Question: Construct a candlestick chart for the data

Construct a candlestick chart for the data presented in Exercise 13.

Exercise 13:

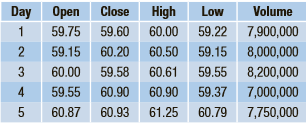

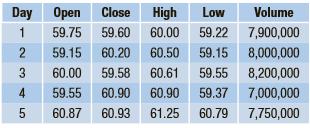

Use the following data to construct a stock bar chart for the 5-day period.

Transcribed Image Text:

Day Open Close High Low Volume 1 59.75 59.60 60.00 59.22 7,900,000 59.15 60.20 60.50 59.15 8,000,000 3 60.00 59.58 60.61 59.55 8,200,000 4 59.55 60.90 60.90 59.37 7,000,000 60.87 60.93 61.25 60.79 7,750,000 Day Open Close High Low Volume 1 59.75 59.60 60.00 59.22 7,900,000 59.15 60.20 60.50 59.15 8,000,000 3 60.00 59.58 60.61 59.55 8,200,000 4 59.55 60.90 60.90 59.37 7,000,000 60.87 60.93 61.25 60.79 7,750,000

> The Sundaram family just bought a third car. The annual premium would have been x dollars to insure the car, but they are entitled to a 10% discount since they have other cars insured with the company. a. Express their annual premium after the discount

> How do those words apply to an investor? How do those words apply to a stockbroker?

> Write the profit function for the given expense and revenue functions. E = 220,000p + 190,000 R = 22,170p2 + 187,000p

> Julianne currently pays x dollars for her annual premium. She will be away at college for the upcoming year and will only use the car when she is home on vacations. Since she is using the car much less, she is less of a risk and her insurance company off

> Explain how the quote can be interpreted from what you have learned.

> Sixteen men and sixteen women purchased magazine subscriptions. The distribution of prices had the same mean, minimum score, and maximum score. The red markings on each number line below show where their prices fell. a. What is

> Eric must pay his p dollar annual insurance premium by himself. He works at a job after school. a. Express how much he must save each month to pay this premium algebraically. b. If he gets into a few accidents and his company raises his insurance 15%, e

> Jared’s car slides into a stop sign during an ice storm. There is x dollars damage to his car, where x . 1,000, and the stop sign will cost y dollars to replace. Jared has $25,000 worth of PD insurance, a $1,000 deductible on his collision and comprehens

> Felix has $10,000 worth of property damage insurance and a $1,000 deductible collision insurance policy. He had a tire blowout while driving and crashed into a $1,400 fire hydrant. The crash caused $1,600 in damages to his car. a. Which insurance covers

> Leslie has comprehensive insurance with a $500 deductible on her van. On Halloween her van is vandalized, and the damages total $1,766. Leslie submits a claim to her insurance company. a. How much must Leslie pay for the repair? b. How much must the in

> Nico has a personal injury protection policy that covers each person in, on, around, or under his car for medical expenses as a result of an accident. Each person can collect up to $50,000. Nico is involved in an accident and three people are hurt. One p

> Gary has $10,000 worth of property damage insurance. He collides with two parked cars and causes $12,000 worth of damage. How much money must Gary pay after the insurance company pays its share?

> Ruth has decided to drop her collision insurance because her car is getting old. Her total annual premium is $916, of which $170.60 covers collision insurance. a. What will her annual premium be after she drops the collision insurance? b. What will her

> Gloria pays her insurance in three installments each year. The first payment is 40% of the annual premium, and each of the next two payments is 30% of the annual premium. If the annual premium is $924, find the amounts of the three payments.

> A guy wire is helping to support a utility pole in Ilsi’s backyard, as shown in the diagram. The point U is located 3 feet below the top of the pole. a. What is the angle of elevation of the guy wire? Round to the nearest degree. b.

> Maria is a stock broker and has been following transactions for Ford Motor Co (F). On Tuesday, the last trade of the day for Ford was posted on the ticker as $12.47. On Wednesday, the last trade of the day was $0.56 higher than Tuesday’s close for a purc

> Ronald bought a new car and received these price quotes from his insurance company. personal injury protection ……………………………………………………………… $234 bodily injury liability ………………………………………………………………………. $266 property damage liability ………………………………………………………………… $1

> Rachel has $25,000 worth of property damage insurance. She causes $32,000 worth of damage to a sports car in an accident. a. How much of the damages will the insurance company have to pay? b. How much will Rachel have to pay?

> Interpret the quote in the context of what you learned about auto insurance in this section.

> Emily’s employer offers a pension plan that calculates the annual pension as the product of the final average salary, the number of years of service, and a 2% multiplier. Her employer uses a graded 5-year vesting formula as shown. After 4 years, Emily le

> A certain company offers a 5-year average retirement formula for their employees. The accountant uses a spreadsheet to keep track of employee benefits. The salaries from the last 5 years of employment are listed in cells B5, B6, B7, B8, and B9. The perce

> Office Industries uses a final average formula to calculate employees’ pension benefits. The calculations use the salary average of the final 4 years of employment. The retiree will receive an annual benefit that is equivalent to 1.4% of the final averag

> The Morning Sun offers employees 1.65% of the average of their last 3 years of annual compensation for each year of service. Ramon began working for the Morning Sun in 1994. He retired in 2016. In 2014, he made $76,000 per year. Thereafter, he received a

> Martina’s employer offers an annual pension benefit calculated by multiplying 2.35% of the career average salary times the number of years employed. Here are Martina’s annual salaries over the last 24 years of employment. Goodbye tension, hello pension!

> Integrated Technologies offers employees a flat pension plan in which a predetermined dollar amount (multiplier) is multiplied by the number of years of service to determine the monthly pension benefit using the schedule shown. After working at Integrate

> Janet is retiring after working for a major department store for 20 years. The company offered her a flat retirement benefit of $50 per year for each year of service. a. What was her monthly income in the first year after retirement? b. What was her an

> Write the pre-split market cap formula in cell B5 and the post-split market cap formula in C5. The ratio for the split is entered in cells B2 and C2. For example, the ratio of 2-for-1 would be entered as a 2 in B2 and a 1 in C2. The number of pre-split

> The Gray family is moving into a new home and they are using a wooden ramp to roll furniture over the stairs at the entrance. The ramp, AB, is shown over the staircase in the diagram. a. How far is the bottom of the ramp, A, from the base of the house,

> Pedro is retiring after working for 27 years at a major bank. The company offers him a flat monthly retirement benefit of $55 for each year of service. What will his monthly pension be?

> The Merrick Oaks School District offers their employees the following annual pension benefit. First 15 Years of Service ……………………………………………. Service in Excess of 15 Years 2.12% multiplier ………………………………………………………………………… 2.25% multiplier Years of service up t

> Sara works for the City of Northbeck. The city calculates an employee’s pension according to the following formula. • Determine the average of the highest 3 years of annual earnings. • Determine the monthly average using the above amount. • Subtract $

> Sunshine Living calculates its pension benefits as follows: Years of service × 2.25%multiplier × Average of last five annual salaries. What is Killian’s annual pension benefit if he worked for Sunshine Living for 16 years and his last annual salaries we

> Jamal is retiring after working 45 years for the same company. The company pays a monthly retirement benefit of $35 for each year of service less than 20 years. The benefit increases by % 1 10 for each year of service beyond 20 years. a. What is Jamal’s

> Peterson Products calculates its pension benefits as follows: Years of service × 1.98%multiplier × Average of last two annual salaries What is Mary’s monthly pension benefit if she worked for Peterson for 28 years and her last two annual salaries were $

> Grant’s employer offers a pension plan that calculates the annual pension as the product of the final average salary, the number of years of service, and a 2% multiplier. His employer uses a graded 5-year vesting formula as shown. Grant’s starting salary

> Explain how that quote can be interpreted in light of what you have learned in this section.

> A company that produces widgets has found its demand function to be q p 1,500 90,00052 1 . a. For each dollar increase in the wholesale price, how many fewer widgets are demanded? b. How many widgets would be demanded at a price of $20? c. How many wi

> Write the spreadsheet formula that will calculate the post-split price per share in C4. The ratio for the split is entered in cells B2 and C2. For example, the ratio of 2-for-1 would be entered as a 2 in B2 and a 1 in C2. The number of pre-split shares

> Debbie is president of a company that produces garbage cans. The company has developed a new type of garbage can that is animal-proof, and Debbie wants to use the demand function to help set a price. She surveys 10 retailers to get an approximation of ho

> Caroline and her mom are building a skateboard ramp for their driveway. The angled ramp is 20 feet long. It starts on ground level and ends at a height of 1.5 feet. What is the angle of elevation of the ramp? Round to the nearest tenth.

> The supply and demand curves for a new widget are shown in the lower graph on the right. Notice there are two demand curves. The original demand curve is d1. Months after the product was introduced, there was a possible health concernÂ&

> The middle graph on the right shows supply and demand curves for a new MP3 player accessory. a. What is the equilibrium price? b. Describe the relationship of supply and demand if the item were sold for $20. c. Describe the relationship

> The upper graph on the right shows supply and demand curves for the newest Super Widget. a. What is the equilibrium price? b. What will happen if the price is set at $0.98? c. How many SuperWidgets are demanded at a price of $0.98? d. How many Supe

> A bicycle sells for a retail price of b dollars from an online store. The wholesale price of the bicycle is w. a. Express the markup algebraically. b. Express the percent increase of the markup algebraically.

> A CD storage rack is sold to stores at a wholesale price of $18. a. If a store has a $13 markup, what is the retail price of the CD rack? b. Find the percent increase of the markup to the nearest percent.

> An automobile GPS system is sold to stores at a wholesale price of $97. A popular store sells them for $179.99. What is the store’s markup?

> An interest-only balloon mortgage for a principal of p dollars for 18 years has total interest of t dollars. Express the amount of each monthly payment before the balloon payment algebraically.

> Siegell’s Locksmith Shop is taking out a mortgage on a new building. It is going to be an interest-only, 12-year balloon mortgage for $350,000. The APR is 3.35%. The last payment will be the balloon payment of the full principal. a. Find the total inter

> Write the spreadsheet formula that will calculate the post-split number of outstanding shares in C3. The ratio for the split is entered in cells B2 and C2. For example, the ratio of 2-for-1 would be entered as a 2 in B2 and a 1 in C2. The number of pre

> Construct a candlestick chart for the data presented in Exercise 12. Exercise 12: Use the following data to construct a stock bar chart for the 5-day period. Day Open Close High Low Volume 1 20.48 20.24 20.50 20.20 58,000,000 2 20.21 20.25 20.30

> The Americans with Disabilities Act (ADA) states that ramps for wheelchairs should have a slope of 1/12 or less. The Glen Head Boys Club built a ramp for a local school. The dimensions of the ramp are shown below. a. What is the height of the ramp at p

> Use the candlestick chart to answer the questions. a. On which days were opening prices higher than the closing prices? b. On which days were the closing prices higher than the opening prices? c. What was the approximate closing price on April 28? d

> Use the following data to construct a stock bar chart for the 5-day period. Day Open Close High Low Volume 1 59.75 59.60 60.00 59.22 7,900,000 59.15 60.20 60.50 59.15 8,000,000 3 60.00 59.58 60.61 59.55 8,200,000 4 59.55 60.90 60.90 59.37 7,000,000

> Use the following data to construct a stock bar chart for the 5-day period. Day Open Close High Low Volume 1 20.48 20.24 20.50 20.20 58,000,000 2 20.21 20.25 20.30 20.00 52,000,000 3 20.30 20.10 20.34 20.02 42,000,000 4 20.17 20.44 20.45 20.10 50,00

> Suppose that the volume numbers had been listed in hundreds on the table. How would that have changed the labels? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> Approximately how many fewer shares were traded on April 28 than on May 2? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> Interpret the quote in the context of what you learned about supply and demand in this lesson.

> Approximately how many shares were traded on April 30? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> On December 14, XTO Energy Inc. executed a 5-for-4 split. At that time, Bill owned 325 shares of that stock. The price per share was $65.80. After the split he received a check for a fractional part of a share. What was the amount of that check?

> What was the approximate net change from April 30 to May 1? Express that net change as a monetary amount and as a percent to the nearest tenth. 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> What was the approximate net change from April 29 to April 30? Express that net change as a monetary amount and as a percent to the nearest tenth. 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> What was the day’s close on May 2? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> Jorge is installing a staircase so he can have access to his attic. The rise of the stairs is 8 inches and the run of each stair is 11 inches. What is the slope of the staircase, expressed as a fraction?

> What was the day’s low price on May 1? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> What was the day’s high price on April 29? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> What was the day’s opening price on the following days? April 28 April 29 April 30 May 1 May 2 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> On what date did the stock close at a price higher than it opened? 695 690 685 680 675 670 665 660 655 650 Volume - 60 40 20 Apr. 28 29 30 May 1 2. Thousands

> How might those words apply to what you have learned? Why is the author warning readers that a share is not a lottery ticket?

> The Joseph family took out a $175,000, 25-year mortgage at an APR of 4%. The assessed value of their house is $9,000. The annual property tax rate is 97.22% of assessed value. What is the annual property tax?

> On June 19, Note Quest Inc. instituted a 3-for-2 split. At that time Keisha owned 205 shares of that stock. The price per share was $33.99. After the split, Keisha received a check for a fractional part of a share. What was the amount of that check?

> The spreadsheet on the right can be used to compute the yield. Write the formula that can be used to compute the yield in cell C2. A B 1 Price per Share Annual Dividend Yield 2 37.12 1.51 44.55 1.77 65.29 2.01 5 14.35 0.48 3. 4,

> Jim is taking out a $135,000 mortgage. His bank offers him an APR of 3.32%. He wants to compare monthly payments on a 20- and a 30-year mortgage. Find, to the nearest dollar, the difference in the monthly payments for these two loans.

> The market value of Christine and Gene’s home is $275,000. The assessed value is $230,000. The annual property tax rate is $17.50 per $1,000 of assessed value. a. What is the property tax on their home? b. How much do they pay monthly toward property t

> The monthly payment on a mortgage with a principal of p dollars is m dollars. The mortgage is taken out for y years. Express the interest I as a function of p, m, and y.

> The assessed value of the Weber family’s house is $186,000. The annual property tax rate is 2.15% of assessed value. What is the property tax on the Webers’ home?

> Ed is setting up the locations of the corners of a 16-foot by 30-foot rectangular deck he is going to build in his backyard. To make sure he has a perfect rectangle, he checks to make sure the diagonals are the same. What should the length of each diagon

> United Bank offers a 15-year mortgage at an APR of 4.2%. Capitol Bank offers a 25-year mortgage at an APR of 4.5%. Marcy wants to borrow $120,000. a. What would the monthly payment be from United Bank? b. What would the total interest be from United Ba

> If you borrow $220,000 at an APR of 3.5 for 25 years, you will pay $1,101.37 per month. If you borrow the same amount at the same APR for 30 years, you will pay $987.90 per month. a. What is the total interest paid on the 25-year mortgage? b. What is t

> The Smiths took out a $130,000, 30-year mortgage at an APR of 3.4%. The monthly payment was $576.53. What will be their total interest charges after 30 years?

> Find the monthly payment (before the balloon payment) for a 20-year, interest-only balloon mortgage for $275,000 at an APR of 3.1%. Round to the nearest $10.

> Ron has a homeowner’s insurance policy, which covers theft, with a deductible of d dollars. Two bicycles, worth b dollars each, and some tools, worth t dollars, were stolen from his garage. If the value of the stolen items was greater than the deductible

> Monarch Financial Holdings Inc. executed a 6-for-5 traditional split on October 5. Before the split there were approximately 4,800,000 shares outstanding, each at a share price of $18.00. a. Use the method outlined in Examples 2 and 3 to determine the p

> Andy is a single father who wants to purchase a home. His adjusted gross income for the year is a dollars. His monthly mortgage is m dollars, and his annual property tax bill is p dollars. His monthly credit card bill is c dollars, and he has a monthly c

> The Ungers have an adjusted gross income of $117,445. They are looking at a new house that would carry a monthly mortgage payment of $1,877. Their annual property taxes would be $6,780, and their semi-annual homeowner’s premium would be $710. a. Find th

> Miguel and Cara had an adjusted gross income of a dollars. Miguel just got a $3,000 raise and Cara got a $1,500 raise. They are considering moving to a new house with monthly mortgage payments of m dollars, annual property taxes of p dollars, and an annu

> Allison has a mortgage with North End Bank. The bank requires that she pay her homeowner’s insurance, property taxes, and mortgage in one monthly payment. Her monthly mortgage payment is $1,390, her semi-annual property tax bill is $3,222, and her quarte

> The Jordans are considering buying a house with a market value of $250,000. The assessed value of the house is a dollars. The annual property tax is $2.45 per $100 of assessed value. What is the property tax on this house?

> Sara is setting up a volleyball net in her backyard. The poles to hold the net up are 10 feet high. Sara needs to run a wire from the top of the pole to the ground to help make sure that when players hit the net, the pole doesn’t fall down. This wire is

> Interpret the quote in the context of your own home.

> Let the Medicare tax withheld in Box 6 be represented by x as shown. Write an algebraic expression that represents the federal income tax withheld assuming that the taxpayer pays 28% of his income in federal taxes and that there are no tax-deferred entri

> Examine this portion of a taxpayer’s W-2 form. Assume that the taxpayer’s wages for the year are under the Social Security limit. What entry should be in Box 1? Safe, accurate, FAST! Use Visit the IRS website er f

> Andres is taxed at a 17% tax rate for his federal taxes. Last year, he reduced his taxable income by contributing $350 per biweekly paycheck to his tax-deferred retirement account and $50 per biweekly paycheck to his FSA. How much did he reduce his annu

> Why should investors be cautious when a split occurs? How might those words apply to what you have learned?

> Complete the missing entries in the following pay stub. a. As indicated in the paycheck number box, this is the 18th paycheck of the year. Determine the current gross pay. b. What is the Social Security tax for this pay period? c. What is the year-t

> Let A represent the number of the paycheck for the year. For example, if the paycheck was the fifth of the year, A is 5. Let B represent the biweekly gross pay. Let C represent the biweekly union dues contribution. Let D represent the biweekly health ins

> Use the partial information given in Leslie’s electronic W-2 form (see question 3) to calculate the amount in Box 1.

> Leslie works for Blanck Corporation. His annual salary is $57,285.50. a. What is Leslie’s annual Social Security deduction? b. What is Leslie’s annual Medicare deduction? c. Leslie is paid every other week. What is

> Linda is a salesperson for Spooner’s Cleaning Service, which cleans office buildings. She receives a 14% commission for every office that signs a contract for the cleaning services. Last week she received $1,233.60 in commissions. What was the total valu

> Joe makes an hourly wage of $14.10. For hours worked over 40, he is paid at a rate of $21.15 per hour. Last week, Joe worked 45 hours. a. What is Joe’s gross pay for this pay period? b. What is Joe’s Social Security deduction? c. What is Joe’s Medicar

> The Lamberti family is building a rectangular deck that measures 30 feet by 22 feet. They need to run an electric line across the diagonal, underneath the deck. How long is the diagonal of the deck, to the nearest foot?