Question: Endnote Enterprises entered into the following

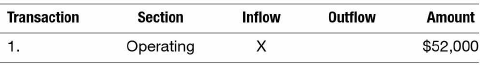

Endnote Enterprises entered into the following transactions during 2021:

1. Sold merchandise for $52,000 in cash.

2. Purchased a parcel of land. The company paid $12,000 in cash and issued a $30,000 note payable for the remainder.

3. Purchased a three-year insurance policy for $30,000.

4. Purchased a building in exchange for a long-term note with a face value and present value of $115,000.

5. Collected $100,000 on a note receivable. Included in the $100,000 is $6,000 in interest earned and accrued in the previous period and $4,000 in interest earned in the current period.

6. Collected from customers $45,000 that will not be earned until 2022.

7. Reacquired 5,000 shares of its common stock for $10 per share.

8. Declared and paid a cash dividend of $40,000.

9. Paid $25,000 for salaries and wages accrued in a prior year.

10. Retired $500,000 in bonds payable. The company gave the creditor $300,000 in cash and $200,000 in common stock.

11. Purchased $60,000 of inventory on account.

12. Wrote off an open account ($5,000) as uncollectible (allowance method).

13. Recorded $84,000 in depreciation expense for the year.

Endnote Enterprises is in the process of preparing its statement of cash flows under the direct method.

INSTRUCTIONS:

Use the chart format given here and the one that follows to indicate the following:

a. The section of the statement of cash flows in which each transaction would be listed. Use the following terms:

(1) Operating-for operating activities

(2) Investing-for investing activities

(3) Financing-for financing activities

(4) N/ A-for items that would not be included on the statement of cash flows

b. Whether the transaction would involve an inflow or an outflow of cash.

c. The dollar amount, if appropriate, that the company would report on the statement of cash flows.

The first transaction is done for you as an example.

> The following disclosure was included in the footnotes of Caterpillar's 2019 annual report. The company uses the LIFO cost flow assumption and reported net income of $6,093 for 2019. The company's effective tax rate is 22 percent (dollars in millions). a

> Heller Bottling Company began business in 2017. Inventory units purchased and sold for the first year of operations and each of the following four years follow: Inadequate cash flows forced Heller Bottling Company to cease operations at the end of 2021.

> Dallas Manufacturing engaged in five transactions involving inventory at the end of 2020: 1. Ordered $50,000 of inventory on December 29, 2020. The goods were shipped on December 30, 2020, with the terms FOB shipping point. Dallas received the inventory

> On January 1, 2021, Outreach Incorporated sold services to a Canadian supply company and accepted a three-year note in the amount of 11,000 Canadian dollars. Assume that exchange rates between the U.S. dollar and the Canadian dollar are as follows: Provi

> Potter Stables uses the aging method to estimate its bad debts. Sherman Potter, the company president, has given you the following aging of accounts receivable as of December 31 , 2021, along with the historical probabilities that the account balances wi

> Kyocera is a Japanese telecommunications company that publishes IFRS-based financial statements. On its March 31, 2019, statement of cash flows (indirect method) in the operating section it reported a "provision for doubtful accounts" of 33,276 million y

> The 2021 annual report of Johnson Services reveals the following information. The dollar amounts are end-of-year balances. Johnson estimates bad debts each year at 2 percent of credit sales. a. Compute the actual amount of write-offs during 2021 . b. Inf

> The following items were extracted from the 2019 financial records of Cummins Inc. ( dollars in millions): During the following year, assume the company writes off $5 of accounts receivable as uncollectible and then estimates $6 of the year's receivables

> During 2019, Advanced Micro Devices (A M D) entered into the transactions listed below. a. On a separate sheet of paper, complete the following chart to show the effect of these transactions on the accounting equation and compute the net effect (doll

> In its 2020 financial report, Sound Unlimited reported the following items: 1. A credit balance of $200,000 in allowance for bad debts. 2. A debit balance of $7,500,000 in accounts receivable. 3. Sales of $3,250,000. During 2020, the company was involved

> Arlington Cycle Company began operations on January 1, 2020. The company reported the following selected items in its 2021 financial report: Arlington estimates bad debts at 2 percent of gross sales. Analyze the activity in the allowance for bad debts T-

> The following items were taken from the financial records of Melvin Construction Company. a. $2,000 in a checking account. b. $8,000 invested in a treasury note due to mature in 90 days. c. $3,000 in a savings account that cannot be withdrawn until a $10

> Assume that Outreach (in E6.9) hedged the 11 ,000 (Canadian dollar) receivable by borrowing 11 ,000 Canadian dollars from a Canadian bank on January I , 2021. Use journal entries to demonstrate how this transaction removes Outreach's exposure to the risk

> Boyer International is currently preparing its financial statements for 2020. The company has several different sources of cash and is trying to decide how to classify them. The sources of cash follow: a. $30,000 in a checking account with The First Nati

> Assume Cummings, Inc., a leading diesel engine manufacturer, enters into the following transactions during 2020. 1. Purchased inventory on account. 2. Purchased plant machinery by issuing long-term debt. 3. Made a principal payment on long-term debt. 4.

> The financial information below was taken from the records of Lotechnic Enterprises. The company pays no dividends. a. Compute the current ratio, the debt/equity ratio, and return on assets for each of the four years. Assume that the year-end balances in

> Corporation began operations on January 1, 2017. The initial investment by the owners was $100,000. The following information was extracted from the company's records. a. Compute the return on equity for each year. Has the company been effective at manag

> The following data are from the 2020 financial report of Generic Clothing Company: a. Based upon the above data, compute the following for Generic Clothing Company for both 2019 and 2020: (1) The current ratio. (2) The quick ratio. b. Assume that net cre

> Excerpted financial information from the records of The Gap Inc., a major clothing retailer, follows (dollars in millions): a. Compute the current ratio for each year. b. Compute the gross margin ((Sales - COGS)/Sales) for each year. c. Compute inventory

> During 2019, Abercrombie & Fetch entered into the transactions listed below. a. On a separate sheet of paper, complete the following chart to show the effect of these transactions on the accounting equation and compute the net effect (dollars in mill

> The 2020 and 2019 financial statements of Ken's Sportswear follow: a. Compute the two performance ratios, leverage (debt/equity and interest coverage only), solvency (current and quick only), asset quality (receivable and inventory turnover only), expens

> The chief executive officer of Ginny's Fashions has included the following financial statements in a loan application submitted to Priority Bank. The company intends to acquire additional equipment and wishes to finance the purchase with a long-term note

> Excerpts from the 2019 financial report of Intel, a computer-processor manufacturer, are as follows (dollars in millions). From the information above, compute ROE, ROA, capital structure leverage, profit margin, and total asset turnover for 2018 and 2019

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle and prepare projected balance sheets and income statements for 2020 and 2021 for Walmart, the discount retail giant. Compute ROE, ROA, asset turnover, profit margin, capi

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle and prepare projected balance sheets and income statements for 2020 and 2021 for Accenture, the computer systems company. Compute ROE, ROA, capital structure leverage, pr

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle and prepare projected balance sheets and income statements for 2020 and 2021 for Verizon, the telecommunications company. Compute ROE, ROA, capital structure leverage, pr

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle and prepare a projected balance sheet and income statement for FedEx, the delivery service, for 2020. Assume that company management expects sales growth of 8 percent dur

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle and prepare a projected balance sheet and income statement for DuPont, the chemical company, for 2020. Assume that company management expects sales growth of 5 percent du

> Access the Data Analytic worksheet in at www.wiley.com/go/pratt/financialaccountinglle and create a table that includes statement of cash flow information for General Electric and Lockheed Martin, competitors in aerospace services, and compare their cash

> Access the Data Analytic worksheet in at www.wiley.com/go/pratt/financialaccountinglle and create a table that includes statement of cash flow information for Fiat Chrysler and Tesla, competing motor vehicle manufacturers, and compare their cash manageme

> During 2019, Intel entered into the transactions listed below. a. On a separate sheet of paper, complete the following chart to show the effect of these transactions on the accounting equation and compute the net effect (dollars in millions). b. Which on

> Access the Data Analytic worksheet atwww.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of International Paper and Weyerhaeuser, competing manufacturers in the paper products industry, on return on sales (profi

> Access the Data Analytic worksheet atwww.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Caterpillar and Terex, competing companies in the farm and construction machinery industry, on return on sales (profit

> Access the Data Analytic worksheet atwww.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Ford and General Motors, competing motor vehicle manufacturers, on return on assets, capital structure leverage, and re

> Access the Data Analytic worksheet atwww.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Walmart and Dollar General, competing discount department stores, on return on assets, capital structure leverage, and

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Pfizer and Merck, competing drug manufacturers, on long-term debt as a percent of total assets (long-term debt ratio)

> J. Hartney, president of Doyle Industries, has a choice of three bonus contracts. The first option is to receive an immediate cash payment of $25,000. The second option is a deferred payment of $60,000, to be received in eight years. The final option is

> Access the Data Analytic worksheet atwww.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Macy's and Dillards, competing firms in the apparel industry, on long-term liabilities as a percent of total assets (lo

> The terms of three different contracts follow: 1. $8,000 received at the beginning of each year for ten years, compounded at a 6 percent annual rate. 2. $8,000 received today and $20,000 received ten years from today. The relevant interest rate is 12 per

> Wharton Company is planning to make the following investments: 1. $1,000 at the end of each year for five years at a 10 percent annual rate. Wharton Company will leave the accumulated principal and earnings in the bank for another five years at a 12 perc

> Christie Bauer is contemplating investing in South Bend Ironworks. She estimates that the company will pay the following dividends per share at the end of the next four years and that the current price of the company's common stock ($100) will remain unc

> The shareholders' equity section of Mountvale Associates is as follows: The following selected transactions occurred during 2021: 1. 1/1/21: A 20 percent stock dividend was issued. The fair market value of the stock at the time was $3 per share. 2. 8/25/

> Webb Industries reported the following information concerning the company's property, plant, and equipment in its 2021 financial report: Listed here are four independent cases involving buildings, equipment, and land during 2021. 1. The company purchased

> The following information was taken from the 2019 annual report of Hewlett-Packard, a leading technology manufacturer (dollars in millions): INSTRUCTIONS: a. Compute the missing dollar amounts. b. Comment on the company's cash management policies across

> Ruttman Enterprises began operations in early 2019. Summaries of the statement of cash flows for the years 2019, 2020, and 2021 follow: INSTRUCTIONS: a. Compute the missing dollar amounts. b. Briefly comment on the company's cash management policy over t

> Several transactions entered into by Travis Retail during 2021 follow: 1. Received $50,000 for wine previously sold on account. 2. Paid $55,000 in salaries and wages. 3. Sold a building for $100,000. The building had cost $170,000, and the related accumu

> Cash flows from three well-known Internet companies are provided in the following chart (dollars in millions): INSTRUCTIONS: Describe the similarities and differences of the cash flow policies across the three companies.

> MHT Enterprises entered into the following transactions during 2021 : 1. Sold a piece of equipment with a book value of $8,000 for $1,200. 2. Purchased a parcel of land for $13,000. 3. Purchased a three-year insurance policy for $9,000. 4. Issued 1,000 s

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Accenture and Amdocs, competing companies in the computer systems industry, on accounts payable turnover for 2019 and

> Mick's Photographic Equipment began operations on January 1, 2020. During 2020, the company entered into the following transactions: 1. Issued 50,000 shares of $15 par value common stock for $30 per share in exchange for cash. Also issued, for cash, 1,00

> Lynch Engineering Firm provided the following income statement for 2021 in its annual financial report: 1. The company declared and paid a dividend of $550,000 in 2020 but did not declare any dividends in 2021. 2. 2020: (a) 35 percent of the sales were o

> The following information was taken from the 2021 financial records of Price Restaurant Supply Company: The company sold a piece of equipment for cash that had originally cost $100,000. The accumulated depreciation associated with the equipment at the ti

> The following information was taken from the financial records of Bower Manufacturing Industries: The company purchased equipment in exchange for 10,000 shares of common stock. The stock was selling for $20 per share at that time. The notes receivable wa

> Sunshine Enterprises included the following statements in its 2021 financial report: INSTRUCTIONS: a. Convert each of the accrual-basis income statement accounts to a cash basis. Would you classify this method as directly or indirectly computing cash pro

> ISS Inc. began operations on January 1, 2021. It engaged in the following economic events during 2021: 1. Issued 6,000 shares of no-par common stock for $10 per share. 2. Purchased on account 20,000 units of inventory for $1 per unit. 3. Paid and capital

> The 2020 and 2021 balance sheets and related income statement of Watson and Holmes Detective Agency follow: INSTRUCTIONS: Prepare a statement of cash flows under both the direct and indirect methods for 2021.

> Pendleton Enterprises began operations on January 1, 2019. Balance sheet and income statement information for 2019, 2020, and 2021 follow: INSTRUCTIONS: a. Prepare the operating sections of the statement of cash flows for 2019, 2020, and 2021 under the d

> Battery Builders Inc. prepared statements of cash flows under both the direct and indirect methods. The operating sections of each statement under the two methods follow: INSTRUCTIONS: Prepare an income statement from the information provided.

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Verizon and T-Mobile, competing firms in the telecommunications industry, on accounts payable turnover for 2018 and 20

> Taylor Brothers began operations in 2020. The following selected information was extracted from its financial records: INSTRUCTIONS: a. Compute gross sales (accrual basis) for 2020 and 2021. b. Calculate the amount of cash paid to suppliers during 2021 f

> The following events occurred during 2021 for Frames Unlimited: 1. Purchased inventory for $60,000 in cash. 2. Recorded $40,000 in insurance expense for the portion of an insurance policy acquired in 2020 that expired during 2021. 3. Paid $40,000 for ren

> Tom Brown, controller of Microbiology Labs, informs you that the company has sold a segment of its business. Mr. Brown also provides you with the following information for 2021: The following information is not reflected in any of the above amounts: 1. M

> Woodland Farm Corporation has the following items to include in its financial statements: None of the listed amounts includes any income tax effects. The company's tax rate is 25 percent. INSTRUCTIONS: a. Describe how each item above would be disclosed o

> The lower portion of the 2019 income statement for Duke Energy Corporation follows ( dollars in millions, except per-share amounts): INSTRUCTIONS: a. Why is there a distinction among income from continuing operations, income from discontinued operations,

> This excerpt was taken from an income statement for McDonald's (dollars in millions): INSTRUCTIONS: a. Why is there a distinction between net earnings from continuing operations and net earnings from discontinued operations? b. Estimate the number of com

> The following information has been obtained from the internal financial records of MTM Company: The company's tax rate is 25 percent. Assume that financial accounting income equals income for tax purposes. INSTRUCTIONS: a. What is the company's net incom

> In its 2021 financial report, Meeks Company reported $850,000 under the line item "other losses" on the income statement. The company's tax rate is 25 percent. The footnote pertaining to other losses indicates that the $850,000 loss, before tax, is compo

> Excerpts from Crozier Industries' financial records as of December 31, 2021, follow: The amounts shown do not include any tax effects. Crozier's tax rate is 25 percent. Assume that all items are treated the same for accounting and income tax purposes. IN

> The managers of Martin House are paid a salary and share in a bonus that is determined at the end of each year. The total bonus is determined by multiplying the company's income from operations by 25 percent. The bonus is not considered an operating expe

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of Merck and Abbvie, competing drug manufacturers, on operating expenses as a percent of sales and long-term asset turnov

> Lai dig Industries has prepared the following unadjusted trial balance as of December 31, 2021: ADDITIONAL INFORMATION: 1. A physical count of inventory on December 31, 2021, indicated that the company had $480,000 of inventory on hand. 2. An aging of ac

> Group Danone, a French-based food processor that publishes IFRS-based financial statements, reported 2018 net income of 2.6 billion euros. Accumulated currency translation adjustments and net holding gains/losses from securities, both of which directly a

> Over a two-year period, Sears reported an 83 percent earnings drop: Net income of $309 million on sales of $10 billion dropped to net income of $53 million on sales of $8.8 billion. It so happened, however, that the $309 million in profits was boosted by

> Lundy Manufacturing produces and sells football equipment. The company was involved in the following transactions or events during 2021: 1. The company purchased $250,000 worth of materials to be used during 2022 to manufacture helmets and shoulder pads.

> The shareholders' equity section of Buzytown Industries' balance sheet reports the following: INSTRUCTIONS: a. How many shares of preferred stock were issued during 2021? What was the average issue price? b. How many shares of common stock were issued du

> The shareholders' equity section of Rudnicki Corporation contained the following balances as of December 31, 2020: During 2021, Rudnicki Corporation entered into the following transactions affecting shareholders' equity: 1. On May 13, the company repurch

> The 2019 statement of shareholders' equity of Starbucks, the coffee shop retailer, included the following information concerning common stock (in millions): INSTRUCTIONS: a. Compute the average prices at which the shares in 2018 and 2019 were issued and

> The following selected financial information was taken from the December 31, 2020, financial records of Cotter Company: The company's board of directors is currently contemplating declaring a dividend. The company's common stock is presently selling for

> The following information came from the financial records of Maverick Corporation: Maverick began operations on January 1, 2015. The company has paid the following amounts in cash dividends over the past seven years: INSTRUCTIONS: Prepare a sheet to cont

> Royal Company is currently considering declaring a dividend to its common shareholders according to one of the following plans: 1. Declare a cash dividend of $15 per share. 2. Declare a 10 percent stock dividend. Royal Company would distribute one share

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountingl le. a. Create a table that compares the performance of General Electric (GE) and Raytheon, competing firms in the aerospace services industry, on operating expenses as a pe

> Pierce and snowden is an established manufacturer of a wide variety of household items sold

> Several independent transactions are as follows: 1. 10,000 shares of no-par common stock are issued for $50 per share. 2. 10,000 shares of $1 par value common stock are issued for $40 per share. 3. 10,000 shares of $10 par value common stock are issued f

> The balance sheet of Alex Bros. follows: Of the 200,000 common shares authorized, 50,000 shares were issued for $8 each when the company began operations. There have been no common stock issuances since; 45,000 shares are currently outstanding, and 5,000

> The balance sheet of Natathon International is as follows: Although the balance sheet appears reasonably healthy, Natathon is on the verge of ceasing operations. Appraisers have estimated that, while current assets are worth $200,000, the property, plant

> Five shareholders together own 35 percent of the outstanding stock of Edmonds Industries. The remaining 65 percent is divided among several thousand shareholders. There are 400,000 shares of Edmonds stock currently outstanding. A condensed balance sheet

> Aspen Industries became a corporation in the state of Colorado on March 23, 2018. The company was authorized to issue 1 million shares of $6 par value common stock. Since the date of incorporation, Aspen Industries has entered into the following transact

> Tracey Corporation reports the following in its December 31, 2020, financial report: The total balance in treasury stock on December 31 , 2019, represents the acquisition of 1,500 shares of common stock on March 3, 2018. INSTRUCTIONS: a. Compute the numb

> Lambert Corporation issued 1,000 shares of $100 par value, 8 percent preferred stock for $100 each. The preferred shareholders do not vote at the annual shareholders' meeting. The condensed balance sheet of Lambert prior to the issuance follows: INSTRUCT

> Consider the three notes payable listed here . Each was issued on January 1, 2021, and matures on December 31, 2023. Interest payments are made annually on December 31. INSTRUCTIONS: a. Compute the present value of the remaining cash outflows for each no

> Ross Running Shoes issued ten $1,000 bonds with a stated annual rate of 10 percent on June 30, 2021. These bonds mature on June 30, 2024. The bonds have an effective interest rate of 8 percent, and interest is paid semiannually on December 31 and June 30

> Hartney Enterprises issued twenty $1,000 bonds on June 30, 2021, with a stated annual interest rate of 6 percent. The bonds mature in six years. Interest is paid semiannually on December 31 and June 30. The effective interest rate as of June 30, 2021, th

> Access the Data Analytic worksheet at www.wiley.com/go/pratt/financialaccountinglle. a. Create a table that compares the performance of DuPont and Lyondel!Basell Industries, competing firms in the chemical industry, on inventory turnover and cost of good

> Earl Rix, president of Rix Driving Range and Health Club, has provided you with the following information: The stated annual interest rate on the notes is 10 percent, and interest is paid annually on December 31. The $95,000 in interest expense is due so

> The balance sheet as of December 31, 2021, for Boyton Sons follows: The company needs capital to finance operations and purchase new equipment. Boyton is not certain how much money it will need and is considering one of the following three-year notes pay

> Patnon Plastics needs some cash to finance expansion. Patnon issued the following debt to acquire the cash: A. A five-year note with a stated interest rate of zero, a face value of $20,000, and an effective interest rate of 10 percent. B. An eight-year

> The balance sheet as of December 31, 2020, for Manheim Corporation follows: INSTRUCTIONS: a. Compute Manheim Corporation's long-term debt/equity ratio. b. Assume that Manheim Corporation is considering borrowing money and signing a five-year note with th

> Hartl Enterprises issued ten $1,000 bonds on September 30, 2020, with a stated annual interest rate of 8 percent. These bonds will mature on October 1, 2030, and have an effective rate of 10 percent. Interest is paid semiannually on October 1 and April 1

> On June 1, 2020, Mayberry Imports purchased bonds on the open market, paying $92,994. The bonds had a face value of $100,000, a stated annual interest rate of 4 percent, and a remaining time to maturity of two years. Interest was paid semiannually on Nov

> Hodge Sports bonds are selling on the open market at par value. The bonds have a stated interest rate of 9 percent and mature in five years. You have determined that the risk-free rate is 7 percent. INSTRUCTIONS: a. What is the maximum risk premium you c