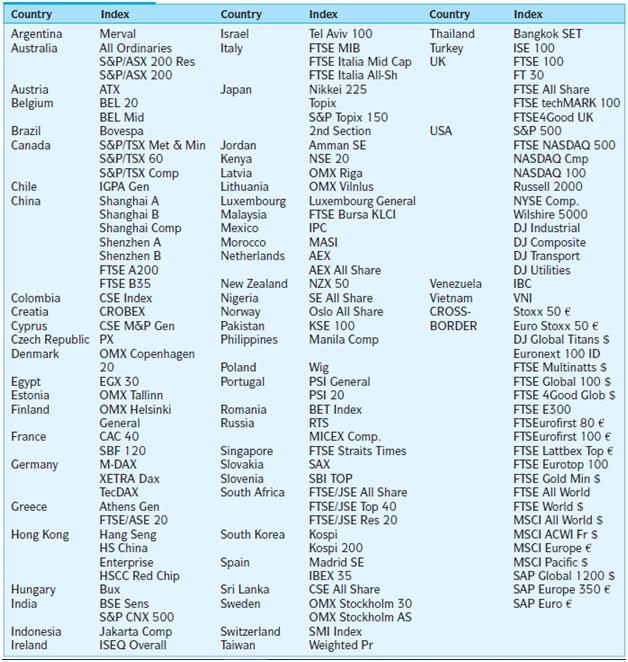

Question: Exhibit 13.11 presents a listing of

Exhibit 13.11 presents a listing of major national stock market indexes as displayeddaily in the print edition of the Financial Times. At www.ft.com , you canfind an online tracking of these national stock market indexes that shows performanceover the past day, month, and year. Go to this website and compare theperformance for several stock market indexes from various regions of the world.How does the performance compare? What do you think accounts for differences?

Exhibit 13.11

Transcribed Image Text:

Country Index Country Index Country Index Tel Aviv 100 FTSE MIB FTSE Italia Mid Cap UK FTSE Italia All-Sh Nikkei 225 Topix SắP Topix 150 2nd Section Argentina Australia Thailand Turkey Bangkok SET ISE 100 FTSE 100 Merval Israel Italy All Ordinaries S&PIASX 200 Res S&PIASX 200 ATX BEL 20 FT 30 FTSE AIl Share FTSE techMARK 100 FTSE4Good UK S&P 500 Austria Belgium Japan BEL Mid Bovespa S&PITSX Met & Min Jordan Brazil USA Canada Amman SE NSE 20 FTSE NASDAQ 500 NASDAQ Cmp NASDAQ 100 Russell 2000 NYSE Comp. Wilshire 5000 Kenya Latvia S&PITSX 60 S&PITSX Comp IGPA Gen OMX Riga OMX Vilnlus Chile China Lithuania Shanghai A Shanghai B Shanghai Comp Shenzhen A Luxembourg General FTSE Bursa KLCI IPC MASI AEX AEX All Share Luxembourg Malaysia Mexico DJ Industrial Morocco Netherlands DJ Composite DJ Transport DJ Utilities Shenzhen B FTSE A200 FTSE B35 New Zealand NZX 50 Venezuela Vietnam CROSS- BORDER IBC SE All Share Oslo All Share VNI Stoxx 50 € Euro Stoxx 50 € DJ Global Titans s Euronext 100 ID FTSE Multinatts S FTSE Global 100 s FTSE 4Good Glob s FTSE E300 FTSEurofirst 80 € FTSEurofirst 100 € FTSE Lattbex Top € FTSE Eurotop 100 FTSE Gold Min S FTSE AIl World FTSE World S MSCI All World S MSCI ACWI Fr S MSCI Europe € MSCI Pacific S Colombia Creatia CSE Index CROBEX Nigeria Norway Cyprus Czech Republic PX Denmark CSE M&P Gen Pakistan KSE 100 Philippines Manila Comp OMX Copenhagen 20 ЕСX 30 OMX Tallinn OMX Helsinki General CAC 40 Poland Wig PSI General PSI 20 BET Index RTS MICEX Comp. FTSE Straits Times SAX SBI TOP FTSE/JSE AIl Share FTSE/JSE Top 40 FTSE/JSE Res 20 Kospi Kospi 200 Madrid SE Egypt Estonia Portugal Finland Romania Russia France SBF 120 Singapore Slovakia Germany M-DAX XETRA Dax TecDAX Athens Gen FTSE/ASE 20 Slovenia South Africa Greece Hong Kong Hang Seng HS China South Korea Spain Enterprise HSCC Red Chip Bux BSE Sens SăP CNX 500 IBEX 35 CSE All Share OMX Stockholm 30 OMX Stockholm AS SMI Index Weighted Pr SAP Global 1200 s Hungary India Sri Lanka SAP Europe 350 € SAP Euro € Sweden Indonesia Ireland Jakarta Comp ISEQ Overall Switzerland Taiwan

> Given the following information, what are the NZD/SGD currency against currencybid-ask quotations? American Terms European Terms Bank Quotations Bid Ask Bid Ask .7265 .6135 New Zealand dollar .7272 1.3751 1.3765 Singapore dollar .6140 1.6287 1.6300

> Describe the key factors contributing to effective cash management within a firm. Why is the cash management process more difficult in a MNC?

> The time from acceptance to maturity on a $1,000,000 banker’s acceptance is120 days. The importer’s bank’s acceptance commission is 1.75 percent and themarket rate for 120-day B/As is 5.75 percent. What amount will the exporterreceive if he holds the B/A

> What is the difference between a buy-back transaction and a counterpurchase?

> DVR, Inc. can borrow dollars for five years at a coupon rate of 2.75 percent. Alternatively,it can borrow yen for five years at a rate of .85 percent. The five-year yenswap rates are 0.64–0.70 percent and the dollar swap rates are 2.41–2.44 percent.The c

> Comment on the proposition that the Bretton Woods system was programmed toan eventual demise.

> Exchange rate uncertainty may not necessarily mean that firms face exchange riskexposure. Explain why this may be the case.

> A bank sells a “three against six” $3,000,000 FRA for a three-month period beginningthree months from today and ending six months from today. The purposeof the FRA is to cover the interest rate risk caused by the maturity mismatchfrom having made a three

> Suppose that you hold a piece of land in the city of London that you may want tosell in one year. As a U.S. resident, you are concerned with the dollar value of theland. Assume that if the British economy booms in the future, the land will be worth£2,000

> Suppose you are a British venture capitalist holding a major stake in an e-commercestart-up in Silicon Valley. As a British resident, you are concerned with the poundvalue of your U.S. equity position. Assume that if the American economy booms inthe futu

> A U.S. firm holds an asset in France and faces the following scenario: In the above table, P * is the euro price of the asset held by the U.S. firm and P isthe dollar price of the asset. a. Compute the exchange exposure faced by the U.S. firm. b. What

> Economic Exposure of Albion Computers PLCConsider Case 3 of Albion Computers PLC discussed in the chapter. Now, assume thatthe pound is expected to depreciate to $1.50 from the current level of $1.60 perpound. This implies that the pound cost of the impo

> Compare and contrast the three basic types of taxation that governments levy within their tax jurisdiction.

> How does a time draft become a banker’s acceptance?

> Under what conditions would you recommend that the foreign subsidiary conform to the local norm of financial structure?

> Explain the difference in the translation process between the monetary/nonmonetary method and the temporal method.

> Explain how to compute the overall balance and discuss its significance.

> What three basic documents are necessary to conduct a typical foreign commerce trade? Briefly discuss the purpose of each.

> It is, generally, not possible to completely eliminate both translation exposure andtransaction exposure. In some cases, the elimination of one exposure will alsoeliminate the other. But in other cases, the elimination of one exposure actuallycreates the

> Describe the remeasurement and translation process under FASB 52 of a whollyowned affiliate that keeps its books in the local currency of the country in which itoperates, which is different than its functional currency.

> Grecian Tile Manufacturing of Athens, Georgia, borrows $1,500,000 at LIBORplus a lending margin of 1.25 percent per annum on a six-month rollover basisfrom a London bank. If six-month LIBOR is 41⁄2 percent over the first six-monthinterval and 53⁄8 percen

> Using the quotations in Exhibit 7.3, note that the September 2013 Mexican pesofutures contract has a price of $0.07713 per MXN. You believe the spot pricein September will be $0.08365 per MXN. What speculative position would youenter into to attempt to p

> Identify some instances under FASB 52 when a foreign entity’s functionalcurrency would be the same as the parent firm’s currency.

> How are translation gains and losses handled differently according to the currentrate method in comparison to the other three methods, that is, the current/ noncurrent method, the monetary/nonmonetary method, and the temporal method?

> Cray Research sold a supercomputer to the Max Planck Institute in Germany oncredit and invoiced €10 million payable in six months. Currently, the six-monthforward exchange rate is $1.10/€ and the foreign exchange adviser for CrayResearch predicts that th

> A corporation enters into a five-year interest rate swap with a swap bank in whichit agrees to pay the swap bank a fixed rate of 9.75 percent annually on a notionalamount of €15,000,000 and receive LIBOR. As of the second reset date, determinethe price o

> A bank is quoting the following exchange rates against the dollar for the Swissfranc and the Australian dollar: SFr/$ = 1.5960–70 A$/$ = 1.7225–35 An Australian firm asks the bank for an A$/SFr quote. What cross-rate wouldthe bank quote?

> Assume the time from acceptance to maturity on a $2,000,000 banker’s acceptanceis 90 days. Further assume that the importing bank’s acceptance commission is1.25 percent and that the market rate for 90-day B/As is 7 percent. Determine theamount the export

> Suppose that your firm is operating in a segmented capital market. What actions would you recommend to mitigate the negative effects?

> Explain the conditions under which the forward exchange rate will be an unbiasedpredictor of the future spot exchange rate.

> Assume that FASB 8 is still in effect instead of FASB 52. Construct a translationexposure report for Centralia Corporation and its affiliates that is the counterpartto Exhibit 10.6 in the text. Centralia and its affiliates carry inventory and fixedassets

> What is a forfaiting transaction?

> George Johnson is considering a possible six-month $100 million LIBOR-based,floating-rate bank loan to fund a project at terms shown in the table below. Johnsonfears a possible rise in the LIBOR rate by December and wants to use theDecember Eurodollar fu

> Recall the FRA problem presented as Example 11.2. Show how the bank canalternatively use a position in Eurodollar futures contracts to hedge the interestrate risk created by the maturity mismatch it has with the $3,000,000 sixmonthEurodollar deposit and

> Jacob Bower has a liability that: • has a principal balance of $100 million on June 30, 2008, • accrues interest quarterly starting on June 30, 2008, • pays interest quarterly, • has

> Suppose that you are a U.S.-based importer of goods from the United Kingdom.You expect the value of the pound to increase against the U.S. dollarover the next 30 days. You will be making payment on a shipment of importedgoods in 30 days and want to hedge

> It is September 1990 and Detroit Motors of Detroit, Michigan, is consideringestablishing an assembly plant in Latin America for a new utility vehicle it has justdesigned. The cost of the capital expenditures has been estimated at $65,000,000.There is not

> Explain how Eurocurrency is created.

> Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discountfor the U.S. dollar versus the British pound using European term quotations. Forsimplicity, assume each month has 30 days. What is the interpretation of your results?

> Your firm has just issued five-year floating-rate notes indexed to six-monthU.S. dollar LIBOR plus 1/4 percent. What is the amount of the first coupon paymentyour firm will pay per U.S. $1,000 of face value, if six-month LIBOR iscurrently 7.2 percent?

> Consider 8.5 percent Swiss franc/U.S. dollar dual-currency bonds that pay$666.67 at maturity per SF1,000 of par value. It sells at par. What is the implicitSF/$ exchange rate at maturity? Will the investor be better or worse off at maturityif the actual

> The Centralia Corporation is a U.S. manufacturer of small kitchen electrical appliances.It has decided to construct a wholly owned manufacturing facility in Zaragoza, Spain, tomanufacture microwave ovens for sale in the European Union. The plant is expec

> A five-year, 4 percent Euroyen bond sells at par. A comparable risk five-year,5.5 percent yen/dollar dual-currency bond pays $833.44 at maturity. It sells for¥110,000. What is the implied ¥/$ exchange rate at maturity? Hint: The par valueof the bond is n

> In Example 10.2, a forward contract was used to establish a derivatives “hedge” toprotect Centralia from a translation loss if the euro depreciated from €1.1000/ $1.00 to€1.1786/$1.00.

> Discuss what factors motivated Novo Industri to seek U.S. listing of its stock.What lessons can be derived from Novo’s experiences?

> Use the binomial option-pricing model developed in the chapter to value the callof problem 9. The volatility of the Swiss franc is 14.2 percent.

> Explain the internalization theory of FDI. What are the strengths and weaknesses of the theory?

> Sara Lee Corp. is serving up a brand name and a shorter maturity than other recentcorporate borrowers to entice buyers to its first-ever dollar Eurobonds. The U.S.maker of consumer products, from Sara Lee cheesecake to Hanes pantyhose and HillshireFarm m

> Comment on the following statement: “Since the United States imports more thanit exports, it is necessary for the United States to import capital from foreign countriesto finance its current account deficits.”

> Assess the possibility for the euro to become another global currency rivaling theU.S. dollar. If the euro really becomes a global currency, what impact will it haveon the U.S. dollar and the world economy?

> Sigma Corporation of Boston is contemplating establishing a wholly owned subsidiaryoperation in the Mediterranean. Two countries under consideration are Spain andCyprus. Sigma intends to repatriate all after-tax foreign-source income to the UnitedStates.

> Why do you think the empirical studies about factors affecting equity returns basicallyshowed that domestic factors were more important than international factors,and, secondly, that industrial membership of a firm was of little importance inforecasting

> Why might it be easier for an investor desiring to diversify his portfolio internationallyto buy depository receipts rather than the actual shares of the company?

> Why do you think closed-end country funds often trade at a premium or discount?

> Discuss any benefits you can think of for a company to (a) cross-list its equityshares on more than one national exchange, and (b) to source new equity capitalfrom foreign investors as well as domestic investors.

> Assume that FASB 8 is still in effect instead of FASB 52. Construct a consolidated balancesheet for Centralia Corporation and its affiliates after a depreciation of the euro from€1.1000/$1.00 to €1.1786/$1.00 that is the counterpart to Exhibit 10.7 in th

> Briefly discuss the cause and the solution(s) to the international bank crisisinvolving less-developed countries.

> Evaluate a home country’s multinational corporations as a tool for international diversification.

> What are the various means the taxing authority of a country might use to determine if a transfer price is reasonable?

> Would exchange rate changes always increase the risk of foreign investment?Discuss the condition under which exchange rate changes may actually reduce the risk of foreign investment.

> A speculator is considering the purchase of five three-month Japanese yen call optionswith a striking price of 96 cents per 100 yen. The premium is 1.35 cents per 100 yen.The spot price is 95.28 cents per 100 yen and the 90-day forward rate is 95.71 cent

> San Pico is a rapidly growing Latin American developing country. The country isblessed with miles of scenic beaches that have attracted tourists by the thousands inrecent years to new resort hotels financed by joint ventures of San Pico businessmenand mo

> Explain the concept of the Sharpe performance measure.

> Security returns are found to be less correlated across countries than within a country. Why can this be?

> In contrast to the United States, Japan has realized continuous current account surpluses.What could be the main causes for these surpluses? Is it desirable to havecontinuous current account surpluses?

> Discuss the advantages and disadvantages of closed-end country funds (CECFs) relative to American depository receipts (ADRs) as a means of international diversification.

> Explain how exchange rate fluctuations affect the return from a foreign market, measured in dollar terms. Discuss the empirical evidence for the effect of exchange rate uncertainty on the risk of foreign investment.

> Assume today’s settlement price on a CME EUR futures contract is $1.3140/EUR.You have a short position in one contract. Your performance bond account currentlyhas a balance of $1,700. The next three days’ settlement prices are $1.3126, $1.3133,and $1.304

> Explain the concept of the world beta of a security.

> Sundance Sporting Goods, Inc., is a U.S. manufacturer of high-quality sportinggoods—principally golf, tennis, and other racquet equipment, and also lawn sports,such as croquet and badminton—with administrative offices

> American Machine Tools is a mid-western manufacturer of tool-and-die-making equipment.The company has had an inquiry from a representative of the Moldovan governmentabout the terms of sale for a $5,000,000 order of machinery. The salesmanager spoke with

> AffiliateA sells 5,000 units to Affiliate B per year. The marginal income tax ratefor Affiliate A is 25 percent and the marginal income tax rate for Affiliate B is40 percent. The transfer price per unit is currently $2,000, but it can be set atany level

> Discuss the twin objectives of taxation. Be sure to define the key words.

> Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium ordiscount for the Canadian dollar versus the U.S. dollar using American term quotations.For simplicity, assume each month has 30 days. What is the interpretationof your results

> Define and discuss indirect world systematic risk.

> What factors are responsible for the recent surge in international portfolio investment (IPI)?

> Compare and contrast the various types of secondary market trading structures.

> The Eastern Trading Company of Singapore presently follows a decentralized systemof cash management where it and its affiliates each maintain their own transactionand precautionary cash balances. Eastern Trading believes that it and its affiliatesâ

> Consider a U.S.-based company that exports goods to Switzerland. The U.S. Companyexpects to receive payment on a shipment of goods in three months. Becausethe payment will be in Swiss francs, the U.S. Company wants to hedge against adecline in the value

> Why do investors invest the lion’s share of their funds in domestic securities?

> Mr. James K. Silber, an avid international investor, just sold a share of Nestlé,a Swiss firm, for SF5,080. The share was bought for SF4,600 a year ago. Theexchange rate is SF1.60 per U.S. dollar now and was SF1.78 per dollar a year ago.Mr. Silber receiv

> Rebecca Taylor, an international equity portfolio manager, recognizes that anoptimal country allocation strategy combined with an optimal currency strategyshould produce optimal portfolio performance. To develop her strategies, Taylorproduced the followi

> The United States has experienced continuous current account deficits since theearly 1980s. What do you think are the main causes for the deficits? What wouldbe the consequences of continuous U.S. current account deficits?

> Explain official reserve assets and its major components.

> Suppose we obtain the following data in dollar terms: The correlation coefficient between the two markets is 0.58. Suppose that you invest equally, that is, 50 percent in each of the two markets. Determine the expected return and standard deviation ris

> A foreign exchange trader with a U.S. bank took a short position of £5,000,000when the $/£ exchange rate was 1.55. Subsequently, the exchange rate has changedto 1.61. Is this movement in the exchange rate good from the point of view ofthe position taken

> Japan Life Insurance Company invested $10,000,000 in pure-discount U.S. bonds in May 1995 when the exchange rate was 80 yen per dollar. The company liquidated the investment one year later for $10,650,000. The exchange rate turned out to be 110 yen per d

> The HFS Trustees have solicited input from three consultants concerning the risksand rewards of an allocation to international equities. Two of them strongly favorsuch action, while the third consultant commented as follows:“The risk re

> Explain the pricing spillover effect.

> The Cadbury Code of Best Practice,adopted in the United Kingdom, led to asuccessful reform of corporate governance in the country. Explain the key requirementsof the code and discuss how it contributed to the success of reform.

> Suppose you are interested in investing in the stock markets of seven countries—i.e., Australia, Canada, Germany, Japan, Switzerland, the United Kingdom,and the United States—the same seven countries that appear in Exh

> At the start of 1996, the annual interest rate was 6 percent in the United Statesand 2.8 percent in Japan. The exchange rate was 95 yen per dollar at the time.Mr. Jorus, who is the manager of a Bermuda-based hedge fund, thought thatthe substantial intere

> In problem 2, suppose that Mr. Silber sold SF4,600, his principal investmentamount, forward at the forward exchange rate of SF1.62 per dollar. How wouldthis affect the dollar rate of return on this Swiss stock investment? In hindsight,should Mr. Silber h

> Evaluate the usefulness of relative PPP in predicting movements in foreignexchange rates on: a. Short-term basis (for example, three months). b. Long-term basis (for example, six years).

> The Docket Company of Asheville, NC, USA, is considering establishing anaffiliate operation in the city of Wellington, on the south island ofNew Zealand.It is undecided whether to establish the affiliate as a branch operation or a whollyowned subsidiary.

> As an investor, what factors would you consider before investing in the emergingstock market of a developing country?

> What is a mortgage backed security?

> Using the American term quotes from Exhibit 5.4,calculate a cross-rate matrixfor the euro, Swiss franc, Japanese yen, and British pound so that the resulting triangular matrix is similar to the portion above the diagonal in Exhibit 5.6. Exhibit 5.4: Ex

> Discuss foreign equity ownership restrictions. Why do you think countries impose these restrictions?

> Suppose you are a euro-based investor who just sold Microsoft shares that you hadbought six months ago. You had invested 10,000 euros to buy Microsoft sharesfor $120 per share; the exchange rate was $1.15 per euro. You sold the stock for$135 per share an