Question: FlyWiz, Inc., is a small manufacturer of

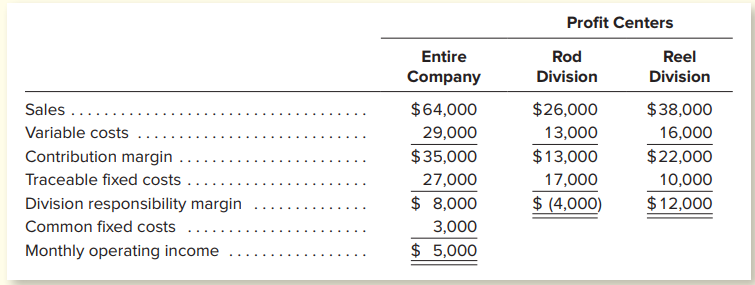

FlyWiz, Inc., is a small manufacturer of professional fishing equipment. The company has two divisions—the rod division and the reel division. Data for the month of January are shown.

Nick Fulbright, the company’s chief financial officer since January 1 of the current year, wants to close the unprofitable rod division. He believes that doing so will benefit FlyWiz and benefit him, given that his end-of-year bonus is to be based on the company’s overall operating income. In a recent interview, Fulbright summarized his business philosophy as follows: “A company is only as strong as its least profitable segment. As long as I’m at the financial helm, only the strongest shall survive at FlyWiz.â€

Instructions:

a. Had the rod division been closed on January 1, what would the company’s operating income for the month have been?

b. After learning about Fulbright’s business philosophy, the rod division’s director of marketing made the following statement: “Nick Fulbright may understand numbers, but he doesn’t understand the complementary relationship between rods and reels, nor the seasonal nature of our business.†What did the director of marketing mean by this statement? How might such information influence Fulbright’s assessment of the company’s rod division?

c. By how much would the rod division’s monthly sales have to increase for it to generate a positive responsibility margin of $4,000 in any given month? Show all of your computations.

> The University of Devonport consists of six faculties and an administration unit. Under the university’s management philosophy, each faculty is treated, as far as is reasonable, as an independent entity. Each faculty is responsible for

> Pieman Products Ltd makes road trailers to the precise specifications of individual customers. The following are predicted to occur during the forthcoming year, which is about to start: All direct labor is paid at the same hourly rate. A customer has as

> You have recently taken a management post in a large divisionalised business. A substantial proportion of the business of your division is undertaken through inter-divisional transfers. Required: (a) What are the objectives of a system of transfer pri

> The GB Company manufactures a variety of electric motors. The business is currently operating at about 70 per cent of capacity and is earning a satisfactory return on investment. International Industries (II) has approached the management of GB with an o

> Pisces plc produced the following statement of financial position (balance sheet) and income statement at the end of the third year of trading: An analysis of the underlying records reveals the following: 1 R&D costs relate to the development of a

> You have overheard the following statements: (a) ‘To maximise profit you need to sell your output at the highest price.’ (b) ‘Elasticity of demand deals with the extent to which costs increase as demand increases.’ (c) ‘Provided that the price is larg

> Tufty plc produces a small range of industrial pumps using automated methods. The business is now considering production of a new model of pump, starting on 1 January 20X3. The business wishes to assess the new pump over a four-year timescale. Production

> Computer Tuition Ltd (CT) specialises in providing courses for computer users, often tailoring its courses to meet the specific needs of particular clients. CT’s primary financial objective is to maximise the wealth of its shareholders. CT has been asked

> Plaything plc has just developed a new mechanical toy, the Nipper. The development costs totaled £300,000. To assess the commercial viability of the Nipper, a market survey has been undertaken at a cost of £35,000. The survey su

> The accountant of your business has recently been taken ill through overwork. In his absence his assistant has prepared some calculations of the profitability of a project, which are to be discussed soon at the board meeting of your business. His working

> C. George (Controls) Ltd manufactures a thermostat that can be used in a range of kitchen appliances. The manufacturing process is, at present, semi-automated. The equipment used cost £540,000 and has a carrying amount (as shown on the state

> Arkwright Mills plc is considering expanding its production of a new yarn, code name X15. The plant is expected to cost £1 million and have a life of five years and a nil residual value. It will be bought, paid for and ready for operation on

> Lanyon and Co. is engaged in providing and marketing a standard advice service. Summarised results for the past two months reveal the following: There were no price changes of any description during these two months. Required: (a) Deduce the BEP (in

> Brave plc has the following standards for its only product: There were no inventories of any description at the beginning and end of May. Required: Prepare the original budget and a budget flexed to the actual volume. Use these to compare the budget

> Mowbray Ltd makes and sells one product, the standard costs of which are as follows The monthly production and sales are planned to be 1,200 units. The actual results for May were as follows: There were no inventories at the start or end of May. As a r

> Antonio plc makes Product X, the standard costs of which are:v The budgeted output for March was 1,000 units of Product X; the actual output was 1,100 units, which was sold for £34,950. There were no inventories at the start or end of March

> Brown and Jeffreys, a West Midlands business, makes one standard product for use in the motor trade. The product, known as the Fuel Miser, for which the business holds the patent, when fitted to the fuel system of production model cars has the effect of

> Daniel Chu Ltd, a new business, will start production on 1 April, but sales will not start until 1 May. Planned sales for the next nine months are as follows: The selling price of a unit will be a consistent £100 and all sales will be made

> You have overheard the following statements: (a) ‘A budget is a forecast of what is expected to happen in a business during the next year.’ (b) ‘Monthly budgets must be prepared with a column for each month so that you can see the whole year at a glanc

> A business manufactures refrigerators for domestic use. There are three models: Lo, Mid and Hi. The models, their quality and their price are aimed at different markets. Product costs are computed on a blanket (business-wide) overhead-rate basis using a

> Comment critically on the following statements that you have overheard: (a) ‘Direct labour hours are the most appropriate basis to use to charge indirect cost (overheads) to jobs in the modern manufacturing environment where people are so important.’ (

> Jerry’s Taxis Ltd operates a taxi service in a large provincial city. All of the taxis are owned by the business and all the drivers are employees rather than owner drivers. The managers wish to benchmark the operating efficiency of the business against

> Athena Ltd is an engineering business doing work for its customers to their particular requirements and specifications. It determines the full cost of each job taking a ‘job-costing’ approach, accounting for overheads

> The chief executive officer of Spark rite Ltd, a trading business, has just received summary sets of financial statements for last year and this year: The chief financial officer has expressed concern at the increase in inventories and trade receivables

> Distinguish between corporations and partnerships in terms of the following characteristics: a. Owners’ liability for debts of the business. b. Transferability of ownership interest. c. Continuity of existence. d. Federal taxation on income.

> Minnie Reed is a partner in Computer Works, a retail store. During the current year, she withdraws $45,000 in cash from this business and takes for her personal use inventory costing $3,200. Her share of the partnership net income for the year amounts to

> Nate Inc. is a newly organized manufacturing business that plans to manufacture and sell 40,000 units per year of a new product. The following estimates have been made of the company’s costs and expenses (other than income taxes). Inst

> Footware, Inc., is a small manufacturer of shoes. The company has two divisions—the sandal division and the moccasin division. Data for the month of October are as follows. Junette, the company’s chief financial offic

> Halliday Company has manufacturing subsidiaries in Thailand and Mexico. It is considering shipping the subcomponents of Product X to one or the other of these countries for final assembly. The final product will be sold in the country where it is assembl

> For many years New York Studios has produced television shows and operated several FM radiostations. Throughout the current year, the company had 3 million shares of common stock and alarge number of shares of convertible preferred stock outstanding. Ear

> Ski Powder Resort ends its fiscal year on April 30. The business adjusts its accounts monthly, but closes them only at year-end (April 30). The resort’s busy season is from December 1 through March 31. Adrian Pride, the resortâ

> Locate the Home Depot, Inc., 2018 financial statements in Appendix A of this text. Briefly peruse the financial statements and answer the following questions. a. Name the titles of each of Home Depot’s financial statements that provide specific informat

> Some companies that use process costing simply assign the entire cost of production to those units completed and transferred during the month, even if some units remain in process at the end of the period. Is this practice reasonable?

> Clown Around, Inc., provides party entertainment for children of all ages. The following is the company’s trial balance dated February 1, current year Clown Around engaged in the following transactions in February Instructions: a. Re

> Spear Custom Furniture uses an activity-based cost accounting system to apply overhead to production. The company maintains four overhead cost pools. The four cost pools, and their budgeted amounts for the upcoming period, are as follows. Four cost driv

> Six events pertaining to financial assets are described as follows. a. Invested idle cash in marketable securities and classified them as available for sale. b. Collected an account receivable. c. Sold marketable securities at a loss (proceeds from the

> Baxter Corporation has been using FIFO during a period of rising costs. Explain whether you would expect each of the following measurements to be higher or lower if the company had been using LIFO. a. Net income. b. Inventory turnover rate. c. Income

> Elliot-Cole is a publicly owned international corporation, with operations in over 90 countries. Net income has been growing at approximately 15 percent per year, and the stock consistently trades at about 20 times earnings. To attract and retain key man

> Undem Scientific provides research consulting services to both university and corporate clients. The company closes its temporary accounts once each year on December 31. It recently issued the following income statement as part of its annual report. The

> Maggie Miller owns Miller Construction Co. The company maintains accounting records for the purposes of exercising control over its construction activities and meeting its reporting obligations regarding payrolls and income tax returns. As it has no othe

> Crasher Company had net income in the current year of $500,000. In addition, the company had a gain on foreign currency translation of $20,000, net of related income taxes. Assuming the company uses the two-income statement approach for presenting elemen

> Describe at least two products or production processes that might use both process and job order costing methods to determine the cost of a finished unit.

> What is meant by the phrase “natural hedging against exchange rate risk"?

> Jensen Tire had two large shipments in transit at December 31. One was a $130,000 inbound shipment of merchandise (shipped December 28, F.O.B. shipping point), which arrived at Jensen’s receiving dock on January 2. The other shipment was a $95,000 outbou

> Robinson International began operations in early February. The company has provided the following summary of total manufacturing costs assigned to the job sheets of its entire client base during its first three months of operations. Job no. 1002 was com

> Explain why transfer pricing decisions between divisions in separate countries may involve tax or tariff issues.

> DuPont reports in a recent balance sheet $299 million of 6.50 percent bonds payable due in 2028. The company’s effective income tax rate is approximately 27 percent. a. Compute the company’s after-tax cost of borrowing on this bond issue stated as a tot

> Queen Enterprises is a furniture wholesaler. Queen hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the following transactions based on when cash receipts and disbursements c

> Company A, a U.S. company, has a subsidiary located in Country Z, where various forms of bribery are accepted and expected. To oversee the operations of the subsidiary, Company A sent one of its top U.S. managers to Country Z. Manager M engaged in the fo

> D. Lawrence designs and manufactures fashionable men’s clothing. For the coming year, the company has scheduled production of 40,000 suede jackets. Budgeted costs for this product are as follows. The management of D. Lawrence is consid

> A comedy club called Comedy Today was organized as a partnership with Abbott investing $80,000 and Martin investing $120,000. During the first year, net income amounted to $110,000. Instructions: a. Determine how the $110,000 net income would be divid

> A U.S.-based company, IBC, has wholly owned subsidiaries across the world. IBC is in the medical products market; the company sources most of its sales of medical devices from the United States, but it sells most of those devices to the European market.

> Book Web, Inc., sells books and software over the Internet. A recent article in a trade journal has caught the attention of management because the company has experienced soaring inventory handling costs. The article notes that similar firms have purchas

> Fox Run Outfitters manufactures lightweight frames that it uses in several of its backpack products. Management is considering whether to continue manufacturing the frames or to buy them from an outside source. The following information is available. 1.

> In general terms, identify several factors that prompt different countries to develop different accounting principles.

> Refer to the Demonstration Problem illustrated in the previous chapter. Prepare a 10-column worksheet for Internet Consulting Service, Inc., dated December 31, current year. At the bottom of your worksheet, prepare a brief explanation keyed to each adjus

> Our Little Secret is a small manufacturer of swimsuits and other beach apparel. The company is closely held and has no external reporting obligations, other than payroll reports and income tax returns. The company’s accounting system is grossly inadequat

> Describe the three principles guiding the design of management accounting systems.

> Simon Tough is considering investing in a vending machine operation involving 20 vending machines located in various plants around the city. The machine manufacturer reports that similar vending machine routes have produced a sales volume ranging from 60

> Sheila Lufty manages the plant that produces dining room furniture for Bastile Furniture Company. Sheila’s annual performance is evaluated based on how well she manages all the costs incurred to run the plant and produce the furniture. For her annual eva

> Warthers Corporation produces auto parts. The company acquires other companies when they are considered a good strategic fit. Several years ago Warthers acquired Landis Company, a supplier of dashboards. Warthers decided to maintain Landisâ€&#

> The year-end balance sheet of Mirror, Inc., includes the following stockholders’ equity section (with certain details omitted) Instructions From this information, compute answers to the following questions. a. How many shares of pref

> Use Exhibit 15–1 to evaluate the following statement: “The nexus of business activity has shifted eastward so the United States and Europe don’t matter much anymore.

> Accessory World makes floor mats for the automobile industry. Finished sets of mats must pass through two departments: Cutting and Coating. Large sheets of synthetic material are cut to size in the Cutting Department and then transferred to the Coating D

> Shown as follows are selected transactions of the architectural firm of Munson, Chang, and Alverez, Inc

> Shown are data from recent reports of two toy makers. Dollar amounts are stated in thousands. a. Compute for each company (1) the debt ratio and (2) the interest coverage ratio. (Round the debt ratio to the nearest percent and the interest coverage rati

> In a process costing system, what condition must be present in order for accountants to combine direct labor and manufacturing overhead costs and treat them simply as conversion costs?

> In the following list, assume each transaction is independent of the others. Each of these transactions occurs in a single division of Wrangling International, a multidivisional company. Each transaction may impact capital turnover, ROI, and/or residual

> Sandra Olson manages a restaurant that is part of the Eatwell Chain of restaurants popular in the Southwest. Eatwell has recently adopted a balanced scorecard for the entire company. As a result, the restaurant managers for each individual restaurant hav

> Discuss two ways in which the Foreign Corrupt Practices Act has affected U.S. companies.

> Indicate whether each of the following should be considered a product cost or a period cost. If you identify the item as a product cost, also indicate whether it is a direct or an indirect cost. For instance, the answer to the Example item is “indirect p

> Sparta and Associates produces trophies and has two divisions—the green division and the white division. The green division produces the trophy base, which it can sell to outside markets for $150. A trophy base has variable costs per unit of $65 and fixe

> Joy Sun organized Ray Beam, Inc., in January 2018. The corporation immediately issued at $15 per share one-half of its 260,000 authorized shares of $1 par value common stock. On January 2, 2019, the corporation sold at par value the entire 10,000 authori

> Myer’s Treats uses one gallon of mix for each cake produced by the Baking Department. On August 1, the Baking Department had 600 cakes in process. These units were 100 percent complete with respect to batter transferred in from the Mixing Department duri

> Distinguish between the terms classified, comparative, and consolidated as they apply to financial statements. May a given set of financial statements have more than one of these characteristics?

> Galaxy Quest produces telescopes in a single processing department. All direct materials used in the production of telescopes are added at the beginning of the process. Conversion costs (labor and overhead) are incurred evenly thereafter, as each unit is

> To answer the following questions use the financial statements for Home Depot, Inc., in Appendix A at the end of the textbook. a. Compute the company’s current ratio and quick ratio for the most recent year reported. Do these ratios provide support that

> A prior period adjustment relates to the income of past accounting periods. Explain how such an item is shown in the financial statements.

> The manager of Princeton Therapeutic’s Hospital division is evaluated on her division’s return on investment and residual income. The company requires that all divisions generate a minimum return on invested assets of 20 percent. Consistent failure to ac

> Big Boomers makes custom clubs for golfers. The company also provides repair services for golfers with broken clubs. Most of the work is done by hand and with small tools used by craftsmen. Customers are quoted a price in advance of their clubs being man

> Logan Pharmaceutical produces two products: Caltrate and Dorkamine. The company uses activitybased costing (ABC) to allocate manufacturing costs to each product line. The costs incurred by the Quality Control Department average $5 million per year and co

> Fire Code manufactures smoke detectors that are sold to homeowners throughout the United States at $20 apiece. Each detector is equipped with a sensory cell that is guaranteed to last two full years before needing to be replaced. The company currently ha

> During the current year, Central Auto Rentals purchased 60 new automobiles at a cost of $24,000per car. The cars will be sold to a wholesaler at an estimated $8,000 each as soon as they have been driven 50,000 miles. Central Auto Rentals computes depreci

> The following income statement and selected balance sheet account data are available for Terence, Inc., at December 31, 2021. Additional Information: 1. Dividend revenue is recognized on the cash basis. All other income statement amounts are recognized

> Bronson Corporation recently filed the following information with the SEC regarding its executive compensation. Base Salary: The Board of Directors annually reviews each executive officer’s salary. The Board believes that the company’s primary competitor

> What does a consistently negative responsibility margin imply will happen to the operating income of the business if the center is closed? Why? Identify several other factors that should be considered in deciding whether or not to close the center.

> Euroam is a U.S. corporation that purchases motors from European manufacturers for distributionin the United States. A recent purchase involved the following events. Instructions: a. Prepare in general journal form the entries necessary to record the pr

> Briefly explain the difference between the direct and indirect methods of computing net cash flows from operating activities. Which method results in higher net cash flows?

> Each of the following situations describes an event that affected the stock market price of a particular company. a. The price of a common share of McDonnell Douglas, Inc., increased by over $5 per share in the several days after it was announced that Sa

> Shown are selected financial data for THIS Star, Inc., and THAT Star, Inc., at the end of the current year. Assume that the year-end balances shown for accounts receivable and for inventory also represent the average balances of these items throughout t

> The Comfort Store sells heating oil, coal, and kerosene fuel to residential customers. Heating oil is kept in large storage tanks that supply the company’s fleet of delivery trucks. Coal is kept in huge bins that are loaded and emptied from the top by gi

> An important focus of management accounting is decision-making authority. Everyone within an organization has some decision-making authority. How do employees and managers know what decision-making authority they have regarding firm assets?

> At the end of the year, the following information was obtained from the accounting records of Solar Systems, Inc. Instructions: a. From the information given, compute the following. b. Solar Systems has an opportunity to obtain a long-term loan at an a

> Rochester Corporation is engaged primarily in the business of manufacturing raincoats and umbrellas. Shown is selected information from a recent annual report. (Dollar amounts are stated in thousands.) The company has long-term liabilities that bear int

> At the beginning of 2021, Greene, Inc., showed the following amounts in the stockholders’ equitysection of its balance sheet. Instructions:a. Prepare in general journal form the entries to record these transactions.b. Prepare the stoc

> Eastern Aviation operated both an airline and several restaurants located near airports. During the year just ended, all restaurant operations were discontinued and the following operating results were reported. All of these amounts are before income ta

> Harry Haney, manager of the Eastern Division of Mattock Co., made the following comment to the manager of the Central Division: It’s all well and good for you to say that I should disregard sunk costs when I consider whether to replace the old, inefficie

> What are the four significant parts of the production cost report for process costing?

> Wolves Company has defective products in inventory. It haste opportunity to either sell, scrap, or rebuild the defective products. Identify several factors Wolves Company should consider before making a decision.

> Use the Internet search engine of your choice and do a general search on the name of a company of interest to you (e.g., General Motors, Procter & Gamble, Coca-Cola, etc.). Explore the website of the company you choose and locate that companyâ&