Question: During 2017, Darwin Corporation started a

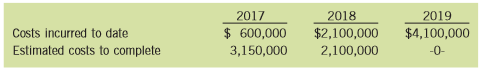

During 2017, Darwin Corporation started a construction job with a contract price of $4.2 million. Darwin ran into severe technical difficulties during construction but managed to complete the job in 2019. The contract is non-cancellable. Under the terms of the contract, Darwin sends billings as revenues are earned. Billings are nonrefundable. The following information is available:

Instructions:

(a) Calculate the amount of gross profit that should be recognized each year under the percentage-of-completion method.

(b) Prepare the journal entries for 2018 to recognize the revenue from the contract, assuming the percentage-of completion method is used. Explain the treatment of losses under the percentage-of-completion method.

(c) Calculate the amount of gross profit or loss that should be recognized each year under the completed-contract method. Explain the treatment of losses under the completed-contract method.

Transcribed Image Text:

2017 2018 2019 Costs incurred to date $ 600,000 $2,100,000 $4,100,000 Estimated costs to complete 3,150,000 2,100,000 -0-

> Cyan Corporation is a manufacturer of paints and specialty coatings. In March 2017, Beck Inc. fi led a lawsuit against Cyan Corporation for alleged patent infringement, claiming $1.1 million in damages. Cyan’s lawyer disputed the claim, but in December 2

> Store-it-Here owns a warehouse. On September 1, it rented storage space to a lessee (tenant) for six months for a total cash payment of $12,000 received in advance. Prepare two sets of journal entries for Store-it-Here, with each set of journal entries r

> Several of Kimper Corporation’s major customers experienced cash flow problems in 2017, mainly due to their increasing labour and production costs in 2016 and 2017. As a result, Kimper’s accounts receivable turnover ratio (net sales revenue/average trade

> What is the purpose of a financial audit?

> In 2017, I & T Corporation reported net income of $8.6 million, and declared and paid preferred share dividends of $3.2 million. During 2017, I & T had a weighted average of 900,000 common shares outstanding. Calculate I & T’s 2017 earnings per share.

> Obtain the auditor’s reports for TELUS Corporation. Identify and read the opinion paragraph. Explain why it is important for auditors to understand the business model and business environment (including the nature of the industry) before they can render

> Neon Limited had 40,000 common shares on January 1, 2017. On April 1, 8,000 shares were repurchased. On August 31, 12,000 shares were issued. Calculate the number of shares outstanding at December 31, 2017, and the weighted average number of shares for 2

> Brookfield Asset Management’s financial statements can be found at the end of this book Instructions: Refer to the company’s financial statements and accompanying notes to answer these questions. (a) What business is Brookfield Asset Management in? (b)

> Use the information in BE4-17 to prepare a statement of retained earnings for Global Corporation, assuming that in 2017, Global discovered that it had overstated 2014 depreciation by $40,000 (net of tax). Data from BE4-17: Global Corporation prepares f

> Global Corporation prepares financial statements in accordance with ASPE. At January 1, 2017, the company had retained earnings of $1,038,000. In 2017, net income was $335,000, and cash dividends of $70,000 were declared and paid. Prepare a 2017 statemen

> Parfait Limited reports the following for 2017: sales revenue, $900,000; cost of sales, $750,000; operating expenses, $100,000; and unrealized gain on FV-OCI investments, $60,000. The company had January 1, 2017 balances as follows: common shares, $600,0

> The Blue Collar Corporation had income from continuing operations of $12.6 million in 2017. During 2017, it disposed of its restaurant division at an after-tax loss of $89,000. Before the disposal, the division operated at a loss of $315,000 (net of tax)

> Use the information in BE4-12 to prepare a multiple-step income statement for Sierra Corporation, showing expenses by function. Data from BE4-12: Sierra Corporation had net sales revenue of $5,850,000 and investment revenue of $227,000 for the year end

> Sierra Corporation had net sales revenue of $5,850,000 and investment revenue of $227,000 for the year ended December 31, 2017. Other items pertaining to 2017 were as follows: Sierra has 100,000 common shares outstanding throughout the year. Prepare a

> Argon Noble Limited has approved a formal plan to sell its head office tower to an outside party. A detailed plan has been approved by the board of directors. The building is on the books at $50 million (net book value). The estimated selling price is $4

> Sunmart Inc. is a discount retailer with 1,000 stores located across North America. Sunmart purchases bulk quantities of groceries and household goods, and then sells the goods directly to retail customers at a markup. Pharmedical Inc. is a pharmaceutica

> What are the major objectives of financial reporting?

> Pelican Inc. made a December 31 adjusting entry to debit Salaries and Wages Expense and credit Salaries and Wages Payable for $2,700. On January 2, Pelican paid the weekly payroll of $5,000. Prepare Pelican’s (a) January 1 reversing entry, (b) January 2

> The financial statements of Quebecor Inc. and Thomson Reuters Corporation for their fi scal years ended December 31, 2014, can be found on SEDAR (www.sedar.com) or the companies’ websites. Instructions: (a) What business is Quebecor Inc. in? Is Thomson

> Jerry Holiday is the maintenance supervisor for Ray’s Insurance Co. and has recently purchased a riding lawn mower and accessories that will be used in caring for the grounds around corporate headquarters. He sent the following informat

> Included in Carville Corp.’s December 31, 2017 trial balance is a note payable of $20,000. The note is an eight-month, 12% note dated October 1, 2017. Prepare Carville’s December 31, 2017 adjusting entry to record the accrued interest, and June 1, 2018 j

> On August 1, Secret Sauce Technologies Inc. paid $12,600 in advance for two years’ membership in a global technology association. Prepare two sets of journal entries for Secret Sauce, with each set of journal entries recording the August 1 journal entry

> Presented below are four different transactions related to materiality. Explain whether you would classify these transactions as material. (a) Blair Inc. has reported a positive trend in earnings over the last three years. In the current year, it reduces

> Determine the amount of interest that will be earned on each of the following investments: (n) () Interest Rate Number of Type of Interest Simple Simple Compound Investment Periods (a) (b) (c) $100 $500 $500 5% 6% 6% 122

> Medici Patriarchs purchased the following investments during 2017: (a) 1,000 shares of Private Limited, a start-up company. The value of this investment was based on an internally developed model. (b) 5,000 shares of CIBC, a public company listed on the

> Identify which specific qualitative characteristic of accounting information is best described in each item below. (a) The annual financial reports of Treelivingo Corp. are audited by public accountants. (b) Able Corp. and Mona, Inc., both use the straig

> Assume that you are following IFRS 13 and measuring the fair value of a building. The building is currently being rented out. Under IFRS 13, the entity must determine the following: (a) how the item could be/is used (b) the market and (c) the valuation t

> Alpha Company signs a contract to sell the use of its patented manufacturing technology to Delta Corp for 15 years. The contract for this transaction stipulates that Delta Corp pays Alpha $18,000 at the end of each year for the use of this technology. Us

> Chang Company must perform an impairment test on its equipment. The equipment will produce the following cash flows: Year 1, $35,000; Year 2, $45,000; Year 3, $55,000. The discount rate is 10%. What is the value in use for this equipment?

> Obtain the 2001 and 2014 annual reports of Goldcorp Inc. from SEDAR (www.sedar.com). Read the annual report material leading up to the financial statement section and answer the following questions: (a) Explain how the company’s business changed in the t

> For each item that follows, identify the foundational principle of accounting that best describes it. (a) For its annual reports, Sumsong Corp. divides its economic activities into 12-month periods. (b) Sullivan, Inc., does not adjust amounts in its fina

> Assume that Enter Inc. just issued a $1,000, 10-year bond bearing annual interest of 4%. The company would like to determine the amount that should be recognized on the financial statements. The bond carries a fixed interest rate of 4% (interest is payab

> When using the discounted cash flow model, there are two approaches that are generally accepted. List these two approaches and explain when each might be used to measure a financial statement element.

> Present value concepts are often used for measurement in financial reporting. List five situations where present value techniques are used to measure assets and explain how. List five situations where present value techniques are used to measure liabilit

> In the chapter, there are two common types of valuation techniques noted. Explain the differences between these two models. Note when each of these techniques might be used in measuring financial statement elements.

> Below are some financial statement elements and their basis of measurement for a public company that follows IFRS. Complete the third column by noting whether the basis of measurement is a cost-based measure, a current value measure, or a hybrid measure.

> Tiger Inc. has the following year-end account balances: Sales Revenue $928,900; Interest Income $17,500; Cost of Goods Sold $406,200; Operating Expenses $129,000; Income Tax Expense $55,100; and Dividends $15,900. Prepare the year-end closing entries.

> Assets are the cornerstone of financial reporting; often it is unclear whether an expenditure is an asset or an expense. For each of the transactions described below, consider whether the expenditure should be recorded as an asset or as an expense. Be su

> What is the likely limitation on “general-purpose financial statements”?

> What is the value of having a common set of standards in financial accounting and reporting?

> The audited annual financial statements of Maple Leaf Foods Inc. for the year ended December 31, 2014, can be found on the company’s website or from SEDAR (www.sedar.com). Instructions: (a) Calculate the liquidity and coverage (solvency) ratios identifi

> Discuss whether the following items would meet the definition of an asset using the IFRS definitions currently in place. If so, explain with reference to the appropriate criteria. (a) MBI Ltd. owns a corporate fleet of cars for senior management’s use in

> How are financial accountants pressured when they need to make ethical decisions in their work? Is having technical mastery of GAAP enough to practice financial accounting?

> Some foreign countries have reporting standards that are different from standards in Canada. What are some of the main reasons why reporting standards are often different among countries?

> If the market rate of interest in BE3-34 were 10%, would you choose the same option? Data from BE3-34: As CFO of a small manufacturing firm, you have been asked to determine the best financing for the purchase of a new piece of equipment. If the vendor

> As CFO of a small manufacturing firm, you have been asked to determine the best financing for the purchase of a new piece of equipment. If the vendor is offering repayment options of $10,000 per year for five years, or no payment for two years followed b

> Assume the same information as in BE3-32, except that you can afford to make annual payments of only $6,000. If you decide to trade in your current car to help reduce the amount of financing required, what trade-in value would you need to negotiate to en

> You would like to purchase a car with a list price of $30,000, and the dealer offers financing over a five-year period at 8%. If repayments are to be made annually, what would your annual payments be? Show calculations using three methods (tables, financ

> You are told that a note has repayment terms of $4,000 per year for fi ve years, with a stated interest rate of 4%. How much of the total payment is for principal, and how much is for interest? Show calculations using two methods (financial calculator an

> Guillen Inc. began work on a $7,000,000 non-cancellable contract in 2017 to construct an office building. Guillen uses the completed-contract method under ASPE. At December 31, 2017, the balances in certain accounts were Contract Asset $1,715,000; Accoun

> The financial statements for Bombardier Inc. for the year ended December 31, 2014, can be found on the company’s website or from SEDAR (www.sedar.com). Instructions: (a) What form of presentation does the company use in preparing its balance sheet? (b)

> On April 1, 2017, Dougherty Inc. entered into a cost plus fixed fee non-cancellable contract to construct an electric generator for Altom Corporation. At the contract date, Dougherty estimated that it would take two years to complete the project at a cos

> Nate Beggs signs a one-year contract with BlueBox Video. The terms of the contract are that Nate is required to pay a non-refundable initiation fee of $100. After the first year, membership can be renewed by paying an annual membership fee of $5 per mont

> Lang Inc. had beginning inventory of $22,000 at cost and $30,000 at retail. Net purchases were $157,500 at cost and $215,000 at retail. Net markups were $10,000, net markdowns were $7,000, and sales were $184,500. Calculate the ending inventory at cost u

> Use the information for Brent Hill Company from BE10-23 and BE10-24. Calculate the company’s avoidable borrowing costs assuming Brent Hill Company follows IFRS. How would your answer change if the company followed ASPE? Data from BE10-23: Brent Hill Co

> Brent Hill Company borrowed $1 million on March 1 on a five-year, 12% note to help finance the building construction. In addition, the company had outstanding all year a $2-million, five-year, 13% note payable and a $3.5-million, four-year, 15% note paya

> On December 31, 2017, Grando Company sells production equipment to Fargo Inc. for $50,000. Grando includes a one-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on December 31, 2017. Gr

> On May 31, 2017, Eisler Company consigned 80 freezers, costing $500 each, to Remmers Company. The cost of shipping the freezers amounted to $740 and was paid by Eisler Company. On December 30, 2017, a report was received from the consignee, indicating th

> Using the data from BE12-19, assume that Pipeline Corporation is a private entity. Explain how goodwill will be tested for impairment. If the unit’s carrying amount (including goodwill) is $3,581,000 and its fair value is $3,474,000, determine the amount

> Using the data from BE12-19, assume that Pipeline Corporation is a public company and that the goodwill was allocated entirely to one cash-generating unit (CGU). Two years later, information about the CGU is as follows: carrying amount $3,740,000; value

> Instructions: (a) Explain the principles and criteria for revenue recognition under the earnings approach. (b) For each scenario noted in E6-1, discuss when revenue should be recognized under the earnings approach. Provide the journal entries that would

> The financial statements of Brookfield Asset Management Inc. for its year ended December 31, 2014, appear at the end of this book. Instructions: (a) What alternative formats could the company have used for its balance sheet? Which format did it adopt? (

> se the data provided in BE12-16, except assume that useful life is expected to be unlimited. How would your response change if Coffee Time reported under (a) ASPE or (b) IFRS? Data from BE12-16: Coffee Time Limited has a trademark with a carrying amoun

> Use the data provided in BE12-16. How would your response change if Coffee Time were a public company reporting under IFRS? Data from BE12-16: Coffee Time Limited has a trademark with a carrying amount of $83,750, and expected useful life of 15 years.

> Uddin Publishing Co. publishes college textbooks that are sold to bookstores on the following terms. Each title has a fixed wholesale price, terms f.o.b. shipping point, and payment is due 60 days after shipment. The retailer may return a maximum of 30%

> Organic Growth Company is presently testing a number of new agricultural seeds that it has recently harvested. To stimulate interest, it has decided to grant five of its largest customers the unconditional right to return these products if not fully sati

> Use the information in BE12-13 and assume that in January 2019, Lakeshore spends $26,000 successfully defending a patent suit. In addition, Lakeshore now feels the patent will be useful only for another seven years. Prepare the journal entries to record

> Lakeshore Corporation purchased a patent from MaFee Corp. on January 1, 2017, for $87,000. The patent had a remaining legal life of 16 years. Prepare Lakeshore’s journal entries to record the 2017 patent purchase and amortization.

> Appliance Centre is an experienced home appliance dealer. Appliance Centre also offers a number of services together with the home appliances that it sells. Assume that Appliance Centre sells ovens on a stand-alone basis. Appliance Centre also sells inst

> Seymour Ltd. traded a used welding machine (cost $9,000, accumulated depreciation $2,000, fair value $3,000) for office equipment with an estimated fair value of $8,000. Seymour also paid $4,000 cash in the transaction. Prepare the journal entry to recor

> Chuckwalla Limited purchased a computer for $7,000 on January 1, 2017. Straight-line depreciation is used for the computer, based on a five-year life and a $1,000 residual value. In 2019, the estimates are revised. Chuckwalla now expects the computer wil

> Budget Vacations is a monthly magazine that has been on the market for 18 months. It is owned by a private company and has a circulation of 1.4 million copies. The company is thinking of going public to raise funds for expansion. However, currently, nego

> An excerpt from Section 10.2 of the Management Discussion and Analysis in the 2014 annual report of BCE Inc. is shown below. The excerpt shows summarized financial information, including calculations of earnings before interest, tax, depreciation, and am

> Sanchez Co. enters into a contact to sell Product A and Product B on January 2, 2017, for an upfront cash payment of $150,000. Product A will be delivered in two years (January 2, 2019) and Product B will be delivered in five years (January 2, 2022). San

> TELUS Corporation is one of Canada’s largest telecommunications companies and provides both products and services. Its shares are traded on the Toronto and New York stock exchanges, and its credit facilities contain certain covenants relating to the amou

> On June 3, 2017, Hunt Company sold to Ann Mount merchandise having a sales price of $8,000 (cost $5,600) with terms of 2/10, n/60, f.o.b. shipping point. Hunt estimates that merchandise with a sales value of $800 will be returned. An invoice totalling $1

> Aaron’s Agency sells an insurance policy offered by Capital Insurance Company for a commission of $100. In addition, Aaron will receive a further commission of $10 each year for as long as the policyholder does not cancel the policy. After selling the po

> Sherry Chan has just started up a small corporation that produces jewellery. She has applied for and received a government grant. The grant will automatically be renewed as long as the business shows a profit at year end. Because she is trying to control

> Lots Lumber Limited is a private company that operates in the forestry sector and owns timber lots. The company produces specialty lumber and sells to distributors and retailers. Currently, Lots uses ASPE when preparing its financial statements. It has a

> Jupiter Company sells goods to Danone Inc. on account on January 1, 2017. The goods have a sales price of $610,000 (cost $500,000). The terms of the sale are net 30. If Danone pays within five days, it receives a cash discount of $10,000. Past history in

> The following are independent situations that require professional judgement for determining when to recognize revenue from the transactions. 1. Costco sells you a one-year membership with a single, one-time upfront payment. This non-refundable fee is pa

> Turner Inc. began work on a $7,000,000 non-cancellable contract in 2017 to construct an office building. During 2017, Turner Inc. incurred costs of $1,700,000, billed its customers for $1,200,000 (non-refundable), and collected $960,000. At December 31,

> Brent Hill Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1.5 million on March 1, $1.2 million on June 1, and $3 million on December 31. Calculate Brent Hill’s weighted-average ac

> Access the Investor Perspectives article written by Steve Cooper, a member of the IASB, in June 2015, entitled “A tale of ‘prudence’?” (www.ifrs.org). Mr. Cooper states that two different meanings have been attributed to the term “prudence” when it is us

> Shipper Inc. has acquired a large transport truck at a cost of $90,000 (with no breakdown of the component parts). The truck’s estimated useful life is 10 years. At the end of the seventh year, the powertrain requires replacement. It is determined that i

> On September 1, 2017, Pipeline Corporation acquired Tunneling Limited for a cash payment of $954,000. At the time of purchase, Tunneling’s statement of financial position showed assets of $780,000, liabilities of $420,000, and owners’ equity of $360,000.

> Coffee Time Limited has a trademark with a carrying amount of $83,750, and expected useful life of 15 years. As part of an impairment test on December 31, 2017, due to a change in customer tastes, Coffee Time gathered the following data about the tradem

> On December 31, 2017, Convenient Cabs Incorporated was granted 10 taxi licences by the City of Somerdale, at a cost of $1,000 per licence. It is probable that Convenient Cabs will receive the expected future economic benefits of the taxi licences. There

> Green Earth Corp. has capitalized software costs of $450,000 on a product to be sold externally. During its first year, sales of this product totaled $195,000. Green Earth expects to earn $1,250,000 in additional future revenue from this product, which i

> In the late 1990s, CIBC helped Enron Corporation structure 34 “loans” that appeared in the financial statements as cash proceeds from sales of assets. Enron subsequently went bankrupt in 2001 and left many unhappy investors and creditors with billions of

> Rouge Valley Golf and Health Club (RVGH) is a public company that operates eight clubs in a large city and offers one-year memberships. Membership provides members with access to golf and the fitness centre including fitness classes. The members may use

> Save the Trees (STT) is a not-for-profit organization whose mandate is to keep our cities green by planting and looking after trees. STT is primarily funded by government grants and must comply with a significant number of criteria in order to obtain add

> Find it Gold Inc. (FGI) was created in 2008 and is 25% owned by Find it Mining Corporation (FMC). FGI’s shares trade on the local exchange and its objective is to become a substantial low-cost mineral producer in developing countries. FMC provided substa

> Real Estate Investment Trust (RE) was created to hold hotel properties. RE currently holds 15 luxury and first-class hotels in Europe. The entity is structured as an investment trust, which means that the trust does not pay income taxes because it distri

> Extensible business reporting language (XBRL) has been under development and promotion for many years. Because of its potential for effective and efficient analysis of financial and other reports, XBRL has received support from many jurisdictions around

> Sweet Tooth, Inc., a private company that applies ASPE, incurred $15,000 in materials and $12,000 in direct labour costs between January and March 2017 to develop a new product. In May 2017, the criteria required to capitalize development costs were met.

> Indicate whether the following items are capitalized or expensed in the current year, assuming IFRS was used to prepare financial statements. Assume that any items that may qualify for capitalization have met all six “development phase” criteria. (a) Th

> Programming for Kids Ltd. decided that it needed to update its computer programs for its supplier relationships. It purchased an off-the-shelf program and modified it internally to link it to Programming for Kids’ other programs. The following costs may

> Bountiful Industries Ltd. had one patent recorded on its books as at January 1, 2017. This patent had a book value of $365,000 and a remaining useful life of eight years. During 2017, Bountiful incurred research costs of $140,000 and brought a patent inf

> Hubbub Company Ltd. acquired equipment at the beginning of Year 1. The asset has an estimated useful life of fi ve years. An employee has prepared depreciation schedules for this asset using two different methods, in order to compare the results of using