Question: Data (in millions) from recent financial statements

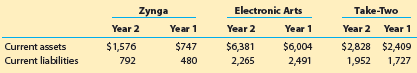

Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows:

a. Compute the working capital for Year 2 and Year 1 for each company.

b. Which company has the largest working capital?

c. Compute the current ratio for Year 2 and Year 1 for each company. Round to one decimal place.

d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.

> Perform the indicated operation and reduce your answer to lowest terms.

> Use a scientific calculator to perform the necessary operations. China’s GDP In 2013, the GDP (see Exercise 65) of China was about $9.24 trillion, and the population of China was about 1.396 billion people. Determine China’s GDP per person by dividing th

> The primes 2 and 3 are consecutive natural numbers. Is there another pair of consecut

> Rationalize the denominator.

> Perform the indicated operation and reduce your answer to lowest terms.

> Write the mathematical expression as a phrase. (There are several acceptable answers.) 3x + 5

> China’s Population. In September 2014, the population of China was about 1.396 billion people, and the population of the world was about 7.194 billion people. Determine the ratio of China’s population to the world’s population by dividing China’s populat

> Landscape Trimming Bianca trims her palm trees every 45 days and her viburnum shrubs every 25 days. If Bianca trims both her palm trees and her viburnum shrubs on the same day, how many days will it be until they are both trimmed on the same day again?

> Rationalize the denominator.

> Perform the indicated operation and reduce your answer to lowest terms.

> Use a scientific calculator to perform the necessary operations. Spain’s Debt per Person In 2014, the Spanish national debt was about 849 billion euros (the euro is the unit of currency in Spain). Spain’s population in 2014 was about 46.7 million people.

> Car Maintenance For many sport utility vehicles, it is recommended that the oil be changed every 3500 miles and that the tires be rotated every 6000 miles. If Carmella just had the oil changed and tires rotated on her SUV during the same visit to her mec

> Rationalize the denominator.

> Perform the indicated operation and reduce your answer to lowest terms.

> List the numbers from smallest to largest. 267,000,000; 3.14 * 107; 1,962,000; 4.79 * 106

> Stacking Trading Cards Desmond collects trading cards. He has 432 baseball cards and 360 football cards. He wants to make stacks of cards on a table so that each stack contains the same number of cards and each card belongs to one stack. If the baseball

> A = lw; determine A when l = 9 and w = 4.(geometry)

> Perform the indicated operation. Simplify the answer when possible.

> Perform the indicated operation and reduce your answer to lowest terms.

> List the numbers from smallest to largest. 8.5 × 10-5; 8.2 × 103 ; 1.3 × 10-1 ; 6.2 × 104

> Barbie and Ken Mary collects Barbie dolls and Ken dolls. She has 390 Barbie dolls and 468 Ken dolls. Mary wishes to display the dolls in groups so that the same number of dolls are in each group and that each doll belongs to one group. If each group is t

> Perform the indicated operation. Simplify the answer when possible.

> Express each repeating decimal number as a quotient of two integers. If possible, reduce the quotient to lowest terms.

> Perform the indicated operation without the use of a calculator and express each answer in scientific notation. (b) Confirm your answer from part (a) by using a scientific calculator to perform the operations. If the calculator displays the answer in dec

> U.S. Senate Committees The U.S. Senate consists of 100 members. Senate committees are to be formed so that each of the committees contains the same number of senators and each senator is a member of exactly one committee. The committees are to have more

> Perform the indicated operation. Simplify the answer when possible.

> Express each repeating decimal number as a quotient of two integers. If possible, reduce the quotient to lowest terms.

> Write the mathematical expression as a phrase. (There are several acceptable answers.) x – 2

> Perform the indicated operation without the use of a calculator and express each answer in scientific notation. (b) Confirm your answer from part (a) by using a scientific calculator to perform the operations. If the calculator displays the answer in dec

> Find (a) the greatest common divisor (GCD) and (b) the least common multiple (LCM). 18, 78, and 198

> Perform the indicated operation. Simplify the answer when possible.

> Express each repeating decimal number as a quotient of two integers. If possible, reduce the quotient to lowest terms.

> Perform the indicated operation without the use of a calculator and express each answer in scientific notation. (b) Confirm your answer from part (a) by using a scientific calculator to perform the operations. If the calculator displays the answer in dec

> Find (a) the greatest common divisor (GCD) and (b) the least common multiple (LCM). 240 and 285

> Perform the indicated operation.

> Express each repeating decimal number as a quotient of two integers. If possible, reduce the quotient to lowest terms.

> Perform the indicated operation without the use of a calculator and express each answer in scientific notation. (b) Confirm your answer from part (a) by using a scientific calculator to perform the operations. If the calculator displays the answer in dec

> Find (a) the greatest common divisor (GCD) and (b) the least common multiple (LCM). 120 and 240

> Fill in the blank with an appropriate word, phrase, or symbol(s). An equation that typically has a real-life application is called a(n)________ .

> (2). for the rational number p/q p is called the __________.

> During the current year, merchandise is sold for $186,500 cash and $1,437,200 on account. The cost of the goods sold is $900,000. What is the amount of the gross profit?

> Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, n/30. The cost of the goods sold is $67,200. Shore paid freight of $1,800. Shore Co. issued a credit memo for $7,500 to Blue Star Co. for merchandise that was r

> Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

> The Gorman Group is a financial planning services firm owned and operated by Nicole Gorman. As of October 31, 20Y9, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows: Instructions

> Light-It-Up Company maintains and repairs warning lights, such as those found on radio towers and lighthouses. Light-It-Up Company prepared the following end-of-period spreadsheet at August 31, 20Y5, the end of the fiscal year: Instructions 1. Prepare an

> Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabet’s primary source of revenue is fro

> Caterpillar Inc. (CAT) is one of the world’s largest manufacturers of construction and mining equipment with revenue over $50 billion per year. The following year-end data were taken from a recent Caterpillar balance sheet (in millions)

> The following year-end data were taken from recent balance sheets of Under Armour, Inc. (UA) (in millions): a. Compute the working capital and the current ratio as of December 31, Year 2 and Year 1. Round to one decimal place. b. What conclusions concer

> The Foot Locker, Inc. (FL) and Dick’s Sporting Goods, Inc. (DKS) are two retail chains. The current assets and current liabilities from recent balance sheets for both companies are as follows (in millions): a. Compute the working capit

> On July 1, the supplies account balance was $1,680. During July, supplies of $5,250 were purchased, and $1,810 of supplies was on hand as of July 31. Determine supplies expense for July.

> Amazon.com, Inc. (AMZN) is the largest Internet retailer in the United States. Best Buy, Inc. (BBY) is a leading retailer of technology and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells throu

> An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct.

> Easy Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on November 30, 20Y7, the end of the fiscal year, the balances of selected accounts from the ledger of Easy Weight Loss are

> Paoli Consulting is a consulting firm owned and operated by Mary Paoli. The following end-of-period spreadsheet was prepared for the year ended March 31, 20Y9: Based on the preceding spreadsheet, prepare an income statement, statement of stockholders&a

> A cash T account for Pryor Consulting Services’ first month of operations ended March 31, 20Y3, is as follows: a. Classify each of the March cash transactions as an operating, investing, or financing activity using the preceding forma

> The cash account for Kelly Consulting’s first month of operations ending April 30, 20Y8, is shown in Exhibit 18. a.Classify each of the April cash transactions as an operating, investing, or financing activity using the following format

> Based on the data in Exercise 4-26, journalize the closing entries for Alert Security Services Co.

> Microsoft Corporation (MSFT) is a technology company that develops, licenses, and supports a wide variety of software and hardware products, including personal computers, tablets, video games, and operating systems. On recent financial statements, Micros

> PepsiCo, Inc. (PEP) is a food and beverage company with a variety of brands, including Frito- Lay, Gatorade, Pepsi-Cola, and Tropicana. On recent financial statements, Pepsi reported net income of $7,314 million and $2,257 million of depreciation expense

> In Exhibit 15, Kelly Consulting reported accrual net income of $18,300. Under the cash basis of accounting, Kelly Consulting would have reported net income of $15,000. a. Why are the accrual- and cash-basis net incomes different? b. Provide an example of

> Journalize the payment of dividends on May 20 for $75,000.

> Net solutions reported December accrual net income of $4,055 in Exhibit 20, while under the cash basis of accounting , it would have reported a net loss of $(935). a. Why are the accrual- and cash-basis net incomes different? b. From the December transa

> After the accounts have been adjusted at June 30, the end of the fiscal year, the following balances were taken from the ledger of Classic Landscaping Co.: Retained Earnings $1,100,000 Dividends 30,000 Fees Earned 975,000 Wages Expense 580,000 Rent Expen

> Brenda Tooley owns and operates Speedy Delivery Services. On January 1, 20Y7, Common Stock had a balance of $75,000, and Retained Earnings had a balance of $615,700. During the year, $15,000 of additional common stock was issued, and $6,000 of dividends

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjusted trial balance at July 31, 20Y9: The data n

> Martin Editing Company is a small editorial services company owned and operated by Andrew Martin. On August 31, 20Y1, the end of the current year, Martin Editing Company’s accounting clerk prepared the following unadjusted trial balance

> Reliable Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance on November 30, 20Y3: For preparing the adjusting entries, the following data were assembled: • Fees earned but unbilled on N

> On October 31, the following data were accumulated to assist the accountant in preparing the Adjusting entries for bickle Realty: • The supplies account balance on October 31 is $8,125. The supplies on hand on October 31 are $1,150. • The unearned rent a

> Amazon.com, Inc. (AMZN) is the largest Internet retailer in the United States. Amazon’s income statements through operating income for two recent years are as follows (in millions): a. Prepare a vertical analysis of the two income sta

> The following income statement data for AT&T Inc. (T) and Verizon Communications Inc. (VZ) were taken from their recent annual reports (in millions): a. Prepare a vertical analysis of the income statement for AT&T. Round to one decimal place. b

> Journalize the entry on October 19 for cash received for services rendered, $8,774.

> Chipotle Mexican Grill, Inc. (CMG) is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s income statements through operating income for two recent years are as follows (in thousands): a. Pre

> World Wrestling Entertainment, Inc. (WWE) is a sports media and entertainment company primarily focused on professional wrestling. WWE’s income statements through operating income for two recent years are as follows (in thousands): a.

> Netflix, Inc. (NFLX) provides Internet streaming services featuring TV series, documentaries, and films throughout the world. Netflix’s income statements through operating income for two recent years are as follows (in thousands):

> The wages payable and wages expense accounts at February 28, after adjusting entries have been posted at the end of the first month of operations, are shown in the following T accounts: Determine the amount of wages paid during the month.

> Stenberg Realty Co. pays weekly salaries of $18,500 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends (a) on Monday and (b) on Thursday.

> At the end of the current year, $17,950 of fees has been earned but has not been billed to clients. a. Journalize the adjusting entry to record the accrued fees. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry h

> The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accountant’s adjusting ent

> For a recent year, the balance sheet for The Campbell Soup Company (CPB) includes accrued expenses of $609 million. The income before taxes for Campbell for the year was $979 million. a. Assume the adjusting entry for $609 million of accrued expenses was

> For a recent period, the balance sheet for Costco Wholesale Corporation (COST) reported accrued expenses of $3,176 million. For the same period, Costco reported income before income taxes of $4,737 million. Assume that the adjusting entry for $3,176 mill

> On a recent balance sheet, Microsoft Corporation (MSFT) reported Property, Plant, and Equipment of $71,807 million and Accumulated Depreciation of $35,330 million. a. What was the book value of the fixed assets? b. Would the book value of Microsoft’s fix

> Journalize the entry for the purchase of office supplies on February 13 for $3,175, paying $1,000 cash and the remainder on account.

> The estimated amount of depreciation on equipment for the current year is $66,290. Journalize the adjusting entry to record the depreciation.

> The balance in the prepaid insurance account, before adjustment at the end of the year, is $22,500. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (a) the amount of insurance

> The balance in the supplies account, before adjustment at the end of the year, is $5,175. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $615.

> The balance in the unearned fees account, before adjustment at the end of the year, is $18,000. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $3,600.

> When preparing the financial statements for the year ended December 31, 20Y5, accrued salaries owed to employees for December 30 and 31 were overlooked. The accrued salaries were included in the first salary payment on January 6, 20Y6. Indicate which ite

> Accrued salaries owed to employees for August 30 and 31 are not considered in preparing the financial statements for the year ended August 31. Indicate which items will be erroneously stated, because of the error, on (a) the income statement for the year

> Classify the following items as (1) accrued revenue, (2) accrued expense, (3) unearned revenue, or (4) prepaid expense: a. Cash paid for rent of office space b. Fees received for services to be performed c. Wages owed but not yet paid d. Services ren

> Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry: a. Building b. Cash c. Common Stock d. Land e. Prepaid Rent f. Wages Expense

> Two income statements for Cornea Company follow: a. Prepare a vertical analysis of Cornea Company’s income statements. b. Does the vertical analysis indicate a favorable or an unfavorable trend?

> For the year ending June 30, O’Keefe Medical Services Co. mistakenly omitted adjusting entries for (1) $2,000 of supplies that were used, (2) unearned revenue of $7,500 that was earned, and (3) insurance of $11,300 that expired. Indicate the combined eff

> The following errors took place in journalizing and posting transactions: a. The receipt of $10,700 for services rendered was recorded as a debit to Accounts Receivable and a credit to Fees Earned. b. The purchase of supplies of $4,300 on account was rec

> The prepaid insurance account had a beginning balance of $6,000 and was debited for $12,500 of premiums paid during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future per

> On June 1, 20Y2, Monarch Co. received $9,000 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 20Y2.

> City Realty Co. pays weekly salaries of $34,500 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday.

> At the end of the current year, $6,750 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees.

> On June 1 of the current year, Chris Bates established a business to manage rental property. The following transactions were completed during June: a. Opened a business bank account with a deposit of $75,000 in exchange for common stock. b. Purchased off

> Erin Murdoch, an architect, organized Modern Architects on January 1, 20Y4. During the month, Modern Architects completed the following transactions: a. Issued common stock to Erin Murdoch in exchange for $50,000. b. Paid January rent for office and work