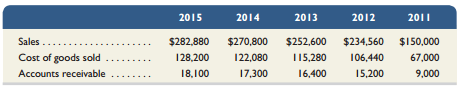

Question: Compute trend percents for the following accounts,

Compute trend percents for the following accounts, using 2011 as the base year (round the percents to whole numbers). State whether the situation as revealed by the trends appears to be favorable or unfavorable for each account.

Transcribed Image Text:

2015 2014 2013 2012 2011 Sales... $282,880 $270,800 $252,600 $234,560 $150,000 Cost of goods sold .. 128,200 122,080 115,280 106,440 67,000 Accounts receivable 18,100 17,300 16,400 15,200 9,000

> Where on the statement of cash flows is the payment of cash dividends reported?

> Describe the indirect method of reporting cash flows from operating activities.

> Describe the direct method of reporting cash flows from operating activities.

> If a company reports positive net income for the year, can it also show a net cash outflow from operating activities? Explain.

> Key figures for Polaris and Arctic Cat follow. Required1. Compute the recent two years’ cash flow on total assets ratios for Polaris and Arctic Cat. 2. What does the cash flow on total assets ratio measure? 3. Which company has the hi

> Assume that a company purchases land for $1,000,000, paying $400,000 cash and borrowing the remainder with a long-term note payable. How should this transaction be reported on a statement of cash flows?

> When a statement of cash flows is prepared using the direct method, what are some of the operating cash flows?

> What are some financing activities reported on the statement of cash flows?

> What are some investing activities reported on the statement of cash flows?

> Refer to Piaggio’s statement of cash flows in Appendix A. What investing activities result in cash outflows for the year ended December 31, 2011? List items and amounts.

> What is the reporting purpose of the statement of cash flows? Identify at least two questions that this statement can answer.

> Use the following selected data from Success Systems’ income statement for the three months ended March 31, 2014, and from its March 31, 2014, balance sheet to complete the requirements below: computer services revenue, $25,160; net sales (of goods), $18

> A review of the notes payable files discovers that three years ago the company reported the entire amount of a payment (principal and interest) on an installment note payable as interest expense. This mistake had a material effect on the amount of income

> Compute the annual dollar changes and percent changes for each of the following accounts. 2013 2012 Short-term investments $374,634 $234,000 Accounts receivable 97,364 101,000 Notes payable 88,000

> Refer to the information in QS 13-2. Use that information for Tide Corporation to determine the 2012 and 2013 common-size percents for cost of goods sold using net sales as the base. In QS 13-2 (S thousands) 2013 2012 Net sales $801,810 $453,000 Co

> Use the following information for Tide Corporation to determine the 2012 and 2013 trend percents for net sales using 2012 as the base year. (S thousands) 2013 2012 Net sales $801,810 $453,000 Cost of goods sold ... 392,887 134,088

> Which of the following items (a) through (i) are part of financial reporting but are not included as part of general-purpose financial statements? (a) balance sheet, (b) financial statement notes, (c) statement of shareholders’ equity, (d) prospectus,

> The following information is available for Morgan Company and Parker Company, similar firms operating in the same industry. Write a half-page report comparing Morgan and Parker using the available information. Your discussion should include their ability

> For each ratio listed, identify whether the change in ratio value from 2012 to 2013 is usually regarded as favorable or unfavorable. Ratio 2013 2012 Ratio 2013 2012 1. Profit margin 9% 5. Accounts receivable turnover 8% 5.5 6.7 2. Debt ratio 47% 6.

> What are four possible standards of comparison used to analyze financial statement ratios? Which of these is generally considered to be the most useful? Which one is least likely to provide a good basis for comparison?

> Answer each of the following related to international accounting and analysis. a. Identify a limitation to using ratio analysis when examining companies reporting under different accounting systems such as IFRS versus U.S. GAAP. b. Identify an advantage

> Refer to Arctic Cat’s statement of cash flows in Appendix A. What are its cash flows from financing activities for the year ended March 31, 2011? List the items and amounts.

> Selected account balances from the adjusted trial balance for Harbor Corp. as of its calendar year-end December 31, 2013, follow. RequiredAnswer each of the following questions by providing supporting computations. 1. Assume that the companyâ

> Summary information from the financial statements of two companies competing in the same industry follows. Required1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including notes) receivable turnover, (d) inv

> Selected year-end financial statements of Overton Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2012, were inventory, $17,400; total assets, $94,900; common stock, $35,500; and retained earnings, $18,800.)

> Koto Corporation began the month of June with $300,000 of current assets, a current ratio of 2.5:1, and an acid-test ratio of 1.4:1. During the month, it completed the following transactions (the company uses a perpetual inventory system). June 1 Sold me

> Selected comparative financial statements of Tripoly Company follow. Required1. Compute trend percents for all components of both statements using 2008 as the base year. (Round percents to one decimal.) Analysis Component 2. Analyze and comment on the

> Selected comparative financial statement information of Bluegrass Corporation follows. Required1. Compute each year’s current ratio. (Round ratio amounts to one decimal.) 2. Express the income statement data in common-size percents.

> Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar yearend December 31, 2013, follow. RequiredAnswer each of the following questions by providing supporting computations. 1. Assume that the companyâ

> Summary information from the financial statements of two companies competing in the same industry follows. Required1. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including notes) receivable turnover, (d) inv

> Selected year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2012, were inventory, $48,900; total assets, $189,400; common stock, $90,000; and retained earnings, $22,748.)

> Plum Corporation began the month of May with $700,000 of current assets, a current ratio of 2.50:1, and an acid-test ratio of 1.10:1. During the month, it completed the following transactions (the company uses a perpetual inventory system). May 2 Purchas

> Refer to Polaris’s statement of cash flows in Appendix A. (a) Which method is used to compute its net cash provided by operating activities? (b) Its balance sheet shows an increase in accounts (trade) receivables from 2010 to 2011; why is this increase

> Selected comparative financial statements of Haroun Company follow. Required1. Compute trend percents for all components of both statements using 2008 as the base year. (Round percents to one decimal.) Analysis Component 2. Analyze and comment on the

> Selected comparative financial statements of Korbin Company follow. Required1. Compute each year’s current ratio. (Round ratio amounts to one decimal.) 2. Express the income statement data in common-size percents. (Round percents to

> 1. Which two ratios are key components in measuring a company’s operating efficiency? Which ratio summarizes these two components? 2. What measure reflects the difference between current assets and current liabilities? 3. Which two short-term liquidity r

> Match the ratio to the building block of financial statement analysis to which it best relates. A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects 1. Equity ratio 2. Return on total assets 3.

> Use the financial data for Randa Merchandising, Inc., in Exercise 13-13 to prepare its income statement for calendar year 2013. (Ignore the earnings per share section.) Exercise 13-13: Section Item Debit Credit I. Net sales. 2. Gain on state's conde

> In 2013, Randa Merchandising, Inc., sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement fo

> Refer to Simon Company’s financial information in Exercises 13-7 and 13-9. Additional information about the company follows. To help evaluate the company’s profitability, compute and interpret the following ratios for

> Refer to Simon Company’s financial information in Exercises 13-7 and 13-9. Evaluate the company’s efficiency and profitability by computing the following for 2014 and 2013: (1) profit margin ratio—per

> Refer to the Simon Company information in Exercises 13-7 and 13-9. Compare the company’s long-term risk and capital structure positions at the end of 2014 and 2013 by computing these ratios: (1) debt and equity ratios—

> Refer to the Simon Company information in Exercise 13-7. The company’s income statements for the years ended December 31, 2014 and 2013, follow. Assume that all sales are on credit and then compute: (1) days’ sales un

> Is depreciation a source of cash flow?

> Refer to Simon Company’s balance sheets in Exercise 13-7. Analyze its year-end short-term liquidity position at the end of 2014, 2013, and 2012 by computing (1) the current ratio and (2) the acid-test ratio. Comment on the ratio resul

> Simon Company’s year-end balance sheets follow. Express the balance sheets in common-size percents. Round amounts to the nearest one-tenth of a percent. Analyze and comment on the results. At December 3I 2014 2013 2012 Assets Cash

> Roak Company and Clay Company are similar firms that operate in the same industry. Clay began operations in 2013 and Roak in 2010. In 2015, both companies pay 7% interest on their debt to creditors. The following additional information is available. Wr

> Express the following comparative income statements in common-size percents and assess whether or not this company’s situation has improved in the most recent year (round the percents to one decimal). GOMEZ CORPORATION Comparative

> Common-size and trend percents for Rustynail Company’s sales, cost of goods sold, and expenses follow. Determine whether net income increased, decreased, or remained unchanged in this three-year period. Common-Size Percents Trend P

> Nintendo Company, Ltd., reports the following financial information as of, or for the year ended, March 31, 2011. Nintendo reports its financial statements in both Japanese yen and U.S. dollars as shown (amounts in millions). Current assets . . . . . .

> Use KTM’s financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2011.

> Refer to Piaggio’s financial statements in Appendix A. Compute its debt ratio as of December 31, 2011, and December 31, 2010.

> Refer to Arctic Cat’s financial statements in Appendix A to compute its equity ratio as of March 31, 2011, and March 31, 2010.

> Key comparative information for Piaggio (www.piaggio.com), which manufactures two-,three- and four-wheel vehicles, and is Europe’s leading manufacturer of motorcycles and scooters, follows. Required1. Compute the recent two years&acir

> Refer to Polaris’s financial statements in Appendix A to answer the following. 1. Is Polaris’s statement of cash flows prepared under the direct method or the indirect method? How do you know? 2. For each year 2011, 2010, and 2009, is the amount of cash

> Currently the National Football League has a system for drafting college players by which each player is picked by only one team. The player must sign with that team or not play in the league. What would happen to the wages of both newly drafted and more

> For a monopsonist, what is the relationship between the supply of an input and the marginal expenditure on it?

> Suppose there are two groups of workers, unionized and nonunionized. Congress passes a law that requires all workers to join the union. What do you expect to happen to the wage rates of formerly nonunionized workers? Of those workers who were originally

> The demands for the factors of production listed below have increased. What can you conclude about changes in the demands for the related consumer goods? If demands for the consumer goods remain unchanged, what other explanation is there for an increase

> Using your knowledge of marginal revenue product, explain the following: a. A famous tennis star is paid $200,000 for appearing in a 30-second television commercial. The actor who plays his doubles partner is paid $500. b. The president of an ailing sav

> Assume that workers whose incomes are less than $10,000 currently pay no federal income taxes. Suppose a new government program guarantees each worker $5000, whether or not he or she earns any income. For all earned income up to $10,000, the worker must

> Suppose that the wage rate is $16 per hour and the price of the product is $2. Values for output and labor are in units per hour. q………………………………………………….L 0………………………………………………….0 20………………………………………………….1 35………………………………………………….2 47………………………………………………….3 57…………

> A firm uses a single input, labor, to produce output q according to the production function q= 8 L . The commodity sells for $150 per unit and the wage rate is $75 per hour. a. Find the profit-maximizing quantity of L. b. Find the profit-maximizing quan

> Using the same information as in Exercise 8, suppose now that the only labor available is controlled by a monopolistic labor union that wishes to maximize the rent earned by union members. What will be the quantity of labor employed and the wage rate? Ho

> The demand for labor by an industry is given by the curve L = 1200 ! 10w, where L is the labor demanded per day and w is the wage rate. The supply curve is given by L = 20w. What is the equilibrium wage rate and quantity of labor hired? What is the econo

> Sal’s satellite company broadcasts TV to subscribers in Los Angeles and New York. The demand functions for each of these two groups are QNY = 60 – 0.25PNY QLA = 100 – 0.50PLA where Q is in thousands of subscriptions per year and P is the subscription p

> The only legal employer of military soldiers in the United States is the federal government. If the government uses its knowledge of its monopsonistic position, what criteria will it employ when determining how many soldiers to recruit? What happens if a

> Suppose a firm’s production function is given by Q = 12L ! L2, for L = 0 to 6, where L is labor input per day and Q is output per day. Derive and draw the firm’s demand for labor curve if the firm’s output sells for $10 in a competitive market. How many

> What is a dominant strategy? Why is an equilibrium stable in dominant strategies?

> What is a “tit-for-tat” strategy? Why is it a rational strategy for the infinitely repeated prisoners’ dilemma?

> How does a Nash equilibrium differ from a game’s maximin solution? When is a maximin solution a more likely outcome than a Nash equilibrium?

> Explain the meaning of a Nash equilibrium. How does it differ from an equilibrium in dominant strategies?

> What is the difference between a cooperative and a noncooperative game? Give an example of each.

> Why is the winner’s curse potentially a problem for a bidder in a common-value auction but not in a private-value auction?

> A strategic move limits one’s flexibility and yet gives one an advantage. Why? How might a strategic move give one an advantage in bargaining?

> Can the threat of a price war deter entry by potential competitors? What actions might a firm take to make this threat credible?

> Many retail video stores offer two alternative plans for renting films: • A two-part tariff: Pay an annual membership fee (e.g., $40) and then pay a small fee for the daily rental of each film (e.g., $2 per film per day). • A straight rental fee: Pay n

> What is a “strategic move”? How can the development of a certain kind of reputation be a strategic move?

> What is meant by “first-mover advantage”? Give an example of a gaming situation with a first-mover advantage.

> Suppose you and your competitor are playing the pricing game shown in Table 13.8. Both of you must announce your prices at the same time. Can you improve your outcome by promising your competitor that you will announce a high price?

> Consider a game in which the prisoners’ dilemma is repeated 10 times and both players are rational and fully informed. Is a tit-for-tat strategy optimal in this case? Under what conditions would such a strategy be optimal?

> Two computer firms, A and B, are planning to market network systems for office information management. Each firm can develop either a fast, high-quality system (High), or a slower, low-quality system (Low). Market research indicates that the resulting pr

> Many industries are often plagued by overcapacity: Firms simultaneously invest in capacity expansion, so that total capacity far exceeds demand. This happens not only in industries in which demand is highly volatile and unpredictable, but also in industr

> In many oligopolistic industries, the same firms compete over a long period of time, setting prices and observing each other’s behavior repeatedly. Given the large number of repetitions, why don’t collusive outcomes typically result?

> Defendo has decided to introduce a revolutionary video game. As the first firm in the market, it will have a monopoly position for at least some time. In deciding what type of manufacturing plant to build, it has the choice of two technologies. Technolog

> You play the following bargaining game. Player A moves first and makes Player B an offer for the division of $100. (For example, Player A could suggest that she take $60 and Player B take $40). Player B can accept or reject the offer. If he rejects it, t

> You are a duopolist producer of a homogeneous good. Both you and your competitor have zero marginal costs. The market demand curve is P = 30 ! Q where Q = Q1 + Q2. Q1 is your output and Q2 your competitor’s output. Your competitor has also read this boo

> Elizabeth Airlines (EA) flies only one route: Chicago-Honolulu. The demand for each flight is Q = 500 – P. EA’s cost of running each flight is $30,000 plus $100 per passenger. a. What is the profit-maximizing price that EA will charge? How many people w

> We can think of U.S. and Japanese trade policies as a prisoners’ dilemma. The two countries are considering policies to open or close their import markets. The payoff matrix is shown below. a. Assume that each country knows the payoff m

> Two competing firms are each planning to introduce a new product. Each will decide whether to produce Product A, Product B, or Product C. They will make their choices at the same time. The resulting payoffs are shown below. a. Are there any Nash equilibr

> Two major networks are competing for viewer ratings in the 8:00!9:00 P.M. and 9:00!10:00 P.M. slots on a given weeknight. Each has two shows to fill this time period and is juggling its lineup. Each can choose to put its “biggerâ&

> Two firms are in the chocolate market. Each can choose to go for the high end of the market (high quality) or the low end (low quality). Resulting profits are given by the following payoff matrix: a. What outcomes, if any, are Nash equilibria? b. If the

> Why is the Cournot equilibrium stable? (i.e., Why don’t firms have any incentive to change their output levels once in equilibrium?) Even if they can’t collude, why don’t firms set their outputs at the joint profit-maximizing levels (i.e., the levels the

> Some experts have argued that too many brands of breakfast cereal are on the market. Give an argument to support this view. Give an argument against it.

> Why is the firm’s demand curve flatter than the total market demand curve in monopolistic competition? Suppose a monopolistically competitive firm is making a profit in the short run. What will happen to its demand curve in the long run?

> What are the characteristics of a monopolistically competitive market? What happens to the equilibrium price and quantity in such a market if one firm introduces a new, improved product?

> Why has the OPEC oil cartel succeeded in raising prices substantially while the CIPEC copper cartel has not? What conditions are necessary for successful cartelization? What organizational problems must a cartel overcome?

> Why does price leadership sometimes evolve in oligopolistic markets? Explain how the price leader determines a profit-maximizing price.

> A monopolist is deciding how to allocate output between two geographically separated markets (East Coast and Midwest). Demand and marginal revenue for the two markets are: P 1 = 15 – Q1 MR 1 = 15 – 2Q1 P 2 = 25 – 2Q2 MR 2 = 25 – 4Q2 The monopo

> The kinked demand curve describes price rigidity. Explain how the model works. What are its limitations? Why does price rigidity occur in oligopolistic markets?