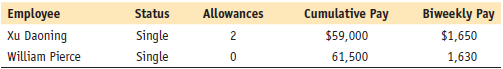

Question: Compute the net pay for each employee

Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that FICA OASDI tax is 6.2% on a wage base limit of $117,000, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies.

Transcribed Image Text:

Employee Status Allowances Cumulative Pay Biweekly Pay Xu Daoning Single $59,000 $1,650 2 William Pierce Single 61,500 1,630

> Complete the following chart by placing an X in the appropriate column. Use the indirect method. Add to Cash Flow Subtract from Cash Flow from Operations from Operations Increase in Accounts Receivable Increase in Prepaid Insurance

> From the following, prepare the long-term liabilities section of a balance sheet: a. Bond sinking fund b. Premium on 12% bonds c. Discount on 13% bonds d. 12% Bonds Payable e. 13% Bonds Payable $250,000 10,000 11,000 575,000 180,000

> Evans Corporation and Hayes Corporation have both earned $100,000 before bond interest and taxes. The companies have the same number of outstanding shares but different capital structures. Calculate the earnings per share of common stock for both compani

> On July 31, 201X, Carnival Corporation had the following stockholders’ equity: Common Stock, $9 par value, authorized 93,000 shares, 62,000 shares issued and outstanding ………………………………………………………………….……….. $558,000 Retained Earnings ………………………………………………………………

> Record the following transaction in the transaction analysis chart: Shawna Portia bought a new piece of computer equipment for $25,000, paying $6,000 down and charging the rest.

> Lucky Corporation has 250,000 shares of common stock issued and outstanding. On June 9, 201X, the board of directors declared a $0.54 per share dividend, payable on July 16, 201X, to stockholders of record on June 29, 201X. Record the appropriate journal

> From Exercise 2, calculate Ben’s net pay. The state income tax rate is 5%, and health insurance is $35.

> Complete the following: Account Category Normal Balance A. Salaries Payable B. Taxable Fees Earned C. Accounts Receivable D. Sam Slater, Capital E. Sam Slater, Withdrawals F. Prepaid Advertising G. Rent Expense

> Jacksonville Corporation in its first 3 years of operation paid out the following dividends: • Year 1: 0 • Year 2: $33,000 • Year 3: $89,000 Given that Jacksonville has 3,200 shares of $99 par 10% cumulative, nonparticipating preferred stock and 15,100 s

> On July 10, 201X, Becker Corporation issued 2,200 shares of common stock with a par value of $104 in exchange for equipment with a fair market value of $326,000. Journalize the appropriate entry.

> Josh, Chase, and Cameron have capital balances before liquidation of $12,000, $28,000, and $34,000, respectively. Cash balance is $45,000, and the partners share losses and gains in a 3:2:1 ratio. All noncash assets with a book value of $29,000 are sold

> L. White, V. Sable, and E. Rabel are partners with capital balances of $93,000, $84,000, and $70,000, respectively. Rabel sells his interest in the company for $88,000 to P. Skou. White and Sable have consented to the new partner. Record the journal entr

> Julie Eagle, Tami DeBurgo, and Abby Ellis are partners who share losses and gains in a ratio of 2:2:1. Their capital balances are $5,200, $5,700, and $3,700, respectively. The partners are anxious to have Tami retire and have paid her $10,800. Give the j

> A. Lot and B. Sharpless have decided their partnership earnings will be shared as follows: (a) 12% interest allowance on capital balances at beginning of year, (b) remainder to be shared equally. Capital balances of Lot and Sharpless at the beginning of

> Hobbs Company bought a light general-purpose truck for $9,200 on January 7, 2006. Calculate the yearly depreciation using the MACRS method.

> On May 1, 2014, Falcon Company bought a patent at a cost of $5,400. It is estimated that the patent will give Falcon a competitive advantage for 9 years. Record in general journal form amortization for 2014 and 2015. (Assume December 31 is the end of the

> Blue Company incurred the following expenditures to buy a new machine: • Invoice, $28,000 less 9% cash discount. • Freight charges, $490. • Assembly charges, $1,100. • Special base to support machine, $508. • Machine dropped and repaired, $350. What is t

> Given the following accounts, complete the table by inserting appropriate numbers next to the individual transaction to indicate which account is debited and which account is credited. 1. Cash 2. Accounts Receivable 3. Equipment 4. Accounts Payable 5. B

> Ben Stein, single, claiming one exemption, has cumulative earnings before this biweekly pay period of $116,200. If he is paid $1,980 this period, what will his deductions be for FIT and FICA (OASDI and Medicare)? The FICA tax rate for Social Security is

> Kelly Company on September 1, 201X, had inventory costing $30,000 and during September had net purchases of $67,900. Over the years, Kelly Company’s gross profit averaged 42% on sales. Given that the company has net sales of $108,000, calculate an estima

> Mirage Company’s July 1 inventory had a cost of $60,100 and a retail value of $74,100. During July, net purchases cost $256,600 with a retail value of $406,000. Net sales at retail for Mirage Company during July were $226,200. Calculate the ending invent

> From the following facts, calculate the correct cost of inventory for Ann Company. • Cost of inventory on shelf, $4,700, which includes $270 of goods received on consignment. • Goods in transit en route to Ann Company shipped F.O.B. shipping point, $22

> The Lakeview Company uses the periodic inventory system. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO, (b) LIFO, and (c) weighted-average methods. Lakeview sells only one product, called SM57. Ending inventory is 59

> Jamie Slater negotiated a bank loan for $24,000 for 120 days at a bank rate of 8%. Assuming the interest is deducted in advance, prepare the entry for Jamie to record the bank loan.

> On May 15, 201X, Raleigh Co. gave Octarine Co. a 180-day, $8,000, 10% note. On July 14, Octarine Co. discounted the note at 12%. a. Journalize the entry for Octarine to record the proceeds. b. Record the entry for Octarine if Raleigh fails to pay at mat

> Calculate the interest for the following: $10,000 5% 1 year a. b. $25,000 8% 6 months c. $ 9,500 18% 80 days с.

> Assuming that in Exercise 13A-2 the balance sheet approach is used, prepare a journalized adjusting entry for Bad Debts Expense. Based on an aging of Accounts Receivable, an $8,700 balance in the Allowance account will be needed to cover bad debts. Exer

> Journalize the adjusting entry on December 31, 2015, for Bad Debts Expense, which is estimated to be 9% of net credit sales. The income statement approach is used. The following information is given: Accounts Receivable Sales (credit) Sales Returns

> Mark Smith bought merchandise with a list price of $4,300. Mark was entitled to a 31% trade discount as well as a 5% cash discount. What was Mark’s actual cost of buying this merchandise after the cash discount?

> Calculate the total wages earned (assume an overtime rate of time and a half over 40 hours). Employee Hourly Rate No. of Hours Worked Adam Williams $17 34 Arnold Smith 14 53

> From the following, prepare a chart of accounts. Microsoft Surface ……………………………… Tablet Legal Fees Salary Expense ………………..………………… L. Janas, Capital Accounts Payable ……………………….………………………… Cash Accounts Receivable ……………………… Advertising Expense Repair Expens

> Record the following transaction in a transaction analysis chart for the buyer: Bought merchandise for $9,400 on account. Shipping terms were F.O.B. destination. The cost of shipping was $470. Assume the periodic inventory system.

> From Exercise 10A-3, prepare a schedule of accounts payable and verify that the total of the schedule equals the amount in the controlling account. Exercise 10A-3: Journalize, record, and post when appropriate the following transactions into the genera

> On October 10, 201X, Carrol Co. issued debit memorandum no. 1 for $440 to Roger Co. for merchandise returned from invoice no. 312. Your task is to journalize, record, and post this transaction as appropriate. Use the periodic inventory system.

> From Exercise 9A-2, journalize the receipt of a check from Cart Co. for payment of invoice no. 1 on December 24. Exercise 9A-2: Journalize, record, and post when appropriate the following transactions in the general journal (all sales carry terms of 5/

> From the general journal in Figure 9.15, record to the accounts receivable subsidiary ledger and post to the general ledger accounts as appropriate. General Journal Date Account Titles and Explanations PR Dr. Cr. 201X Sept. 18 Accounts Receivable,

> Assuming a semiweekly depositor, from the following T accounts, record: (a) the July 3 payment for FICA (OASDI and Medicare) and federal income taxes, (b) the July 31 payment of SUTA tax, and (c) the July 31 deposit of any FUTA tax that may be required.

> If Lauren’s Grocery Store downsized its operation during the second quarter of 201B and, as a result, paid only $6,121.54 in Form 941 taxes for the quarter that ended on June 30, 201B, should Lauren’s Grocery Store make its Form 941 payroll tax deposits

> Lauren’s Grocery Store made the following Form 941 payroll tax deposits during the look-back period of July 1, 201A, through June 30, 201B: Quarter Ended …………………………………. Amount Paid in 941 Taxes September 30, 201A …………………………………………………. $15,781.57 December

> At the end of October 201X, the total amount of OASDI, $530, and Medicare, $210, was withheld as tax deductions from the employees of Training, Inc. Federal income tax of $2,970 was also deducted from their paychecks. Training is classified as a monthly

> Draw a T account for Mark Beckham, Capital, and post to it all entries from Question 3 that affect it. What is the final balance of the Capital account? Question 3: From the following accounts, journalize the closing entries (assume December 31).

> Based on the following payroll tax depositor classifications, determine the 941 tax deposit due date for each taxpayer: a. Monthly depositor, owing $1,500 tax for the first quarter. b. Monthly depositor, owing $5,000 tax for the month of July. c. Mo

> Record the following transactions in the basic accounting equation. Treat each one separately. Assets ∙ Liabilities ∙ Owner’s Equity a. Matty invests $130,000 in company. b. Bought equipment for cash, $1,100. c. Bought equipment on account, $950.

> Blanca Company uses a special payroll account to pay employees. The gross amount of the payroll this week is $5,000; the net amount is $4,125. Journalize the transfer of funds to the payroll account and the distribution of paychecks to the employees.

> From the following data, estimate the annual premium for workers’ compensation insurance: Type of Work Estimated Payroll Rate per $100 Office $32,000 $0.22 Repairs 77,000 1.78

> At the end of the first quarter of 201X, you are asked to determine the FUTA tax liability for Aim Company. The FUTA tax rate is 0.6% on the first $7,000 each employee earns during the year (assuming 13 weeks for the first quarter) and each employee earn

> Refer to Exercise 7A-3. If Q. Roberts earned $2,100 for the week instead of $330, what effect would this change have on the total payroll tax expense? Exercise 7A-3: From the following information, calculate the payroll tax expense for Driving Company

> Refer to Exercise 7A-3 and assume that the state changed Driving Company’s SUTA tax rate to 4.6%. What effect would this change have on the total payroll tax expense? Exercise 7A-3: From the following information, calculate the payrol

> From the following information, calculate the payroll tax expense for Driving Company for the payroll of April 9: The FICA tax rate for OASDI is 6.2% on the first $117,000 earned, and Medicare is 1.45% on all earnings. Federal unemployment tax is 0.6%

> a. Calculate the total wages earned for each hourly employee assuming an overtime rate of time and a half over 40 hours. b. Calculate the total biweekly earnings of these newly hired salaried employees. Monthly Salary John Smith …&

> Draw a T account of Income Summary and post to it all entries from Question 3 that affect it. Is Income Summary a temporary or permanent account? Question 3: From the following accounts, journalize the closing entries (assume December 31). Mark Be

> If in Exercise 6A-2 cash on hand is $28, prepare the entry to replenish the petty cash on March 31. Exercise 6A-2: In general journal form, prepare journal entries to establish a petty cash fund on March 1 and replenish it on March 31. 201X March

> If in Exercise 6A-2 cash on hand is $16, prepare the entry to replenish the petty cash on March 31. Exercise 6A-2: In general journal form, prepare journal entries to establish a petty cash fund on March 1 and replenish it on March 31. 201X March

> Complete the following table: Assets Liabilities + Owner's Equity a. $30,000 ? $22,000 b. $7,000 + $98,000 C. $25,000 $11,000 +

> Based on the following accounts, calculate (a) net sales, (b) cost of goods sold, (c) gross profit, and (d) net income. Accounts Payable …………………………………………………………. $ 5,600 Operating Expenses ……………………………………………………….... 1,800 Walker Co., Capital …………………………………

> Using the information from Problem 8B-3, please complete Form 940 for Turner’s Sporting Goods for the current year. Additional information needed to complete the form is as follows: Problem 8B-3: The following is the monthly payroll f

> John Andrews, the accountant for White Company, must complete Form 941 for the first quarter of the current year. John gathered the needed data as presented in Problem 8B-1. Suddenly called away to an urgent budget meeting, John requested that you assist

> The bookkeeper of Triad Co. gathered the following data from individual employee earnings records and daily time cards. Your task is to complete a payroll register on August 8. Assume the following: 1. FICA OASDI is 6.2% on $117,000; FICA Medicare is 1

> From the following information, please complete the chart for gross earnings for the week. (Assume an overtime rate of time and a half over 40 hours.) Employee Hourly Rate No. of Hours Worked Gross Earnings Jag Valleria $ 8 49 Lara Harrison 16 45 Na

> Use the following adjustment data on December 31 to complete a partial worksheet up to the adjusted trial balance (see Figure 4.25). Figure 4.25: a. Fitness supplies on hand, $600. b. Depreciation taken on fitness equipment, $900. JANA'S FITNESS C

> At the end of April, Red Fuman decided to open his own computer service. Analyze the following transactions he completed by recording their effects into the expanded accounting equation. a. Invested $10,000 in his computer service business. b. Bought ne

> Explain the four steps of the closing process given the following: May 31 ending balance, before closing Fees Earned ………………………………………….. $ 200 Rent Expense ………..………………………………….. 350 Advertising Expense …………………………………….. 60 T. Molanaro, Capital…………………………………

> Update the trial balance for Lajoie’s Landscaping Service (Figure 4.26) for January 31, 201X. Figure 4.26: Adjustment Data to Update the Trial Balance a. Rent expired, $300. b. Landscaping supplies on hand (remaining), $350. c. Depre

> Fabio Company uses a voucher system. Record the following transactions in the voucher register: 201X Purchased office equipment on account from Tiani Corporation, $1,200; voucher no. 300 was prepared. June 12 Established a petty cash fund of $140; v

> On July 13, 2014, Caldwell Company bought equipment for $5,280. Its estimated life is 4 years with a residual value of $336. Prepare depreciation schedules for 2014, 2015, and 2016 for (a) straight-line and (b) double declining-balance at twice the strai

> Ashley Company, using the periodic inventory system, began the year with 250 units of product B in inventory with a unit cost of $36. The following additional purchases of the product were made: (30 min) LO3 Check Figure: At the end of year, Ashley Com

> From the trial balance in Figure 11.16 and additional data, complete the worksheet for Jack’s Wholesale Clothing Company. Additional Data a./b. Ending merchandise inventory on December 31, $5,200. c. Supplies on hand, $450. d. Insuranc

> The owner of Cannon Company asked you to prepare a worksheet from the trial balance shown in Figure 11.15 and additional data. Additional Data a./b. Ending merchandise inventory on December 31, $1,835. c. Office supplies used up, $210. d. Rent expired,

> From the trial balance in Figure 11.14, complete a worksheet for Jabar’s Hardware. Assume the following: a./b. Ending inventory on December 31 is calculated at $270. c. Insurance expired, $180. d. Depreciation on store equipment, $90. e

> Mandy Anabelle decided to open Mandy’s Nail Spa. Mandy completed the following transactions: a. Invested $21,000 cash from her personal bank account into the business. b. Bought store equipment for cash, $3,500. c. Bought additional store equipment on a

> Using the information from Problem 8A-3, please complete Form 940 for Allen’s Sporting Goods for the current year. Additional information needed to complete the form is as follows: Problem 8A-3: The following is the monthly payroll fo

> John Andrews, the accountant for White Company, must complete Form 941 for the first quarter of the current year. John gathered the needed data as presented in Problem 8A-1. Suddenly called away to an urgent budget meeting, John requested that you assist

> From the following balance sheet (Figure 4.18, which was made from the worksheet and other financial statements), explain why the lettered numbers were not found on the worksheet. Hint: No debits or credits appear on the formal financial statements. Fig

> The bookkeeper of Triad Co. gathered the following data from individual employee earnings records and daily time cards. Your task is to complete a payroll register on October 13. Assume the following: 1. FICA OASDI is 6.2% on $117,000; FICA Medicare is

> April Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: Assume the following: 1. FICA OASDI is 6.2% on $117,000; FICA Medicare is 1.45% on all earnin

> From the following information, please complete the chart for gross earnings for the week. (Assume an overtime rate of time and a half over 40 hours.) Employee Hourly Rate No. of Hours Worked Gross Earnings Jade Martina $ 9 50 Lauren McBride 15 39 N

> Use the following adjustment data on August 31 to complete a partial worksheet up to the adjusted trial balance (see Figure 4.21). Figure 4.21: a. Fitness supplies on hand, $3,900. b. Depreciation taken on fitness equipment, $800. JACK'S FITNESS C

> At the end of June, Rick Fontan decided to open his own computer service. Analyze the following transactions he completed by recording their effects in the expanded accounting equation. a. Invested $25,000 in his computer service. b. Bought new computer

> Update the trial balance for Lemmings’s Landscaping Service (Figure 4.22) for August 31, 201X. Figure 4.22: Adjustment Data to Update the Trial Balance a. Rent expired, $700. b. Landscaping supplies on hand (remaining), $325. c. Dep

> Fair Corporation uses a voucher system. Record the following transactions in the voucher register: 201X Purchased office equipment on account from Tam Corporation, $1,000; voucher no. 300 was prepared. June 8 12 Established a petty cash fund of $100

> On May 13, 2014, Cabe Company bought equipment for $5,520. Its estimated life is 4 years with a residual value of $144. Prepare depreciation schedules for 2014, 2015, and 2016 for (a) straight-line and (b) double declining-balance at twice the straight-l

> Abby Company, using the periodic inventory system, began the year with 260 units of product B in inventory with a unit cost of $37. The following additional purchases of the product were made: At end of year, Abby Company had 480 units of its product u

> From the trial balance in Figure 11.13 and additional data, complete the worksheet for Ron’s Wholesale Clothing Company. Additional Data a./b. Ending merchandise inventory on December 31, $5,100. c. Supplies on hand, $650. d. Insurance

> From the following adjusted trial balance titles of a worksheet, identify in which column each account will be listed on the last four columns of the worksheet: (ID) Income Statement Dr. Column (IC) Income Statement Cr. Column (BD) Balance Sheet Dr. Col

> The owner of Carol Company asked you to prepare a worksheet from the trial balance in Figure 11.12 and additional data. Additional Data a./b. Ending merchandise inventory on December 31, $1,825. c. Office supplies used up, $210. d. Rent expired, $205. e

> From the trial balance in Figure 11.11, complete a worksheet for Jim’s Hardware. Assume the following: a./b. Ending inventory on December 31 is calculated at $340. c. Insurance expired, $110. d. Depreciation on store equipment, $70. e.

> Based on the following accounts, calculate (a) net sales, (b) cost of goods sold, (c) gross profit, and (d) net income. Accounts Payable ……………………………………………… $ 6,300 Operating Expenses ……………………………………………… 1,600 Market Co., Capital …………………………………………….. 19,70

> Morgan Amberson decided to open Morgan’s Nail Spa. Morgan completed the following transactions: a. Invested $16,000 cash from her personal bank account into the business. b. Bought store equipment for cash, $3,700. c. Bought additional store equipment o

> Smith Computer Center currently has a $13,095.00 balance in Accounts Receivable. Here is a current schedule of Accounts Receivable: Smith Computer Center Schedule of Accounts Receivable March 31, 201X Phil’s Photography ……………………………………………….. $ 4,095 Worl

> Go to the consolidated balance sheet in the 2013 annual report for Kellogg’s Company at http://investor.kelloggs.com/investor-relations/annual-reports. What is the amount of retained earnings in 2013? What is the par value of the stock?

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs .com/investor-relations/annual-reports and, in note 3, find how much impairment has decreased from 2012 to 2013.

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report and find the Consolidated Statement of Income. What was the Interest Expense in 2012 and 2013?

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report and locate the consolidated statement of Income. How much has Selling and General Administrative Expense decreased from 2012 to 2013?

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report, and locate the balance sheet. How much has merchandise inventory increased or decreased from 2012 to 2013?

> Before Adjustment Given: Accrued Salaries, $125. a. Complete a transaction analysis box for this adjustment. b. What will be the balance of these two accounts on the adjusted trial balance? Salaries Expense Salaries Payable 1,000

> Go to http://investor.kelloggs.com/investor-relations/annual-reports to access the Kellogg’s 2013 Annual Report. Look at Notes to Consolidated Financial Statements and use information from Note 17 page 68 to calculate how much Advertising Expense has inc

> Go to http://investor.kelloggs.com/investor-relations/annual-reports/ to access Kellogg’s 2013 Annual Report. Find the statement of earnings. Sales are the revenue for a merchandise company. How much did Kellogg’s sales increase or decrease from 2012 to

> Go to http://investor.kelloggs.com/investor-relations/annual-reports/ to access the Kellogg’s 2013 Annual Report and find the balance sheet of Kellogg’s. Did Kellogg’s Accounts Payable go up or down from 2012 to 2013? What does this change mean? Into wha

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs .com/investor-relations/annual-reports. What is the cost of finished goods inventory for 2013 as shown in note 17?

> Go to the 2013 annual report for Kellogg’s Company at http://investor.kelloggs.com/ investor-relations/annual-reports. Find the net sales figure for Latin America for 2013 in Project K in note 3.