Question: Chinese economic growth is the outstanding feature

Chinese economic growth is the outstanding feature of the world economic scene over the past two decades.

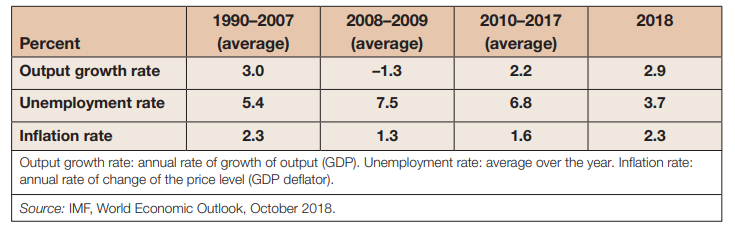

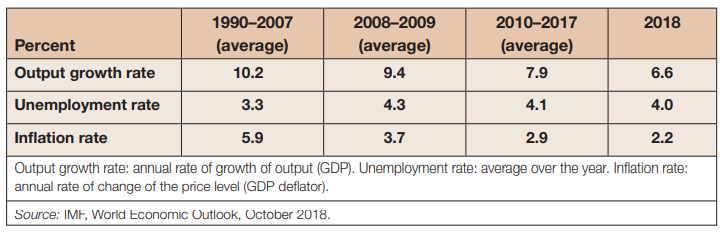

a. In 2018, US output was $20.5 trillion, and Chinese output in 2017 was $13.5 trillion. Suppose that from 2017 the output of China grows at an annual rate of 7.9%, whereas the output of the United States grows from 2018 at an annual rate of 2.2%. These are the values in each country for the most recent periods in Tables 1-2 and 1-4, respectively. Using these assumptions and a spreadsheet, calculate and plot US and Chinese output from 2017 or 2018 over the next 100years. How many years will it take for China to have a total level of output equal to that of the United States?

b. When China catches up with the United States in total output, will residents of China have the same standard of living as US residents? Explain.

c. Another term for standard of living is output per person. How has China raised its output per person in the last two decades? Are these methods applicable to the United States?

d. Do you think China’s experience in raising its standard of living (output per person) provides a model for developing countries to follow? Explain.

Table 1-2:

Table 1-4:

> A new president, who promised during the campaign that she would cut taxes, has just been elected. People trust that she will keep her promise, but expect that the tax cuts will be implemented only in the future. Determine the impact of the election vict

> Using fiscal policy to avoid the meltdown and debt crisis of 2009. As a result of the combined effects of the Great Recession and the European sovereign debt crisis, GDP of Greece declined from €281.44 billion in 2008 to €176.5 billion in 2015. a. What i

> Consider the following statement: “The rational expectations assumption is unrealistic because, essentially, it amounts to the assumption that every consumer has perfect knowledge of the economy.” Discuss.

> For each of the changes in expectations in parts a through d, determine whether there is a shift in the IS curve, the LM curve, both curves, or neither. In each case assume that no other exogenous variable is changing. a. a decrease in the expected futur

> The European Central Bank (ECB) conducts a press conference each month where the president of the ECB presents the measures decided by the Bank Council and answers public questions. a. What do you think is the purpose of such press conferences? b. Accord

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. Changes in the current one-year real interest rate are likely to have a much larger effect on spending than changes in expected f

> The OECD built a consumer confidence and a business confidence index that you may find at https://data.oecd.org/searchresults/?r=+f/ type/indicators. Extract this index for all 19 member countries in the euro area and for China for the period 2008–2017 (

> Go to the World Bank database and select the historical series for gross capital formation (annual % growth) and household final consumption expenditure (annual % growth) for Argentina and Brazil for the period 1995–2016. You may find the data series at

> Consider a consumer across three periods: youth, middle age, and old age. In her youth, the consumer earns €20,000 in labor income. Earnings during middle age are uncertain; there is a 50% chance that the consumer will earn €40,000 and a 50% chance that

> Refer to Problem 5. Suppose now that there are certain borrowing constraints for consumers in their youth. Given that sum of income and total financial wealth is cash in hand, the borrowing constraints mean that consumers cannot consume more than their c

> Suppose that every consumer is born with zero financial wealth and lives for three periods youth, middle age, and old age. Consumers work in the first two periods and retire in the last one. Their income is €5 in the first period, €25 in the second, and

> The South Korean won (or KRW) is the official currency of the Republic of Korea. Suppose that you have just finished college and have been offered a job as a photographer with a famous KPop company (like BigHit) with a starting salary of 1.5 million KRW

> 1.Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The largest component of GDP is consumption. b. Government spending, including transfers, was equal to 17.4% of GDP in 2018. c.

> A private hospital in Europe is deciding on its next investments. Purchasing the latest medical equipment would cost the hospital €1 million and is expected to earn an annual revenue of €150,000. The real interest rate is 8% this year and is expected to

> Lucy and Adam are university graduates who start working at the same time. Lucy is a computer programmer earning an annual salary of €70,000, and Adam is a teacher with an annual salary of €45,000. Both expect their annual salary to increase by 2% in rea

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. For a typical college student, human wealth and nonhuman wealth are approximately equal. b. Natural experiments, such as retireme

> The Economist annually publishes The Economist House Price Index. It attempts to assess which housing markets, by country, are the most overvalued or undervalued relative to fundamentals. Find the most recent version of this data on the Web. a. One index

> Houses can be thought of as assets with a fundamental value equal to the expected present discounted value of their future real rents. a. Would you prefer to use real payments and real interest rates to value a house or nominal payments and n

> Suppose that an investor has a choice between buying a three-year bond with a face value of $60 and a stock paying a constant dividend of $20 per year, which the investor plans to hold for three years. The real interest rate on the stock and the bond is

> Assume the short-term real policy rate, current and expected, had been 2% until now. Suppose the Fed decides to tighten monetary policy and increase the short-term policy rate (r1t) from 2% to 3%. a. What happens to stock prices if the change in r1t is e

> The present value of an infinite stream of dollar payments of $z (that starts next year) is $z/i when the nominal interest rate, i, is constant. This formula gives the price of a consol a bond paying a fixed nominal payment each year, forever. It is also

> Compute the two-year nominal interest rate using the exact formula and the approximation formula for each set of assumptions listed in parts a through c. The term premium on a two-year bond is 1%.

> The Consumer Price Index represents the average price of goods that households consume. Many thousands of goods are included in such an index. Here consumers are represented as buying only fresh food and renting property as their basket of goods. Here is

> For which of the problems listed in parts a through c would you want to use real payments and real interest rates, and for which would you want to use nominal payments and nominal interest rates to compute the expected present discounted value? In each c

> Go to the Web site of the Japanese Ministry of Finance and get the historical data about government bond yields. The data categorizes government bonds according to their maturity. a. Construct the yield curve for the latest available data. What do you ob

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The present discounted value of a stream of returns can be calculated in real or nominal terms. b. The higher the one-year intere

> In this question, we look at the evolution of real wages. According to the International Labour Office’s (ILO) latest Global Wage Report’s appendix on Asia and the Pacific, available on its website, real wage growth has been very strong in the Asia and P

> In 2014, the European Commission (EC) presented a report on the European Vacancy and Recruitment, containing data on occupations with the largest job declines and the largest job growth in the European Union (EU) member states in previous years. a. Find

> In the appendix to Chapter 7, we learned how the wage-setting and price-setting equations could be expressed in terms of labor demand and labor supply. In this problem, we extend the analysis to account for technological change. Consider the wage-setting

> Discuss the following statement: “Those who argue that technological progress does not reduce employment should look at agriculture. At the start of the last century, there were more than 11 million farm workers. Today, there are fewer than 1 million. If

> In Chapter 12 you computed a residual term representing the growth rate of technology using the expression and the annual growth rates of output, gY; labor input, gN; and capital input, gK. What was the value of that residual for the period from 2000 to

> The Real Exchange Rate and Domestic and Foreign Real Interest Rates

> Deriving the IS Relation under Fixed Exchange Rates

> Consider the economy described in Problem 4. a. Construct real GDP for years 2012 and 2013 by using the average price of each good over the two years. b. By what percentage does real GDP change from 2012 to 2013? c. What is the GDP deflator in 2012 and 2

> Fixed Exchange Rates, Interest Rates, and Capital Mobility

> Derivation of the Marshall-Lerner Condition

> The Congressional Budget Office (CBO) is required to produce a forecast of the federal fiscal situation each year. This question uses the version published in January 2019. There is a document entitled “A Visual Summary of The Budget and Economic Outlook

> Derivation of the Expected Present Value of Profits under Static Expectations

> From the FRED economic database at the Federal Reserve Bank of St. Louis, you can retrieve two series: General Government Gross Debt of the United States (GGGDTAUSA188N) and a measure of the primary deficit (USAGGXONLBGDP). Both are measured as a percent

> Deriving the Expected Present Discounted Value Using Real or Nominal Interest Rates

> How to Measure Technological Progress, and the Application to China

> The Cobb-Douglas Production Function and the Steady State

> Derivation of the Relation Between Inflation, Expected Inflation, and Unemployment

> Wage- and Price-Setting Relations Versus Labor Supply and Labor Demand.

> a. Use the prices for 2012 as the set of common prices to compute real GDP in 2012 and in 2013. Compute the GDP deflator for 2012 and for 2013, and compute the rate of inflation from 2012 to 2013. b. Use the prices for 2013 as the set of common prices to

> The Construction of Real GDP and Chain-Type Indexes

> What do macroeconomists do?

> Where to find the numbers

> The rate of growth of output per person was identified as a major issue facing the United States as of the writing of this chapter. Go to the 2018 Economic Report of the President a. Find the column with numbers that describe the level of output per hour

> Beware of simplistic answers to complicated macroeconomic questions. Consider each of the following statements and comment on whether there is another side to the story. a. There is a simple solution to the problem of high European unemployment: Reduce

> Using the information in this chapter and by referring to the IMF data mapper (http://www.imf.org/external/datamapper/datasets/ WEO/3) or the World Bank database (https://data.worldbank. org/) for updated information, label each of the following statemen

> Continuing with the logic from Problem 7, suppose that the economy’s production function is given by Y = K1/3 N2/3 and that the saving rate, s, and the depreciation rate, are equal to 0.10. a. What is the steady-state level of capital

> An economy produces three goods: cars, computers, and oranges. Quantities and prices per unit for years 2012 and 2013 are as follows: a. What is nominal GDP in 2012 and in 2013? By what percentage does nominal GDP change from 2012 to 2013? b. Using th

> Suppose that an economy is characterized by the following production function a. Derive the steady-state level of output per worker, and the steady-state level of capital per worker in terms of the saving rate, s, and the depreciation rate, (. b. Deriv

> Suppose that in a given economy, both the saving rate and the depreciation rate increase. What would the effect of this dual movement be on the economy’s capital per worker and output per worker, in the short and the long run?

> Discuss how the level of output per person in the long run would likely be affected by each of the following changes: a. The right to exclude saving from income when paying income taxes. b. A higher rate of female participation in the labor market (but c

> In Chapter 3 we saw that an increase in the saving rate can lead to a recession in the short run (i.e., the paradox of saving). We examined the issue in the medium run in Problem 5 at the end of Chapter 7. We can now examine the long-run effects of an in

> Suppose that the head of the Finance Ministry in your country were to go on the record advocating an effort to restrain current consumption, arguing that lower consumption now means higher saving; and higher saving now means a permanent higher level of c

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The saving rate is always equal to the investment rate. b. A higher investment rate can sustain higher growth of output forever.

> Your institution may have a subscription to The Economist news magazine, or you may be able to find this graphic on the web. The March 23, 2019 issue, in a section entitled “Graphic Detail: Happiness Economics,” makes the same point as Figure 1. a. Doe

> Using the Penn World Tables, find the data on real GDP per person (chained series) for 1970 for all available countries. Do the same for a recent year of data where the data are available for most countries (it takes more time to produce this measure in

> Consider three rich countries: France, Belgium, and Italy, and four poor countries, Ethiopia, Kenya, Nigeria, and Uganda. Define for each country the ratio of its real GDP per person to that of the United States in 1970 and in the latest year available (

> During a given year, suppose the following activities occur in an economy. i. An automobile manufacturing company pays its workers €10 million to assemble 5,000 cars. The cars are then sold to an automobile store for €12 million. ii. That year, the store

> This section looks at US recessions over the past 60 years. To work out this problem, first obtain quarterly data on US output growth for the period 1960 to the most recent data from www.bea. gov. Table 1.1. 1 presents the percent change in real gross do

> Consider Camp Rainbow’s cost equation results obtained in E5–14 using least-squares regression. Suppose that Rainbow is contemplating staying open one additional week during the summer. Required: 1. Determine Rainbow&a

> Consider Camp Rainbow’s cost estimated in E5–13 using the high-low method and in E5–14 using regression. The two methods yielded very different results, especially in their estimates of fixed cost. Re

> Refer to the Camp Rainbow data presented in E5–13. Required: 1. Perform a least-squares regression analysis on Camp Rainbow’s data. 2. Using the regression output, create a cost equation (y = a + bx) for estimating Cam

> Explain how the primary difference between financial and managerial accounting results in other differences between the two.

> What is the primary difference between financial accounting and managerial accounting?

> From last year to this year, Berry Barn reported that its Net Sales increased from $300,000 to $400,000 and its Gross Profit increased from $90,000 to $130,000. Was the Gross Profit increase caused by (a) an increase in sales volume only, (b) an incr

> From last year to this year, Colossal Company’s current ratio increased and its inventory turnover decreased. Does this imply a higher, or lower, risk of obsolete inventory?

> Camp Rainbow offers overnight summer camp programs for children ages 10 to 14 every summer during June and July. Each camp session is one week and can accommodate up to 200 children. The camp is not coed, so boys attend during the odd-numbered weeks and

> Slow Cellar’s current ratio increased from 1.2 to 1.5. What is one favorable interpretation of this change? What is one unfavorable interpretation of this change?

> Why are some analyses called horizontal and others called vertical?

> Into what three categories of performance are most financial ratios reported? To what in particular does each of these categories relate?

> What benchmarks are commonly used for interpreting ratios?

> What is ratio analysis? Why is it useful?

> How is a year-over-year percentage calculated?

> Explain whether the following situations, taken independently, would be favorable or unfavorable: (a) increase in gross profit percentage, (b) decrease in inventory turnover ratio, (c) increase in earnings per share, (d) decrease in days to collect,

> What is the general goal of trend analysis?

> Explain why a $50,000 increase in inventory during the year must be included in computing cash flows from operating activities under both the direct and indirect methods.

> Explain why cash outflows during the period for purchases and salaries are not specifically reported on a statement of cash flows prepared using the indirect method.

> Odessa, Inc., manufactures one model of computer desk. The following data are available regarding units shipped and total shipping costs Required: 1. Prepare a scattergraph of Odessa’s shipping cost and draw the line you believe best fi

> Under the indirect method, depreciation expense is added to net income to report cash flows from operating activities. Does depreciation cause an inflow of cash?

> Describe the types of items used to compute cash flows from operating activities under the two alternative methods of reporting

> What are the typical cash inflows from operating activities? What are the typical cash outflows from operating activities?

> What are the major categories of business activities reported on the statement of cash flows? Define each of these activities.

> What are cash equivalents? How are they reported on the statement of cash flows?

> What information does the statement of cash flows report that is not reported on the other required financial statements?

> How is the sale of equipment reported on the statement of cash flows using the indirect method?

> What are noncash investing and financing activities? Give one example. How are noncash investing and financing activities reported on the statement of cash flows?

> What are the typical cash inflows from financing activities? What are the typical cash outflows from financing activities?

> What are the typical cash inflows from investing activities? What are the typical cash outflows from investing activities?

> Consider Mountain Dental’s cost equation results obtained in E5–9 using least-squares regression. Required: 1. Determine Mountain Dental’s unit contribution margin and contribution margin ratio if it

> As a junior analyst, you are evaluating the financial performance of Digilog Corporation. Impressed by this year’s growth in sales (20 percent increase), receivables (40 percent increase), and inventories (50 percent increase), you plan to report a fa

> Loan covenants require that E-Gadget Corporation (EGC) generate $200,000 cash from operating activities each year. Without intervening during the last month of the current year, EGC will generate only $180,000 cash from operations. What are the pros and

> Compare the purposes of the income statement, the balance sheet, and the statement of cash flows.

> When would you use an annuity factor in a net present value calculation instead of a present value factor for a single cash flow?

> What do a positive NPV and a negative NPV indicate about an investment?

> In everyday terms, explain what information the payback period provides about an investment.