Question: Following are the titles of various information

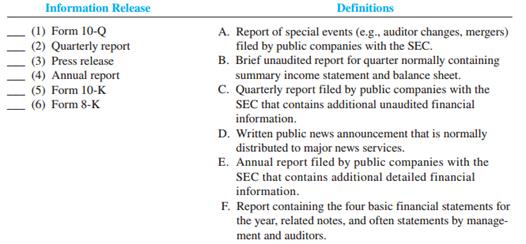

Following are the titles of various information releases. Match each definition with the related release by entering the appropriate letter in the space provided.

Transcribed Image Text:

Information Release Definitions (1) Form 10-Q (2) Quarterly report (3) Press release (4) Annual report (5) Form 10-K (6) Form 8-K A. Report of special events (e.g., auditor changes, mergers) filed by public companies with the SEC. B. Brief unaudited report for quarter normally containing summary income statement and balance sheet. C. Quarterly report filed by public companies with the SEC that contains additional unaudited financial information. D. Written public news announcement that is normally distributed to major news services. E. Annual report filed by public companies with the SEC that contains additional detailed financial information. F. Report containing the four basic financial statements for the year, related notes, and often statements by manage- ment and auditors.

> Micro Warehouse was a computer software and hardware online and catalog sales company.* A 1996 Wall Street Journal article disclosed the following: MICRO WAREHOUSE IS REORGANIZING TOP MANAGEMENT Micro Warehouse Inc. announced a “significant reorganizatio

> A press release for Seneca Foods (licensee of the Libby’s brand of canned fruits and vegetables) included the following information: The current year’s net earnings were $8,019,000 or $0.65 per diluted share, compared with $32,067,000 or $2.63 per dilute

> If a company is successful in acquiring several large buildings at the end of the year, what is the effect on the total asset turnover ratio? a. The ratio will increase. b. The ratio will not change. c. The ratio will decrease. d. Either (a) or (c).

> According to GAAP, what ratio must be reported on the financial statements or in the notes to the statements? a. Earnings per share ratio. b. Return on equity ratio. c. Net profit margin ratio. d. Current ratio.

> A recent annual report of Gannett Co., Inc., an international diversified media and marketing solutions company that currently includes numerous television stations, newspapers (such as USA Today), and Internet businesses (such as Cars.com and Career-Bui

> Refer to Exercise 10. Data from Exercise 10: Stacey’s Piano Rebuilding Company has been operating for one year. At the start of the second year, its income statement accounts had zero balances and its balance sheet account balances were as follows: Cash

> The following transactions are July activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount and

> The following transactions are July activities of Craig’s Bowling, Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount and

> The following data are from annual reports of Jen’s Jewelry Company: Compute Jen’s net profit margin ratio for each year. What do these results suggest to you about Jen’s Jewelry Company? 2018 201

> Refer to the financial statements of American Eagle Outfitters in Appendix B, Urban Outfitters in Appendix C, and the Industry Ratio Report in Appendix D at the end of this book. Financial statements of American Eagle: Financial statements of Urban Outf

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of the book. Data from Urban Outfitters: Required: 1. How much is in the Prepaid Expenses and Other Current Assets account at the end of the most recent year (for the year e

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Financial Statement of American Eagle Outfitters: Required: 1. What does the company include in its category of cash and cash equi

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of the book. Financial Statements of American Eagle Outfitters: Required: 1. How much cash did the company pay for income taxes in its 2014 fiscal year (for the year

> Refer to the financial statements of American Eagle Outfitters in Appendix B, Urban Outfitters in Appendix C, and the Industry Ratio Report in Appendix D at the end of this book. Financial statements of American Eagle: Financial statements of Urban Outf

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of the book. Data from Urban Outfitters: Required: 1. What is the company’s revenue recognition policy? (Hint: Look in the notes to the financial statement

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of the book. Financial Statements of American Eagle Outfitters: Required: 1. State the amount of the largest expense on the income statement for the year ended Janua

> What are the three major classifications on a statement of cash flows?

> Briefly explain the major classifications of stockholders’ equity for a corporation.

> List the six major classifications reported on a balance sheet.

> What are the four major subtotals or totals on the income statement?

> Briefly explain the normal sequence and form of financial reports produced by private companies in a typical year.

> What basis of accounting (cash or accrual) does GAAP require on the (a) income statement, (b) balance sheet, and (c) statement of cash flows?

> Refer to the financial statements of American Eagle Outfitters in Appendix B and Urban Outfitters in Appendix C. Financial statements of American Eagle: Financial statements of Urban Outfitters: Required: 1. Compute the receivables turnover ratio for b

> Explain what a material amount is.

> Briefly describe the role of information services in the communication of financial information.

> Pool Corporation, Inc., reported in its recent annual report that “In 2010, our industry experienced some price deflation. . . . In 2011, our industry experienced more normalized price inflation of approximately 2% overall despite price

> Refer to Mini Exercise 8. Prepare a statement of stockholders’ equity in good form for the current year. Mini Exercise 8: Romney’s Marketing Company has the following adjusted trial balance at the end of the current y

> Romney’s Marketing Company has the following adjusted trial balance at the end of the current year. No dividends were declared. However, 500 shares ($0.10 par value per share) issued at the end of the year for $3,000 are included below:

> In each of the following transactions (a) through (c) for Romney’s Marketing Company, use the three step process illustrated in the chapter to record the adjusting entry at the end of the current year. The process includes (1) determining if revenue was

> In each of the following transactions (a) through (c) for Romney’s Marketing Company, use the three step process illustrated in the chapter to record the adjusting entry at the end of the current year. The process includes (1) determining if revenue was

> Hagadorn Company has the following adjusted accounts and balances at year-end (June 30): Prepare an adjusted trial balance in good form for the Hagadorn Company at June 30. $ 250 Accounts Payable Accounts Receivable Interest Expense $ 70 420 Interest

> 1. Refer to M4-8. Prepare a classified balance sheet in good form for the end of the current year. 2. Explain how the adjustments in M4-4 and M4-6 affected the operating, investing, and financing activities on the statement of cash flows. Mini Exercise

> Dana Holding Corporation designs and manufactures component parts for the vehicular, industrial, and mobile off-highway original equipment markets. In a recent annual report, Dana’s inventory note indicated the following: Dana changed its method of accou

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book. Financial statements of Urban Outfitters: Required: 1. How much cash and cash equivalents does the company report at the end of the current year? 2. What was

> In its annual report, Caterpillar, Inc., a major manufacturer of farm and construction equipment, reported the following information concerning its inventories: Inventories are stated at the lower of cost or market. Cost is principally determined using t

> Tiffany & Co. is one of the world’s premier jewelers and a designer of other fine gifts and housewares. Presented here are selected income statement and balance sheet amounts (dollars in thousands). Required: 1. Compute ROA for the

> Avalos Corporation is preparing its annual financial statements at December 31 of the current year. Listed here are the items on its statement of cash flows presented in alphabetical order. Parentheses indicate that a listed amount should be subtracted o

> Listed here are selected aggregate transactions for Modern Style Furniture Company from the first quarter of a recent year (dollars in millions). Complete the following tabulation, indicating the sign (+ for increase, - for decrease, and NE for no effect

> Hasbro is one of the world’s leading toy manufacturers and the maker of such popular board games as Monopoly, Scrabble, and Clue, among others. Listed here are selected aggregate transactions from a recent year (dollars in millions). Co

> The Kroger Co. is one of the largest retailers in the United States and also manufactures and processes some of the food for sale in its supermarkets. Kroger reported the following January 31 balances in its statement of stockholders’ e

> Supply the missing dollar amounts for the current year income statement of BGT Company for each of the following independent cases. (Hint: Organize each case in the format of the classified or multiple step income statement discussed in the chapter. Rely

> Supply the missing dollar amounts for the current year income statement of NexTech Company for each of the following independent cases. (Hint: Organize each case in the format of the classified or multiple step income statement discussed in the chapter.

> Most people know Hewlett Packard Company (HP) as a leading supplier of personal computers, printers and scanners, and storage and networking products for large and small customers alike. However, HP also is a major provider of technology consulting, outs

> The following data were taken from the records of Township Corporation at December 31 of the current year: Sales revenue……………………………………..$85,000 Gross profit…………………………………………..30,000 Selling (distribution) expense…………………. 7,000 Administrative expense………………

> The following data were selected from the records of Sharkim Company for the year ended December 31, current year. Balances January 1, current year: Accounts receivable (various customers) $116,000 Allowance for doubtful accounts 5,200 In the following o

> Macy’s, Inc., operates the two best-known high-end department store chains in North America: Macy’s and Bloomingdale’s. The following data (in millions) were taken from its recent annual report for the year ended February 1: Cost of sales…………………………………………

> Snyder’s-Lance manufactures, markets, and distributes a variety of snack food products including pretzels, sandwich crackers, kettle chips, cookies, potato chips, tortilla chips, other salty snacks, sugar wafers, nuts, and restaurant-st

> Campbell Soup Company is the world’s leading maker and marketer of soup and sells other well-known brands of food in 120 countries. Presented here are the items listed on its recent balance sheet (dollars in millions) presented in alpha

> Following are information items included in various financial reports. Match each information item with the report(s) where it would most likely be found by entering the appropriate letter(s) in the space provided. Information Item Report (1) Summari

> Match each player with the related definition by entering the appropriate letter in the space provided. Players Definitions (1) Financial analyst A. Financial institution or supplier that lends money to the (2) Creditor (3) Independent auditor (4) Pr

> Papa John’s is one of the fastest-growing pizza delivery and carry-out restaurant chains in the country. Presented here are selected income statement and balance sheet amounts (dollars in thousands). Required: 1. Compute ROA for the cu

> Penny’s Pool Service & Supply, Inc. (PPSS) is completing the accounting process for the year just ended, December 31 of the current year. The transactions during the year have been journalized and posted. The following data with respect to adjusting entr

> Explain briefly the application of the LCM concept to the ending inventory and its effect on the income statement and balance sheet when market is lower than cost.

> Contrast the effects of LIFO versus FIFO on cash outflow and inflow.

> The December 31, current year, bank statement for Rivas Company and the December current year ledger accounts for cash follow. The November current year bank reconciliation showed the following: correct cash balance at November 30, $64,100; deposits in t

> Contrast the income statement effect of LIFO versus FIFO (i.e., on pretax income) when (a) prices are rising and (b) prices are falling.

> Contrast the effects of LIFO versus FIFO on reported assets (i.e., the ending inventory) when (a) prices are rising and (b) prices are falling.

> Explain how income can be manipulated when the specific identification inventory costing method is used.

> The chapter discussed four inventory costing methods. List the four methods and briefly explain each.

> Define beginning inventory and ending inventory.

> Explain the application of the cost principle to an item in the ending inventory.

> Why is inventory an important item to both internal (management) and external users of financial statements?

> When a perpetual inventory system is used, unit costs of the items sold are known at the date of each sale. In contrast, when a periodic inventory system is used, unit costs are known only at the end of the accounting period. Why are these statements cor

> Refer to the financial statements of American Eagle Outfitters in Appendix B and Urban Outfitters in Appendix C. Financial statements of American Eagle: Financial statements of Urban Outfitters: Required: 1. Compute the inventory turnover ratio for bo

> Refer to the financial statements of Urban Outfitters in Appendix C at the end of this book Financial statements of Urban Outfitters: Required: 1. The company uses lower of cost or market to account for its inventory. At the end of the year, do you ex

> Perry Corporation is a local grocery store organized seven years ago as a corporation. At that time, a total of 10,000 shares of common stock were issued to the three organizers. The store is in an excellent location, and sales have increased each year.

> Refer to the financial statements of American Eagle Outfitters in Appendix B at the end of this book. Financial Statement of American Eagle Outfitters: Required: 1. How much inventory does the company hold at the end of the most recent year? 2. Estim

> Dixon Company uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Required: Compute the cost of (a) goods available for sale, (b

> The income statements for four consecutive years for Colca Company reflected the following summarized amounts: Subsequent to development of these amounts, it has been determined that the physical inventory taken on December 31, 2017, was understated by $

> Income is to be evaluated under four different situations as follows: a. Prices are rising: (1) Situation A: FIFO is used. (2) Situation B: LIFO is used. b. Prices are falling: (1) Situation C: FIFO is used. (2) Situation D: LIFO is used. The basic data

> At the end of January of the current year, the records of NewRidge Company showed the following for a particular item that sold at $16 per unit: Required: 1. Assuming the use of a periodic inventory system, prepare a summarized income statement through

> Which of the following best describes the proper presentation of accounts receivable in the financial statements? a. Gross accounts receivable plus the allowance for doubtful accounts in the asset section of the balance sheet. b. Gross accounts receivabl

> When using the allowance method, as bad debt expense is recorded, a. Total assets remain the same and stockholders’ equity remains the same. b. Total assets decrease and stockholders’ equity decreases. c. Total assets increase and stockholders’ equity de

> Which of the following is not a step toward effective internal control over cash? a. Require signatures from a manager and one financial officer on all checks. b. Require that cash be deposited daily at the bank. c. Require that the person responsible fo

> When a company using the allowance method writes off a specific customer’s $100,000 account receivable from the accounting system, which of the following statements are true? 1. Total stockholders’ equity remains the same. 2. Total assets remain the same

> A company has been successful in reducing the amount of sales returns and allowances. At the same time, a credit card company reduced the credit card discount from 3 percent to 2 percent. What effect will these changes have on the company’s net sales, al

> Briggs & Stratton Engines Inc. uses the aging approach to estimate bad debt expense at the end of each accounting year. Credit sales occur frequently on terms n/45. The balance of each account receivable is aged on the basis of four time periods as f

> Gross sales total $300,000, one-half of which were credit sales. Sales returns and allowances of $15,000 apply to the credit sales, sales discounts of 2 percent were taken on all of the net credit sales, and credit card sales of $100,000 were subject to

> Sales discounts with terms 2/10, n/30 mean: a. 10 percent discount for payment within 30 days. b. 2 percent discount for payment within 10 days, or the full amount (less returns) due within 30 days. c. Two-tenths of a percent discount for payment within

> Which of the following is not a component of net sales? a. Sales returns and allowances b. Sales discounts c. Cost of goods sold d. Credit card discounts

> Using the following categories, indicate the effects of the transactions listed in E6-8. Use + for increase and - for decrease and indicate the accounts affected and the amounts. Assets = Liabilities + Stockholders’ Equity

> During the current year, Sun Electronics, Incorporated, recorded credit sales of $5,000,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a. On November 13 of

> During the current year, Adams Assembly, Inc., recorded credit sales of $1,300,000. Based on prior experience, it estimates a 1 percent bad debt rate on credit sales. Required: Prepare journal entries for each transaction: a. On September 29 of the curr

> Upon review of the most recent bank statement, you discover that you recently received an “insufficient funds check” from a customer. Which of the following describes the actions to be taken when preparing your bank reconciliation? Balance per Books

> You have determined that Company X estimates bad debt expense with an aging of accounts receivable schedule. Company X’s estimate of uncollectible receivables resulting from the aging analysis equals $250. The beginning balance in the allowance for doubt

> Brazen Shoe Company records Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts as contra-revenues. Complete the following tabulation, indicating the effect (+ for increase, - for decrease, and NE for no effect) and amount of the eff

> The following transactions were selected from among those completed by Cadence Retailers in November and December: Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net

> Under various registered brand names, Saucony, Inc., and its subsidiaries develop, manufacture, and market bicycles and component parts, athletic apparel, and athletic shoes. It recently disclosed the following information concerning the allowance for do

> Match each definition with its related term by entering the appropriate letter in the space provided. Definition Term А. Ассrued expense B. Deferred expense C. Accrued revenue (1) A revenue not yet earned; collected in advance. (2) Rent not yet colle

> The following transactions were selected from the records of OceanView Company: Required: Assuming that Sales Discounts and Credit Card Discounts are treated as contra-revenues, compute net sales for the two months ended August 31. 12 Sold merchandi

> During the months of January and February, Hancock Corporation sold goods to three customers. The sequence of events was as follows: Required: Assuming that Sales Discounts is treated as a contra-revenue, compute net sales for the two months ended Febru

> Bentley Company’s June 30 bank statement and June ledger accounts for cash are summarized below: Required: 1. Reconcile the bank account. A comparison of the checks written with the checks that have cleared the bank shows outstanding c

> Stride Rite Corporation manufactures and markets shoes under the brand names Stride Rite, Keds, and Sperry Top-Sider. Three recent years produced a combination of declining sales revenue and net income culminating in a net loss of $8,430,000. Each year,

> A recent annual report for Dell, Inc., contained the following data: Required: 1. Determine the receivables turnover ratio and average days sales in receivables for the current year. 2. Explain the meaning of each number. (dollars in thousands) Curr

> A recent annual report for FedEx contained the following data: Required: 1. Determine the receivables turnover ratio and average days’ sales in receivables for the current year. 2. Explain the meaning of each number. (dollars in th

> Brown Cow Dairy uses the aging approach to estimate bad debt expense. The ending balance of each account receivable is aged on the basis of three time periods as follows: (1) not yet due, $14,000; (2) up to 120 days past due, $4,500; and (3) more than

> During the current year, Bob’s Ceramics Shop had sales revenue of $60,000, of which $25,000 was on credit. At the start of the current year, Accounts Receivable showed a $3,500 debit balance, and the Allowance for Doubtful Accounts showed a $300 credit b

> During the current year, Robby’s Camera Shop had sales revenue of $170,000, of which $75,000 was on credit. At the start of the current year, Accounts Receivable showed a $16,000 debit balance, and the Allowance for Doubtful Accounts showed a $900 credit

> A recent annual report for Target contained the following information (dollars in thousands) at the end of its fiscal year: A footnote to the financial statements disclosed that uncollectible accounts amounting to $414,000 and $854,000 were written off a

> After completing her first year of operations, Penny Cassidy used a number of ratios to evaluate the performance of Penny’s Pool Service & Supply, Inc. She was particularly interested in the effects of the following transactions fro