Question: Deep Valley Foods manufactures a product that

Deep Valley Foods manufactures a product that is first smoked and then packed for shipment to

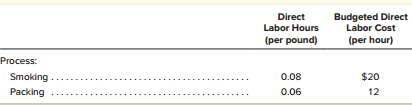

customers. During a normal month the product’s direct labor cost per pound is budgeted using the following information

The budget for March calls for the production of 500,000 pounds of product. However, March’s

Direct labor costs for smoking are expected to be 5 percent above normal due to anticipated scheduling inefficiencies. Yet direct labor costs in the packing room are expected to be 4 percent below normal because of changes in equipment layout. Prepare a budget for direct labor costs in March using three column headings: Total, Smoking, and Packing.

> Golf World sold merchandise to Mulligans for $10,000, offering terms of 1/15, n/30. Mulligans paid for the merchandise within the discount period. Both companies use perpetual inventory systems. a. Prepare journal entries in the accounting records of Go

> Explain the concept of complementary products and why this concept is important in incremental decisions about individual products.

> Olson manufactures and sells 5,000 gun cabinets each month. A principal component part in each cabinet is a lock mechanism to keep them secure. Olson’s plant currently has the monthly capacity to produce 8,000 lock mechanisms. The costs

> Walker Domestic manufactures and sells a single product. In preparing its master budget for the current quarter, the company’s controller has assembled the following information. Walker Domestic uses the average cost method to report i

> Refer to the section in Appendix A of this textbook entitled “Impairment of Long-Lived Assets.” Write a short paragraph regarding Home Depot’s policies for evaluating whether to close any of its stores. Identify the incremental, sunk, and opportunity cos

> Visit the Home Depot’s website and locate the “Corporate Information” link in the “About Us” section. From there, follow the “Corporate Responsibility” link to “The Home Depot Foundation.” Read about the company’s Team Depot initiative to learn how this

> A recent balance sheet of Save-A-Lot Supplies is provided as follows. Other information provided by the company is as follows. Compute and discuss briefly the significance of the following measures as they relate to Save-ALot Supplies. a. Net income p

> Gulf Breeze Corporation produces three products for water skiing enthusiasts: life vests, tow ropes, and water skis. Information relating to each product line is as follows. Gulf Breeze pays its direct labor workers an average of $10 per hour. At full

> Visionary Game Company sells 600,000 units per year of a particular video game at $20 each. The current unit cost of the game is broken down as follows. At the beginning of the current year, Visionary received a special order for 12,000 of these games

> Marzipan Corporation sells relays at a selling price of $28 per unit. The company’s cost per unit, Based on full capacity of 160,000 units, is as follows: Marzipan has been approached by a distributor in Montana offering to buy a spe

> Bimorphs Corporation produces three products in a monthly joint production process. During the first stage of the process liquids and chemicals costing $60,000 are heated and three different compounds emerge: 3,000 gallons of Molecule worth $22 per gallo

> Treadwell Pharmaceuticals produces two medications in a joint process: Amoxiphore and Denigrate. With each production run, Treadwell incurs $4,000 in common costs up to the split-off point.Amoxiphore can be sold for $2,700 at the split-off point or be pr

> Explain how the unit contribution margin can be used to determine the unit sales required to break even.

> Listed as follows are seven technical accounting terms introduced or emphasized in this chapter. Each of the following statements may (or may not) describe one of these terms. For each statement, indicate the accounting term or terms described, or answe

> Dinklemyer Corporation uses direct labor hours as its single cost driver. Actual overhead costs and actual direct labor hours for the first five months of the current year are as follows. a. Compute the company’s estimated variable man

> What is a flexible budget? Explain how a flexible budget increases the usefulness of budgeting as a means of evaluating performance.

> Home Run Corporation produces three products for baseball enthusiasts: bats, gloves, and balls. Information relating to each product line is as follows. Home Run pays its direct labor workers an average of $8 per hour. At full capacity, 60,000 direct la

> Shown are selected data from a recent annual report of CVS Health, a large drugstore chain. (Dollar amounts are in millions.) a. Compute for the year CVS Health’s return on average total assets. (Round computations to the nearest two-t

> Listed as follows are nine technical accounting terms introduced in this chapter. Each of the following statements may (or may not) describe one of these technical terms. For each statement, indicate the accounting term described, or answer â€

> TPS Incorporated is using activity-based cost information to determine whether it can save money by reassigning activities in its retail stores. The following information has been gathered for a typical store. In its activity analysis, TPS found that cl

> The three activities described as follows were part of the production process in November at Foundry & Bellows, Inc. Describe how each activity creates additional costs and whether it is value-added or non–value-added. If it is non–value-added, identify

> Charles Berkley is the managers of No gain Manufacturing and is interested in doing a cost of quality analysis. The following cost and revenue data are available for the most recent year ended December 31. a. Classify each of these costs into the four q

> Carts Corporation is trying to determine how long it takes for one product to pass through the production process. The following information was gathered regarding how many days the product spent in various production activities. a. Which of these acti

> Expo Lube is interested in producing and selling an industrial line of oil filters. Market research Indicates that wholesale customers are currently willing to pay $8 for similar filters, and that Expo Lube could sell 80,000 units per year at that price.

> You are the controller for Foxboro Technologies. Your staff has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the company’s balance sheet accounts. Addi

> Blake Furniture, Inc., maintains an Accounts Receivable Department that currently employs eight people. Blake is interested in doing an activity analysis because an outside firm has offered to take over a portion of the activities currently handled by th

> Dainty Diners, Inc., produces various types of bird feeders. The following is a detailed description of the steps involved in the production of wooden bird feeders. 1. Raw materials, such as wood, nails, and clear plastic are purchased. 2. The raw materi

> Assume you have just been hired as the management accountant in charge of providing your firm’s managers with product cost information. Identify the activities you might undertake for the following four value chain components. a. Research and development

> Briefly explain at least three ways in which a business may expect to benefit from preparing a formal budget.

> In the Home Depot financial statements in Appendix A at the end of this textbook, find Note 1 to the financial statements summarizing the company’s significant accounting policies. Read the section in Note 1 entitled “Merchandise Inventories.” a. How doe

> Vitamin Bits Co. produces three joint products from mint leaves. At the split-off point, three basic products emerge: B1, B3, and B15. Each of these products can be either sold at the split-off point or processed further. If they are processed further, t

> “When special orders are accepted that are below full product cost (variable cost plus fixed costs), companies run the risk of filling up their capacity with products that do not provide enough contribution to cover fixed costs such ascent and management

> Flip Flop’s To Go has gathered the following data on its quality costs for the past two years. a. Compute the percentage change in the total quality costs from year 1 to year 2. b. Explain what you think caused the change.

> Classify each of the following activities into one of the four cost of quality categories and/or identify it as a value-added or a non–value-added activity. a. Rework, due to poor materials, on bicycles at Trek. b. Inspection costs incurred by Wal-Mart o

> Pizza Pies Limited has the following value chain for its pizzas. Boxes are designed by Shula Designers Inc. and printed and delivered by Redoes Printing Co. for $0.95 per box. The pizzas are made in the stores with fresh ingredients and baked in the oven

> The following information is related to manufacturing office furniture at Outreach, Inc. a. Accept and arrange raw materials in inventory—1 day. b. Store raw materials in inventory—6 days. c. Issue raw materials to various points in the production proces

> As a fundraiser, the pep band at Melrose University sells T-shirts fans can wear when attending the school’s 12 home basketball games. As the band’s business manager, you must choose among several options for ordering and selling the T-shirts. 1. Place

> Dust Buster’s Inc. manufactures two types of small hand-operated vacuum cleaners. Dust Busters is concerned about quality issues and has compiled the following information for the past year associated with the two vacuums. Find the qua

> The following are eight technical accounting terms introduced or emphasized in this chapter. Each of the following statements may (or may not) describe one of these terms. For each statement, indicate the accounting term described, or answer â

> Comparative balance sheets report average total assets for the year of $2,575,000 and average total equity of $1,917,000 (dollar amounts in thousands, except earnings per share). a. Prepare an income statement for the year in a multiple-step format. b. C

> A condensed balance sheet for Bradford Corporation prepared at the end of the year appears as follows. During the year the company earned a gross profit of $1,116,000 on sales of $2,950,000. Accounts receivable, inventory, and plant assets remained almo

> a. Determine the amount of total liabilities reported in Coca-Cola’s balance sheet at the beginning of the year. b. Determine the amount of total owners’ equity reported in Coca-Cola’s balance sheet at the end of the year. c. Retained earnings was repo

> What important relationships are shown on a cost volume-profit (break-even) graph?

> Carnival Corporation & PLC is one of the world’s largest cruise line companies. Its printing costs for brochures are initially recorded as Prepaid Advertising and are later charged to Advertising Expense when they are mailed. Passenger deposits for upcom

> The Rockford Rollers, a professional roller derby team, prepares financial statements on a monthly basis. The roller derby season begins in February, but in January, the team engaged in the following transactions: 1. Paid $33,000 to the Sunbury Skating

> Springfield Company’s master budget includes estimated costs and expenses of $500,000 for its third quarter of operations. Of this amount, $300,000 is expected to be financed with current payables. Depreciation expense for the quarter is budgeted at $60,

> Selected financial data for Quick Sell, Inc., a retail store, appear as follows. a. Compute the following for both years: 1. Gross profit percentage. 2. Inventory turnover. 3. Accounts receivable turnover. b. Comment on favorable and unfavorable trends

> Lock Tight, Inc., produces outside doors for installation on homes. The following information was gathered to prepare budgets for the upcoming year beginning January 1. The manufacture of each door requires 20 pounds of steel and 6 square feet of glass.

> Naylor Manufacturing produces floor tiles. The managers at Naylor are trying to develop budgets for the upcoming quarter. The following data have been gathered for a particular tile design. a. Using this information, develop Naylor’s s

> The following information is from the manufacturing budget and the budgeted financial statements of Scheck Development Partners. Compute the budgeted amounts for a. Purchases of direct materials during the year. b. Cash payments during the year to suppl

> William George is the marketing manager at Crunchy Cookie Company. Each quarter, he is responsible for submitting a sales forecast to be used in the formulation of the company’s master budget. George consistently understates the sales forecast because, a

> Hills Hardware purchased new shelving for its store on April 1, 2021. The shelving is expected to have a 20-year life and no residual value. The following expenditures were associated with the purchase. Instructions: a. Compute depreciation expense for

> The cost accountant for Upload Games Company prepared the following monthly performance Report relating to the packaging department. Prepare a revised performance report in which the variances are computed by comparing the actual costs incurred with est

> Outdoor Outfitters has created a flexible budget for the 70,000-unit and the 80,000-unit levels of activity shown as follows. Complete Outdoor Outfitters’ flexible budget at the 90,000-unit level of activity. Assume that the cost of go

> Why is target costing most effectively applied at the research and development and production process design stage of the value chain?

> On March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company’s sales are made on account. The following information has been provided by Spicerâ

> Assume that you will soon graduate from college and that you have job offers with two pharmaceutical firms. The first offer is with Alpha Research, a relatively new and aggressive company. The second is with Omega Scientific, a very well established, mat

> Sales on account for the first two months of the current year are budgeted as follows. All sales are made on terms of 2/10, n/30 (2 percent discount if paid in 10 days, full amount by 30 days); collections on accounts receivable are typically made as fo

> Ramón’s Jewelers has accumulated the following budgeted overhead information (dollar amounts may include both fixed and variable costs). Use this information to create the overhead budget for 2,800 direct labor employee ho

> On February 1, Willmar Corporation borrowed $100,000 from its bank by signing a 12 percent, 15-year note payable. The note calls for 180 monthly payments of $1,200. Each payment includes an interest and a principal component. a. Compute the interest expe

> Messer Company purchased equipment for $24,000. The company is considering whether to determine annual depreciation using the straight-line method or the declining-balance method at 150 percent of the straight-line rate. Messer expects to use the equipme

> Twin-Cities, Inc., purchased a building for $600,000. Straight-line depreciation was used for each of the first two years using the following assumptions: 25-year estimated useful life, with a residual value of $100,000. a. Calculate the annual depreciat

> Amigos, Inc., purchased a used piece of heavy equipment for $30,000. Delivery of the equipment to Amigos’ business site cost $750. Expenditures to recondition the equipment and prepare it for use totaled $2,230. The maintenance for the first year Amigos

> Swanson & Hiller, Inc., purchased a new machine on September 1 of the current year at a cost of $108,000. The machine’s estimated useful life at the time of the purchase was five years, and its residual value was $8,000. The company reports on a calendar

> M. C. Jones purchased a truck for $30,500 to be used in his business. He is considering depreciating the truck by two methods: units-of-output (assuming total miles to be driven of 80,000) and double-declining-balance (assuming a 5-year useful life). The

> Miller Mining acquired rights to a tract of land with the intent of extracting from the land a valuable mineral. The cost of the rights was $2,500,000 and an estimated 10,000 tons of the mineral are expected to be extracted. Assuming that 1,600 tons of t

> Taylor Company purchased equipment for $27,500. It depreciated the equipment over a 5-year life by the double-declining-balance method until the end of the second year, at which time the asset was sold for $8,300. Calculate the gain or loss on the sale a

> Frequently, the disadvantages of budgeting are not discussed in textbooks. Go to the website www.strategiccontrol.24xls.com/en211. What dysfunctional aspects of budgeting are highlighted by the authors?

> Define (a) contribution margin, (b) contribution margin ratio, and (c) average contribution margin ratio.

> Should depreciation continue to be recorded on a building when ample evidence exists that the current market value is greater than original cost and that the rising trend of market Values are continuing? Explain.

> Alexander Company purchased a piece of equipment for $14,000 and depreciated it for three years over a 5-year estimated life with an expected residual value at the end of 5 years of $2,000. At the end of the third year, Alexander decided to upgrade to eq

> Fin, Inc., purchased a truck for $40,000. The truck is expected to be driven 15,000 miles per year over a 5-year period and then sold for approximately $5,000. Determine depreciation for the first year of the truck’s useful life by the straight-line and

> Equipment costing $86,000 was purchased by Spence, Inc., at the beginning of the current year. The company will depreciate the equipment by the declining-balance method, but it has not determined whether the rate will be at 150 percent or 200 percent of

> The following expenditures were incurred in connection with a new machine acquired by a metals manufacturing company. Identify those that should be included in the cost of the asset. (a) Freight charges, (b) sales tax on the machine, (c) payment to a pas

> Identify the basic “accountable events” in the life of a depreciable plant asset. Which of these events directly affect the net income of the current period? Which directly affect cash flows (other than income tax payments)?

> Notes to the financial statements of two clothing manufacturers follow: Inventories: The inventories are stated at the lower of cost, determined principally by the LIFO method, or market. Inventories: Inventories are stated at the lower of cost (first-in

> Coca-Cola’s distinctive trademark is more valuable to the company than its bottling plants. But the company’s bottling plants are listed in the balance sheet, and the famous Trademark is not. Explain

> Explain two approaches to computing depreciation for fractional period in the year in which an asset is purchased.(Neither of your approaches should require the computation of depreciation to the nearest day or week.)

> Dorsal Ranch raises fish for sale in the restaurant industry. The company can obtain batches of two million eggs from its supplier. Management is trying to decide whether to raise cod or salmon. Cod eggs cost $14,000 per batch, while salmon eggs cost $18

> Evaluate the following quotation: “We shall have no difficulty in paying for new plant assets needed during the coming year because our estimated outlays for new equipment amount to only $80,000, and we have more than twice that amount in our Accumulated

> One accelerated depreciation method is called fixed percentage-of-declining-balance. Explain what is meant by the terms fixed-percentage and declining-balance. For what purpose is this method most widely used?

> Assume you are the manager of the finished goods warehouse of a stereo manufacturer. What costs are being incurred as stereos are stored while awaiting shipment to retail stores?

> Explain what is meant by an accelerated depreciation method. Are accelerated methods more widely used in financial statements or in income tax returns? Explain.

> Should depreciation continue to be recorded on a building when ample evidence exists that the current market value is greater than original cost and that the rising trend of market values is continuing? Explain.

> Shoppers’ Market purchased a site on which it planned to build a new store for $265,000. The site consisted of three acres of land and included an old house and two barns. County property tax records showed the following appraised values for this propert

> If a capital expenditure is erroneously treated as revenue expenditure, will the net income of the current year be overstated or understated? Will this error have any effect on the net income reported in future years? Explain.

> What is the distinction between a capital expenditure and a revenue expenditure?

> Hamlet College recently purchased new computing equipment for its library. The following information refers to the purchase and installation of this equipment. 1. The list price of the equipment was $285,000; however, Hamlet College qualified for an “edu

> A friend offers you a ticket to a Chicago Cubs baseball game for $40. You know you can sell the ticket to another friend for $50. What is the opportunity cost of buying the ticket but thenchoosingto go to the game?

> Selected information taken from the financial statements of Wiley Company for two successive years follows. Compute the percentage change from year 1 to year 2 whenever possible. Round all calculations to the nearest whole percentage.

> It’s Alarming! produces alarm systems for cars and trucks. The company is trying to decide whether to outsource its Installation Department to A-One Technicians for $50 per installation. Although the company estimates that its current costs are only $40

> Vermont Treats makes blueberry jam and blueberry syrup. Both products come out of a joint process costing $60,000 per year. The sales value of the blueberry jam is $20,000 per year. The sales value of the blueberry syrup is $80,000 per year. Use the rela

> Yi Corporation produces a large number of fishing products. The costs per unit of a particular fishing reel are as follows. The company recently decided to buy 8,000 fishing reels from another manufacturer for $28 per unit because “it

> A company regularly sells 100,000 washing machines at an average price of $250. The average cost of producing these machines is $180. Under what circumstances might the company accept especial order for 20,000 washing machines at $175 per machine?

> Explain how the high-low method determines a. The variable portion of a semi variable cost. b. The fixed portion of a semi variable cost.

> Vickery Machining Company is nearly finished constructing a specially designed piece of machining equipment when the customer declares bankruptcy and cannot pay for the equipment. Vickeryestimates that the cost associated with making the uncompleted equi

> A variety of products—chicken wings, drumsticks, thighs, and so on—are the result of a joint production process of butchering a chicken that costs $0.25 per pound. The wings can be sold at the split-off point for $0.35 per pound, or they can be processed

> Match the following decisions in column 1 (a through e) to all relevant costs or revenue in column 2 (1 through 5):

> A local gym has 20 stationary bicycles that are available for classes a combined total of 840 hours per week. The bicycles are used in two different exercise programs. A cycling class lasts one hour and earns a contribution margin of $18 per customer. A

> During the current year, Rothschild, Inc., purchased two assets that are described as follows. Rothschild depreciates heavy equipment by the declining-balance method at 150 percent of the straight-line rate. It amortizes intangible assets by the straigh