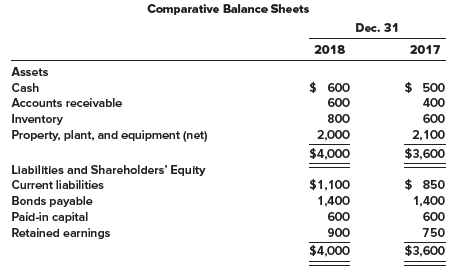

Question: Financial statements for Askew Industries for 2018

Financial Statements for Askew Industries for 2018 are shown below (in thousands):

2018 Income Statement

Sales ………………………………………….. $ 9,000

Cost of goods sold ……………………….. (6,300)

Gross profit …………………………………… 2,700

Operating expenses ……………………… (2,000)

Interest expense …………………………….. (200)

Tax expense …………………………………… (200)

Net income ……………………………………. $ 300

Required:

Calculate the following ratios for 2018.

1. Inventory turnover ratio

2. Average days in inventory

3. Receivables turnover ratio

4. Average collection period

5. Asset turnover ratio

6. Profit margin on sales

7. Return on assets

8. Return on shareholders’ equity

9. Equity multiplier

10. Return on shareholders’ equity (using the DuPont framework)

Transcribed Image Text:

Comparative Balance Sheets Dec. 31 2018 2017 Assets Cash $ 600 $ 500 Accounts receivable 600 400 Inventory 800 600 Property, plant, and equipment (net) 2,000 2,100 $4,000 $3,600 Liabilities and Shareholders' Equity $ 850 1,400 Current liabilities $1,100 Bonds payable Paid-in capital Retained earnings 1,400 600 600 900 750 $4,000 $3,600

> Access the FASB Standards Codification at the FASB website (www.fasb.org). Required: Determine the specific citation for accounting for each of the following items: 1. On what basis is a contract’s transaction price allocated to its performance obligati

> Video Planet (VP) sells a big screen TV package consisting of a 60-inch plasma TV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer’s home

> Ski West, Inc., operates a downhill ski area near Lake Tahoe, California. An all-day adult lift ticket can be purchased for $85. Adult customers also can purchase a season pass that entitles the pass holder to ski any day during the season, which typical

> Access the FASB’s Accounting Standards Codification at the FASB website (www.fasb.org). Required: Determine the specific citation for accounting for each of the following items: 1. What are the five key steps to applying the revenue recognition principl

> Horizon Corporation manufactures personal computers. The company began operations in 2013 and reported profits for the years 2013 through 2016. Due primarily to increased competition and price slashing in the industry, 2017’s income statement reported a

> On October 1, 2018, the Submarine Sandwich Company entered into a franchise agreement with an individual. In exchange for an initial franchise fee of $300,000, Submarine will provide initial services to the franchisee to include assistance in design and

> Assume the same facts as in E 5–33, but that Richardson Systems reports under IFRS. How would your answers change? (Assume for requirement 2 that separate shipment is part of the normal course of Richardson’s operations, and successful customer installat

> Richardson Systems sells integrated bottling manufacturing systems that involve a conveyer, a labeler, a filler, and a capper. All of this equipment is sold separately by other vendors, and the fair values of the separate equipment are as follows: Convey

> Easywrite Software Company shipped software to a customer on July 1, 2018. The arrangement with the customer also requires the company to provide technical support over the next 12 months and to ship an expected software upgrade on January 1, 2019. The t

> Assume the same information as in E 5–18. In E 5–18 On June 15, 2018, Sanderson Construction entered into a long-term construction contract to build a baseball stadium in Washington, D.C., for $220 million. The expect

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Required: Determine the specific citation for accounting for each of the following items: Circumstances indicating when the installment method or cost recovery method

> On April 1, 2018, the Apex Corporation sold a parcel of underdeveloped land to the Applegate Construction Company for $2,400,000. The book value of the land on Apex’s books was $480,000. Terms of the sale required a down payment of $120,000 and 19 annual

> Sanchez Development Company uses the installment sales method to account for some of its installment sales. On October 1, 2018, Sanchez sold a parcel of land to the Kreuze Corporation for $4 million. This amount was not considered significant relative to

> Wolf Computer Company began operations in 2018. The company allows customers to pay in installments for many of its products. Installment sales for 2018 were $1,000,000. If revenue is recognized at the point of delivery, $600,000 in gross profit would be

> On July 1, 2018, the Foster Company sold inventory to the Slate Corporation for $300,000. Terms of the sale called for a down payment of $75,000 and three annual installments of $75,000 due on each July 1, beginning July 1, 2019. Each installment also wi

> Cutler Education Corporation developed a software product to help children under age 12 learn mathematics. The software contains two separate parts: Basic Level (Level I) and Intermediate Level (Level II). Parents purchase each level separately and are e

> In May 2001, the Securities and Exchange Commission sued the former top executives at Sunbeam, charging the group with financial reporting fraud that allegedly cost investors billions in losses. Sunbeam Corporation is a recognized designer, manufacturer,

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material is also available under the Investor Relations li

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are provided Connect. This mater

> Companies often voluntarily provide non-GAAP earnings when they announce annual or quarterly earnings. Required: 1. What is meant by the term non-GAAP earnings in this context? 2. How do non-GAAP earnings relate to the concept of earnings quality?

> Companies often are under pressure to meet or beat Wall Street earnings projections in order to increase stock prices and also to increase the value of stock options. Some resort to earnings management practices to artificially create desired results. R

> The appearance of restructuring costs in corporate income statements increased significantly in the 1980s and 1990s and continues to be relevant today. Required: 1. What types of costs are included in restructuring costs? 2. When are restructuring costs

> The financial community in the United States has become increasingly concerned with the quality of reported company earnings. Required: 1. Define the term earnings quality. 2. Explain the distinction between permanent and temporary earnings as it relate

> You are a new staff accountant with a large regional CPA firm, participating in your first audit. You recall from your auditing class that CPAs often use ratios to test the reasonableness of accounting numbers provided by the client. Since ratios reflect

> What is meant by a change in accounting principle? Describe the possible accounting treatments for a mandated change in accounting principle.

> You are a part-time financial advisor. A client is considering an investment in common stock of a waste recycling firm. One motivation is a rumor the client heard that the company made huge investments in a new fuel creation process. Unable to confirm th

> Ralph Lauren Corporation is a global leader in the design, marketing, and distribution of premium lifestyle products, including men’s, women’s and children’s apparel. Below are selected financial stat

> Refer to the income statement of Sherwin Williams Company in Illustration 4–2 of this chapter. In Illustration 4–2 Statement of Consolidated Income ($ in thousands, except per share data) __________________________Year ended December 31, 2015 Net sales

> Rice Corporation is negotiating a loan for expansion purposes and the bank requires financial statements. Before closing the accounting records for the year ended December 31, 2018, Rice’s controller prepared the following financial sta

> Companies often voluntarily provide non-GAAP earnings when they announce annual or quarterly earnings. These numbers are controversial as they represent management’s view of permanent earnings. The Sarbanes-Oxley Act (SOX), issued in 2002, requires that

> It has been suggested that not all accounting choices are made by management in the best interest of fair and consistent financial reporting. Required: What motivations can you think of for management’s choice of accounting methods?

> Norse Manufacturing Inc. prepares an annual single, continuous statement of income and comprehensive income. The following situations occurred during the company’s 2018 fiscal year: 1. Restructuring costs were incurred due to the closing of a factory. 2.

> GlaxoSmithKline Plc. (GSK) is a global pharmaceutical and consumer health-related products company located in the United Kingdom. The company prepares its financial statements in accordance with International Financial Reporting Standards. Below is a por

> The following events occurred during 2018 for various audit clients of your firm. Consider each event to be independent and the effect of each event to be material. 1. A manufacturing company recognized a loss on the sale of investments. 2. An automobile

> The accrual of restructuring costs creates obligations (liabilities) referred to as exit or disposal cost obligations. Required: 1. Obtain the relevant authoritative literature on exit or disposal cost obligations using the FASB Accounting Standards Cod

> How are discontinued operations reported in the income statement?

> Duke Company’s records show the following account balances at December 31, 2018: Sales ……………………………………………………………………. $ 15,000,000 Cost of goods sold ………………………………………………………9,000,000 General and administrative expenses ………………………….. 1,000,000 Selling expenses

> The following income statement items appeared on the adjusted trial balance of Schembri Manufacturing Corporation for the year ended December 31, 2018 ($ in thousands): sales revenue, $15,300; cost of goods sold, $6,200; selling expenses, $1,300; general

> Rembrandt Paint Company had the following income statement items for the year ended December 31, 2018 ($ in thousands): Net sales ……………………………………………………………………. $ 18,000 Interest income ………………………………………………………….……… 200 Interest expense ……………………………………………………………

> Required: Refer to the information presented in P 4–4. Prepare a revised income statement for 2018 reflecting the additional facts. Use a multiple-step format. Assume that an income tax rate of 40% applies to all income statement items, and that 20 milli

> The preliminary 2018 income statement of Alexian Systems, Inc., is presented below: ALEXIAN SYSTEMS, INC. Income Statement For the Year Ended December 31, 2018 ($ in millions, except earnings per share) Revenues and gains: Net sales ………………………………………………………

> For the year ending December 31, 2018, Micron Corporation had income from continuing operations before taxes of $1,200,000 before considering the following transactions and events. All of the items described below are before taxes and the amounts should

> The following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2018 and 2017: On October 15, 2018, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The d

> Selected information about income statement accounts for the Reed Company is presented below (the company’s fiscal year ends on December 31). On July 1, 2018, the company adopted a plan to discontinue a division that qualifies as a co

> Branson Electronics Company is a small, publicly traded company preparing its first quarter interim report to be mailed to shareholders. The following information for the quarter has been compiled: Fixed operating expenses include payments of $50,000 t

> Presented below are condensed financial statements adapted from those of two actual companies competing as the primary players in a specialty area of the food manufacturing and distribution industry ($ in millions, except per share amounts). Required:

> Define intraperiod tax allocation. Why is the process necessary?

> Cadux Candy Company’s income statement for the year ended December 31, 2018, reported interest expense of $2 million and income tax expense of $12 million. Current assets listed in its balance sheet include cash, accounts receivable, and inventories. Pro

> Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industry—Johnson and Johnson (J&J) and Pfizer, Inc. ($ in millions, except per share amounts). Required:

> Presented below are the 2018 income statement and comparative balance sheets for Santana Industries. Additional information for the 2018 fiscal year ($ in thousands): 1. Cash dividends of $1,000 were declared and paid. 2. Equipment costing $4,000 was p

> The chief accountant for Grandview Corporation provides you with the company’s 2018 statement of cash flows and income statement. The accountant has asked for your help with some missing figures in the company’s compar

> The Diversified Portfolio Corporation provides investment advice to customers. A condensed income statement for the year ended December 31, 2018, appears below: Service revenue ………â€&

> On September 17, 2018, Ziltech, Inc., entered into an agreement to sell one of its divisions that qualifies as a component of the entity according to generally accepted accounting principles. By December 31, 2018, the company’s fiscal year-end, the divis

> Kandon Enterprises, Inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined by generally accepted accounting principles. The horse division has been

> Esquire Comic Book Company had income before tax of $1,000,000 in 2018 before considering the following material items: 1. Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting pri

> Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been un

> On December 31, 2018, the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $9 million. The business segment qualifies as a component of the entity according to GAAP. The book value of the assets of the segm

> The following incorrect income statement was prepared by the accountant of the Axel Corporation: Required: Prepare a multiple-step income statement for 2018 applying generally accepted accounting principles. The income tax rate is 40%. AXEL CORPORA

> The trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2018, included the following income accounts: The trial balance does not include the accrual for income taxes. Lindor’s income tax rate

> The following is a partial trial balance for General Lighting Corporation as of December 31, 2018: 300,000 shares of common stock were outstanding throughout 2018. Income tax expense has not yet been recorded. The income tax rate is 40%. Required: 1.

> The following is a partial trial balance for the Green Star Corporation as of December 31, 2018: 100,000 shares of common stock were outstanding throughout 2018. Required: 1. Prepare a single-step income statement for 2018, including EPS disclosures.

> Pandora Corporation operates several factories in the Midwest that manufacture consumer electronics. The December 31, 2018, year-end trial balance contained the following income statement items: Required: Calculate the company’s opera

> The 2018 income statement of Anderson Medical Supply Company reported net sales of $8 million, cost of goods sold of $4.8 million, and net income of $800,000. The following table shows the company’s comparative balance sheets for 2018 a

> The following is a portion of the condensed income statement for Rowan, Inc., a manufacturer of plastic containers: Required: 1. Determine Rowan’s inventory turnover. 2. What information does this ratio provide? Net sales $2,460,0

> Listed below are several terms and phrases associated with income statement presentation and the statement of cash flows. Pair each item from List A (by letter) with the item from List B that is most appropriately associated with it. List A List B 1

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for each of the following items: 1. The calculation of the weighted average number of shares for basic earnings per share purposes 2. Th

> The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obtain the relevant authoritative literature on earnings per share using the FASB Accounting Standards C

> Explain what is meant by the term earnings quality.

> Refer to the situation described in E 4–20. In E 4–20 Presented below is the 2018 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare the cash flows from operating act

> Presented below is the 2018 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tiger’s statement of cash flows, using the indirect method to present cash flows from operating activities

> The statement of cash flows for the year ended December 31, 2018, for Bronco Metals is presented below. Required: Prepare the statement of cash flows assuming that Bronco prepares its financial statements according to International Financial Reporting

> Chew Corporation prepares its statement of cash flows using the indirect method of reporting operating activities. Net income for the 2018 fiscal year was $1,250,000. Depreciation expense of $140,000 was included with operating expenses in the income sta

> Cemptex Corporation prepares its statement of cash flows using the indirect method to report operating activities. Net income for the 2018 fiscal year was $624,000. Depreciation and amortization expense of $87,000 was included with operating expenses in

> The following transactions occurred during March 2018 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 30,000 shares of capital stock in exchange for $300,000 in cash. 2. Purchased equipment at a cost of $40

> The accounting records of Hampton Company provided the data below ($ in thousands). Net income …………………………………………………………… $ 17,300 Depreciation expense ………………………………………………… 7,800 Increase in accounts receivable ………………………………….. 4,000 Decrease in inventory ………

> Refer to the situation described in E 4–13. In E 4–13 The following summary transactions occurred during 2018 for Bluebonnet Bakers: Cash Received from: Customers ……………………………………………….. $ 380,000 Interest on note receivable ………………………………. 6,000 Principal o

> The following summary transactions occurred during 2018 for Bluebonnet Bakers: Cash Received from: Customers ……………………………………………….. $ 380,000 Interest on note receivable ………………………………. 6,000 Principal on note receivable …………………………… 50,000 Sale of investment

> The statement of cash flows classifies all cash inflows and outflows into one of the three categories shown below and lettered from a through c. In addition, certain transactions that do not involve cash are reported in the statement as noncash investing

> Briefly explain the difference between the single-step and multiple-step income statement formats.

> The Massoud Consulting Group reported net income of $1,354,000 for its fiscal year ended December 31, 2018. In addition, during the year the company experienced a positive foreign currency translation adjustment of $240,000 and had unrealized losses on i

> O’Reilly Beverage Company reported net income of $650,000 for 2018. In addition, the company deferred a $60,000 pretax loss on derivatives and had pretax net unrealized holding gains on investment securities of $40,000. Prepare a separate statement of co

> Refer to the situation described in BE 4–8. Assume instead that the estimated fair value of the segment’s assets, less costs to sell, on December 31 was $7 million rather than $10 million. Prepare the lower portion of the 2018 income statement beginning

> Refer to the situation described in BE 4–7. Assume that the semiconductor segment was not sold during 2018 but was held for sale at year-end. The estimated fair value of the segment’s assets, less costs to sell, on December 31 was $10 million. Prepare th

> On December 31, 2018, the end of the fiscal year, California Microtech Corporation completed the sale of its semiconductor business for $10 million. The business segment qualifies as a component of the entity according to GAAP. The book value of the asse

> The following are partial income statement account balances taken from the December 31, 2018, year-end trial balance of White and Sons, Inc.: restructuring costs, $300,000; interest revenue, $40,000; before-tax loss on discontinued operations, $400,000;

> The following is a partial year-end adjusted trial balance. Income tax expense has not yet been recorded. The income tax rate is 40%. Determine the following: (a) Operating income (loss), (b) Income (loss) before income taxes, and (c) Net income (loss)

> Refer to the situation described in BE 4–1. If the company’s accountant prepared a multiple-step income statement, what amount would appear in that statement for (a) Operating income and (b) Nonoperating income? In BE 4–1: The adjusted trial balance of

> During 2018, Rogue Corporation reported sales revenue of $600,000. Inventory at both the beginning and end of the year totaled $75,000. The inventory turnover ratio for the year was 6.0. What amount of gross profit did the company report in its 2018 inco

> Refer to the facts described in BE 4–16. Show the DuPont framework’s calculation of the three components of the 2018 return on shareholders’ equity for Anderson TV and Appliance. In BE 4–16 The 2018 income statement for Anderson TV and Appliance reporte

> Refer to the situation described in BE 4–1. Prepare a multiple-step income statement for 2018. Ignore EPS disclosures. In BE 4–1: The adjusted trial balance of Pacific Scientific Corporation on December 31, 2018, the end of the company’s fiscal year, co

> The 2018 income statement for Anderson TV and Appliance reported sales revenue of $420,000 and net income of $65,000. Average total assets for 2018 was $800,000. Shareholders’ equity at the beginning of the year was $500,000 and $20,000 was paid to share

> Universal Calendar Company began the year with accounts receivable (net) and inventory balances of $100,000 and $80,000, respectively. Year-end balances for these accounts were $120,000 and $60,000, respectively. Sales for the year of $600,000 generated

> Refer to the situation described in BE 4–11 and BE 4–12. How might your solution to those brief exercises differ if Hilliard Healthcare Co. prepares its statement of cash flows according to International Financial Reporting Standards? In BE 4–11 and BE

> Net income of Mansfield Company was $45,000. The accounting records reveal depreciation expense of $80,000 as well as increases in prepaid rent, salaries payable, and income taxes payable of $60,000, $15,000, and $12,000, respectively. Prepare the cash f

> Refer to the situation described in BE 4–11. Prepare the cash flows from investing and financing activities sections of HHC’s statement of cash flows. In BE 4–11 The following are summary cash transactions that occurred during the year for Hilliard Heal

> The following are summary cash transactions that occurred during the year for Hilliard Healthcare Co. (HHC): Cash received from: Customers ……………………………………………. $ 660,000 Interest on note receivable …………………………. 12,000 Collection of note receivable …………………….

> What is the primary difference between interim reports under IFRS and U.S. GAAP?

> Interim reports are issued for periods of less than a year, typically as quarterly financial statements. Should these interim periods be viewed as separate periods or integral parts of the annual period?

> Show the DuPont framework’s calculation of the three components of return on shareholders’ equity. What information about a company do these ratios offer?

> Show the calculation of the following profitability ratios: (1) The profit margin on sales, (2) The return on assets, and (3) The return on shareholders’ equity. What information about a company do these ratios offer?