Question: Eastside Medical Testing performs five different

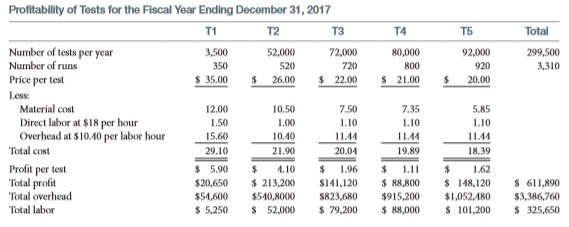

Eastside Medical Testing performs five different tests (T1–T5) to detect drug use. Most clients are referred to the company by potential employers who pay for the tests. Revenue and costs related to the tests, for the most recent fiscal year, are detailed in the table below.

Setting up equipment to conduct a test is the responsibility of three highly skilled technicians, one of whom is Emmet Wilson, founder and owner of the company. Tests T2 to T5 are high- volume tests that are conducted in batches of 100 tests per batch. Thus, for example, T5 is run approximately three times a day to annually process 92,000 tests in 920 batches. T1 is a test with relatively low demand. However, it is run almost every day (350 runs per year), so that results can be quickly communicated to employers. This fast turnaround represents a significant competitive advantage for the company.

Nuclear Systems, Inc., is one of the few companies that requires T1. Indeed, it accounted for almost half of the 3,500 T1 tests conducted in the past year. Recently, Ron Worth, vice president of operations at Nuclear Systems, questioned the relatively high price being charged for T1. In a letter to Emmet Wilson he noted:

We pay $35 for each T1 test, which is about 40% higher than your next most expensive test. Is this charge warranted? Frankly, this isn’t just a matter of dollars and cents. We believe that we are being taken advantage of because we are one of the few companies that requires the test, and you are one of the few companies that provide it. If we believed that the high price was justified in terms of significantly higher costs, we would not be writing this letter. Before responding to Worth’s letter, Emmet reviewed the revenue and cost data presented in the table below. As indicated, T1 produced a profit of $5.90 per test, which was much higher than the profit per test of any of the other procedures. However, since taking a day-long continuing education course at City College (titled ABC and Managing by the Right Numbers!), Emmet has wondered whether the profitability of tests is being distorted by the company’s simple approach to allocating overhead—overhead allocation is based on direct labor cost. Direct labor consists of wages and benefits paid to relatively unskilled technicians who prepare samples for testing. This cost, $325,650, is only 9.6 percent of total overhead. With help from his bookkeeper, Emmet began to analyze overhead costs in an attempt to calculate the ABC costof the five tests. In the past year, overhead amounted to $3,386,760, as follows:

Overhead costs Setup labor…………. $ 925,760

Equipment…………………………………..1,476,000

Rent……………………………………………..390,000

Billing……………………………………………235,000

Clerical…………………………………………. 160,000

Other……………………………………………200,000

Total………………………………………. $3,386,760

Emmet’s analysis of these six overhead cost categories was as follows:

Setup labor ($925,760). This amount is essentially the salary and benefits paid to Emmet and the two other skilled technicians who set up equipment for testing batches of T1 to T5. Emmet believes that the number of runs (batches of tests) is a valid driver for this cost pool. In the past year, there were 3,310 runs.

Equipment ($1,476,000). This amount is depreciation on equipment used to process the tests. All of the major pieces of equipment are used in each test. (In other words, no major piece of equipment is used exclusively for any individual test.) Emmet believes that the amount of direct labor cost is a valid driver for this cost pool. This follows because equipment hours vary with direct labor hours and direct labor cost. In the past year, total direct labor was $325,650.

Rent ($390,000). This amount is the annual rent on the facility occupied by Eastside Medical Testing. Emmet believes that the number of tests (299,500 in the prior year) is a valid driver for this cost pool since each test benefits equally from the incurrence of rent expense.

Billing ($235,000). This amount is the annual salary and benefits of two billing clerks as well as a variety of other charges (e.g., billing software costs). Emmet believes that the number of tests (299,500 in the prior year) is a valid driver for this cost pool since each test requires a separate billing charge.

Clerical ($160,000). This amount is the annual salary and benefits of two general clerical employees who process orders for supplies, file records, and so on. Emmet believes that the number of tests (299,500 in the prior year) is a valid driver for this cost pool since each test benefits equally from the incurrence of clerical expense.

Other ($200,000). This amount includes the salary and benefits of the bookkeeper, depreciation on office equipment, utilities, and so on. Emmet believes that the number of tests (299,500 in the prior year) is a valid driver for this cost pool since each test benefits equally from the incurrence of these expenses.

Required:

a. Based on Emmet’s assumptions, calculate the ABC cost per unit and profit per unit of each test. Round to 4 decimal places.

b. Should Emmet lower the price of the T1 test, or keep the current price and risk losing the business of Nuclear Systems?

c. Assume that Emmet, based on his ABC analysis, decides not to lower the price of the T1 test. What will be the effect on annual company profit if the company loses the business of Nuclear Systems (i.e., T1 tests decrease by 1,750)?

Transcribed Image Text:

Profitability of Tests for the Fiscal Year Ending December 31, 2017 T1 T2 T3 T4 T5 Total Number of tests per year Number of runs 3,500 52,000 72,000 80,000 92,000 299,500 350 520 720 800 920 3,310 Price per test $ 35.00 26.00 $ 22.00 $ 21.00 24 20.00 Less: Material cost 12.00 10.50 7.50 7.35 5.85 Direct labor at $18 per hour Overhead at $10.40 per labor hour Total cost 1.50 1.00 1.10 1.10 1.10 15.60 10.40 11.44 11.44 11.44 29.10 21.90 20.04 19.89 18.39 Profit per test Total profit Total overhead $ 5.90 24 4.10 1.96 1.11 1.62 $ 213,200 $540,8000 $ 88,800 $915,200 $ 148,120 $1,052,480 $20,650 $141,120 $ 611,890 $3,386,760 $ 325,650 $54,600 $823,680 Total labor $ 5,250 $ 52,000 $ 79,200 $ 88,000 $ 101,200

> Based on the information in Problem 9-14, what is the internal rate of return of the investment, assuming an inflation rate of 4 percent applicable to labor and costs other than depreciation? Should the company make the investment if its cost of capital

> Edward Laren, an accountant with Tenergy Industries, prepared the following analysis of an investment in manufacturing equipment: Edward’s boss, Megan Mangione, reviewed the calculation and made the following observation: â€

> True Fresh Grocery operates a chain of 40 grocery stores. Currently the company is considering starting a new division, TrueFresh.com, to provide home delivery services. Customers will be able to order groceries by phone or using the Internet, and TrueFr

> Van Doren Corporation is considering producing a new temperature regulator called Digidial. Marketing data indicate that the company will be able to sell 45,000 units per year at $30. The product will be produced in a section of an existing factory that

> Pritchard Manufactured Products is considering investing in a flexible manufacturing system that will enable the company to respond rapidly to customer requests. Ben Jarvis, the controller of Pritchard, has estimated that the system will have a nine-year

> Island Ferry plans to expand operations by acquiring another boat. It has a bid of $950,000 from a boat manufacturer to provide a boat that can carry 40 passengers. The boat has an expected life of 7 years with an expected residual value for financial re

> Pronto Cleaners, a chain of dry cleaning stores, has the opportunity to invest in one of two dry cleaning machines. Machine A has a four-year expected life and a cost of $30,000. It will cost an additional $6,500 to have the machine delivered and install

> Adrian Sonnetson, the owner of Adrian Motors, is considering the addition of a paint and body shop to his automobile dealership. Construction of a building and the purchase of necessary equipment is estimated to cost $800,000, and both the building and e

> Penguin Productions is evaluating a film project. The president of Penguin estimates that the film will cost $20,000,000 to produce. In its first year, the film is expected to generate $16,500,000 in net revenue, after which the film will be released to

> Albert Shoe Company is considering investing in one of two machines that attach heels to shoes. Machine A costs $70,000 and is expected to save the company $20,000 per year for 6 years. Machine B costs $95,000 and is expected to save the company $25,000

> Memory Florist is considering replacing an old refrigeration unit with a larger unit to store flowers. Because the new refrigeration unit has a larger capacity, Memory estimates that it can sell an additional $9,000 of flowers a year. (The cost of the fl

> Palermo Pizzeria is considering expanding operations by establishing a delivery business. This will require the purchase of an oven that will cost $50,000, including installation. The oven is expected to last 5 years, have a $5,000 residual value, and wi

> Refer to the information in Exercise 8-15. For the coming year, Delta Products has told Johnson Brands that it will be switched to an activity-based pricing system or it will be dropped as a customer. In addition to regular prices, Johnson will be requir

> The chief engineer at Future Tech has proposed production of a portable electronic storage device to be sold at a 30 percent markup above its full cost. Management estimates that the fixed costs per year will be $210,000, and the variable cost of the sto

> World View is considering production of a lighted world globe that the company would price at a markup of 25 percent above full cost. Management estimates that the variable cost of the globe will be $80 per unit and fixed costs per year will be $240,000.

> PowerDrive produces a hard disk drive that sells for $175 per unit. The cost of producing 25,000 drives in the prior year was: Direct material……………..$ 725,000 Direct labor……………………..475,000 Variable overhead……………225,000 Fixed overhead……………. 1,500,000 Tota

> Erin Hamill is the owner/operator of a tanning salon. She is considering four prices for a weekly tanning pass. Her estimate of price and quantity demanded are: Price………………. Quantity Demanded $12.50……………………….330 $11.50………………………..380 $10.50…………………

> The editor of Spunk magazine is considering three alternative prices for her new monthly periodical. Her estimate of price and quantity demanded are: Price…………………Quantity Demanded $7.95…………………………………25,000 $6.95 …………………………………..1,000 $5.95…………………………………37,0

> The Portland Brewing Company is a small craft brewer that produces five standard varieties of beer. The beers sell for $6 per six-pack, and the company currently sells 10,000 six-packs per month. The company is considering producing a seasonal beer that

> The Brindle Corporation is considering an initiative to assess customer profitability. The company’s CFO, John Bradley, stated his position as follows: “I strongly suspect that some of our customers are losers—in other words, they’re not covering product

> Consider a company that manufactures and sells personal computers (let’s call the company Bell Computers). Recently the company lowered its prices dramatically. The company is very efficient and needs only 5 days of inventory, collects its receivables wi

> Refer to the information in Exercise 8-17. For the coming year, the Triumph Corporation has told the Julius Company that it will be switched to an activity-based pricing system or it will be dropped as a customer. In addition to regular prices, Julius wi

> Selzer & Hollinger, a legal services firm, is considering outsourcing its payroll function. It has received a bid from ABC Payroll Services for $22,000 per year. ABC Payroll will provide all payroll processing, including employee checks and payroll tax r

> Oakland College is considering outsourcing grounds maintenance. In this regard, Oakland has received a bid from Highline Grounds Maintenance for $300,000 per year. Highline states that its bid will cover all services and planting materials required to “k

> Joan Paxton, VP of marketing for Supertone Recording Equipment, has developed a marketing plan for presentation to the company’s president. The plan calls for television ads, something the company has never used. As part of her presenta

> Primus is a firm of consultants that focuses on process reengineering and quality improvement initiatives. Northwood Industries has asked Primus to conduct a study aimed at improving on-time delivery. Normal practice for Primus is to bill for consultant

> Five Star Tools is a small family-owned firm that manufactures diamond-coated cutting tools (chisels and saws) used by jewelers. Production involves three major processes. First, steel “blanks” (tools without the diamo

> Briefly explain how traditional methods of allocating overhead to products might under allocate costs to low-production-volume products.

> Explain one possible advantage to having two cost pools for each service department: one for variable costs and one for fixed costs.

> Is the following statement true: “Cost allocation refers to the process of assigning direct costs”? Discuss.

> How does activity-based costing differ from the traditional costing approach?

> The Eldon Company has two production plants. Recently, the company conducted an ABM study to determine the cost of activities involved in processing orders for parts at each of the plants. Required: How might an operations manager use this information

> Auburn Banking and Loan Company has a graphic design department that designs loan forms and other documents used by the company’s two subsidiaries, Auburn Personal Banking and Auburn Business Banking. For practical purposes, the costs of the graphic desi

> Morton Manufacturing allocates factory overhead using one cost pool with direct labor hours as the allocation base. Morton has two production departments, P1 and P2. The new accountant at Morton estimates that next year, the total factory overhead costs

> Auburn Banking and Loan Company has six service departments—human resources, duplicating, janitorial, accounting, graphic design, and food services—whose costs are allocated to the company’s two subsidiaries, Auburn Personal Banking and Auburn Business B

> Vance Mason, the manager of the service department at the Proton Electronics Company, is evaluated based on the profit performance of his department. The profit of the department is down this year because the service department’s share of allocated gener

> Custom Metal Works received an offer from a big-box retail company to purchase 3,000 metal outdoor tables for $220 each. Custom Metal Works accountants determine that the following costs apply to the tables: Direct material……………………..$125 Direct labor…………

> The building maintenance department for the Taylor Manufacturing Company budgets annual costs of $5,250,000 based on the expected operating level for the coming year. The costs are allocated to two production departments. Taylor is considering two alloca

> Auburn Banking and Loan Company has six service departments: 1. Human Resources (hires employees and manages benefits) 2. Duplicating (performs copy services) 3. Janitorial (provides routine cleaning services) 4. Accounting (provides accounting servi

> The Warner Development Company has a security department that provides security services to other departments within the company. Department managers are responsible for working with the head of security to ensure that their departments are protected. R

> The provost at San Francisco University is considering allocating the cost of campus security to the university’s various colleges (Arts and Science, Business, Engineering, Nursing, etc.). In this regard, she is considering three allocation bases: 1. Co

> Mansard Hotels has five luxury hotels located in Boston, New York, Chicago, San Francisco, and Los Angeles. For internal reporting purposes, each hotel has an income statement showing its revenue and direct expenses. Additionally, the company allocates t

> Explain how the allocation process can make a fixed cost appear variable, leading to a poor decision.

> When would activity-based costing give more relevant costs than traditional costing systems?

> Why might noncontrollable costs be allocated to a department?

> What is a responsibility accounting system?

> Why is it generally a good idea to allocate budgeted, rather than actual, service department costs?

> If a company is allocating cafeteria costs to all departments within the company, what allocation base might result in a cause-and-effect relationship?

> Explain what a cost objective is and give two examples.

> QuantumTM manufactures electronic testing and measurement instruments. Many products are custom-designed with recent orders for function generators, harmonic analyzers, logic analyzers, temperature measurement instruments, and data-logging instruments. T

> The American Produce Company purchased a truckload of cantaloupes (weighing 4,000 pounds) for $900. American Produce separated the cantaloupes into two grades: superior and economy. The superior-grade cantaloupes had a total weight of 3,200 pounds, and t

> Bailey Products produces two joint products (A and B). Prior to the split-off point, the company incurs costs of $6,000. Product A weighs 30 pounds, and Product B weighs 120 pounds. Product A sells for $100 per pound, and Product B sells for $35 per poun

> Bailey Products produces two joint products (A and B). Prior to the split-off point, the company incurs costs of $6,000. Product A weighs 30 pounds, and Product B weighs 120 pounds. Product A sells for $100 per pound, and Product B sells for $35 per poun

> For each of the following situations, indicate a qualitative factor that should be considered prior to making a decision: a. A company that produces and sells bottled water is considering outsourcing its bottling operation. The company will still source

> Computer Village sells computer equipment and home office furniture. Currently the furniture product line takes up approximately 50 percent of the company’s retail floor space. The president of Computer Village is trying to decide wheth

> Imperial produces whirlpool tubs. Currently the company uses internally manufactured pumps to power water jets. Imperial has found that 40 percent of the pumps have failed within their 12-month warranty period, causing huge warranty costs. Because of the

> The Howell Corporation produces an executive jet for which it currently manufactures a fuel valve; the cost of the valve is indicated below: Variable costs Cost per Unit Direct material…………………$ 950 Direct labor…………………………650 Variable o

> Go to the financial glossary Investorwords.com at www.investorwords. com and look up the phrases sunk cost and opportunity cost. Required: Why are sunk costs never relevant to a decision whereas opportunity costs are always relevant?

> Jordan Walken owns and operates an electronics store in Seattle, Washington. Her accountant has prepared a product line income statement that is reproduced below. (Jordan’s two lines are music devices and accessories.) In preparing the

> Describe a decision and provide an example of a fixed cost that is incremental in the context of the decision. Then provide an example of a fixed cost that is not incremental in the context of the decision.

> At RM Sharpton, the engraving department is a bottleneck, and the company is considering hiring an extra worker, whose salary will be $55,000 per year, to mitigate the problem. With the extra worker, the company will be able to produce and sell 7,000 mor

> Icon.com sells software and provides consulting services to companies that conduct business over the Internet. The company is organized into two lines of business (software and consulting), and profit statements are prepared as follows: Direct costs inc

> Each month, senior managers at Vermont Wireless Technologies review cost reports for the company’s various departments. The report for the human resource (HR) group for April is as follows: Jason Fox, the new vice president of operatio

> Primary Savings and Loan of Denver is conducting an ABM study of its teller operations. In this regard, the company has identified the following major activities performed by bank tellers: 1. Process deposits 2. Process withdrawals 3. Process requests

> Talbot Partners is a consulting firm with clients across the nation. Within the company is a travel group that arranges flights and hotel accommodations for its over 2,000 consultants. The cost of operating the travel group (excluding the costs associate

> The Riverdale Printing Company prints limited edition art books with production runs of 15,000 to 100,000. It has recently adopted an activity-based costing system to assign manufacturing overhead to products. The following data relate to one product, Ar

> TriTech Company has been allocating overhead to individual product lines based on each line’s relative shares of direct labor hours. For the upcoming year, the company estimated that manufacturing overhead will be $1,800,000 and estimat

> Tannhauser Financial is a banking services company that offers many different types of checking accounts. It has recently adopted an activity-based costing system to assign costs to various types of checking accounts. The following data relate to one typ

> The Cheesecake Shoppe is a national bakery that is known for its strawberry cheesecake. It makes 12 different kinds of cheesecake as well as many other types of bakery items. It has recently adopted an activity-based costing system to assign manufacturin

> The Summit Manufacturing Company produces two products. One is a recreational whitewater kayak molded from plastic and designed to perform as a durable whitewater play boat. The other product is a high-performance competition kayak molded with high-tech

> Simon Products manufactures jewelry settings and sells them to retail stores. In the past, most settings were made by hand, and the overhead allocation rate in the prior year was $12 per labor hour ($2,700,000 overhead ÷ 225,000 labor hours). In the curr

> Snowcap Electronics is a manufacturer of data storage devices. Snowcap consists of two service departments (maintenance and computing) and two production departments (assembly and testing). Maintenance costs are allocated on the basis of square footage o

> Armstrong Industries produces electronic equipment for the marine industry. Armstrong has two service departments (maintenance and computing) and two production departments (assembly and testing). Maintenance costs are allocated on the basis of square fo

> World Airlines has three service departments: (1) ticketing, (2) baggage handling, and (3) engine maintenance. The service department costs are estimated for separate cost pools formed by department and are allocated to two revenue-producing departmen

> Pelton Instruments manufactures a variety of electronic instruments that are used in military and civilian applications. Sales to the military are generally on a cost-plus-profit basis with profit equal to 10 percent of cost. Instruments used in military

> Brennen produces a mint syrup used by gum and candy companies. Recently, the company has had excess capacity due to a foreign supplier entering its market. Brennen is currently bidding on a potential order from Quality Candy for 5,000 cases of syrup. The

> Binder Manufacturing produces small electric motors used by appliance manufacturers. In the past year, the company has experienced severe excess capacity due to competition from a foreign company that has entered Problems Binder’s market. The company is

> The Kiddo Company manufactures and ships children’s stuffed animals across the nation. The following are profit statements for the company’s two lines of business: Costs that are easily associated with each line of bu

> DataPoint, Inc. has decided to discontinue manufacturing its Quantum model personal organizer. Currently the company has a number of partially completed personal organizers on hand. The company has spent $110 per unit to manufacture these organizers. To

> E-Teller manufactures ATM machines. Recently the company has begun manufacturing and marketing a machine that can recognize customer fingerprints. Demand for this machine is very strong, and the chief executive officer of E-Teller is considering dropping

> Consider the information in Exercise 7-8 and identify the following statements as true or false. a. Supervisory salary is an avoidable cost if the company decides to buy the valves. b. Depreciation of building is an avoidable cost if the company decides

> The Tufanzi Furniture Company manufactures leather furniture. The manufacturing process uses a variety of metal pieces, such as brackets, braces, and casters. Carla Reid, the resource officer of Tufanzi, has been asked to determine whether it is advisabl

> The following are six cost pools established for a company using activity-based costing. The pools are related to the company’s products using cost drivers. Cost pools: 1. Inspection of raw materials 2. Production equipment repairs and maintenance 3.

> Reece Herbal Supplements purchases, in bulk, a variety of dietary supplements that the company bottles, packages, and ships to health-food stores and drugstores around the country. The company has a good reputation, and its products are in high demand. L

> At Dalton Playground Equipment, the powder-coating process is a bottleneck. Typically, it takes approximately 2 hours to switch between jobs. The time is spent cleaning nozzles and paint tanks and recalibrating equipment. Currently the company runs relat

> Northwest Minerals operates a mine. During July, the company obtained 500 tons of ore, which yielded 250 pounds of gold and 62,500 pounds of copper. The joint cost related to the operation was $500,000. Gold sells for $950 per ounce, and copper sells for

> Gavin West is a commercial fisherman, and he has just returned from a trip off the coast of Maine. He has calculated the cost of his catch as follows: Wages of deckhands…………………………………………….$35,000 Gavin’s wage……………………………………………………….…18,000 Food, medical sup

> Good Earth Products produces orange juice and candied orange peels. A 1,000-pound batch of oranges, costing $500, is transformed using labor of $50 into 100 pounds of orange peels and 300 pints of juice. The company has determined that the sales value of

> Sylvan Wood Products purchases alder logs for $100 per log. After the bark is stripped, the log is spun on a veneer cutter, which peels thin layers of wood (referred to as veneer) that are sold to furniture manufacturers for $150 per 3′ × 30′ sheet of ve

> Carpets Unlimited produces and sells three lines of carpet: economy, standard, and deluxe. Jeff Choi, the chief financial officer of the company, has prepared the following report on the profitability in the past year. In the report, fixed costs are allo

> Lennon Fans manufactures three model fans for industrial use. The standard selling price and cost of each fan follow: Essentially, all overhead costs are fixed. Some of the fixed overhead costs are direct costs to particular models, and others are commo

> Midwestern Sod produces two products, fescue grass and Bermuda grass: The company has 130,000 square yards of growing space available. In the past year, the company dedicated 65,000 square yards to fescue and 65,000 square yards to Bermuda grass. Annu

> Pantheon Gaming, a computer enhancement company, has three product lines: audio enhancers, video enhancers, and connection-speed accelerators. Common costs are allocated based on relative sales. A product line income statement follows: Since the profit

> Mulan Carpet produced 1,200 yards of its economy-grade carpet. In the coloring process, there was a pigment defect, and the resulting color appeared to be faded. The carpet normally sells for $15 per yard: $7 of variable cost per yard and $6 of fixed cos

> The Curtis Corporation is beginning production of Mighty Mint, a new mouthwash in a small spray container. The product will be sold to wholesalers and large drugstore chains in packages of 30 containers for $20 per package. Management allocates $225,000

> Susan Crossing purchased a used Ford Focus for $12,000. Since purchasing the car, she has spent the following amounts on parts and labor: New stereo system…………$1,500 New paint job………………....2,500 New tires………………………..1,200 New muffler……………………..250 Total……

> Emerson Ventures is considering producing a new line of hang gliders. The company estimates that variable costs will be $400 per unit and fixed costs will be $400,000 per year. Required: a. Emerson has a pricing policy that dictates that a product’s pr

> Consider the information in Problem 8-11. Lauden Conference Solutions has decided to adopt an activity-based pricing scheme. On future jobs, the company will charge a 35 percent markup on the sum of product costs plus installer salaries. In addition, the

> Lauden Conference Solutions specializes in the design and installation of meeting and conference centers for large corporations. When bidding on jobs, the company estimates product cost and direct labor for installers and marks up the total cost by 35 pe

> Symphony Sound is designing a portable recording studio to be sold to consumers. The team developing the product includes representatives from marketing, engineering, and cost accounting. The recording studio will include sound-canceling monitor headphon