Question: During the months of January and February,

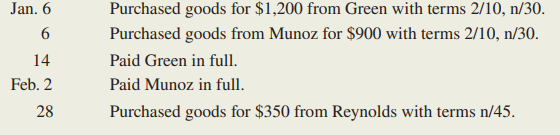

During the months of January and February, Axe Corporation purchased goods from three suppliers. The sequence of events was as follows:

Required:

Assume that Axe uses a perpetual inventory system, the company had no inventory on hand at the beginning of January, and no sales were made during January and February. Calculate the cost of inventory as of February 28.

> Refer to the data in E9-10. Assume each company spent $319,800 at the beginning of the current year for additional Developed Technology. Because of its proprietary nature, the technology is estimated to have no residual value at the end of its estimated

> Amazon, Alphabet, and TripAdvisor rely on various intangible assets to operate their businesses. These companies amortize the cost of these assets using the straight-line method over the following average estimated useful lives (in years), as reported in

> The following is a list of account titles and amounts (in millions) reported at December 27, 2015, by Hasbro, Inc., a leading manufacturer of games, toys, and interactive entertainment software for children and families: Required: 1. Prepare the asset

> Assume that Simple Co. had credit sales of $250,000 and cost of goods sold of $150,000 for the period. Simple uses the aging method and estimates that the appropriate ending balance in the Allowance for Doubtful Accounts is $3,000. Before the end-of-peri

> Fraud Investigators Inc. operates a fraud detection service. Required: 1. Prepare journal entries for each transaction below. a. On March 31, 10 customers were billed for detection services totaling $25,000. b. On October 31, a customer balance of $

> Innovative Tech Inc. (ITI) has been using the percentage of credit sales method to estimate bad debts. During November, ITI sold services on account for $100,000 and estimated that ½ of 1 percent of those sales would be uncollectible. Required: 1. Pr

> Brown Cow Dairy uses the aging approach to estimate Bad Debt Expense. The balance of each account receivable is aged on the basis of three time periods as follows: (1) 1–30 days old, $12,000; (2) 31–90 days old, $5,000; and (3) more than 90 days old, $3,

> Young and Old Corporation (YOC) uses two aging categories to estimate uncollectible accounts. Accounts less than 60 days are considered young and have a 5% uncollectible rate. Accounts more than 60 days are considered old and have a 40% uncollectible rat

> For each transaction listed in E8-4, indicate the amount and direction (+ or −) of effects on the financial statement accounts and on the overall accounting equation. Data from E8-4: Prior to recording the following, Elite Electronics

> Why are the income statement accounts closed but the balance sheet accounts are not?

> Prior to recording the following, Elite Electronics, Inc., had a credit balance of $2,000 in its Allowance for Doubtful Accounts. Required: Prepare journal entries for each transaction. a. On August 31, a customer balance for $300 from a prior year w

> During the year ended December 31, 2018, Kelly’s Camera Shop had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2018, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $600 cre

> For each transaction listed in E8-1, indicate the amount and direction (+ or −) of effects on the financial statement accounts and on the overall accounting equation.

> Trevorson Electronics is a small company privately owned by Jon Trevorson, an electrician who installs wiring in new homes. Because the company’s financial statements are prepared only for tax purposes, Jon uses the direct write-off method. During 2018,

> Which of the four basic accounting reports indicates that it is appropriate to consider revenues and expenses as subcategories of retained earnings? Explain.

> FedEx Corporation reported the following rounded amounts (in millions): Required: 1. Determine the receivables turnover ratio and days to collect for 2016. Round your answers to one decimal place. 2. Do the measures calculated in requirement 1 represe

> Refer to the information about Sears given in E8-14. Required: Complete the following table indicating the direction of the effect (+ for increase, − for decrease, and NE for no effect) of each transaction during 2016: Data from E8-

> The annual report for Sears Holdings Corporation contained the following information: Assume that accounts receivable write-offs amounted to $1 during 2016 and $9 during 2015 and that Sears did not record any recoveries. Required: Determine the Bad D

> Microsoft Corporation develops, produces, and markets a wide range of computer software including the Windows operating system. Microsoft reported the following information about Net Sales Revenue and Accounts Receivable (all amounts in millions). Accor

> To attract retailers to its shopping center, the Marketplace Mall will lend money to tenants under formal contracts, provided that they use it to renovate their store space. On November 1, 2017, the company loaned $100,000 to a new tenant on a one-year n

> The following transactions took place for Parker’s Grocery Required: Prepare the journal entries Parker’s Grocery would record for the above transactions.

> How do permanent accounts differ from temporary accounts?

> The following transactions took place for Smart Solutions Inc. Required: Prepare the journal entries that Smart Solutions Inc. would record for the above transactions.

> Blackhorse Productions, Inc., used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $19,750. The account had an unadjusted credit balance of $10,000 at that time. Required: Prepare journal entries

> Use the following information to complete this exercise: sales, 550 units for $12,500; beginning inventory, 300 units; purchases, 400 units; ending inventory, 150 units; and operating expenses, $4,000. Begin by setting up the following table and then com

> Assume Simple Co. had credit sales of $250,000 and cost of goods sold of $150,000 for the period. Simple uses the percentage of credit sales method and estimates that 1 percent of credit sales would result in uncollectible accounts. Before the end-of-per

> Courtney Company uses a periodic inventory system. The following data were available: beginning inventory, 1,000 units at $35; purchases, 4,000 units at $38; operating expenses (excluding income taxes), $91,500; ending inventory per physical count at Dec

> Scoresby Inc. tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information

> Orion Iron Corp. tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following informati

> Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki’s records show the

> Spotter Corporation reported the following for June in its periodic inventory records. Required: 1. Calculate the cost of ending inventory and the cost of goods sold under the (a) FIFO, (b) LIFO, and (c) weighted average cost methods. 2. Which of the t

> Refer to the information in E7-2. Required: For each item (a)–(d), prepare the journal entry to correct the balances presently reported. If a journal entry is not required, indicate so Data from E7-2: Seemore Lens Company (SLC) sells contact lenses F

> Seemore Lens Company (SLC) sells contact lenses FOB destination. For the year ended December 31, the company reported Inventory of $70,000 and Cost of Goods Sold of $420,000. a. Included in Inventory (and Accounts Payable) are $10,000 of lenses SLC is ho

> What is the purpose of closing journal entries?

> Dallas Corporation prepared the following two income statements: During the third quarter, the company’s internal auditors discovered that the ending inventory for the first quarter should have been $4,400. The ending inventory for the

> Refer to the information in E7-6. Assume Orion Iron applies its inventory costing method perpetually at the time of each sale. Calculate the cost of ending inventory and the cost of goods sold using the FIFO and LIFO methods. Data from E7-6: Orion Iron

> Using the following categories, indicate the effects of the following transactions. Use + for increase and − for decrease and indicate the accounts affected and the amounts. Assets = Liabilities + Stockholders’ Equity a. During the period, customer balan

> Refer to the information in E7-5. Assume Oahu Kiki applies its inventory costing method perpetually at the time of each sale. The company sold 240 units between January 16 and 23. Calculate the cost of ending inventory and the cost of goods sold using th

> Simple Plan Enterprises uses a periodic inventory system. Its records showed the following: Required: 1. Compute the number and cost of goods available for sale, the cost of ending inventory, and the cost of goods sold under FIFO and LIFO. 2. Compute

> Polaris Industries Inc. is the biggest snowmobile manufacturer in the world. It reported the following amounts in its financial statements (in millions): Required: 1. Calculate to one decimal place the inventory turnover ratio and average days to sell

> Sandals Company is preparing the annual financial statements dated December 31. Ending inventory is presently recorded at its total cost of $5,465. Information about its inventory it Required: 1. Compute the LCM/NRV write-down per unit and in total for

> Peterson Furniture Designs is preparing the annual financial statements dated December 31. Ending inventory information about the five major items stocked for regular sale follows: Required: 1. Complete the table column “Write-Down pe

> TrackR, Inc., (TI) has developed a coin-sized tracking tag that attaches to key rings, wallets, and other items and can be prompted to emit a signal using a smartphone app. TI sells these tags, as well as water-resistant cases for the tags, with terms FO

> Second Chance Clothing (SCC) sells vintage apparel, which it obtains on consignment and through purchase. The following events occurred close to SCC’s October 31 year-end. Required: Indicate (Yes or No) whether SCC should include each

> PCM, Inc., is a direct marketer of computer hardware, software, peripherals, and electronics. In a recent annual report, the company reported that its revenue is “recognized upon receipt of the product by the customer.” Required: 1. Indicate whether P

> What is the equation for each of the following statements: (a) income statement, (b) balance sheet, and (c) statement of retained earnings?

> During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: Required: Assume that Ace uses a perpetual inventory system and that the company had no inventory on hand at the beginning of the month

> Prepare journal entries for each transaction listed. a. At the end of June, bad debt expense is estimated to be $14,000. b. In July, customer balances are written off in the amount of $7,000.

> For each of the following, indicate whether it would be reported on the balance sheet (B/S), reported on the income statement (I/S), or not shown in the company’s financial statements (Not).

> Supply the missing dollar amounts for each of the following independent cases:

> Supply the missing dollar amounts for each of the following independent cases:

> In fiscal 2015, Macy’s reported cost of goods sold (before shrinkage) of $16.5 billion, ending inventory for 2015 of $5.5 billion, and ending inventory for the previous year (2014) of $5.4 billion. Required: If the cost of inventory purchases was $16.9

> Calculate the missing information for each of the following independent cases:

> Kangaroo Jim Company reported beginning inventory of 100 units at a per unit cost of $25. It had the following purchase and sales transactions during the year: Required: Record each transaction, assuming that Kangaroo Jim Company uses (a) a perpetual i

> Using the information in E6-12, prepare journal entries to record the transactions, assuming Bear’s Retail Store records discounts using the net method in a perpetual inventory system. Forfeited discounts are recorded as Other Revenue.

> Using the information in E6-12, prepare journal entries to record the transactions, assuming Bear’s Retail Store records discounts using the gross method in a perpetual inventory system. Data from E6-12: The following transactions wer

> Using the information in E6-11, prepare journal entries to record the transactions, assuming Evergreen Company records discounts using the net method in a perpetual inventory system. Forfeited discounts are recorded as Other Revenue. Data from E6-11: T

> What is the equation for each of the following statements: (a) income statement, (b) balance sheet, and (c) statement of retained earnings?

> Let’s go a bit further with the example from M8-3. Assume that on February 2, 2018, Extreme Fitness received a payment of $500 from one of the customers whose balance had been written off. Prepare the journal entries to record this transaction.

> If you deposited $10,000 in a savings account that earns 10 percent, how much would you have at the end of 10 years? Use a convenient format to display your computations and round to the nearest dollar.

> Using the information in E6-11, prepare journal entries to record the transactions, assuming Evergreen Company records discounts using the gross method in a perpetual inventory system. Data from E6-11: The following transactions were selected from the

> Using the information in E6-10, prepare journal entries to record the transactions, assuming Solitare records discounts using the net method in a perpetual inventory system. Forfeited discounts are recorded as Other Revenue. Data from E6-10: During the

> Using the information in E6-10, prepare journal entries to record the transactions, assuming Solitare records discounts using the gross method in a perpetual inventory system. Data from E6-10: During the months of January and February, Solitare Corpora

> Using the information in E6-8, prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. Data from E6-8: During the month of June, Ace Incorporated purchased goods from tw

> Using the information in E6-8, prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system Data fromE6-8: During the month of June, Ace Incorporated purchased goods from two s

> Using the information in E6-7, prepare journal entries to record the transactions, assuming Axe records discounts using the net method in a perpetual inventory system. Forfeited discounts are charged to Other Operating Expenses. Data from E6-7: During

> The Gap, Inc., is a specialty retailer that operates stores selling clothes under the trade names Gap, Banana Republic, Athleta, and Old Navy. Assume that you are employed as a stock analyst and your boss has just completed a review of the annual report

> Using the information in E6-7, prepare journal entries to record the transactions, assuming Axe records discounts using the gross method in a perpetual inventory system. Data from -7: During the months of January and February, Axe Corporation purchased

> Wolverine World Wide, Inc., prides itself as being the “world’s leading marketer of U.S. branded non-athletic footwear.” The following data (in millions) were reported for the third quarter of 2016:

> On December 31, 2017, Extreme Fitness has adjusted balances of $800,000 in Accounts Receivable and $55,000 in Allowance for Doubtful Accounts. On January 2, 2018, the company learns that certain customer accounts are not collectible, so management author

> The following data were provided by Mystery Incorporated for the year ended December 31: Required: 1. Based on these data, prepare a multistep income statement for external reporting purposes (showing appropriate subtotals and totals). 2. What was the

> Using the information in question 8, prepare the journal entry and adjusting journal entries to be made on December 31, January 31, February 28, and March 31. Data from 8: On December 31, a company makes a $9,000 payment for renting a warehouse in Janu

> Supply the missing dollar amounts for the income statement of Williamson Company for each of the following independent cases:

> A company separately sells home security equipment and 12 months of system monitoring service for $120 and $240, respectively. The company sells an equipment/monitoring bundle on January 1 for a total price of $270. The monitoring service begins immediat

> Cycle Wholesaling sold merchandise on account, with terms n/60, to Sarah’s Cycles on February 1 for $800 (cost of goods sold of $500). On February 9, Sarah’s Cycles returned to Cycle Wholesaling one-quarter of the merchandise from February 1 (cost of goo

> Complete the following table, indicating the amount and direction of effect (+ for increase, − for decrease, and NE for no effect) of each transaction on each item in Rockland Shoe Company’s income statement. Be sure t

> The following transactions were selected from among those completed by Bear’s Retail Store: Required: Compute the total revenue to be reported over the two months

> The following transactions were selected from the records of Evergreen Company: Required: Compute the amount of revenue to be reported for the month ended July 31.

> During the months of January and February, Solitare Corporation sold goods to two customers. The sequence of events was as follows: Required: Compute the total revenue Solitare would report over the two months.

> For each of the following, indicate whether the item would be reported on the balance sheet (B/S), reported on the income statement (I/S), or not shown in the financial statements (Not). Also indicate whether it relates to a service company (SC) or merch

> Last year, Pastis Productions reported $100,000 in sales and $40,000 in cost of goods sold. The company estimates it would have doubled its sales and cost of goods sold had it allowed customers to buy on credit, but it also would have incurred $50,000 in

> Sunshine Health established a $100 petty cash fund on January 1. From January 2 through 10, payments were made from the fund, as listed below. On January 12, the fund had only $10 remaining; a check was written to replenish the fund. a. January 2—Paid c

> Gatti Corporation reported the following balances at June 30. Required: 1. What amount should be reported as “Cash and Cash Equivalents”? 2. Prepare a classified balance sheet. Do not show the components that add up

> Briefly explain the purposes of adjustments.

> Expedia, Inc., reported total cash of $1,862 million at September 30, 2016. Of this amount, $18 million was set aside and could be used only to fulfill the requirement of an aviation authority of a certain foreign country to protect against the potential

> The September 30 bank statement for Cadieux Company and the September ledger account for cash are summarized here: No outstanding checks and no deposits in transit were noted in August. However, there are deposits in transit and checks outstanding at th

> Hills Company’s June 30 bank statement and the June ledger account for cash are summarized here: Required: 1. Prepare a bank reconciliation. A comparison of the checks written with the checks that have cleared the bank shows outstandi

> Home Repair Corp. (HRC) operates a building maintenance and repair business. The business has three office employees—a sales manager, a materials/crew manager, and an accountant. HRC’s cash payments system is described below. a. After a contract is sign

> Locker Rentals Corp. (LRC) operates locker rental services at several locations throughout the city including the airport, bus depot, shopping malls, and athletics facilities. Unlike some of the old mechanical lockers that charge a fixed amount per use,

> Your student club recently volunteered to go door-to-door collecting cash donations on behalf of a local charity. The charity’s accountant went berserk when you said you wrote receipts only for donors who asked for one. Required: Identify the control

> Mountain Air Company established a $200 petty cash fund on January 1. From January 3 through 15, payments were made from the fund, as listed below. On January 17, the fund was replenished with a check for $158. a. January 3—Paid cash for deliveries to c

> Complete all the requirements of M8-3, except assume Extreme Fitness uses the direct write-off method. Note this means Extreme does not have an Allowance for Doubtful Accounts balance.

> At most movie theaters, one employee sells tickets and another employee collects them. One night, when you’re at the movies, your friend comments that this is a waste of the theater’s money. Required: 1. Identify the name of the control principle to w

> For each of the transactions in E4-8, indicate the amount and direction of effects of the adjusting journal entry on the elements of the accounting equation. Using the following format, indicate + for increase, − for decrease, and NE f

> Jaworski’s Ski Store is completing the accounting process for its first year ended December 31, 2018. The transactions during 2018 have been journalized and posted. The following data are available to determine adjusting journal entries: a. The unadjust

> Explain the expense recognition principle (“matching”).

> Prepare adjusting journal entries at December 31, 2018, for (a) insurance and (b) supplies. Data from E4-6: Fes Company is making adjusting journal entries for the year ended December 31, 2018. In developing information for the adjusting journal entri

> Fes Company is making adjusting journal entries for the year ended December 31, 2018. In developing information for the adjusting journal entries, you learned the following: a. A two-year insurance premium of $7,200 was paid on January 1, 2018, for cove

> Record the required adjusting journal entry for transactions (a) and (b). Data from E4-4: Mobo, a wireless phone carrier, completed its first year of operations on October 31. All of the year’s entries have been recorded, except for the following: a.

> Mobo, a wireless phone carrier, completed its first year of operations on October 31. All of the year’s entries have been recorded, except for the following: a. At year-end, employees earned wages of $6,000, which will be paid on the next payroll date,