Question: Daniel Company started operations on January 1

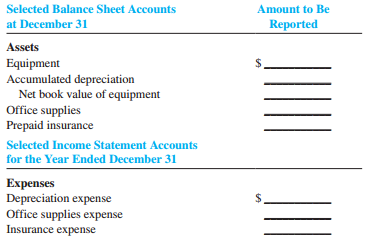

Daniel Company started operations on January 1 of the current year. It is now December 31, the end of the current annual accounting period. The part-time bookkeeper needs your help to analyze the following three transactions:

a. During the year, the company purchased office supplies that cost $3,000. At the end of the year, office supplies of $800 remained on hand.

b. On January 1 of the current year, the company purchased a special machine for cash at a cost of $25,000. The machine’s cost is estimated to depreciate at $2,500 per year.

c. On July 1, the company paid cash of $1,000 for a two-year premium on an insurance policy on the machine; coverage began on July 1 of the current year.

Required:

Complete the following schedule with the amounts that should be reported for the current year:

Transcribed Image Text:

Selected Balance Sheet Accounts Amount to Be at December 31 Reported Assets Equipment Accumulated depreciation Net book value of equipment Office supplies Prepaid insurance Selected Income Statement Accounts for the Year Ended December 31 Expenses depreciation expense Office supplies expense Insurance expense

> In its recent annual report, PepsiCo included the following information in its balance sheets (dollars in millions): Required: Explain the effects of the changes in inventory and accounts payable on cash flow from operating activities for the current ye

> Several years ago, the financial statements of Gibson Greeting Cards, now part of American Greetings, contained the following note: On July 1, the Company announced that it had determined that the inventory . . . had been overstated. . . . The overstatem

> Snyder’s-Lance is a leading snack-food company. The following note was contained in its recent annual report: Required: 1. What amount of ending inventory would have been reported in the current year if Snyder’s-Lance

> The following note was contained in a recent Ford Motor Company annual report: Required: 1. What amount of ending inventory would have been reported in the current year if Ford had used only FIFO? 2. The cost of goods sold reported by Ford for the curre

> The records at the end of January of the current year for Young Company showed the following for a particular kind of merchandise: Beginning Inventory at FIFO: 19 Units @ $16 = $304 Beginning Inventory at LIFO: 19 Units @ $12 = $228 Required: Compute th

> Define goods available for sale. How does it differ from cost of goods sold?

> The August current year bank statement for Allison Company and the August current year ledger account for cash follow: Outstanding checks at the end of July were for $270, $430, and $320. No deposits were in transit at the end of July. Required: 1. Comp

> Dell Inc. is the leading manufacturer of personal computers. In a recent year, it reported the following in dollars in millions: Net sales revenue…………………………...$62,071 Cost of sales……………………………………...48,260 Beginning inventory………………………….…..1,301 Ending inve

> Parson Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending inventory information about the four major items stocked for regular sale follows: Required: 1. Compute t

> Jones Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows: Required: Compute the valuation that should be used for the curre

> All of the current year’s entries for Zimmerman Company have been made, except the following adjusting entries. The company’s annual accounting year ends on December 31. a. On September 1 of the current year, Zimmerman collected six months’ rent of $8,40

> Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes), $194,500; ending

> Following is partial information for the income statement of Arturo Technologies Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and

> Following is partial information for the income statement of Audio Solutions Company under three different inventory costing methods, assuming the use of a periodic inventory system: Required: 1. Compute cost of goods sold under the FIFO, LIFO, and aver

> Beck Inc. uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Required: 1. Prepare a separate income statement through pr

> Broadhead Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Required: 1. Prepare a separate income statement th

> Hamilton Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Required: Compute ending inventory and cost of goods

> The bookkeeper at Jefferson Company has not reconciled the bank statement with the Cash account, saying, “I don’t have time.” You have been asked to prepare a reconciliation and review the procedures

> Refer to Exercise 10. Data from Exercise 10: Stacey’s Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts had zero balances and its balance sheet account balances wer

> Penn Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 1: Required: Compute ending inventory and cost of goods sol

> Supply the missing dollar amounts for the income statement for each of the following independent cases: Pretax Ending Cases Revenue Inventory Purchases Available Inventory Goods Sold Profit Expenses (Loss) Sales Beginning Total Cost of Gross Income A

> Supply the missing dollar amounts for the income statement for each of the following independent cases. Case A Case B Case C Net sales revenue $7,500 $ ? $5,000 Beginning inventory $11,200 $ 7,000 $ 4,000 Purchases 4,500 ? 9,500 Goods available for s

> Based on its physical count of inventory in its warehouse at year-end, December 31 of the current year, Madison Company planned to report inventory of $34,500. During the audit, the independent CPA developed the following additional information: a. Goods

> Stacey’s Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Required: 1. Create T-accounts f

> Blaine Air Transport Service, Inc., has been in operation for three years. The following transactions occurred in February: February 1 Paid $275 for rent of hangar space in February. February 2 Purchased fuel costing $490 on account for the next flight

> Vail Resorts, Inc., owns and operates five premier year-round ski resort properties (Vail Mountain, Beaver Creek Resort, Breckenridge Mountain, and Keystone Resort, all located in the Colorado Rocky Mountains, and Heavenly Valley Mountain Resort, located

> Sysco, formed in 1969, is North America’s largest marketer and distributor of food service products, serving approximately 425,000 restaurants, hotels, schools, hospitals, and other institutions. The following summarized transactions are typical of those

> Wolverine World Wide, Inc., manufactures military, work, sport, and casual footwear and leather accessories under a variety of brand names, such as Hush Puppies, Wolverine, Merrell, Stride Rite, and Bates, to a global market. The following transactions o

> Tungsten Company, Inc., sells heavy construction equipment. There are 10,000 shares of capital stock outstanding. The annual fiscal period ends on December 31. The following condensed trial balance was taken from the general ledger on December 31, curren

> Amazon.com, Inc., headquartered in Seattle, WA, started its electronic commerce business in 1995 and expanded rapidly. The following transactions occurred during a recent year (dollars in millions): a. Issued stock for $6 cash (example). b. Purchased equ

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. Required: 1. Pool Corp. reported the following information related to bad debt estimates and write-offs for the current year. Prepare journal e

> Revenues are normally recognized when a company transfers promised goods or services to customers in the amount the company expects to receive. Expense recognition is guided by an attempt to match the costs associated with the generation of those revenue

> Revenues are normally recognized when the company transfers promised goods or services in the amount the company expects to receive. The amount recorded is the cash-equivalent sales price. The following transactions occurred in September: a. A popular sk

> What are the general guidelines for deciding which items should be included in inventory?

> Payson Sports, Inc., sells sports equipment to customers. Its fiscal year ends on December 31. The following transactions occurred in the current year: a. Purchased $250,000 of new sports equipment inventory; paid $90,000 in cash and owed the rest on acc

> Match each definition with its related term by entering the appropriate letter in the space provided. There should be only one definition per term (that is, there are more definitions than terms). Answer: TERM K (1) Expenses E (2) Gains G (3) Rev

> Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three time periods as follow

> Refer to Exercise 20. Data from Exercise 20: Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify the case, the amounts given are in thousands of dollars. Other data not ye

> Refer to Exercise 20. Data from Exercise 2o: Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify the case, the amounts given are in thousands of dollars. Other data not ye

> Match each player with the related definition by entering the appropriate letter in the space provided. Players Definitions (1) Independent auditor A. Adviser who analyzes financial and other economic (2) CEO and CFO information to form forecasts and

> Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify the case, the amounts given are in thousands of dollars. Other data not yet recorded at December 31 include: a. Insuranc

> The following amounts were selected from the annual financial statements for Genesis Corporation at December 31, 2015 (end of the third year of operations): From the 2015 income statement: Sales revenue…………………….……………………………$275,000 Cost of goods sold………….

> Jay, Inc., a party rental business, completed its first year of operations on December 31. Because this is the end of the annual accounting period, the company bookkeeper prepared the following tentative income statement: You are an independent CPA hired

> On December 31, the bookkeeper for Grillo Company prepared the following income statement and balance sheet summarized here but neglected to consider three adjusting entries. Data on the three adjusting entries follow: a. Rent revenue of $2,500 earned in

> On December 31, Fawzi Company prepared an income statement and balance sheet and failed to take into account four adjusting entries. The income statement, prepared on this incorrect basis, reflected pretax income of $65,000. The balance sheet (before the

> Cohen & Boyd, Inc., publishers of movie and song trivia books, made the following errors in adjusting the accounts at year-end (December 31): a. Did not accrue $1,400 owed to the company by another company renting part of the building as a storage fa

> Select Apparel purchased 90 new shirts and recorded a total cost of $2,258 determined as follows: Invoice cost ……………………………………………….………………………..$1,800 Shipping charges…………………………………..………………………………….185 Import taxes and duties……….……………………………………………………165 Intere

> Deere & Company is the world’s leading producer of agricultural equipment; a leading supplier of a broad range of industrial equipment for construction, forestry, and public works; a producer and marketer of a broad line of lawn and

> Note 1: On April 1, 2017, Warren Corporation received a $30,000, 10 percent note from a customer in settlement of a $30,000 open account receivable. According to the terms, the principal of the note and interest are payable at the end of 12 months. The a

> At the beginning of the current year, Donna Company had $1,000 of supplies on hand. During the current year, the company purchased supplies amounting to $6,400 (paid for in cash and debited to Supplies). At the end of the current year, a count of supplie

> Sony is a world leader in the manufacture of consumer and commercial electronics as well as in the entertainment and insurance industries. Its ROA has decreased over the last three years. Required: Indicate the most likely effect of each of the changes

> JJ Company owns a building. Which of the following statements regarding depreciation as used by accountants is false? a. As depreciation is recorded, stockholders’ equity is reduced. b. Depreciation is an estimated expense to be recorded over the buildin

> An adjusted trial balance a. Shows the ending account balances in a “debit” and “credit” format before posting the adjusting journal entries. b. Is prepared after closing entries have been posted. c. Shows the ending account balances resulting from the a

> Failure to make an adjusting entry to recognize accrued salaries payable would cause which of the following? a. An understatement of expenses, liabilities, and stockholders’ equity. b. An understatement of expenses and liabilities and an overstatement of

> On June 1, 2016, Oakcrest Company signed a three-year $110,000 note payable with 9 percent interest. Interest is due on June 1 of each year beginning in 2017. What amount of interest expense should be reported on the income statement for the year ended D

> On October 1, 2017, the $12,000 premium on a one-year insurance policy for the building was paid and recorded as Prepaid Insurance. On December 31, 2017 (end of the accounting period), what adjusting entry is needed? a. Insurance Expense (+E) 2,000 Prepa

> Assume the prior year ending inventory was understated by $50,000. Explain how this error would affect the prior year and current year pretax income amounts. What would be the effects if the prior year ending inventory were overstated by $50,000 instead

> Which account is least likely to appear in an adjusting journal entry? a. Cash b. Interest Receivable c. Property Tax Expense d. Salaries Payable

> Which of the following accounts would not appear in a closing entry? a. Salary Expense b. Interest Income c. Accumulated Depreciation d. Retained Earnings

> Indicate the most likely effect of the following changes in inventory management on the inventory turnover ratio (use + for increase, − for decrease, and NE for no effect). ___ a. Have parts inventory delivered daily by suppliers instead of weekly. ___b.

> Massa Company, which has been operating for three years, provides marketing consulting services worldwide for dot-com companies. You are a financial analyst assigned to report on the Massa management team’s effectiveness at managing its

> Wood Company had the following inventory items on hand at the end of the year: Computing the lower of cost or market on an item-by-item basis, determine what amount would be reported on the balance sheet for inventory. Cost Net Realizable Quantity pe

> Indicate whether the FIFO or LIFO inventory costing method would normally be selected when inventory costs are rising. Explain why.

> Netherlands-based Royal Ahold ranks among the world’s three largest food retailers. In the United States it operates the Stop & Shop and Giant supermarket chains. Dutch and U.S regulators and prosecutors have brought criminal and civil charges against th

> Indicate whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. a. Declining costs Highest net income _____ Highest inventory _____ b. Rising costs Highest net income _____ Highes

> JCPenney Company, Inc., is a major retailer with department stores in all 50 states. The dominant portion of the company’s business consists of providing merchandise and services to consumers through department stores that include catalog departments. In

> Operating costs incurred by a manufacturing company become either (1) part of the cost of inventory to be expensed as cost of goods sold at the time the finished goods are sold or (2) expenses at the time they are incurred. Indicate whether each of the f

> Given the transactions in M3-7 and M3-8 (including the examples), indicate how the transactions will affect the statement of cash flows for Craig’s Bowling, Inc., for the month of July. Create a table similar to the one below for transa

> The following accounts are used by Britt’s Knits, Inc. Required: For each of the following nine independent situations, prepare the journal entry by entering the appropriate code(s) and amount(s). The first transaction is used as an exa

> Refer to Exercise 9. Data from Exercise 9: John’s Boat Yard, Inc., repairs, stores, and cleans boats for customers. It is completing the accounting process for the year just ended on November 30. The transactions for the past year have

> Complete the following tabulation, indicating the sign of the effect (+ for increase, - for decrease, and NE for no effect) of each transaction. Consider each item independently. a. Recorded sales on account of $300 and related cost of goods sold of $200

> Indicate the order in which the following disclosures or reports are normally issued by public companies. No. Title………………………………………………………………… _____........................................................... Form 10-K _____ …………………………………Earnings press

> Refer to Exercise 8. Data from Exercise 8: Dittman’s Variety Store is completing the accounting process for the current year just ended, December 31. The transactions during the year have been journalized and posted. The following data

> John’s Boat Yard, Inc., repairs, stores, and cleans boats for customers. It is completing the accounting process for the year just ended on November 30. The transactions for the past year have been journalized and posted. The following data with respect

> Dittman’s Variety Store is completing the accounting process for the current year just ended, December 31. The transactions during the year have been journalized and posted. The following data with respect to adjusting entries are available: a. Wages ear

> Refer to Exercise 3 and Exercise 5. Required: For each of the transactions in Exercise 3 and Exercise 5, indicate the amount and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Using the followi

> Gauge Construction Company is making adjusting entries for the year ended March 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. The company paid $1,800 on January 1 of the current year

> Aubrae Company is making adjusting entries for the year ended December 31 of the current year. In developing information for the adjusting entries, the accountant learned the following: a. A two-year insurance premium of $4,800 was paid on October 1 of t

> Elana’s Traveling Veterinary Services, Inc., completed its first year of operations on December 31. All of the year’s entries have been recorded except for the following: a. On March 1 of the current year, the company borrowed $60,000 at a 10 percent int

> Diane Company completed its first year of operations on December 31. All of the year’s entries have been recorded except for the following: a. At year-end, employees earned wages of $4,000, which will be paid on the next payroll date in January of next y

> In a recent annual report, Hewlett-Packard Company states, “We are a leading global provider of products, technologies, software, solutions and services to individual consumers, small- and medium-sized businesses (‘SMB

> Paige Consultants, Inc., provides marketing research for clients in the retail industry. The company had the following unadjusted balances at the end of the current year: Required: Prepare in good form an unadjusted trial balance for Paige Consultants,

> You are evaluating your current portfolio of investments to determine those that are not performing to your expectations. You have all of the companies’ most recent annual reports. Required: For each of the following, indicate where you would locate the

> Megan Company (not a corporation) was careless about its financial records during its first year of operations, 2013. It is December 31, 2013, the end of the annual accounting period. An outside CPA has examined the records and discovered numerous errors

> Josh and Kelly McKay began operations of their furniture repair shop (Furniture Refinishers, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1, 2017, was as follows: Transactions during 2017 follow: a.

> Brothers Mike and Tim Hargen began operations of their tool and die shop (H & H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1, 2017, follows: Transactions during 2017 follow: a. Borrowed

> What would be the direction of the effect of the following transactions on the following ratios (+ for increase, - for decrease, and NE for no effect)? Consider each item independently. a. Repaid principal of $2,000 on a long-term note payable with the b

> In a recent year, Coach, Inc., a designer and marketer of handbags and other accessories, issued 12,100 shares of its $0.01 par value stock for $344,000 (these numbers are rounded). These additional shares were issued under an employee stock option plan.

> Following is a list of classifications on the balance sheet. Number them in the order in which they normally appear on a balance sheet. No. ……………………………........Title ___ …………………………....Long-term liabilities ___..................................C

> Micro Warehouse was a computer software and hardware online and catalog sales company.* A 1996 Wall Street Journal article disclosed the following: MICRO WAREHOUSE IS REORGANIZING TOP MANAGEMENT Micro Warehouse Inc. announced a “significant reorganizatio

> A press release for Seneca Foods (licensee of the Libby’s brand of canned fruits and vegetables) included the following information: The current year’s net earnings were $8,019,000 or $0.65 per diluted share, compared with $32,067,000 or $2.63 per dilute

> If a company is successful in acquiring several large buildings at the end of the year, what is the effect on the total asset turnover ratio? a. The ratio will increase. b. The ratio will not change. c. The ratio will decrease. d. Either (a) or (c).

> According to GAAP, what ratio must be reported on the financial statements or in the notes to the statements? a. Earnings per share ratio. b. Return on equity ratio. c. Net profit margin ratio. d. Current ratio.

> A recent annual report of Gannett Co., Inc., an international diversified media and marketing solutions company that currently includes numerous television stations, newspapers (such as USA Today), and Internet businesses (such as Cars.com and Career-Bui

> Refer to Exercise 10. Data from Exercise 10: Stacey’s Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash

> The following transactions are July activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount and

> The following transactions are July activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount and

> The following data are from annual reports of Jen’s Jewelry Company: Compute Jen’s net profit margin ratio for each year. What do these results suggest to you about Jen’s Jewelry Company? 2018 201

> Refer to the financial statements of American Eagle Outfitters in Appendix B, Urban Outfitters in Appendix C, and the Industry Ratio Report in Appendix D at the end of this book. Financial statements of American Eagle: Financial statements of Urban Outf

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of the book. Data from Urban Outfitters: Required: 1. How much is in the Prepaid Expenses and Other Current Assets account at the end of the most recent year (for the year e