Question: Duck, an accrual basis corporation, sponsored a

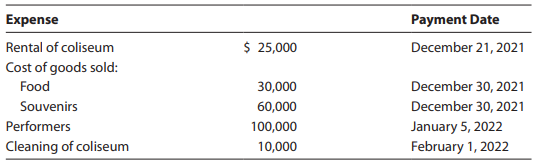

Duck, an accrual basis corporation, sponsored a rock concert on December 29, 2021. Gross receipts were $300,000. The following expenses were incurred and paid as indicated:

Because the coliseum was not scheduled to be used again until January 15, the company with which Duck had contracted did not perform the cleanup until January 8–10, 2022.

a. Calculate Duck’s net income from the concert for tax purposes for 2021.

b. Using the present value tables in Appendix E, what is the true cost to Duck if it had to defer the $100,000 deduction for the performers until 2022? Assume a 5% discount rate and a 21% marginal tax rate in 2021 and 2022.

> Complete the table and use the result to estimate the limit. Use a graphing utility to graph the function to confirm your result.

> Complete the table and use the result to estimate the limit. Use a graphing utility to graph the function to confirm your result.

> Find the derivative of the function by the limit process. f(x) = 7

> Complete the table and use the result to estimate the limit. Use a graphing utility to graph the function to confirm your result.

> Complete the table and use the result to estimate the limit. Use a graphing utility to graph the function to confirm your result.

> Complete the table and use the result to estimate the limit. Use a graphing utility to graph the function to confirm your result.

> Complete the table and use the result to estimate the limit. Use a graphing utility to graph the function to confirm your result.

> Is the limit of f(x) as x approaches c always equal to f(c)? Why or why not?

> Given the limit use a sketch to show the meaning of the phrase “0

> Identify three types of behavior associated with the nonexistence of a limit. Illustrate each type with a graph of a function.

> Write a brief description of the meaning of the notation

> Consider the length of the graph of f(x) = 5/x from (1, 5) to (5, 1).

> How would you describe the instantaneous rate of change of an automobile’s position on a highway?

> Find the slope of the tangent line to the graph of the function at the given point. h(t) = t2 + 4t, (1, 5)

> Estimate the slope of the graph at the points (x1, y1) and (x2, y2).

> How does the tax benefit rule apply in the following cases? a. In 2019, the Orange Furniture Store, an accrual method sole proprietorship, sold furniture on credit for $1,000 to Sammy. The cost of the furniture was $600. In 2020, Orange took a bad debt d

> Sanjay receives a settlement letter from the IRS after his discussion with an IRS appeals officer. He is not satisfied with the $101,000 settlement offer. Identify the relevant issues facing Sanjay if he chooses to contest the settlement offer.

> Starting in 2010 Chuck and Luane have been purchasing Series EE bonds in their name to use for the higher education of their daughter Susie, who currently is age 18. During the year, they cash in $12,000 of the bonds to use for freshman year tuition, fee

> Tonya, who lives in California, inherited a $100,000 State of California bond in 2021. Her marginal Federal tax rate is 35%, she itemizes deductions on her Federal tax return, and her marginal state tax rate is 5%. The California bond pays 3.3% interest,

> In January 2021, Ezra purchased 2,000 shares of Gold Utility Mutual Fund for $20,000. In June, Ezra received an additional 100 shares as a dividend, in lieu of receiving $1,000 in cash dividends. In December, the company declared a two-for-one stock spli

> On March 15, 2021, Helen purchased and placed in service a new Escalade. The purchase price was $62,000, and the vehicle had a rating of 6,500 GVW. The vehicle was used 100% for business. a. Assuming that Helen does not use additional first-year deprecia

> George is a U.S. citizen who is employed by Hawk Enterprises, a global company. Beginning on June 1, 2021, George began working in London. He worked there until January 31, 2022, when he transferred to Paris. He worked in Paris the remainder of 2022. His

> On October 15, 2021, Jon purchased and placed in service a used car. The purchase price was $38,000. This was the only business use asset Jon acquired in 2021. He used the car 80% of the time for business and 20% for personal use. Jon used the regular MA

> On June 5, 2020, Javier Sanchez purchased and placed in service a new 7-year class asset costing $560,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez Landscaping LLC). During 2020, his business generated a net i

> Olga is the proprietor of a small business. In 2021, the business’s income, before consideration of any cost recovery or § 179 deduction, is $250,000. Olga spends $620,000 on new 7-year class assets and elects to take the § 179 deduction on them. She doe

> Lori, who is single, purchased 5-year class property for $200,000 and 7-year class property for $420,000 on May 20, 2021. Lori expects the taxable income derived from her business (before considering any amount expensed under § 179) to be about $550,000.

> Debra acquired the following new assets during 2021. Determine Debra’s cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any available additional first-ye

> On November 4, 2019, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2019 and 2020, respectively, Blue deducted $642 and $5,128 of cost recovery. These amounts were incorrect; Blue applied the

> Jed, age 55, is married with no children. During 2021, Jed had the following income and expense items: a. Three years ago, Jed loaned a friend $10,000 to help him purchase a new car. In June of the current year, Jed learned that his friend had been decla

> During 2021, Rick and his wife, Sara, had the following items of income and expense to report: Gross receipts from business ……………………………………………………………..$400,000 Business expenses ……………………………………………………………………………….525,000 Interest income from bank savings accou

> Xinran, who is married and files a joint return, owns a grocery store. In 2021 his gross sales were $276,000, and operating expenses were $320,000. Other items on his 2021 return were as follows: Nonbusiness capital gains (short term) â€&brvba

> Patrick and Eva are planning to divorce in 2021. Patrick has offered to pay Eva $12,000 each year until their 11-year-old daughter reaches age 21. Alternatively, Patrick will transfer to Eva common stock that he owns with a fair market value of $100,000.

> Rosa’s employer has instituted a flexible benefits program. Rosa will use the plan to pay for her daughter’s dental expenses and other medical expenses that are not covered by health insurance. Rosa is in the 24% marginal tax bracket and estimates that t

> Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2021: Gross receipts from business …………………………………………………………..$144,000 Business expenses ……………………………………………………………………………180,000 Net capital gain …………………

> Timothy Gates and Prada Singh decide to form a new company, TGPS LLC (a multimember LLC that will report its operations as a partnership). Timothy is married, and Prada is single. Each contributes $400,000 of capital to begin the business, and both mater

> During 2021, Leisel, a single taxpayer, operates a sole proprietorship in which she materially participates. Her proprietorship generates gross income of $142,000 and deductions of $420,000, resulting in a loss of $278,000. The large deductions are due t

> Blue Corporation, a manufacturing company, decided to develop a new line of merchandise. The project began in 2019. Blue had the following expenses in connection with the project: The new product will be introduced for sale beginning in July 2021. Determ

> On July 24 of the current year, Trevor Pickard was involved in an accident with his business use automobile. Trevor had purchased the car for $30,000. The automobile had a fair market value of $20,000 before the accident and $8,000 immediately after the

> Heather owns a two-story building. The building is used 40% for business use and 60% for personal use. During 2021, a fire caused major damage to the building and its contents. Heather purchased the building for $800,000 and has taken depreciation of $10

> Olaf lives in the state of Minnesota. In May 2021, a tornado hit the area and damaged his home and automobile. Applicable information is as follows: Because of the extensive damage caused by the tornado, the President designated the area a Federal disast

> Monty loaned his friend Ned $20,000 three years ago. Ned signed a note and made payments on the loan. Last year, when the remaining balance was $11,000, Ned filed for bankruptcy and notified Monty that he would be unable to pay the balance on the loan. M

> For 2021, MSU Corporation has $500,000 of adjusted taxable income, $22,000 of business interest income, and $120,000 of business interest expense. It has average annual gross receipts of more than $26,000,000 over the prior three taxable years. a. What i

> Chee, single, age 40, had the following income and expenses during 2021: Income Salary………………………………………………………………………… $43,000 Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) ………………………………….4,000 Municipal bond interes

> Bluebird, Inc., does not provide its employees with any tax-exempt fringe benefits. The company is considering adopting a hospital and medical benefits insurance plan that will cost approximately $9,000 per employee. To adopt this plan, the company may h

> Comment on the availability of head-of-household filing status for 2021 in each of the following independent situations: a. Taxpayer lives alone but maintains the household of his parents. In July 2021, the parents use their savings to purchase a new BMW

> Alex, who is single, conducts an activity in 2021 that is appropriately classified as a hobby. The activity produces the following revenues and expenses: Revenue ………………………………………………………….$18,000 Property taxes ……………………………………………………..3,000 Materials and supp

> Jamari Peters (Social Security number 123-45-6789) conducts a business with the following results in 2021: Revenue ………………………………………………………….$20,000 Depreciation on car ………………………………………………3,960 Operating expenses of car ………………………………………3,100 Rent ………………………………

> Terry traveled to a neighboring state to investigate the purchase of two hardware stores. His expenses included travel, legal, accounting, and miscellaneous expenses. The total was $52,000. He incurred the expenses in June and July 2021. Under the follow

> Fynn incurred and paid the following expenses during 2021: • $50 for a ticket for running a red light while he was commuting to work. • $100 for a ticket for parking in a handicapped parking space. • $200 to an attorney to represent him in traffic court

> Suzanne, a single taxpayer, operates a printing business as a sole proprietor. The business has two employees who are paid a total of $90,000 during 2021. Assume that the business has no significant assets. During 2021, the business generates $150,000 of

> A list of the items that Faith sold and the losses she incurred during the current tax year is as follows: Yellow, Inc. stock ………………………………………………$ 1,600 Faith’s personal use SUV ………………………………………8,000 Faith’s personal residence …………………………………...10,000 City o

> María, age 32, earns $60,000 working in 2021. She has no other income. Her medical expenses for the year total $6,000. During the year, she suffers a casualty loss of $9,500 when her apartment is damaged by flood waters (part of a Federally declared disa

> Daniel, age 38, is single and has the following income and expenses in 2021: Salary income ………………………………………………………………………………$65,000 Net rent income………………………………………………………………………………. 6,000 Dividend income ………………………………………………………………………………3,500 Payment of alimony (

> Bertha is considering taking an early retirement offered by her employer. She would receive $3,000 per month, indexed for inflation. However, she would no longer be able to use the company’s health facilities, and she would be required to pay her hospita

> Tim is the vice president of western operations for Maroon Oil Company and is stationed in San Francisco. He is required to live in an employer-owned home, which is three blocks from his company office. The company-provided home is equipped with high-spe

> Belinda spent the last 60 days of 2021 in a nursing home. The cost of the services provided to her was $18,000 ($300 per day). Medicare paid $8,500 toward the cost of her stay. Belinda also received $7,500 of benefits under a long-term care insurance pol

> The UVW Union and HON Corporation are negotiating contract terms. Assume that the union members are in the 24% marginal tax bracket and that all benefits are provided on a nondiscriminatory basis. Write a letter to the UVW Union members, explaining the t

> Rex purchased a 30% interest in a partnership for $200,000. In 2021, the partnership generated $400,000 of taxable income and Rex withdrew $100,000. In 2022, the partnership earned $600,000 of taxable income and Rex withdrew $200,000. What is Rex’s gross

> Adrian was awarded an academic scholarship to State University for the 2021–2022 academic year. He received $6,500 in August and $7,200 in December 2021. Adrian had enough personal savings to pay all expenses as they came due. Adrian’s expenditures for t

> Donald was killed in an accident while he was on the job. Darlene, Donald’s wife, received several payments as a result of Donald’s death. What is Darlene’s gross income from the items listed below? a. Donald’s employer paid Darlene an amount equal to Do

> What is the taxpayer’s gross income in each of the following situations? a. Darrin received a salary of $50,000 from his employer, Green Construction. b. In July, Green gave Darrin an all-expense-paid trip to Las Vegas (value of $3,000) for exceeding his

> In March 2021, Kuni asks you to prepare his Federal income tax returns for tax years 2018, 2019, and 2020. In discussing this matter with him, you discover that he also has not filed for tax year 2017. When you mention this fact, Kuni tells you that the

> Regarding the statute of limitations on additional assessments of tax by the IRS, determine the applicable period in each of the following situations. Assume a calendar year individual with no fraud or substantial omission involved. a. The income tax ret

> In each of the following situations, indicate whether the 50% reduction for meals applies. Assume the year is 2023. a. Each year, the employer awards its top salesperson an all-expense-paid trip to Jamaica. b. The employer has a cafeteria for its employe

> Interpret each of the following citations: a. 14 T.C. 74 (1950). b. 592 F.2d 1251 (CA–5, 1979). c. 95–1 USTC ¶50,104 (CA–6, 1995). d. 75 AFTR2d 95–110 (CA–6, 1995). e. 223 F.Supp. 663 (W.D. Tex., 1963). f. 491 F.3d 53 (CA–1, 2007). g. 775 F.Supp.2d 765 (

> Paul wholly owns and operates an office supplies business and a printing/ shipping business through separate entities. The office supplies business and printing/shipping business share centralized purchasing to obtain volume discounts and share a central

> Identify the requirements that must be met in order to aggregate businesses for purposes of the QBI deduction.

> At the beginning of the current year, Henry purchased a ski resort for $10,000,000. Henry does not own the land on which the resort is located. The Federal government owns the land, and Henry has the right to operate the resort on the land pursuant to Sp

> Aubry, a cash basis and calendar year taxpayer, decides to reduce his taxable income for 2021 by buying $65,000 worth of supplies for his business on December 27, 2021. The supplies will be used up in 2022. a. Can Aubry deduct the expenditure for 2021? E

> In May 2021, Gwen began searching for a trade or business to acquire. In anticipation of finding a suitable acquisition, Gwen hired an investment banker to evaluate three potential businesses. She also hired a law firm to begin drafting regulatory approv

> Amos began a business, Silver LLC (a single-member LLC), on July 1, 2018. The business extracts and processes silver ore. During 2021, as a result of a decline in demand for silver ore, Amos expects to generate a large loss. Identify the relevant tax iss

> In 2018, John opened an investment account with Randy Hansen, who held himself out to the public as an investment adviser and securities broker. John contributed $200,000 to the account in 2018. John provided Randy with a power of attorney to use the $20

> In 2021, Kelsey sustained a loss on the theft of a painting. She had paid $20,000 for the painting, but it was worth $40,000 at the time of the theft. Evaluate the tax consequences of treating the painting as investment property or as personal use proper

> Dolly is a cash basis taxpayer. In 2021, she filed her 2020 South Carolina income tax return and received a $2,200 refund. Dolly took the standard deduction on her 2020 Federal income tax return but will itemize her deductions in 2021. Molly, a cash basi

> In January 2021, Sonja deposited $20,000 in a bank in the Bahamas. She earned $500 interest income. She closed the account in December 2021. a. Is Sonja subject to the FBAR reporting requirement? Explain. b. Is the interest income taxable in the United S

> Nanette, a single taxpayer, is a first-grade teacher. Potential deductions are charitable contributions of $800, personal property taxes on her car of $240, and various supplies purchased for use in her classroom of $225 (none reimbursed by her school).

> Connor purchased an annuity that was to pay him a fixed amount each month for the remainder of his life. He began receiving payments in 2004, when he was 65 years old. In 2021, Connor was killed in an automobile accident. What are the effects of the annu

> In 2020, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2020, Henry’s qualified business income from drivi

> In 2021, the CEO of Crimson, Inc., entertains seven clients at a skybox in Memorial Stadium for a single athletic event during the year. Substantive business discussions occurred at various times during the event. The box costs $2,000 per event and seats

> In 2021, Larry and Susan each invest $10,000 in separate investment activities. They each incur deductible expenses of $800 associated with their respective investments. Explain why Larry’s expenses might not be deductible and Susan’s expenses might be a

> On March 25, Parscale Company purchases the rights to a mineral interest for $8,000,000. At that time, the remaining recoverable units in the mineral interest are estimated to be 500,000 tons. If 80,000 tons are mined and 75,000 tons are sold this year,

> On October 1, 2021, Verónica purchased a business. Of the purchase price, $60,000 is allocated to a patent and $375,000 is allocated to goodwill. Calculate Verónica’s 2021 § 197 amortization deduction.

> On April 5, 2021, Kinsey places in service a new automobile that cost $60,000. He does not elect $179 expensing, and he elects not to take any available additional first-year depreciation. The car is used 70% for business and 30% for personal use in each

> McKenzie purchased qualifying equipment for his business that cost $212,000 in 2021. The taxable income of the business for the year is $5,600 before consideration of any § 179 deduction. a. Calculate McKenzie’s § 179 expense deduction for 2021 and any c

> Diana acquires, for $65,000, and places in service a 5-year class asset on December 19, 2021. It is the only asset that Diana acquires during 2021. Diana does not elect immediate expensing under § 179. She elects additional firstyear deprecation. Calcula

> Andre acquired a computer on March 3, 2021, for $2,800. He elects the straight-line method for cost recovery. Andre does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. Calculate Andre’s cost

> Lopez acquired a building on June 1, 2016, for $1,000,000. Calculate Lopez’s cost recovery deduction for 2021 if the building is: a. Classified as residential rental real estate. b. Classified as nonresidential real estate.

> Hamlet acquires a 7-year class asset on November 23, 2021, for $100,000 (the only asset acquired during the year). Hamlet does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. Calculate Hamlet

> Emily, who is single, sustains an NOL of $7,800 in 2021. The loss is carried forward to 2022. For 2022, Emily’s income tax information before taking into account the 2021 NOL is as follows: How much of the NOL carryforward can Emily use

> Valeria and Trey are married and file a joint tax return. For 2021, they have $4,800 of nonbusiness capital gains, $2,300 of nonbusiness capital losses, $500 of interest income, and no itemized deductions. The standard deduction for married filing jointl

> Sally Andrews calls you on the phone. She says that she has found a 2015 letter ruling that agrees with a position she wants to take on her tax return. She asks you about the precedential value of a letter ruling. Draft a memo for the tax files, outlinin

> Sandstorm Corporation decides to develop a new line of paints. The project begins in 2021. Sandstorm incurs the following expenses in 2021 in connection with the project: Salaries ………………………………………………………………$85,000 Materials ……………………………………………………………...30,000

> Belinda was involved in a boating accident in 2021. Her speedboat, which was used only for personal use and had a fair market value of $28,000 and an adjusted basis of $14,000, was completely destroyed. She received $10,000 from her insurance company. He

> Noelle’s diamond ring was stolen in November 2017. She originally paid $8,000 for the ring, but it was worth considerably more at the time of the theft. Noelle filed an insurance claim for the stolen ring, but the claim was denied. Because the insurance

> On May 9, 2019, Calvin acquired 250 shares of stock in Hobbes Corporation, a new startup company, for $68,750. Calvin acquired the stock directly from Hobbes, and it is classified as § 1244 stock (at the time Calvin acquired his stock, the corporation ha

> In 2021, David is age 78, is a widower, and is being claimed as a dependent by his son. How does this situation affect the following? a. David’s own individual filing requirement. b. The standard deduction allowed to David. c. The availability of any add

> Lime Finance Company requires its customers to purchase a credit life insurance policy associated with the loans it makes. Lime is the beneficiary of the policy to the extent of the remaining balance on the loan at the time of the customer’s death. In 20

> In late 2021, the Polks come to you for tax advice. They are considering selling some stock investments for a loss and making a contribution to a traditional IRA. In reviewing their situation, you note that they have large medical expenses and a casualty

> In 2019, Emma purchased an automobile, which she uses for both business and personal purposes. Although Emma does not keep records as to operating expenses (e.g., gas, oil, and repairs), she can prove the percentage of business use and the miles driven e

> Fred specified in his will that his nephew John should serve as executor of Fred’s estate. John received $10,000 for serving as executor. John inherited $100,000 of cash from his uncle as well. He also borrowed $5,000 when he bought a new car this year.