Question: Dr. Emma Armstrong, M.D., maintains the

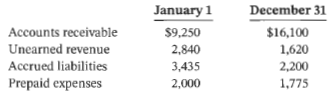

Dr. Emma Armstrong, M.D., maintains the accounting records of the Blood Sugar Clinic on a cash basis. During 2020, Dr. Armstrong collected $146,000 in revenues and paid $55,470 in expenses. At January 1, 2020, and December 31, 2020, she had accounts receivable, unearned revenue, accrued liabilities, and prepaid expenses as follows (all long-lived assets are rented):

Instructions

Last week, Dr. Armstrong asked you, her CPA, to help her determine her income on the accrual basis. Write a letter to her explaining what you did to calculate net income on the accrual basis. Be sure to state net income on the accrual basis and to include a schedule of your calculations.

> Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019: Transactions during 2020 and other information relating to Desrosiers' long-term receivables were as follows: 1. The $1.8-million note receivable is dated May

> On December 31, 2020, Zhang Ltd. rendered services to Beggy Corp. at an agreed price of $91,844.10. In payment, Zhang accepted $36,000 cash and agreed to receive the balance in four equal installments of $18,000 that are due each December 31. An interest

> On October 1, 2020, Healy Farm Equipment Corp. sold a harvesting machine to Homestead Industries. Instead of a cash payment, Homestead Industries gave Healy Farm Equipment a $150,000, two-year, 10% notes; 10% is a realistic rate for a note of this type.

> The SFP of Alice Inc. at December 31, 2019, includes the following: Transactions in 2020 include the following: 1. Accounts receivable of $146,000 was collected. 2. Customer accounts of $39,500 were written off during the year. 3. An additional $16,700

> The following information relates to Shea Inc.'s accounts receivable for the 2020 fiscal year: 1. An aging schedule of the accounts receivable as at December 31, 2020, is as follows: 2. The Accounts Receivable control account has a debit balance of $37

> Use the information presented for Volumetrics Corporation in BEll.19, but assume that the machinery is sold for $5,200 instead of $13,500. Prepare journal entries to (a) update depreciation for 2022 and (b) record the disposal.

> Gelato Corporation, a private entity reporting under ASPE, was incorporated on January 3, 2019. The corporation's financial statements for its first year of operations were not examined by a public accountant. You have been engaged to audit the financial

> Fortini Corporation had record sales in 2020. It began 2020 with an Accounts Receivable balance of $475,000 and an Allowance for Doubtful Accounts of $33,000. Fortini recognized credit sales during the year of $6,675,000 and made monthly adjusting entrie

> A series of unrelated situations follow for several companies that use ASPE: 1. Atlantic Inc.'s unadjusted trial balance at December 31, 2020, included the following accounts: 2. An analysis and aging of Central Corp.'s accounts receivable at December

> Information follows for Quartz Industries Ltd.: Additional information: 1. One June 26 transactions were for bank service charges. 2. One June 30 transactions was a bank debit memo for $1,050.00 for a customer's cheque returned and marked NSF (includ

> The cash account of Villa Corp. shows a ledger balance of $3,969.85 on June 30, 2020. The bank statement as at that date shows a balance of $4,150. When the statement was compared with the cash records, the following facts were determined: 1. There were

> Joseph Kiuvik is reviewing the cash accounting for Connolly Corporation, a local mailing service. Joseph's review will focus on the petty cash account and the bank reconciliation for the month ended May 31, 2020. Petty cash Joseph has collected the follo

> The Patchwork Corporation manufactures sweaters for sale to athletic-wear retailers. The following information was available on Patchwork for the years ended December 31, 2019 and 2020: During 2020, Patchwork had the following transactions: 1. On June

> The Cormier Corporation sells office equipment and supplies to many organizations in the city and surrounding area on contract terms of 2/10, n/30. In the past, over 75% of the credit customers have taken advantage of the discount by paying within 10 day

> In 2020, Ibran Corp. required additional cash for its business. Management decided to use accounts receivable to raise the additional cash and has asked you to determine the income statement effects of the following transactions: 1. On July 1, 2020, Ibra

> Logo Limited follows ASPE. It manufactures sweatshirts for sale to athletic-wear retailers. The following summary information was available for Logo for the year ended December 31, 2019: Part 1 During 2020, Logo had the following transactions: 1. Total

> Dev Equipment Corp. usually closes its books on December 31, but at the end of 2020 it held its cash book open so that a more favorable statement of financial position could be prepared for credit purposes. Cash receipts and disbursements for the first 1

> Volumetrics Corporation owns machinery that cost $20,000 when purchased on January 1, 2020. Depreciation has been recorded at a rate of $3,000 per year, resulting in a balance in accumulated depreciation of $6,000 at December 31, 2021. The machinery is s

> Essan Construction Inc., which has a calendar year end, has entered into a non-cancellable fixed price contract for $2.8 million beginning September 1, 2020, to build a road for a municipality. It has been estimated that the road construction will be com

> Hale Hardware takes pride in being the "shop around the corner" that can compete with the big box home improvement stores by providing good service from knowledgeable sales associates (many of whom are retired local handymen). Hale has developed the foll

> Tablet Tailors sells tablet PCs combined with Internet service (Tablet Bundle A) that permits the tablet to connect to the Internet anywhere (that is, set up a WiFi hot spot). The price for the tablet and a four-year Internet connection service contract

> Martz Inc. has a customer loyalty program that rewards a customer with one customer loyalty point for every $100 of purchases. Each point is redeemable for a $3 discount on any future purchases. On July 2, 2020, customers purchase products for $300,000 (

> Ritt Ranch & Farm is a distributor of ranch and farm equipment. Its products include small tools, power equipment for trench-digging and fencing, grain dryers, and barn winches. Most products are sold direct via its company Internet site. However, gi

> Presented below are three independent revenue arrangements for Colbert Company. The company follows IFRS. Instructions Respond to the requirements related to each revenue arrangement. a. Colbert sells 3-D printer systems. Recently, Colbert provided a sp

> Van Hatten Consolidated has three operating divisions: DeMent Publishing Division, Ankiel Security Division, and Depp Advisory Division. Each division maintains its own accounting system but follows IFRS. DeMent Publishing Division The DeMent Publishing

> Economy Appliance Co. manufactures low-price, no-frills appliances that are in great demand for rental units. Pricing and cost information on Economy's main products are as follows. Customers can contract a purchase either individually at the stated pr

> Assume the facts given in P6.9 for Essan Construction Inc. except assume that at December 31, 2021, Essan estimates the costs to complete the road contract at $1,050,000 instead of $600,000. Instructions a. Using the percentage-of-completion method, cal

> Respond to the requirements related to the following independent revenue arrangements for BBQ Master Products and services. Assume that BBQ Master follows IFRS. a. BBQ Master offers contract BM205, which consists of a free-standing gas barbecue for small

> Caley Inc. owns a building with a carrying amount of $1.5 million, as at January 1, 2020. On that date, Caley's management determined that the building's location is no longer suitable for the company's operations and decided to dispose of the building

> The statement of financial position of Manion Corporation follows (in thousands): Instructions Evaluate the statement of financial position. Briefly describe the proper treatment of any item that you find incorrect. Assume the company follows IFRS.

> The statement of financial position of Sargent Corporation follows for the current year, 2020: The following additional information is available: 1. The Current Assets section includes the following: cash $150,000; accounts receivable $170,000, less $10,

> Jia Inc. applies ASPE and had the following statement of financial position at the end of operations for 2019: During 2020, the following occurred: 1. Jia Inc. sold some of its trademarks. The trademarks had an unlimited useful life and a cost of $10,000

> Aero Inc. had the following statement of financial position at the end of operations for 2019: During 2020, the following occurred: 1. Aero liquidated its FV-NI investments portfolio at a loss of $5,000. 2. A parcel of land was purchased for $38,000. 3.

> In an examination of Garganta Limited as at December 31, 2020, you have learned about the following situations. No entries have been made in the accounting records for these items. 1. The corporation erected its present factory building in 2004. Deprecia

> Lydia Trottier has prepared baked goods for sale since 1998. She started a baking business in her home and has been operating in a rented building with a storefront since 2003. Trottier incorporated the business as MLT Inc. on January 1, 2020, with an in

> The statement of financial position of Delacosta Corporation as at December 31, 2020, is as follows: Note 1: Goodwill in the amount of $70,000 was recognized because the company believed that the carrying amount of assets was not an accurate representati

> The trial balance of Eastwood Inc. and other related information for the year 2020 follows: Additional information: 1. The inventory has a net realizable value of $212,000. The FIFO method of inventory valuation is used. 2. The FV-OCI investments' fair v

> Martineau Inc., a major retailer of high-end office furniture, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows. The comparative statement of financial position and income statement

> L&G Inc., a retailer of garden tools that follows ASPE, had the following statements prepared as of December 31, 2020: Additional information: 1. Dividends on common shares in the amount of $12,000 were declared and paid during 2020. 2. Depreciation

> Compare the cost recovery impairment model used under ASPE with the rational entity model used under IFRS. Which model provides better information for financial statement users?

> A comparative statement of financial position for Spencer Corporation follows: Additional information: 1. Net income for the fiscal year ending December 31, 2020, was $19,000. 2. In March 2020, a plot of land was purchased for future construction of a pl

> Statement of financial position items for Montoya Inc. Follow for the current year, 2020: Instructions a. Prepare a classified statement of financial position in good form. The numbers of authorized shares are as follows: unlimited common and 20,000 pref

> The following financial statement was prepared by employees of Intellisys Corporation, which follows ASPE: Note 1: New styles and rapidly changing consumer preferences resulted in a $37,000 loss on the disposal of discontinued styles and related accessor

> The trial balance follows for Thompson Corporation at December 31, 2020: A physical count of inventory on December 31 showed that there was $64,000 of inventory on hand. Instructions Prepare a condensed single-step income statement and a statement of re

> Wave crest Inc. reported income from continuing operations before tax of $1,790,000 during 2020. Additional transactions occurring in 2020 but not included in the $1,790,000 were as follows: 1. The corporation experienced an insured flood loss of $80,000

> Information for 2020 follows for Rolling Thunder Corp.: Rolling Thunder decided to discontinue its entire wholesale division (a major line of business) and to keep its manufacturing division. On September 15, it sold the wholesale division to Dylane Corp

> On November l, 2019, Campbell Corporation management decided to discontinue operation of its Racketeer Division and approved a formal plan to dispose of the division. Campbell is a successful corporation with earnings of $150 million or more before tax f

> On January 1, 2020, Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing $90,000 cash. The new company, Razorback Sales and Service, had the following transactions in January: 1. Paid $6,000 in advance f

> Greentree Properties Ltd. is a publicly listed company following IFRS. Assume that on December 31, 2020, the carrying amount of land on the statement of financial position (SFP) is $500,000. Management determines that the land's value in use is $425,000

> The equity accounts of Good Karma Corp. as at January 1, 2020, were as follows: During 2020, the following transactions took place: Instructions Prepare a statement of changes in equity for the year ended December 31, 2020. The company follows IFRS. Ass

> Amos Corporation was incorporated and began business on January 1, 2020. It has been successful and now requires a bank loan for additional capital to finance an expansion. The bank has requested an audited income statement for the year 2020 using IFRS.

> Faldo Corp. is a public company and has 100,000 common shares outstanding. In 2020, the company reported income from continuing operations before income tax of $2,710,000. Additional transactions not considered in the $2,710,000 are as follows: 1. In 202

> In recent years, Grace Inc. has reported steadily increasing income. The company reported income of $20,000 in 2017, $25,000 in 2018, and $30,000 in 2019. Several market analysts have recommended that investors buy Grace Inc. shares because they expect t

> Zephyr Corporation began operations on January 1, 2017. Recently the corporation has had several unusual accounting problems related to the presentation of its income statement for financial reporting purposes. The company follows ASPE. You are the CPA f

> A combined statement of income and retained earnings for DC 5 Ltd. for the year ended December 31, 2020, follows. (As a private company, DC 5 has elected to follow ASPE.) Also presented are three unrelated situations involving accounting changes and the

> Using Excel functions, calculate the present value of the net cash flows required of Dunn Inc. for (1) The purchase alternative and (2) The lease alternative. Hint: For the annuity due for the lease payments, use type 1. b. Which of the two alternatives

> Using a financial calculator, calculate the present value of the net cash flows required of Dunn Inc. for: 1. The purchase alternative and 2. The lease alternative. Hint: For the annuity due for the lease payments, program your calculator to annuity due

> M&B Tooling Ltd. is assessing two available options for the purchase of new equipment with a negotiated cash price of $100,000. The manufacturer is willing to accept a down payment of 20% of the purchase price and an instalment note for the balance. The

> EMI Inc. is a public company that operates numerous movie theatres in Canada. Historically, it operated as a trust and its business model consisted of distributing all of its earnings to shareholders through dividends. As a result of tax changes two year

> Hambrecht Corp. is preparing its financial statements for the fiscal year ending November 30, 2020. Certain specialized equipment was scrapped on January 1, 2021. At November 30, 2020, this equipment was being used in production by Hambrecht and had a ca

> Grappa Grapes Inc. (GGI) grows grapes and produces sparkling wines. The company is located in a very old area of town with easy access to fertile farmland that is excellent for growing grapes. It is owned by the Grappa family. The company has been in ope

> Snow Spray Corp. (SSC) recently filed for bankruptcy protection. The company manufactures downhill skis and reports under ASPE. With the increased popularity of such alternative winter sports as snowboarding and tubing, sales of skis are sagging. The com

> Iskra Vremec and Colin McFee are experienced scuba divers who have spent many years in the salvage business. About a year ago, they decided to start their own company to recover damaged and sunken vessels and their cargoes off the east coast of Canada. T

> ASPE and IFRS have differing criteria for whether an element should be recognized or not. Assume that Thatcher Inc. (TI) is the subject of a lawsuit. TI sells prepared food on a wholesale basis to supermarket chains (which resell the food at a retail lev

> The ASPE conceptual framework acknowledges the concept of conservatism. Instructions a. Define the term "conservatism." b. IFRS introduced the term "prudence" in the new Conceptual Framework. Explain what this means. c. Is conservatism and/or prudence i

> Jasper Bakery Limited signed a purchase order to buy 50 kg of butter from a farmer over the next month at a fixed price. The butter is of exceptional quality and will be used in baked goods that will be sold in the bakery. Instructions a. Define the ter

> On December 31, 2019, Zurich Corp. provided you with the following pre-adjustment information regarding its portfolio of investments held for short-term profit-taking: During 2020, the Bilby Corp. shares were sold for $9,500. The fair values of the secur

> Refer to the information in E9.3, except assume that Mustafa hopes to make a gain on the bonds as interest rates are expected to fall. Mustafa accounts for the bonds at fair value with changes in value taken to net income, and separately recognizes and r

> On January 1, 2020, Phantom Corp. acquires $300,000 of Spider Products Inc. 9% bonds at a price of $278,384. The interest is payable each December 31, and the bonds mature on December 31, 2022. The investment will provide Phantom Corp. with a 12% yield.

> On January 1, 2020, Mustafa Limited paid $537,907.40 for 12% bonds with a maturity value of $500,000. The bonds provide the bondholders with a 10% yield. They are dated January 1, 2020, and mature on January 1, 2025, with interest receivable on December

> Chuckwalla Limited purchased a computer for $7,000 on January l, 2020. Straight-line depreciation is used for the computer, based on a five-year life and a $1,000 residual value. In 2022, the estimates are revised. Chuckwalla now expects the computer wil

> (Entries for Cost/ Amortized Cost Investments) On January 1, 2020, Kenn Corp. purchased at par 10% bonds having a maturity value of $300,000. They are dated January 1, 2020, and mature on January 1, 2025, with interest receivable on December 31 of each y

> Each of the following investments is independent of the others. 1. A bond that will mature in four years was bought one month ago when the price dropped. As soon as the value increases, which is expected next month, it will be sold. 2. Ten percent of the

> Tennessee Corp., reporting under ASPE, has provided the following information regarding its intangible assets: 1. A patent was purchased from Marvin Inc. for $1.2 million on January 1, 2019. Tennessee estimated the patent's remaining useful life to be 1

> In 2020, Inventors Corp. spent $392,000 on a research project, but by the end of 2020 it was impossible to determine whether any benefit would come from it. Inventors prepares financial statements in accordance with IFRS. Instructions a. What account

> Oakville Corp. incurred the following costs during 2020 in connection with its research and development phase activities: Instructions a. Calculate the amount to be reported as research and development expense by Oakville on its income statement for 20

> In early January 2020, FJS Corporation applied for and received approval for a trade name, incurring legal costs of $52,500. In early January 2021, FJS incurred $28,200 in legal fees in a successful defense of its trade name. Instructions a. Management

> Institute Limited organized late in 2019 and set up a single account for all intangible assets. The following summary shows the entries in 2020 (all debits) that have been recorded in Intangible Assets since then: Instructions a. Prepare the necessary

> As the recently appointed auditor for Daleara Corporation, you have been asked to examine selected accounts before the six-month financial statements of June 30, 2020, are prepared. The controller for Daleara Corporation mentions that only one account is

> Selected information follows for Mount Olympus Corporation for three independent situations: 1. Mount Olympus purchased a patent from Bakhshi Co. for $1.8 million on January 1, 2018. The patent expires on January l, 2028, and Mount Olympus is amortizing

> Net income figures for Belgian Ltd. are as follows: Future income is expected to continue at the average amount of the past five years. The company's identifiable net assets are appraised at $460,000 on December 31, 2020. The business is to be acquired b

> Wildcat Mining Limited is nearing the end of the useful life of its only remaining natural resource that it is mining in northern Quebec. The balance of its Common Shares account is $2,500,000, Retained Earnings is $3,850,000, and Accumulated Depletion i

> Rotterdam Corporation's pretax accounting income of $725,000 for the year 2020 includedthe following items: Ewing Industries Ltd. would like to purchase Rotterdam Corporation. In trying to measure Rotterdam's normalized earnings for 2020, Ewing determine

> The following is net asset information for the Dhillon Division of Klaus Inc.: The purpose of the Dhillon Division (also identified as a reporting unit or cash-generating unit) is to develop a nuclear-powered aircraft. If successful, travelling delays t

> Berrie Electric Inc. has the following amounts included in its general ledger at December 31, 2020: Instructions a. Based on the information provided, calculate the total amount for Berrie to report as intangible assets on its statement of financial p

> On July 1, 2020, Zoe Corporation purchased the net assets of Soorya Company by paying $415,000 cash and issuing a $50,000 note payable to Soorya Company. At July 1, 2020, the statement of financial position of Soorya Company was as follows: The recorded

> Fred Moss, owner of Medici Interiors Inc., is negotiating for the purchase of Athenian Galleries Ltd. The condensed statement of financial position of Athenian follows in an abbreviated form: Medici and Athenian agree that the land is undervalued by $40,

> Refer to the information provided in El2.l 7, but now assume that Lighting Designs Corp. is a publicly accountable company. At December 31, 2020, the copyright's value in use is $1,850,000 and its selling costs are $100,000. Instructions a. Prepare th

> The following information is for a copyright owned by Lighting Designs Corp., a private entity, at December 31, 2020. Lighting Designs Corp. applies ASPE. Assume that Lighting Designs Corp. will continue to use this copyright in the future. As at Decem

> Repeat El2.13, but now assume that the licence was granted in perpetuity and has an indefinite life, and that Dayton prepares financial statements in accordance with ASPE. At the end of 2020, Dayton Corporation owns a licence with a remaining life of 10

> Repeat El2.13, but now assume that the licence was granted in perpetuity and has an indefinite life. In El2.13 At the end of 2020, Dayton Corporation owns a licence with a remaining life of 10 years and a carrying amount of $530,000. Dayton expects undis

> Repeat El2.13, but now assume that Dayton prepares financial statements in accordance with ASPE, and that the recoverable amount under ASPE (undiscounted future cash flows) is calculated to be $500,000 at the end of 2021. In El2.13 At the end of 2020, D

> Andeo Corporation purchased a truck at the beginning of 2020 for $48,000. The truck is estimated to have a residual value of $3,000 and a useful life of 275,000 km. It wasdriven for 52,000 km in 2020 and 65,000 km in 2021. (a) Calculate depreciation expe

> Blue and White Town Taxi Incorporated applied for several taxi licences for its taxicab operations in the Town of Somerville and, on August 31, 2020, incurred costs of $12,500 in the application process. The outcome of applying for taxi licences in theto

> During 2020, Saskatchewan Enterprises Ltd., a private entity, incurred$4.7 million in costs to develop a new software product called Dover. Of this amount, $1.8 million was spent before the company determined that the product was technologically and fina

> Selected account information follows for Entertainment Inc. as at December 31, 2020. All the accounts have debit balances. Assume the company uses IFRS when preparing financial statement Instructions a. Identify which items should be classified as inta

> In early January 2020, Chi Inc., a private enterprise that applies ASPE, purchased 40% of the common shares of Washi Corp. for $410,000. Chi was now able to exercise considerable influence in decisions made by Washi's management. Washi Corp.'s statement

> On January 3, 2020, Mego Limited purchased 3,000 (30%) of the common shares of Sonja Corp. for $438,000. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: During 2020, Sonja reported

> The following are two independent situations. Situation 1: Lauren Inc. received dividends from its common share investments during the year ended December 31, 2020, as follows: • A cash dividend of $12,250 is received from Peel Corporation. Lauren owns a

> On January l, 2020, Rae Corporation purchased 30% of the common shares of Martz Limited for $196,000. Martz Limited shares are not traded in an active market. The carrying amount of Martz's net assets was $520,000 on that date. Any excess of the purchase