Question: Farnsworth Company has gathered data on its

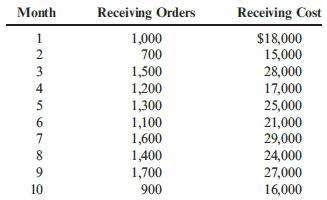

Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controller’s department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:

However, assume that Tracy has used the method of least squares on the receiving data and has gotten the following results:

Intercept ………………………………………….. 3,212

Slope ………………………………………………… 15.15

Required:

1. Using the results from the method of least squares, prepare a cost formula for the receiving activity.

2. Using the formula from Requirement 1, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? (Note: Round your answer to the nearest dollar.)

3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated?

Transcribed Image Text:

Month Receiving Orders Receiving Cost 1 1,000 700 $18,000 15,000 28,000 2 3 1,500 1,200 1,300 1,100 1,600 1,400 1,700 900 4 17,000 5 25,000 21,000 7 29,000 24,000 8 27,000 10 16,000

> The accounts of Consolidated Can contain the following amounts at December 31, 2012: Cost of products sold …………………………………..$410,000 Dividends…………………………………………………………3,000 Extraordinary gain (net of tax)…………………………..1,000 Income taxes……………………………………………………9,300

> (1). Lennar Homebuilding costs and expenses include $51.3 million, $373.5 million and $340.5 million, respectively, of valuation adjustments and write-offs of option deposits and pre-acquisition costs for the years ended November 30, 2010, 2009 and 2008

> Last year, Barnard Company incurred the following costs: Direct materials …………………………………… $ 50,000 Direct labor …………………………………………….. 20,000 Manufacturing overhead ……………………….. 130,000 Selling expense ………………………………………. 40,000 Administrative expense ………………………

> Last year, Barnard Company incurred the following costs: Direct materials …………………………………… $ 50,000 Direct labor …………………………………………….. 20,000 Manufacturing overhead ……………………….. 130,000 Selling expense ………………………………………. 40,000 Administrative expense ………………………

> Last year, Barnard Company incurred the following costs: Direct materials …………………………………… $ 50,000 Direct labor …………………………………………….. 20,000 Manufacturing overhead ……………………….. 130,000 Selling expense ………………………………………. 40,000 Administrative expense ………………………

> Last year, Barnard Company incurred the following costs: Direct materials …………………………………… $ 50,000 Direct labor …………………………………………….. 20,000 Manufacturing overhead ……………………….. 130,000 Selling expense ………………………………………. 40,000 Administrative expense ………………………

> Last year, Barnard Company incurred the following costs: Direct materials …………………………………… $ 50,000 Direct labor …………………………………………….. 20,000 Manufacturing overhead ……………………….. 130,000 Selling expense ………………………………………. 40,000 Administrative expense ………………………

> Jack Man Company produces diecast metal bulldozers for toy shops. Jack Man estimated the following average costs per bulldozer: Direct materials ………………………………. $8.65 Direct labor ………………………………………… 1.10 Manufacturing overhead …………………… 0.95 Prime cost per

> Solve the following independent problems. Required: 1. Andromeda Company’s break-even point is 2,400 units. Variable cost per unit is $42; total fixed costs are $67,200 per year. What price does Andromeda charge? 2. Immelt Company charges a price of $6.

> Suppose a company finds that shipping cost is $3,560 each month plus $6.70 per package shipped. What is the cost formula for monthly shipping cost? Identify the independent variable, the dependent variable, the fixed cost per month, and the variable rate

> Jasper Company provided the following information for last year: Sales in units ………………………………………………. 280,000 Selling price ………………………………………………………. $ 12 Direct materials …………………………………………… 180,000 Direct labor …………………………………………………. 505,000 Manufacturing over

> The method of least squares was used to develop a cost equation to predict the cost of receiving purchased parts at a video game manufacturer. Ninety-six data points from monthly data were used for the regression. The following computer output was receiv

> Allyson Ashley makes jet skis. During the year, Allyson manufactured 94,000 jet skis. Finished goods inventory had the following units: January 1 ……………………………. 6,800 December ……………………….. 31 7,200 Required: 1. How many jet skis did Allyson sell during th

> Melford Company sold 26,800 units last year at $16.00 each. Variable cost was $11.50, and total fixed cost was $126,000. Required: 1. Prepare an income statement for Melford for last year. 2. Calculate the break-even point in units. 3. Calculate the uni

> Grin Company manufactures digital cameras. In January, Grin produced 4,000 cameras with the following costs: Direct materials …………………………….. $400,000 Direct labor ……………………………………….. 80,000 Manufacturing overhead …………………. 320,000 There were no beginning o

> Head-First Company had planned to sell 5,000 bicycle helmets at $75 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $49,500 (in

> Luisa Crimini has been operating a beauty shop in a college town for the past 10 years. Recently, Luisa rented space next to her shop and opened a tanning salon. She anticipated that the costs for the tanning service would primarily be fixed but found th

> Martinez Manufacturing Inc. showed the following costs for last month: Direct materials …………………………………….. $7,000 Direct labor ……………………………………………… 3,000 Manufacturing overhead ………………………….. 2,000 Selling expense ……………………………………….. 8,000 Last month, 4,000 un

> Ben Pal man owns an art gallery. He accepts paintings and sculpture on consignment and then receives 20% of the price of each piece as his fee. Space is limited, and there are costs involved, so Ben is careful about accepting artists. When he does accept

> Ben Pal man owns an art gallery. He accepts paintings and sculpture on consignment and then receives 20% of the price of each piece as his fee. Space is limited, and there are costs involved, so Ben is careful about accepting artists. When he does accept

> Wachman Company produces a product with the following per-unit costs: Direct materials ……………………………….. $15 Direct labor ………………………………………… 6 Manufacturing overhead …………………… 19 Last year, Wachman produced and sold 2,000 units at a price of $75 each. Total

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $49,500 (includes

> Select the graph (A through K) that best matches the numbered (1 through 6) descriptions of various cost behavior. For each graph, the vertical (y) axis represents total dollars of cost, and the horizontal (x) axis represents output units during the peri

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $49,500 (includes

> Slaps hot Company makes ice hockey sticks and sold 1,880 sticks during the month of June at a total cost of $433,000. Each stick sold at a price of $400. Slaps hot also incurred two types of selling costs: commissions equal to 10% of the sales price, and

> Alva Community Hospital has five laboratory technicians who are responsible for doing a series of standard blood tests. Each technician is paid a salary of $30,000. The lab facility represents a recent addition to the hospital and cost $300,000. It is ex

> Pizza Vesuvio makes specialty pizzas. Data for the past eight months were collected: Coefficients shown by a regression program for Pizza Vesuvio’s data are: Intercept ………&a

> Slaps hot Company makes ice hockey sticks. On June 1, Slaps hot had $48,000 of materials in inventory. During the month of June, the company purchased $132,000 of materials. On June 30, materials inventory equaled $45,000. Required: Calculate the direct

> Slaps hot Company makes ice hockey sticks. Last week, direct materials (wood, paint, Kevlar, and resin) costing $32,000 were put into production. Direct labor of $28,000 (10 workers 3 200 hours 3 $14 per hour) was incurred. Manufacturing overhead equaled

> Slaps hot Company makes ice hockey sticks. Last week, direct materials (wood, paint, Kevlar, and resin) costing $32,000 were put into production. Direct labor of $28,000 (10 workers 3 200 hours 3 $14 per hour) was incurred. Manufacturing overhead equaled

> Last year, Barnard Company incurred the following costs: Direct materials …………………………………… $ 50,000 Direct labor …………………………………………….. 20,000 Manufacturing overhead ……………………….. 130,000 Selling expense ………………………………………. 40,000 Administrative expense ………………………

> Wachman Company produces a product with the following per-unit costs: Direct materials ………………………………….. $15 Direct labor ……………………………………………. 6 Manufacturing overhead ………………………. 19 Last year, Wachman produced and sold 2,000 units at a price of $75 each. T

> How can sensitivity analysis be used in conjunction with CVP analysis?

> Suppose that Head-First Company now sells both bicycle helmets and motorcycle helmets. The bicycle helmets are priced at $75 and have variable costs of $45 each. The motorcycle helmets are priced at $220 and have variable costs of $140 each. Total fixed

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Variable cost is 60% of the sales price; contribution margin is 40% of the sales price. Total fixed cost equals $49,500 (includes fixed factory overhead and fixed sell

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $49,500 (includes

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Variable cost is 60% of the sales price; contribution margin is 40% of the sales price. Total fixed cost equals $49,500 (includes fixed factory overhead and fixed sell

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is $20,000 and fix

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Unit variable cost is $45 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Total fixed cost equals $49,500 (includes

> Head-First Company plans to sell 5,000 bicycle helmets at $75 each in the coming year. Product costs include: Direct materials per helmet …………………………………… $ 30 Direct labor per helmet ………………………………………………. 8 Variable factory overhead per helmet ………………………….

> Head-First Company now sells both bicycle helmets and motorcycle helmets. Next year, Head First expects to produce total revenue of $570,000 and incur total variable cost of $388,000. Total fixed cost is expected to be $58,900. Required: 1. Calculate th

> Danna Lumus, the marketing manager for a division that produces a variety of paper products, is considering the divisional manager’s request for a sales forecast for a new line of paper napkins. The divisional manager has been gathering data so that he c

> Briefly describe some of the common themes or pressures faced by executives who commit corporate fraud.

> Artistic Wood crafting Inc. began several years ago as a one-person, cabinet-making operation. Employees were added as the business expanded. Last year, sales volume totaled $850,000. Volume for the first five months of the current year totaled $600,000,

> The management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power c

> About 8 years ago, Kicker faced the problem of rapidly increasing costs associated with workplace accidents. The costs included the following: State unemployment insurance premiums ……………………………….. $100,000 Average cost per injury ………………………………………………………………

> Li Ming Yuan and Tiffany Shaden are the department heads for the accounting department and human resources department, respectively, at a large textile firm in the southern United States. They have just returned from an executive meeting at which the nec

> Jana Morgan is about to sign up for cellular telephone service. She is primarily interested in the safety aspect of the phone; she wants to have one available for emergencies. She does not want to use it as her primary phone. Jana has narrowed her option

> Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern city. Carlos Ruiz, one of the firm’s founders, appreciates the success his firm has enjoyed and wants to give something back to his community. He believ

> Consider each of the following independent situations: a. Shaniqua Boyer just started her new job as controller for St. Matthias General Hospital. She wants to get a feel for the cost behavior of various departments of the hospital. Shaniqua first looks

> Consider each of the following independent situations: a. A computer service agreement in which a company pays $150 per month and $15 per hour of technical time b. Fuel cost of the company’s fleet of motor vehicles c. The cost of beer for a bar d. The co

> Louise McDermott, controller for the Galvin plant of Vero mar Inc., wanted to determine the cost behavior of moving materials throughout the plant. She accumulated the following data on the number of moves (from 100 to 800 in increments of 100) and the t

> What is ethical behavior? Is it possible to teach ethical behavior in a managerial accounting course?

> The total cost for monthly supervisory cost in a factory is $4,500 regardless of how many hours the supervisor works or the quantity of output achieved. This cost a. is strictly variable. b. is strictly fixed. c. is a mixed cost. d. is a step cost. e. c

> An advantage of the scatter graph method is that it a. is objective. b. is easier to use than the high-low method. c. is the most accurate method. d. removes outliers. e. is descriptive of nonlinear data.

> The following six months of data were collected on maintenance cost and the number of machine hours in a factory: Select the correct set of high and low months. Month Maintenance Cost Machine Hours 5,600 4,500 3,800 3,700 4,215 4,980 January Febru

> The following six months of data were collected on maintenance cost and the number of machine hours in a factory: Select the independent and dependent variables. Month Maintenance Cost Machine Hours 5,600 4,500 3,800 3,700 4,215 4,980 January Febr

> An advantage of the high-low method is that it a. is subjective. b. is objective. c. is the most accurate method. d. removes outliers. e. is descriptive of nonlinear data.

> The following cost formula for total purchasing cost in a factory was developed using monthly data. Total Cost = $235,000 + ($75 3 × Number of Purchase Orders) Next month, 8,000 purchase orders are predicted. The total cost predicted for the purchasing

> The following cost formula was developed by using monthly data for a hospital. Total Cost = $128,000,000 + ($12,000 3 × Number of Patient Days) In the cost formula, the term ‘‘Total cost’’ a. is the variable rate. b. is the intercept. c. is the depende

> The following cost formula was developed by using monthly data for a hospital. Total Cost = $128,000,000 + ($12,000 3 × Number of Patient Days) In the cost formula, the term ‘‘Number of patient days’’ a. is the variable rate. b. is the intercept. c. is

> The following cost formula was developed by using monthly data for a hospital. Total Cost = $128,000,000 + ($12,000 3 × Number of Patient Days) In the cost formula, the term $12,000 a. is the variable rate. b. is the dependent variable. c. is the indep

> The following describes the job responsibilities of two employees of Barney Manufacturing. Joan Dennison, Cost Accounting Manager. Joan is responsible for measuring and collecting costs associated with the manufacture of the garden hose product line. She

> The following cost formula was developed by using monthly data for a hospital. Total Cost = $128,000,000 + ($12,000 3 × Number of Patient Days) In the cost formula, the term $128,000,000 a. is the total variable cost. b. is the dependent variable. c. i

> Which of the following would probably be a fixed cost in an automobile insurance company? a. Application forms b. The salary of customer service representatives c. Time spent by adjusters to evaluate accidents d. All of these. e. None of these.

> Which of the following would probably be a variable cost in a soda bottling plant? a. Direct labor b. Bottles c. Carbonated water d. Power to run the bottling machine e. All of these.

> A factor that causes or leads to a change in a cost or activity is a(n) a. slope. b. intercept. c. driver. d. variable term. e. cost object.

> The method of least squares was used to develop a cost equation to predict the cost of receiving purchased parts at a video game manufacturer. Ninety-six data points from monthly data were used for the regression. The following computer output was receiv

> During the past year, the high and low use of three different resources for Fly High Airlines occurred in July and April. The resources are airplane depreciation, fuel, and airplane maintenance. The number of airplane flight hours is the driver. The tota

> Luisa Crimini has been operating a beauty shop in a college town for the past 10 years. Recently, Luisa rented space next to her shop and opened a tanning salon. She anticipated that the costs for the tanning service would primarily be fixed but found th

> Examine the graphs in Exercise 3-26. In Exercise 3-26: Required: Using the letters (A through J) as reference points, which graph(s) depict a (1) purely variable cost (i.e., no fixed component), (2) purely fixed cost (i.e., no variable component), or

> Bellati Inc. produces large industrial machinery. Bellati has a machining department and a group of direct laborers called machinists. Each machinist can machine up to 500 units per year. Bellati also hires supervisors to develop machine specification pl

> Alisha Incorporated manufactures medical stents for use in heart bypass surgery. Based on past experience, Alisha has found that its total maintenance costs can be represented by the following formula: Maintenance Cost = $1,750,000 + $125X, where X = Num

> Adriana Alvarado has decided to purchase a personal computer. She has narrowed the choices to two: Drantex and Confiar. Both brands have the same processing speed, 6.4 gigabytes of hard-disk capacity, two USB ports, a DVDRW drive, and each comes with the

> Alisha Incorporated manufactures medical stents for use in heart bypass surgery. Based on past experience, Alisha has found that its total maintenance costs can be represented by the following formula: Maintenance Cost = $1,750,000 + $125X, where X = Num

> Smith Concrete Company owns enough ready-mix trucks to deliver up to 100,000 cubic yards of concrete per year (considering each truck’s capacity, weather, and distance to each job). Total truck depreciation is $200,000 per year. Raw materials (cement, gr

> What follows are a number of resources that are used by a manufacturer of futons. Assume that the output measure or cost driver is the number of futons produced. All direct labor is paid on an hourly basis, and hours worked can be easily changed by manag

> Gordon Company’s controller, Eric Junior, estimated the following formula, based on monthly data, for overhead cost: Overhead Cost = $150,000 + ($52 × Direct Labor Hours) Required: 1. Link each term in column A to the corresponding term in column B.

> What are the advantages of the scatter graph method over the high-low method? The high low method over the scatter graph method?

> Describe how the scatter graph method breaks out the fixed and variable costs from a mixed cost. Now describe how the high-low method works. How do the two methods differ?

> Explain why the concept of relevant range is important when dealing with step costs.

> Explain the difference between committed and discretionary fixed costs. Give examples of each.

> Some firms assign mixed costs to either the fixed or variable cost categories without using any formal methodology to separate them. Explain how this practice can be defended.

> Bill Lewis, manager of the Thomas Electronics Division, called a meeting with his controller, Brindon Peterson, and his marketing manager, Patty Fritz. The following is a transcript of the conversation that took place during the meeting: Bill: Brindon, t

> Briefly explain the practice of enterprise risk management and the role that can be played by managerial accountants in enterprise risk management.

> For the past 5 years, Garner Company has had a policy of producing to meet customer demand. As a result, finished goods inventory is minimal, and for the most part, units produced equal units sold. Recently, Garner’s industry entered a

> Jean Erickson, manager and owner of an advertising company in Charlotte, North Carolina, arranged a meeting with Leroy Gee, the chief accountant of a large, local competitor. The two are lifelong friends. They grew up together in a small town and attende

> Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateway’s work comes from contracts with city and state agencies in Nebraska. The company&

> Five to six times a year, Kicker puts on tent sales in various cities throughout Oklahoma and the surrounding states. The tent sales are designed to show Kicker customers new products, engender enthusiasm about those products, and sell soon to be out-of-

> Melissa Vassar has decided to open a printing shop. She has secured two contracts. One is a 5-year contract to print a popular regional magazine. This contract calls for 5,000 copies each month. The second contract is a 3-year agreement to print tourist

> Luisa Giovanni is a student at New York University. To help pay her way through college, Luisa started a dog walking service. She has 12 client dogs—six are walked on the first shift (6:30 A.M. and 5:00 P.M.), and six are walked on the second shift (7:30

> W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for $400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished

> Berry Company is an architectural firm located in Detroit, Michigan. The company works with small and medium-size construction businesses to prepare building plans according to the client’s contract. The following data are provided for the previous year:

> Following is a list of cost terms described in the chapter as well as a list of brief descriptive settings for each item. Cost terms: a. Opportunity cost b. Period cost c. Product cost d. Direct labor cost e. Selling cost f. Conversion cost g. Prime cost

> Describe the method of least squares. Why is this method better than either the high-low method or the scatter graph method?

> Explain why today’s managerial accountant must have a cross-functional perspective.

> La world Inc. manufactures small camping tents. Last year, 200,000 tents were made and sold for $60 each. Each tent includes the following costs: Direct materials ……………………………………………. $18 Direct labor …………………………………………………….. 12 Manufacturing overhead ……………

> Bisby Company manufactures fishing rods. At the beginning of July, the following information was supplied by its accountant: Raw materials inventory …………………………………………………… $40,000 Work-in-process inventory …………………………………………………… 21,000 Finished goods invent

> Harry Whipple, owner of an inkjet printer, has agreed to allow Mary and Natalie, two friends who are pursuing master’s degrees, to print several papers for their graduate courses. However, he has imposed two conditions. First, they must supply their own

> Pop’s Drive-Thru Burger Heaven produces and sells quarter-pound hamburgers. Each burger is wrapped and put in a ‘‘burger bag,’’ which also includes a serving of fri