Question: Choice Chicken Company was organized on January

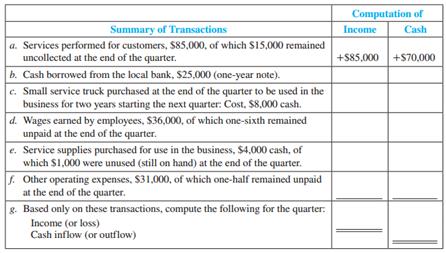

Choice Chicken Company was organized on January 1. At the end of the first quarter (three months) of operations, the owner prepared a summary of its activities as shown in transaction (a) of the following table:

Required:

1. For items (b) through (g), enter what you consider to be the correct amounts. Enter a zero when appropriate. The first transaction is illustrated.

2. For each transaction, explain the basis for your response in requirement (1).

Transcribed Image Text:

Computation of Summary of Transactions Income Cash a. Services performed for customers, S85,000, of which S15,000 remained uncollected at the end of the quarter. +S85,000 +S70,000 b. Cash borrowed from the local bank, $25,000 (one-year note). c. Small service truck purchased at the end of the quarter to be used in the business for two years starting the next quarter: Cost, $8,000 cash. d. Wages earned by employees, $36,000, of which one-sixth remained unpaid at the end of the quarter. e. Service supplies purchased for use in the business, $4,000 cash, of which $1,000 were unused (still on hand) at the end of the quarter. f. Other operating expenses, $31,000, of which one-half remained unpaid at the end of the quarter. &. Based only on these transactions, compute the following for the quarter. Income (or loss) Cash inflow (or outflow)

> The income statement for Pruitt Company summarized for a four-year period shows the following: An audit revealed that in determining these amounts, the ending inventory for 2017 was overstated by $18,000. The company uses a periodic inventory system. Re

> An annual report for International Paper Company included the following note: The last-in, first-out inventory method is used to value most of International Paper’s U.S. inventories. If the first-in, first-out method had been used, it would have increase

> Mears and Company has been operating for five years as an electronics component manufacturer specializing in cellular phone components. During this period, it has experienced rapid growth in sales revenue and in inventory. Mr. Mears and his associates ha

> Jaffa Company prepared its annual financial statements dated December 31 of the current year. The company applies the FIFO inventory costing method; however, the company neglected to apply LCM to the ending inventory. The preliminary current year income

> Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic data

> Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Inventory is valued at cost using the LIFO inventory method. Required: 1. Complete the following inco

> At the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $16 per unit: Required: 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through gr

> Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Required: Compute the amount of (a) goods available for

> Travis Company has just completed a physical inventory count at year-end, December 31 of the current year. Only the items on the shelves, in storage, and in the receiving area were counted and costed on a FIFO basis. The inventory amounted to $80,000. Du

> Symbol Technologies, Inc., was a fast-growing maker of bar-code scanners. According to the federal charges, Tomo Razmilovic, the CEO at Symbol, was obsessed with meeting the stock market’s expectation for continued growth. His executive team responded by

> Define the following three users of financial accounting disclosures and the relationships among them: (a) financial analysts, (b) private investors, and (c) institutional investors.

> Cripple Creek Company has one trusted employee who, as the owner said, “handles all of the bookkeeping and paperwork for the company.” This employee is responsible for counting, verifying, and recording cash receipts and payments; making the weekly bank

> Refer to the annual report for American Eagle Outfitters in Appendix B. Financial Statements of American Eagle Outfitters: Required: 1. The annual report or 10-K report for American Eagle Outfitters provides selected financial data for the last five ye

> The October 4, 2004, edition of BusinessWeek presented an article titled “Fuzzy Numbers” on issues related to accrual accounting and its weaknesses that have led some corporate executives to manipulate estimates in their favor, sometimes fraudulently. Yo

> Penny’s Pool Service & Supply, Inc. (PPSS) had the following transactions related to operating the business in its first year’s busiest quarter ended September 30: a. Placed and paid for $2,600 in advertisements with several area newspapers (including th

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. At the bottom of each statement, the company warns readers to “Refer to Notes to Consolidated Financial Statements.”

> Refer to the financial statements of American Eagle Outfitters in Appendix B and Urban Outfitters in Appendix C. Financial statements of American Eagle: Financial statements of Urban Outfitters: Required: 1. Compute return on assets for the most recent

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book. At the bottom of each statement, the company warns readers that “The accompanying notes are an integral part of these financial statements.&aci

> Stoscheck Moving Corporation has been in operation since January 1, 2017. It is now December 31, 2017, the end of the annual accounting period. The company has not done well financially during the first year, although revenue has been fairly good. The th

> You are the regional sales manager for Miga News Company. Miga is making adjusting entries for the year ended March 31, 2018. On September 1, 2017, customers in your region paid $36,000 cash for three-year magazine subscriptions beginning on that date. T

> What are the purposes of a bank reconciliation? What balances are reconciled?

> Describe the roles and responsibilities of management and independent auditors in the financial reporting process.

> Why should cash-handling and cash-recording activities be separated? How is this separation accomplished?

> Summarize the primary characteristics of an effective internal control system for cash.

> Define cash and cash equivalents in the context of accounting. Indicate the types of items that should be included and excluded.

> What is the distinction between sales allowances and sales discounts?

> What is a sales discount? Use 1/10, n/30 in your explanation.

> What is a credit card discount? How does it affect amounts reported on the income statement?

> Briefly explain how the total amount of cash reported on the balance sheet is computed.

> Indicate whether the following items would be added (+) or subtracted (-) from the company’s books or the bank statement during the construction of a bank reconciliation. Reconciling Item Company's Books Bank Statement Outstanding c

> Indicate the most likely effect of the following changes in credit policy on the receivables turnover ratio (+ for increase, - for decrease, and NE for no effect). a. Granted credit with shorter payment deadlines. b. Increased effectiveness of collection

> Using the following categories, indicate the effects of the following transactions. Use + for increase and - for decrease and indicate the accounts affected and the amounts. a. At the end of the period, bad debt expense is estimated to be $15,000. b. Dur

> Briefly define return on assets and what it measures.

> Prepare journal entries for each transaction listed. a. During the period, bad debts are written off in the amount of $14,500. b. At the end of the period, bad debt expense is estimated to be $16,000.

> Total gross sales for the period include the following: Credit card sales (discount 3%) $ 9,400 Sales on account (2/15, n/60) $12,000 Sales returns related to sales on account were $650. All returns were made before payment. One half of the remaining sal

> Merchandise invoiced at $9,500 is sold on terms 1/10, n/30. If the buyer pays within the discount period, what amount will be reported on the income statement as net sales?

> (Chapter Supplement) Under the gross method of recording sales discounts discussed in this chapter, is the amount of sales discount taken recorded (a) at the time the sale is recorded or (b) at the time the collection of the account is recorded?

> Does an increase in the receivables turnover ratio generally indicate faster or slower collection of receivables? Explain.

> What is the effect of the write-off of bad debts (using the allowance method) on (a) net income and (b) accounts receivable, net?

> Using the allowance method, is bad debt expense recognized in (a) the period in which sales related to the uncollectible account are made or (b) the period in which the seller learns that the customer is unable to pay?

> Which basic accounting principle is the allowance method of accounting for bad debts designed to satisfy?

> Differentiate accounts receivable from notes receivable.

> What is gross profit or gross margin on sales? In your explanation, assume that net sales revenue was $100,000 and cost of goods sold was $60,000.

> Match each financial statement with the items presented on it by entering the appropriate letter in the space provided. Elements of Financial Statements Financial Statements (1) Expenses (2) Cash from operating activities (3) Losses A. Income stateme

> For each of the transactions in Mini Exercise 6, indicate the amounts and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Using the following format, indicate + for increase, −

> According to its annual report, P&G’s billion-dollar brands include Pampers, Tide, Ariel, Always, Pantene, Bounty, Charmin, Downy, Olay, Crest, Vicks, Gillette, Duracell, and others. The following are items taken from its recent balance sheet and income

> Match each definition with its related term or abbreviation by entering the appropriate letter in the space provided. Term or Abbreviation Definition (1) SEC (2) Audit (3) Sole proprietorship B. Measurement of information about an entity in terms of

> The following items were taken from a recent cash flow statement. Note that different companies use slightly different titles for the same item. Without referring to Exhibit 1.5, mark each item in the list as a cash flow from operating activities (O), in

> Penny Cassidy is considering forming her own pool service and supply company, Penny’s Pool Service & Supply, Inc. (PPSS). She has decided to incorporate the business to limit her legal liability. She expects to invest $20,000 of her own savings and recei

> Upon graduation from high school, Sam List immediately accepted a job as an electrician’s assistant for a large local electrical repair company. After three years of hard work, Sam received an electrician’s license and decided to start his own business.

> Assume that you are the president of Influence Corporation. At the end of the first year (December 31) of operations, the following financial data for the company are available: Cash………………………………………………………………………………………………………..$ 13,150 Receivables from custo

> Refer to the financial statements of American Eagle Outfitters in Appendix B and Urban Outfitters in Appendix C. Financial statements of American Eagle: Financial statements of Urban Outfitters: Required: 1. Total assets is a common measure of the size

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book Financial statements of Urban Outfitters: Required: 1. What is the amount of net income for the most recent year? 2. What amount of revenue was earned in the mo

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Financial Statement of American Eagle Outfitters: Required: Skim the annual report. Look at the income statement, balance sheet, and cash flow statem

> State the equation for the net profit margin ratio and explain how it is interpreted.

> Which of the following regarding GAAP is true? a. U.S. GAAP is the body of accounting knowledge followed by all countries in the world. b. Changes in GAAP can affect the interests of managers and stockholders. c. GAAP is the abbreviation for generally ac

> Which of the following is false regarding the balance sheet? a. The accounts shown on a balance sheet represent the basic accounting equation for a particular business entity. b. The retained earnings balance shown on the balance sheet must agree with th

> Which of the following is true regarding the income statement? a. The income statement is sometimes called the statement of operations. b. The income statement reports revenues, expenses, and liabilities. c. The income statement reports only revenue for

> Which of the following is not a typical note included in an annual report? a. A note describing the auditor’s opinion of the management’s past and future financial planning for the business. b. A note providing more detail about a specific item shown in

> Which of the following statements regarding the statement of cash flows is true? a. The statement of cash flows separates cash inflows and outflows into three major categories: operating, investing, and financing. b. The ending cash balance shown on the

> Which of the following is not one of the four items required to be shown in the heading of a financial statement? a. The financial statement preparer’s name. b. The title of the financial statement. c. The unit of measure in the financial statement. d. T

> Which of the following regarding retained earnings is false? a. Retained earnings is increased by net income and decreased by a net loss. b. Retained earnings is a component of stockholders’ equity on the balance sheet. c. Retained earnings is an asset o

> Which of the following is true? a. FASB creates SEC. b. GAAP creates FASB. c. SEC creates AICPA. d. FASB creates U.S. GAAP.

> As stated in the audit report, or Report of Independent Accountants, the primary responsibility for a company’s financial statements lies with a. The owners of the company. b. Independent financial analysts. c. The auditors. d. The company’s management.

> Which of the following is not one of the four basic financial statements? a. Balance sheet b. Audit report c. Income statement d. Statement of cash flows

> Identify whether the following transactions affect cash flow from operating, investing, or financing activities, and indicate the effect of each on cash (+ for increase and − for decrease). If there is no cash flow effect, write â

> Refer to the financial statements of American Eagle Outfitters in Appendix B, Urban Outfitters in Appendix C, and the Industry Ratio Report in Appendix D at the end of this book. Financial statements of American Eagle: Financial statements of Urban Outf

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book. Data from Urban Outfitters: Required: 1. Use the company’s balance sheet to determine the amounts in the accounting equation (A = L + SE) as

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Data from American Eagle Outfitters: Required: 1. Is the company a corporation, a partnership, or a sole proprietorship? How do you know? 2. The compan

> Assume that you are the president of Highlight Construction Company. At the end of the first year of operations (December 31), the following financial data for the company are available: Cash ………………………………………………………………………………………$25,600 Receivables from cu

> On January 1 of the current year, three individuals organized Northwest Company as a corporation. Each individual invested $10,000 cash in the business. On December 31 of the current year, they prepared a list of resources owned (assets) and debts owed (

> Huang Trucking Company was organized on January 1. At the end of the first quarter (three months) of operations, the owner prepared a summary of its activities as shown in item (a) of the following table: Required: 1. For items (b) through (g), enter wh

> During the summer between his junior and senior years, James Cook needed to earn sufficient money for the coming academic year. Unable to obtain a job with a reasonable salary, he decided to try the lawn care business for three months. After a survey of

> Explain the equation for the income statement. What are the three major items reported on the income statement?

> Briefly define net income and net loss.

> What information should be included in the heading of each of the four primary financial statements?

> Complete the following matrix by entering either increase or decrease in each cell: Item Debit Credit Revenues Losses Gains Expenses

> Complete the following: Name of Statement Alternative Title a. Income statement a. b. Balance sheet

> The accounting process generates financial reports for both internal and external users. Identify some of the groups of users.

> Briefly distinguish financial accounting from managerial accounting.

> Define accounting.

> (Supplement A) Briefly differentiate between a sole proprietorship, a partnership, and a corporation. Supplement A: Types of Business Entities: This textbook emphasizes accounting for profit-making business entities. The three main types of business ent

> Briefly explain the responsibility of company management and the independent auditors in the accounting communication process.

> Briefly describe the way that accounting measurement rules (generally accepted accounting principles) are determined in the United States.

> The financial statements discussed in this chapter are aimed at external users. Briefly explain how a company’s internal managers in different functional areas (e.g., marketing, purchasing, human resources) might use financial statement information from

> Explain the equation for retained earnings. Explain the four major items reported on the statement of stockholders’ equity related to retained earnings.

> Explain the equation for the statement of cash flows. Explain the three major components reported on the statement of cash flows.

> Complete the following matrix by entering either debit or credit in each cell: Item Increase Decrease Revenues Losses Gains Expenses

> Explain the equation for the balance sheet. Define the three major components reported on the balance sheet.

> Briefly explain the importance of assets and liabilities to the decisions of investors and creditors.

> Explain why the income statement and the statement of cash flows are dated “For the Year Ended December 31,” whereas the balance sheet is dated “At December 31.”

> What are the purposes of (a) the income statement, (b) the balance sheet, (c) the statement of cash flows, and (d) the statement of stockholders’ equity.

> What is an accounting entity? Why is a business treated as a separate entity for accounting purposes?

> Briefly distinguish investors from creditors.

> (Supplement B) List and briefly explain the three primary services that CPAs in public practice provide. Supplement B: Employment in the Accounting Profession Today: Since 1900, accounting has attained the stature of professions such as law, medicine, e

> Apple Inc., headquartered in Cupertino, California, designs, manufactures, and markets mobile communication and media devices, personal computers, and portable digital music players and sells a variety of related software and services. The following is A

> Cougar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: Cash $22,000 Accounts payable $15,000 Investments (short-term) 3

> East Hill Home Healthcare Services was organized by four friends who each invested $10,000 in the company and, in turn, was issued 8,000 shares of $1.00 par value stock. To date, they are the only stockholders. At the end of last year, the accounting rec

> Explain why revenues are recorded as credits and expenses are recorded as debits.

> Exxon Mobil Corporation explores, produces, refines, markets, and supplies crude oil, natural gas, and petroleum products in the United States and around the world. The following are accounts from a recent balance sheet of Exxon Mobil Corporation: Requi