Question: Construction on the Atlantis Full-Service Car

Construction on the Atlantis Full-Service Car Wash is nearing completion. The owner is Jay Giolti, a retired accounting professor. The car wash is strategically located on a busy street that separates an affluent suburban community from a middle-class community. It has two state-of-theart stalls. Each stall can provide anything from a basic two-stage wash and rinse to a five-stage luxurious bath. It is all “touchless,†meaning there are no brushes to potentially damage the car. Outside each stall, there is also a 400- horsepower vacuum. Jay likes to joke that these vacuums are so strong that they will pull the carpet right out of your car if you aren't careful.

Jay has some important decisions to make before he can open the car wash.

First, he knows that there is one drive-through car wash attached to a gas station only a 10-minute drive away. It charges $5 for a basic wash, and $4 if you also buy at least 30 litres of gas. It is a brush-type wash with rotating brush heads. There is also a self-serve “stand outside your car and spray until you are soaked†car wash a 15-minute drive away. He went over and tried this out. He went through $3 in quarters to get the equivalent of a basic wash. He knows that both of these locations always have long lines, which is one reason he decided to build a new car wash.

Jay is planning to offer three levels of wash service: basic, deluxe, and premium. The basic is all automated; it requires no direct intervention by employees. The deluxe is all automated except that, at the end, an employee will wipe down the car and put a window treatment on the windshield that reduces glare and allows rainwater to run off more quickly. The premium level is a “pampered†service. This will include all the services of the deluxe, plus a special wax after the machine wax, and an employee will vacuum the car, wipe down the entire interior, and wash the inside of the windows. To provide the premium service, Jay will have to hire a couple of car wash specialists to do the additional pampering.

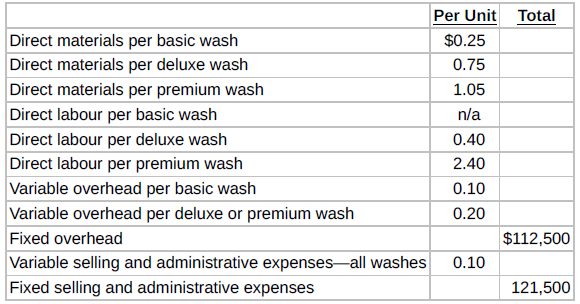

Jay has made the following estimates, based on data he received from the local chamber of commerce and information from a trade association:

The total estimated number of washes of any type is 45,000 per year. Jay has invested assets of $324,000. He would like a return on investment of 25%.

Instructions

a. Identify the issues that Jay must consider in deciding on the price of each level of service of his car wash. Also discuss what issues he should consider in deciding on what levels of service to provide.

b. Jay estimates that of the total 45,000 washes, 20,000 will be basic, 20,000 will be deluxe, and 5,000 will be premium. Using cost-plus pricing, calculate the selling price that Jay should use for each type of wash to achieve his desired ROI of 25%.

c. During the first year, instead of selling 45,000 washes, Jay sold 43,000 washes. He was quite accurate in his estimate of first-year sales, but he was way off on the types of washes that he sold. He sold 3,000 basic, 31,000 deluxe, and 9,000 premium. His actual total fixed expenses were as he expected, and his variable cost per unit was as estimated. Calculate Jay’s net income and his actual ROI.

d. Jay is using a traditional approach to allocate overhead. As a result, he is allocating overhead equally to all three types of washes, even though the basic wash is considerably less complicated and uses very little of the technical capabilities of the machinery. What should Jay do to determine more accurate costs per unit? How will this affect his pricing and, consequently, his sales?

Transcribed Image Text:

Per Unit Total Direct materials per basic wash Direct materials per deluxe wash Direct materials per premium wash $0.25 0.75 1.05 Direct labour per basic wash n/a Direct labour per deluxe wash 0.40 Direct labour per premium wash 2.40 Variable overhead per basic wash 0.10 Variable overhead per deluxe or premium wash 0.20 Fixed overhead $112,500 Variable selling and administrative expenses-all washes Fixed selling and administrative expenses 0.10 121,500

> Each day, Iwaniuk Corporation processes one tonne of a secret raw material into two resulting products, AB1 and XY1. When it processes one tonne of the raw material, the company incurs joint processing costs of $60,000. It allocates $25,000 of these cost

> Your roommate asks for your help in understanding the two types of cost accounting systems. (a) Distinguish between the two types of cost accounting systems for your roommate. (b) Explain to your roommate why a company may use both types of cost account

> Based on the compatibility and efficiency of its newly designed sprinkler systems, Waterways was successful in its bid to upgrade the irrigation systems for 10 soccer fields owned by the local municipality. Three of the local installation operators were

> For Korb Company, actual sales are $1 million and break-even sales are $840,000. Calculate (a) the margin of safety in dollars and (b) the margin of safety ratio. Calculate margin of safety and ratio.

> You have a talent for sewing and designing. After you graduate with a degree in fashion design, you start a small business with some financial help from your parents. Your business, Shrtz for Me, has been quite successful and you are now faced with some

> Data pertaining to job cost sheets for Reyes Tool & Die are given in BE3.4 and BE3.5. Prepare the job cost sheets for each of the three jobs. (Note: You may omit the column for Manufacturing Overhead.) Prepare job cost sheets. Data from BE 3.4 & 3.5: In

> ESU Printing provides printing services to many different corporate clients. Although ESU bids on most jobs, some jobs, particularly new ones, are negotiated on a cost-plus basis. Cost-plus means that the buyer is willing to pay the actual cost plus a re

> Triple C Ltd. is in the business of manufacturing cabinets, computer stands, and countertops. Most of its jobs are contracts for home builders. The following information is available for the month of July: // Activity in accounts: On July 1, finished

> Baehr Company is a manufacturer with a fiscal year that runs from July 1 to June 30. The company uses a normal job-order cost accounting system for its production costs. It uses a predetermined overhead rate based on direct labour hours to apply overhead

> The following data were taken from the records of Cougar Enterprises, a Canadian manufacturer that uses a normal job-order costing system: During December, the company worked on jobs numbered 70 through 90 and incurred the following costs: Additional

> Avid Assemblers uses normal job-order costing to assign costs to products. The company assembles and packages 25 different products according to customer specifications. Products are worked on in batches of 20 to 40 units. Each batch is given a job numbe

> Pine Products Company uses a job-order cost system. For a number of months there has been an ongoing rift between the sales department and the production department concerning a special-order product, TC-1. TC-1 is a seasonal product that is manufactured

> After deciding on a mortgage, one of the most difficult decisions for new homeowners is when and how to upgrade their home heating system. There are many different home heating fuels and types of equipment to consider. The skills you have learned in this

> Price-Gordon Architectural Consultants Ltd. Uses a modified job-order costing system to keep track of project costs. During October 2020, the firm worked on four projects. The following table provides a summary of the cost of materials used and the numbe

> Martin Footwear Co. produces high-quality shoes. To prepare for next year's marketing campaign, the company's controller has prepared the following information for the current year, 2020: Determine the contribution margin, break-even point in units, and

> Blazer Delivery is a rapidly growing delivery service. Last year, 80% of its revenue came from the delivery of mailing “pouches” and small, standardized delivery boxes (which provides a 20% contribution margin). The other 20% of its revenue came from del

> Spivey Company's fiscal year ends on June 30. The following accounts are found in its job-order cost accounting system for the first month of the new fiscal year: Analyze manufacturing accounts and determine missing amounts. / / Other data: 1. On July

> Net Play Company uses a job-order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labour cost in Department A, direct labour hours in Department B, and machine hours in Departme

> Laramie Ltd. uses a normal job-order cost system. At the beginning of the month of June, two orders were in process as follows: Prepare entries and close out under-or over-applied overhead. There was no inventory of finished goods on June 1. During the

> Factory labour data for Reyes Tool & Die are given in BE3.3. Prepare an entry for the assignment of factory labour costs. Data from BE 3.3: During January, its first month of operations, Reyes Tool & Die accumulated the following manufacturing costs: ra

> SNC produces fire trucks. The company uses a normal joborder costing system to calculate its cost of goods manufactured. The company's policy is to price its job at cost plus 40% markup. On January 1, 2020, there was only one job in process, which had th

> Giovanni Lofaro is a contractor specializing in custombuilt Jacuzzis. On May 1, 2020, his ledger contains the following data: Prepare entries in a job-order cost system and cost of goods manufactured schedule. Raw Materials Inventory â€&brvba

> Tel Corp. has the following estimated costs for 2020: Calculate the predetermined overhead rate and job cost. Direct materials …………………………….. $ 160,000 Direct labour ………………………………… 2,000,000 Rent on factory building …………………… 150,000 Sales salaries …………………

> For the year ended December 31, 2020, the job cost sheets of Mazzone Company contained the following data: Prepare entries in a job-order cost system and a partial income statement. Other data: 1. Raw materials inventory totalled $20,000 on January 1.

> Lowry Manufacturing uses a job-order cost system and applies overhead to production on the basis of direct labour hours. On January 1, 2020, Job No. 25 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct

> Robert Buey became chief executive officer of Phelps Manufacturing two years ago. At the time, the company was reporting lagging profits and Robert was brought in to “stir things up.” The company has three divisions: electronics, fibre optics, and plumbi

> Olin Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 18% of sales. The forecast income statement for the year ending December 31, 2020, is as follows: Determine the co

> Vargas Corporation's fiscal year ends on June 30. The following accounts are found in its job-order cost accounting system for the first month of the new fiscal year: Analyze manufacturing accounts and determine missing amounts. Other data: 1. On July

> Red Fire Inc. produces fire trucks. The company uses a normal job-order costing system to calculate its cost of goods manufactured. The company's policy is to price its job at cost plus 30% markup. On January 1, 2020, there was only one job in process, w

> Agassi Company uses a job-order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labour cost in Department D, direct labour hours in Department E, and machine hours in Department

> On November 30, 2020, there was a fire in the factory of Able Manufacturing Limited, where you work as the controller. The work in process inventory was completely destroyed, but both the materials and finished goods inventories were undamaged. Analyze a

> Nicole Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by fo

> In January, Reyes Tool & Die requisitions raw materials for production as follows: Job 1 $900, Job 2 $1,400, Job 3 $700, and general factory use $800. Prepare a summary journal entry to record raw materials used. Prepare an entry for the assignment of ra

> Enos Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fibreglass, and lumber, depending on customer preference. On June 1, 2020, the general ledger for Enos Inc. contains the following data: Pre

> For the year ended December 31, 2020, the job cost sheets of DeVoe Company contained the following data: Prepare entries in a job-order cost system and a partial income statement. Other data: 1. Raw materials inventory totalled $15,000 on January 1. Du

> Bertrand Manufacturing uses a job-order cost system and applies overhead to production on the basis of direct labour costs. On January 1, 2020, Job No. 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: dir

> The consulting firm CMA Financial employs 40 full-time staff. The estimated compensation per employee is $105,000 for 1,750 hours. It charges all direct labour costs to clients. It includes any other costs in a single indirect cost pool and allocates the

> Newton Cellular Ltd. manufactures and sells the TopLine cellphone. For its 2020 business plan, Newton Cellular estimated the following: Determine the contribution margin, break-even point, and target operating income. Selling price ……………………………… $750 Var

> John Bourcier operates a small machine shop. He manufactures one standard product that is also available from many other similar businesses, and he also manufactures deluxe products to order. His accountant prepared the following annual income statement:

> Easy Decorating uses a job-order costing system to collect the costs of its interior decorating business. Each client's consultation is treated as a separate job. Overhead is applied to each job based on the number of decorator hours incurred. Listed bel

> Pedro Morales and Associates, a CPA firm, uses joborder costing to capture the costs of its audit jobs. There were no audit jobs in process at the beginning of November. Listed below are data concerning the three audit jobs conducted during November: Det

> Shown below are the job cost-related accounts for the law firm of De Witte, Ozols, and Morton and their manufacturing equivalents: Prepare entries for costs of services provided. Law Firm Accounts ………………………….. Manufacturing Firm Accounts Supplies ………………

> Laubitz Company begins operations on April 1. Information from job cost sheets shows the following: Calculate work in process and finished goods from job cost sheets. Each job was sold for 25% above its cost in the month following completion. Instruct

> Use the data for ITA International from BE9.7, but assume that the units being requested are special high-performance units, and that the division’s variable cost would be $24 per unit. What is the minimum transfer price that the machining division shoul

> If ITA’s assembly division is currently buying from an outside supplier at $75 per unit, what will be the effect on overall company profits if internal sales for 400 units take place at the optimum transfer price? Determine effect of transfer on profit.

> Part 1 Waterways uses time and material pricing when it bids on drainage projects. Budgeted data for 2020 for installation division 1 are as follows. Waterways desires a $23 profit margin per hour of labour and 25% profit on materials. Materials are tr

> Paying for parking your car is never pleasant, but it hurts a lot when you have to pay to park your vehicle when you go to the hospital, either to visit someone who is ill or as a patient yourself. Many publicly funded hospitals in Canada charge visitors

> Giant Airlines operates out of three main “hub” airports in Canada. Recently, Mosquito Airlines began operating a flight from Smallville into Giant’s Metropolis hub for $360. Giant Airlines offers a price of $595 for the same route. The management of Gia

> Kosinksi Manufacturing carries no inventories. Its product is manufactured only when a customer's order is received. It is then shipped immediately after it is made. For its fiscal year ended October 31, 2020, Kosinksi's break-even point was $1,350,000.

> Future Industries operates as a decentralized, vertically integrated, multidivisional company. One of its divisions, the systems division, manufactures scientific instruments and uses the products of two of the other divisions. The board division manufac

> At May 31, 2020, the accounts of Hannifan Manufacturing Company show the following: Prepare cost of goods manufactured schedule and partial financial statements. 1. May 1 inventories—Finished Goods $12,600, Work in Process $17,400, and Raw Materials $8,2

> National Industries is a diversified corporation with separate operating divisions. Each division’s performance is evaluated based on its total dollar profits and return on division investment. The WindAir division manufactures and sell

> The machining division of ITA International has a capacity of 2,000 units. Its sales and cost data are: Determine minimum transfer price. Selling price per unit ………………………………………… $ 80 Variable manufacturing costs per unit ………………….. 25 Variable selling co

> Solco Industries is a decentralized company with two divisions: mining and processing. They are both evaluated as profit centres. The mining division transfers raw diamonds to the processing division. The processing division is currently operating at 1 m

> West-Coast Industries is a decentralized firm. It has two production centres: Vancouver and Kamloops. Each one is evaluated based on its return on investment. Vancouver has the capacity to manufacture 100,000 units of component TR222. Vancouver’s variabl

> Aurora Manufacturing has multiple divisions that make a wide variety of products. Recently the bearing division and the wheel division got into an argument over a transfer price. The wheel division needed bearings for garden tractor wheels. It normally b

> The Pacific Company is a multidivisional company. Its managers have full responsibility for profits and complete autonomy to accept or reject transfers from other divisions. Division A produces a sub-assembly part for which there is a competitive market.

> Family Inc. has two divisions. Division A makes and sells Tshirts. Division B manufactures and sells ties. Determine minimum transfer price under different situations. Each T-shirt has a tie as one of its components. Division A needs 10,000 ties for the

> Poole Corporation has collected the following information after its first year of sales. Net sales were $1.6 million on 100,000 units, selling expenses were $240,000 (40% variable and 60% fixed), direct materials were $511,000, direct labour was $285,000

> Santana Furniture Inc. is setting a target price on its newly designed leather recliner sofa. Cost data for the sofa at a budgeted volume of 3,000 units are as follows: Calculate various amounts using absorption-cost pricing and variable-cost pricing. /

> Refer back to P9.51B, where we learned that Wamser Corporation uses cost-plus pricing methods to set the target selling price of its product E2-D2. Because some managers prefer to work with absorption-cost pricing and other managers prefer variable-cost

> Love Inc. manufactures a line of men’s colognes and aftershave lotions. The manufacturing process is basically a series of mixing operations, with the addition of certain aromatic and colouring ingredients. The finished product is packa

> Garnett Printing Corp. uses a job-order cost system. The following data summarize the operations related to the first quarter's production: Prepare entries for manufacturing costs. 1. Materials purchased on account were $192,000, and factory wages incurr

> Comput Industries is a high-tech company in the United States with several subsidiaries, including Cancomput, which is located in Canada, and Heavencomput, which is located in another country with very favourable tax laws. Both subsidiaries are considere

> Heartland Engines is a division of EverGreen Lawn Equipment Company. Heartland makes engines for lawn mowers, snow blowers, and other types of lawn and garden equipment. It sells its engines to the company’s lawn mower division and snow blower division,

> Swayze Small Engine Repair charges $42 per hour of labour. It has a material loading percentage of 40%. On a recent job to replace the engine of a riding lawn mower, Swayze worked 10.5 hours and used parts with a cost of $700. Calculate Swayze’s total bi

> Chula Vista Pump Company makes irrigation pump systems. The company is divided into several autonomous divisions that can either sell to internal units or sell externally. All divisions are located in buildings on the same piece of property. The pump div

> Sun Motors Inc. operates as a decentralized multidivisional car company. Its safety division buys most of its airbags from the airbag division. The airbag division’s incremental costs for manufacturing the airbags are $270 per unit. The airbag division i

> Cosmic Sounds is a record company with different labels. Each label has contracts with various recording artists. It also owns a recording studio called Blast Off. The record labels and the recording studio operate as separate profit centres. The studio

> Alice Oritz is the advertising manager for Value Shoe Store. She is currently working on a major promotional campaign. Her ideas include the installation of a new lighting system and increased display space that will add $18,000 in fixed costs to the $21

> The data for Pointe Claire Inc. are given in P9.55B. Assume that the transfer price has been set at $504, which is division A’s total cost plus a 20% markup. Division A’s total cost of a component is $420, which includes fixed overhead applied at the rat

> Pointe Claire Inc. operates as a decentralized multidivisional electronics company. It has two divisions. Division A transfers partially completed components to division B at a predetermined transfer price. Division A’s standard variable production cost

> Lemond Bike Repair Shop has budgeted the following time and material for 2020: Use time-and-material pricing to determine bill. // Lemond budgets 2,500 hours of repair time in 2020. It will bill a profit of $5 per labour hour along with a 15% profit m

> Bosworth Electronics Inc. is setting a selling price on a new CDL component it has just developed. The accounting department has provided the following cost estimates for this component for a budgeted volume of 100,000 units: Use cost-plus pricing to det

> During January, its first month of operations, Reyes Tool & Die accumulated the following manufacturing costs: raw materials $4,000 on account; factory labour $6,000, of which $5,200 relates to factory wages payable and $800 relates to payroll taxes paya

> Carrier Fabrication Company (CFC) manufactures and sells only one product, a special front-mounting bicycle rack for large vehicles. CFC entered into a one-time contract to produce an additional 1,000 racks for the local public transit authority at a pri

> Wamser Corporation needs to set a target price for its newly designed product, E2-D2. The following data relate to it: Use cost-plus pricing to determine various amounts. These costs are based on a budgeted volume of 1 million units produced and sold e

> The data for Kirkland Metal Corporation have been given in P9.49A. Assume that the transfer price for the component has been set at $374, which is the fabrication division’s total cost plus a 10% markup. The fabrication division’s total cost of a compone

> During the current year, Bierko Corporation expects to produce 10,000 units and has budgeted the following: net income $300,000; variable costs $1.1 million; and fixed costs $100,000. It has invested assets of $1.5 million. What was the company’s budgete

> Kirkland Metal Corporation has two divisions. The fabrication division transfers partially completed components to the assembly division at a predetermined transfer price. The fabrication division’s standard variable production cost per unit is $300. The

> The vice-president of marketing, Carol Chow, thinks that her firm can increase sales by 15,000 units for each $5-per-unit reduction in its selling price. The company's current selling price is $90 per unit and variable expenses are $60 per unit. Fixed ex

> Computech Company operates as a decentralized multidivisional electronics company. Its laptop division buys most of its monitors from the screen division. The screen division’s incremental costs for manufacturing the monitors are $280 per unit. The scree

> Weather Guard Windows Inc. is setting a target price on its newly designed tinted window. Cost data for the window at a budgeted volume of 4,000 units are as follows: Calculate various amounts using absorption-cost and variable-cost approaches. Weather

> Fast Buck Corporation needs to set a target price for its newly designed product EverRun. The following data relate to this new product: Calculate target price using absorption-cost and variable-cost approaches. The costs above are based on a budgeted

> Lemon Quench manufactures a soft drink. The company is organized into two divisions: glass and filling. The glass division makes bottles and sells them to the filling division. Each division manager receives a bonus based on the divisionâ€

> The Atlantic Company is a multidivisional company. Its managers have full responsibility for profits and complete autonomy to accept or reject transfers from other divisions. Division A produces a sub-assembly part for which there is a competitive market

> A job cost sheet of Nilson Company is given below. Analyze a job cost sheet and prepare an entry for the completed job. Instructions a. Determine the source documents for direct materials, direct labour, and manufacturing overhead costs assigned to thi

> Next Level (NL) is a division of Global Electronics Inc. NL produces video game systems. These systems are sold to retailers. NL recently approached the manager of the personal computer (PC) division regarding a request to buy a special circuit board for

> Wood Inc. manufactures wood poles. Wood Inc. has two responsibility centres, harvesting and sawing, which are both evaluated as profit centres. The harvesting division does all the harvesting operations and transfers logs to the sawing division, which co

> Zapp Manufacturing Company makes various electronic products. The company is divided into autonomous divisions that can either sell to internal units or sell externally. All divisions are located in buildings on the same piece of property. The board divi

> Wordsmith is a publishing company with several different book lines. Each line has contracts with different authors. The company also owns a printing operation called Pronto Press. The book lines and the printing operation each operate as a separate prof

> Gorham Manufacturing's sales slumped badly in 2020. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 60,000 units of product: net sales $1.8 million; total costs and expens

> Schuman Corporation produces microwave units. The following per-unit cost information is available: direct materials $36; direct labour $24; variable manufacturing overhead $18; fixed manufacturing overhead $40; variable selling and administrative expens

> Ampro Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Determine minimum transfer price under different situations. Each desk has a reading lamp as one of its components. Division A needs

> St-Cyr’s Electronic Repair Shop has budgeted the following time and material for 2020: Use time-and-material pricing to determine bill. St-Cyr’s budgets 5,000 hours of repair time in 2020 and will bill a profit of $5

> Bolus Computer Parts Ltd. is setting a selling price on a new component it has just designed and developed. The following cost estimates for this new component have been provided by the accounting department for a budgeted volume of 50,000 units: Use cos

> Berg and Son Ltd. builds custom-made pleasure boats that range in price from $10,000 to $250,000. For the past 30 years, Mr. Berg Sr. has determined the selling price of each boat by estimating the cost of material, labour, and a prorated portion of over

> Lafleur Corporation needs to set a target price for its newl designed product, M14-M16. The following data relate to it: Use cost-plus pricing to determine various amounts. These costs are based on a budgeted volume of 250,000 units produced and sold e

> Millefeuille Company applies operating overhead to photocopying jobs on the basis of machine hours used. It expects overhead costs to total $290,000 for the year and estimates machine usage at 125,000 hours. For the year, the company incurs $295,000 of o

> Auto Glass Company (AGC) manufactures and sells windshield products. AGC entered into a one-time contract to produce an additional 1,000 windshields for the local public transit authority, at a price of “cost plus 20%.” The company has a plant with a cap