Question: Each team member has the responsibility to

Each team member has the responsibility to become an expert on an inventory method. This expertise will be used to facilitate teammates’ understanding of the concepts relevant to that method.

1. Each learning team member should select an area for expertise by choosing one of the following inventory methods: specific identification, LIFO, FIFO, or weighted average.

2. Form expert teams made up of students who have selected the same area of expertise. The instructor will identify where each expert team will meet.

3. Using the following data, each expert team must collaborate to develop a presentation that illustrates the relevant concepts and procedures for its inventory method. Each team member must write the presentation in a format that can be shown to the learning team.

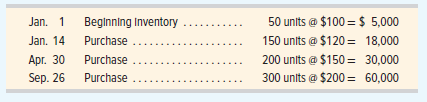

Data: The Company uses a perpetual inventory system. It had the following beginning inventory and current-year purchases of its product.

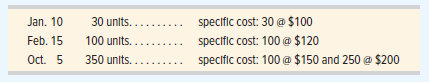

The company transacted sales on the following dates at a $350 per unit sales price.

Concepts and Procedures to Illustrate in Expert Presentation

a. Identify and compute the costs to assign to the units sold. (Round per unit costs to three decimals.)

b. Identify and compute the costs to assign to the units in ending inventory. (Round inventory balances to the dollar.)

c. How likely is it that this inventory costing method will reflect the actual physical flow of goods? How relevant is that factor in determining whether this is an acceptable method to use?

d. What is the impact of this method versus others in determining net income and income taxes?

e. How closely does the ending inventory amount reflect replacement cost?

4. Re-form learning teams. In rotation, each expert is to present to the team the presentation developed in part 3. Experts are to encourage and respond to questions.

> Lopez Company reports unadjusted first year merchandise sales of $100,000 and cost of merchandise sales of $30,000. a. Compute gross profit (using the unadjusted numbers above). b. The company expects future returns and allowances equal to 5% of sales an

> Prepare journal entries to record each of the following transactions. The company records purchases using the gross method and a perpetual inventory system. Aug. 1 purchased merchandise with an invoice price of $60,000 and credit terms of 3∕10, n∕30. 1

> The following information is available to reconcile Severino Co.’s book balance of cash with its bank statement cash balance as of December 31. a. The December 31 cash balance according to the accounting records is $32,878.30, and the bank statement cash

> Match each of the descriptions with the term or phrase it best reflects. A. Ethics B. Fraud triangle C. Prevention D. Internal controls E. Audit 1. Examines whether financial statements are prepared using GAAP; it does not ensure

> Chico Company allows its customers to return merchandise within 30 days of purchase. At December 31, the end of its first year of operations, Chico estimates futureperiod merchandise returns of $60,000 (cost of $22,500) related to its currentyear sales

> Med Labs has the following December 31 yearend unadjusted balances: Allowance for Sales Discounts, $0; and Accounts Receivable, $5,000. Of the $5,000 of receivables, $1,000 are within a 2% discount period, meaning that it expects buyers to take $20 in f

> Refer to Exercise 410 and prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system and the gross method are used by both the buyer and the seller.

> Refer to Exercise 49 and prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system and the gross method are used by both the buyer and the seller.

> Refer to the information in QS C-4. (1) After the fair value adjustment is made, prepare the assets section of Kitty Company’s December 31 classified balance sheet. (2) In which income statement section is the unrealized gain (or loss) on the portfolio o

> Refer to Exercise 43 and prepare journal entries to record each of the merchandising transactions assuming that the buyer uses the periodic inventory system and the gross method.

> Compute the acid test ratio for each of the following separate cases. (b) Which company is in the best position to meet short-term obligations?

> Refer to the information in Exercise 415 and indicate whether the failure to include in transit inventory as part of the physical count results in an overstatement, understatement, or no effect on the following ratios. a. Gross margin ratio b. Profit ma

> Adams Co. reports the following balance sheet accounts as of December 31. Prepare a classified balance sheet.

> On February 19 of the current year, Quartzite Co. pays $5,400,000 for land estimated to contain 4 million tons of recoverable ore. It installs and pays for machinery costing $400,000 on March 21. The company removes and sells 254,000 tons of ore during i

> Fit­for­Life Foods reports the following income statement accounts for the year ended December 31. Pre­ pare a multiple step income statement that includes separate categories for net sales; cost of goods sold; selling ex

> Prepare journal entries to record each of the following transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. Nov. 5 Purchased 600 units of product at a cost of $10 per unit. Terms of the sale are 2∕

> Match each of the descriptions with the term or phrase it best reflects. A. Audit B. GAAP C. Ethics D. FASB E. SEC F. Public accountants G. Net income H. IASB 1. An assessment of whether financial statements follow GAAP. 2. Amount a business earns in e

> A company reports the following sales related information. Compute and prepare the net sales portion only of this company’s multiple step income statement.

> A retailer completed a physical count of ending merchandise inventory. When counting inventory, employees did not include $3,000 of incoming goods shipped by a supplier on December 31 under FOB shipping point. These goods had been recorded in Merchandise

> The following list includes temporary accounts from the December 31 adjusted trial balance of Emiko Co. Use these normal account balances to journalize closing entries.

> Each team member is to become an expert on one depreciation method to facilitate teammates’ understanding of that method. Follow these procedures: a. Each team member is to select an area of expertise from one of the following depreciation methods: strai

> At the beginning of the year, SnapIt had $10,000 of inventory. During the year, SnapIt purchased $35,000 of merchandise and sold $30,000 of merchandise. A physical count of inventory at yearend shows $14,000 of inventory exists. Prepare the entry to rec

> Prepare journal entries for the following merchandising transactions of Dollar Store assuming it uses a perpetual inventory system and the gross method. Nov. 1 Dollar Store purchases merchandise for $1,500 on terms of 2∕5, n∕30, FOB shipping point, and

> The following summarizes Tesla’s merchandising activities for the year. Set up T-accounts for Merchandise Inventory and for Cost of Goods Sold. Enter each line item into one or both of the two T-accounts and compute the T-account balanc

> Blues Music Center had the following petty cash transactions in March of the current year. Blues uses the perpetual system to account for merchandise inventory. Mar.5 Wrote a $250 check to establish a petty cash fund. 6 Paid $12.50 shipping charges (tran

> Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the following transactions. Both Sydney and Troy use a perpetual inventory system and the gross method. May 11 Sydney accepts delivery of $40,000 of merchandise it purchases for resale fro

> Santa Fe Retailing purchased merchandise “as is” (with no returns) from Mesa Wholesalers with credit terms of 3∕10, n∕60 and an invoice price of $24,000. The merchandise had cost Mesa $16,000. Assume that both buyer and seller use a perpetual inventory s

> Refer to Exercise 4-6 and prepare journal entries for Macy Co. to record each of the May transactions. Macy is a retailer that uses the gross method and a perpetual inventory system; it purchases these units for resale.

> Analyze each transaction in Exercise 4-6 by indicating its effects on the income statement—specifically, identify the accounts and amounts (including + or −) for each transaction.

> Identify the following users as either External users or internal users.

> Compute the amount to be paid for each of the four separate invoices assuming that all invoices are paid within the discount period.

> Allied Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of Allied (seller) products. Prepare journal entries to record the following transactions for Allied assuming it uses a perpetual inventory system and the gross method. May

> Baine Company purchased Vera Company at a price of $500,000. The fair value of the net assets purchased equals $420,000. Compute the amount of goodwill that Baine records at the purchase date.

> For each transaction of Sealy Co., (a) determine whether or not Sealy owns the goods during transit. (b) If Sealy is responsible for transportation costs, record the entry for shipping costs assuming they are paid in cash and the perpetual inventory syst

> Prepare journal entries to record the following transactions of Recycled Fashion retail store. Recycled Fashion uses a perpetual inventory system and the gross method. Mar. 3 Purchased $1,150 of merchandise from GreenWorld Company with credit terms of 2∕

> Review financial news sources such as Yahoo! Finance (finance.yahoo.com) and Google Finance (google.com/finance). Identify a company that has recently purchased 50% or more of another company’s outstanding shares and will report consolidated financial st

> Prepare journal entries to record the following transactions for a retail store. The company uses a perpetual inventory system and the gross method. Apr. 2 purchased $4,600 of merchandise from Lyon Company with credit terms of 2∕15, n∕60, invoice dated A

> Refer to the information in QS 5-11 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.)

> The operating cycle of a merchandiser with credit sales includes the following five activities. Starting with merchandise acquisition, identify the chronological order of these five activities. a. Prepare merchandise for sale. b. Collect cash from custom

> Refer to the information in QS 5-11 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method.

> Fill in the blanks in the following separate income statements a through e.

> Try to find at least one store that does not use bar coding. If a store does not use bar coding, ask the store’s manager or clerk whether he or she knows which type of inventory method the store employs. Create a table that shows columns for the name of

> Determine whether each of the following accounting duties mainly involves financial accounting, managerial accounting, or tax accounting. 1. Internal auditing. 2. External auditing. 3. Cost accounting. 4. Budgeting. 5. Enforcing tax laws. 6. Planning tra

> Journ Co. purchased short-term investments in available-for-sale debt securities at a cost of $50,000 cash on November 25. At December 31, these securities had a fair value of $47,000. This is the first and only time the company has purchased such securi

> Access the Yahoo! (renamed as Altaba, ticker: AABA) 10-K report for the year ended December 31, 2016, filed on March 1, 2017, at SEC.gov. Required 1. What amount of goodwill is reported on Yahoo!’s balance sheet? What percentage of total assets does its

> Refer to QS 48 and prepare journal entries to record each of the merchandising transactions assuming that the company records purchases using the net method and a perpetual inventory system.

> Moya Co. establishes a petty cash fund for payments of small amounts. The following transactions involving the petty cash fund occurred in January (the last month of the company’s fiscal year). Jan. 3 A company check for $150 is written and made payable

> Review the chapter’s opening feature highlighting Jeff Bezos and Whole Foods. Assume that the business consistently maintains an inventory level of $30,000, meaning that its average and ending inventory levels are the same. Also assume its annual cost of

> Refer to QS 45 and prepare journal entries to record each of the merchandising transactions assuming that the company records purchases using the net method and a perpetual inventory system.

> ProBuilder reports merchandise sales of $50,000 and cost of merchandise sales of $20,000 in its first year of operations ending June 30. It makes fiscalyearend adjusting entries for estimated future returns and allowances equal to 2% of sales, or $1,00

> Access the September 29, 2018, 10-K report for Apple, Inc. (ticker: AAPL), filed on November 5, 2018, from the EDGAR filings at SEC.gov. Required 1. What products are manufactured by Apple? 2. What inventory method does Apple use? Hint: See Note 1 to its

> ProBuilder has the following June 30 fiscalyearend unadjusted balances: Allowance for Sales Discounts, $0; and Accounts Receivable, $10,000. Of the $10,000 of receivables, $2,000 are within a 3% discount period, meaning that it expects buyers to take $

> You are a financial adviser with a client in the wholesale produce business that just completed its first year of operations. Due to weather conditions, the cost of acquiring produce to resell has escalated during the latter part of this period. Your cli

> Use the following information (in random order) from a merchandising company and from a service company. Hint: Not all information may be necessary for the solutions. a. For the merchandiser only, compute (1) goods available for sale, (2) cost of goods s

> Refer to the information in QS 5-5 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to cents.)

> Teams are to select an industry, and each team member is to select a different company in that industry. Each team member is to acquire the financial statements (Form 10-K) of the company selected— see the company’s website or the SEC’s EDGAR database (S

> Following are five separate cases involving internal control issues. a. Tywin Company keeps very poor records of its equipment. Instead, the company asserts its employees are honest and would never steal from the company. b. Marker Theater has a computer

> Classify the following activities as part of the Identifying, Recording, or Communicating aspects of accounting. 1. Analyzing and interpreting reports. 2. Presenting financial information. 3. Keeping a log of service costs. 4. Measuring the costs of a pr

> Refer to QS 48 and prepare journal entries to record each of the merchandising transactions assuming that the company records purchases using the gross method and a periodic inventory system.

> Golf Challenge Corp. is a retail sports store carrying golf apparel and equipment. The store is at the end of its second year of operation and is struggling. A major problem is that its cost of inventory has continually increased in the past two years. I

> Refer to QS 45 and prepare journal entries to record each of the merchandising transactions assuming that the company records purchases using the gross method and a periodic inventory system.

> Refer to Samsung’s financial statements in Appendix A. What percent of its current assets is inventory as of December 31, 2018 and 2017?

> The following information on current assets and current liabilities is for Belkin Company. (a) Compute Belkin’s acid test ratio. (b) If its competitor, Logit, has an acid test ratio of 1.2, which company is better able to pay for curren

> Refer to Samsung’s financial statements in Appendix A. Compute its cost of goods available for sale for the year ended December 31, 2018.

> Clear Water Co. reports the following balance sheet accounts as of December 31. Prepare a classified balance sheet.

> Refer to Apple’s financial statements in Appendix A and compute its cost of goods available for sale for the year ended September 29, 2018.

> Save-the-Earth Co. reports the following income statement accounts for the year ended December 31. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrat

> Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,028 and No. 5893 for $494. Check No. 5893 was still outstanding as of September 30. The following in

> Flo Choi owns a small business and manages its accounting. Her company just finished a year in which a large amount of borrowed funds was invested in a new building addition as well as in equipment and fixture additions. Choi’s banker requires her to sub

> Refer to Apple’s financial statements in Appendix A. On September 29, 2018, what percent of current assets is represented by inventory?

> In a recent year’s financial statements, Home Depot reported the following results. (a) Compute Home Depot’s return on assets. (b) Is Home Depot’s return on assets better than the 11% return of Lowe&

> Using the yearend information from QS 415, prepare the gross profit section of a multiple step income statement.

> Key figures for Samsung follow. Required 1. For the most recent two years, compute Samsung’s (a) inventory turnover and (b) days’ sales in inventory. 2. Is the change in Samsung’s inventory turnover f

> Vitamix reports the following information for its year ended December 31: cash sales of $60,000; sales on credit of $90,000; general and administrative expenses of $17,000; sales returns of $11,000; cost of goods sold of $80,000; sales discounts of $2,00

> Comparative figures for Apple and Google follow. Required 1. Compute inventory turnover for each company for the most recent two years shown. 2. Compute days’ sales in inventory for each company for the three years shown. 3. Did the cur

> Compute the missing amounts in the separate (partial) income statements A, B, and C.

> Use Apple’s financial statements in Appendix A to answer the following. Required 1. What amount of inventories did Apple report as a current asset (a) on September 29, 2018? (b) On September 30, 2017? 2. Inventories make up what percent of total assets (

> Indicate whether each statement describes a multiple step income statement or a single step income statement. 1. Commonly reports detailed computations of net sales and other costs and expenses. 2. Statement limited to two main categories (revenues and e

> The following information is available to reconcile Branch Company’s book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company’s Cash account has a $27,497 debit balance, but its July bank statement shows a $27,2

> Santana Rey of Business Solutions is evaluating her inventory to determine whether it must be adjusted based on lower of cost or market rules. Business Solutions has three different types of software in its inventory, and the following information is ava

> Refer to Samsung’s December 31, 2018, balance sheet in Appendix A. What long-term assets discussed in this chapter is reported by the company?

> Refer to QS 411 and prepare journal entries to close the balances in temporary revenue and expense accounts. Remember to consider the entry for shrinkage from QS 411.

> Otingo Equipment Co. wants to prepare interim financial statements for the first quarter. The company wishes to avoid making a physical count of inventory. Otingo’s gross profit rate averages 35%. The following information for the first

> Return on assets for Deutsche Auto for each of the last three years follows. Over the three-year period shown, did the company’s return on assets improve or worsen?

> Match each phrase with its definition. A. Sales discount B. Credit period C. Discount period D. FOB destination E. FOB shipping point F. Gross profit H. Purchases discount G. Merchandise inventory 1. Goods a company owns and expects to sell to its custom

> Refer to the information in QS 5-5 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to cents.)

> The records of Macklin Co. provide the following information for the year ended December 31. Required 1. Use the retail inventory method to estimate the company’s year-end inventory. 2. A year-end physical inventory at retail prices yie

> Shepard Company sold 4,000 units of its product at $100 per unit during the year and incurred operating expenses of $15 per unit in selling the units. It began the year with 840 units in inventory and made successive purchases of its product as follows.

> Seneca Co. began the year with 6,500 units of product in its January 1 inventory costing $35 each. It made four purchases of its product during the year as follows. The company uses a periodic inventory system. On December 31, a physical count reveals th

> Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise inventory. Feb. 2 Wrote a $400 check to establish a petty cash fund. 5 Purchased paper for the co

> Hallam Company’s year-end financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Year 1 ending inventory is overstated by $18,000 and Year

> A physical inventory of Office Necessities Company taken at December 31 reveals the following. Required 1. Compute the lower of cost or market for the inventory applied separately to each item. 2. If the market amount is less than the recorded cost of th

> Refer to Samsung’s balance sheet in Appendix A. What does it title its plant assets? What is the book value of its plant assets at December 31, 2018?

> Refer to the information in Problem 5-3B and assume the perpetual inventory system is used. Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute th

> Aloha Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. (For specific identification, the May 9 sale consisted of 80 units from beginning inventory and 100 units from the May 6 purchas

> Refer to the information in Problem 5-1B and assume the perpetual inventory system is used. Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory. 3. Compute th

> Preparing a statement of cash flows 1. Cash purchase of equipment 2. Cash dividends to shareholders 3. Cash paid for advertising 4. Cash paid for wages 5. Cash paid on account payable to supplier 6. Cash received from clients 7. Cash paid for rent 8. Cas

> Ming Company uses a periodic inventory system. It entered into the following purchases and sales transactions for April. (For specific identification, the April 9 sale consisted of 8 units from beginning inventory and 27 units from the April 6 purchase;

> Wayward Company wants to prepare interim financial statements for the first quarter. The company wishes to avoid making a physical count of inventory. Wayward’s gross profit rate averages 34%. The following information for the first qua

> Refer to the information in QS 5-5 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to cents.)