Question: Comparative financial statement data of Bloomfield

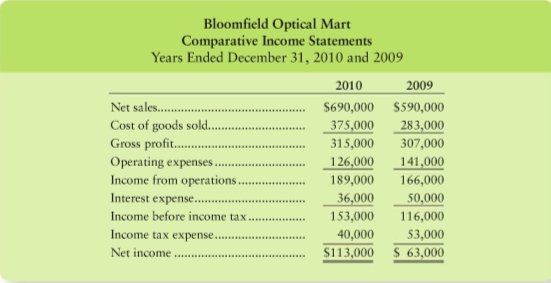

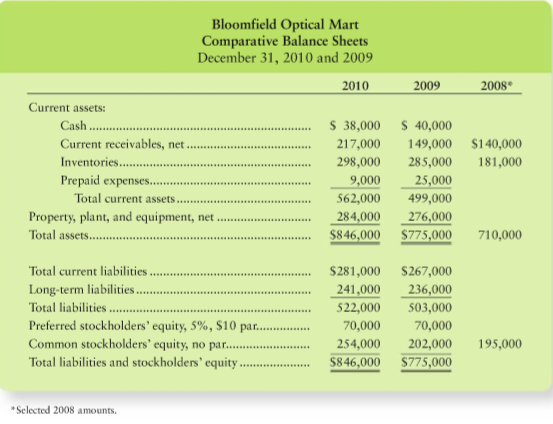

Comparative financial statement data of Bloomfield Optical Mart follow:

Other information:

1. Market price of Bloomfield common stock: $82.20 at December 31, 2010, and $52.96 at December 31, 2009.

2. Common shares outstanding: 20,000 during 2010 and 18,000 during 2009.

3. All sales on credit.

Requirements

1. Compute the following ratios for 2010 and 2009:

a. Current ratio

b. Inventory turnover

c. Times-interest-earned ratio

d. Return on assets

e. Return on common stockholders’ equity

f. Earnings per share of common stock

g. Price/earnings ratio

2. Decide whether

(a) Bloomfields financial position improved or deteriorated during 2010 and

(b) the investment attractiveness of Bloomfields common stock appears to have increased or decreased.

3. How will what you learned in this problem help you evaluate an investment?

Transcribed Image Text:

Bloomfield Optical Mart Comparative Income Statements Years Ended December 31, 2010 and 2009 2010 2009 Net sales . Cost of goods sold. Gross profit. $690,000 $590,000 375,000 283,000 307,000 315,000 Operating expenses . Income from operations. Interest expense.. Income before income tax . 126,000 141,000 189,000 166,000 36,000 153,000 50,000 116,000 Income tax expense... 40,000 53,000 Net income $113,000 $ 63,000 Bloomfield Optical Mart Comparative Balance Sheets December 31, 2010 and 2009 2010 2009 2008* Current assets: Cash $ 38,000 $ 40,000 Current receivables, net . 217,000 149,000 $140,000 Inventories. 298,000 285,000 181,000 Prepaid expenses. 9,000 562,000 25,000 Total current assets. 499,000 Property, plant, and equipment, net. 284,000 276,000 $846,000 $775,000 Total assets. 710,000 $281,000 $267,000 236,000 503,000 Total current liabilities . Long-term liabilities.. Total liabilities . Preferred stockholders' equity, 5%, $10 par.. Common Stockholders' equity, no par.. 241,000 522,000 70,000 70,000 254,000 202,000 195,000 Total liabilities and stockholders' equity. $846,000 S775,000 *Selected 2008 amounts.

> What were the dollar amount of change and the percentage of each change in Wilderness Lodges working capital during 2010 and 2009? Is this trend favorable or unfavorable? 2010 2009 2008 Total current assets $270,000 $320,000 $340,000 Total current li

> How many items enter the computation of Sheehans net cash provided by operating activities? a. 3 b. 2 c. 7 d. 5

> Click Camera Co. sold equipment with a cost of $21,000 and accumulated depreciation of $9,000 for an amount that resulted in a gain of $1,000. What amount should Click report on the statement of cash flows as proceeds from sale of plant assets ? a. $10,0

> Hialeah Bells long-term debt bears interest at 11%. During the year ended December 31, 2010, Bells times-interest-earned ratio was a. 137 times. b. 144 times. c. 147 times. d. 150 times.

> Onan indirect method statement of cash flows,a gain on the sale of plant assetswould be a. reported in the investing activities section. b. added to net income in the operating activities section. c. deducted from net income in the operating activitie

> Hialeah Bells days sales in average receivables during 2010 was a. 29 days. b. 117 days. c. 21 days. d. 25 days

> Hialeah Bells common-size income statement for 2010 would report cost of goods sold as a. 79.5%. b. Up by 16.8%. c. 130.5%. d. $34,000 million.

> Which of the following terms appears on a statement of cash flows indirect method? a. Cash receipt of interest revenue b. Collections from customers c. Depreciation expense d. Payments to suppliers

> What is the largest single item included in Hialeah Bells debt ratio at December 31, 2010? a. Cash and cash equivalents b. Investments c. Accounts payable d. Common stock

> Hialeah Bells acid-test ratio at year-end 2010 is closest to a. $0.68. b. $0.75. c. $8,533 million. d. 0.45.

> Hialeah Bells current ratio at year end 2010 is closest to a. 1.2. b. 9,390. c. 20.8. d. 0.9.

> Motorsports of Miami, Inc., reported the following financial statements for 2010: Compute the following investing cash flows: (Enter all amounts in thousands.) a. Acquisitions of plant assets (all were for cash). Motorsports of Miami sold no plant ass

> During 2010, Hialeah Bells total assets a. increased by $9,390 million. b. increased by 26.2%. c. both a and b. d. increased by 20.8%.

> Income Tax Payable was $4,500 at the end of the year and $3,000 at the beginning. Income tax expense for the year totaled $59,500. What amount of cash did the company pay for income tax during the year? a. $62,500 b. $58,000 c. $61,000 d. $59,500

> Credit sales totaled $820,000, accounts receivable increased by $50,000, and accounts payable decreased by $30,000. How much cash did the company collect from customers? a. $800,000 b. $820,000 c. $770,000 d. $870,000

> Sheehans net cash flow from financing activities for 2010 was a. net cash used of $21,000. b. net cash used of $50,000. c. net cash provided of $9,000. d. net cash used of $44,000.

> Sheehans largest financing cash flow for 2010 resulted from a. payment of dividends. b. sale of equipment. c. purchase of equipment. d. issuance of common stock.

> Book value per share of Hialeah Bells common stock outstanding at December 31, 2010, was a. $5,649. b. $1.84. c. $1.96. d. $2.08.

> How many shares of common stock did Hialeah Bell have outstanding, on average, during 2010? Hint: Compute earnings per share. a. 2,947 million b. 5,258 million c. 5,244 million d. 2,965 million

> Examine the statement of cash flows of Clock, Inc. Suppose Clocks operating activities provided, rather than used, cash. Identify three things under the indirect method that could cause operating cash flows to be positive. Clock, Inc. Consolidated S

> U.S. Rondeau, Inc., has experienced an unbroken string of nine years of growth in net income. Nevertheless, the company is facing bankruptcy. Creditors are calling all of U.S. Rondeaus loans for immediate payment, and the cash is simply not available. It

> Fitzgerald Corporation reported the following amounts on its 2010 comparative income statement: Perform a horizontal analysis of revenues and net income both in dollar amounts and in percentages for 2010 and 2009. (In thousands) 2010 2009 2008 Reven

> Use the data in Short Exercise 12-7 to prepare Ethan Corporations statement of cash flows for the year ended June 30, 2010. Ethan uses the indirect method for operating activities. From 12-7: Ethan Corporation accountants have assembled the following da

> Use the financial statements of Gagnon, Inc., in Short Exercises 13-6 and 13-7 to compute these profitability measures for 2010. Show each computation. a. Rate of return on sales. b. Rate of return on total assets. c. Rate of return on common stockhol

> Use the financial statements of Gagnon, Inc., in Short Exercises 13-6 and 13-7. Requirements 1. Compute the companys debt ratio at December 31, 2010. 2. Compute the companys times-interest-earned ratio for 2010. For operating income, use income befor

> Use the Gagnon 2010 income statement below and balance sheet from Short Exercise 13-6 to compute the following: a. Gagnons rate of inventory turnover for 2010. b. Days sales in average receivables during 2010. (Round dollar amounts to one decimal place

> The comparative balance sheets of Franny Franklin Design Studio, Inc., at June 30, 2010 and 2009, and transaction data for fiscal 2010 are as follows: Transaction data for the year ended June 30, 2010: a. Net income, $73,400 b. Depreciation expense on

> Use the Gagnon, Inc., balance sheet data on the following page. Requirements 1. Compute Gagnon, Inc.s acid-test ratio at December 31, 2010 and 2009. 2. Use the comparative information from the table on the bottom of page 811 for Horner, Inc., Isaacson

> Dunleavy Furniture Gallery, Inc., provided the following data from the companys records for the year ended December 31, 2010: a. Credit sales, $567,000 b. Loan to another company, $12,800 c. Cash payments to purchase plant assets, $59,900 d. Cost of g

> Examine the financial data of Jacob Corporation. Show how to compute Jacobs current ratio for each year 2008 through 2010. Is the company’s ability to pay its current liabilities improving or deteriorating? Year Ended December 31 2

> Hartigan, Inc., and Pintal Corporation are competitors. Compare the two companies by converting their condensed income statements to common size. Which company earned more net income? Which companys net income was a higher percentage of its net sales? E

> Craft Software reported the following amounts on its balance sheets at December 31, 2010, 2009, and 2008: Sales and profits are high. Nevertheless, Craft is experiencing a cash shortage. Perform a vertical analysis of Craft Softwares assets at the end o

> Neighbor Software Corp. has assembled the following data for the year ended December 31, 2010: Requirement 1. Prepare Neighbor Software Corp.s statement of cash flows using the indirect method to report operating activities. Include an accompanying sch

> Use the consolidated financial statements and the data in Amazon.com, Inc. s annual report (Appendix A at the end of the book) to evaluate the companys comparative performance for 2008 versus 2007. Does the company appear to be improving or declining in

> Use the Sweet Automobiles of Pepperell, Inc., data from Problem 12-69B. Requirements 1. Prepare Sweets income statement for the year ended December 31, 2010. Use the singlestep format, with all revenues listed together and all expenses together. 2. Pr

> Sweet Automobiles of Pepperell, Inc., was formed on January 1, 2010. The following transactions occurred during 2010: On January 1, 2010, Sweet issued its common stock for $350,000. Early in January, Sweet made the following cash payments: a. $140,000 f

> The comparative balance sheets of Stephen Summers Design Studio, Inc., at June 30, 2010 and 2009, and transaction data for fiscal 2010 are as follows: Transaction data for the year ended June 30, 2010: a. Net income, $80,700 b. Depreciation expense on

> Compute economic value added (EVA) for Beverly Software. The companys cost of capital is 5%. Net income was $770 thousand, interest expense $409 thousand, beginning long-term debt $700 thousand, and beginning stockholders equity was $3,060 thousand. Roun

> Ramirez Furniture Gallery, Inc., provided the following data from the company’s records for the year ended May 31, 2010: a. Credit sales, $584,500 b. Loan to another company, $12,300 c. Cash payments to purchase plant assets, $72,100 d. Cost of goods

> Take the role of an investment analyst at Merrimack Lowell. It is your job to recommend investments for your client. The only information you have is the following ratio values for two companies in the graphics software industry. Write a report to the M

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to CDROM.com and E-shop Stores and have assembled the following data. Selected income statement data for current year: Selected balance sheet and market pric

> Comparative financial statement data of Rourke Optical Mart follow: Other information: 1. Market price of Rourke common stock: $78.12 at December 31, 2010, and $59.10 at December 31, 2009. 2. Common shares outstanding: 19,000 during 2010 and 17,000 du

> Morgensen Software Corp. has assembled the following data for the years ending December 31, 2010 and 2009. Requirement 1. Prepare Morgensen Software Corp.s statement of cash flows using the indirect method to report operating activities. Include an ac

> Use the Antique Automobiles of Dallas, Inc., data from Problem 12-60A. Requirements 1. Prepare Antiques income statement for the year ended December 31, 2010. Use the single-step format, with all revenues listed together and all expenses together. 2.

> Use Amazon.com, Inc. s consolidated statement of cash flows along with the companys other consolidated financial statements, all in Appendix A at the end of the book, to answer the following questions. Requirements 1. By which method does Amazon.com, I

> Antique Automobiles of Dallas, Inc., was formed on January 1, 2010. The following transactions occurred during 2010: On January 1, 2010, Antique issued its common stock for $440,000. Early in January , Antique made the following cash payments: a. $180,0

> The annual report of Tri-State Cars, Inc., for the year ended December 31, 2010, included the following items (in millions): Requirements 1. Compute earnings per share (EPS) and the price/earnings ratio for Tri-State Cars stock. Round to the nearest ce

> Ethan Corporation accountants have assembled the following data for the year ended June 30, 2010. Prepare the operating activities section of Ethans statement of cash flows for the year ended June 30, 2010. Ethan uses the indirect method for operating c

> Assume that you are considering purchasing stock as an investment. You have narrowed the choice to DVR.com and Express Shops and have assembled the following data. Selected income statement data for the current year: Selected balance sheet and market p

> Financial statement data of Greatland Engineering include the following items: Requirements 1. Compute Greatlands current ratio, debt ratio, and earnings per share. (Round all ratios to two decimal places.) 2. Compute the three ratios after evaluating

> You are evaluating two companies as possible investments. The two companies, similar in size, are commuter airlines that fly passengers up and down the West Coast. All other available information has been analyzed and your investment decision depends on

> Campbell Clinic, Inc., is preparing its statement of cash flows (indirect method) for the year ended March 31, 2010. Consider the following items in preparing the companys statement of cash flows. Identify each item as an operating activity addition to n

> Beautiful America Transportation (BAT) began 2010 with accounts receivable, inventory, and prepaid expenses totaling $58,000. At the end of the year, BAT had a total of $55,000 for these current assets. At the beginning of 2010, BAT owed current liabilit

> Top managers of Tranquility Inns are reviewing company performance for 2010. The income statement reports a 25% increase in net income over 2009. However, most of the increase resulted from an extraordinary gain on insurance proceeds from fire damage to

> Use the Foot Locker, Inc., consolidated financial statements in Appendix B at the end of this book to address the following questions. 1. Perform a trend analysis of Foot Lockers net sales, gross profit, operating income, and net income. Use 2005 as the

> Compute four ratios that measure the ability to earn profits for Harmon Decor, Inc., whose comparative income statements follow: Additional data: Harmon Decor, Inc. Comparative Income Statements Years Ended December 31, 2010 and 2009 2010 2009 Net s

> Identify any weaknesses revealed by the statement of cash flows of California Fruit Growers, Inc. California Fruit Growers, Inc. Statement of Cash Flows For the Current Year Operating activities: Income from operations.. Add (subtract) noncash items:

> Fore Golf Company has requested that you perform a vertical analysis of its balance sheet to determine the component percentages of its assets, liabilities, and stockholder’s equity. Fore Golf Company Balance Sheet December 31, 2010

> Compute the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable are $20,000 and $17,000, respectively. Credit sales for the period total $61,000. How much are cash collections from customers? b. Cost of goods so

> Two companies with different economic-value-added (EVA) profiles are Houle Oil Pipeline, Inc., and Johnson Bank Limited. Adapted versions of the two company’s financial statements are presented here (in millions): Requirements 1. Befo

> Compute four ratios that measure the ability to earn profits for Jarvis Decor, Inc., whose comparative income statements follow: Additional data: Did the companys operating performance improve or deteriorate during 2010? Jarvis Decor, Inc. Comparat

> Identify any weaknesses revealed by the statement of cash flows of Massachusetts Chowder Distributors, Inc. Massachusetts Chowder Distributors, Inc. Statement of Cash Flows For the Current Year Operating activities: Income from operations.. $ 77,000

> Epsilon Golf Company has requested that you perform a vertical analysis of its balance sheet to determine the component percentages of its assets, liabilities, and stockholders equity Epsilon Golf Company Balance Sheet December 31, 2010 Assets Total

> Two companies with different economic-value-added (EVA) profiles are Barton Oil Pipeline Incorporated and Crompton Bank Limited. Adapted versions of the two companies financial statements are presented here (in millions): Requirements 1. Before perform

> The following data (dollar amounts in millions) are from the financial statements of County Corporation: Requirement 1. Complete the following condensed income statement. Report amounts to the nearest million dollars. Average stockholders' equity.

> Refer to the Foot Locker, Inc., consolidated financial statements in Appendix B at the end of this book. Focus on fiscal 2007 (year ended February 2, 2008). 1. What is Foot Locker, Inc.s main source of cash? Is this good news or bad news to Foot Locker

> Delorme Specialties reported the following at December 31, 2010 (in thousands): Requirement 1. Determine the following items for Delorme Specialties during 2010: a. Gain or loss on the sale of property and equipment b. Amount of long-term debt issued

> Tip Top, Inc., reported the following in its financial statements for the year ended May 30, 2010 (in thousands): Requirement 1. Determine the following cash receipts and payments for Tip Top, Inc., during 2010: (Enter all amounts in thousands.) a. Co

> The following data (dollar amounts in millions) are taken from the financial statements of Floor 1 Industries, Inc.: Requirement 1. Complete the following condensed balance sheet. Report amounts to the nearest million dollars. Total liabilities...

> The income statement and additional data of Happy Life, Inc., follow: Additional data: a. Collections from customers are $16,500 more than sales. b. Payments to suppliers are $1,200 more than the sum of cost of goods sold plus advertising expense. c.

> Evaluate the common stock of Basic Distributing Company as an investment. Specifically, use the three common stock ratios to determine whether the common stock increased or decreased in attractiveness during the past year. 2010 2009 Net income.. $ 91

> The accounting records of One Stop Pharmaceuticals, Inc., reveal the following: Requirement 1. Compute cash flows from operating activities by the direct method. Also evaluate One Stops operating cash flow. Give the reason for your evaluation. Paym

> Compute the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, are $102,000 and $97,000, respectively. Depreciation for the period was $12,000, and purchases of new plant assets were $30,000. Plant assets were so

> Con-sider three independent cases for the cash flows of 424 Promenade Shoes. For each case, identify from the statement of cash flows how 424 Promenade Shoes generated the cash to acquire new plant assets. Rank the three cases from the healthiest financi

> The income statement and additional data of Norton Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $170,000. Of this amount, $140,000 was paid in cash and $30,000 by signing a note payable. b. Proceeds from sale of

> The accounting records of Lawrence Fur Traders include these accounts: Requirement 1. Compute Lawrences net cash provided by (used for) operating activities during October. Use the indirect method. Does Lawrence have trouble collecting receivables or s

> Turnberry Golf Corporations long-term debt agreements make certain demands on the business. For example, Turnberry may not purchase treasury stock in excess of the balance of retained earnings. Also, long-term debt may not exceed stockholders equity , an

> The accounting records of Central Distributors, Inc., reveal the following: Requirement 1. Compute cash flows from operating activities by the indirect method. Use the format of the operating activities section of Exhibit 12-6. Also evaluate the operat

> Indicate whether each of the following transactions records an operating activity, an investing activity, a financing activity, or a noncash investing and financing activity. Cash 85,000 g. Equipment 15,600 a. Common Stock 14,000 Cash 15,600 Capital

> Burke-Cassidy Investments specializes in low-risk government bonds. Identify each of Burke-Cassidys transactions as operating (O), investing (I), financing (F), noncash investing and financing (NIF), or a transaction that is not reported on the statement

> Compute the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable are $25,000 and $20,000, respectively. Credit sales for the period total $62,000. How much are cash collections from customers? b. Cost of goods so

> The income statement and additional data of Cobbs Hill, Inc., follow: Additional data: a. Collections from customers are $13,000 more than sales. b. Payments to suppliers are $1,300 less than the sum of cost of goods sold plus advertising expense. c.

> Evaluate the common stock of Regal Distributing Company as an investment. Specifically, use the three common stock ratios to determine whether the common stock increased or decreased in attractiveness during the past year. 2010 2009 Net income.. $ 83

> The accounting records of Princeton Pharmaceuticals, Inc., reveal the following: Requirement 1. Compute cash flows from operating activities by the direct method. Also evaluate Princeton’s operating cash flow. Give the reason for your

> Compute the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, are $110,000 and $106,000, respectively. Depreciation for the period was $9,000, and purchases of new plant assets were $33,000. Plant assets were so

> Consider three independent cases for the cash flows of 579 Pavilion Shoes. For each case, identify from the statement of cash flows how 579 Pavilion Shoes generated the cash to acquire new plant assets. Rank the three cases from the most healthy financia

> The income statement and additional data of Newbury Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $212,000. Of this amount, $160,000 was paid in cash and $52,000 by signing a note payable. b. Proceeds from sale of

> Suppose AOL Time Warner, Inc., is having a bad year in 2011, as the company has incurred a $4.9 billion net loss. The loss has pushed most of the return measures into the negative column and the current ratio dropped below 1.0. The companys debt ratio is

> The accounting records of Wilderness Fur Traders include these accounts: Requirement 1. Compute Wilderness net cash provided by (used for) operating activities during May. Use the indirect method. Does Wilderness have trouble collecting receivables or

> The accounting records of North East Distributors, Inc., reveal the following: Requirement 1. Compute cash flows from operating activities by the indirect method. Use the format of the operating activities section of Exhibit 12-6. Also evaluate the ope

> A skeleton of Athol Country Florists income statement appears as follows (amounts in thousands): Use the following ratio data to complete Athol Country Florists income statement: a. Inventory turnover was 4 (beginning inventory was $784; ending invento

> Tucker-Breen Investments specializes in low-risk government bonds. Identify each of Tucker-Breens transactions as operating (O), investing (I), financing (F), noncash investing and financing (NIF), or a transaction that is not reported on the statement o

> Use the data in Short Exercise 12-14 to prepare Middleton Golf Club, Inc.s statement of cash flows for the year ended September 30, 2010. Middleton uses the direct method for operating activities. From 12-14: Middleton Golf Club, Inc., has assembled the

> Middleton Golf Club, Inc., has assembled the following data for the year ended September 30, 2010: Prepare the operating activities sectionof Middleton Golf Club, Inc.s statement of cash flows for the year ended September 30, 2010. Middleton uses the di

> Horse Heaven Horse Farm, Inc., began 2010 with cash of $170,000. During the year, Horse Heaven earned service revenue of $590,000 and collected $480,000 from customers. Expenses for the year totaled $320,000, with $310,000 paid in cash to suppliers and e

> Use the Motorcars of Miami data in Short Exercise 12-9 to compute the following: (Enter all amounts in thousands). a. Payments to employees b. Payments of other expenses from 12-9: Motorsports of Miami, Inc., reported the following financial statement

> A skeleton of Athol Country Florists balance sheet appears as follows (amounts in thousands): Use the following ratio data to complete Athol Country Florists balance sheet: a. Debt ratio is 0.50. b. Current ratio is 1.30. c. Acid-test ratio is 0.40.

> Selected accounts of Elizabeth Antiques show the following: Requirement 1. For each account, identify the item or items that should appear on a statement of cash flows prepared by the direct method. State where to report the item. Salary Payable Be

> Selected accounts of Ashley Antiques show the following: Requirement 1. For each account, identify the item or items that should appear on a statement of cash flows prepared by the direct method. State where to report the item. Salary Payable Begin

> Indicate whether each of the following transactions records an operating activity , an investing activity , a financing activity , or a noncash investing and financing activity . Depreciation Expense Accumulated Depreciation a. 11,000 h. Cash 50,000