Question: Downhill Fast manufactures three ski products:

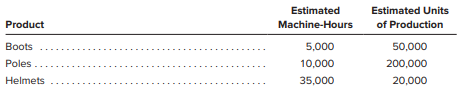

Downhill Fast manufactures three ski products: boots, poles, and helmets. The company allocates manufacturing costs to each product line based on machine-hours. A large portion of its manufacturing overhead cost is incurred by the Maintenance Department. This year, the department anticipates that it will incur $250,000 in total costs. The following estimates pertain to the upcoming year.

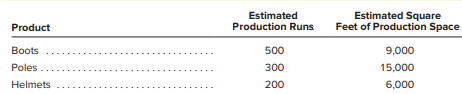

arol Salome, the company’s cost accountant, suspects that unit costs are being distorted by using a single activity base to allocate Maintenance Department costs to products. She is considering the implementation of an activity-based costing system (ABC). Under the proposed ABC system, the maintenance costs would be allocated to the following activity cost pools using the number of work orders as an activity base: (1) the equipment set-up pool, and (2) the custodial pool. Of the 2,400 work orders filed with the Maintenance Department each year, approximately 600 relate to equipment set-up activities, whereas 1,800 relate to custodial functions. Equipment set-ups correlate with the number of production runs associated with each product line. Thus, the equipment set-up pool would be allocated based on the number of production runs required for each product. Custodial services correlate with square feet of production space and would be allocated based on the space required to produce each product line. The following table provides a summary of annual production activity and square footage requirements

Instructions:

a. Calculate the amount of Maintenance Department costs that would be allocated to each product line (on a per-unit basis) using machine-hours as a single activity base.

b. Calculate the amount of Maintenance Department costs that would be allocated to each product line (on a per-unit basis) using the proposed ABC system.

c. Are cost allocations currently being distorted using machine-hours as a single activity base? Defend your answer.

> Sharon Guenther and Robert Firmin, both of whom are CPAs, form a partnership, with Guenther investing $100,000 and Firmin, $80,000. They agree to share net income as follows: 1. Salary allowances of $80,000 to Guenther and $60,000 to Firmin. 2. Interest

> How is the inventory turnover computed? Why is this measurement of interest to short-term creditors?

> Badgersize Company has the following information for its Forming Department for the month of August. Assume materials are added at the start of processing. Instructions: a. Calculate the equivalent units for the Forming Department for the month of Augu

> Sells is a retail department store. The following cost-volume relationships were used in developing a flexible budget for the company for the current year. Management expected to attain a sales level of $12 million during the current year. At the end of

> Smithfield Hotel recently purchased new exercise equipment for its exercise room. The following information refers to the purchase and installation of this equipment. 1. The list price of the equipment was $42,000; however, Smithfield qualified for a spe

> During the current year, Delta Products Corporation incurred the following expenditures, which Should be recorded either as operating expenses or as intangible assets. a. Expenditures were made for the training of new employees. The average employee rema

> During the current year, Blake Construction disposed of plant assets in the following transactions. Instructions: a. Prepare journal entries to record each of the disposal transactions. Assume that depreciation expense on each asset has been recorded up

> Bush Company budgeted that it would incur $176,000 of manufacturing overhead costs in the upcoming period. By the end of the period, Bush had actually incurred manufacturing overhead costs totaling $200,000. Other information from the company’s accountin

> This problem focuses on the following question: Is it ethical for a CPA (or CPA firm) to provide similar services to companies that compete directly with one another? These services may include assistance in the preparation of financial statements, incom

> Brite Ideas, Inc., mass-produces reading lamps. Materials used in constructing the body of the lamp are added at the start of the process, while the materials used in wiring the lamps are added at the halfway point. All labor and overhead are added evenl

> Barnum Distributors wants a projection of cash receipts and cash payments for the month of November. On November 28, a note will be payable in the amount of $98,500, including interest. The cash balance on November 1 is $29,600. Accounts payable to merch

> The realization principle determines when a business should recognize revenue. Listed are three common business situations involving revenue. After each situation, we give two alternatives as to the accounting period (or periods) in which the business mi

> Street Smarts, Inc., mass-produces street lights. Materials used in constructing the body of the lights are added at the start of the process, while the materials used in wiring the lights are added at the halfway point. All labor and overhead are added

> Red Robin Gourmet Burgers is an upscale restaurant chain founded in the Pacific Northwest. The chain’s former chairman, Michael Snyder, encouraged employees to be “unbridled”? in everything they did. Unfortunately, Snyder was too unbridled with his use o

> Prudent cash management is an important function in any business. Large amounts of cash sitting idle in non–interest-bearing checking accounts can cost a company thousands—even millions— of dollars annually in foregone revenue. Many businesses invest lar

> What are the pitfalls to avoid when investing in overseas activities? The following key issues have been identified as important. ∙ Lower cost offshore does not always mean gains in efficiency. ∙ Choose your model carefully; either run your own offshore

> Grizzly Community Hospital in central Wyoming provides health care services to families living within a 200-mile radius. The hospital is extremely well equipped for a relatively small, community facility. However, it does not have renal dialysis equipmen

> The management of Metro Printers is considering a proposal to replace some existing equipment with a new highly efficient laser printer. The existing equipment has a current book value of $2,200,000 and a remaining life (if not replaced) of 10 years. The

> Miracle Tool, Inc., sells a single product (a combination screwdriver, pliers, hammer, and crescent wrench) exclusively through television advertising. The comparative income statements and balance sheets are for the past two years. Additional Informati

> To obtain a better understanding of economic value added, visit the website that outlines the EVA philosophy of Stern Stewart & Co www.valuebasedmanagement.net/methods_eva.html. In the center of the page find information about usage of the EVA method. L

> Snug-As-A-Bug manufactures sleeping bags. For the coming year, the company has budgeted the following costs for the production and sale of 80,000 units. Instructions: a. Compute the sales price per unit that would result in a budgeted operating income o

> What is the meaning of the term loss contingency? Give several examples. How are loss contingencies presented in financial statements? Explain.

> Marshall uses a job order costing system to account for projects. It applies manufacturing over head to jobs on the basis of direct labor hours and pays its direct labor workers $30 per hour. The following information relates to the month of December (so

> Compute trend percentages for the following items taken from the financial statements of Lopez Plumbing over a five-year period. Treat 2017 as the base year. State whether the trends are favorable or unfavorable. (Dollar amounts are stated in thousands.)

> D. J. Fletcher, a trusted employee of Bluestem Products, found himself in personal financial difficulties and decided to “borrow” $3,000 from the company and to conceal his theft. As a first step, Fletcher removed $3,000 in currency from the cash registe

> Affections manufactures candy and sells only to retailers. It is not a publicly owned company and its financial statements are not audited. But the company frequently must borrow money. Its creditors insist that the company provide them with unaudited fi

> Nevis Corporation manufactures and sells a single product. In preparing the budget for the first quarter, the company’s cost accountant has assembled the following information. The company uses the first-in, first-out method to report

> Windfall Industries uses straight-line depreciation on all of its depreciable assets. The company records annual depreciation expense at the end of each calendar year. On January 11, 2017, the company purchased a machine costing $90,000. The machine’s us

> The Printer Division is evaluated as an investment center. Wolfe expects all of its investment centers to earn a minimum annual return of 10 percent on average invested capital. Division managers receive a bonus equal to 1 percent of their division’s res

> Wolfe Computer manufactures computers and peripheral equipment. The following data relate to Wolfe’s printer division for the year just ended. The Printer Division is evaluated as an investment center. Wolfe expects all of its investme

> Jams and Jellies, Inc., uses a standard cost system to track inventories and cost of goods sold. The blueberry factory that produces blueberry jams and jellies increased its standard product costs at the beginning of the fourth quarter of its operations

> Data Management, Inc., provided the following information at December 31, year 1. Marketable Securities The company invested $75,000 in a portfolio of marketable securities on December 9, year 1. The portfolio’s market value on Decembe

> Healthy Hound, Inc., makes two lines of dog food: (1) Basic Chunks and (2) Custom Cuts. The Basic Chunks line is a dry food that is processed almost entirely by an automated process. Custom Cuts is a canned food made with real horsemeat. The slabs of mea

> Each year, a large clothing store in New York City sends its top five salespersons on a five-day retreat in Orlando, Florida. The retreat begins on the first Monday in February and ends the following Friday afternoon. The company must purchase five coach

> Armstrong Chemical began operations in January. The company manufactures an acrylic car wax called Tough-Coat. The following standard cost estimates were developed several months before the company began operations, based on an estimated production of 1,

> Cabinets, Inc., is a large manufacturer of modular kitchen cabinets, sold primarily to builders and developers. The company uses a standard cost system. Standard production costs have been developed for each type of cabinet; these costs and any cost vari

> Rock, Inc., sells stereo equipment. Traditionally, the company’s sales have been in the following categories: cash sales, 25 percent; customers using national credit cards, 35 percent; sales on account (due in 30 days), 40 percent. With

> Happy Cat, Inc., makes two lines of cat food: (1) Tabby Treat, and (2) Fresh n’ Fishy. The Tabby Treat line is a dry food that is processed almost entirely by an automated process. Fresh n’ Fishy is a canned food made

> Under the Public Company Accounting Oversight Board (PCAOB) procedures, companies are required to disclose “material weaknesses” in their internal controls. A material weakness means a company’s deficiencies are so bad that there’s more than a remote cha

> Working in small groups, view the following master budgeting video: https://www.youtube.com/watch?v=Wy9MGFjS7ZA Instructions: a. What does the video identify as three primary outputs of the master budgeting process? Are these three outputs the same as t

> The income statement of Walmart reports net sales of $495,761 million and cost of goods sold of $373,396 million for the year ended January 31, 2018. The comparable sales and cost of goods sold figures for the year ended one year earlier were $481,317 mi

> Renfrew International manufactures and sells a single product. In preparing its master budget for the current quarter, the company’s controller has assembled the following information: Renfrew International uses the average cost meth

> Each of the following statements may (or may not) describe these technical terms. For each statement, indicate the term described, or answer “None” if the statement does not correctly describe any of the terms. a. An

> The importance of cash budgets for all types of businesses and individuals cannot be overemphasized. The following six steps to cash flow control are critical. 1. Create a monthly cash flow budget. Determine the amount you need to achieve your business a

> During a period of steadily increasing purchase costs, which inventory flow assumption results in the highest reported profits? The lowest taxable income? The valuation of inventory that is closest to current replacement cost? Briefly explain your answer

> Beta Computers is experiencing financial difficulties attributed to declining sales of its mainframe computer systems. Several years ago, the company obtained a large loan from Midland State Bank. The covenants of the loan agreement strictly state that i

> Hi-tech Manufacturing Company has 1,000,000 shares of $1 par value capital stock outstanding on January 1. The following equity transactions occurred during the current year.

> In each of the situations described, indicate the accounting principles or concepts, if any that have been violated and explain briefly the nature of the violation. If you believe the practice is in accord with generally accepted accounting principles, s

> The purpose of this problem is to demonstrate some of the interrelationships in the budgeting process. Shown as follows is a very simple balance sheet at January 1, along with a simple budgeted income statement for the month. (Assume dollar amounts are s

> Ethical dilemmas often face university and college administrators as they attempt to provide students with services and products to make college life easier. For example, the University of Minnesota and University of Illinois issue “U Cards” to students.

> Dixon Robotics manufactures three robot models: the A3B4, the BC11, and the C3PO. Dixon allocates manufacturing overhead to each model based on machine-hours. A large portion of the company’s manufacturing overhead costs is incurred by

> General Mills produces and sells a variety of food products in numerous countries. Access its home page and look at the company overview at the following address: www.generalmills.com. Now consider Kirby Company. It manufactures and sells one product lin

> Researchers suggest that many angioplasties and implanted cardiac pacemaker surgeries done in the United States each year are medically unwarranted. The additional risk to patients’ health posed by these surgeries and the high cost of health care that re

> Osborn Diversified Products, Inc., is a billion-dollar manufacturing company with headquarters in Dayton, Ohio. The company has 15 divisions, two of which are the battery division and the golf cart division. The company’s battery division supplies the go

> McKay Chemical Company is based in the town of Swamp ton. The company is Swamp ton’s “economic lifeblood,” generating annual income of $100 million and employing nearly 75 percent of its workforce. Mc

> You have just been hired as the controller of Land’s End Hotel. The hotel prepares monthly responsibility income statements in which all fixed costs are allocated among the various profit centers in the hotel, based on the relative amounts of revenue gen

> Midtown Distribution sells a variety of merchandise to retail stores on account, but it insists that any customer who fails to pay an invoice when due must replace their account receivable with an interest-bearing note at the current interest rate. The c

> Why is the contribution margin an important concept for incremental decision making?

> Superior Instruments produces two models of instruments. Information for each model is as follows. The demand for either product is sufficient to keep the plant operating at full capacity (15,000machine-hours per month). Assume that only one product is

> A recent annual report of the Kraft Heinz Company reveals the following information (dollar amounts are stated in millions). a. Compute Kraft Heinz’s inventory turnover for the year (round to nearest tenth). b. Compute the number of da

> Ulsan Company has manufacturing subsidiaries in Malaysia and Malta. It is considering shipping the subcomponents of Product Y to one or the other of these countries for final assembly. The final product will be sold in the country where it is assembled.

> The SEC was once reluctant to hit companies with big fines for wrongdoing because the penalties hurt shareholders whose stock prices had already been hammered by scandal. But the Sarbanes–Oxley Act now lets the SEC use the fine funds to repay stockholder

> Dow Corporation produces a wide variety of products ranging from raw chemicals that are used as inputs by other firms to final goods that are sold to consumers. Access Dow’s home page at the following address: www.dow.com. Instructions: a. Select “Marke

> Friendly Software recently developed new spreadsheet software, Easy-Calc, which it intends to market by mail through ads in computer magazines. Just prior to introducing Easy-Calc, Friendly receives an unexpected offer from Jupiter Computer to buy all ri

> We have made the point that managers often attempt to maximize the contribution margin per unit of a particular resource that limits output capacity. The following are five familiar types of businesses. 1. Small medical or dental practice. 2. Restaurant.

> Identify two characteristics of estimated liabilities. Provide at least two examples of estimated liabilities.

> Wrigley Company (a subsidiary of Mars Incorporated) manufactures chewing gum. Visit the following address for the company: http://www.wrigley.com/ea/about-us/how-gum-made.aspx. From this link, you will be provided an overview of how gum is made. Instruc

> Norton Chemical Company produces two products: Amatol and Bitrate. The company uses activity-based costing (ABC) to allocate manufacturing overhead to these products. The costs incurred by Norton’s Purchasing Department average $80,000

> Listed as follows are eight technical accounting terms introduced in this chapter Each of the following statements may (or may not) describe one of these technical terms. For each statement, indicate the term described, or answer “None

> Identify one local business that uses a perpetual inventory system and another that uses a periodic system. Interview an individual in each organization who is familiar with the inventory system and the recording of sales transactions. Instructions Separ

> Indicate the effects of the following errors on each of the items listed in the column headings. Use the following symbols: O = overstated, U = understated, and NE = no effect. Assume that the company does not use the direct write-off method to account f

> In each of the following situations, indicate whether you would expect the business to use a periodic inventory system or a perpetual inventory system. Explain the reasons for your answer. a. The Frontier Shop is a small retail store that sells boots an

> Visit the home page of the Ford Motor Company at www.ford.com. From Ford’s home page, access the company’s most recent annual report (select the “Investors” menu item near the bottom of the page). Locate the notes to the financial statements and identify

> The flow of manufacturing costs through the ledger accounts of Superior Locks, Inc., in the current year is illustrated as follows in summarized form. Instructions: Indicate the following amounts requested. Some amounts are shown in the illustrated T ac

> For the year ended December 31, Southern Supply had net sales of $3,875,000, costs and other expenses (including income tax) of $3,100,000, and a gain from discontinued operations (net of income tax) of $210,000. a. To the extent possible from the limite

> Listed are five items that may or may not require disclosure in the notes that accompany financial statements. a. Mandella Construction Co. uses the percentage-of-completion method to recognize revenue on long-term construction contracts. This is one of

> Perform an Internet search of “The Hershey Company Investor Relations.” After gaining to access to Hershey’s Investor Relations homepage, access the link to the company’s most recent annual report. Examine the Hershey’s balance sheet and identify the acc

> The following information was taken from annual reports of Goodyear Tire & Rubber and PPL Corp., a public utility: a. Compute for each company the accounts receivable turnover rate for the year. b. Compute for each company the average number of day

> The Sarbanes–Oxley Act requires that the CEO (chief executive officer) and CFO (chief financial officer) of publicly traded corporations include statements of personal certification in the disclosures accompanying the financial reports filed with the SEC

> The accounting records of NuTronics, Inc., include the following information for the year ended December 31. Overhead assigned to production was $192,000. a. Prepare a schedule of the cost of finished goods manufactured. (Not all of the data given are u

> Parsons Plumbing & Heating manufactures thermostats that it uses in several of its products. Management is considering whether to continue manufacturing the thermostats or to buy them from an outside source. The following information is available. 1.

> Johnson & Johnson’s 2017 financial statements include the following items (all dollars in millions). Compute the following ratios and comment on the trend you can observe from the limited two years of data you have available. a. Gr

> Hearthstone sells commercial kitchen equipment. At December 31, year 1, Hearthstone’s inventory amounted to $900,000. During the first week of January, year 2, the company made only one purchase and one sale. These transactions were as

> Dr. Cravat, DMD, opened a dental clinic on August 1, current year. The following are the business transactions for August. A partial list of account titles used by Dr. Cravati includes the following. Instructions : a. Analyze the effects that each of t

> Satellite World was founded in 2020 to apply a new technology for efficiently transmitting closed-circuit (cable) television signals without the need for an in-ground cable. The company earned a profit of $115,000 in 2020, its first year of operations, e

> In March, current year, Mary Tone organized a corporation to provide package delivery services. The company, called Tone Deliveries, Inc., began operations immediately. Transactions during the month of March were as follows. The account titles used by T

> Jensen Fences uses job order costing. Manufacturing overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labor costs. The following information appears in the company’s Work in Process

> Dana, Inc., provides civil engineering services. During October, its transactions included the following. Instructions: a. Analyze the effects that each of these transactions will have on the following six components of the company’s

> Lyons, Inc., provides consulting services. A few of the company’s business transactions occurring during June are described as follows. 1. On June 1, the company billed customers $6,000 on account for consulting services rendered. Customers are required

> Chris North is the founder and president of North Enterprises, a real estate development venture. Instructions: a. Prepare journal entries to record these transactions. Select the appropriate account titles from the following chart of accounts. b. Ind

> Boom, Inc., sells business software. Currently, all of its programs come on disks. Due to their complexity, some of these applications occupy as many as seven disks. Not only are the disks cumbersome for customers to load, but they are relatively expensi

> Jackson Mountain is a small ski resort located in northern Connecticut. In recent years, the resort has experienced two major problems: (1) unusually low annual snowfalls and (2) long lift lines. To remedy these problems, management is considering two in

> Explain why errors in the valuation of inventory at the end of the year are sometimes called “counterbalancing” or “self-correcting.”

> Guthrie Generators manufactures a solenoid that it uses in several of its products. Management is considering whether to continue manufacturing the solenoids or to buy them from an outside source. The following information is available. 1. The company ne

> Computer Resources Inc. is a computer retailer. Computer Resources began operations in December of the current year and engaged in the following transactions during that month. Computer Resources uses a perpetual inventory system. Instructions: a. Compu

> The former bookkeeper of White Electric Supply is serving time in prison for embezzling nearly $416,000 in less than five years. She describes herself as “an ordinary mother of three kids and a proud grandmother of four.” Like so many other “ordinary” em

> The flow of manufacturing costs through the ledger accounts of ISP, Inc., in the current year is illustrated as follows in summarized form. Instructions: Indicate the following amounts requested. Some amounts are shown in the T accounts provided; others

> Easy Living Corporation manufactures houseboats. During its first year of operations, the company started and completed 40 boats at a cost of $96,000 per unit. Of these, 30 were sold for $156,000 each and 10 remain in finished goods inventory. In additio

> Kent Corporation manufactures filtration systems. The manufacturing costs incurred during its first year of operations are as follows. During the year, 220 completed units were manufactured, of which 180 were sold. (Assume that ending Finished Goods Inv

> Company P, a U.S. company, has a foreign subsidiary in Country Q, where various forms of bribery are accepted and expected. Company P sent one of its top U.S. managers to oversee operations in its subsidiary in Country Q. That manager engaged in the foll