Question: Early in January 2018, Hopkins Company is

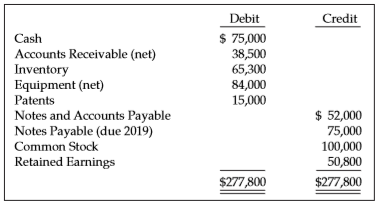

Early in January 2018, Hopkins Company is preparing for a meeting with its bankers to discuss a loan request. Its bookkeeper provided the following accounts and balances at December 31, 2017.

Except for the following items, Hopkins has recorded all adjustments in its accounts.

1. Cash includes $500 petty cash and $15,000 in a bond sinking fund.

2. Net accounts receivable is comprised of $52,000 in accounts receivable and $13,500 in allowance for doubtful accounts.

3. Equipment had a cost of $112,000 and accumulated depreciation of $28,000.

4. On January 8, 2018, one of Hopkins’ customers declared bankruptcy. At December 31, 2017, this customer owed Hopkins $9,000.

Accounting

Prepare a corrected December 31, 2017, balance sheet for Hopkins Company.

Analysis

Hopkins’ bank is considering granting an additional loan in the amount of $45,000, which will be due December 31, 2018. How can the information in the balance sheet provide useful information to the bank about Hopkins’ ability to repay the loan?

Principles

In the upcoming meeting with the bank, Hopkins plans to provide additional information about the fair value of its equipment and some internally generated intangible assets related to its customer lists. This information indicates that Hopkins has significant unrealized gains on these assets, which are not reflected on the balance sheet. What objections is the bank likely to raise about the usefulness of this information in evaluating Hopkins for the loan renewal?

Transcribed Image Text:

Debit Credit $ 75,000 38,500 65,300 84,000 15,000 Cash Accounts Receivable (net) Inventory Equipment (net) Patents Notes and Accounts Payable Notes Payable (due 2019) Common Stock Retained Earnings $ 52,000 75,000 100,000 50,800 $277,800 $277,800

> Use the information for Jones Company as presented in E7-20. Jones is planning to factor some accounts receivable at the end of the year. Accounts totaling $25,000 will be transferred to Credit Factors, Inc. with recourse. Credit Factors will retain 5% o

> Presented below is information for Jones Company. 1. Beginning-of-the-year Accounts Receivable balance was $15,000. 2. Net sales (all on account) for the year were $100,000. Jones does not offer cash discounts. 3. Collections on accounts receivable du

> Presented below are a number of independent situations. Instructions For each individual situation, determine the amount that should be reported as cash. If the item(s) is not reported as cash, explain the rationale. 1. Checking account balance $925,0

> Beyoncé Corporation factors $175,000 of accounts receivable with Kathleen Battle Financing, Inc. on a with recourse basis. Kathleen Battle Financing will collect the receivables. The receivables records are transferred to Kathleen Battle Financing on Aug

> The trial balance before adjustment for Phil Collins Company shows the following balances. Instructions Using the data above, give the journal entries required to record each of the following cases. (Each situation is independent.) 1. To obtain additi

> On December 31, 2015, Ed Abbey Co. performed environmental consulting services for Hayduke Co. Hayduke was short of cash, and Abbey Co. agreed to accept a $200,000 zero-interest-bearing note due December 31, 2017, as payment in full. Hayduke is somewhat

> On July 1, 2017, Agincourt Inc. made two sales. 1. It sold land having a fair value of $700,000 in exchange for a 4-year zero-interest-bearing promissory note in the face amount of $1,101,460. The land is carried on Agincourt’s books at a cost of $590,0

> Stacy Corporation had income from operations of $7,200,000. In addition, it suffered an unusual and infrequent pretax loss of $770,000 from a volcano eruption, interest revenue of $17,000, and a write-down on buildings of $53,000. The corporation’s tax r

> The chief accountant for Dickinson Corporation provides you with the following list of accounts receivable written off in the current year. Dickinson follows the policy of debiting Bad Debt Expense as accounts are written off. The chief accountant main

> Clarence Weatherspoon, a super salesman contemplating retirement on his fifty-fifth birthday, decides to create a fund on an 8% basis that will enable him to withdraw $20,000 per year on June 30, beginning in 2021 and continuing through 2024. To develop

> Presented below are three unrelated situations. a. Dwayne Wade Company recently signed a lease for a new office building, for a lease period of 10 years. Under the lease agreement, a security deposit of $12,000 is made, with the deposit to be returned a

> Using the appropriate interest table, answer the following questions. (Each case is independent of the others). a. What is the future value of 20 periodic payments of $4,000 each made at the beginning of each period and compounded at 8%? b. What is the

> Ricky Fowler borrowed $70,000 on March 1, 2015. This amount plus accrued interest at 6% compounded semiannually is to be repaid March 1, 2025. To retire this debt, Ricky plans to contribute to a debt retirement fund five equal amounts starting on March 1

> Nerwin, Inc. is a furniture manufacturing company with 50 employees. Recently, after a long negotiation with the local labor union, the company decided to initiate a pension plan as a part of its compensation plan. The plan will start on January 1, 2017.

> Hincapie Inc. manufactures cycling equipment. Recently, the vice president of operations of the company has requested construction of a new plant to meet the increasing demand for the company’s bikes. After a careful evaluation of the request, the board

> The current assets and current liabilities sections of the balance sheet of Allessandro Scarlatti Company appear as follows. The following errors in the corporation’s accounting have been discovered: 1. January 2018 cash disbursement

> Frederic Chopin Corporation is preparing its December 31, 2017, balance sheet. The following items may be reported as either a current or long-term liability. 1. On December 15, 2017, Chopin declared a cash dividend of $2.50 per share to stockholders of

> The bookkeeper for Geronimo Company has prepared the following balance sheet as of July 31, 2017. The following additional information is provided. 1. Cash includes $1,200 in a petty cash fund and $15,000 in a bond sinking fund. 2. The net accounts re

> Finley Corporation had income from continuing operations of $10,600,000 in 2017. During 2017, it disposed of its restaurant division at an after-tax loss of $189,000. Prior to disposal, the division operated at a loss of $315,000 (net of tax) in 2017 (as

> Uhura Company has decided to expand its operations. The bookkeeper recently completed the balance sheet presented below in order to obtain additional funds for expansion. Instructions Prepare a revised balance sheet given the available information. As

> Assume that Denis Savard Inc. has the following accounts at the end of the current year. 1. Common Stock. 2. Discount on Bonds Payable. 3. Treasury Stock (at cost). 4. Notes Payable (short-term). 5. Raw Materials. 6. Preferred Stock Investments (long-

> On September 30, 2016, Rolen Machinery Co. sold a machine and accepted the customer’s zero-interest-bearing note. Rolen normally makes sales on a cash basis. Since the machine was unique, its sales price was not determinable using Rolen’s normal pricing

> Corrs Wholesalers Co. sells industrial equipment for a standard 3-year note receivable. Revenue is recognized at time of sale. Each note is secured by a lien on the equipment and has a face amount equal to the equipment’s list price. Each note’s stated i

> Part 1: On July 1, 2017, Wallace Company, a calendar-year company, sold special-order merchandise on credit and received in return an interest-bearing note receivable from the customer. Wallace Company will receive interest at the prevailing rate for a n

> Kimmel Company uses the net method of accounting for sales discounts. Kimmel also offers trade discounts to various groups of buyers. On August 1, 2017, Kimmel sold some accounts receivable on a without recourse basis. Kimmel incurred a finance charge. K

> Wayne Rogers, an administrator at a major university, recently said, “I’ve got some CDs in my IRA, which I set up to beat the IRS.” As elsewhere, in the world of accounting and finance, it often helps to be fluent in abbreviations and acronyms. Instruc

> Marvin Company is a subsidiary of Hughes Corp. The controller believes that the yearly allowance for doubtful accounts for Marvin should be 8% of gross accounts receivable. Given the recession and the high interest rate environment, the president, nervou

> Some accountants have said that politicization in the development and acceptance of generally accepted accounting principles (i.e., rule-making) is taking place. Some use the term “politicization” in a narrow sense to mean the influence by governmental a

> The partner in charge of the Kappeler Corporation audit comes by your desk and leaves a letter he has started to the CEO and a copy of the cash flow statement for the year ended December 31, 2017. Because he must leave on an emergency, he asks you to fin

> Discuss whether the changes described in each of the cases below require recognition in the CPA’s audit report as to consistency. (Assume that the amounts are material.) a. The company changed its inventory method to FIFO from weighted-average, which ha

> The assets of Fonzarelli Corporation are presented below (000s omitted). Instructions Indicate the deficiencies, if any, in the foregoing presentation of Fonzarelli Corporation’s assets. FONZARELLI CORPORATION BALANCE SHEET (PART

> The following financial statement was prepared by employees of Walters Corporation. Instructions Identify and discuss the weaknesses in classification and disclosure in the single-step income statement above. You should explain why these treatments ar

> Kellogg Company has its headquarters in Battle Creek, Michigan. The company manufactures and sells ready-to-eat breakfast cereals and convenience foods including cookies, toaster pastries, and cereal bars. Selected data from Kellogg Companyâ€&

> One of the more closely watched ratios by investors is the price/earnings (P/E) ratio. By dividing price per share by earnings per share, analysts get insight into the value the market attaches to a company’s earnings. More specifically, a high P/E ratio

> Hardly a day goes by without an article appearing on the continuing fallout from the financial crisis of 2008. An overheated real estate market, fueled by home purchase incentives, poor lending practices, and securitization through high-risk, mortgage-ba

> Microsoft is the leading developer of software in the world. To continue to be successful Microsoft must generate new products, which requires significant amounts of cash. The following is the current asset and current liability information from Microsof

> Consolidated Natural Gas Company (CNG), with corporate headquarters in Pittsburgh, Pennsylvania, is one of the largest producers, transporters, distributors, and marketers of natural gas in North America. Periodically, the company experiences a decrease

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the accompanying notes to ans

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to these financial statements and the accompanying notes to ans

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the related information in th

> The financial statements of P&G are presented in Appendix B. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G’s financial statements and the accompanying notes to ans

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> After the presentation of your report on the examination of the financial statements to the board of directors of Piper Publishing Company, one of the new directors expresses surprise that the income statement assumes that an equal proportion of the reve

> The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies’ complete annual reports, including the notes to the financial statements, are available online. Instructions Use the companies’ financi

> The Amato Theater is nearing the end of the year and is preparing for a meeting with its bankers to discuss the renewal of a loan. The accounts listed below appeared in the December 31, 2017, trial balance. Additional information is available as follow

> William Murray achieved one of his life-long dreams by opening his own business, The Caddie Shack Driving Range, on May 1, 2017. He invested $20,000 of his own savings in the business. He paid $6,000 cash to have a small building constructed to house the

> Johnson Co. accepts a note receivable from a customer in exchange for some damaged inventory. The note requires the customer make semiannual installments of $50,000 each for 10 years. The first installment begins six months from the date the customer tak

> Counting Crows Inc. provided the following information for the year 2017. Retained earnings, January 1, 2017…………………………………………………………...$ 600,000 Administrative expenses………………………………………………………………………………. 240,000 Selling expenses…………………………………………………………………………………

> The Flatiron Pub provides catering services to local businesses. The following information was available for The Flatiron Pub for the years ended December 31, 2016 and 2017. Flatiron management is preparing for a meeting with its bank concerning renewa

> Will Smith will receive $80,000 5 years from now, from a trust fund established by his father. Assuming the appropriate interest rate for discounting is 12% (compounded semiannually), what is the present value of this amount today?

> What is the likely limitation of “general-purpose financial statements”?

> What are the two ways that other comprehensive income may be displayed (reported)?

> In an examination of Arenes Corporation as of December 31, 2017, you have learned that the following situations exist. No entries have been made in the accounting records for these items. 1. The corporation erected its present factory building in 2001. D

> On January 30, 2016, a suit was filed against Frazier Corporation under the Environmental Protection Act. On August 6, 2017, Frazier Corporation agreed to settle the action and pay $920,000 in damages to certain current and former employees. How should t

> During 2017, Liselotte Company reported income of $1,500,000 before income taxes and realized a gain of $450,000 on the disposal of assets related to a discontinued operation. The criteria for classification as a discontinued operation is appropriate for

> Cooper Investments reported an unusual gain from the sale of certain assets in its 2017 income statement. How does intraperiod tax allocation affect the reporting of this unusual gain?

> Answer the following questions. a. On May 1, 2017, Goldberg Company sold some machinery to Newlin Company on an installment contract basis. The contract required five equal annual payments, with the first payment due on May 1, 2017. What present value c

> On January 1, 2017, Lombard Co. sells property for which it had paid $690,000 to Sargent Company, receiving in return Sargent’s zero-interest-bearing note for $1,000,000 payable in 5 years. What entry would Lombard make to record the sale, assuming that

> The New York Knicks, Inc. sold 10,000 season tickets at $2,000 each. By December 31, 2017, 16 of the 40 home games had been played. What amount should be reported as a current liability at December 31, 2017?

> In its December 31, 2017, balance sheet Oakley Corporation reported as an asset, “Net notes and accounts receivable, $7,100,000.” What other disclosures are necessary?

> Becker Ltd. is planning to adopt IFRS and prepare its first IFRS financial statements at December 31, 2018. What is the date of Becker’s opening balance sheet, assuming one year of comparative information? What periods will be covered in Becker’s first I

> The trial balance before adjustment of Taylor Swift Inc. shows the following balances. Instructions Give the entry for estimated bad debts assuming that the allowance is to provide for doubtful accounts on the basis of (a) 4% of gross accounts receiv

> At the end of 2017, Aramis Company has accounts receivable of $800,000 and an allowance for doubtful accounts of $40,000. On January 16, 2018, Aramis Company determined that its receivable from Ramirez Company of $6,000 will not be collected, and managem

> The following is the balance sheet of Sameed Brothers Corporation (000s omitted). Instructions Evaluate the balance sheet presented. State briefly the proper treatment of any item criticized. SAMEED BROTHERS CORPORATION BALANCE SHEET DECEMBER 31,

> What would you pay for a $100,000 debenture bond that matures in 15 years and pays $5,000 a year in interest if you wanted to earn a yield of: a. 4%? b. 5%? c. 6%?

> Karen Weller, D.D.S., opened a dental practice on January 1, 2017. During the first month of operations, the following transactions occurred. 1. Performed services for patients who had dental plan insurance. At January 31, $750 of such services was perf

> Colin Davis Machine Company maintains a general ledger account for each class of inventory, debiting such accounts for increases during the period and crediting them for decreases. The transactions below relate to the Raw Materials inventory account, whi

> Presented below are selected accounts for Alvarez Company as reported in the worksheet at the end of May 2017. Instructions Complete the worksheet by extending amounts reported in the adjusted trial balance to the appropriate columns in the worksheet.

> Oasis Company has used the dollar-value LIFO method for inventory cost determination for many years. The following data were extracted from Oasis’ records. Instructions Calculate the index used for 2018 that yielded the above results

> JFK Corp. factors $300,000 of accounts receivable with LBJ Finance Corporation on a without recourse basis on July 1, 2017. The receivables records are transferred to LBJ Finance, which will receive the collections. LBJ Finance assesses a finance charge

> On April 1, 2017, Rasheed Company assigns $400,000 of its accounts receivable to the Third National Bank as collateral for a $200,000 loan due July 1, 2017. The assignment agreement calls for Rasheed to continue to collect the receivables. Third National

> Presented below is financial information for two different companies. Instructions Compute the missing amounts. Alatorre Company Eduardo Company Sales revenue $90,000 (a) 81,000 56,000 (b) 15,000 (c) (d) $ 5,000 95,000 (e) 38,000 23,000 15,000 Sal

> Presented below is information related to Gonzales Corporation for the month of January 2017. Instructions Prepare the necessary closing entries. $ 61,000 8,000 13,000 350,000 Salaries and wages expense Cost of goods sold Delivery expense Insuranc

> The adjusted trial balance of Lopez Company shows the following data pertaining to sales at the end of its fiscal year, October 31, 2017: Sales Revenue $800,000, Delivery Expense $12,000, Sales Returns and Allowances $24,000, and Sales Discounts $15,000.

> Bobek Inc. has recently reported steadily increasing income. The company reported income of $20,000 in 2014, $25,000 in 2015, and $30,000 in 2016. A number of market analysts have recommended that investors buy the stock because they expect the steady gr

> Midori Company had ending inventory at end-of-year prices of $100,000 at December 31, 2016; $119,900 at December 31, 2017; and $134,560 at December 31, 2018. The year-end price indexes were 100 at 12/31/16, 110 at 12/31/17, and 116 at 12/31/18. Compute t

> Bienvenu Enterprises reported cost of goods sold for 2017 of $1,400,000 and retained earnings of $5,200,000 at December 31, 2017. Bienvenu later discovered that its ending inventories at December 31, 2016 and 2017, were overstated by $110,000 and $35,000

> On October 1, 2017, Chung, Inc. assigns $1,000,000 of its accounts receivable to Seneca National Bank as collateral for a $750,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 9%. Prepare the Octo

> Dold Acrobats lent $16,529 to Donaldson, Inc., accepting Donaldson’s 2-year, $20,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare Dold’s journal entries for the initial transaction, recognition of interest each year, and the col

> Milner Family Importers sold goods to Tung Decorators for $30,000 on November 1, 2017, accepting Tung’s $30,000, 6-month, 6% note. Prepare Milner’s November 1 entry, December 31 annual adjusting entry, and May 1 entry for the collection of the note and i

> Use the information presented in BE7-5 for Wilton, Inc. a. Instead of an Allowance for Doubtful Accounts Balance of $2,400 credit, the balance was $1,900 debit. Assume that 10% of accounts receivable will prove to be uncollectible. Prepare the entry to

> Wilton, Inc. had net sales in 2017 of $1,400,000. At December 31, 2017, before adjusting entries, the balances in selected accounts were Accounts Receivable $250,000 debit, and Allowance for Doubtful Accounts $2,400 credit. If Wilton estimates that 8% of

> Roeher Company sold $9,000 of its specialty shelving to Elkins Office Supply Co. on account. Prepare the entries when (a) Roeher makes the sale, (b) Roeher grants an allowance of $700 when some of the shelving does not meet exact specifications but sti

> Use the information from BE7-2, assuming Restin Co. uses the net method to account for cash discounts. Prepare the required journal entries for Restin Co. From BE 7-2: Restin Co. uses the gross method to record sales made on credit. On June 1, 2017, it

> Restin Co. uses the gross method to record sales made on credit. On June 1, 2017, it made sales of $50,000 with terms 3/15, n/45. On June 12, 2017, Restin received full payment for the June 1 sale. Prepare the required journal entries for Restin Co.

> O’Malley Corporation was incorporated and began business on January 1, 2017. It has been successful and now requires a bank loan for additional working capital to finance expansion. The bank has requested an audited income statement for

> Assume that Toni Braxton Company has recently fallen into financial difficulties. By reviewing all available evidence on December 31, 2017, one of Toni Braxton’s creditors, the National American Bank, determined that Toni Braxton would pay back only 65%

> Kraft Enterprises owns the following assets at December 31, 2017. What amount should be reported as cash? 68,000 Checking account balance Postdated checks Certificates of deposit (180-day) Cash in bank- savings account 17,000 Cash on hand 9,300 750

> Morgan Freeman is investing $9,069 at the end of each year in a fund that earns 5% interest. In how many years will the fund be at $100,000?

> Refer to the data in BE6-7. Assuming quarterly compounding of amounts invested at 8%, how much of John Fillmore’s inheritance must be invested to have enough at retirement to buy the boat? From BE 6-7 John Fillmore’s lifelong dream is to own his own fis

> John Fillmore’s lifelong dream is to own his own fishing boat to use in his retirement. John has recently come into an inheritance of $400,000. He estimates that the boat he wants will cost $300,000 when he retires in 5 years. How much of his inheritance

> Steve Madison needs $250,000 in 10 years. How much must he invest at the end of each year, at 5% interest, to meet his needs?

> Adams Inc. will deposit $30,000 in a 6% fund at the end of each year for 8 years beginning December 31, 2017. What amount will be in the fund immediately after the last deposit?

> Maria Alvarez is investing $300,000 in a fund that earns 4% interest compounded annually. What equal amounts can Maria withdraw at the end of each of the next 20 years?

> Use the information presented in BE5-8 for Adams Company to prepare the long-term liabilities section of the balance sheet. From BE 5-8: Included in Adams Company’s December 31, 2017, trial balance are the following accounts: Accounts Payable $220,000,

> Included in Adams Company’s December 31, 2017, trial balance are the following accounts: Accounts Payable $220,000, Pension Liability $375,000, Discount on Bonds Payable $29,000, Unearned Rent Revenue $41,000, Bonds Payable $400,000, Salaries and Wages P

> In January 2017, Susquehanna Inc. requested and secured permission from the commissioner of the Internal Revenue Service to compute inventories under the last-in, first-out (LIFO) method and elected to determine inventory cost under the dollar-value LIFO