Question: Do It Right, Inc.’s actuary provided

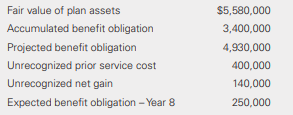

Do It Right, Inc.’s actuary provided the company with the following information regarding its defined benefit pension plan for the year ended December 31, Year 7:

The company reported net periodic pension cost of $310,000 on its income statement and made a $500,000 contribution to the pension plan during Year 7. The company’s effective tax rate is 40%. What amount should Do It Right report in accumulated other comprehensive income related to its pension plan on its December 31, Year 7, balance sheet?

a. $156,000

b. $400,000

c. $260,000

d. $240,000

> On January 1, Douglas Stores, Incorporated acquired 30% of Kirk Shoe Company. Douglas is acquiring the affiliate to secure a reliable source of supply. Douglas acquired 195,000 shares of the 650,000 shares of the investee company at a cost of $2,540,000.

> On January 1, 2018, Mesa Machinery Corporation issued 75 of 12-year, 12% convertible bonds at par. Each bond had a par value of $1,000 and pays interest annually on December 31. Because the bonds were issued at par, the yield on the bond is also equal to

> Using the information provided in P14-9, complete the following requirements assuming that Super View Video is an IFRS reporter. Required: a. Prepare the journal entry to record the bond issue. b. Prepare the amortization table. c. Prepare the journal e

> On January 1, 2017, Antonia Lee Stores, Inc., borrowed $700,000 and immediately received the full amount. The note carried a 7% interest rate and requires annual payments of $146,857 beginning on December 31, 2017. The note matures on December 31, 2022.

> Jackson Corporation employs 45 production workers and pays them all the same salary. Jackson employs 10 administrative staff personnel and pays them all the same salary. The following annual information is available for each employee group. Required:

> Packard Products manufactures wireless routers for home use. The company reported total sales on account of $11,200,000 during the current year. The cost of the merchandise sold was $5,000,000. Packard offers an assurance-type warranty that covers all re

> Using the information from P13-5, assume that Exwella Pharmaceuticals, Inc., reports under IFRS. Required: a. Explain how each lawsuit is accounted for under IFRS. Prepare any journal entries required. Under IFRS, Exwella has a contingent liability of

> Exwella Pharmaceuticals, Inc. is involved in various lawsuits regarding product liability, commercial liability, and other matters that arise from time to time in the ordinary course of business. The lawsuits pending at the beginning of the year and thos

> On January 1 of the current year, ListenUp Telecommunication invested idle cash of $12,500,000 in transmission towers and $9,000,000 in poles and lines to improve service to its customers. ListenUp is responsible for dismantling and removing the towers,

> Dott Manufacturing retired its $6,000,000 par value, 7%, 10-year bonds early on February 28, 2018, for $6,720,408, including accrued interest of $70,000. The carrying value of the bonds at retirement was $6,330,956. What is the gain or loss on early reti

> On January 1 of the current year, Wright Oil invested $7,500,000 to construct an offshore oil platform and paid cash. As part of its offshore drilling agreement, Wright is responsible for dismantling and removing the platform at the end of its 15-year us

> Smart Cookie Corporation purchased 40% of the 320,000 outstanding shares of JT’s Fine Foods, Inc. on January 1 of the current year. Smart Cookie acquired the shares at a price of $3.20 per share. JT’s Fine Foods, Inc. reported net income of $64,000 and d

> Sukulo Stores, Inc. completed the following transactions during the current year, the company’s first year of operations. Sukulo Stores has a December 31 year-end. 1. September 2: Purchased $65,000 of merchandise inventory from Texrex Company using a tr

> James Stores, Inc. completed the following transactions during the current year, the company’s first year of operations. James Stores has a December 31 year-end. 1. January 16: Purchased $546,000 of merchandise inventory from various suppliers on accoun

> The Taurus Group sold a piece of equipment on December 30 of the current year for $250,000 when the equipment’s carrying value was $290,000. Three years ago, the equipment had been revalued to $500,000. At the time of the revaluation, Taurus eliminated a

> Essex Plc. is revaluing equipment with a carrying value of £715,000 to its fair value of £673,000. The original cost of the equipment was £1,000,000. The equipment has a 10-year useful life and scrap value of £50,000. Essex uses straight-line depreciatio

> Hampton Plc. revalues equipment with a carrying value of £715,000 to its fair value of £750,000. The original cost of the equipment was £1,000,000. Hampton uses straight-line depreciation. The equipment has a 10-year useful life and scrap value of £50,00

> Use the same information from P12-5 and the following additional information, now assuming that Green River Company is an IFRS reporter. The following are estimates of current fair values less costs to sell: Required: a. Compute the amount of goodwill t

> On December 31, Year 1, Brown Brothers purchased machine A for $770,000 and machine B for $300,000. The machines are depreciated on the straight-line basis over 10 years with no salvage value. Brown reviews its assets for impairment annually. While doing

> Sumrall Corporation owns machinery that was purchased 20 years ago. The machinery, which originally cost $2,000,000, has been depreciated using the straight-line method using a 40-year useful life and no salvage value and has a current carrying amount of

> Which of the following supplemental disclosures to the statement of cash flows is not required when the indirect method is used? a. Income taxes paid b. Reconciliation of net income to net cash provided by operating activities c. Interest paid d. Non

> On January 1, Todd Manufacturing issued $4,500,000 par value 8%, 5-year bonds (i.e., there were 4,500 of $1,000 par value bonds in the issue). Interest is payable semiannually each January 1 and July 1 with the first interest payment due at the end of th

> On January 1, Chloe Mikenzie Incorporated acquired 32% of the outstanding voting shares of Mannin Company at a cost of $2,196,000 by acquiring 72,000 of the company’s total 225,000 outstanding shares at a cost of $30.50 per share. During the year, Mannin

> During Year 1, Brianna Company had the following transactions related to its financing operations: On its Year 1 statement of cash flows, net cash used in financing activities should be: a. $717,000 b. $716,000 c. $597,000 d. $535,000

> Sykes Corporation’s comparative balance sheets at December 31, Year 2 and Year 1, reported accumulated depreciation balances of $800,000 and $600,000, respectively. Property acquired at a cost of $50,000 and a carrying amount of $40,000 was the only prop

> The Year 11 balance sheet of Cool Tools, Inc. reported the following fixed asset balances: On January 1, Year 11, Cool Tools purchased fixed assets for $50,000 and sold fixed assets with an original cost of $18,000 and a book value of $6,000 for $10,000.

> Which of the following items would not be included in the operating activities section of an entity’s statement of cash flows under U.S. GAAP? a. Interest received b. Proceeds from the sale of trading securities c. Dividends paid d. Income taxes paid

> Big Dollars Corporation’s comparative financial statements included the following amounts for the current year: On its current year statement of cash flows, what is Big Dollars’ net cash provided by operating activitie

> In its year-end income statement, Black Knights Company reports cost of goods sold of $450,000. Changes occurred in several balance sheet accounts during the year as follows: What amount should the Black Knights Company report as cash paid to suppliers i

> Oscar Company is preparing its financial statements for the current year. Which of the following statements is/are correct? I. A main difference between the income statement and the statement of cash flows is that the income statement is based on the ac

> Gonzales Company purchased a machine on January 1, Year 1, for $600,000. On the date of acquisition, the machine had an estimated useful life of 6 years with no salvage value. The machine was being depreciated on a straight-line basis. On January 1, Year

> On August 31 of the current year, Harvey Co. decided to change from the FIFO periodic inventory system to the weighted-average periodic inventory system. Harvey uses IFRS and is on a calendar-year basis. The cumulative effect of the change is shown as an

> On August 31 of the current year, Harvey Co. decided to change from the FIFO periodic inventory system to the weighted-average periodic inventory system. Harvey uses U.S. GAAP, is on a calendar-year basis, and does not present comparative financial state

> IFRS. Repeat E16-10 assuming that Tekky is an IFRS reporter. Tekky accounts for the investment as a fair value through other comprehensive income investment because the corporation does not intend to trade it nor is holding it as contingent consideration

> Using the information provided in BE14-1, prepare the journal entry required to record Scudder’s full payment of the note at maturity. Data from BE14-1: Scudder Products, Inc. borrowed $600,000 by issuing a 6-month note on September 1 of the current fis

> The proper accounting treatment to account for a change in inventory valuation from FIFO to LIFO under U.S. GAAP is: a. Prospective application b. Retrospective application c. Retroactive approach d. Ignored

> On December 31, Year 10, Brown Company changed its inventory valuation method from the weighted average method to FIFO for financial statement purposes. The change will result in an $800,000 decrease in the beginning inventory at January 1, Year 10. The

> In determining earnings per share, interest expense net of applicable income taxes on convertible debt that is dilutive should be: a. Added back to net income for diluted earnings per share and ignored for basic earnings per share. b. Added back to net

> Refer to the information about Hutchins Company in MC20-1. Diluted earnings per share for the current year was (rounded to the nearest penny): a. $5.00 b. $3.35 c. $3.53 d. $3.06

> Anson Company had 8,000,000 shares of common stock outstanding on December 31, Year 11. Anson issued an additional 1,200,000 shares of common stock on April 1, Year 12, and 1,000,000 more on July 1, Year 12. On October 1, Year 12, Anson issued 50,000 of

> Alvarado Company had the following common stock balances and transactions during the current year: What was the number of Alvarado’s current-year weighted-average shares outstanding for basic EPS? a. 78,000 b. 73,250 c. 72,500 d. 71

> Burken Co. has one class of common stock outstanding and no other securities that are potentially convertible into common stock. During Year 10, 100,000 shares of common stock were outstanding. In Year 11, two distributions of additional common shares oc

> Hutchins Company had 200,000 shares of common stock, 50,000 shares of convertible preferred stock, and $2,000,000 of 10% convertible bonds outstanding during the entire year. The preferred stock was convertible into 40,000 shares of common stock. During

> The following information applies to Babydoll Company’s defined benefit pension plan at December 31, Year 8: The company’s employees have an average remaining service life of 10 years. The company has no unrecognized

> Tekky Corporation purchased an equity investment in Hui Zu, Ltd. on December 15 for $100,000. Tekky accounts for the equity investment by using market comparables. Hui Zu, Ltd.’s equity is not actively traded, and it does not have a readily determinable

> The following information relates to the pension plan for the employees of Neal Co.: Neal estimates that the average remaining service life is 16 years. Neal’s contribution was $315,000 in Year 5 and benefits paid were $235,000. The am

> For each of the following scenarios, compute the accrued interest and cash received when the bond is issued.

> Giant Jobs, Inc. amended its overfunded pension plan on December 31, Year 7, resulting in the recognition of prior service cost of $700,000. On December 31, Year 7, Giant Job’s employees had an average remaining service life of 20 years. The company has

> The following information applies to Babydoll Company’s defined benefit pension plan: The company’s employees have an average remaining service life of 10 years. The company has no unrecognized net gains or losses. Wh

> The following information pertains to Burnel Corporation’s defined benefit pension plan for Year 1: What amount should Burnel report as total pension expense in Year 1? a. $250,000 b. $220,000 c. $210,000 d. $180,000

> Gregory’s on Ormond, Inc. grants its president 2,000 stock options on January 1, Year 1, that give him rights to purchase shares of the company for $40 per share on December 31, Year 2. At the time the options were granted, the fair value of the options

> On January 1, Year 1, Sweeney Company granted an employee option to purchase 100 shares of Sweeney’s common stock at $40 per share. The options became exercisable on December 31, Year 1, after the employee had completed 1 year of servic

> Bischoff Enterprises leases office space from Kally-Mack Properties for a term of 30 years. The office space that is available will permit the use of existing office equipment and computer equipment. In addition, Kally-Mack will deliver all maintenance s

> Inc., an IFRS reporter, leases a high-capacity forge from Bleake Metal Works Company for total lease payments of $4,200, which is the fair value of the asset. Under the terms of the agreement, Frankel will make equal payments over the 42-month rental per

> The Davis Group acquired $4,500,000 par value, 4%, 20-year bonds on their date of issue, January 1 of the current year. The market rate at the time of issue was 6%, and interest is paid annually on December 31. Davis will use the effective interest rate

> DC Products, Inc. leases several copy machines from Avenue Office Services. Under the terms of the agreement, DC will pay rentals of $1,000 per month for an eight-month period. The journal entry made each month is:

> You are given the following information for a 4-year lease, with $65,000 payments due at the beginning of each year. The fair value of the underlying asset is $250,000 and the deferred initial indirect costs of the lessor amounted to $15,592. The lessor’

> Balsam Associates issued $600,000 par value, 10-year bonds on January 1, 2018, with a 2% stated interest rate. It will make interest payments semiannually each June 30 and December 31 with the first interest payment at the end of the period on June 30, 2

> Lowe Leasing Company recently leased machinery to Amina Associates. The 8-year lease contract requires rental payments of $11,000 at the beginning of each year. The lease meets at least one of the Group I criteria. The 4% implicit rate on the lease is kn

> Insight Corporation leases equipment for 5 years with annual rentals of $2,000 per year. The agreement also requires that Insight purchase supplies such as oil, fasteners, and filters directly from the lessor and must spend a minimum of $350 per year ove

> Zhou Systems signed a 5-year lease at the beginning of the current year. The leased equipment is from standard dealer stock and has an economic life of 8 years and a fair value of $21,500. Under the terms of the lease, Zhou is required to pay $4,500 at t

> Baxter Brothers, Inc. enters into a four-year equipment lease with annual payments of $700 per year. The lease payments are due at the beginning of each year. The implicit rate of interest is 5% and is known to Baxter. Baxter pays $250 in initial direct

> The pretax financial income and taxable income of Zeus Corporation were the same for the following years (i.e., there were no permanent or temporary differences): What amount of income tax benefit will Zeus Corporation record in Year 6 under U.S. GAAP,

> The pretax financial income and taxable income of Zeus Corporation were the same for the following years (i.e., there were no permanent or temporary differences): What amount of income tax benefit will Zeus Corporation record in Year 6 under U.S. GAAP,

> At the end of Year 6, the tax effects of temporary differences reported in Maple Company’s year-end financial statements were as follows: A valuation allowance was not considered necessary. Maple anticipates that $40,000 of the deferre

> Samuel Company has the following accounts in its shareholders’ equity section at the beginning of the current year: Required: Prepare the journal entries required to record the following share buyback transactions assuming that Samuel

> On January 1, 2018, Gato Company issued 1,000 shares of $80 par callable preferred shares for $200,000. Gato can call these preferred shares on January 1, 2019, for $200 per share. On June 1, 2019, Gato calls the shares. Required: a. What is the journ

> Two independent situations are described here. Each situation has future deductible amounts and/or future taxable amounts produced by temporary differences: The enacted tax rate is 40% for both situations. Determine the income tax expense for the year.

> Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary diffe The enacted tax rate is 40% for both situations. Determine the deferred tax asset balance at year-end.

> Cavan Company prepared the following reconciliation between book income and taxable income for the current year Cavan’s effective income tax rate for Year 1 is 30%. The depreciation difference will reverse equally over the next 3 years

> Using the information provided in BE14-14, prepare the amortization table for the first 2 years assuming that Stark uses the straight-line method Data from BE14-14: On January 1, 2018, Stark Incorporated issued $1,500,000 par value, 5%, 7-year bonds (i.

> Cavan Company prepared the following reconciliation between book income and taxable income for the current year Cavan’s effective income tax rate for Year 1 is 30%. The depreciation difference will reverse equally over the next 3 years

> On January 2, year 1, Kean Co. purchased a 30% interest in Pod Co. for $250,000. On this date, Pod’s stockholders’ equity was $500,000. The carrying amounts of Pod’s identifiable net assets approximated their fair values, except for land, whose fair valu

> Money for Nothing Enterprises (“MNE”) held the following available-for-sale debt securities during Year 2: What will MNE report as accumulated other comprehensive income on its 12/31/Y2 balance sheet (ignore taxes)?

> Money for Nothing Enterprises (“MNE”) held the following available-for-sale debt securities during year 2 What will MNE report as unrealized gain on available-for-sale debt securities on its Year 2 statement of compreh

> Merlin Enterprises sold the following debt investment on September 30, Year 2: What is the amount of the realized gain or loss on Merlin’s Year 2 income statement, assuming that the investment in Beard Inc. is classified as an available

> Merlin Enterprises sold the following debt investment on September 30, year 2: What is the amount of the realized gain or loss on Merlin’s Year 2 income statement, assuming that the investment in Beard Inc. is classified as a trading d

> Several years ago, Indirect Bookie Company issued 10,000 shares of $2 par value common stock for $24 per share. Since that time, the company entered into several treasury stock transactions. Assume that additional paid-in capital from treasury stock tran

> The following data pertains to Tyne Co.’s investments in marketable debt securities: What amount should Tyne report as net unrealized loss on available-for-sale marketable debt securities at December 31, year 2, in accumulated other com

> Deutsch Imports has three securities in its available-for-sale debt investment portfolio. Information about these securities is as follows: TRR was sold in Year 2 for $127,400. Which of the following statements is correct? i. On its 12/31/Year 2 balanc

> Backdoor Inc. had 200,000 shares of $5 par common stock outstanding. The company declared a stock dividend of 100,000 shares when the market price was $25. By how much did additional paid-in capital increase when the dividend was distributed to the share

> Backdoor Inc. had 200,000 shares of $5 par common stock outstanding. The company declared a stock dividend of 30,000 shares when the market price was $25. By how much did additional paid-in capital increase when the dividend was declared? a. $0 b. $600

> Using the information provided in BE14-14, determine the issue price of the bonds assuming that the market rate of interest is 4%, and prepare the amortization table for the first 2 years assuming that Stark uses the effective interest rate method. Data

> On January 1, Year 1, Black Dog Corp. began operations and issued 30,000 shares of $5 par common stock for $9 per share. On June 30, the company bought back 10,000 shares for $8 per share. Then, on September 15, the company resold 5,000 shares for $12 pe

> Classic Cars Corp. has 50,000 shares of $10 par common stock and 20,000 shares of $15 par fully participating 10% cumulative preferred stock. If the company declares cash dividends of $100,000 during the current year and there are no dividends in arrears

> On September 1, Year 1, Royal Corp., a newly formed company, had the following stock issued and outstanding: • Common stock, no par, $1 stated value, 5,000 shares originally issued for $15 per share. • Preferred stoc

> McCarty Company issued 100,000 shares of its $10 par common stock at $11Â per share. During the current year, McCarty acquired 30,000 shares of its common stock at $16 per share and accounted for them using the cost method. Subsequently, these

> Boone Corporation’s outstanding capital stock on December 15 consisted of the following: • 30,000 shares of 5% cumulative preferred stock, par value $10 per share, fully participating as to dividends. No dividends were in arrears. • 200,000 shares of c

> Paragon Stores Company’s weekly payroll amounts to $400,000. Paragon is responsible for paying its share of Social Security tax. The company is also responsible for federal and state unemployment taxes. The state unemployment tax rate is 4.7%, but Parago

> On December 30, Year 1, Wayne Corporation issued 1,000 of its 10-year, 8%, $1,000 face value bonds with detachable stock warrants at par. Each bond carried a detachable warrant for one share of Wayne’s common stock at a specified option price of $25 per

> On July 1, Year 1, after recording interest and amortization, Wake Company’s shareholders converted $1,000,000 of its 10% convertible bonds into 50,000 shares of its $1 par value common stock. On the conversion date, the carrying amount of the bonds was

> Walco Manufacturing Inc. holds 500 convertible bonds from Indwell Semiconductor that it purchased on January 1, Year 1, for $518,110. The face amount of each bond is $1,000. Each bond is convertible into one share of Indwell common stock. The par value o

> Clothes Horse Corp. (CHC) issued $500,000 bonds due in 10 years on January 1, Year 1, at a premium for $567,105. On January 1, Year 6, when the carrying value of the bond was $539,940, CHC redeemed the bonds at 102. What amount of gain should CHC record

> On January 1, Year 1, Congo.com issued $1,000,000 of its 10-year, 9% bonds (interest paid annually) to yield 8%. The present value of $1 at 9% for 10 years is 0.4224, and the present value of an ordinary annuity of $1 at 9% for 10 years is 6.4177. The pr

> Using the information provided in BE14-14, prepare the amortization table for the first 2 years assuming that Stark uses the straight-line method. Data from BE14-14: On January 1, 2018, Stark Incorporated issued $1,500,000 par value, 5%, 7-year bonds (i

> On November 1, Year 1, Dixon Corporation issued $800,000 of its 10-year, 8% term bonds dated October 1, Year 1. The bonds were sold to yield 10% with total proceeds of $700,000 plus accrued interest. Interest is paid every April 1 and October 1. What amo

> On July 1, Year 1, Planet Corporation sold Ken Company 10-year, 8% bonds with a face amount of $500,000 for $520,000. The market rate was 6%. The bonds pay interest semiannually on June 30 and December 31. For the 6 months ended December 31, Year 1, what

> On July 1, Year 1, Cobb Company issued 9% bonds in the face amount of $1,000,000 that mature in 10 years. The bonds were issued for $939,000 to yield 10%, resulting in a bond discount of $61,000. Cobb uses the effective interest method of amortizing bond

> Use the information provided in MC14-9 except that immediately after issuance, the market value of each warrant was $120. In its December 31, Year 1, balance sheet, what amount should Wayne report as the book value of bonds payable? a. $880,000 b. $900

> The stockholders’ equity section of DRB plc’s balance sheet at December 31, 2018, was as follows: Required: a. Prepare the journal entry required on January 9, 2019, if on that date DRB repurchased 50,000 shares of