Question: Drinkwater Inc. reported the following

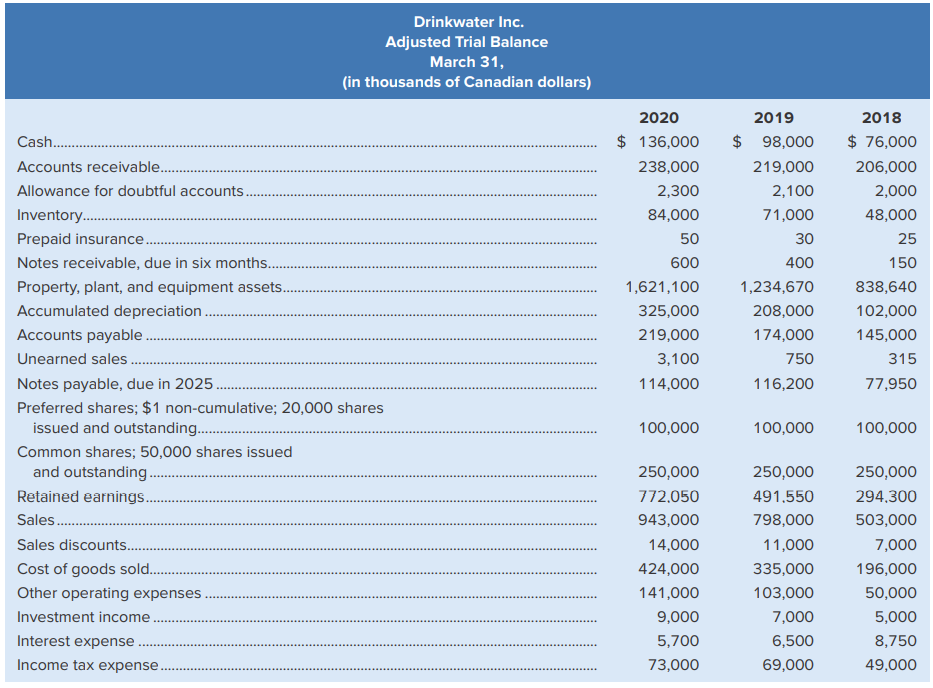

Drinkwater Inc. reported the following information:

Other information:

1. No shares were issued during the years ended March 31, 2020 and 2019.

2. No dividends were declared or paid during the years ended March 31, 2020 and 2019.

3. The market values per common share at March 31, 2020, and March 31, 2019, were $29 and $25, respectively.

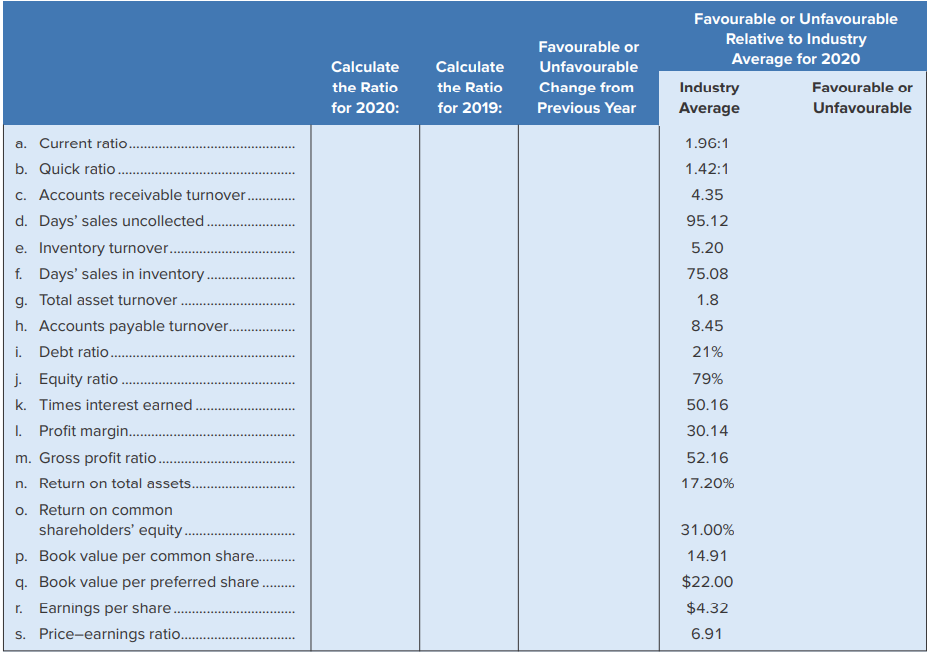

4. Industry averages for 2020 were as provided in the chart on the following page.

Required

1. Using the information provided for Drinkwater Inc., prepare a comparative, single-step income statement and statement of changes in equity for the years ended March 31, 2020 and 2019, as well as a comparative classified balance sheet at March 31, 2020 and 2019.

2. Complete the chart below for Drinkwater Inc. (round all ratios to two decimal places):

> Phillip and Case are in the process of forming a partnership to import Belgian chocolates, to which Phillip will contribute one-third time and Case full time. They have discussed the following alternative plans for sharing profit and losses. a. In the ra

> Jenkins, Willis, and Trent invested $100,000, $175,000, and $225,000, respectively, in a partnership. During its first year, the firm recorded profit of $300,000. Required: Prepare entries to close the firm’s Income Summary account as of December 31 and

> Eyelash Extension Co.’s liabilities as reported on the June 30, 2020, balance sheet are shown below, along with its statement of changes in equity. Jan is selling the business. A potential buyer has hired an accountant to review the acc

> Western Refrigeration borrowed $230,000 to purchase inventory on September 15, 2020 for 45 days at 6% interest by signing a note. On December 6, 2020, Western Refrigeration sold an industrial fridge for cash of $12,000 (cost $9,400) with a two-year parts

> Modern Electronics Company purchases merchandise inventory from several suppliers. On April 1, 2020, Modern Electronics purchased from Speedy Supplies $100,000 of inventory on account. On May 15, 2020, Modern Electronics sold inventory to a Jones Apartme

> White Water Adventure is a travel adventure business that operates from about April to October each year. The company has an outstanding reputation for the quality of its tours and as a result pre-books customers a full year in advance. Customers must pa

> The equity section from the December 31, 2020 balance sheet of Candace Candy Corporation appeared as follows: The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Candace Candy): Feb. 10 A $1.50 per shar

> Okanagan Refrigeration manufactures and markets commercial refrigeration systems for food trucks and specialized transport trucks. It was disclosed in notes to the company’s financial statements that estimated warranty costs are accrued at the time produ

> On November 10, 2020, Singh Electronics began to buy and resell scanners for $55 each. Singh uses the perpetual system to account for inventories. The scanners are covered under a warranty that requires the company to replace any non-working scanner with

> Zing Cell Phone Company entered into the following transactions involving current liabilities during 2020 and 2021: Required 1. Determine the maturity dates of the three notes just described. 2. Present journal entries for each of the preceding dates.

> Quebec Construction Company purchased some equipment on September 10, 2020, that had a cost of $190,000 (ignore GST/PST). Show the journal entries that would record this purchase and payment under these three separate situations: a. The company paid cash

> Golden Wedding Dress Company designs custom wedding dresses for brides to be. The person preparing the adjusting entries at year-end was unable to complete the adjustments due to illness. You have been given the following unadjusted trial balance along w

> On January 2, 2020, Brook Company acquired machinery by issuing a 3%, $360,000 note due in five years on December 31, 2024. Annual payments are $78,608 each December 31. The payment schedule is: Required: Using the information provided, complete the foll

> Ocean Fishers Ltd. had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2012, for $77,000. The PPE subledger shows the following information regarding the boat: On June 27, 2020, $63,000 cash was paid for a new motor to replace

> Copper Explorations recently acquired the rights to mine a new site. Equipment and a truck were purchased to begin mining operations at the site. Details of the mining assets follow: Copper’s year-end is December 31 and it uses the stra

> On October 1, 2020, Kingsway Broadcasting purchased for $288,000 the copyright to publish the music composed by a local Celtic group. Kingsway expects the music to be sold over the next three years. The company uses the straight-line method to amortize i

> Zephyr Minerals completed the following transactions involving machinery. Machine No. 1550 was purchased for cash on April 1, 2020, at an installed cost of $52,900. Its useful life was estimated to be six years with a $4,300 trade-in value. Straight-line

> The following table shows the balances from various accounts in the adjusted trial balance for Decoma International Corp. as of December 31, 2020: Required 1. Assuming that the company’s income tax rate is 25%, what are the tax effects

> In 2020, Staged Home Ltd. completed the following transactions involving delivery trucks: July 5: Traded in an old truck and paid $25,600 in cash for furniture. The accounting records on July 1 showed the cost of the old truck at $36,000 and related accu

> Vita Water purchased a used machine for $116,900 on January 2, 2020. It was repaired the next day at a cost of $4,788 and installed on a new platform that cost $1,512. The company predicted that the machine would be used for six years and would then have

> Endblast Productions showed the following selected asset balances on December 31, 2020: Required: Prepare the entries for each of the following (round final calculations to the nearest whole dollar). 1. The land and building were sold on September 27, 20

> Safety-First Company completed all of its October 31, 2020, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance. Other information: 1. All accounts have normal balances. 2. $26,400 of the note

> Pete’s Propellers Company showed the following information in its Property, Plant, and Equipment subledger regarding Machine #5027. On January 7, 2020, the machine blade cracked and it was replaced with a new one costing $10,400 purchas

> The December 31, 2020, adjusted trial balance of Maritime Manufacturing showed the following information: Early in 2021, the company made a decision to stop making the items produced by the machinery and buy the items instead. As a result, the remaining

> NeverLate Ltd. completed the following transactions involving delivery trucks: Required: Prepare journal entries to record the transactions.

> At December 31, 2020, Halifax Servicing’s balance sheet showed capital asset information as detailed in the schedule below. Halifax calculates depreciation to the nearest whole month. Required Complete the schedule (round only your fina

> A machine that cost $504,000, with a four-year life and an estimated $48,000 residual value, was installed in Haley Company’s factory on September 1, 2020. The factory manager estimated that the machine would produce 475,000 units of pr

> Logic Co. recently negotiated a lump-sum purchase of several assets from a company that was going out of business. The purchase was completed on March 1, 2020, at a total cash price of $1,260,000 and included a building, land, certain land improvements,

> Fitz Products Inc. reported $1,075,049 profit in 2020 and declared preferred dividends of $75,100. The following changes in common shares outstanding occurred during the year. Jan. 1 78,000 common shares were outstanding. Mar. 1 Declared and issued a 30%

> CHECK FIGURES: 1. Dr. Depreciation Expense, Building $53,000. 1. Dr. Depreciation Expense, Equipment $77,184. 2. Total PPE = $1,144,736 Required 1. Calculate and record depreciation for the year just ended April 30, 2021, for both the building and equipm

> Refer to the information in Problem 9-5A. Redo the question assuming that depreciation for partial periods is calculated using the half-year convention. Data from Problem 9-5: West Coast Tours runs boat tours along the West Coast of British Columbia. On

> West Coast Tours runs boat tours along the West Coast of British Columbia. On March 5, 2020, it purchased, with cash, a cruising boat for $828,000, having a useful life of 10 years or 13,250 hours, with a residual value of $192,000. The companyâ

> Yorkton Company purchased for $415,000 equipment having an estimated useful life of 10 years with an estimated residual value of $25,000. Depreciation is calculated to the nearest month. The company has a December 31 year-end. Required: Complete the fol

> On January 2, 2018, Country Lumber installed a computerized machine in its factory at a cost of $168,000. The machine’s useful life was estimated at four years or a total of 190,000 units with a $35,000 trade in value. Country Lumber&ac

> 1. Classification of current and non-current liabilities is important for the following reason(s): a. Allows external users to assess whether the company has the ability to pay, enabling better financial analysis and decision making b. Internal decision

> 1. Two features distinguishing property, plant, and equipment (PPE) from other assets are that: a. PPE is used in business operations to generate revenue and provides benefits for more than one accounting period. b. PPE is acquired through a contract and

> 1. What are the four key building blocks of financial statement analysis? a. liquidity and efficiency, solvency, profitability, and market b. liquidity and efficiency, solvency, profitability, and industry c. liquidity and efficiency, solvency, profitabi

> 1. Financial statement users are concerned with the statement of cash flows for which of the following reasons: a. It helps users evaluate liquidity and ability to generate resources to repay liabilities b. It helps users evaluate solvency, including the

> 1. Corporations may choose to engage in a non-strategic investment in debt or shares for which of the following reasons: a. To earn greater interest or dividend income on available excess cash b. To earn investment income over the original purchase price

> The equity accounts for Kalimantan Corp. showed the following balances on December 31, 2019: The company completed these transactions during 2020: Jan. 10 Issued 20,000 common shares at $9.60 cash per share. 15 The directors declared a 10% share dividend

> 1. Which of the following terms does not refer to the stated coupon rate of the bond? a. Nominal Rate b. Market Rate c. Contract Rate d. All of the above. 2. Financial leverage is an important finance term that results from which of the following scenar

> 1. A share dividend involves the distribution of which of the following items: a. Shares of the company’s stock without receiving any payment in return b. Income of the company based on the amount declared by the board of directors c. Equity from the com

> 1. Which of the following is not an advantage of the corporate form for organizations: a. Ownership rights are easily transferable b. Continuous life c. Corporate taxation d. Ease of capital accumulation 2. The costs of organizing a corporation are: a.

> 1. Which of the following items should not be included in the partnership agreement: a. Names and contributions of each partner b. Rights and duties expected to be carried out by each partner c. Allocation of profit and losses d. Information on the pers

> Required Answer the following questions by referring to the December 31, 2017, balance sheets for each of WestJet and Spin Master in Appendix II. a. WestJet shows Advance ticket sales of $695,111 (thousand) under current liabilities. Explain what this is

> On August 31, 2020, World Travel Consulting showed the following adjusted account balances in alphabetical order: Required 1. Prepare the liability section of the balance sheet at August 31, 2020 based on the above trial balance. 2. Prepare a corrected b

> Refer to the financial statements for each of Spin Master, Indigo, and WestJet. Required Answer the following questions. Part 1 The *December 31, 2017, balance sheet for Spin Master reports $32,978 (thousand) of PPE. a. What does the $32,978 (thousand) r

> Times TeleCom’s PPE subledger at January 1, 2020, appeared as follows: Required a. Complete the PPE subledger; round calculations to the nearest dollar. b. Using the information from the PPE subledger completed in part (a) and the follo

> Refer to the financial statements for Spin Master, WestJet, Telus, and Indigo. Calculate the following ratios for 2017 and 2016 for each company, indicating whether the change was favourable or unfavourable (round calculations to two decimal places). Fo

> Ozzi Development Inc. showed the following equity account balances on the December 31, 2019, balance sheet: Common shares, unlimited authorized shares, 660,000 shares issued and outstanding = $3,960,000 Retained earnings = 2,030,000 During 2020, the foll

> Refer to WestJet’s statement of cash flows and answer the following questions. a. Identify WestJet’s largest cash outflow during 2017. b. What was the largest cash inflow during 2017? c. Under the operating section of the statement of cash flows, WestJet

> Wong Corporation began operations on January 1, 2019. Its adjusted trial balance at December 31, 2019 and 2020, is shown below along with some other information. Other information regarding Wong Corporation and its activities during 2020: a. Assume all a

> Canadian Tire, a major Canadian retailer, reported the following in its December 30, 2017, financial statements: No other investments were reported. Required 1. On which financial statement would the above information have appeared? 2. Are the investment

> Delta Corporation showed the following adjusted trial balance at its year-end, December 31, 2020: Required Using the information provided, prepare a single-step income statement and a classified balance sheet, in thousands. Analysis Component: Explain th

> Required: Answer the following questions by referring to the 2017 financial statements for each of Spin Master and WestJet. 1. How much of Spin Master’s total assets are financed by debt? by equity? 2. How much total debt does WestJet report on its balan

> ZedCon Inc. intends to raise $10,000,000 for the purpose of expanding operations internationally. Two options are available: • Plan 1: Issue $10,000,000 of 5% bonds payable due in 2030, or • Plan 2: Issue 100,000 commo

> Refer to the financial statements. Part 1 Required Answer the following questions regarding Indigo. a. Did retained earnings increase or decrease from April 1, 2017 to March 31, 2018? b. On what statement can you find Indigo’s earnings per share? Show th

> CHECK FIGURES: 1. Profit = $393,400; 2. Total assets = $2,851,250; Total equity = $2,614,650 LR Enterprises Inc. had the following equity account balances at December 31, 2019: Sales during 2020 totalled $1,560,000 and operating expenses were $998,000. A

> WestJet is a a Canadian company with clear focus on its employees and customers. Reference the financial statements in Appendix II, particularly the link to the notes, referring to Note 11 and 12. Below are selected sections presented for your review: Re

> Barry Bowtie incorporated his business under the name BowTie Fishing Expeditions Corp. on March 1, 2020. It was authorized to issue 30,000 $2 cumulative preferred shares and an unlimited number of common shares. During March, the following equity transac

> Tropical Vacation Inc. has tentatively prepared its financial statements for the year ended December 31, 2020, and has submitted them to you for review. The equity account balances at December 31, 2020, are as follows: The company’s 202

> Refer to the financial statements for Spin Master and WestJet. Required: Answer the following questions. 1. Is Spin Master a partnership? Explain why or why not. 2. Identify whether each of Indigo, Telus, and WestJet is a sole proprietorship, partnership

> Les Waruck, Kim Chau, and Leena Manta formed a partnership, WCM Sales, on January 11, 2020, by investing $68,250, $109,200, and $95,550, respectively. The partnership agreement states that profits and losses are to be shared on the basis of a salary allo

> On January 1, 2020, Bona Vista Co. purchased land, a building, equipment, and tools for a total price of $4,320,000, paying cash of $1,104,000 and borrowing the balance from the bank. The bank appraiser valued the assets as follows: $1,152,000 for the la

> On April 12, 2020, Prism Ltd., a camera lens manufacturer, paid cash of $552,375 for real estate plus $29,400 cash in closing costs. The real estate included land appraised at $249,480; land improvements appraised at $83,160; and a building appraised at

> After planning to build a new plant, Kallisto Backpack Manufacturing purchased a large lot on which a small building was located. The negotiated purchase price for this real estate was $1,200,000 for the lot plus $480,000 for the building. The company pa

> Edmonton Ice Rink purchased a Zamboni ice-resurfacing machine for $28,000, terms 1/10, n/60, FOB shipping point. Edmonton Ice received a freight invoice from On-time Delivery for $450. Edmonton Ice took advantage of the discount. The Zamboni required a s

> Solvency ratios—calculation and analysis Required: Calculate Focus Metals’ solvency ratios for 2019 and 2020 (round answers to two decimal places). Analysis Component: Identify whether the change in each ratio from 201

> Liquidity and efficiency ratios—calculation and analysis Required: Calculate Airspace’s liquidity and efficiency ratios for 2020 and 2019 (round answers to two decimal places). Analysis Component: Identify whether the

> Refer to the information in Exercise 17-6 and calculate the days’ sales in inventory for Furniture Retailers and Custom Furniture Corp for 2020 (round to two decimal places). Which company has the more favourable ratio? Explain why. Da

> Inventory turnover—calculation and analysis a. Calculate the inventory turnover for 2020 for each company (round to two decimal places). b. Can you compare these companies? Explain. c. Review the turnover for Fresh-Cut Flowers Inc. Does

> The equity sections from the December 31, 2019 and 2020, balance sheets of Synergy Acquisition Corporation appeared as follows: The following occurred during 2020: Feb. 15 A $0.48 per share cash dividend was declared, and the date of record was five days

> Western Windows constructs and installs windows for new homes. The sales staff are having a meeting and reviewing the following information to determine how to help reduce days’ sales uncollected. Required a. Calculate the daysâ&#

> Accounts receivable turnover—calculation and analysis You review the above information for your daycare business and it reveals decreasing profits despite increasing sales. You hire an analyst who highlights several points, including th

> Part of your job is to review customer requests for credit. You have three new credit applications on your desk and part of your analysis requires that the current ratios and quick ratios be compared. a. Complete the following schedule (round to two deci

> The following companies are competing in the same industry where the industry norm for the current ratio is 1.6. Required a. Complete the schedule (round to two decimal places). b. Identify the company with the strongest liquidity position. c. Identify t

> CHECK FIGURES: 3. Book value per common share = $92.00 4. Book value per common share = $90.75 Delta Tech Corporation’s common shares are currently selling on a stock exchange at $85 per share, and a recent balance sheet shows the follo

> Book value per common share; Western Grass Inc. Equity Section of Balance Sheet December 31, 2020. Required Using the information provided, calculate book value per common share assuming: a. There are no dividends in arrears. b. There are three years of

> Spence Resources Inc.’s December 31 incomplete balance sheet information follows along with additional information: Required 1. Prepare a three-year comparative balance sheet for Spence Resources Inc. 2. To evaluate the companyâ&#

> The following information is available from the financial statements of Landscape Enhancements Inc.: Calculate Landscape Enhancements’ return on total assets for 2019 and 2020. (Round answers to one decimal place.) Comment on whether th

> Use the following information to calculate the ratio of pledged assets to secured liabilities for both companies: Which company appears to have the riskier secured debt?

> Trend analysis, profitability ratios (millions of $) Required: Calculate Tia’s Trampolines Inc.’s profitability ratios for 2020 (round calculations to two decimal places). Also identify whether each of Tiaâ€

> The original income statements for ZoomMed Inc. presented the following information when they were first published in 2019, 2020, and 2021: The company also experienced some changes in the number of outstanding common shares over the three years through

> Brainium Technologies showed the following information in its Property, Plant, and Equipment subledger regarding a warehouse. During 2020, it was determined that the original useful life on the warehouse doors should be reduced to a total of 12 years and

> Common-size and trend percentages for a company’s net sales, cost of goods sold, and expenses follow: Required: Determine whether the company’s profit increased, decreased, or remained unchanged during this three-year

> Laura’s Fresh Cooking Inc. began operations on January 1, 2019. Laura’s prepares gourmet dinners and delivers to customers in fresh coolers; customers put them in the oven and have a meal within 30 minutes. The busines

> Refer to the information about Western Environmental Inc. presented in Exercise 16-7. Use the direct method and prepare a statement of cash flows. Data from Exercise 16-7: Required: Use the Western Environmental Inc. information given below to prepare a

> Required: Use the Western Environmental Inc. information given below to prepare a statement of cash flows for the year ended June 30, 2020, using the indirect method. a. A note is retired at carrying value. b. The only changes affecting retained earnings

> Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the indirect method: Changes in current asset and current liability accounts dur

> Analyzing cash inflows and outflows Required: Which of the three competing corporations is in the strongest relative position as indicated by its comparative statements of cash flows?

> Green Forest Corp.’s 2020 income statement showed the following: profit, $292,600; depreciation expense, building, $43,000; depreciation expense, equipment, $6,630; and gain on sale of equipment, $7,000. An examination of the company’s current assets and

> The account balances for the non-cash current assets and current liabilities of Kid-game Software Inc. are as follows: During 2020, Kid-game Software Inc. reported depreciation expense of $57,000. All purchases and sales are on account. Profit for 2020 w

> Making adjustments to derive cash flow from operating activities (indirect method) Indicate by an X in the appropriate column whether an item is added or subtracted to derive cash flow from operating activities.

> The summarized journal entries below show the total debits and credits to the Zebra Corporation’s Cash account during 2020. Required Use the information to prepare a statement of cash flows for 2020. The cash flow from operating activit

> Pace Oil & Gas Corp. began operations in 2018. Its balance sheet reported the following components of equity on December 31, 2018. The corporation completed these transactions during 2019 and 2020: Required 1. Prepare journal entries to record the tr

> Rosetta Inc.’s records contain the following information about the 2020 cash flows. Required Prepare a statement of cash flows using the direct method and a note describing non-cash investing and financing activities.

> Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the direct method: Changes in current asset and current liability accounts durin

> In each of the following cases, use the information provided about the 2020 operations of River Bungee Inc. to calculate the indicated cash flow:

> In each of the following cases, use the information provided about the 2020 operations of Prestige Water Corp. to calculate the indicated cash flow:

> The following occurred during the year. Assuming that the company uses the direct method of reporting cash provided by operating activities, indicate the proper accounting treatment for each item by placing an X in the appropriate column.