Question: Consider an open economy with flexible exchange

Consider an open economy with flexible exchange rates. Let UIP stand for the uncovered interest parity condition.

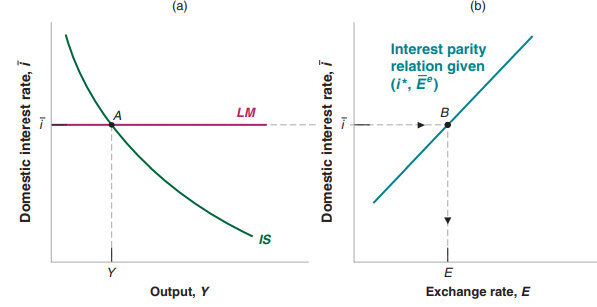

a. In an IS-LM–UIP diagram, such as Figure 19-2, show the effect of an increase in foreign output, Y*, on domestic output (Y) and the exchange rate (E), when the domestic central bank leaves the policy interest rate unchanged. Explain in words.

b. In an IS-LM–UIP diagram, show the effect of an increase in the foreign interest rate, i*, on domestic output (Y) and the exchange rate (E), when the domestic central bank leaves the policy interest rate unchanged. Explain in words.

Figure 19-2:

> For each of the economic changes listed in parts a and b, assess the likely impact on the growth rate and the level of output over the next five years and over the next five decades. a. A permanent reduction in the rate of technological progress. b. A pe

> a. Where does technological progress come from for the economic leaders of the world? b. Do developing countries have other alternatives to the sources of technological progress you mentioned in part (a)? c. Examples of developing countries shows that st

> a. Why is the amount of R&D spending important for growth? How do the appropriability and fertility of research affect the amount of R&D spending? How do each of the policy proposals listed in (b) through (e) affect the appropriability and fertility of r

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. Writing the production function in terms of capital and effective labor implies that as the level of technology increases by 10%

> It is possible to extend the production function so that output is produced with labor input, N; capital input, K; and carbon-intensive energy input, E. If we write a production function as Y = N (1/3) K (1/3) E (1/3) a. Using the input values below, doe

> How might the policy changes in parts a through e affect the wage gap between low-skill and high-skill workers in the United States? a. Increased spending on computers in public schools. b. Restrictions on the number of foreign temporary agricultural wor

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. It is clear that the rate of technological growth has declined in the last decade. b. The change in employment and output per per

> There is a great deal of interest in carbon emissions because of global warming. The World Bank produces data on carbon emissions by country in a variety of forms. It is found at https://data.worldbank.org/indicator/en.atm.co2e. pp.gd. One very interesti

> It is often argued that a balanced budget amendment would actually be destabilizing. To understand this argument, consider the economy in Problem 5. a. Solve for equilibrium output. b. Solve for taxes in equilibrium. Suppose that the government starts wi

> a. What evidence is presented in the text that income inequality has increased over time in the United States? b. Use supply and demand of educated workers to explain the increase in income inequality. c. Use supply and demand of less-educated workers to

> Discuss the potential role of each of the factors listed in parts a through g on the steady-state level of output per worker. In each case, indicate whether the effect is through A, through K, through H, or through some combination of A, K, and H. A is t

> Suppose that the economy’s production function is that the saving rate, s, is equal to 16%, and that the rate of depreciation, d, is equal to 10%. Suppose further that the number of workers grows at 2% per year and that the rate of tec

> Suppose that there are only two goods produced in an economy: haircuts and banking services. Prices, quantities, and the number of workers occupied in the production of each good for year 1 and for year 2 are given in the table: a. What is nominal GDP

> Use the official or key interest rates database from the European Central Bank (ECB) Web site (https://www.ecb. europa.eu) and trace the evolution of the decisions of the ECB regarding deposit facility, that is, the remuneration of the commercial bank de

> In this chapter, we discussed the effect of inflation on the effective capital-gains tax rate on the sale of a home. In this question, we explore the effect of inflation on another feature of the tax code the deductibility of mortgage interest. Suppose y

> The United States (unlike other countries) has two types of bank-like financial institutions. Member banks can borrow from the Federal Reserve at the discount rate and must keep currency in their vaults or deposits at the Federal Reserve earning the depo

> Most home-buyers purchase their home with a combination of a cash down payment and a mortgage. The loan-to-value ratio is a rule that establishes the maximum mortgage loan allowed on a home purchase. a. If a home costs $300,000 and the maximum loan-to va

> It was noted in the text that the Federal Reserve purchased, in addition to Treasury bills, large amounts of mortgage-backed securities and long-term government bonds as part of quantitative easing. Figure 23-2 shows that in 2015, there were about $4 tri

> In this chapter we have assumed that the fiscal policy variables G and T are independent of the level of income. In the real world, however, this is not the case. Taxes typically depend on the level of income and so tend to be higher when income is highe

> In Chapter 14, in the Focus Box titled “The Vocabulary of Bond Markets,” the concept of an inflation-indexed bond was introduced. Although such bonds are typically long in maturity, the example that follows compares a standard one-year Treasury bill with

> Nearly every major central bank has chosen an inflation target of 2%. a. Why might a central bank choose a lower inflation target, for example, zero inflation? b. Why might a central bank choose a higher inflation target, for example, 4% inflation?

> The money demand relationship in Chapter 4 is used implicitly in Figure 23-1. That relation is M P = YL1i2 The central bank in conjunction with the political authorities chooses an inflation target π*. a. Derive the target nominal interest ra

> Problem 10 in Chapter 4 asked you to consider the current stance of monetary policy. Here, you are asked to do so again, but with the additional understanding of monetary policy you have gained in this and previous chapters. a. Go to the ECB Web site (ht

> Use the FRED database at the Federal Reserve Bank of St. Louis to find the monthly average nominal policy interest rates for four major central banks. The series for these rates are: United States, federal funds (FEDFUNDS); United Kingdom, (INTDSRGBM193N

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The most important argument in favor of a positive rate of inflation in OECD countries is seignorage. b. Fighting inflation shoul

> Consider an economy characterized by the following facts: i. The debt-to-GDP ratio is 40%. ii. The primary deficit is 4% of GDP. iii. The normal growth rate is 3%. iv. The real interest rate is 3%. a. Using your favorite spreadsheet software, compute

> First consider an economy in which Ricardian equivalence does not hold. a. Suppose the government starts with a balanced budget. Then, there is an increase in government spending, but there is no change in taxes. Show in an IS-LM diagram the effect of th

> For both political and macroeconomic reasons, governments are often reluctant to run budget deficits. Here, we examine whether policy changes in G and T that maintain a balanced budget are macroeconomically neutral. Put another way, we examine whether it

> Consider an economy characterized by the following facts i. The official budget deficit is 7.8% of GDP ii. The debt-to-GDP ratio is 123% iii. The inflation rate is 0.4% iv. The nominal interest rate is 0.25% a. What is the primary deficit/surplus ratio t

> Consider the following statement: A deficit during a war can be a good thing. First, the deficit is temporary, so after the war is over, the government can go right back to its old level of spending and taxes. Second, given that the evidence supports the

> Using information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The deficit is the difference between real government spending and taxes net of transfers. b. The primary deficit is the difference b

> The European Central Bank Created by the Maastricht Treaty on European Union (EU) of 1992, the European Central Bank (ECB) was set up on June 1, 1998. a. In your opinion, does the following excerpt from the statute make the policy goals of the ECB clear

> This exercise tries to illustrate a debate in a centralized economy, which is in the process of being modernized, with a single political party. Social stability is the main concern of the government, but it faces two obstacles: one being support a stren

> In 2018 New Zealand rewrote the charter of its central bank to include high employment as well as low inflation as its goals. Why would New Zealand want to do this?

> In 1989, New Zealand rewrote the charter of its central bank to make low inflation its only goal. Why would New Zealand want to do this?

> Suppose the government amends the constitution to prevent government officials from negotiating with terrorists. What are the advantages of such a policy? What are the disadvantages?

> Use the economy described in Problem 2. a. Compute private saving, public saving, and investment spending. b. Solve for equilibrium output. Compute total demand. Explain how it affects production. c. Assume that G is now equal to €300 b

> From Problem 5, write down the quarters in which the recessions started. Find the monthly series in the Federal Reserve Bank of St. Louis (FRED) database for the seasonally adjusted unemployment rate in the United States entitled civilian unemployment ra

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. There is so much uncertainty about the effects of monetary policy that we would be better off not using it. b. Depending on the m

> Two of the largest trading partners of the United States are Canada and Mexico. The FRED database at the Federal Reserve Bank of St. Louis maintains four series that are useful to us: A Real Broad Effective Exchange rate for Mexico (RBMXBIS); A Real Broa

> Look at Figure 1 in the box “The 1992 EMS Crisis.” European nominal exchange rates had been fixed between the major currencies from roughly 1979 to 1992. a. Explain how to read the vertical axis of Figure 1. What count

> Equation (20.5) provides insight into the movements of nominal exchange rates between a domestic and a foreign country. Remember that the time periods in the equation can refer to any time unit. The equation is: a. Suppose we are thinking of one-day time

> An exchange rate crisis occurs when the peg (the fixed exchange rate) loses its credibility. Bond holders no longer believe that next period’s exchange rate will be this period’s exchange rate. a. Solve the uncovered

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. If the nominal exchange rate is fixed, the real exchange rate is fixed. b. When domestic inflation equals foreign inflation, the

> Suppose that an economy is characterized by the following behavioral equations (in billions of euros): a. Equilibrium GDP (Y) b. Disposable income (YD) c. Consumption spending (C).

> This question explores how an increase in global demand for domestic assets may slow down the depreciation of the domestic currency. Here, we modify the IS-LM-UIP framework to analyze the effects of an increase in the demand for foreign assets. Write the

> The effectiveness of monetary policy in an open economy is enhanced when the central bank has the flexibility to change the exchange rate and the willingness to change interest rates. Suppose that there is a decrease in consumer confidence in Tunisia, gi

> Consider a fixed exchange rate system, in which a group of countries (called follower countries) peg their currencies to the currency of one country (called the leader country). Because the currency of the leader country is not fixed against the currenci

> Suppose there is an expansionary fiscal policy in the foreign country that increases Y* and i* at the same time. a. In an IS-LM–UIP diagram, such as Figure 19-2, show the effect of the increase in foreign output, Y*, and the increase in

> In this chapter, we showed that a reduction in the interest rate in an economy operating under flexible exchange rates leads to an increase in output and a depreciation of the domestic currency. a. How does the reduction in interest rates in an economy w

> Consider an open economy with flexible exchange rates. Suppose output is at the natural level, but there is a trade deficit. The goal of policy is to reduce the trade deficit and leave the level of output at its natural level. What is the appropriate fis

> Use a search engine to find material on the Trump administration tariffs’ impact on the economy. What do economists say about them? You will learn something even by just reading the heading and the first paragraph of three to five articles.

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The interest rate parity condition means that interest rates are equal across countries. b. other things being equal, the intere

> a. National saving is defined as private saving plus government surplus, that is, S + T - G. Now, using equation (18.5), describe the relation among current account deficit, net investment income, and the difference between national saving and domestic i

> The Tax Cut and Jobs Act was passed by Congress in December 2017. GDP grew from $18,000 billion (2012 dollars) in 2017 to $18,500 billion (2012 dollars) in 2018. a. By what percentage did real GDP grow from 2017 to 2018? b. Estimates from the Congression

> Consider an open economy in which the real exchange rate is fixed and equal to one. Consumption, investment, government spending, and taxes are given by C = 10 + 0.8 (Y – T), I = 10, G = 10, and T = 10 Imports and exports are given by IM = 0.3 Y and

> Consider an open economy characterized by the following equations: C = c0 + c1(Y – T) I = d0 + d1Y IM = m1Y X = x1Y* The parameters m1 and x1 are the propensities to import and export. Assume that the real exchange rate is fixed at a value of 1 and tre

> a. Consider an economy with a trade deficit (NX < 0) and with output equal to its natural level. Suppose that, even though output may deviate from its natural level in the short run, it returns to its natural level in the medium run. Assume that the natu

> a. Suppose there is an increase in foreign output. Show the effect on the domestic economy (i.e., replicate Figure 18-4). What is the effect on domestic output? On domestic net exports? b. If the interest rate remains constant, what will happen to domest

> A further look at Table 18-1 Table 18-1 has four entries. Using Figure 18-5 as a guide, draw the situations illustrated in each of the four entries in Table 18-1. Be sure you understand why the direction of change in government spending and the real exch

> a. In 2017, European Union spending on US goods accounted for 19% of US exports (see Table 17-2), and US exports amounted to 12.3% of US GDP (see Table 17-1). What was the share of European Union spending on US goods relative to US GDP? b. Assume that th

> Using the definition of the real exchange rate (and Propositions 7 and 8 in Appendix 2 at the end of the book), you can show that In words, the percentage real appreciation equals the percentage nominal appreciation plus the difference between domestic

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The reduction in the current account deficit in Greece from 2008 to 2018 means that citizens in Greece are better off. b. The nat

> Retrieve the most recent World Economic Outlook (WEO) from the Web site of the International Monetary Fund (www.imf.org). In the Statistical Appendix, find the table titled “Summary of Net Lending and Borrowing,” which lists saving and investment (as a p

> Retrieve the most recent World Economic Outlook (WEO) from the Web site of the International Monetary Fund (www.imf. org). In the Statistical Appendix, find the table titled “Balances on Current Account,” which lists current account balances around the w

> In fighting the recession associated with the crisis, taxes were cut and government spending was increased. The result was a large government deficit. To reduce that deficit, taxes must be increased or government spending must be cut. This is the “exit s

> Retrieve the nominal exchange rates between Japan and the United States from the Federal Reserve Bank of St. Louis FRED data site. It is series AEXJPUS. This exchange rate is written as yen per dollar. a. In the terminology of the chapter, when the excha

> Suppose the domestic currency depreciates (i.e., E falls). Assume that P and P* remain constant. a. How does the nominal depreciation affect the relative price of domestic goods (i.e., the real exchange rate)? Given your answer, what effect would a nomin

> Consider a world with three equal-sized economies (A, B, and C) and three goods (clothes, cars, and computers). Assume that consumers in all three economies want to spend an equal amount on all three goods. The value of production of each good in the thr

> Each of the governments of Brazil and Turkey has issued bonds in Brazilian real (BRL) and Turkish lira (TRY), respectively. Assume that both government securities are one-year bonds, i.e., paying the face value of the bond one year from now. Suppose that

> Consider two fictional economies, one called the domestic country and the other the foreign country. Given the transactions listed in (a) through (g), construct the balance of payments for each country. If necessary, include a statistical discrepancy. a.

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. If there are no statistical discrepancies, countries with current account deficits must receive net capital inflows. b. Although

> After the financial crisis of 2007 as noted in the chapter, almost every country has had to resorb the high fiscal deficit created to fight recession. However, the challenge was to restore a fiscal balance without stopping the growth recovery. a. Go to t

> Suppose, in a hypothetical economy, that the chairman of the Fed unexpectedly announces that he will retire in one year. At the same time, the President announces her nominee to replace the retiring Fed chair. Financial market participants expect the nom

> Refer to the Focus Box “Can a Budget Deficit Reduction Lead to an Output Expansion? The Case of South Africa.” It provides an example of fiscal discipline in a developing country. a. What are the reasons that led the SA government to choose this tight fi

> A new president, who promised during the campaign that she would cut taxes, has just been elected. People trust that she will keep her promise, but expect that the tax cuts will be implemented only in the future. Determine the impact of the election vict

> Using fiscal policy to avoid the meltdown and debt crisis of 2009. As a result of the combined effects of the Great Recession and the European sovereign debt crisis, GDP of Greece declined from €281.44 billion in 2008 to €176.5 billion in 2015. a. What i

> Consider the following statement: “The rational expectations assumption is unrealistic because, essentially, it amounts to the assumption that every consumer has perfect knowledge of the economy.” Discuss.

> For each of the changes in expectations in parts a through d, determine whether there is a shift in the IS curve, the LM curve, both curves, or neither. In each case assume that no other exogenous variable is changing. a. a decrease in the expected futur

> The European Central Bank (ECB) conducts a press conference each month where the president of the ECB presents the measures decided by the Bank Council and answers public questions. a. What do you think is the purpose of such press conferences? b. Accord

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. Changes in the current one-year real interest rate are likely to have a much larger effect on spending than changes in expected f

> The OECD built a consumer confidence and a business confidence index that you may find at https://data.oecd.org/searchresults/?r=+f/ type/indicators. Extract this index for all 19 member countries in the euro area and for China for the period 2008–2017 (

> Go to the World Bank database and select the historical series for gross capital formation (annual % growth) and household final consumption expenditure (annual % growth) for Argentina and Brazil for the period 1995–2016. You may find the data series at

> Consider a consumer across three periods: youth, middle age, and old age. In her youth, the consumer earns €20,000 in labor income. Earnings during middle age are uncertain; there is a 50% chance that the consumer will earn €40,000 and a 50% chance that

> Refer to Problem 5. Suppose now that there are certain borrowing constraints for consumers in their youth. Given that sum of income and total financial wealth is cash in hand, the borrowing constraints mean that consumers cannot consume more than their c

> Suppose that every consumer is born with zero financial wealth and lives for three periods youth, middle age, and old age. Consumers work in the first two periods and retire in the last one. Their income is €5 in the first period, €25 in the second, and

> The South Korean won (or KRW) is the official currency of the Republic of Korea. Suppose that you have just finished college and have been offered a job as a photographer with a famous KPop company (like BigHit) with a starting salary of 1.5 million KRW

> 1.Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. The largest component of GDP is consumption. b. Government spending, including transfers, was equal to 17.4% of GDP in 2018. c.

> A private hospital in Europe is deciding on its next investments. Purchasing the latest medical equipment would cost the hospital €1 million and is expected to earn an annual revenue of €150,000. The real interest rate is 8% this year and is expected to

> Lucy and Adam are university graduates who start working at the same time. Lucy is a computer programmer earning an annual salary of €70,000, and Adam is a teacher with an annual salary of €45,000. Both expect their annual salary to increase by 2% in rea

> Using the information in this chapter, label each of the following statements true, false, or uncertain. Explain briefly. a. For a typical college student, human wealth and nonhuman wealth are approximately equal. b. Natural experiments, such as retireme

> The Economist annually publishes The Economist House Price Index. It attempts to assess which housing markets, by country, are the most overvalued or undervalued relative to fundamentals. Find the most recent version of this data on the Web. a. One index

> Houses can be thought of as assets with a fundamental value equal to the expected present discounted value of their future real rents. a. Would you prefer to use real payments and real interest rates to value a house or nominal payments and n

> Suppose that an investor has a choice between buying a three-year bond with a face value of $60 and a stock paying a constant dividend of $20 per year, which the investor plans to hold for three years. The real interest rate on the stock and the bond is

> Assume the short-term real policy rate, current and expected, had been 2% until now. Suppose the Fed decides to tighten monetary policy and increase the short-term policy rate (r1t) from 2% to 3%. a. What happens to stock prices if the change in r1t is e

> The present value of an infinite stream of dollar payments of $z (that starts next year) is $z/i when the nominal interest rate, i, is constant. This formula gives the price of a consol a bond paying a fixed nominal payment each year, forever. It is also

> Compute the two-year nominal interest rate using the exact formula and the approximation formula for each set of assumptions listed in parts a through c. The term premium on a two-year bond is 1%.

> The Consumer Price Index represents the average price of goods that households consume. Many thousands of goods are included in such an index. Here consumers are represented as buying only fresh food and renting property as their basket of goods. Here is

> For which of the problems listed in parts a through c would you want to use real payments and real interest rates, and for which would you want to use nominal payments and nominal interest rates to compute the expected present discounted value? In each c

> Go to the Web site of the Japanese Ministry of Finance and get the historical data about government bond yields. The data categorizes government bonds according to their maturity. a. Construct the yield curve for the latest available data. What do you ob