Question: Consider the following information: 1. On December

Consider the following information:

1. On December 1, 2014, a U.S. firm plans to purchase a piece of equipment (with an asking price of 100,000 francs) in Switzerland during January of 2015. The transaction is probable, and the transaction is to be denominated in euros.

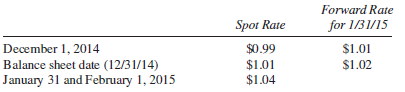

2. On December 1, 2014, the company enters into a forward contract to buy 100,000 francs for $1.01 on January 31, 2015.

3. Spot rates and the forward rates for January 31, 2015, settlement were as follows (dollars per franc):

4. On February 1, the equipment was purchased for 100,000 francs.

Required:

A. Prepare all journal entries needed on December 1, December 31, January 31, and February 1 to account for the forecasted transaction, the forward contract, and the transaction to buy the equipment.

B. When should the company reclassify any amounts reported in other accumulated comprehensive income as a result of the cash flow hedge?

Transcribed Image Text:

Forward Rate Spot Rate for 1/31/15 December 1, 2014 Balance sheet date (12/31/14) $0.99 $1.01 $1.01 $1.02 January 31 and February 1, 2015 $1.04

> The partnership of Cain, Gallo, and Hamm engaged you to adjust its accounting records and convert them uniformly to the accrual basis in anticipation of admitting Kerns as a new partner. Some accounts are on the accrual basis and some are on the cash bas

> Dave, Brian, and Paul are partners in a retail appliance store. The partnership was formed January 1, 2014, with each partner investing $45,000. They agreed that profits and losses are to be shared as follows: 1. Divided in the ratio of 40:30:30 if net i

> Day and Night formed an accounting partnership in 2014. Capital transactions for Day and Night during 2014 are as follows: Partnership net income for the year ended December 31, 2014; is $68,400 before considering salaries or interest. Required: Determ

> The following statement is an excerpt from ASC 270–10–45–1, 2 [paragraphs 9 and 10 of APB Opinion No. 28, “Interim Financial Reporting”]: “Interim financial information is essential to provide investors and others with timely information as to the progre

> Actual quarterly earnings and quarterly estimates of annual earnings for Sloan Company for the year ended December 31, 2014 are as follows: The combined state and federal tax rate for 2014 is 30%. Sloan Company estimated it would have permanent differe

> The ABC Partnership is in the process of liquidation. The account balances prior to liquidation are given below: The partners share profits in the following ratio: Amos, 1/5; Boone, 2/5; Childs, 2/5. Required: Prepare a schedule showing the calculatio

> Bismac Industries is a diversified company whose operations are conducted in five product lines, L, M, N, O, and P. Segmented financial information is to be included with the December 31, 2014 annual report. Financial information pertaining to each segme

> Examine the Statement of Activities in the appendix to this chapter. 1. For each of the six governmental activities listed (from general government to Parks, Recreation, and Cultural Activities), did the program revenue exceed program expenses? List the

> Branson Industries conducts operations in five major industries, A, B, C, D, and E. Financial data relevant to each industry for the year ending December 31, 2014, are as follows: Included in the sales of segments C and E are intersegment sales of $120

> Perez Industries, a publicly held corporation, consists of several companies, each of which provides an array of products and services to unaffiliated customers. In your opinion, each of these companies qualifies as a separate operating segment. The corp

> Pacheco Industries is comprised of four separate profit centers, which are distributed throughout the United States. Relevant data for each profit center are summarized for 2014: You determine that intersegment sales are distributed as follows: Commo

> Bacon Industries operates in seven different segments. Information concerning the operations of these segments for the most recent fiscal period follows: Required: Determine which of the segments must be treated as reportable segments. Орerating Se

> On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company. On January 2, 2014, SFr Company reported a retained earnings balance of 480,000 francs. SFr’s books are maintained in fra

> Babbit, Inc., a multinational corporation based in the United States, owns an 80% interest in Nakima Company, which is located in Sydney, Australia. The acquisition occurred on January 1, 2014. The difference between the implied value of 810,625 Australi

> P Company holds an 80% interest in SFr Company, a Swiss company. A trial balance for P Company and SFr Company at December 31, 2015, and other data are given in Problems 13-3 and 13-4. Ignore deferred income taxes in the assignment of the difference betw

> For this problem, refer to the information provided in Problem 13-3 for P Company and SFr Company. Ignore deferred income taxes in the assignment of the difference between implied and book value. Required: A. If you have not already done so, prepare a w

> John, Jake, and Joe are partners with capital accounts of $90,000, $78,000, and $64,000 respectively. They share profits and losses in the ratio of 30:40:30. When the partners decide to liquidate, the business has $70,000 in cash, noncash assets totaling

> Pasquale Company is a manufacturer of oil drilling equipment located in Canada. The company is 90% owned by a U.S. parent company. The accounting department of Pasquale Company accumulated the following 2014 information for the company’

> Use the information provided in Problem 13-3 for P Company and SFr Company. Problem 13-3: On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2014, SFr Compan

> Examine the appendixes in both Chapter 17 and this chapter (specifically the reconciliation between the Governmental Fund Balance Sheet and the Government-wide Statement of Net Position. 1. What are the top two categories of reconciling differences betwe

> On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2014, SFr Company reported a retained earnings balance of 480,000 francs. SFr’s books are

> Refer to the information given in Problem 13-1. Problem 13-1: On January 1, 2014, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. Al

> P Company holds an 80% interest in SFr Company, a Swiss company. A trial balance for P Company and SFr Company at December 31, 2015, and other data are given in Problems 13-9 and 13-10. The following numbers should change, however, from the amounts state

> For this problem, refer to the information provided in Problem 13-9 for P Company and SFr Company. Ignore deferred income taxes in the allocation of the difference between implied and book value. Problem 13-9: On January 2, 2014, P Company, a U.S.-base

> Use the information provided in Problem 13-9 for P Company and SFr Company. Problem 13-9: On January 2, 2014, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company. On January 2, 2014, SFr Company reported a reta

> On January 1, 2014, a U.S. company purchased 100% of the outstanding stock of Ventana Grains, a company located in Latz City, New Zealand. Ventana Grains was organized on January 1, 2000. All the property, plant, and equipment held on January 1, 2014, wa

> Centennial Exchange of St. Louis, Missouri, imports and exports grains. The company has a September 30 fiscal year-end. The periodic inventory system and the weighted-average cost flow method are used by the company to account for inventory cost. The com

> The trial balance for the MAD Partnership is as follows just before declaring bankruptcy. Partners share profits in the ratio 45:30:25. Required: A. Prepare a schedule to show how available cash would be distributed to the partners after creditors are

> Crystal Exporting Co. is a U.S. wholesaler engaged in foreign trade. The following transactions are representative of its business dealings. The company uses a periodic inventory system and is on a calendar-year basis. All exchange rates are direct quota

> GAF manufactures electrical cells at its St. Louis facility. The company’s fiscal year-end is September 30. It has adopted the perpetual inventory cost flow method to control inventory costs. The company entered into the following trans

> On October 1, 2014, Fairchange Corporation ordered some equipment from a supplier for 300,000 euros. Delivery and payment are to occur on November 15, 2014. The spot rates on October 1 and November 15, 2014, are $1.20 and $1.30, respectively. Required:

> Examine the financial statements for the City of Atlanta in the appendix to this chapter. 1. The balance in unrestricted net position can be positive or negative. A negative balance would indicate that the government owes more than it owns. What is the b

> On October 1, 2014, Fairchange Corporation ordered some equipment from a supplier for 300,000 euros. Delivery is to occur on November 15, 2014, while payment is expected to occur on December 15, 2014. The spot rates on October 1, November 15, and Decembe

> On October 1, 2014, Fairchange Corporation ordered some equipment from a supplier for 300,000 euros. Delivery and payment are to occur on November 15, 2014. The spot rates on October 1 and November 15, 2014, are $1.20 and $1.30, respectively. Required:

> Consider the following information: 1. On December 1, 2011, a U.S. firm plans to sell a piece of equipment [with an asking price of 200,000 units of a foreign currency (FC)] during January of 2012. The transaction is probable, and the transaction is to b

> Slocome Travel owns a travel agency that operates in London. Account balances in pounds for the subsidiary are summarized below: Exchange rates for 2014 were as follows: January 1 ………â&#

> Refer to the data provided in Exercise 13-7 for Dorsey Corporation and Lansing Company. Exercise 13-7: Dorsey Corporation purchased 90% of the common stock of Lansing Company on January 1, 2008. The cost of the investment was equal to the book value in

> Dorsey Corporation purchased 90% of the common stock of Lansing Company on January 1, 2008. The cost of the investment was equal to the book value interest acquired. Lansing Company operates two retail stores and an exporting business in London that spec

> Refer to Exercise 13-4. Using the same information, assume that the Brazilian real is identified as the functional currency of the subsidiary. Exercise 13-4: On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in

> On January 1, 2014, Trenten Systems, a U.S.-based company, purchased a controlling interest in Grant Management Consultants located in Zurich, Switzerland. The acquisition was treated as a purchase transaction. The 2014 financial statements stated in Swi

> Select the best answer choice for each of the following items. 1. Perez Company’s operations are unrelated to the operations of its subsidiary. Certain balance sheet accounts of the foreign subsidiary at December 31, 2014, have been tra

> A U.S. company estimated that, in the first two months of 2016, its export sales to a Swiss company would generate 400,000 francs. On December 1, 2015, in an effort to protect against the weakening franc, the company purchased an option (out of the money

> Select the best answer for each of the following items: 1. Golf Company acquired 80% of the outstanding stock of Ping Company, a foreign company, in an acquisition accounted for as a purchase transaction. In preparing consolidated statements, the paid-in

> A U.S. company owns an 80% interest in a company located on Mars. Martian currency is called the Martian Credit. During the year the parent company sold inventory that had cost $24,000 to the subsidiary on account for $30,000 when the exchange rate was $

> Accounts are listed below for a foreign subsidiary that maintains its books in its local currency. The equity interest in the subsidiary was acquired in a purchase transaction. In the space provided, indicate the exchange rate that would be used to trans

> During December of the current year, Teletex Systems, Inc., a company based in Seattle, Washington, entered into the following transactions: Required: A. Prepare journal entries to record the transactions above on the books of Teletex Systems, Inc. The

> On April 18, 2011, Eli Lilly and Co. reported first quarter profits for 2011 of $0.95 per share. Analysts projected earnings to be $1.16 or $1.17 per share. However, Lilly reported non-GAAP earnings per share of $1.24. Lilly states that non-GAAP results

> 1. On June 1, 2014, a U.S. firm contracts to sell equipment (with an asking price of 2,000,000 krona) in Sweden. The firm will take delivery and will pay for the equipment on August 1, 2014. 2. Spot rates were as follows (dollars per krona): Spot Rate J

> Consider the following information: 1. On December 1, 2014, a U.S. firm contracts to sell equipment (with an asking price of 1,000,000 pesos) in Mexico. The firm will take delivery and will pay for the equipment on March 1, 2015. 2. On December 1, 2014,

> On November 15, 2014, Solanski Inc. imported 500,000 barrels of oil from an oil company in Venezuela. Solanski agreed to pay 50,000,000 bolivars on January 15, 2015. To ensure that the dollar outlay for the purchase will not fluctuate, the company entere

> Roland Brothers, Inc. purchased equipment from a British firm for £120,000 on April 1, 2014. To finance the purchase of the equipment, the president of the company signed a note for £120,000 with a British bank. The loan is denominated in pounds, matures

> During her first quarter review of the financial statements, Debra Bell, the CFO of HAL Computer Corporation, was distressed to notice the company’s transaction loss had been steadily increasing each month. HAL is a publicly held manufacturer of “PC clon

> Use the data given in Exercise 12-9, except assume that on November 1, Sitco Products entered into a 90-day forward contract to buy 900,000 Swedish kronas on January 30 for $.5085 per krona. Exercise 12-9: Sharon Myers, chief finance officer for Sitco

> Sharon Myers, chief finance officer for Sitco Products, convinced the president of the company to enter into a 90-day forward contract to sell 900,000 Swedish kronas as a speculative venture. When the forward contract was acquired on November 1, 2014, th

> Vanderbilt Clothing Company placed a clothing order with a company located in Taiwan. The order was placed on November 1, 2014, for delivery on May 1, 2015. Vanderbilt agreed to pay for the goods on May 1, 2015, with the delivery of 5,000,000 Taiwan doll

> ASI recently completed the development and installation of an accounting information system for a company located in Rio De Janeiro, Brazil. The company considered that all revenue realization criteria were satisfied and accordingly recorded on October 2

> Agentel Corporation is a U.S.-based importing-exporting company. The company entered into the following transactions during the month of November. All the transactions were unsettled at December 31, Agentel’s fiscal year-end. Spot rat

> In the Appendix to this chapter, found online at www.wiley.com/college/jeter, the partial segmental disclosures for General Electric (GE) are provided. 1. How does GE organize and present its segment data? 2. Compute the following ratios for 2011, 2012,

> After the election of a prominent political figure, the principal from a term endowment fund was expendable by Crandall University. The official was elected this year. The fund was restricted to the construction of a Political Science building annex. The

> Jefferson Hospital received money from a donor to set up an endowment fund. The following information pertains to this contribution: During 2015 1. $2,000,000 was received to establish the fund. The requirements were (a) $100,000 of the endowment fund’s

> A well-known celebrity sponsored a telethon for the Help for the Blind Foundation on November 1, 2015. Pledges in the amount of $1,000,000 were called in. Using similar telethon campaigns as a basis, it is estimated that 25% of the pledges will be uncoll

> Hastings College pooled the individual investments of three of its funds on December 31, 2014. The recorded value and the fair market value of the investments on December 31, 2014, are presented here: During 2015 the investment pool earned dividends of

> Citron Company is a U.S.-based citrus grower. On October 1, 2014, the company entered into a contract to ship 25,000 boxes of grapefruit on January 28 to Japan. Payment of 50,100,000 yen is to be received on March 29, 2015. On October 1, Citron also ente

> In the appendix to this chapter, the Statement of Revenues, Expenditures, and Changes in Fund Balances for the General Fund for the City of Atlanta is reported. 1. How is the format used on the Statement of Revenues, Expenditures, and Changes in Fund Bal

> The following events relate to Grearson University Loan Fund: 1. $100,000 is received from an estate to establish a faculty and student loan fund. Annual interest rates range from 8% for students to 10% for faculty. 2. Loans to students totaled $60,000,

> The Franklin Public Library received a restricted contribution of $300,000 in 2015. The donor specified that the money must be used to acquire books of poetry written in the sixteenth century. As of December 31, 2015, only $100,000 of the restricted reso

> Select the best answer for each of the following items: 1. Depreciation should be recognized in the financial statements of (a) Private sector proprietary (for profit) hospitals only. (b) Both private sector proprietary (for profit) hospitals and not-for

> On January 1, 2015, Allentown issued $800,000 of 9% serial bonds at par. Semiannual interest is payable on January 1 and July 1 and principal of $80,000 matures each January 1 starting in 2016. The debt will be serviced through a special tax levy designe

> The following transactions take place: 1. The General Fund repaid the Special Revenue Fund a loan of $10,000 plus $900 in interest on the loan. 2. On January 1, the city issued 9% general obligation bonds with a face value of $2,000,000 payable in 10 yea

> The following events take place: 1. Hector Madras died and left 100 acres of undeveloped land to the city for a future park. He acquired the land at $100 an acre, but at the date of his death the land was appraised at $8,000 an acre. 2. The city authoriz

> On May 24, 2011, Invitel Holdings announced its financial results for the quarter ended March 31, 2011. The results reflect the consolidated financial results of Magyar Telecom B.V. and its subsidiaries. The reporting currency is the euro; however, the f

> The following events take place: 1. The Special Revenue Fund transfers $8,000 to the Internal Service Fund as a temporary loan. 2. The Internal Service Fund bills the Special Revenue Fund $20,000 for services performed. 3. Interest payments in the amount

> The following information was available about items that differed between the governmental funds and the government-wide statements. Assume that there are no internal service funds. The schedule of capital assets prepared for the year ended December 31,

> The following information is available about items that differ between the governmental funds and the government wide statements. Assume that there are no internal service funds. The schedule of capital assets prepared for the year ended December 31, 201

> Apple Company was incorporated in Delaware in 2012. On November 2, 2014, the controller of the company entered into a forward contract to sell 50,000 British pounds for $1.5920 on March 1, 2015. The following exchange rates were quoted on the indicated d

> The following schedule of capital assets was prepared for Capital City. All capital acquisitions were made in a capital projects fund (and paid for with cash). An asset was sold by the general fund for $65,000 cash. Required: Determine how the above i

> On January 1, 2015, Metropolis City issued a 7%, 5-year, $100,000 general obligation bond for $96,007. The bond pays interest annually (on December 31) and was issued to yield 8%. The bond was issued in the capital projects fund, and the proceeds are to

> Required: Using Illustrations 18-10, 18-11, 18-14, and 18-15, determine which of Model City’s funds qualify as major funds using the percentage cutoffs. Calculate aggregate amounts for all other nonmajor funds, and indicate how they would be presented.

> SMC Inc. operates restaurants based on various themes, such as Mex-delight, Chinese for the Buffet, and Steak-it and Eat-it. The Steak-it and Eat-it restaurants have not been performing well recently, but SMC prefers not to disclose these details for fea

> The Shady Tree Company is preparing to announce their quarterly earnings numbers. The company expects to beat the analysts’ forecast of earnings by at least 5 cents a share. In anticipation of the increase in stock value and before the release of the ear

> Executive stock options (ESOs) are used to provide incentives for executives to improve company performance. ESOs are usually granted “at-the-money,” meaning that the exercise price of the options is set to equal the market price of the underlying stock

> A vice president of marketing for your company has been charged with embezzling nearly $100,000 from the company. The vice president allegedly submitted fraudulent vendor invoices in order to receive payments. As the vice president of marketing for the c

> MF Global Holdings Ltd. reported items relating to foreign currency translation in several places in its 2011 10-K report. Included in general and other expenses on the 2011, 2010, and 2009 income statements respectively were translation gains or losses

> On the first page of this chapter, an article is referenced describing the recent activities of the chancellor of Vanderbilt University. Comment on the pros and cons, from an ethical perspective, of allowing a university employee in such a position great

> GASB 45 requires that the expected future costs of retiree health costs be recognized in the current period. Prior to this, governments used a pay-as-you-go plan in which only the current year’s actual payments affected the financial statements. Suppose

> Selco, a U.S. Company, imports and exports tools, shop equipment, and industrial construction supplies. The company uses a periodic inventory system. During April the company entered into the following transactions. All rate quotations are direct exchang

> At State College, where football has long reigned as king and fans are near fanatical in their attendance, the frenzy for football tickets has recently reached an all-time high. With requests for home game tickets at an unprecedented level, prices on eve

> You and two of your former college friends, Freeman and Oxyman, formed a partnership called FOB, which builds and installs fabricated swimming pools. The business has been operating for 15 years and has become one of the top swimming pool companies in th

> Many companies with defined benefit plans are curtailing or eliminating the plans altogether. With a defined benefit plan, the company guarantees some set amount (or formula-determined payment) when the employee retires. Because most pension assets are i

> Are International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) considered authoritative by the Codification?

> Where are estimated income taxes reported on the statement of financial condition for personal financial statements?

> How does the presentation of personal balance sheets differ from balance sheets for entities (in general terms)? Where is this located in the Codification?

> If a company does not present a separate fourth-quarter interim report for its income statement, but presents only the annual income statement at that time, are there any additional disclosure requirements? If so, what are they?

> Are interim periods considered stand-alone financial statements or are they considered an integral part of the annual financial statements under current GAAP? Do you concur with this position? Why or why not?

> Red Hat, Inc. reported comprehensive income from 2008 to 2010 as follows ($ thousands): Required: A. Assuming that Red Hat has not purchased or sold any available-for-sale securities, what has happened to the value of the available-for-sale investments

> If a non-SEC reporting company decided to issue monthly interim financial statements, would the GAAP Codification apply?

> Air France—KLM Group reports the following balance sheet for the year ended December 31, 2013. Required: A. In what order are assets listed on the balance sheet? B. Comment on other differences (IFRS relative to U.S. GAAP) that you mig

> A company incurred an extraordinary loss in the second quarter and has prorated this loss over the three remaining quarters in the current fiscal year. Is this appropriate? Why or why not?

> Is a firm required to report a Statement of Comprehensive Income on an interim basis?

> Practices vary in determining costs of inventory. For example, cost of goods produced may be determined based on standard or actual cost, while cost of inventory may be determined on an average, first-in, first-out (FIFO), or last-in, first-out (LIFO) co