Why should performance measurement systems and rewards focus on performance that employees can control?

> What distinguishes data falsification from gaming activities?

> Can goal congruence be increased if rewards are tied to performance? Explain.

> In a company that takes telephone orders from customers for general merchandise, explain how you would evaluate the performance of the company president, a middle manager who designs the system to coordinate order taking and order shipping, and an employ

> The City of Charlotte, North Carolina, states its vision and mission as follows:12 City Vision The City of Charlotte will be a model of excellence that puts citizens first. Skilled, diverse, and motivated employees will be known for providing quality and

> Think of any setting in need of control. Explain why you think that task control or results control would be more appropriate in the setting that you have chosen. Do not use an example from the text.

> What should a person do if the organization’s stated values conflict with practiced values? What are the individual’s choices? Why do you think such conflicts exist?

> What should a person do if faced with a conflict between his or her values and those of the organization?

> List and describe the hierarchy of ethical considerations.

> How do the scientific management, human relations, and human resource schools differ in their views on human motivation?

> Identify the four components that MACS designers should consider when addressing the relevance of the system’s information and explain why each component is important.

> Eni Corporation’s mission statement includes the following: “Our mission is to continuously improve the company’s value to shareholders, customers, employees, and society.” Interpret how each of Eni Corporation’s stakeholder groups may interpret “the com

> How would you reward a group of people that includes product designers, engineers, production personnel, purchasing agents, marketing staff, and accountants whose job is to identify and develop a new car? How would you reward a person whose job is to dis

> When should an organization use stock options?

> When should an organization use gain sharing?

> Why do a company’s operators/workers, managers, and executives have different informational needs than shareholders and external suppliers of capital?

> What does the controllability principle require?

> When should an organization use a cash bonus?

> You work for a consulting firm and have been given the assignment of deciding whether a particular company president is overpaid both in absolute terms and relative to presidents of comparable companies. How would you undertake this task?

> Explain when one would reward outcomes or outputs, reward inputs, or use knowledge-based pay.

> Do you believe that people value intrinsic rewards? Give an example of an intrinsic reward that you would value and explain why. Why are extrinsic rewards important to people? If you value only extrinsic rewards, explain why.

> What are budgeting games, and why do employees engage in them?

> What are the pros and cons of building slack into the budget from (1) The point of view of the employee building in slack and (2) From a senior manager’s point of view?

> How does participation in the budgeting process differ from consultation?

> What are the advantages for the individual in being able to participate in decision making in the organization, and what are the advantages for the organization in allowing the individual to participate in decision making?

> Can you think of instances when gaming behavior is appropriate in an organization?

> List some methods of gaming performance indicators.

> What is management accounting?

> In December 2002, Time magazine named Cynthia Cooper, Coleen Rowley, and Sherron Watkins as its Persons of the Year. Cynthia Cooper was vice president of internal audit for WorldCom and informed the firm’s audit committee that the firm had improperly tre

> Chow Company is an insurance company in Hong Kong. Chow hires 55 people to process insurance claims. The volume of claims is extremely high, and all claims examiners are kept extremely busy. The number of claims in which errors are made runs about 10%. I

> Frits Seegers, President of Citibank California, was meeting with his management team to review the performance evaluation and bonus decisions for the California branch managers. James McGaran’s performance evaluation was next. Frits felt uneasy about th

> What is a quality function deployment matrix, and how does it relate to value index computations for target costing?

> What is target costing?

> What three substages typically occur in the postsale service and disposal stage of total life- cycle costing?

> What are the three substages of the RD&E stage of total-life-cycle costing?