Question: Despite being a publicly traded company only

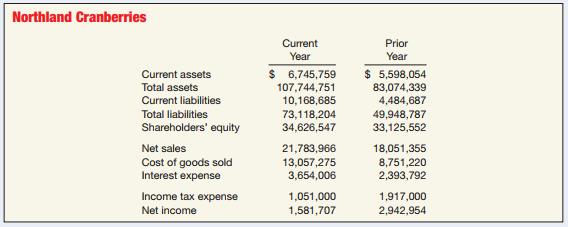

Despite being a publicly traded company only since 1987, Northland Cranberries of Wisconsin Rapids, Wisconsin, is one of the world’s largest cranberry growers. During its short life as a publicly traded corporation, it has engaged in an aggressive growth strategy. As a consequence, the company has taken on significant amounts of both short-term and long-term debt. The following information is taken from recent annual reports of the company

Instructions

(a) Evaluate the company’s liquidity by calculating and analyzing working capital and the current ratio.

(b) The discussion of the company’s liquidity, shown on page 770, was provided by the company in the Management Discussion and Analysis section of the company’s annual report. Comment on whether you agree with management’s statements, and what might be done to remedy the situation.

The lower comparative current ratio in the current year was due to $3 million of short-term borrowing then outstanding which was incurred to fund the Yellow River Marsh acquisitions last year. As a result of the extreme seasonality of its business, the company does not believe that its current ratio or its underlying stated working capital at the current, fiscal year-end is a meaningful indication of the Company’s liquidity. As of March 31 of each fiscal year, the Company has historically carried no significant amounts of inventories and by such date all of the Company’s accounts receivable from its crop sold for processing under the supply agreements have been paid in cash, with the resulting cash received from such payments used to reduce indebtedness. The Company utilizes its revolving bank credit facility, together with cash generated from operations, to fund its working capital requirements throughout its growing season.

Transcribed Image Text:

Northland Cranberries Current Prior Year Year $ 6,745,759 $ 5,598,054 83,074,339 4,484,687 Current assets Total assets 107,744,751 10,168,685 Current liabilities Total liabilities 73,118,204 34,626,547 49,948,787 33,125,552 Shareholders' equity Net sales 21,783,966 18,051,355 Cost of goods sold Interest expense 13,057,275 3,654,006 8,751,220 2,393,792 1,051,000 1,581,707 Income tax expense 1,917,000 Net income 2,942,954

> Explain how a non-consolidated subsidiary can be a form of off-balance-sheet financing.

> Alvarado Company sells a machine for $7,400 under a 12-month warranty agreement that requires the company to replace all defective parts and to provide the repair labor at no cost to the customers. With sales being made evenly throughout the year, the co

> How is present value related to the concept of a liability?

> Presented below is a note disclosure for Matsui Corporation. Litigation and Environmental: The Company has been notified, or is a named or a potentially responsible party in a number of governmental (federal, state and local) and private actions associat

> Dos Passos Company sells televisions at an average price of $900 and also offers to each customer a separate 3-year warranty contract for $90 that requires the company to perform periodic services and to replace defective parts. During 2012, the company

> Assume the facts in E13-5, except that Matthewson Company has chosen not to accrue paid sick leave until used, and has chosen to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to a

> Sport Pro Magazine sold 12,000 annual subscriptions on August 1, 2012, for $18 each. Prepare Sport Pro’s August 1, 2012, journal entry and the December 31, 2012, annual adjusting entry.

> On February 1, 2013, one of the huge storage tanks of Viking Manufacturing Company exploded. Windows in houses and other buildings within a one-mile radius of the explosion were severely damaged, and a number of people were injured. As of February 15, 20

> Brooks Corporation sells computers under a 2-year warranty contract that requires the corporation to replace defective parts and to provide the necessary repair labor. During 2012, the corporation sells for cash 400 computers at a unit price of $2,500. O

> Matthewson Company began operations on January 2, 2012. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year fo

> At December 31, 2012, Burr Corporation owes $500,000 on a note payable due February 15, 2013. (a) If Burr refinances the obligation by issuing a long-term note on February 14 and using the proceeds to pay off the note due February 15, how much of the $50

> Describe the accounting entry for a stock dividend, if any. Describe the accounting entry for a stock split, if any.

> A company proposes to include in its SEC registration statement a balance sheet showing its subordinate debt as a portion of stockholders’ equity. Will the SEC allow this? Why or why not?

> Andretti Inc. issued $10,000,000 of short-term commercial paper during the year 2012 to finance construction of a plant. At December 31, 2012, the corporation’s yearend, Andretti intends to refinance the commercial paper by issuing long-term debt. Howeve

> Under what conditions must an employer accrue a liability for employees’ compensation for future absences?

> Under what conditions should a provision be recorded?

> Below is a payroll sheet for Otis Import Company for the month of September 2012. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal

> On December 31, 2012, Santana Company has $7,000,000 of short-term debt in the form of notes payable to Golden State Bank due in 2013. On January 28, 2013, Santana enters into a refinancing agreement with Golden that will permit it to borrow up to 60% of

> Takemoto Corporation borrowed $60,000 on November 1, 2012, by signing a $61,350, 3-month, zero-interest-bearing note. Prepare Takemoto’s November 1, 2012, entry; the December 31, 2012, annual adjusting entry; and the February 1, 2013, entry.

> Describe how a company would classify debt that includes covenants. What conditions must exist in order to depart from the normal rule?

> Dumars Corporation reports in the current liability section of its balance sheet at December 31, 2012 (its year-end), short-term obligations of $15,000,000, which includes the current portion of 12% long-term debt in the amount of $10,000,000 (matures in

> Define a provision, and give three examples of a provision.

> Distinguish among: cash dividends, property dividends, liquidating dividends, and stock dividends.

> An important consideration in evaluating current liabilities is a company’s operating cycle. The operating cycle is the average time required to go from cash to cash in generating revenue. To determine the length of the operating cycle,

> What are three examples of estimates that are used in accounting that are not contingencies? Can you explain why they are not considered contingencies?

> Cedarville Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August. Because August is their vacation period, vacation pay is also listed. Assume that the federal income tax withheld is 10%

> On December 31, 2012, Alexander Company had $1,200,000 of short-term debt in the form of notes payable due February 2, 2013. On January 21, 2013, the company issued 25,000 shares of its common stock for $36 per share, receiving $900,000 proceeds after br

> Assume that your friend Will Morris, who is a music major, asks you to define and discuss the nature of a liability. Assist him by preparing a definition of a liability and by explaining to him what you believe are the elements or factors inherent in the

> Upland Company borrowed $40,000 on November 1, 2012, by signing a $40,000, 9%, 3-month note. Prepare Upland’s November 1, 2012, entry; the December 31, 2012, annual adjusting entry; and the February 1, 2013, entry.

> What guidance does the Codification provide on the disclosure of long-term obligations?

> What evidence is necessary to demonstrate the ability to defer settlement of short-term debt?

> Presented below is the current liabilities section and related note of Mohican Company Notes to Consolidated Financial Statements Note 1 (in part): Summary of Significant Accounting Policies and Related Data Accrued Warranty The company provides an acc

> Rodriguez Corporation includes the following items in its liabilities at December 31, 2012. 1. Notes payable, $25,000,000, due June 30, 2013. 2. Deposits from customers on equipment ordered by them from Rodriguez, $6,250,000. 3. Salaries payable, $3,750,

> What disclosures are required relative to long-term debt and sinking fund requirements?

> What must an entity disclose about its asset retirement obligations?

> Listed below are selected transactions of Schultz Department Store for the current year ending December 31. 1. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage product

> The following are selected 2012 transactions of Darby Corporation. Sept. 1 Purchased inventory from Orion Company on account for $50,000. Darby records purchases gross and uses a periodic inventory system. Oct. 1 Issued a $50,000, 12-month, 8% note to Or

> Distinguish between a current liability and a long-term debt.

> Access the glossary (Master Glossary) to answer the following. (a) What does the term “callable obligation” mean? (b) What is an imputed interest rate? (c) What is a long-term obligation? (d) What is the definition of “effective interest rate”?

> Presented below is the current liabilities section of Micro Corporation. Instructions Answer the following questions. (a) What are the essential characteristics that make an item a liability? (b) How does one distinguish between a current liability and

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) How much working capital do each of these companies have at the end of 2009? (b) Compute both comp

> The financial statements of P&G are presented in Appendix 5B or can be accessed at the book’s companion website, www.wiley.com/college/kieso. Instructions Refer to these financial statements and the accompanying notes to answer the following questions.

> Access the glossary (“Master Glossary”) to answer the following. (a) What is an asset retirement obligation? (b) What is the definition of “current liabilities”? (c) What does it mean if something is “reasonably possible”? (d) What is a warranty?

> Under what conditions should a short-term obligation be excluded from current liabilities?

> What are the principal considerations of a board of directors in making decisions involving dividend declarations? Discuss briefly.

> The following information is taken from the 2012 annual report of Bugant, Inc. Bugant’s fiscal year ends December 31 of each year. Bugant’s December 31, 2012, balance sheet is as follows. Bugant, Inc. Balance Sheet December 31, 2012 Assets Cash ………………………

> In this simulation, you are asked to address questions related to the accounting for current liabilities. Prepare responses to all parts. • KwW_Professional_Simulation Current Time Remaining O hour 20 minutes Liabilities Unspit Spk Hortz Spit Vertic

> Pleasant Co. manufactures specialty bike accessories. The company is known for product quality, and it has offered one of the best warranties in the industry on its higher-priced products—a lifetime guarantee, performing all the warranty work in its own

> YellowCard Company manufactures accessories for iPods. It had the following selected transactions during 2012. 1. YellowCard provides a 2-year warranty on its docking stations, which it began selling in 2012. During 2012, YellowCard spent $6,000 servicin

> Described below are certain transactions of Edwardson Corporation. The company uses the periodic inventory system. 1. On February 2, the corporation purchased goods from Martin Company for $70,000 subject to cash discount terms of 2/10, n/30. Purchases a

> How would each of the following items be reported on the balance sheet? (a) Accrued vacation pay. (b) Estimated taxes payable. (c) Service warranties on appliance sales. (d) Bank overdraft. (e) Personal injury claim pending. Be paid from current assets.

> Go to the book’s companion website and use information found there to answer the following questions related to The Coca-Cola Company and PepsiCo, Inc. (a) What is the par or stated value of Coca-Cola’s and PepsiCo’s common or capital stock? (b) What per

> The financial statements of P&G are presented in Appendix 5B or can be accessed at the book’s companion website, www.wiley.com/college/kieso. Instructions Refer to these financial statements and the accompanying notes to answer the following questions.

> Lois Kenseth, president of Sycamore Corporation, is concerned about several large stockholders who have been very vocal lately in their criticisms of her leadership. She thinks they might mount a campaign to have her removed as the corporation’s CEO. She

> Mask Company has 30,000 shares of $10 par value common stock authorized and 20,000 shares issued and outstanding. On August 15, 2012, Mask purchased 1,000 shares of treasury stock for $18 per share. Mask uses the cost method to account for treasury stock

> What is the “call” feature of a bond issue? How does the call feature affect the amortization of bond premium or discount?

> Kulikowski Inc., a client, is considering the authorization of a 10% common stock dividend to common stockholders. The financial vice president of Kulikowski wishes to discuss the accounting implications of such an authorization with you before the next

> The directors of Merchant Corporation are considering the issuance of a stock dividend. They have asked you to discuss the proposed action by answering the following questions. Instructions (a) What is a stock dividend? How is a stock dividend distingui

> Statements of Financial Accounting Concepts set forth financial accounting and reporting objectives and fundamentals that will be used by the Financial Accounting Standards Board in developing standards. Concepts Statement No. 6 defines various elements

> Penn Company was formed on July 1, 2010. It was authorized to issue 300,000 shares of $10 par value common stock and 100,000 shares of 8% $25 par value, cumulative and nonparticipating preferred stock. Penn Company has a July 1–June 30

> Earnhart Corporation has outstanding 3,000,000 shares of common stock of a par value of $10 each. The balance in its Retained Earnings account at January 1, 2012, was $24,000,000, and it then had Paid-in Capital in Excess of Par—Common Stock of $5,000,00

> Oregon Inc. $10 par common stock is selling for $110 per share. Four million shares are currently issued and outstanding. The board of directors wishes to stimulate interest in Oregon common stock before a forthcoming stock issue but does not wish to dis

> The following is a summary of all relevant transactions of Vicario Corporation since it was organized in 2012. In 2012, 15,000 shares were authorized and 7,000 shares of common stock ($50 par value) were issued at a price of $57. In 2013, 1,000 shares we

> Myers Company provides you with the following condensed balance sheet information. Instructions For each transaction below, indicate the dollar impact (if any) on the following five items: (1) Total assets, (2) Common stock, (3) Paid-in capital in exce

> The books of Conchita Corporation carried the following account balances as of December 31, 2012. Cash …………………………………………………………………………………………………… $ 195,000 Preferred Stock (6% cumulative, nonparticipating, $50 par) ……………………… 300,000 Common Stock (no-par valu

> Washington Company has the following stockholders’ equity accounts at December 31, 2012. Common Stock ($100 par value, authorized 8,000 shares) ………… $480,000 Retained Earnings ……………………………………………………………………… 294,000 Instructions (a) Prepare entries in journ

> Briggs and Stratton recently reported unamortized debt issue costs of $5.1 million. How should the costs of issuing these bonds be accounted for and classified in the financial statements?

> Before Gordon Corporation engages in the treasury stock transactions listed below, its general ledger reflects, among others, the following account balances (par value of its stock is $30 per share). Instructions Record the treasury stock transactions

> Seles Corporation’s charter authorized issuance of 100,000 shares of $10 par value common stock and 50,000 shares of $50 preferred stock. The following transactions involving the issuance of shares of stock were completed. Each transaction is independent

> Hatch Company has two classes of capital stock outstanding: 8%, $20 par preferred and $5 par common. At December 31, 2012, the following accounts were included in stockholders’ equity. Preferred Stock, 150,000 shares …………………………………….. $ 3,000,000 Common S

> Clemson Company had the following stockholders’ equity as of January 1, 2012. Common stock, $5 par value, 20,000 shares issued …………………….. $100,000 Paid-in capital in excess of par—common stock …………………………….. 300,000 Retained earnings ………………………………………………………

> On January 5, 2012, Phelps Corporation received a charter granting the right to issue 5,000 shares of $100 par value, 8% cumulative and nonparticipating preferred stock, and 50,000 shares of $10 par value common stock. It then completed these transaction

> Hagar Company has outstanding 2,500 shares of $100 par, 6% preferred stock and 15,000 shares of $10 par value common. The schedule below shows the amount of dividends paid out over the last 4 years. Instructions Allocate the dividends to each type of st

> Martinez Company’s ledger shows the following balances on December 31, 2012. Preferred Stock (5%; $10 par value, outstanding 20,000 shares) ………….. $ 200,000 Common Stock ($100 par value, outstanding 30,000 shares) ………………. 3,000,000 Retained Earnings …………

> The outstanding capital stock of Pennington Corporation consists of 2,000 shares of $100 par value, 6% preferred, and 5,000 shares of $50 par value common. Instructions Assuming that the company has retained earnings of $70,000, all of which is to be pa

> Presented below is information from the annual report of Potter Plastics, Inc. Operating income ……………………………… $ 532,150 Bond interest expense ………………………….. 135,000 …………………………………………………………… 397,150 Income taxes ………………………………………. 183,432 Net income ……………………………

> Shown below is the liabilities and stockholders’ equity section of the balance sheet for Ingalls Company and Wilder Company. Each has assets totaling $4,200,000. For the year, each company has earned the same income before interest an

> What are the considerations in imputing an appropriate interest rate?

> Elizabeth Company reported the following amounts in the stockholders’ equity section of its December 31, 2012, balance sheet. Preferred stock, 8%, $100 par (10,000 shares authorized, 2,000 shares issued) ……. $200,000 Common stock, $5 par (100,000 shares

> Teller Corporation’s post-closing trial balance at December 31, 2012, was as follows. At December 31, 2012, Teller had the following number of common and preferred shares. The dividends on preferred stock are $4 cumulative. In addit

> The following information has been taken from the ledger accounts of Sampras Corporation. Total income since incorporation ……………………………………. $287,000 Total cash dividends paid …………………………………………………… 60,000 Total value of stock dividends distributed ………………………

> The following data were taken from the balance sheet accounts of Wickham Corporation on December 31, 2012. Current assets …………………………………………………………….. $540,000 Debt investments ………………………………………………………….. 624,000 Common stock (par value $10) ………………………………………. 6

> The stockholders’ equity accounts of Lawrence Company have the following balances on December 31, 2012. Common stock, $10 par, 200,000 shares issued and outstanding ……………. $2,000,000 Paid-in capital in excess of par—common stock ………………………………………… 1,200,00

> The common stock of Warner Inc. is currently selling at $110 per share. The directors wish to reduce the share price and increase share volume prior to a new issue. The per share par value is $10; book value is $70 per share. Five million shares are issu

> Addison Corporation has 10 million shares of common stock issued and outstanding. On June 1, the board of directors voted a 60 cents per share cash dividend to stockholders of record as of June 14, payable June 30. Instructions (a) Prepare the journal e

> The following are selected transactions that may affect stockholders’ equity. 1. Recorded accrued interest earned on a note receivable. 2. Declared and distributed a stock split. 3. Declared a cash dividend. 4. Recorded a retained earni

> For a recent 2-year period, the balance sheet of Franklin Company showed the following stockholders’ equity data at December 31 in millions. Instructions (a) Answer the following questions. (1) What is the par value of the common stoc

> Davison Inc. recently hired a new accountant with extensive experience in accounting for partnerships. Because of the pressure of the new job, the accountant was unable to review what he had learned earlier about corporation accounting. During the first

> When is the stated interest rate of a debt instrument presumed to be fair?

> Weisberg Corporation has 10,000 shares of $100 par value, 6% preferred stock and 50,000 shares of $10 par value common stock outstanding at December 31, 2012. Instructions Answer the questions in each of the following independent situations. (a) If the

> Sanborn Company has outstanding 40,000 shares of $5 par common stock which had been issued at $30 per share. Sanborn then entered into the following transactions. 1. Purchased 5,000 treasury shares at $45 per share. 2. Resold 500 of the treasury shares a

> Loxley Corporation is authorized to issue 50,000 shares of $10 par value common stock. During 2012, Loxley took part in the following selected transactions. 1. Issued 5,000 shares of stock at $45 per share, less costs related to the issuance of the stock

> Hartman Inc. issues 500 shares of $10 par value common stock and 100 shares of $100 par value preferred stock for a lump sum of $100,000. Instructions (a) Prepare the journal entry for the issuance when the market price of the common shares is $168 each

> Fogelberg Corporation is a regional company which is an SEC registrant. The corporation’s securities are thinly traded on NASDAQ (National Association of Securities Dealers Quotes). Fogelberg has issued 10,000 units. Each unit consists of a $500 par, 12%

> Twenty-five thousand shares reacquired by Pierce Corporation for $48 per share were exchanged for undeveloped land that has an appraised value of $1,700,000. At the time of the exchange, the common stock was trading at $60 per share on an organized excha

> Abernathy Corporation was organized on January 1, 2012. It is authorized to issue 10,000 shares of 8%, $50 par value preferred stock, and 500,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were com

> During its first year of operations, Sitwell Corporation had the following transactions pertaining to its common stock. Jan. 10 Issued 80,000 shares for cash at $6 per share. Mar. 1 Issued 5,000 shares to attorneys in payment of a bill for $35,000 for se

> Nottebart Corporation has outstanding 10,000 shares of $100 par value, 6% preferred stock and 60,000 shares of $10 par value common stock. The preferred stock was issued in January 2012, and no dividends were declared in 2012 or 2013. In 2014, Nottebart

> Use the information from BE15-13, but assume Green Day Corporation declared a 100% stock dividend rather than a 5% stock dividend. Prepare the journal entries for both the date of declaration and the date of distribution. In BE15-13 Green Day Corporatio

> How should discount on bonds payable be reported on the financial statements? Premium on bonds payable?