Question: Corporation VB was formed in 2019. Immediately

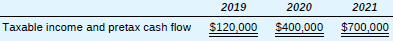

Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2019, or wait until 2020. However, if it waits, the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pretax cash lows and taxable income for 2019, 2020, and 2021.

a. Using a 5 percent discount rate, compute the NPV of VB’s after-tax cash flows if the expenditure is in 2019.

b. Using a 5 percent discount rate, compute the NPV of VB’s after-tax cash flows if the expenditure is in 2020.

c. Based on your calculations, when should VB make this expenditure?

> A 15-year annuity pays $1,750 per month, and payments are made at the end of each month. If the APR is 9 percent compounded monthly for the first seven years, and APR of 6 percent compounded monthly thereafter, what is the value of the annuity today?

> What is the value today of $5,100 per year, at a discount rate of 7.9 percent, if the first payment is received 6 years from today and the last payment is received 20 years from today?

> Consider a firm with a contract to sell an asset for $175,000 four years from now. The asset costs $104,600 to produce today. Given a relevant discount rate of 11 percent per year, will the firm make a profit on this asset? At what rate does the firm jus

> You have just purchased a new warehouse. To finance the purchase, you’ve arranged for a 30-year mortgage loan for 80 percent of the $2.6 million purchase price. The monthly payment on this loan will be $14,200. What is the APR on this loan? The EAR?

> You just won the TVM Lottery. You will receive $1 million today plus another 10 annual payments that increase by $450,000 per year. Thus, in one year, you receive $1.45 million. In two years, you get $1.9 million, and so on. If the appropriate interest r

> In Problem 17, suppose Raines Umbrella Corp. paid out $128,000 in cash dividends. Is this possible? If net capital spending and net working capital were both zero, and if no new stock was issued during the year, what do you know about the firm’s long-ter

> The present value of the following cash flow stream is $8,200 when discounted at 9 percent annually. What is the value of the missing cash flow? Year ………………………….. Cash Flow 1 …………………………………... $2,100 2 …………………………………….…….. ? 3 …………………………………….. 2,740 4 ……

> You need a 30-year, fixed-rate mortgage to buy a new home for $245,000. Your mortgage bank will lend you the money at an APR of 4.8 percent for this 360-month loan. However, you can afford monthly payments of only $900, so you offer to pay off any remain

> You want to borrow $95,000 from your local bank to buy a new sailboat. You can afford to make monthly payments of $1,850, but no more. Assuming monthly compounding, what is the highest rate you can afford on a 60-month APR loan?

> You’re prepared to make monthly payments of $225, beginning at the end of this month, into an account that pays an APR of 6.5 percent compounded monthly. How many payments will you have made when your account balance reaches $15,000?

> An investment offers $3,850 per year for 15 years, with the first payment occurring one year from now. If the required return is 6 percent, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years?

> What is the relationship between the value of an annuity and the level of interest rates? Suppose you just bought an annuity with 13 annual payments of $10,000 per year at a discount rate of 10 percent per year. What happens to the value of your investme

> Your job pays you only once a year for all the work you did over the previous 12 months. Today, December 31, you just received your salary of $48,000 and you plan to spend all of it. However, you want to start saving for retirement beginning next year. Y

> You have just won the lottery and will receive $1.8 million in one year. You will receive payments for 30 years, and the payments will increase by 2.7 percent per year. If the appropriate discount rate is 5.4 percent, what is the present value of your wi

> You’ve just joined the investment banking firm of Dewey, Cheatum, and Howe. They’ve offered you two different salary arrangements. You can have $90,000 per year for the next two years, or you can have $77,000 per year for the next two years, along with a

> You want to be a millionaire when you retire in 40 years. How much do you have to save each month if you can earn an APR of 10.2 percent? How much do you have to save each month if you wait 10 years before you begin your deposits? 20 years?

> During 2021, Raines Umbrella Corp. had sales of $865,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $535,000, $125,000, and $170,000, respectively. In addition, the company had an interest expense of $90,000

> You have an investment that will pay you .83 percent per month. How much will you have per dollar invested in one year? In two years?

> You are planning to save for retirement over the next 30 years. To do this, you will invest $850 per month in a stock account and $250 per month in a bond account. The return of the stock account is expected to be 11 percent, and the bond account will re

> You receive a credit card application from Shady Banks Savings and Loan offering an introductory rate of 1.25 percent per year, compounded monthly for the first six months, increasing thereafter to 17.8 percent compounded monthly. Assuming you transfer t

> You are looking at an investment that has an effective annual rate of 14.3 percent. What is the effective semiannual return? The effective quarterly return? The effective monthly return?

> Christie, Inc., has identified an investment project with the following cash flows. If the discount rate is 6 percent, what is the future value of these cash flows in Year 4? What is the future value at a discount rate of 13 percent? At 27 percent? Year

> If the appropriate discount rate for the following cash flows is 9.32 percent per year, what is the present value of the cash flows? Year ……………………………………. Cash Flow 1 …………………………………………….. $2,480 2 ……………………………………………………… 0 3 ……………………………………………….. 3,920 4 ……

> If the appropriate discount rate for the following cash flows is 8.5 percent compounded quarterly, what is the present value of the cash flows? Year ……………………………………… Cash Flow 1 ………………………………………………….. $ 815 2 ……………………………………………………. 990 3 ………………………………………………

> Beginning three months from now, you want to be able to withdraw $3,000 each quarter from your bank account to cover college expenses over the next four years. If the account pays .57 percent interest per quarter, how much do you need to have in your ban

> In the previous problem, suppose you make $5,700 annual deposits into the same retirement account. How large will your account balance be in 40 years?

> You are planning to make monthly deposits of $475 into a retirement account that pays 10 percent interest compounded monthly. If your first deposit will be made one month from now, how large will your retirement account be in 40 years?

> Polska, Inc., is obligated to pay its creditors $10,300 during the year. a. What is the market value of the shareholders’ equity if assets have a market value of $11,600? b. What if assets equal $9,400?

> Live Forever Life Insurance Co. is selling a perpetuity contract that pays $1,500 monthly. The contract currently sells for $260,000. What is the monthly return on this investment vehicle? What is the APR? The effective annual return?

> One of your customers is delinquent on his accounts payable balance. You’ve mutually agreed to a repayment schedule of $500 per month. You will charge 1.8 percent per month interest on the overdue balance. If the current balance is $18,000, how long will

> You want to buy a new sports coupe for $84,500, and the finance office at the dealership has quoted you an APR of 4.7 percent for a 60-month loan to buy the car. What will your monthly payments be? What is the effective annual rate on this loan?

> Investment X offers to pay you $5,300 per year for eight years, whereas Investment Y offers to pay you $7,300 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 5 percent? If the discount rate i

> Big Dom’s Pawn Shop charges an interest rate of 25.5 percent per month on loans to its customers. Like all lenders, Big Dom must report an APR to consumers. What rate should the shop report? What is the effective annual rate?

> An investment will pay you $95,000 in 10 years. If the appropriate discount rate is 9 percent compounded daily, what is the present value?

> Spartan Credit Bank is offering 8.3 percent compounded daily on its savings accounts. If you deposit $7,500 today, how much will you have in the account in 5 years? In 10 years? In 20 years?

> What is the future value of $5,500 in 17 years at an APR of 8.4 percent compounded semiannually?

> Evergreen Credit Corp. wants to earn an effective annual return on its consumer loans of 18.2 percent per year. The bank uses daily compounding on its loans. What interest rate is the bank required by law to report to potential borrowers? Explain why thi

> First National Bank charges 13.8 percent compounded monthly on its business loans. First United Bank charges 14.1 percent compounded semiannually. As a potential borrower, which bank would you go to for a new loan?

> Prepare a 2021 balance sheet for Willis Corp. based on the following information: Cash = $165,000; Patents and copyrights = $858,000; Accounts payable = $273,000; Accounts receivable = $149,000; Tangible net fixed assets = $2,093,000; Inventory = $372,00

> Graff, Inc., has sales of $49,800, costs of $23,700, depreciation expense of $2,300, and interest expense of $1,800. If the tax rate is 22 percent, what is the operating cash flow, or OCF?

> Four individuals are evaluating the tax cost of operating their business as an S corporation. They assume that the corporation will pay no tax on its annual business income. They plan to incorporate the business in a state with a 7 percent corporate inco

> The 18 partners in KT Limited Partnership unanimously voted to convert their partnership to an LLC. To make the conversion, each partner will exchange his interest in KT for a membership interest in the newly formed LLC.

> Nine years ago, Fred paid $20,000 cash for a 2 percent limited interest in a very profitable partnership. Every year Fred has properly included his distributive share of partnership income in taxable income. This year, Fred sold his interest to an unrela

> Lola owns a 15 percent limited interest in AF Partnership, which uses a calendar year for tax purposes. On April 12, Lola sold her entire interest to the R Corporation; consequently, she was a partner for only 102 days during the year. AF generated $845,

> Travis is a professional writer who maintains his business office in one room of his personal residence. The office contains Travis’s desk, filing cabinets, personal computer and printer, copying machine, phone system, and fax machine. It also contains h

> Mr. and Mrs. Chou file a joint income tax return. Mr. Chou reports the income from his full-time landscaping business on a Schedule C, which lists him as the sole proprietor. He also reports 100 percent of the net profit as his self-employment income and

> Javier is a full-time employee of B Inc. and operates a sole proprietorship. This year, his salary was $70,000, and his net earnings from self-employment were $60,000.

> FG Inc. owned a 3 percent limited interest in a partnership that has been unprofitable for several years. The partnership recently informed its partners that they must contribute additional capital if the partnership is to survive. FG decided not to cont

> Company Y began business in February 2019. By the end of the calendar year, it had billed its clients for $3.5 million of services and had incurred $800,000 of operating expenses. As of December 31, it had collected $2.9 million of its billings and had p

> Calculate the total Social Security and Medicare tax burden on a sole proprietorship earning 2019 profit of $300,000, assuming a single sole proprietor with no other earned income.

> The management of Nixon Company must decide between locating a new branch office in foreign Jurisdiction F or foreign Jurisdiction G. Regardless of location, the branch operation will use tangible property (plant and equipment) worth $10 million and shou

> Mr. Rouse’s tax situation for the year is very complicated. He engaged in several multi-million dollar investment transactions involving unresolved tax issues. He has instructed his accountant to take the most aggressive position possible with respect to

> On March 1, 2019, Eve and Frank each contributed $30,000 cash to the newly formed EF Partnership in exchange for a 50 percent general interest. The partnership immediately borrowed $50,000 from an unrelated creditor, a debt that it does not have to repay

> Visit the website for the Internal Revenue Service (www.irs.gov). What is the name of the commissioner of the IRS? Can you locate the IRS Taxpayer Assistance Center closest to your hometown?

> Visit the website for the Federation of Tax Administrators (www.taxadmin.org) to find out if your state has either an individual or a corporate income tax. If so, what is the maximum tax rate?

> On December 10, 2018, the representative of a national charitable organization contacted the CEO of Wilkie Inc., a calendar year accrual basis corporation, to solicit a $100,000 donation. The CEO presented the solicitation to Wilkie’s board of directors

> In early 2019, Connor Inc. announced its intention to construct a manufacturing facility in the Shenandoah Valley. To persuade Connor to locate the facility in Augusta County, the county government contributed a six-acre tract of undeveloped county land

> Jetex, an accrual basis, calendar year corporation, engages in the business of long-distance freight hauling. Every year, Jetex is required to purchase several hundred permits and licenses from state and local governments in order to legally operate its

> Moleri, an accrual basis corporation with a fiscal taxable year ending on July 31, owns real estate on which it pays annual property tax to Madison County, Texas. The county assesses the tax for the upcoming calendar year on January 1, and the tax become

> CheapTrade, an accrual basis, calendar year corporation, operates a discount securities brokerage business. CheapTrade accepts orders to buy or sell marketable securities for its customers and charges them a commission fee for effecting the transaction i

> For 2019, Ms. Deming earned wages totaling $225,000. Calculate any .9 percent additional Medicare tax owed, assuming that: a. Ms. Deming is single. b. Ms. Deming files a joint return with her husband who earned $100,000 of wages for 2019.

> Bontaine Publications, an accrual basis, calendar year corporation, publishes and sells weekly and monthly magazines to retail bookstores and newsstands. The sales agreement provides that the retailers may return any unsold magazines during the one-month

> Visit the website for the Tax Foundation (www.taxfoundation.org). Select the link “About Us” to read the organization’s mission statement. Select the link “Tax Topics” to research the following: a. What and when was Tax Freedom Day in 2018? b. How many a

> Visit the website for the Congressional Budget Office (www.cbo.gov), follow the link to Budget and Economic Information, and look up the most current Monthly Budget Review. What is the CBO’s estimate of the U.S. government’s total budget surplus or defic

> The next time you buy groceries in a supermarket, study your receipt. Which items that you purchased were subject to your state’s sales tax, and which items were exempt from sales tax?

> Conduct a search on the Internet to find a brief description of the flat tax. Write a short paragraph describing the flat tax and explaining how it differs from the federal individual income tax.

> Mrs. Cora Yank (age 42) is divorced and has full custody of her 10- year-old son, William. From the following information, compute Mrs. Yank’s 2019 federal income tax (including any AMT) and the amount due with her Form 1040 or the refund she should rece

> Blake and Valerie Meyer (both age 30) are married with one dependent child (age 5). On the basis of the following information, compute the Meyers’ 2019 federal income tax (including any AMT) on their joint return. * Blake’s gross salary from his corporat

> Tom and Allie Benson (ages 53 and 46) are residents of Fort Worth, Texas, and file a joint federal income tax return. They provide the entire support for their two children, ages 19 and 17. On the basis of the following information, compute Mr. and Mrs.

> Univex is a calendar year, accrual basis retail business. Its financial statements provide the following information for the year. Revenues from sales of goods …………………………………………………………. $783,200 Cost of goods sold (FIFO) ………………………………………………………………. (417,500

> Ms. Cross didn’t request an extension of time to file her 2018 income tax return and didn’t mail the completed return to the IRS until August 8, 2019. She enclosed a check for $2,380, the correct balance of tax due with the return. a. Assuming that Ms. C

> Firm F is a cash basis legal firm. In 2018, it performed services for a client, mailed the client a bill for $6,150, and recorded a $6,150 receivable. In 2019, Firm F discovered that the client was under criminal indictment and had fled the country. Afte

> Mr. and Mrs. Wickham did not apply for an extension of time to file their 2018 Form 1040. Because they were vacationing outside the United States, they neglected to file their Form 1040 until July 14, 2019. Compute the Wickhams’ late filing and late paym

> Mr. and Mrs. Pratt failed to apply for an extension of time to file their 2018 Form 1040 and didn’t mail the return to the IRS until May 29, 2019. Assuming the Pratts had no excuse for filing a delinquent return, compute their late-filing and late-paymen

> Zucker Inc. uses a fiscal year as the taxable year for filing its Form 1120. a. If Zucker’s fiscal year ends on March 31, what is the filing date and the extended filing date for Zucker’s Form 1120 for the fiscal year ending March 31, 2019? b. If Zucker’

> Mr. Leon filed his 2017 Form 1040 on March 29, 2018. In 2020, the IRS issued a notice of deficiency to Mr. Leon, in which it assessed $7,700 of additional 2017 income tax. Compute the total amount that Mr. Leon owes to the federal government assuming: a.

> Mr. and Mrs. Lear filed their 2017 Form 1040 on April 1, 2018. In November 2019, they received a notice of deficiency in which the IRS assessed $19,044 of additional 2017 income tax. Compute the total amount that the Lears owe the federal government assu

> Mr. and Mrs. Boyd Knevel use a fiscal year ending July 31 as the taxable year for filing their joint Form 1040. a. What is the last date on which the Knevels can apply for an automatic extension of time to file their return for fiscal year ending July 31

> During the audit of Mr. and Mrs. Jessel’s 2016 and 2017 tax returns, the revenue agent learned that they kept two sets of books for their sole proprietorship. A comparison of the two revealed that Mr. and Mrs. Jessel earned more than $80,000 unreported i

> Upon audit of Mr. Tom Staton’s 2017 Form 1040, the revenue agent determined that he understated his tax liability by $4,300. Compute Mr. Staton’s penalty for substantial understatement if his correct tax liability for 2017 was: a. $40,800. b. $69,700.

> Upon audit of Ms. Evlyn Carlyle’s 2017 Form 1040, the revenue agent determined that she understated her tax liability by $17,000. Compute Ms. Carlyle’s penalty for substantial understatement if her correct tax liability for 2017 was: a. $218,500. b. $142

> Egolf Corporation failed to include $300,000 of taxable interest income on its 2018 calendar year Form 1120. The gross income reported on the return was $4.7 million, and the return was filed on February 20, 2019. a. What is the last day on which the IRS

> Mr. Williams is employed by BDF Inc. Compute BDF’s 2019 employer payroll tax with respect to Mr. Williams assuming that: a. His annual compensation is $60,000. b. His annual compensation is $200,000.

> Mrs. Fugate failed to include $28,000 lottery winnings on her 2018 Form 1040. The only gross income she reported was her $78,000 salary. She filed her return on January 19, 2019. a. What is the last date on which the IRS can assess additional tax for 201

> LZ Corporation uses a fiscal year ending September 30. The controller filed LZ’s Form 1120 for the year ending September 30, 2019, on October 23, 2019. a. What is the last day on which the IRS may assess additional tax for this fiscal year? b. How would

> Percy Wilson is a calendar year taxpayer. What is the un-extended filing date of Percy Wilson’s 2019 federal income tax return if: a. Percy Wilson Inc. is a corporation? b. Mr. Percy Wilson is an individual?

> Mr. Dunn, who has a 32 percent marginal rate on ordinary income and a 15 percent marginal rate on adjusted net capital gain, recognized a $15,000 capital loss in 2019. Compute the tax savings from this loss assuming that: a. He also recognized an $18,000

> For the following problem, assume the taxable year is 2019. Mr. Ballard retired in 2019 at age 69 and made his first withdrawal of $35,000 from his traditional IRA. At year-end, the IRA balance was $441,000. In 2020, he withdrew $60,000 from the IRA. At

> For the following problem, assume the taxable year is 2019. Mrs. Shin retired in 2018 at age 63 and made her first withdrawal of $20,000 from her traditional IRA. At year-end, the IRA balance was $89,200. In 2019, she withdrew $22,000 from the IRA. At ye

> For the following problem, assume the taxable year is 2019. In 2012 (year 0), Mrs. Linsey exercised a stock option by paying $100 per share for 225 shares of ABC stock. The market price at date of exercise was $312 per share. In 2019, she sold the 225 sh

> For the following problem, assume the taxable year is 2019. In 2010, BB granted an incentive stock option (ISO) to Mr. Yarnell to buy 8,000 shares of BB stock at $7 per share for 10 years. At date of grant, BB stock was trading on the AMEX for $6.23 per

> For the following problem, assume the taxable year is 2019. In 2014, BT granted a nonqualified stock option to Ms. Pearl to buy 500 shares of BT stock at $20 per share for five years. At date of grant, BT stock was trading on Nasdaq for $18.62 per share.

> For the following problems, assume the taxable year is 2019. Mr. and Mrs. Brown report taxable income of $130,000 in 2019. In addition, they report the following. Excess Social Security withholding credit …………………… $ 2,200 Estimate tax payments ………………………

> For the following problems, assume the taxable year is 2019. Determine Ms. Arnout’s filing status in each of the following independent cases. a. Ms. Arnout and Mr. Eckes have been living together since 2017. They were married on December 13, 2019. b. Ms.

> For the following problems, assume the taxable year is 2019. In January, Ms. Northcut projects that her employer will withhold $25,000 from her 2020 salary. However, she has income from several other sources and must make quarterly estimated tax payments

> For the following problems, assume the taxable year is 2019. Jaclyn Biggs, who files as a head of household, never paid AMT before 2019. In 2019, her regular tax liability was $102,220 which included $39,900 capital gain taxed at 20 percent, and her AMTI

> Refer to the facts in the preceding problem. In 2020, the CFC’s income was $600,000, none of which was subpart F income or GILTI, and it distributed a $300,000 dividend to its shareholders ($120,000 to Jumper). How much of this actual dividend is taxable

> Jumper Inc., which has a 21 percent tax rate, owns 40 percent of the stock of a CFC. At the beginning of 2019, Jumper’s basis in its stock was $660,000. The CFC’s 2019 income was $1 million, $800,000 of which was subpart F income. The CFC paid no foreign

> In 2018, NB Inc.’s federal taxable income was $242,000. Compute the required installment payments of 2019 tax in each of the following cases: a. NB’s 2019 taxable income is $593,000. b. NB’s 2019 taxable income is $950,000. c. NB’s 2019 taxable income is

> In 2018, Bartley Corporation’s federal income tax due was $147,000. Compute the required installment payments of 2019 tax in each of the following cases: a. Bartley’s 2019 taxable income is $440,000. b. Bartley’s 2019 taxable income is $975,000. c. Bartl