Question: Emily Jackson (Social Security number 765-12-

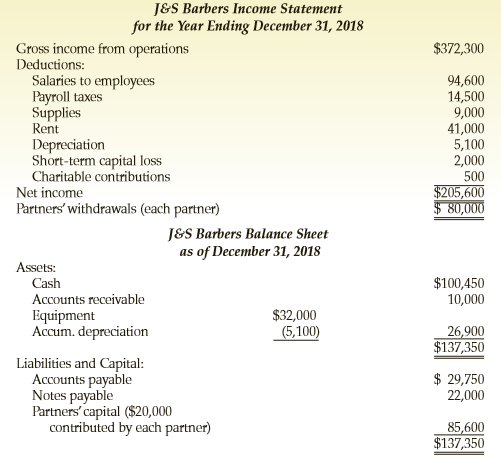

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership’s first year of operation is 2018. Emily and James divide income and expenses equally. The partnership name is J&S Barbers, it is located at 1023 Broadway, New York, NY 10004, and its Federal ID number is 95-6767676. The 2018 financial statements for the partnership are presented below.

Emily lives at 456 E. 70th Street, New York, NY 10006, and James lives at 436 E. 63rd Street, New York, NY 10012.

Required:

Complete J&S Barbers’ Form 1065 and Emily and James’ Schedule K-1s. Do not fill in Schedule D for the capital loss, Form 4562 for depreciation, or Schedule B-1 related to ownership of the partnership. Make realistic assumptions about any missing data.

Transcribed Image Text:

JES Barbers Income Statement for the Year Ending December 31, 2018 $372,300 Gross income from operations Deductions: Salaries to employees Payroll taxes Supplies Rent 94,600 14,500 9,000 41,000 5,100 2,000 500 $205,600 $ 80,000 Depreciation Short-term capital loss Charitable contributions Net income Partners' withdrawals (each partner) JES Barbers Balance Sheet as of December 31, 2018 Assets: $100,450 10,000 Cash Accounts receivable Equipment Accum. depreciation $32,000 (5,100) 26,900 $137,350 Liabilities and Capital: Accounts payable Notes payable Partners' capital ($20,000 contributed by each partner) $ 29,750 22,000 85,600 $137,350

> Joan is a self-employed attorney in New York City. Joan took a trip to San Diego, CA, primarily for business, to consult with a client and take a short vacation. On the trip, Joan incurred the following expenses: Calculate Joan’s tra

> Your supervisor has asked you to research the following situation concerning Owen and Lisa Cordoncillo. Owen and Lisa are brother and sister. In May 2018, Owen and Lisa exchange land they both held separately for investment. Lisa gives up a 2 acre proper

> Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2018 of $46,300. He uses the standard deduction and has no dependents. a. Calculate Jonathan’s taxable income. Please show your work. b. When you calculate Jonathan’s tax liability a

> Alicia, age 27, is a single, full-time college student. She earns $13,200 from a part time job and has taxable interest income of $1,450. Her itemized deductions are $845. Calculate Alicia’s taxable income for 2018.

> Teresa is a civil engineer who uses her automobile for business. Teresa drove her automobile a total of 11,965 miles during 2018, of which 80 percent was business mileage. The actual cost of gasoline, oil, depreciation, repairs, and insurance for the yea

> Leslie is a single taxpayer who is under age 65 and in good health. For 2018, she has a salary of $24,000 and itemized deductions of $1,000. Leslie allows her mother to live with her during the winter months (3–4 months per year), but her mother provides

> Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: What is the net income Margaret should show on her Schedule C? Show the calculation of her taxable business inc

> Melissa and Aaron are married taxpayers with taxable income of $105,000. a. When you calculate their tax liability, are you required to use the tax tables or the tax rate schedules, or does it matter? b. What is their 2018 tax liability

> Carey opens a law office in Chicago on January 1, 2018. On January 1, 2018, Carey purchases an annual subscription to a law journal for $170 and a 1-year legal reference service for $1,500. Carey also subscribes to Chicago Magazine for $54 so she can fi

> Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2018: Тахрауerts) Filing Status Тахаble Income Income Tax Allen Single MFS $21,000 24,545 35,784 27,450 45,000 Воyd Caldwell $ $. MFJ H o

> Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in 2018: a. How much is Marty’s deduction for entertainment expenses for 2018? b. For each item listed above that you believe

> For each of the following independent cases, indicate the amount of gross income that must be included on the taxpayer’s 2018 income tax return. a. Malchia won a $4,000 humanitarian award. b. Rob won a new automobile (with a sticker price of $15,700 and

> While preparing Massie Miller’s 2018 Schedule A, you review the following list of possible charitable deductions provided by Massie: What would you say to Massie regarding her listed deductions? How much of the deduction is allowed fo

> How much of each of the following is taxable? a. Cheline, an actress, received a $6,400 gift bag for attending the Academy Awards Ceremony during 2018. b. Jon received a gold watch worth $660 for 25 years of service to his accounting firm (not a qualifie

> Scott Butterfield is self-employed as a CPA. He uses the cash method of account ing, and his Social Security number is 644-47-7833. His principal business code is 541211. Scott’s CPA practice is located at 678 Third Street, Riverside, C

> Linda and Richard are married and file a joint return for 2018. During the year, Linda, who works as an accountant for a national airline, used $2,100 worth of free passes for travel on the airline; Richard used the same amount. Linda and Richard also us

> Ulysses and Penelope are married and file separate returns for 2018. Penelope itemizes her deductions on her return. Ulysses’ adjusted gross income was $17,400, his itemized deductions were $2,250. Neither have any dependents. Calculate Ulysses’ income t

> Kristen, a single taxpayer, receives two 2018 Forms W-2 from the two employers she worked for during the year. One Form W-2 lists her wages in Boxes 1, 3, and 5 as $18,700. Her other employer’s Form W-2 has $43,000 in Box 1 but only $46,500 in both Box 3

> Jane is a roofing contractor. Jane’s friend needed a new roof but did not have the cash to pay. Jane’s friend instead paid with a used truck that Jane could use in her roofing business. The truck had originally cost the friend $17,500 but it was gently

> Greg died on July 1, 2018, and left Lea, his wife, a $45,000 life insurance policy which she elects to receive at $9,000 per year plus interest for 5 years. In the current year, Lea receives $9,500. How much should Lea include in her gross income?

> Lola, age 67, began receiving a $1,000 monthly annuity in the current year upon the death of her husband. She received seven payments in the current year. Her husband contributed $48,300 to the qualified employee plan. Use the Simplified Method Worksheet

> Ellen’s tax client, Tom, is employed at a large company that offers health care flexible spending accounts to its employees. Tom must decide at the beginning of the year whether he wants to put as much as $2,650 of his salary into the health care flexibl

> Indicate whether each of the items listed below would be included (I) in or excluded (E) from gross income for the 2018 tax year. a. Welfare payments b. Commissions c. Hobby income d. Scholarships for room and board e. $300 set of golf clubs, an employee

> Jason and Mary Wells, friends of yours, were married on December 30, 2018. They know you are studying taxes and have sent you an e-mail with a question concerning their filing status. Jason and Mary would each like to file single for tax year 2018. Jason

> Jim, age 50, and Martha, age 49, are married with three dependent children. They file a joint return for 2018. Their income from salaries totals $49,500, and they received $10,125 in taxable interest, $5,000 in royalties, and $3,000 in other ordinary inc

> Diego, age 28, married Dolores, age 27, in 2018. Their salaries for the year amounted to $47,230 and they had interest income of $3,500. Diego and Dolores’ deductions for adjusted gross income amounted to $2,000, their itemized deductions were $16,000,

> Go to the Turbo Tax Blog (http://blog.turbotax.intuit.com/) and search the blog for an article on deductions related to service animals. Determine which of the following expenses might be deductible: purchase of the service animal, training the service a

> Go to the IRS website (www.irs.gov) and print out a copy of the most recent Schedule F of Form 1040.

> In each of the following situations, determine whether the taxpayer(s) has/have a dependent. Dependent? (Yes/No) a. Donna, a 20-year-old single taxpayer, supports her mother, who lives in her own home. Her mother has income of $1,350. b. William, age 43,

> Jason and Mary are married taxpayers in 2018. They are both under age 65 and in good health. For 2018 they have a total of $41,000 in wages and $700 in interest income. Jason and Mary’s deductions for adjusted gross income amount to $5,000 and their item

> During the 2018 tax year, Irma incurred the following expenses: If Irma’s adjusted gross income is $23,000, calculate her miscellaneous deductions. $244 150 Union dues Tax return preparation fee Brokerage fees for the purchase of

> Lydia, a married individual, was unemployed for a few months during 2018. During the year, she received $3,250 in unemployment compensation payments. How much of her unemployment compensation payments must be included in gross income?

> On January 3, 2018, Carey discovers his diamond bracelet has been stolen. The bracelet had a fair market value and adjusted basis of $7,500. Assuming Carey had no insurance coverage on the bracelet and his adjusted gross income for 2018 is $45,000, calcu

> In June of 2018, Maureen’s house is vandalized during a long-term power failure after a hurricane hit the city. The president of the United States declares Maureen’s city a disaster area as a result of the wide-scale vandalism. In which tax year may Maur

> Jerry, age 23, a full-time student and not disabled, lives with William and Sheila Carson. Jerry is William’s older brother. Jerry is single, a U.S. citizen, and does not provide more than one-half of his own support. William and Sheila are both 21 and f

> For each of the following cases, indicate the filing status for the taxpayer(s) for 2018 using the following legend: A—Single B—Married filing a joint return C—Married filing separate returns Dâ

> Jerry made the following contributions during 2018: In addition, Jerry donated used furniture to the Salvation Army that he purchased years ago for $400 with a fair market value of $200. Assuming Jerry has adjusted gross income of $45,000, has the nece

> Barbara donates a painting that she purchased three years ago for $8,000, to a university for display in the president’s office. The fair market value of the painting on the date of the gift is $14,000. If Barbara had sold the painting, the difference be

> For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is (are) required to file a tax return for 2018. Explain your answer. a. Helen is a single taxpayer with interest income in 2018 of $8,750.

> Helen paid the following amounts of interest during the 2018 tax year: Calculate the amount of Helen’s itemized deduction for interest (after limitations) for 2018. Mortgage interest on Dallas residence (loan balance $50,000) Auto

> Mike bought a solar electric pump to heat his pool at a cost of $2,500 in 2018. What is Mike’s credit?

> Carl and Jenny adopt a Korean orphan. The adoption takes 2 years and two trips to Korea and is finalized in 2018. They pay $7,000 in 2017 and $7,500 in 2018 for qualified adoption expenses. In 2018, Carl and Jenny have AGI of $150,000. a. What is the ado

> What is the total dollar amount of personal and dependency exemptions which a married couple with one child and $80,000 of adjusted gross income would claim in 2018?

> Vandell is a taxpayer in the 25 percent tax bracket. He invests in Otay Mesa Water District Bonds that pay 4.5 percent interest. What interest on a taxable bond would provide the same after-tax return to Vandell?

> Janie graduates from high school in 2018 and enrolls in college in the fall. Her parents pay $4,000 for her tuition and fees. a. Assuming Janie’s parents have AGI of $170,000, what is the American Opportunity tax credit they can claim for Janie? b. Assu

> In 2018, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade at the local high school. Gale and Cathy did not claim

> 1. Which of the following is not a change made to individual taxation by the Tax Cuts and Jobs Act? a. Repeal of personal exemptions b. General lowering of tax rates c. Repeal of the individual alternative minimum tax d. Introduction of the qualified bus

> Laura is a single taxpayer living in New Jersey with adjusted gross income for the 2018 tax year of $35,550. Laura’s employer withheld $3,300 in state income tax from her salary. In April of 2018, she pays $600 in additional state taxes

> Lisa Kohl (age 44) is an unmarried high school principal. Lisa received the following tax documents: During the year, Lisa paid the following amounts (all of which can be substantiated): Lisa’s sole stock transaction was reported

> Sherry Hopson owns a retail family clothing store. Her store is located at 4321 Heather Drive, Henderson, NV 89002. Her employer identification number is 95­ 1234321 and her Social Security number is 123­45­6789. Sherry k

> Patty Banyan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2018, Patty has no dependents, and her W-2, from her job at a local restaurant where she parks cars, contains the following inf

> Warner and Augustine Robins, both 33 years old, have been married for 9 years and have no dependents. Warner is the president of Dragon Lady Corporation located in Macon. The Dragon Lady stock is owned 40 percent by Warner, 40 percent by Augustine, and 2

> Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21-3434) have a 19-year-old son (born 10/2/99 Social Security number 555-55-1212), Jack who is a full-time student at th

> David and Darlene Jasper have one child, Sam, who is 6 years old (birthdate July 1, 2012). The Jaspers reside at 4639 Honeysuckle Lane, Los Angeles, CA 90248. David’s Social Security number is 577-11-3311, Darlene’s is

> John Fuji (birthdate June 6, 1980) moved from California to Washington in December 2017. His earnings and income tax withholding for 2018 for his job as a manager at a Washington apple-processing plant are: John’s other income include

> Bea Jones (birthdate March 27, 1984) moved from Texas to Florida in December 2017. She lives at 654 Ocean Way, Gulfport, FL 33707. Bea’s Social Security number is 466-78-7359 and she is single. Her earnings and income tax withholding fo

> Richard and Christine McCarthy have a 19-year-old son (born 10/2/99; Social Security number 555-55-1212), Jack, who is a full-time student at the University of Key West. Years ago, the McCarthys shifted a significant amount of investments into Jackâ

> William sold Section 1245 property for $25,000 in 2018. The property cost $37,000 when it was purchased 5 years ago. The depreciation claimed on the property was $17,000. a. Calculate the adjusted basis of the property. b. Calculate the recomputed basis

> In 2018, Professor Patricia (Patty) Pâté retired from the Palm Springs Culinary Arts Academy (PSCAA). She is a single taxpayer and is 62 years old. Patty lives at 98 Colander Street, Apt. 206D, Henderson, NV 89052. Professor P&A

> The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. Required: Complete the Black’s federal tax return for 2018. Use Form 1040, Schedule 1

> John Williams (birthdate August 2, 1975) is a single taxpayer. John’s earnings and withholdings as the manager of a local casino for 2018 are reported on his Form W-2: John’s other income includes interest on a savin

> Christopher Crosphit (age 42) owns and operates a health club called “Catawba Fitness.” The business is located at 4321 New Cut Road, Spartanburg, SC 29303. The principal business code is 812190. Chris had the followin

> Russell (birthdate February 2, 1967) and Linda (birthdate August 30, 1972) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landsca

> Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a homemaker and Walt is a high school teacher. Skylar’s Social Security number is 222-43-7690 and Walt’s i

> Carl Conch and Mary Duval are married and file a joint return. Carl works for the Key Lime Pie Company and Mary is a homemaker after losing her job in 2017. Carl’s birthdate is June 14, 1973 and Mary’s is October 2, 19

> Ray and Maria Gomez have been married for 3 years. Ray is a propane salesman for Palm Oil Corporation and Maria works as a city clerk for the City of McAllen. Ray’s birthdate is February 21, 1990 and Maria’s is Decembe

> Ken (birthdate July 1, 1987) and Amy (birthdate July 4, 1989) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of these items must be used to calculate taxable income.

> Abigail (Abby) Boxer is a single mother working as a civilian accountant for the U.S. Army. Her Social Security number is 676-73-3311 and she lives at 3456 Alamo Way, San Antonio, TX 78249. Helen, Abby’s 18-year-old daughter (Social Sec

> elly, age 38, has a $140,000 IRA with Blue Mutual Fund. He has read good things about the management of Green Mutual Fund, so he opens a Green Fund IRA. Telly asked for and received his balance from the Blue Fund on May 1, 2018. Telly opted to have no wi

> Leslie and Leon Lazo are married and file a joint return for 2018. Leslie’s Social Security number is 466-47-3311 and Leon’s is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2018, Leslie did not w

> Beverly and Ken Hair have been married for 3 years. Beverly works as an accountant at Cypress Corporation. Ken is a full-time student at Southwest Missouri State University (SMSU) and also works part-time during the summer at Cypress Corp. Kenâ

> David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1973. David was employed as a delivery person for a local pizza restaurant. Da

> Steve Jackson (birthdate December 13, 1965) is a single taxpayer living at 3215 Pacific Dr., Apt. B, Pacific Beach, CA 92109. His Social Security number is 465-88-9415. In 2018, Steve’s earnings and income tax withholding as laundry att

> Assume that Olive Corporation, in Comprehensive Problem 1, is an S corporation owned 50 percent by Linda Holiday and 50 percent by Ralph Winston. The corporation is not subject to any special taxes. Using the relevant information given in Comprehensive P

> Olive Corporation was formed and began operations on January 1, 2018. The corporation’s income statement for the year and the balance sheet at year-end are presented below. The corporation made estimated tax payments of $5,000 and th

> Beech Corporation, an accrual basis calendar year taxpayer, was organized and began business on August of the current calendar tax year. During the current year, the corporation incurred the following expenses: Assuming that Beech Corporation does not

> Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2018. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45%. a. Calcula

> In the 2018 tax year, Michelle paid the following amounts relating to her 2016 tax return: Which of the above items may be deducted on Michelle’s 2018 individual income tax return? Explain Tax deficiency Negligence penalty Interes

> For its current tax year, Ilex Corporation has ordinary income of $260,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporation’s tax liability for 2018.

> Describe ways in which LLCs might differ from partnerships.

> Your supervisor has asked you to research a potential tax deduction for a client, Nancy Fradette. Nancy is a seat-filler at a number of the award shows that are filmed in the greater Los Angeles area. Although typically seat-fillers are not compensated,

> Vanessa Lazo was an amazing high school student and so it was no great surprise when she was accepted into Prestige Private University (PPU). To entice Vanessa to attend PPU, the school offered her a reduced tuition of $13,000 per year (full-time tuition

> Ulmus Corporation is an engineering consulting firm and has $1,120,000 in taxable income for 2018. Calculate the corporation’s income tax liability for 2018.

> Quince Corporation has taxable income of $485,000 for its calendar tax year. Calculate the corporation’s income tax liability for 2018 before tax credits.

> The Loquat Corporation has book net income of $50,000 for the current year. Included in this figure are the following items, which are reported on the corporation’s Schedule M-1, Reconciliation of Income (Loss) per Books with Income per

> DeMaria Corporation, a calendar year corporation, generates the following taxable income (net operating losses) since its inception in 2016: Assuming Demaria makes no special elections with regard to NOLs, what is DeMaria’s net operat

> Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda’s basis in her stock is $21,000. On May 26, 2018, Bill sells his stock, with a basis of $40,000, to Loraine for $50,000. For the 2018 tax year, Radiata Corp

> Cedar Corporation has an S corporation election in effect. During the 2018 calendar tax year, the corporation had ordinary taxable income of $200,000, and on January 15, 2018, the corporation paid dividends to shareholders in the amount of $120,000. How

> Mallory Corporation has a calendar year-end. The corporation has paid estimated taxes of $10,000 during 2018 but still owes an additional $5,000 for its 2018 tax year. a. When is the 2018 tax return due? b. If an automatic extension of time to file is r

> Thuy worked as the assistant manager at Burger Crown through August 2018 and received wages of $87,000. Thuy then worked at Up and Down Burger starting in September of 2018 and received wages of $60,000. Calculate the amount of Thuy’s overpayment of Soci

> Cypress Corporation, a calendar year end corporation, has an AMT credit carryforward from 2017 in the amount of $43,000. In 2018, Cypress has $170,000 of taxable income. Assuming Cypress is not a personal service corporation, what is the amount of refund

> Fidicuary Investments paid its employee, Yolanda, wages of $137,000 in 2018. Calculate the FICA tax: Withheld from Yolanda's wages: Social Security Medicare Paid by Fiduciary: Social Security Medicare Total FICA Tax

> Wilson has a 40 percent interest in the assets and income of the CC&W Partnership, and the basis in his partnership interest is $45,000 at the beginning of 2018. During 2018, the partnership’s net loss is $60,000 and Wilson’s share of the loss is $24,000

> Kana is a single wage earner with no dependents and taxable income of $205,000 in 2018. Her 2017 taxable income was $155,000 and tax liability was $36,382. Calculate the following (note: this question requires the use of the tax tables in Appendix A): Ka

> What is the maximum amount a 45-year-old taxpayer and 45-year-old spouse can put into a Traditional or Roth IRA for 2018 (assuming they have sufficient earned income, but do not have an income limitation and are not covered by another pension plan)?

> Cassie works at Capital Bank and is in charge of issuing Form 1099s to bank customers. Please describe for Cassie the 4 possible situations that require the bank to implement backup withholding on a customer.

> Sophie is a single taxpayer. For the first payroll period in July 2018, she is paid wages of $3,900 monthly. Sophie claims one allowance on her Form W-4. a. Use the percentage method to calculate the amount of Sophie’s withholding for a monthly pay perio

> Ralph and Kathy Gump are married with one 20-year-old dependent child. Ralph earns a total of $98,000 and estimates their itemized deductions to be $28,500 for the year. Kathy is not employed. Use Form W-4 on Pages 9-39 and 9-40 to determine the number o

> Van makes an investment in an LLC in 2018. Van’s capital contributions to the LLC consisted of $30,000 cash and a building with an adjusted basis of $70,000, subject to a nonrecourse liability (seller financing) of $20,000. Calculate the amount that Van

> Go to the IRS website (www.irs.gov) and assuming bonus depreciation is used, redo Problem 11, using the most recent interactive Form 4562, Depreciation and Amortization. Print out the completed Form 4562.