Question: Financial statement data for years ending December

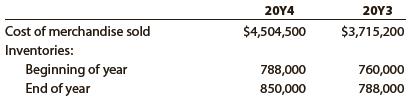

Financial statement data for years ending December 31 for Holland Company follow:

a. Determine the inventory turnover for 20Y4 and 20Y3.

b. Determine the days’ sales in inventory for 20Y4 and 20Y3. Use 365 days and round to one decimal place.

c. Does the change in inventory turnover and the days’ sales in inventory from 20Y3 to 20Y4 indicate a favorable or an unfavorable trend?

Transcribed Image Text:

20Υ4 20Y3 Cost of merchandise sold $4,504,500 $3,715,200 Inventories: Beginning of year End of year 788,000 760,000 850,000 788,000

> During the taking of its physical inventory on December 31, 2019, Waterjet Bath Company incorrectly counted its inventory as $728,660 instead of the correct amount of $719,880. Indicate the effect of the misstatement on Waterjet Bath’s December 31, 2019,

> Journalize the following merchandise transactions: a. Sold merchandise on account, $92,500 with terms 1/10, n/30. The cost of the merchandise sold was $55,500. b. Received payment less the discount. c. Issued a credit memo for returned merchandise that w

> Glacier Mining Co. acquired mineral rights for $494,000,000. The mineral deposit is estimated at 475,000,000 tons. During the current year, 31,500,000 tons were mined and sold. a. Determine the depletion rate. b. Determine the amount of depletion expense

> During the taking of its physical inventory on August 31, 2019, Kate Interiors Company incorrectly counted its inventory as $366,900 instead of the correct amount of $378,500. Indicate the effect of the misstatement on Kate Interiors’ August 31, 2019, ba

> Warwick’s Co., a women’s clothing store, purchased $75,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Warwick’s returned $9,000 of the merchandise, receiving a credit memo, and then paid the amount due within the discou

> Hahn Flooring Company’s perpetual inventory records indicate that $1,333,150 of merchandise should be on hand on December 31, 2019. The physical inventory indicates that $1,309,900 of merchandise is actually on hand. Journalize the adjusting entry for th

> Equipment was acquired at the beginning of the year at a cost of $465,000. The equipment was depreciated using the straight-line method based on an estimated useful life of 15 years and an estimated residual value of $45,000. a. What was the depreciation

> Monet Paints Co. is a newly organized business with a list of accounts arranged in alphabetical order, as follows: Accounts Payable Accounts Receivable Accumulated Depreciation—Office Equipment Accumulated Depreciation—Store Equipment Advertising Expense

> Financial statement data for years ending December 31 for Robinhood Company follow: a. Determine the accounts receivable turnover for 20Y9 and 20Y8. b. Determine the days’ sales in receivables for 20Y9 and 20Y8. Use 365 days and round

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9. Inventory Quantity 6,330 Market Value per Unit (Net Realizable Valu

> Castle Furnishings Company’s perpetual inventory records indicate that $675,400 of merchandise should be on hand on November 30, 2019. The physical inventory indicates that $663,800 of merchandise is actually on hand. Journalize the adjusting entry for t

> Equipment was acquired at the beginning of the year at a cost of $600,000. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 16 years and an estimated residual value of $60,000. a. What was the d

> At the end of the current year, Accounts Receivable has a balance of $3,460,000, Allowance for Doubtful Accounts has a debit balance of $12,500, and sales for the year total $46,300,000. Bad debt expense is estimated at ½ of 1% of sales. Determine (a) Th

> Financial statement data for years ending December 31 for Chiro-Solutions Company follow: a. Determine the accounts receivable turnover for 20Y2 and 20Y1. b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days and

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9. Inventory Quantity Cost per Unit Market Value per Unit (Net Realiza

> What is the nature of (a) A credit memo issued by the seller of merchandise, (b) A debit memo issued by the buyer of merchandise?

> Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the merchandise sold is $67,200. Shore Co. paid freight of $1,800. Journalize the entries for Shore Co. and Blue Star Co. for the sale, pu

> On August 7, Green River Inflatables Co. paid $1,675 to install a hydraulic lift and $40 for an air filter for one of its delivery trucks. Journalize the entries for the new lift and air filter expenditures.

> Prefix Supply Company received a 120-day, 8% note for $450,000, dated April 9, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of

> Hoffman Company purchased merchandise on account from a supplier for $65,000, terms 1/10, n/30. Hoffman Company returned $7,500 of the merchandise and received full credit. a. If Hoffman Company pays the invoice within the discount period, what is the am

> Financial data for Bonita Company follow: ______________________________For Year Ended December 31 Cash on December 31 ……………………………………………………………….. $ 187,180 Cash flow from operations ………………………………………………………… (458,400) a. Compute the ratio of cash to monthl

> The units of an item available for sale during the year were as follows: There are 57 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) The first-in, first-out (FIF

> Sather Co. sold merchandise to Boone Co. on account, $31,800, terms 2/15, n/30. The cost of the merchandise sold is $19,000. Journalize the entries for Sather Co. and Boone Co. for the sale, purchase, and payment of amount due. Assume all discounts are t

> Beginning inventory, purchases, and sales for Item Delta are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) The cost of merchandise sold on July 24 and (b) The inventory on July 31.

> On February 14, Garcia Associates Co. paid $2,300 to repair the transmission on one of its delivery vans. In addition, Garcia paid $450 to install a GPS system in its van. Journalize the entries for the transmission and GPS system expenditures.

> Lundquist Company received a 60-day, 9% note for $28,000, dated July 23, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the n

> Financial data for Otto Company follow: ___________________________For Year Ended December 31 Cash on December 31 ……………………………………………..………….. $ 69,350 Cash flow from operations …………………………………….…………… (114,000) a. Compute the ratio of cash to monthly cash ex

> The units of an item available for sale during the year were as follows: There are 14 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) The first-in, first-out (FIF

> A retailer is considering the purchase of 500 units of a specific item from either of two suppliers. Their offers are as follows: Supplier One: $40 a unit, total of $20,000, 1/10, n/30, no charge for freight. Supplier Two: $39 a unit, total of $19,500, 2

> Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

> At the end of the current year, Accounts Receivable has a balance of $3,460,000, Allowance for Doubtful Accounts has a debit balance of $12,500, and sales for the year total $46,300,000. Using the aging method, the balance of Allowance for Doubtful Accou

> Journalize the following transactions, using the allowance method of accounting for uncollectible receivables: Oct. 2. Received $600 from Rachel Elpel and wrote off the remainder owed of $1,350 as uncollectible. Dec. 20. Reinstated the account of Rachel

> Prepare journal entries for each of the following: a. Issued a check to establish a petty cash fund of $900. b. The amount of cash in the petty cash fund is $115. Issued a check to replenish the fund, based on the following summary of petty cash receipts

> Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) The weighted average unit cost after the October 22 purchase, (b) The cost of the merchandise

> The following data were gathered to use in reconciling the bank account of Conway Company: Balance per bank ………………………………………………….. $23,900 Balance per company records ……………………………………. 8,700 Bank service charges …………………………………………………….. 50 Deposit in transit

> The following items may appear on a bank statement: 1. Bank correction of an error from recording a $6,200 deposit as $2,600 2. EFT payment 3. Note collected for company 4. Service charge Using the following format, indicate whether each item would appea

> After the amount due on a sale of $28,000, terms 2/10, n/eom, is received from a customer within the discount period, the seller consents to the return of the entire shipment for a cash refund. The cost of the merchandise returned was $16,800. (a) What i

> Financial statement data for years ending December 31 for Davenport Company follow: a. Determine the fixed asset turnover ratio for Year 1 and Year 2. b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an

> Financial statement data for years ending December 31 for DePuy Company follow: a. Determine the fixed asset turnover ratio for Year 1 and Year 2. b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unf

> Journalize the entries for the following transactions: a. Sold merchandise for cash, $116,300. The cost of the merchandise sold was $72,000. b. Sold merchandise on account, $755,000. The cost of the merchandise sold was $400,000. c. Sold merchandise to c

> Financial statement data for years ending December 31, 2019 and 2018, for Edison Company follow: a. Determine the asset turnover for 2019 and 2018. b. Does the change in the asset turnover from 2018 to 2019 indicate a favorable or an unfavorable trend?

> On December 31, it was estimated that goodwill of $4,000,000 was impaired. In addition, a patent with an estimated useful economic life of 15 years was acquired for $900,000 on August 1. a. Journalize the adjusting entry on December 31 for the impaired g

> Financial statement data for years ending December 31 for Tango Company follow: a. Determine the inventory turnover for 20Y7 and 20Y6. b. Determine the days’ sales in inventory for 20Y7 and 20Y6. Use 365 days and round to one decimal

> Financial statement data for years ending December 31, 2019 and 2018, for Latchkey Company follow: a. Determine the asset turnover for 2019 and 2018. b. Does the change in the asset turnover from 2018 to 2019 indicate a favorable or an unfavorable tren

> The debits and credits for four related entries for a sale of $15,000, terms 1/10, n/30, are presented in the following T accounts. Describe each transaction.

> On December 31, it was estimated that goodwill of $6,000,000 was impaired. In addition, a patent with an estimated useful economic life of 12 years was acquired for $1,500,000 on April 1. a. Journalize the adjusting entry on December 31 for the impaired

> US Freight Lines Co. incurred the following costs related to trucks and vans used in operating its delivery service: 1. Installed GPS systems on the trucks. 2. Replaced the transmission fluid on a truck that had been in service for the past four years. 3

> New tire retreading equipment, acquired at a cost of $110,000 on September 1 of Year 1 (beginning of the fiscal year), has an estimated useful life of four years and an estimated residual value of $7,500. The manager requested information regarding the e

> Journalize entries for the following related transactions of Manville Heating & Air Company: a. Purchased $90,000 of merchandise from Wright Co. on account, terms 2/10, n/30. b. Paid the amount owed on the invoice within the discount period. c. Discovere

> Assume the following data for Casper Company before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer allowances b. Estimated customer returns Unadjusted Balances Debit Credit Sales $1,750,000 Cost

> Caldwell Mining Co. acquired mineral rights for $127,500,000. The mineral deposit is estimated at 425,000,000 tons. During the current year, 42,000,000 tons were mined and sold. a. Determine the depletion rate. b. Determine the amount of depletion expens

> During the taking of its physical inventory on December 31, 2019, Waterjet Bath Company incorrectly counted its inventory as $728,660 instead of the correct amount of $719,880. Indicate the effect of the misstatement on Waterjet Bath’s December 31, 2019,

> Assume the following data for Lusk Inc. before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer allowances b. Estimated customer returns Unadjusted Balances Debit Credit Sales $3,600,000 Cost of Me

> Glacier Mining Co. acquired mineral rights for $494,000,000. The mineral deposit is estimated at 475,000,000 tons. During the current year, 31,500,000 tons were mined and sold. a. Determine the depletion rate. b. Determine the amount of depletion expense

> During the taking of its physical inventory on August 31, 2019, Kate Interiors Company incorrectly counted its inventory as $366,900 instead of the correct amount of $378,500. Indicate the effect of the misstatement on Kate Interiors’ August 31, 2019, ba

> Warwick’s Co., a women’s clothing store, purchased $75,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Warwick’s returned $9,000 of the merchandise, receiving a credit memo, and then paid the amount due within the discou

> A building with a cost of $1,200,000 has an estimated residual value of $250,000, has an estimated useful life of 40 years, and is depreciated by the straight-line method. (a) What is the amount of the annual depreciation? (b) What is the book value at t

> Hahn Flooring Company’s perpetual inventory records indicate that $1,333,150 of merchandise should be on hand on December 31, 2019. The physical inventory indicates that $1,309,900 of merchandise is actually on hand. Journalize the adjusting entry for th

> Layton Company purchased tool sharpening equipment on October 1 for $108,000. The equipment was expected to have a useful life of three years, or 12,000 operating hours, and a residual value of $7,200. The equipment was used for 1,350 hours during Year 1

> Equipment was acquired at the beginning of the year at a cost of $465,000. The equipment was depreciated using the straight-line method based on an estimated useful life of 15 years and an estimated residual value of $45,000. a. What was the depreciation

> Financial statement data for years ending December 31 for Robinhood Company follow: a. Determine the accounts receivable turnover for 20Y9 and 20Y8. b. Determine the days’ sales in receivables for 20Y9 and 20Y8. Use 365 days and round

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.

> Castle Furnishings Company’s perpetual inventory records indicate that $675,400 of merchandise should be on hand on November 30, 2019. The physical inventory indicates that $663,800 of merchandise is actually on hand. Journalize the adjusting entry for t

> Equipment was acquired at the beginning of the year at a cost of $600,000. The equipment was depreciated using the double-declining-balance method based on an estimated useful life of 16 years and an estimated residual value of $60,000. a. What was the d

> Financial statement data for years ending December 31 for Chiro-Solutions Company follow: a. Determine the accounts receivable turnover for 20Y2 and 20Y1. b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days and

> On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.

> What is the nature of (a) A credit memo issued by the seller of merchandise, (b) A debit memo issued by the buyer of merchandise?

> Equipment acquired at a cost of $105,000 has an estimated residual value of $12,000 and an estimated useful life of 10 years. It was placed into service on May 1 of the current fiscal year, which ends on December 31. Determine the depreciation for the cu

> Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the merchandise sold is $67,200. Shore Co. paid freight of $1,800. Journalize the entries for Shore Co. and Blue Star Co. for the sale, pu

> On August 7, Green River Inflatables Co. paid $1,675 to install a hydraulic lift and $40 for an air filter for one of its delivery trucks. Journalize the entries for the new lift and air filter expenditures.

> The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale ceramic business. The receipts are identified by an asterisk. a. Fee paid to attorney for title search . . . . . . . . . . . . . . .

> Prefix Supply Company received a 120-day, 8% note for $450,000, dated April 9, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of

> Financial data for Bonita Company follow: ______________________________For Year Ended December 31 Cash on December 31 ……………………………………………………………….. $ 187,180 Cash flow from operations ………………………………………………………… (458,400) a. Compute the ratio of cash to monthl

> The units of an item available for sale during the year were as follows: There are 57 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) The first-in, first-out (FIF

> Sather Co. sold merchandise to Boone Co. on account, $31,800, terms 2/15, n/30. The cost of the merchandise sold is $19,000. Journalize the entries for Sather Co. and Boone Co. for the sale, purchase, and payment of amount due. Assume all discounts are t

> On February 14, Garcia Associates Co. paid $2,300 to repair the transmission on one of its delivery vans. In addition, Garcia paid $450 to install a GPS system in its van. Journalize the entries for the transmission and GPS system expenditures.

> Lundquist Company received a 60-day, 9% note for $28,000, dated July 23, from a customer on account. a. Determine the due date of the note. b. Determine the maturity value of the note. c. Journalize the entry to record the receipt of the payment of the n

> Financial data for Otto Company follow: ___________________________For Year Ended December 31 Cash on December 31 ……………………………………………..………….. $ 69,350 Cash flow from operations …………………………………….…………… (114,000) a. Compute the ratio of cash to monthly cash ex

> a. Under what conditions is the use of the straight-line depreciation method most appropriate? b. Under what conditions is the use of the units-of-activity depreciation method most appropriate? c. Under what conditions is the use of the double-declining-

> The units of an item available for sale during the year were as follows: There are 14 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) The first-in, first-out (FIF

> A retailer is considering the purchase of 500 units of a specific item from either of two suppliers. Their offers are as follows: Supplier One: $40 a unit, total of $20,000, 1/10, n/30, no charge for freight. Supplier Two: $39 a unit, total of $19,500, 2

> Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

> Data related to the acquisition of timber rights and intangible assets during the current year ended December 31 are as follows: a. Timber rights on a tract of land were purchased for $1,600,000 on February 22. The stand of timber is estimated at 5,000,0

> At the end of the current year, Accounts Receivable has a balance of $3,460,000, Allowance for Doubtful Accounts has a debit balance of $12,500, and sales for the year total $46,300,000. Using the aging method, the balance of Allowance for Doubtful Accou

> Prepare journal entries for each of the following: a. Issued a check to establish a petty cash fund of $900. b. The amount of cash in the petty cash fund is $115. Issued a check to replenish the fund, based on the following summary of petty cash receipts

> Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) The weighted average unit cost after the October 22 purchase, (b) The cost of the merchandise

> Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

> At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Using the aging method, the balance of Allowance for Doubtful Acco

> Prepare journal entries for each of the following: a. Issued a check to establish a petty cash fund of $1,000. b. The amount of cash in the petty cash fund is $315. Issued a check to replenish the fund, based on the following summary of petty cash receip

> For some of the fixed assets of a business, the balance in Accumulated Depreciation is equal to the cost of the asset. (a) Is it permissible to record additional depreciation on the assets if they are still useful to the business? Explain. (b) When shoul

> Beginning inventory, purchases, and sales for Meta-B1 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) The weighted average unit cost after the July 23 purchase, (b) The cost of the merchandise

> What is the meaning of (a) 1/15, n/60; (b) n/30; (c) n/eom?

> Journalize the following merchandise transactions: a. Sold merchandise on account, $92,500 with terms 1/10, n/30. The cost of the merchandise sold was $55,500. b. Received payment less the discount. c. Issued a credit memo for returned merchandise that w

> At the end of the current year, Accounts Receivable has a balance of $3,460,000, Allowance for Doubtful Accounts has a debit balance of $12,500, and sales for the year total $46,300,000. Bad debt expense is estimated at ½ of 1% of sales. Determine (a) Th

> The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining-balance method of depreciation is used. Year 1 Jan. 4. Purchased a

> The following data were gathered to use in reconciling the bank account of Conway Company: Balance per bank ………………………………………………….. $23,900 Balance per company records ……………………………………. 8,700 Bank service charges …………………………………………………….. 50 Deposit in transit

> Beginning inventory, purchases, and sales for Item Foxtrot are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) The cost of merchandise sold on March 27 and (b) The inventory on March 31.

> Journalize the following merchandise transactions: a. Sold merchandise on account, $72,500 with terms 2/10, n/30. The cost of the merchandise sold was $43,500. b. Received payment less the discount. c. Issued a credit memo for returned merchandise that w

> At the end of the current year, Accounts Receivable has a balance of $3,750,000, Allowance for Doubtful Accounts has a credit balance of $22,750, and sales for the year total $48,400,000. Bad debt expense is estimated at ¾ of 1% of sales. Determine (a) T

> The following data were gathered to use in reconciling the bank account of Torres Company: Balance per bank ………………………………………. $12,175 Balance per company records ………………………. 9,480 Bank service charges ………………………………………… 50 Deposit in transit …………………………………………