Question: Environmental Concerns, Inc., has poor internal

Environmental Concerns, Inc., has poor internal control. Recently , Oscar Benz, the manager, has suspected the bookkeeper of stealing. Details of the businesss cash position at September 30 follow.

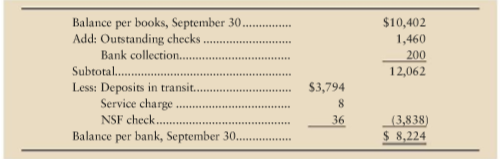

a. The Cash account shows a balance of $10,402. This amount includes a September 30 deposit of $3,794 that does not appear on the September 30 bank statement.

b. The September 30 bank statement shows a balance of $8,224. The bank statement lists a $200 bank collection, an $8 service charge, and a $36 NSF check. The accountant has not recorded any of these items.

c. At September 30, the following checks are outstanding:

d. The bookkeeper receives all incoming cash and makes the bank deposits. He also reconciles the monthly bank statement. Here is his September 30 reconciliation:

Requirement

1. Benz has requested that you determine whether the bookkeeper has stolen cash from the business and, if so, how much. He also asks you to explain how the bookkeeper attempted to conceal the theft. To make this determination, you perform a proper bank reconciliation. There are no bank or book errors. Benz also asks you to evaluate the internal controls and to recommend any changes needed to improve them.

Transcribed Image Text:

Check No. Amount 154 $116 256 150 278 853 291 990 292 206 293 145 Balance per books, September 30... Add: Outstanding checks . Bank collection.. $10,402 1,460 200 12,062 ...... Subtotal. $3,794 Less: Deposits in transi.. Service charge. NSF check.. Balance per bank, September 30.. 36 (3,838) $ 8,224

> 1. Miracle Printers purchased for $700,000 a patent for a new laser printer. Although the patent gives legal protection for 20 years, it is expected to provide Miracle Printers with a competitive advantage for only eight years. Assuming the straight-line

> Mighty Mines paid $432,000 for the right to extract ore from a 425,000-ton mineral deposit. In addition to the purchase price, Mighty Mines also paid a $150 filing fee, a $2,700 license fee to the state of Colorado, and $92,150 for a geologic survey of t

> Trusty Truck Company is a large trucking company that operates throughout the United States. Trusty Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Trusty Truck Company trades in trucks often to keep driver morale high a

> Assume that on January 2, 2010, McKnight of Wyoming purchased fixtures for $8,300 cash, expecting the fixtures to remain in service for five years. McKnight has depreciated the fixtures on a double-declining-balance basis, with $1,700 estimated residua

> Assume B 1 Accounting Consultants purchased a building for $435,000 and depreciated it on a straightline basis over 40 years. The estimated residual value was $73,000. After using the building for 20 years, B 1 realized that the building will remain usef

> For each of the following situations, answer the following questions: 1. What is the ethical issue in this situation? 2. What are the alternatives? 3. Who are the stakeholders? What are the possible consequences to each? Analyze from the following sta

> On June 30, 2010, Roy Corp. paid $200,000 for equipment that is expected to have an eight-year life. In this industry, the residual value is approximately 10% of the assets cost. Roys cash revenues for the year are $140,000 and cash expenses total $100

> Assume that in January 2010, an International Eatery restaurant purchased a building, paying $52,000 cash and signing a $106,000 note payable. The restaurant paid another $62,000 to remodel the building. Furniture and fixtures cost $57,000, and dishes an

> During 2010, Tao Book Store paid $488,000 for land and built a store in Detroit. Prior to construction, the city of Detroit charged Tao $1,800 for a building permit, which Tao paid. Tao also paid $15,800 for architect’s fees. The construction cost of $71

> Assume Delicious Desserts, Inc., purchased conveyor-belt machinery. Classify each of the following expenditures as a capital expenditure or an immediate expense related to machinery: a. Sales tax paid on the purchase price b. Transportation and insuranc

> Eastwood Manufacturing bought three used machines in a $216,000 lump-sum purchase. An independent appraiser valued the machines as shown in the table. What is each machines individual cost? Immediately after making this purchase, Eastwood sold machine 2

> Assume Haledan paid $16 million to purchase Northshore.com. Assume further that Northshore had the following summarized data at the time of the Haledan acquisition (amounts in millions): Northshores long-term assets had a current market value of only $1

> 1. Morris Printers purchased for $900,000 a patent for a new laser printer. Although the patent gives legal protection for 20 years, it is expected to provide Morris Printers with a competitive advantage for only 10 years. Assuming the straight-line meth

> Rocky Mines paid $426,000 for the right to extract ore from a 275,000-ton mineral deposit. In addition to the purchase price, Rocky Mines also paid a $120 filing fee, a $2,100 license fee to the state of Colorado, and $64,030 for a geologic survey of the

> Honest Truck Company is a large trucking company that operates throughout the United States. Honest Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Honest Truck Company trades in trucks often to keep driver morale high a

> Assume that on January 2, 2010, Maxwell of Michigan purchased fixtures for $8,800 cash, expecting the fixtures to remain in service for five years. Maxwell has depreciated the fixtures on a double-declining-balance basis, with $1,300 estimated residual v

> United Jersey Bank of Princeton purchased land and a building for the lump sum of $6.0 million. To get the maximum tax deduction, the banks managers allocated 80% of the purchase price to the building and only 20% to the land. A more realistic allocation

> Assume G-1 Designing Consultants purchased a building for $400,000 and depreciated it on a straight-line basis over 40 years. The estimated residual value was $55,000. After using the building for 20 years, G-1 realized that the building will remain us

> On June 30, 2010, Rockwell Corp. paid $220,000 for equipment that is expected to have an eight-year life. In this industry, the residual value of equipment is approximately 10% of the assets cost. Rockwells cash revenues for the year are $115,000 and cas

> Assume that in January 2010, an Oatmeal House restaurant purchased a building, paying $56,000 cash and signing a $107,000 note payable. The restaurant paid another $61,000 to remodel the building. Furniture and fixtures cost $53,000, and dishes and suppl

> During 2010, Chun Book Store paid $487,000 for land and built a store in Akron. Prior to construction, the city of Akron charged Chun $1,400 for a building permit, which Chun paid. Chun also paid $15,320 for architect’s fees. The construction cost of $69

> Deadwood Manufacturing bought three used machines in a $167,000 lump-sum purchase. An independent appraiser valued the machines as shown in the table. What is each machines individual cost? Immediately after making this purchase, Deadwood sold machine 2

> Harbour Master Marine Supply reported the following comparative income statement for the years ended September 30, 2010, and 2009: Harbour Masters president and shareholders are thrilled by the company’s boost in sales and net income

> Durkin & Davis, a partnership, had these inventory data: Durkin & Davis need to know the company’s gross profit percentage and rate of inventory turnover for 2010 under 1. FIFO 2. LIFO Which method makes the business look be

> Refer to the data in Exercise 6-35B. Compute all ratio values to answer the following questions: Which company has the highest, and which company has the lowest, gross profit percentage? Which company has the highest, and the lowest rate of inventory t

> Ontario Garden Supplies uses a perpetual inventory system. Ontario Garden Supplies has these account balances at May 31, 2010, prior to making the year-end adjustments: A year ago, the replacement cost of ending inventory was $13,400, which exceeded th

> Suppose a Williams store in Cleveland, Ohio, ended September 2010 with 1,100,000 units of merchandise that cost an average of $9.00 each. Suppose the store then sold 1,000,000 units for $9.7 million during October. Further, assume the store made two larg

> During 2010, Vanguard, Inc., changed to the LIFO method of accounting for inventory . Suppose that during 2011, Vanguard changes back to the FIFO method and the following year Vanguard switches back to LIFO again. Requirements 1. What would you think

> MusicLife.net specializes in sound equipment. Because each inventory item is expensive, MusicLife uses a perpetual inventory system. Company records indicate the following data for a line of speakers: Requirements 1. Determine the amounts that MusicLif

> Use the data for Rons, Inc., in Exercise 6-29B to illustrate Rons income tax advantage from using LIFO over FIFO. Sales revenue is $8,750, operating expenses are $2,000, and the income tax rate is 32%. How much in taxes would Rons save by using the LIFO

> Rons, Inc.s inventory records for a particular development program show the following at May 31: At May 31, 10 of these programs are on hand. Journalize for Rons: 1. Total May purchases in one summary entry. All purchases were on credit. 2. Total May

> Accounting records for Rockford Corporation yield the following data for the year ended December 31, 2010: Requirements 1. Journalize Rockfords inventory transactions for the year under the perpetual system. 2. Report ending inventory, sales, cost of

> Big Blue Sea Marine Supply reported the following comparative income statement for the years ended September 30, 2010, and 2009: Big Blue Seas president and shareholders are thrilled by the company’s boost in sales and net income duri

> Thurston & Talty, a partnership, had the following inventory data: Thurston & Talty need to know the company’s gross profit percentage and rate of inventory turnover for 2010 under 1. FIFO 2. LIFO Which method makes the busin

> Refer to the data in Exercise 6-22A. Compute all ratio values to answer the following questions: Which company has the highest, and which company has the lowest, gross profit percentage? Which company has the highest, and the lowest rate of inventory t

> Supply the missing income statement amounts for each of the following companies (amounts adapted, in millions or billions): Requirement 1. Prepare the income statement for Crane Company, for the year ended December 31, 2010. Use the cost-of-goods-sold

> Thames Garden Supplies uses a perpetual inventory system. Thames Garden Supplies has these account balances at July 31, 2010, prior to making the year-end adjustments: A year ago, the replacement cost of ending inventory was $12,000, which exceeded cos

> Suppose a Waldorf store in Atlanta, Georgia, ended November 2010 with 900,000 units of merchandise that cost an average of $5 each. Suppose the store then sold 800,000 units for $4.8 million during December. Further, assume the store made two large purch

> Sunnyvale Loan Company is in the consumer loan business. Sunnyvale borrows from banks and loans out the money at higher interest rates. Sunnyvales bank requires Sunnyvale to submit quarterly financial statements to keep its line of credit. Sunnyvales mai

> MusicPlace.net specializes in sound equipment. Because each inventory item is expensive, MusicPlace uses a perpetual inventory system. Company records indicate the following data for a line of speakers: Requirements 1. Determine the amounts that Music

> Wilson Corporation reported the following for property and equipment (in millions, adapted): During 2011, Wilson paid $2,510 million for new property and equipment. Depreciation for the year totaled $1,546 million. During 2011, Wilson sold property and

> Buff Gym purchased exercise equipment at a cost of $107,000. In addition, Buff paid $3,000 for a special platform on which to stabilize the equipment for use. Freight costs of $1,600 to ship the equipment were borne by the seller. Buff will depreciate th

> All French Press (AFP) is a major French telecommunication conglomerate. Assume that early in year 1, AFP purchased equipment at a cost of 8 million euros (*8 million). Management expects the equipment to remain in service for four years and estimated re

> Norzani, Inc., has a popular line of sunglasses. Norzani reported net income of $66 million for 2010. Depreciation expense for the year totaled $32 million. Norzani, Inc., depreciates plant assets over eight years using the straight-line method and no re

> Suppose Trendy Now Fashions, a specialty retailer, had these records for ladies evening gowns during 2010. Assume sales of evening gowns totaled 130 units during 2010 and that Trendy Now uses the LIFO method to account for inventory. The income tax rat

> T Mart, Inc., declared bankruptcy. Let’s see why. T Mart reported these figures: Requirement 1. Evaluate the trend of T Marts results of operations during 2008 through 2010. Consider the trends of sales, gross profit, and net income.

> Radical Shirt Company sells on credit and manages its own receivables. Average experience for the past three years has been as follows: Jack Ryan, the owner, is considering whether to accept bankcards (VISA, MasterCard). Ryan expects total sales to incr

> Contemporary Co., Inc., the electronics and appliance chain, reported these figures in millions of dollars: Requirements 1. Compute Contemporarys average collection period during 2011. 2. Is Contemporarys collection period long or short? Kurzwel Netwo

> Navajo, Inc., reported the following items at December 31, 2010 and 2009: Requirement 1. Compute Navajos (a) acid-test ratio and (b) days sales in average receivables for 2010. Evaluate each ratio value as strong or weak. Navajo sells on terms of net

> Dan Davis, the chief financial officer, is responsible for The Furniture Marts cash budget for 2010. The budget will help Davis determine the amount of long-term borrowing needed to end the year with a cash balance of $130,000. Daviss assistants have ass

> Susan Healey, the owner of Susans Perfect Presents, has delegated management of the business to Louise Owens, a friend. Healey drops by to meet customers and check up on cash receipts, but Owens buys the merchandise and handles cash payments. Business ha

> Refer to Exercise 5-22A. From 22: On September 30, Hilly Mountain Party Planners had a $30,000 balance in Accounts Receivable and a $2,000 credit balance in Allowance for Uncollectible Accounts. During October, the store made credit sales of $161,000. O

> On September 30, Hilly Mountain Party Planners had a $30,000 balance in Accounts Receivable and a $2,000 credit balance in Allowance for Uncollectible Accounts. During October, the store made credit sales of $161,000. October collections on account were

> Beautiful Meadows Golf Company manufactures a popular line of golf clubs. Beautiful Meadows Golf employs 173 workers and keeps their employment records on time sheets that show how many hours the employee works each week. On Friday the shop foreman colle

> Radley stores use point-of-sale terminals as cash registers. The register shows the amount of each sale, the cash received from the customer, and any change returned to the customer. The machine also produces a customer receipt but keeps no record of tra

> Use the data from Exercise 4-32B to make the journal entries that Smith should record on September 30 to update his Cash account. Include an explanation for each entry From 32: Harry Smith operates a bowling alley. He has just received the monthly bank

> Harry Smith operates a bowling alley. He has just received the monthly bank statement at September 30 from City National Bank, and the statement shows an ending balance of $545. Listed on the statement are an EFT rent collection of $325, a service charge

> D. J. Hills checkbook and February bank statement show the following: Requirement 1. Prepare Hills bank reconciliation at February 28. Date Check No. Item Check Deposit Balance 2/1 $ 515 4 622 Art Cafe $ 15 500 9. Dividends received $ 115 615 13 62

> River Corporation, the investment banking company, often has extra cash to invest. Suppose River buys 600 shares of Eathen, Inc., stock at $40 per share. Assume River expects to hold the Eathen stock for one month and then sell it. The purchase occurs on

> Suppose you are considering investing in two businesses, La Petite France Bakery and Burgers Ahoy! The two companies are virtually identical, and both began operations at the beginning of the current year. During the year, each company purchased inventor

> During 2010, Northern Satellite Systems, Inc., purchased two other companies for $16 million. Also during 2010, Northern made capital expenditures of $7 million to expand its market share. During the year, Northern sold its North American operations, rec

> This exercise summarizes the accounting for patents, which like copyrights, trademarks, and franchises, provide the owner with a special right or privilege. It also covers research and development costs. Suppose Solar Automobiles Limited paid $600,000 to

> On January 1, 2010, ABC Airline Service purchased an airplane for $37,700,000. ABC Airline Service expects the plane to remain useful for six years and to have a residual value of $2,900,000. ABC Airline Service uses the straight-line method to depreciat

> City Technology began the year with inventory of $244,000 and purchased $1,540,000 of goods during the year. Sales for the year are $4,000,000, and Citys gross profit percentage is 60% of sales. Compute Citys estimated cost of ending inventory by using t

> Sam Smith served as executive director of Downtown Scanlon, an organization created to revitalize Scanlon, Minnesota. Over the course of 11 years Smith embezzled $297,000. How did Smith do it? He did it by depositing subscriber cash receipts in his own b

> Mountain Company made sales of $35,482 million during 2010. Cost of goods sold for the year totaled $15,333 million. At the end of 2009, Mountains inventory stood at $1,641 million, and Mountain ended 2010 with inventory of $1,945 million. Compute Mount

> Binders $5.8 million cost of inventory at the end of last year was understated by $1.7 million. 1. Was last years reported gross profit of $3.8 million overstated, understated, or correct? What was the correct amount of gross profit last year? 2. Is th

> ABC, Inc., reported these figures for its fiscal year (amounts in millions): Suppose ABC later learns that ending inventory was overstated by $14 million. What are the correct amounts for (a) net sales, (b) ending inventory, (c) cost of goods sold,

> Greta Cassidy sells memberships to the Phoenix Symphony Association in Phoenix, Arizona. The Symphonys procedure requires Cassidy to write a patron receipt for all memberships sold. The receipt forms are prenumbered. Cassidy is having personal financial

> Barbara Smith manages Jones Advertising. Smith fears that a trusted employee has been stealing from the company . This employee receives cash from clients and also prepares the monthly bank reconciliation. To check up on the employee, Smith prepares her

> Assume Nation Airlines repaired a Boeing 777 aircraft at a cost of $1.5 million, which Nation paid in cash. Further, assume the Nation accountant erroneously capitalized this expense as part of the cost of the plane. Show the effects of the accounting er

> Foley Distribution Service pays $140,000 for a group purchase of land, building, and equipment. At the time of acquisition, the land has a current market value of $75,000, the buildings current market value is $45,000, and the equipment’s current market

> Susan Perry keeps the Accounts Receivable T-account of Abraham & Paige, a partnership. What duty will a good internal control system withhold from Perry? Why?

> McCarver Investments purchased Hoffman shares as a trading security on December 18 for $103,000. 1. Suppose the Hoffman shares decreased in value to $96,000 at December 31. Make the McCarver journal entry to adjust the Short-Term Investment account to m

> Journalize the following assumed transactions for The Pepson Company. Show amounts in billions. a. Cash purchases of inventory, $3.8 billion b. Sales on account, $19.7 billion c. Cost of goods sold (perpetual inventory system), $4.5 billion d. Collec

> The following situations describe two cash payment situations and two cash receipt situations. In each pair, one set of internal controls is better than the other. Evaluate the internal controls in each situation as strong or weak, and give the reason fo

> Ten Flags over Georgia paid $100,000 for a concession stand. Ten Flags started out depreciating the building straight-line over 20 years with zero residual value. After using the concession stand for three years, Ten Flags determines that the building wi

> Assume that on September 30, 2010, LoganAir, the national airline of Switzerland, purchased an Airbus aircraft at a cost of *45,000,000 (* is the symbol for the euro). LoganAir expects the plane to remain useful for six years (4,500,000 miles) and to hav

> This exercise uses the assumed Northeast USA data from Short Exercise 7-5. Assume Northeast USA is trying to decide which depreciation method to use for income tax purposes. The company can choose from among the following methods: (a) straight-line, (b

> Use the Northeast USA data in Short Exercise 7-5 to compute Northeast USAs third-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining balance from 7-5: Assume that at the beginning of

> Assume that at the beginning of 2010, Northeast USA, a FedEx competitor, purchased a used Boeing 737 aircraft at a cost of $53,000,000. Northeast USA expects the plane to remain useful for five years (six million miles) and to have a residual value of $5

> This chapter lists the costs included for the acquisition of land on pages 411 412. First is the purchase price of the land, which is obviously included in the cost of the land. The reasons for including the other costs are not so obvious. For example, p

> Vector, Inc., dominates the snack-food industry with its Tangy-Chip brand. Assume that Vector, Inc., purchased Concord Snacks, Inc., for $8.8 million cash. The market value of Concord Snacks assets is $15 million, and Concord Snacks has liabilities of $8

> North Coast Petroleum, the giant oil company, holds reserves of oil and gas assets. At the end of 2010, assume the cost of North Coast Petroleums mineral assets totaled $120 billion, representing 10 billion barrels of oil in the ground. 1. Which depreci

> Examine Round Rocks assets. 1. What is Round Rocks largest category of assets? List all 2011 assets in the largest category and their amounts as reported by Round Rock. 2. What was Round Rocks cost of property and equipment at May 31, 2011? What was th

> This exercise tests your understanding of the four inventory methods. List the name of the inventory method that best fits the description. Assume that the cost of inventory is rising. 1. Generally associated with saving income taxes. 2. Results in a c

> Identify the internal control weakness in the following situations. State how the person can hurt the company. a. Jason Monroe works as a security guard at CITY parking in Dayton. Monroe has a master key to the cash box where customers pay for parking.

> Smith Saxophone Company is nearing the end of its worst year ever. With two weeks until year-end, it appears that net income for the year will have decreased by 25% from last year. Joe Smith, the president and principal stockholder, is distressed with th

> It is December 31, end of the year, and the controller of Reed Corporation is applying the lower of-cost-or-market (LCM) rule to inventories. Before any year-end adjustments Reed reports the following data: Reed determines that the replacement cost of

> Microdata.com uses the LIFO method to account for inventory. Microdata is having an unusually good year, with net income well above expectations. The company’s inventory costs are rising rapidly. What can Microdata do immediately before the end of the ye

> This exercise should be used in conjunction with Short Exercise 6-4. Jefferson is a corporation subject to a 30% income tax. Compute Jeffersons income tax expense under the average, FIFO, and LIFO inventory costing methods. Which method would you select

> Jeffersons Copy Center uses laser printers. Assume Jefferson started the year with 92 containers of ink (average cost of $9.00 each, FIFO cost of $8.90 each, LIFO cost of $8.05 each). During the year, Jefferson purchased 680 containers of ink at $9.80 an

> Determine whether each of the following actions in buying, selling, and accounting for inventories is ethical or unethical. Give your reason for each answer. 1. In applying the lower-of-cost-or-market rule to inventories, Tewksbury Financial Industries

> Short Exercise 5-14, show how the Green Interstate Bank will report the following: a. Whatever needs to be reported on its classified balance sheet at June 30, 2011. b. Whatever needs to be reported on its income statement for the year ended June 30, 2

> Norbert Medical Service reported the following items, (amounts in thousands): Requirements 1. Classify each item as (a) income statement or balance sheet and as (b) debit balance or credit balance. 2. How much net income (or net loss) did Norbert re

> West Highland Clothiers reported the following amounts in its 2011 financial statements. The 2010 amounts are given for comparison. Requirements 1. Compute West Highlands acid-test ratio at the end of 2011. Round to two decimal places. How does the aci

> Gretchen Rourke, an accountant for Dublin Limited, discovers that her supervisor, Billy Dunn, made several errors last year. In total, the errors overstated the company’s net income by 25%. It is not clear whether the errors were deliberate or accidental

> Record the following note receivable transactions in the journal of Aegean Realty. How much interest revenue did Aegean earn this year? Use a 365-day year for interest computations, and round interest amounts to the nearest dollar. Loaned $15,000 cas

> On August 31, 2010, Nancy Thompson borrowed $2,000 from Green Interstate Bank. Thompson signed a note payable, promising to pay the bank principal plus interest on August 31, 2011. The interest rate on the note is 10%. The accounting year of Green Inters

> 1. Compute the amount of interest during 2010, 2011, and 2012 for the following note receivable: On April 30, 2010, BCDE Bank lent $170,000 to Carl Abbott on a two-year, 7% note. 2. Which party has a (an) a. note receivable? b. note payable? c. inter