Question: Comparative statements of shareholders’ equity for

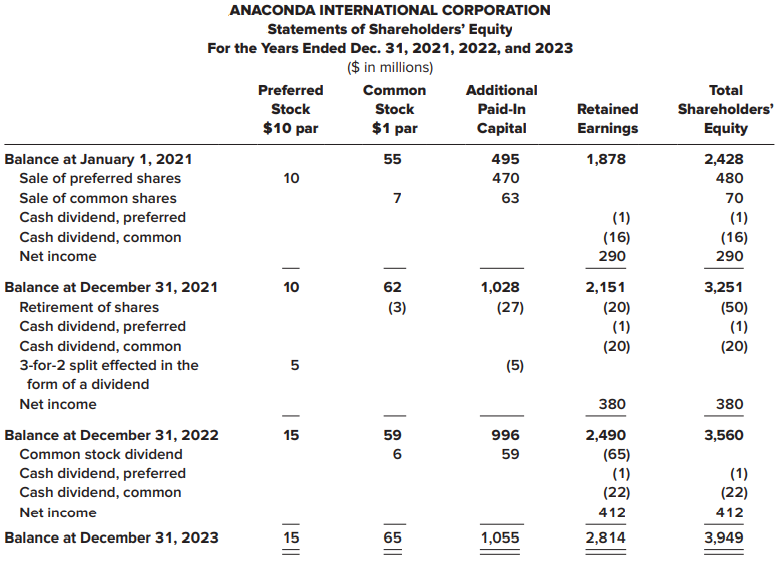

Comparative statements of shareholders’ equity for Anaconda International Corporation were reported as follows for the fiscal years ending December 31, 2021, 2022, and 2023.

Required:

1. Infer from the statements the events and transactions that affected Anaconda International Corporation’s shareholders’ equity during 2021, 2022, and 2023. Prepare the journal entries that reflect those events and transactions. (Hint: In lieu of revenues and expenses, use an account titled “Income summary†to close net income or net loss.)

2. Prepare the shareholders’ equity section of Anaconda’s comparative balance sheets at December 31, 2023 and 2022.

> Digital Telephony issued 10% bonds, dated January 1, with a face amount of $32 million on January 1, 2021. The bonds mature in 2031 (10 years). For bonds of similar risk and maturity the market yield is 12%. Interest is paid semiannually on June 30 and D

> The comparative balance sheets for 2021 and 2020 are given below for Surmise Company. Net income for 2021 was $50 million. Required: Prepare the statement of cash flows of Surmise Company for the year ended December 31, 2021. Use the indirect method to p

> Following are selected balance sheet accounts of Del Conte Corp. at December 31, 2021 and 2020, and the increases or decreases in each account from 2020 to 2021. Also presented is selected income statement information for the year ended December 31, 2021

> Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2021. At January 1, 2021, the corporation had outstanding 105 million common shares, $1 par per share. Required: 1. From the information pr

> The comparative balance sheets for 2021 and 2020 and the income statement for 2021 are given below for Arduous Company. Additional information from Arduous’s accounting records is provided also. Additional information from the accountin

> At the beginning of 2021, Wagner Implements undertook a variety of changes in accounting methods, corrected several errors, and instituted new accounting policies. Required: Indicate for each item 1 to 10 below the type of change and the reporting approa

> Described below are six independent and unrelated situations involving accounting changes. Each change occurs during 2021 before any adjusting entries or closing entries were prepared. Assume the tax rate for each company is 25% in all years. Any tax eff

> In 2021, the Marion Company purchased land containing a mineral mine for $1,600,000. Additional costs of $600,000 were incurred to develop the mine. Geologists estimated that 400,000 tons of ore would be extracted. After the ore is removed, the land will

> For the Coca-Cola bonds described in BE 12–2, prepare journal entries to record (a) any unrealized gains or losses occurring in 2021 and (b) the sale of the bonds in 2022. Data from BE 12-2: S&L Financial buys and sells securities expecting to earn prof

> The year-end adjusted trial balance of the Timmons Tool and Die Corporation included the following account balances: retained earnings, $220,000; dividends, $12,000; sales revenue, $850,000; cost of goods sold, $580,000; salaries expense, $180,000; rent

> During 2019 and 2020, Faulkner Manufacturing used the sum-of-the-years’-digits (SYD) method of depreciation for its depreciable assets, for both financial reporting and tax purposes. At the beginning of 2021, Faulkner decided to change

> Fantasy Fashions had used the LIFO method of costing inventories, but at the beginning of 2021 decided to change to the FIFO method. The inventory as reported at the end of 2020 using LIFO would have been $20 million higher using FIFO. Retained earnings

> The Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1982. In 2021, the company decided to change to the average cost method. Data for 2021 are as follows: Additional Information: 1

> Shown below are net income amounts as they would be determined by Weihrich Steel Company by each of three different inventory costing methods ($ in thousands). Required: 1. Assume that Weihrich used FIFO before 2021, and then in 2021 decided to switch to

> The Pyramid Company has used the LIFO method of accounting for inventory during its first two years of operation, 2019 and 2020. At the beginning of 2021, Pyramid decided to change to the average cost method for both tax and financial reporting purposes.

> George Young Industries (GYI) acquired industrial robots at the beginning of 2018 and added them to the company’s assembly process. During 2021, management became aware that the $1 million cost of the equipment was inadvertently recorde

> You are internal auditor for Shannon Supplies, Inc., and are reviewing the company’s preliminary financial statements. The statements, prepared after making the adjusting entries, but before closing entries for the year ended December 3

> Conrad Playground Supply underwent a restructuring in 2021. The company conducted a thorough internal audit, during which the following facts were discovered. The audit occurred during 2021 before any adjusting entries or closing entries are prepared. a.

> Whaley Distributors is a wholesale distributor of electronic components. Financial statements for the years ended December 31, 2019 and 2020, reported the following amounts and subtotals ($ in millions): In 2021, the following situations occurred or came

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2009 by two talented engineers with little business training. In 2021, the company was acquired by one of its major customers. As part of an internal audit, the fol

> S&L Financial buys and sells securities expecting to earn profits on short-term differences in price. On December 27, 2021, S&L purchased Coca-Cola bonds at par for $875,000 and sold the bonds on January 3, 2022, for $880,000. At December 31, the bonds h

> Williams-Santana Inc. is a manufacturer of high-tech industrial parts that was started in 2009 by two talented engineers with little business training. In 2021, the company was acquired by one of its major customers. As part of an internal audit, the fol

> The Collins Corporation purchased office equipment at the beginning of 2019 and capitalized a cost of $2,000,000. This cost included the following expenditures: The company estimated an eight-year useful life for the equipment. No residual value is antic

> You have been hired as the new controller for the Ralston Company. Shortly after joining the company in 2021, you discover the following errors related to the 2019 and 2020 financial statements: a. Inventory at 12/31/2019 was understated by $6,000. b. In

> The Cecil-Booker Vending Company changed its method of valuing inventory from the average cost method to the FIFO cost method at the beginning of 2021. At December 31, 2020, inventories were $120,000 (average cost basis) and were $124,000 a year earlier.

> Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. At December 31, 2018, paid-in capital consisted of the following: Common stock, 1,855,000 share

> On December 31, 2020, Ainsworth, Inc., had 600 million shares of common stock outstanding. Twenty million shares of 8%, $100 par value cumulative, nonconvertible preferred stock were sold on January 2, 2021. On April 30, 2021, Ainsworth purchased 30 mill

> LCI Cable Company grants 1 million performance stock options to key executives at January 1, 2021. The options entitle executives to receive 1 million of LCI $1 par common shares, subject to the achievement of specific financial goals over the next four

> JBL Aircraft manufactures and distributes aircraft parts and supplies. Employees are offered a variety of share-based compensation plans. Under its nonqualified stock option plan, JBL granted options to key officers on January 1, 2021. The options permit

> Walters Audio Visual, Inc., offers a stock option plan to its regional managers. On January 1, 2021, 40 million options were granted for 40 million $1 par common shares. The exercise price is the market price on the grant date, $8 per share. Options cann

> Refer to the situation described in P 19–2. Assume Pastner prepares its financial statements using International Financial Reporting Standards (IFRS). Required: Would your responses to requirement 1 and requirement 2 be the same using I

> Assume the same facts as in BE 12–18, but that LED does not plan to sell the investment and does not think it is more likely than not that it will have to sell the investment before fair value recovers. What journal entries should LED record to account f

> Refer to the situation described in P 19–2. Assume Pastner measures the fair value of all options on January 1, 2021, to be $4.50 per option using a single weighted-average expected life of the options assumption. Required: 1. Determine

> Pastner Brands is a calendar-year firm with operations in several countries. As part of its executive compensation plan, at January 1, 2021, the company issued 400,000 executive stock options permitting executives to buy 400,000 shares of Pastner stock f

> Witter House is a calendar-year firm with 300 million common shares outstanding throughout 2021 and 2022. As part of its executive compensation plan, at January 1, 2020, the company had issued 30 million executive stock options permitting executives to b

> At January 1, 2021, Canaday Corporation had outstanding the following securities: 600 million common shares 20 million 6% cumulative preferred shares, $50 par 6.4% convertible bonds, $2,000 million face amount, convertible into 80 million common shares T

> On January 1, 2021, Tonge Industries had outstanding 440,000 common shares ($l par) that originally sold for $20 per share, and 4,000 shares of 10% cumulative preferred stock ($100 par), convertible into 40,000 common shares. On October 1, 2021, Tonge so

> At December 31, 2021, the financial statements of Hollingsworth Industries included the following: Net income for 2021 = $560 million Bonds payable, 8%, convertible into 36 million shares of common stock = $300 million Common stock: Shares outstanding on

> Alciatore Company reported a net income of $150,000 in 2021. The weighted-average number of common shares outstanding for 2021 was 40,000. The average stock price for 2021 was $33. Assume an income tax rate of 25%. Required: For each of the following ind

> Information from the financial statements of Henderson-Niles Industries included the following at December 31, 2021: Common shares outstanding throughout the year 100 million Convertible preferred shares (convertible into 32 million shares of common) 60

> On December 31, 2020, Dow Steel Corporation had 600,000 shares of common stock and 300,000 shares of 8%, noncumulative, nonconvertible preferred stock issued and outstanding. Dow issued a 4% common stock dividend on May 15 and paid cash dividends of $400

> On December 31, 2020, Dow Steel Corporation had 600,000 shares of common stock and 300,000 shares of 8%, noncumulative, nonconvertible preferred stock issued and outstanding. Dow issued a 4% common stock dividend on May 15 and paid cash dividends of $400

> Turner Company purchased 40% of the outstanding stock of ICA Company for $10,000,000 on January 2, 2021. Turner elects the fair value option to account for the investment. During 2021, ICA reports $750,000 of net income and on December 30 pays a dividend

> On December 31, 2020, Dow Steel Corporation had 600,000 shares of common stock and 300,000 shares of 8%, noncumulative, nonconvertible preferred stock issued and outstanding. Dow issued a 4% common stock dividend on May 15 and paid cash dividends of $400

> Comparative Statements of Shareholders’ Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2019, 2020, and 2021. Required: Infer from the statements the events and transactions

> On October 15, 2020, the board of directors of Ensor Materials Corporation approved a stock option plan for key executives. On January 1, 2021, 20 million stock options were granted, exercisable for 20 million shares of Ensor’s $1 par common stock. The o

> The shareholders’ equity of Kramer Industries includes the data shown below. During 2022, cash dividends of $150 million were declared. Dividends were not declared in 2020 or 2021. Common stock: $200 Paid-in capital—excess of par, common: 800 Preferred s

> During its first year of operations, Cupola Fan Corporation issued 30,000 of $1 par Class B shares for $385,000 on June 30, 2021. Share issue costs were $1,500. One year from the issue date (July 1, 2022), the corporation retired 10% of the shares for $3

> The following is a portion of the Statement of Shareholders’ Equity from Cisco Systems’ July 29, 2017 annual report. Required: 1. How does Cisco account for its share buybacks? Treasury stock or retired shares? 2. For

> Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie Corporation during the period 2021–2023. At December 31, 2020, the corporation’s accounts included: a. Novembe

> Comparative statements of retained earnings for Renn-Dever Corporation were reported in its 2021 annual report as follows. At December 31, 2018, common shares consisted of the following: Common stock, 1,855,000 shares at $1 par: $1,855,000 Paid-in capita

> National Supply’s shareholders’ equity included the following accounts at December 31, 2020: Shareholders’ Equity Common stock, 6 million shares at $1 par $ 6,000,000 Paid-in capital—excess of par 30,000,000 Retained earnings 86,500,000 Required: 1. Nati

> At the beginning of 2021, Pioneer Products’ ownership interest in the common stock of LLB Co. increased to the point that it became appropriate to begin using the equity method of accounting for the investment. The balance in the investment account was $

> The shareholders’ equity section of the balance sheet of TNL Systems Inc. included the following accounts at December 31, 2020: Shareholders’ Equity ($ in millions) Common stock, 240 million shares at $1 par $ 240 Paid-in capital—excess of par 1,680 Paid

> A new CEO was hired to revive the floundering Champion Chemical Corporation. The company had endured operating losses for several years, but confidence was emerging that better times were ahead. The board of directors and shareholders approved a quasi-re

> In late 2020, the Nicklaus Corporation was formed. The corporate charter authorizes the issuance of 5,000,000 shares of common stock carrying a $1 par value, and 1,000,000 shares of $5 par value, noncumulative, nonparticipating preferred stock. On Januar

> During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders’ equity. The corporation was authorized to issue 100 million common shares, $1 par per share. Required: Prepa

> U.S. Metallurgical Inc., reported the following balances in its financial statements and disclosure notes at December 31, 2020. Plan assets $400,000 Projected benefit obligation 320,000 U.S.M.’s actuary determined that 2021 service cost is $60,000. Both

> A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney, Inc.’s defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits

> Herring Wholesale Company has a defined benefit pension plan. On January 1, 2021, the following pension-related data were available: The rate of return on plan assets during 2021 was 9%, although it was expected to be 10%. The actuary revised assumptions

> Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2021. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of retur

> Sachs Brands’s defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire

> Sachs Brands’s defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire

> Kim Company bought 30% of the shares of Phelps, Inc., at the start of 2021. Kim paid $10 million for the shares. Thirty percent of the book value of Phelps’s net assets is $8 million, and the difference of $2 million is due to land that Phelps owns that

> Sachs Brands’s defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire

> Office Depot, Inc., is a leading global provider of products, services, and solutions for workplaces. The following is an excerpt from a disclosure note in the company’s annual report for the fiscal year ended December 31, 2017: Require

> The information below pertains to the retiree health care plan of Thompson Technologies: Thompson began funding the plan in 2021 with a contribution of $127,000 to the benefit fund at the end of the year. Retirees were paid $52,000. The actuaryâ

> Sachs Brands’s defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire

> Stockton Labeling Company has a retiree health care plan. Employees become fully eligible for benefits after working for the company eight years. Stockton hired Misty Newburn on January 1, 2021. As of the end of 2021, the actuary estimates the total net

> Century-Fox Corporation’s employees are eligible for postretirement health care benefits after both being employed at the end of the year in which age 60 is attained and having worked 20 years. Jason Snyder was hired at the end of 1998

> Reproduced below are the journal entries related to Illustration 17–12 in this chapter that Global Communications used to record its pension expense and funding in 2021 and the new gain and loss that occurred that year. To focus on the core issues, we ig

> Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2021: Prior service cost at Jan. 1, 2021, from plan amendment at the beginning of 2019 (amortization: $4 million per year) $32 million Net loss

> The following pension-related data pertain to Metro Recreation’s noncontributory, defined benefit pension plan for 2021 ($ in thousands): Required: Prepare a pension spreadsheet that shows the relationships among the various pension bal

> The funded status of Hilton Paneling Inc.’s defined benefit pension plan and the balances in prior service cost and the net gain—pensions, are given below ($ in thousands): Retirees were paid $270,000, and the employer

> Turner Company owns 40% of the outstanding stock of ICA Company. During the current year, ICA paid a $5 million cash dividend on its common shares. What effect did this dividend have on Turner’s 2021 financial statements? Explain the reasoning for this e

> Lewis Industries adopted a defined benefit pension plan on January 1, 2021. By making the provisions of the plan retroactive to prior years, Lewis incurred a prior service cost of $2 million. The prior service cost was funded immediately by a $2 million

> The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2021 and 2022 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 202

> Refer to the situation described in P 17–10. Assume Electronic Distribution prepares its financial statements according to International Financial Reporting Standards (IFRS). Also assume that 10% is the current interest rate on high-qua

> Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2021 are as follows: The expected long-term rate of return on plan assets was 8%. There were no AOCI balances related to pensions on January 1, 2021, but at th

> Sachs Brands’s defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire

> Corning-Howell reported taxable income in 2021 of $120 million. At December 31, 2021, the reported amount of some assets and liabilities in the financial statements differed from their tax bases as indicated below: The total deferred tax asset and deferr

> Arndt, Inc. reported the following for 2021 and 2022 ($ in millions): a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021. b. Expenses include $2 millio

> Sherrod, Inc., reported pretax accounting income of $76 million for 2021. The following information relates to differences between pretax accounting income and taxable income: a. Income from installment sales of properties included in pretax accounting i

> You are the new accounting manager at the Barry Transport Company. Your CFO has asked you to provide input on the company’s income tax position based on the following: 1. Pretax accounting income was $45 million and taxable income was $8 million for the

> The DeVille Company reported pretax accounting income on its income statement as follows: 2021 $350,000 2022 270,000 2023 340,000 2024 380,000 Included in the income of 2021 was an installment sale of property in the amount of $50,000. However, for tax p

> Turner Company owns 10% of the outstanding stock of ICA Company. During the current year, ICA paid a $5 million cash dividend on its common shares. What effect did this dividend have on Turner’s 2021 financial statements? Explain the reasoning for this e

> Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $120,000 and is depreciate

> Dixon Development began operations in December 2021. When lots for industrial development are sold, Dixon recognizes income for financial reporting purposes in the year of the sale. For some lots, Dixon recognizes income for tax purposes when collected.

> Times-Roman Publishing Company reports the following amounts in its first three years of operation: The difference between pretax accounting income and taxable income is due to subscription revenue for one-year magazine subscriptions being reported for t

> Tru Developers, Inc., sells plots of land for industrial development. Tru recognizes income for financial reporting purposes in the year it sells the plots. For some of the plots sold this year, Tru took the position that it could recognize the income fo

> The long-term liabilities section of CPS Transportation’s December 31, 2020, balance sheet included the following: a. A lease liability with 15 remaining lease payments of $10,000 each, due annually on January 1: Lease liability $76,061

> Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental Protection Agency for violation of a federal law and paid in 202

> Fore Farms reported a pretax operating loss of $137 million for financial reporting purposes in 2021. Contributing to the loss were (a) a penalty of $5 million assessed by the Environmental Protection Agency for violation of a federal law and paid in 202

> Alsup Consulting sometimes performs services for which it receives payment at the conclusion of the engagement, up to six months after services commence. Alsup recognizes service revenue for financial reporting purposes when the services are performed. F

> Each of the four independent situations below describes a sales-type lease in which annual lease payments of $10,000 are payable at the beginning of each year. Each is a finance lease for the lessee. Determine the following amounts at the beginning of th

> On January 1, 2021, Rick’s Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. Rick’s had no significant economic incentive as of the beginning of the lease to exercise the 3-year extension

> Adams Industries holds 40,000 shares of FedEx common stock, which is not a large enough ownership interest to allow Adams to exercise significant influence over FedEx. On December 31, 2021, and December 31, 2022, the market value of the stock is $95 and

> On January 1, 2021, National Insulation Corporation (NIC) leased equipment from United Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value

> On January 1, 2021, Sweetwater Furniture Company leased office space under a 21-year operating lease agreement. The contract calls for annual lease payments on December 31 of each year. The payments are $10,000 the first year and increase by $500 per yea

> On January 1, 2021, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $80,000 each, beginning December 31, 2021, and at each December 31 through 2023. The lessor,