Question: Dana Martin, president of Mays Electronics, is

Dana Martin, president of Mays Electronics, is concerned about the end-of-the-year marketing report. According to Mary O’Brien, marketing manager, a price decrease for the coming year is again needed to maintain the company’s market share of integrated circuit boards (CBs). The current selling price of $18 per unit is producing a $2 per-unit profit—half the customary $4 per-unit profit. Foreign competitors keep reducing their prices, and to match their latest reduction, the price must drop from $18 to $14. This price drop would put Mays’s price below the cost to produce and sell a CB. How could other firms sell for such a low price?

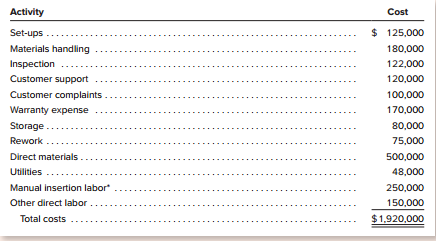

Determined to find out if there are problems with the company’s operations, Dana has decided to hire a consultant to evaluate the way in which the CBs are produced and sold. After two weeks, the consultant has identified the following activities and costs associated with producing 120,000 CBs.

The consultant indicates that some preliminary activity analysis shows that per-unit costs can be reduced by at least $7. The marketing manager indicates that the market share for the CBs could be increased by 50 percent if the price could be reduced to $12.

Instructions:

a. For each activity, determine whether it is value-added or non–value-added.

b. If all the non–value-added activities could be eliminated, by how much would the cost per CB decrease? Was the consultant correct in her preliminary cost reduction assessment?

c. Compute the target cost required to maintain Mays’s current market share while earning the usual profit of $4 per unit. Also compute the target cost required to expand sales by 50 percent. By how much would the cost per unit need to be reduced to achieve each target?

d. The consultant also revealed the following: Switching to automated insertion would save

$90,000 of direct labor, $20,000 in rework, and $40,000 in warranty costs. The yearly cost of the necessary machinery would be $50,000. With this additional information, what is the potential cost reduction per unit available? Can Mays achieve the target cost to maintain its current market share? e.In an effort to reach the target cost, Mays solicited suggestions from customers, suppliers, employees, and other consultants. The following were found to be feasible. Mays’ production manager believes that the factory can be redesigned so that materials handling costs can be reduced by $100,000—which would in turn result in a $10,000 savings in rework costs. The cost to redesign the factory would be $20,000. A supplier suggests leasing a machine that would reduce set-up costs by $80,000. The yearly cost to lease the machine is $15,000. A customer, KD, Inc., proposes setting up a just-in-time delivery system between Mays, KD, and Mays’ largest raw materials supplier. This would reduce Mays’ storage costs by $45,000, while increasing shipping costs by only $5,000. An employee suggests that Mays train all its employees in quality control measures and then offer a bonus for meeting quality targets. An outside consultant estimates that the cost of the training and bonus would be $35,000. In return, inspections could be eliminated and rework, customer complaint costs, and warranty work could be reduced by $120,000. If all of these suggestions are implemented, including the automation of the insertion process, would Mays reach the target cost needed to maintain its current market share?

> Frisbee Hardware uses a perpetual inventory system. At year-end, the Inventory account has a Balance of $250,000, but a physical count shows that the merchandise on hand has a cost of only $246,000. a. Explain the probable reason(s) for this discrepanc

> Insightful Instruments produces two models of binoculars. Information for each model is as follows. Total manufacturing overhead amounts to $180,000 per month, one-third of which is fixed. The demand for either product is sufficient to keep the plant

> Seattle Boat Company pays federal income taxes at a rate of 35 percent on taxable income. Compute the company’s annual after-tax cost of borrowing on a 5 percent, $5 million bond issue. Express this after-tax cost as a percentage of the borrowed $5 milli

> The following information relates to the only product sold by Mastrolia Manufacturing. a. Compute the contribution margin ratio and the dollar sales volume required to break even. b. Assuming that the company sells 30,000 units during the current year,

> Briefly explain the income tax advantage of raising capital by issuing bonds rather than by selling capital stock.

> Branson Electric prepared the following condensed income statements for two successive years. At the end of 2020 (right-hand column), the inventory was understated by $40,000, but the error was not discovered until after the accounts had been closed and

> Research China and write a brief comparison of Chinese political-legal, economic, cultural, and infrastructure factors as contrasted to those in the United States. Explain how these factors might affect accounting practices in the two countries.

> Use the financial statements of Home Depot, Inc., in Appendix A of this text to answer the following questions.

> Song Meister is a popular music store. During the current year, the company’s cost of goods available for sale amounted to $330,000. The retail sales value of this merchandise amounted to $600,000. Sales for the year were $520,000. Instructions: a. Us

> Fenwick Corporation’s manufacturing and finished goods warehouse facilities burned to the ground on January 31. The loss was fully covered by insurance. The insurance company wanted to know the cost of the inventories destroyed in the f

> Prepare general journal entries to a. Summarize the manufacturing costs charged to job no. 321. (Use one compound entry.) b. Record the completion of job no. 321. c. Record the credit sale of 4,000 units from job no. 321 at a unit sales price of $10. R

> Prepare common size income statements for Price Company, a sole proprietorship, for the two years shown as follows by converting the dollar amounts into percentages. For each year, sales will appear as 100 percent and other items will be expressed as a p

> In the long run, is it more important for a business to have positive cash flows from its operating activities, investing activities, or financing activities? Why?

> Explain the fair value adjustment procedure for marketable equity securities

> The accounting staff of Lambert Company has assembled the following information for the year ended December 31 of the current year. Instructions: Prepare a statement of cash flows in the format illustrated in Exhibit 13–1. Place br

> A friend of yours just purchased a small tract of land and has taken out a $50,000, 11 percent mortgage, payable at $476.17 per month. (The relatively high 11 percent interest rate reflects the fact that your friend is still in school and considered a hi

> Home Depot, Inc.’s income statements for 2016, 2017, and 2018 show basic earnings per share of $6.47, $7.33, and $9.78, respectively. Diluted earnings per share figures are slightly lower than these numbers, indicating the impact of potential capital sto

> Explain why an employer’s total cost of a payroll may exceed by a substantial amount the wages and salaries earned by employees.

> Hound Havens produces plastic doghouses as part of a continuous process through two departments: Molding and Finishing. Direct materials and conversion are added throughout the month in both departments, but at different rates. The information presented

> Thompson Tools produces dampers in a continuous process through two departments: Assembly and Packaging. All direct materials are added at the beginning of the process in the Assembly Department, whereas all direct materials are added at the end of the p

> Purcell’s, Inc., sells a single product (Pulse) exclusively through newspaper advertising. The comparative income statements and balance sheets are for the past two years. Additional Information: The following information regarding t

> Osier Company has outstanding 500,000 shares of $50 par value common stock that originally sold for $60 per share. During the three most recent years, the company carried out the following activities in the order presented: declared and distributed a 10

> Define current liabilities and long-term liabilities. Under what circumstances a 10-year bond issue might be classified as a current liability? Under what circumstances might a note payable maturing 30 days after the balance sheet date be classified as a

> Caster Corporation is considering implementation of a JIT inventory system. The company’s industrial engineer recently conducted a study to determine the average number of days spent in each activity of the production process. The follo

> Minor, Inc., had revenue of $572,000 and expenses (other than income taxes) of $282,000 for the current year. The company is subject to a 35 percent income tax rate. In addition, Minor had a gain from foreign currency translation of $1,700 before income

> Listed are seven publicly owned corporations and a liability that regularly appears in each corporation’s balance sheet? a. Wells Fargo & Company (banking): Deposits—interest bearing b. The New York Times Company (newspaper publisher): Unexpired subscr

> Explain the relative priority of the claims of owners and of creditors to the assets of a business. Do all creditors have equal priority? Explain.

> Rogers Products uses a periodic inventory system. The company’s records show the beginning inventory of PH4 oil filters on January 1 and the purchases of this item during the current year to be as follows. A physical count indicates 20

> Fick Psychological Services, Inc., closes its temporary accounts once each year on December 31. The company recently issued the following income statement as part of its annual report. Fick’s statement of retained earnings indicates th

> What does the account Unrealized Holding Gain (or Loss) on Investment represent? How is this account presented in the financial statements for short-term marketable equity securities?

> The accounting staff of Welch Company has assembled the following information for the year ended December 31 of the current year. Instructions: Prepare a statement of cash flows in the format illustrated in Exhibit 13–1. Place bracket

> Define liabilities. Identify several characteristics that distinguish liabilities from owners’ equity

> You have now learned about the following financial statements issued by corporations: statementof financial position (balance sheet), income statement, statement of retained earnings, statementof stockholders’ equity, statement of comprehensive income, a

> Delray Industries manufactures plastic wading pools as part of a continuous process through two departments: Molding and Finishing. Direct materials and conversion are added throughout the month in both departments, but at different rates. The informatio

> Sea Travel sells motor boats. One of Sea Travel’s most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. On April 28, Sea Travel sold five Wings to the Jack Sport racing team. Th

> S & X Co. is a retail store owned solely by Joe Saunder. During the month of November, the equity accounts were affected by the following events. Instructions: a. Assuming that the business is organized as a sole proprietorship: 1. Prepare the jou

> On December 31, Richland Farms sold a tract of land, which had cost $930,000, to Skyline Developers in exchange for $150,000 cash and a 5-year, 4 percent note receivable for $900,000. Interest on the note is payable annually, and the principal amount is

> A company’s inventory turnover is one measure of its potential to convert inventory into cash. But what is considered a good inventory turnover? The answer to that question depends on a variety of industry and company characteristics. Access the EDGAR da

> The owners of City Software are offering the business for sale. The income statements of the business for the three years of its existence are summarized as follows. In negotiations with prospective buyers of the business, the owners are calling attenti

> Custom Truck Builders frequently uses long-term capital lease contracts to finance the sale of its trucks (also referred to as Type A leases). On November 1, 2021, Custom Truck Builders leased to Interstate Van Lines a truck carried in the perpetual inve

> What are deferred income tax liabilities? How are these items presented in financial statements?

> Refer to the information in Problem 18.5A. Instructions: a. Complete a production cost report for the Badgersize Company Forming Department for the month of August. b. Discuss how management might use the production cost report to help manage costs. Da

> Davidson, DDS, purchased new furniture for its dental office on May 1, 2021. The furniture is expected to have a 10-year life and no residual value. The following expenditures were associated with the purchase. Instructions: a. Compute depreciation exp

> On December 1, Showcase Interiors purchased a shipment of furniture from Colonial House by paying $10,500 cash and issuing an installment note payable in the face amount of $28,800. The note is to be paid in 24 monthly installments of $1,200 each. Althou

> On June 30 of the current year, Blue Ridge Power issued bonds with a $40,000,000 face value and an annual coupon rate of 9 percent. The bonds mature in 10 years and pay semiannual interest on December 31 and June 30. They were issued when the annual mark

> Use Table PV–1 (in Exhibit B–7) and Table PV–2 (in Exhibit B–9) to determine the present values of the following cash flows. a. $40,000 to be paid annually for 10 years, discounted

> Refer to the information in Problem 18.5B. Instructions: a. Complete a production cost report for the Balfanz Company Finishing Department for the month of September. b. Discuss how management might use the production cost report to help manage costs.

> Brae mar Saddler uses department budgets and performance reports in planning and controlling. its manufacturing operations. The following annual performance report for the custom saddle production department was presented to the president of the company.

> The following income statement and selected balance sheet account data are available for Royce Interiors, Inc., at December 31, 2021. Additional Information: 1. Dividend revenue is recognized on the cash basis. All other income statement amounts are rec

> Late in the year, Software City began carrying Word Crafter, a new word processing software program. At December 31, Software City’s perpetual inventory records included the following cost layers in its inventory of Word Crafter program

> Scheck Company is required by a bond indenture to make equal annual payments to a bond sinking fund at the end of each of the next 20 years. The sinking fund will earn 8 percent interest and must accumulate to a total of $800,000 at the end of the 20-yea

> Ryan Sound uses a periodic inventory system. One of the store’s products is a wireless headphone. The inventory quantities, purchases, and sales of this product for the most recent year are as follows. Instructions: a. Using periodic

> R&R, Inc., purchased a new machine on September 1 of the current year at a cost of $180,000. The machine’s estimated useful life at the time of the purchase was five years, and its expected residual value was $10,000. The company reports on a calendar ye

> Use Table FA–1 (in Exhibit B–2) and Table FA–2 (in Exhibit B–4) to determine the future amounts of the following investments. a. $90,000 invested for 10 years, at 6 percent interest

> The two cases described as follows are independent of each other. Each case provides the information necessary to prepare the stockholders’ equity section of a corporate balance sheet. a. Early in 2019, Wesson Corporation was formed with the issuance of

> William Boost organized Frontier Western Wear, Inc., early in 2020. On January 15, the corporation issued to Bost and other investors 40,000 shares of capital stock at $20 per share. After the revenue and expense accounts (except Income Tax Expense) were

> The Top Hat, Inc., is a chain of magic shops that is organized as a corporation. During the month of June, the stockholders’ equity accounts of The Top Hat were affected by the following events: Instructions: a. Prepare journal entrie

> Snack Shack is a fast-food restaurant that is operated as a partnership of three individuals. The three partners share profits equally. The following selected account balances are for the current year before any closing entries are made. Instructions On

> Balfanz Company has the following information for its Finishing Department for the month of September. Assume materials are added at the start of processing. Instructions: a. Calculate the equivalent units for the Finishing Department for the month of

> Sharon Guenther and Robert Firmin, both of whom are CPAs, form a partnership, with Guenther investing $100,000 and Firmin, $80,000. They agree to share net income as follows: 1. Salary allowances of $80,000 to Guenther and $60,000 to Firmin. 2. Interest

> How is the inventory turnover computed? Why is this measurement of interest to short-term creditors?

> Badgersize Company has the following information for its Forming Department for the month of August. Assume materials are added at the start of processing. Instructions: a. Calculate the equivalent units for the Forming Department for the month of Augu

> Sells is a retail department store. The following cost-volume relationships were used in developing a flexible budget for the company for the current year. Management expected to attain a sales level of $12 million during the current year. At the end of

> Smithfield Hotel recently purchased new exercise equipment for its exercise room. The following information refers to the purchase and installation of this equipment. 1. The list price of the equipment was $42,000; however, Smithfield qualified for a spe

> During the current year, Delta Products Corporation incurred the following expenditures, which Should be recorded either as operating expenses or as intangible assets. a. Expenditures were made for the training of new employees. The average employee rema

> During the current year, Blake Construction disposed of plant assets in the following transactions. Instructions: a. Prepare journal entries to record each of the disposal transactions. Assume that depreciation expense on each asset has been recorded up

> Bush Company budgeted that it would incur $176,000 of manufacturing overhead costs in the upcoming period. By the end of the period, Bush had actually incurred manufacturing overhead costs totaling $200,000. Other information from the company’s accountin

> This problem focuses on the following question: Is it ethical for a CPA (or CPA firm) to provide similar services to companies that compete directly with one another? These services may include assistance in the preparation of financial statements, incom

> Brite Ideas, Inc., mass-produces reading lamps. Materials used in constructing the body of the lamp are added at the start of the process, while the materials used in wiring the lamps are added at the halfway point. All labor and overhead are added evenl

> Barnum Distributors wants a projection of cash receipts and cash payments for the month of November. On November 28, a note will be payable in the amount of $98,500, including interest. The cash balance on November 1 is $29,600. Accounts payable to merch

> The realization principle determines when a business should recognize revenue. Listed are three common business situations involving revenue. After each situation, we give two alternatives as to the accounting period (or periods) in which the business mi

> Street Smarts, Inc., mass-produces street lights. Materials used in constructing the body of the lights are added at the start of the process, while the materials used in wiring the lights are added at the halfway point. All labor and overhead are added

> Red Robin Gourmet Burgers is an upscale restaurant chain founded in the Pacific Northwest. The chain’s former chairman, Michael Snyder, encouraged employees to be “unbridled”? in everything they did. Unfortunately, Snyder was too unbridled with his use o

> Prudent cash management is an important function in any business. Large amounts of cash sitting idle in non–interest-bearing checking accounts can cost a company thousands—even millions— of dollars annually in foregone revenue. Many businesses invest lar

> What are the pitfalls to avoid when investing in overseas activities? The following key issues have been identified as important. ∙ Lower cost offshore does not always mean gains in efficiency. ∙ Choose your model carefully; either run your own offshore

> Grizzly Community Hospital in central Wyoming provides health care services to families living within a 200-mile radius. The hospital is extremely well equipped for a relatively small, community facility. However, it does not have renal dialysis equipmen

> The management of Metro Printers is considering a proposal to replace some existing equipment with a new highly efficient laser printer. The existing equipment has a current book value of $2,200,000 and a remaining life (if not replaced) of 10 years. The

> Miracle Tool, Inc., sells a single product (a combination screwdriver, pliers, hammer, and crescent wrench) exclusively through television advertising. The comparative income statements and balance sheets are for the past two years. Additional Informati

> To obtain a better understanding of economic value added, visit the website that outlines the EVA philosophy of Stern Stewart & Co www.valuebasedmanagement.net/methods_eva.html. In the center of the page find information about usage of the EVA method. L

> Snug-As-A-Bug manufactures sleeping bags. For the coming year, the company has budgeted the following costs for the production and sale of 80,000 units. Instructions: a. Compute the sales price per unit that would result in a budgeted operating income o

> What is the meaning of the term loss contingency? Give several examples. How are loss contingencies presented in financial statements? Explain.

> Marshall uses a job order costing system to account for projects. It applies manufacturing over head to jobs on the basis of direct labor hours and pays its direct labor workers $30 per hour. The following information relates to the month of December (so

> Compute trend percentages for the following items taken from the financial statements of Lopez Plumbing over a five-year period. Treat 2017 as the base year. State whether the trends are favorable or unfavorable. (Dollar amounts are stated in thousands.)

> D. J. Fletcher, a trusted employee of Bluestem Products, found himself in personal financial difficulties and decided to “borrow” $3,000 from the company and to conceal his theft. As a first step, Fletcher removed $3,000 in currency from the cash registe

> Affections manufactures candy and sells only to retailers. It is not a publicly owned company and its financial statements are not audited. But the company frequently must borrow money. Its creditors insist that the company provide them with unaudited fi

> Nevis Corporation manufactures and sells a single product. In preparing the budget for the first quarter, the company’s cost accountant has assembled the following information. The company uses the first-in, first-out method to report

> Windfall Industries uses straight-line depreciation on all of its depreciable assets. The company records annual depreciation expense at the end of each calendar year. On January 11, 2017, the company purchased a machine costing $90,000. The machine’s us

> The Printer Division is evaluated as an investment center. Wolfe expects all of its investment centers to earn a minimum annual return of 10 percent on average invested capital. Division managers receive a bonus equal to 1 percent of their division’s res

> Wolfe Computer manufactures computers and peripheral equipment. The following data relate to Wolfe’s printer division for the year just ended. The Printer Division is evaluated as an investment center. Wolfe expects all of its investme

> Jams and Jellies, Inc., uses a standard cost system to track inventories and cost of goods sold. The blueberry factory that produces blueberry jams and jellies increased its standard product costs at the beginning of the fourth quarter of its operations

> Data Management, Inc., provided the following information at December 31, year 1. Marketable Securities The company invested $75,000 in a portfolio of marketable securities on December 9, year 1. The portfolio’s market value on Decembe

> Healthy Hound, Inc., makes two lines of dog food: (1) Basic Chunks and (2) Custom Cuts. The Basic Chunks line is a dry food that is processed almost entirely by an automated process. Custom Cuts is a canned food made with real horsemeat. The slabs of mea

> Each year, a large clothing store in New York City sends its top five salespersons on a five-day retreat in Orlando, Florida. The retreat begins on the first Monday in February and ends the following Friday afternoon. The company must purchase five coach

> Armstrong Chemical began operations in January. The company manufactures an acrylic car wax called Tough-Coat. The following standard cost estimates were developed several months before the company began operations, based on an estimated production of 1,

> Cabinets, Inc., is a large manufacturer of modular kitchen cabinets, sold primarily to builders and developers. The company uses a standard cost system. Standard production costs have been developed for each type of cabinet; these costs and any cost vari

> Rock, Inc., sells stereo equipment. Traditionally, the company’s sales have been in the following categories: cash sales, 25 percent; customers using national credit cards, 35 percent; sales on account (due in 30 days), 40 percent. With

> Happy Cat, Inc., makes two lines of cat food: (1) Tabby Treat, and (2) Fresh n’ Fishy. The Tabby Treat line is a dry food that is processed almost entirely by an automated process. Fresh n’ Fishy is a canned food made

> Under the Public Company Accounting Oversight Board (PCAOB) procedures, companies are required to disclose “material weaknesses” in their internal controls. A material weakness means a company’s deficiencies are so bad that there’s more than a remote cha

> Working in small groups, view the following master budgeting video: https://www.youtube.com/watch?v=Wy9MGFjS7ZA Instructions: a. What does the video identify as three primary outputs of the master budgeting process? Are these three outputs the same as t

> The income statement of Walmart reports net sales of $495,761 million and cost of goods sold of $373,396 million for the year ended January 31, 2018. The comparable sales and cost of goods sold figures for the year ended one year earlier were $481,317 mi