Question: Consider three independent cases for the cash

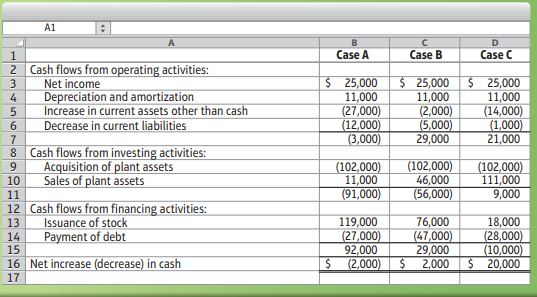

Consider three independent cases for the cash flows of Winter Merchandising Corporation. For each case, identify from the statement of cash flows how the company generated the cash to acquire new plant assets. Rank the three cases from the most healthy financially to the least healthy.

> Fresno Consultants purchased a building for $440,000 and depreciated it on a straight-line basis over 40 years. The estimated residual value was $82,000. After using the building for 20 years, Fresno realized that the building would remain useful only 14

> Shay Corporation owns equity-method investments in several companies. Shay paid $1,600,000 to acquire a 25% investment in Faulk Software Company. Faulk reported net income of $620,000 for the first year and declared and paid cash dividends of $480,000.

> Ardmore Investments purchased Columbia Corporation shares on December 16 for $110,000. Ardmore plans on holding the securities a few months. Ardmore owns less than 2% of the outstanding shares of Columbia. 1. Suppose the Columbia shares decreased in val

> On January 1, 2018, Little City Bar & Grill purchased a building, paying $58,000 cash and signing a $110,000 note payable. The company paid another $62,000 to remodel the building. Furniture and fixtures cost $55,000, and dishes and supplies—a current

> Accounting records for Allegheny Corporation yield the following data for the year ended June 30, 2018: Requirements: 1. Journalize Allegheny’s inventory transactions for the year under the perpetual system. 2. Report ending inventory,

> Banta Tile & Marble Corporation reported the following comparative income statements for the years ended November 30, 2018, and 2017: Banta’s president and shareholders are thrilled by the company’s boost in sales

> Valentine Antiques, Inc., began May with inventory of $49,300. The business made net purchases of $50,200 and had net sales of $81,300 before a fire destroyed the company’s inventory.For the past several years, Valentine’s gross profit percentage has bee

> McGuire Industries prepares budgets to help manage the company. McGuire is budgeting for the fiscal year ended January 31, 2018. During the preceding year ended January 31, 2017, sales totaled $9,200 million and cost of goods sold was $6,300 million. A

> The Hooper Book Company’s accounting records include the following for 2018 (in thousands): Requirements: 1. Prepare Hooper Book Company’s single-step income statement for the year ended December 31, 2018, including e

> Evaluate the common stock of Tristan Distributing Company as an investment. Specifically, use the two common stock ratios to determine whether the common stock became more or less attractive during the past year. (The number of common stock shares was th

> Altar Loan Company’s balance sheet at December 31, 2018, reports the following: During 2018, Altar Loan earned net income of $6,200,000. Calculate Altar Loan’s earnings per common share (EPS) for 2018; round EPS to t

> For 2018 and 2017, calculate return on sales, asset turnover, return on assets (ROA), leverage, return on common stockholders’ equity (ROE), gross profit percentage, operating income percentage, and earnings per share to measure the abi

> Evansville Furniture Company has asked you to determine whether the company’s ability to pay its current liabilities and long-term debts improved or deteriorated during 2018. To answer this question, calculate the following ratios for 2

> During the most recent year, Quinn Co. bought 2,800 shares of Germana-Hall Corporation common stock at $35, 590 shares of Barlengo Corporation stock at $45.50, and 1,000 shares of Frumley Corporation stock at $70. At December 31, Hoover’s Online reports

> The financial statements of Big City News, Inc., include the following items: Requirements: 1. Calculate the following ratios for 2018 and 2017. When calculating days, round your answer to the nearest whole number. a. Current ratio b. Quick (acid-test)

> The following information is for Leary Lodge. What were the dollar amount of change and the percentage of each change in Leary Lodge’s net working capital during 2018 and 2017? Is this trend favorable or unfavorable?

> Prepare a comparative common-size income statement for Monroe Music Co. using the 2018 and 2017 data of E12-27B and rounding to four decimal places. Data from E12-27B:

> Perform a vertical analysis of Chapel Hill Golf Company’s balance sheet to determine the component percentages of its assets, liabilities, and stockholders’ equity.

> Calculate trend percentages LO 2for Oak View Sales & Service’s total revenue and net income for the following five-year period, using year 0 as the base year. Round to the nearest full percent. Which grew faster during the period,

> Prepare a horizontal analysis of the comparative income statements of Monroe Music Co. Round percentage changes to the nearest one-tenth percent (three decimal places)

> The Calloway Book Company’s accounting records include the following for 2018 (in thousands): Requirements: 1. Prepare Calloway Book Company’s single-step income statement for the year ended December 31, 2018, includ

> Evaluate the common stock of Carver Distributing Company as an investment. Specifically, use the two common stock ratios to determine whether the common stock became more or less attractive during the past year. (The number of common stock shares was the

> Palace Loan Company’s balance sheet at December 31, 2018, reports the following: During 2018, Palace Loan earned net income of $6,300,000. Calculate Palace Loan’s earnings per common share (EPS) for 2018. (Round EPS

> For 2018 and 2017, calculate return on sales, asset turnover, return on assets (ROA), leverage, return on common stockholders’ equity (ROE), gross profit percentage, operating income percentage, and earnings per share to measure the abi

> Journalize the following long-term, equity security transactions of Jeakin Department Stores: a. Purchased 450 shares of Fordham Fine Foods common stock at $33 per share (less than 10% of Fordham’s outstanding stock), with the intent of holding the stoc

> Jalbert Furniture Company has asked you to determine whether the company’s ability to pay its current liabilities and long-term debts improved or deteriorated during 2018. To answer this question, calculate the following ratios for 2018

> The financial statements of Explorer News, Inc., include the following items: Requirements: 1. Calculate the following ratios for 2018 and 2017. When calculating days, round your answer to the nearest whole number. a. Current ratio b. Quick (acid-test

> The following information is for Nature Lodge. What were the dollar amounts of change and the percentage of each change in Nature Lodge’s net working capital during 2018 and 2017? Is this trend favorable or unfavorable?

> Prepare a comparative common-size income statement for Norman Music Co., using the 2018 and 2017 data of E12-16A and rounding to four decimal places. Data from E12-16A:

> Perform a vertical analysis of Beta Golf Company’s balance sheet to determine the component percentages of its assets, liabilities, and stockholders’ equity

> Calculate trend percentages LO 2for Blueberry Valley Sales & Service’s total revenue and net income for the following five-year period, using year 0 as the base year. Round to the nearest full percent. Which grew faster during the

> Prepare a horizontal analysis of the comparative income statements of Norman Music Co. Round percentage changes to the nearest one-tenth percent (three decimal places).

> Calculate the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable were $25,000 and $24,000, respectively. Credit sales for the period totaled $69,000. How much were the cash collections from customers? b. Cost of

> The income statement and additional data of Jubilee World, Inc., follow: Additional data: a. Collections from customers are $15,500 more than sales. b. Payments to suppliers are $1,700 less than the sum of cost of goods sold plus advertising expense. c.

> Selected accounts of Roosevelt Framing Company show the following: Requirement: 1. For each account, identify the item or items that should appear on a statement of cash flows prepared using the direct method. State where to report the item.

> Lancaster Corporation, an investment banking company, often has extra cash to invest. Suppose Lancaster buys 500 shares of Knight Corporation stock at $40 per share, representing less than 5% of Knight’s outstanding stock. Lancaster expects to hold the K

> The accounting records of Pepperell Pharmaceuticals, Inc., reveal the following: Requirement: 1. Prepare cash flows from operating activities using the direct method. Also evaluate Pepperell’s operating cash flow. Give the rationale f

> Calculate the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, were $101,000 and $98,000, respectively. Depreciation for the period was $20,000, and purchases of new plant assets were $38,000. Plant assets were

> Consider three independent cases for the cash flows of Lucky Merchandise Company. For each case, identify from the statement of cash flows how the company generated the cash to acquire new plant assets. Rank the three cases from the most healthy financ

> The income statement and additional data of Casey Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $153,000. Of this amount, $102,000 was paid in cash and $51,000 was financed by signing a note payable. b. Proceeds fro

> The accounting records of the Ashby Trading Post Company include these accounts: Requirement: 1. Prepare the company’s net cash provided by (used for) operating activities section of the statement of cash flows for the month of July.

> The accounting records of Steven Corporation reveal the following: Requirements: 1. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. 2. Evaluate the operating cash flow of Steven Corporat

> Vanderpool Investments specializes in low-risk government bonds. Identify each of Vanderpool’s transactions as operating (O), investing (I), financing (F), noncash investing and financing (NIF), or a transaction that is not reported on

> Calculate the following items for the statement of cash flows: a. Beginning and ending Accounts Receivable were $28,000 and $27,000, respectively. Credit sales for the period totaled $66,000. How much were the cash collections from customers? b. Cost of

> income statement and additional data of Hapland Light, Inc., follow: Additional data: a. Collections from customers are $15,500 less than sales. b. Payments to suppliers are $1,500 more than the sum of cost of goods sold plus advertising expense. c. Pay

> Selected accounts of McKay Bricker Framing show the following: Requirement: 1. For each account, identify the item or items that should appear on a statement of cash flows prepared using the direct method. State where to report the item.

> Griffin Company’s inventory records for its retail division show the following at December 31: At December 31, 11 of these units are on hand. Journalize the following for Griffin Company under the perpetual system: 1. Total December p

> The accounting records of Grand Pharmaceuticals, Inc., reveal the following: Requirement: 1. Prepare cash flows from operating activities using the direct method. Also evaluate Grand’s operating cash flow. Give the rationale for your

> Calculate the following items for the statement of cash flows: a. Beginning and ending Plant Assets, Net, were $115,000 and $109,000, respectively. Depreciation for the period was $11,000, and purchases of new plant assets were $25,000. Plant assets were

> The income statement and additional data of Barnaby Travel Products, Inc., follow: Additional data: a. Acquisition of plant assets was $156,000. Of this amount, $104,000 was paid in cash and $52,000 was financed by signing a note payable. b. Proceeds f

> The accounting records of the Porter Trading Post Company include these accounts: Requirement: 1. Prepare the company’s net cash provided by (used for) operating activities section of the statement of cash flows for the month of Decem

> The accounting records of Kelly Corporation reveal the following: Requirements: 1. Prepare the cash flows from operating activities section of the statement of cash flows using the indirect method. 2. Evaluate the operating cash flow of Kelly Corporati

> Aurum Investments specializes in low-risk government bonds. Identify each of Aurum’s transactions as operating (O), investing (I), financing (F), noncash investing and financing (NIF), or a transaction that is not reported on the statem

> Riverside Company reported the following items on its statement of shareholders’ equity for the year ended December 31, 2018 (amounts in thousands of dollars): Requirements: 1. Determine the December 31, 2018, balances in Riverside&aci

> Use the Virginia data in E10-54B to show how the company reported cash flows from financing activities during 2018 (the current year). Data from E10-54b:

> Virginia Company included the following items in its financial statements for 2018, the current year (amounts in millions): Requirements: 1. Use DuPont Analysis to calculate Virginia’s return on assets and return on common equity duri

> Accounting records for Jubilee Corporation yield the following data for the year ended June 30, 2018 (assume sales returns are non-existent): Requirements 1. Journalize Jubilee’s inventory transactions for the year under the perpetual

> The company had no preferred stock. Requirements: 1. Calculate the following ratios: a. Net profit margin b. Asset turnover ratio c. Leverage ratio d. Return on assets (ROA) e. Return on equity (ROE) 2. Which is higher, ROA or ROE? Does this make sense

> Data from the financial statements of Glowing Candle Company included the following: The company had no preferred stock. Requirements: 1. Calculate the following ratios: a. Net profit margin b. Asset turnover ratio c. Leverage ratio d. Return on assets

> Identify the effects—both the direction and the dollar amount—of these transactions on the total stockholders’ equity of Cadberry Corporation. Each transaction is independent. a. Declaration of cash dividends of $75 million. b. Payment of the cash divide

> The stockholders’ equity section of the balance sheet for Yarrow Yogurt Company on August 12, 2019, follows: On August 12, 2019, the market price of Yarrow common stock was $18 per share. Yarrow declared and distributed a 10% stock d

> Huron Manufacturing, Inc., reported the following at December 31, 2018, and December 31, 2019 Huron Manufacturing has paid all preferred dividends only through 2015. Requirement: 1. Calculate the total amounts of dividends to both preferred and common

> Optical Products Company reported the following stockholders’ equity on its balance sheet: Requirements: 1. What caused Optical’s preferred stock to decrease during 2019? Cite all possible causes. 2. What caused the c

> Use the Creator Corporation data in E10-46B to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2019 Data from E10-46:

> At December 31, 2018, Creator Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Creator’s 2019 transactions included a. Net income, $451 mil

> Allenton Marketing Corporation reported the following stockholders’ equity at December 31 (adapted and in millions): During the next year, Allenton purchased treasury stock at a cost of $22 million and resold treasury stock for $10 mil

> Beluga Software had the following selected account balances at December 31, 2018 (all numbers and amounts are in thousands, except par value per share): Requirements: 1. Prepare the stockholders’ equity section of Beluga Softwareâ

> Quimby Sports Authority purchased inventory costing $30,000 by signing a 6% short-term, one-year note payable. The purchase occurred on July 31, 2018. Quimby pays annual interest each year on July 31. Journalize the company’s (a) purchase of inventory; (

> The financial statements of Noble Employment Services, Inc., reported the following accounts (adapted, with dollar amounts in thousands except for par value): Net income has already been closed to Retained Earnings. Prepare the stockholdersâ€

> Coastal Publishing was recently organized as a corporation. The company issued common stock to an attorney who provided legal services worth $25,000 to help with the incorporation. Coastal also issued common stock to an inventor in exchange for her paten

> Caribbean Imports is authorized to issue 16,000 shares of common stock. During a two-month period, Caribbean completed these stock transactions: Requirements: 1. Journalize the transactions. 2. Prepare the stockholders’ equity section

> Complete each of the following statements with one of the terms listed here. a. represents the amount of stockholders’ equity that the corporation has earned through profitable operations less any dividends declared. b. The owners of t

> Lakeside Company reported the following items on its statement of shareholders’ equity for the year ended December 31, 2018 (amounts in thousands of dollars): Requirements: 1. Determine the December 31, 2018, balances in Lakeside&acir

> Use the Carolina Company data in E10-37A to show how the company reported cash flows from financing activities during 2018 (the current year). Data from E10-37:

> Carolina Company included the following items in its financial statements for 2018, the current year (amounts in millions): Requirements: 1. Use DuPont Analysis to calculate Carolina’s return on assets and return on common equity duri

> Financial Services is considering two plans for raising $800,000 to expand operations. Plan A is to borrow at 10%, and plan B is to issue 200,000 shares of common stock at $4.00 per share. Before any new financing, United has net income of $500,000 and

> Data from the financial statements of Eclectic Candle Company included the following: The company had no preferred stock. Requirements: 1. Calculate the following ratios: a. Net profit margin b. Asset turnover ratio c. Leverage ratio d. Return on asse

> Identify the effects—both the direction and the dollar amount—of these transactions on the total stockholders’ equity of Niles Corporation. Each transaction is independent. a. Declaration of cash dividends of $85 million. b. Payment of the cash dividend

> Dean Sales Company completed the following note payable transactions: Requirements: 1. How much interest expense must be accrued at December 31, 2018? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Dean Salesâ€&#

> The stockholders’ equity section of the balance sheet for Warren Corporation on August 16, 2019, follows: On August 16, 2019, the market price of Warren common stock was $20 per share. Warren declared and distributed a 10% stock divi

> Ontario Manufacturing, Inc., reported the following at December 31, 2018, and December 31, 2019: Ontario Manufacturing has paid all preferred dividends only through 2015. Requirement: 1. Calculate the total amounts of dividends to both preferred and co

> Omega Products Company reported the following stockholders’ equity on its balance sheet: Requirements: 1. What caused Omega’s preferred stock to decrease during 2019? Cite all possible causes. 2. What caused the compa

> Use the Atlantic Corporation data in E10-29A to prepare the stockholders’ equity section of the company’s balance sheet at December 31, 2019. Data from E10-29:

> At December 31, 2018, Atlantic Corporation reported the stockholders’ equity accounts shown here (with dollar amounts in millions, except per-share amounts). Atlantic’s 2019 transactions included a. Net income, $440 m

> Wishtown Marketing Corporation reported the following stockholders’ equity at December 31 (adapted and in millions): During the next year, Wishtown purchased treasury stock at a cost of $28 million and resold treasury stock for $14 m

> Bretton Software had the following selected account balances at December 31, 2018 (all numbers and amounts are in thousands, except par value per share): Requirements: 1. Prepare the stockholders’ equity section of Brettonâ€

> The financial statements of Mountainview Employment Services, Inc., reported the following accounts (adapted, with dollar amounts in thousands except for par value): Net income has already been closed to Retained Earnings. Prepare the stockholdersâ

> Excursion Publishing was recently organized as a corporation. The company issued common stock to an attorney who provided legal services worth $24,000 to help with the incorporation. Excursion also issued common stock to an inventor in exchange for her p

> Pickering Stores is authorized to issue 11,000 shares of common stock. During a two-month period, Pickering completed these stock transactions: Requirements: 1. Journalize the transactions. 2. Prepare the stockholders’ equity section

> On August 1, 2019, The Shoppes at Mill Lake, Inc., purchased inventory costing $40,000 by signing a 6%, six-month, short-term note payable. The company will pay the entire note (principal and interest) on the note’s maturity date. Requirements: 1. Journ

> Complete each of the following statements with one of the terms listed here. a. The right to maintain one’s proportionate ownership in the corporation is the right of . b. The right to receive a proportionate share of any assets remain

> Holloway Corporation issued 8%, 10-year bonds with a face value of $2,000,000 at a price of 96 on July 1, 2018. The bonds pay interest each January 1 and July 1. Holloway uses the straight-line amortization method for all bond premiums and discounts. T

> Green Earth Homes, Inc., builds environmentally sensitive structures. The company’s 2018 revenues totaled $2,770 million. At December 31, 2018 and 2017, the company had, respectively, $663 million and $613 million in current assets. The

> Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. Compare three fictitious companies (Biltmore, Mackey, and Vic

> Coldwell Transportation LO 4owns a fleet of 60 semi-trucks. The original cost of the fleet was $9,000,000. Coldwell uses straight-line depreciation for the fleet for accounting purposes, and MACRS depreciation for tax purposes. The company had a deferred

> On January 1, 2017, Ditchey Corporation issued five-year, 6% bonds payable with a face value of $3,500,000. The bonds were issued at 96 and pay interest on January 1 and July 1. Ditchey amortizes bond discounts using the straight-line method. On December

> On June 30, 2018, the market interest rate is 9%. Randall Corporation issues $600,000 of 10%, 15-year bonds payable. The bonds pay interest on June 30 and December 31. The company amortizes bond premium using the effective-interest method. Requirements:

> Energy Ltd. is authorized to issue $3,000,000 of 1%, 10-year bonds payable. On December 31, 2018, when the market interest rate is 8%, the company issues $2,400,000 of the bonds. Energy amortizes bond discount using the effective-interest method. The sem

> Town Bank has $100,000 of 4% debenture bonds outstanding. The bonds were issued at 106 in 2018 and mature in 2038. The bonds have annual interest payments. Requirements: 1. How much cash did Town Bank receive when it issued these bonds? 2. How much cas

> On January 31, 2018, Pristar Logistics, Inc., issued 10-year, 5% bonds payable with a face value of $5,000,000. The bonds were issued at 95 and pay interest on January 31 and July 31. Pristar Logistics amortizes bond discounts using the straight-line met