Question: Following is a list of CCS Company’

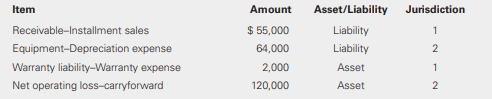

Following is a list of CCS Company’s deferred tax assets and liabilities.

What will CCS report on its balance sheet?

> The following information is provided regarding a company’s defined benefit pension plan. The projected benefit obligation (PBO) was $600,000 at the beginning of the current year. During the year, pension benefits paid were $165,000, service cost for the

> Using the data provided in BE19-24, determine the ending balance of the plan assets and indicate the funded status of the plan at the end of the year under IFRS. Data from BE19-24: Silva Blanca Fashions, Inc. sponsors a defined-benefit pension plan for

> Silva Blanca Fashions, Inc. sponsors a defined-benefit pension plan for its employees. The company’s pension trust provided the following information: fair value of beginning plan assets, $569,000; projected benefit obligation at the beginning of the yea

> Using the data provided in BE19-22, determine the ending balance of the plan assets and indicate the funded status of the plan at the end of the year. Data from BE19-22: Armando Hernandez Fashions, Inc. sponsors a defined-benefit pension plan for its em

> Armando Hernandez Fashions, Inc. sponsors a defined-benefit pension plan for its employees. The company’s pension trust provided the following information: fair value of beginning plan assets, $569,000; projected benefit obligation at the beginning of th

> IFRS. Bidell Builders, an IFRS reporter, has $500,000 of pension cost for the current year. In making this computation, Bidell informs you that the current-year actual return on plan asset in excess of expected returns is a $231,000 net actuarial gain. I

> Bidell Builders reported $500,000 of pension cost for the current year. In making this computation, Bidell informs you that the actual return on plan asset in excess of expected returns in the current year is a $231,000 net gain. In addition, the amortiz

> Vince Pickwick Company awarded 1,000 options to acquire 1,000 shares of its common stock. The options have a fair value of $12 each. The market price and the exercise price were both equal to $6 per share on the date of the grant. Prepare the journal ent

> Airwave Corporation was required to write down one of its plant assets by $1,650,000 on December 31 of the current year because the asset’s technology has been rendered obsolete. It estimated the fair value of the asset using a discounted cash-flow model

> Chester West Shoes, Inc., provided the following information regarding its defined-benefit pension plan: service cost, $257,000; interest on the PVDBO, $121,000; expected return on plan assets, $56,000; past service costs of $24,000, and net actuarial ga

> Chester West Shoes, Inc., provided the following information regarding its defined-benefit pension plan: service cost, $257,000; interest on the beginning PBO, $121,000; expected return on plan assets, $56,000; amortization of prior service costs related

> Northhead Equipment offers its unionized employees a defined-benefit plan. The company determines that the beginning balance of its unamortized net actuarial gain is equal to $136,000. A recent report from the pension plan indicates that the beginning ba

> Jen and Benny’s Ice Cream offers a defined-contribution plan to its employees. Under the terms of the plan, Jen and Benny must contribute 2% of its employees’ salaries. Prepare the journal entry required to record the cost of this plan assuming that tota

> Tash Company offers select executives the opportunity to purchase its $1 par value common stock at a 10% discount. The employees have 2 weeks to elect to participate in the plan. The current market price of the stock is $40 per share. Employees purchased

> Using the information from BE19-13, now assume that Siry Company offers the plan only to top executives. What journal entry will the company make on the date the employees purchase the shares? Data from BE19-13: Siry Company offers all its employees the

> Siry Company offers all its employees the opportunity to purchase its $2 par value common stock at a 5% discount. The employees have 3 weeks to elect to participate in the plan. The current market price of the stock is $80 per share. Employees purchased

> Samsong Company issued 100,000 shares of $1 par value, restricted stock to its top five key employees on January 1, 2017. The market value of Samsong’s shares is $45 per share on the date of issue. The restricted shares require a vesting period of 4 year

> Kogo Incorporation started a share appreciation plan on January 1, 2017, when it granted 100,000 rights to its executives. The vesting period is 2 years. The stock appreciation rights are settled for cash. The plan expires on January 1, 2019. The fair va

> Using the information from BE19-9, now assume that the stock appreciation rights are settled for stock. Prepare the journal entries to record the SAR plan. The par value of common stock is $1 per share. What journal entry will the company make on the dat

> IFRS. Local Craft Designs, Inc., an IFRS reporter, reported goodwill at $600,000 related to its Central Avenue Division. The fair value less costs to sell Central Avenue is $2,500,000. Its value in use is $2,550,000. The firm reports Central Avenue’s car

> Match the type or form of stock compensation with its definition. Form or Type a. Option b. Equity-classified awards c. Liability-classified award d. Stock appreciation rights e. Restricted stock plans f. Employee stock purchase plan

> Using the information provided in BE18-7, prepare the journal entries at the commencement of the lease and at the end of the first year for Perry Leasing assuming now that Perry paid $23,000 to acquire the equipment Data from BE18-7: Jenkins Manufacturi

> Repeat the requirements of BE18-7 for the lessor, Perry Leasing. Data from BE18-7: Jenkins Manufacturing Company leased a piece of nonspecialized machinery for use in its operations from Perry Leasing on January 1. The 10-year lease requires lease payme

> Jenkins Manufacturing Company leased a piece of nonspecialized machinery for use in its operations from Perry Leasing on January 1. The 10-year lease requires lease payments of $4,000 due on January 1 of each year. The machinery is estimated to have a 10

> Using the information provided in BE18-5, prepare the journal entries for the lessee at the commencement of the lease. Data from BE18-5: Iman Iron Works signed a lease on January 1 with Borko Bank for an iron-stamping machine. The equipment is not speci

> Iman Iron Works signed a lease on January 1 with Borko Bank for an iron-stamping machine. The equipment is not specialized in nature. The lease has a 12-year term with no purchase option or transfer of ownership. Under the terms of the contract, Iman mus

> Using the information provided in BE18-3, determine whether this lease is a finance or an operating lease if Dial Digital knows that the lessor’s implicit rate is 6%. Data from BE18-3: Dial Digital Solutions signed a 3-year lease at the beginning of the

> Dial Digital Solutions signed a 3-year lease at the beginning of the current year. The leased equipment has an economic life of 5 years and a fair value of $1,450. Under the terms of the lease, Dial is required to pay $500 on January 1 of each year. Ther

> Scott Manufacturing is considering a lease to acquire new equipment. The useful life of the asset is 10 years. Scott can lease the equipment from New City Bank for $1,000 per year over an 8-year period. The lease does not contain a purchase option. There

> IFRS. Aviata Products, Inc. leases a high-capacity printer from Dewey Office Services for $4,200. The original cost of the printer was $4,900. Under the terms of the agreement, Aviata will make even payments over the 42-month rental period. What is the j

> IFRS. Lenny Schaeffer Bakeries, an IFRS reporter, is required to test goodwill for impairment each year. The current carrying value of its reported goodwill is $800,000. The goodwill pertains to the cash-generating unit. The book value of the net assets

> Morris Products, Inc. leases several copy machines from Stanley Office Services. Under the terms of the agreement, Morris will pay rentals of $800 per month for an 11-month period. Morris elects to apply the exemption for short-term leases. That is, Morr

> Assume that you are given the following information for a 5-year lease (with payments due on January 1 of each year): • The lease payments are $60,000 per year. • The fair value of the underlying asset is $500,000. • The deferred initial indirect cost

> Assume that Anderson Associates, Inc. leases conference and training facilities from The Learning Company. Anderson will conduct training seminars for the clients at the leased space. The lease requires annual payments of $400,000 plus a percentage of sa

> Assume that Sting Stores leases office space from Ramona Realty for $15,000 per month. According to the terms of the lease, monthly rentals will increase by the annual increase in the Consumer Price Index (CPI). Index decreases will not be considered. Wh

> Sun Bank recently leased machinery to Claude Company. The 8-year lease contract requires rental payments of $100,000 due on January 1 of each year. The lease is classified as a finance lease for the lessee and a sales-type lease for the lessor. Claude kn

> VJ Leasing Company recently leased machinery to Berg Building Associates. The 5-year lease contract requires rental payments of $20,000 on January 1 of each year. The lease meets at least one of the Group I criteria. The 9% implicit rate on the lease is

> Assume that Imprescia Industries leases machinery for 3 years with fixed rentals of $8,000 per year. The agreement also requires that Imprescia purchase consumables (such as lubrication, drive belts, and springs) directly from the lessor and must spend a

> IFRS. Repeat the requirements of BE18-9 for the lessor, Perry Leasing assuming that Perry is an IFRS reporter. Perry is not a dealer. Data from BE18-9: Prepare the journal entries at the commencement of the lease and at the end of the first year for Per

> Deane Company leases office space from Blossom Building Associates for a term of 20 years in order to expand its operations into the southern region of the state. The office space includes the use of office equipment and computer equipment. In addition,

> The Block Company uses the accrual basis to account for all sales transactions. Total sales for the current year amounted to $450,000. Of this amount, $120,000 is from sales on installment. The firm uses the installment method (i.e., cash basis) to accou

> IFRS. Genius Auto Malls, an IFRS reporter, recently conducted its annual impairment review of the value of its trademark (an indefinite-life intangible), which it currently carries at $2,500,000. Evidence exists that the trademark may be impaired. Genius

> Mathus, Inc. reported income before tax of $180,000, and taxable income was $200,000. This $20,000 difference resulted from unearned revenues that the firm recorded as revenue for tax purposes but as a liability for book purposes. Mathus is subject to a

> Marlena Group uses straight-line depreciation for financial reporting purposes and accelerated depreciation on its tax returns. The company reported $40,000 in income before tax and depreciation for book purposes. The equipment has an original cost of $2

> Plimmox Company’s income before taxes is $410,000, and its tax rate is 35%. Plimmox included $60,000 in nondeductible fines in the $410,000. There are no other book-tax differences. Prepare a reconciliation of Plimmox’s statutory tax rate to its effectiv

> Simmox Company’s income before taxes is $290,000, and its tax rate is 35%. Note that $40,000 is nontaxable interest income from its investment in municipal bonds and is included in the $290,000. There are no other book-tax differences. Prepare a reconcil

> Plimmox Company’s income before taxes is $410,000, and its tax rate is 35%. Plimmox included $60,000 in nondeductible fines in the $410,000. There are no other book-tax differences. What are its tax expense and taxes payable? What is its net income?

> Simmox Company’s income before taxes is $290,000, and its tax rate is 35%. Note that $40,000 is nontaxable interest income from its investment in municipal bonds and is included in $290,000. There are no other book-tax differences. What are Simmox’s tax

> Bell Junior Apparel Incorporated reported pre-tax book income of $825,000 for the current year. The change in the difference in the basis of plant assets is $210,000; the book basis is higher than the tax basis. Bell invested in tax-free bonds and earned

> Using the data from BE17-22, now assume that Terrell Toy Company is an IFRS reporter. What amount should Terrell Toy report as a tax contingency? Data from BE17-22 Terrell Toy Company uses an acceptable tax method that provided a $10,000 tax deduction f

> Terrell Toy Company uses an acceptable tax method that provided a $10,000 tax deduction for the current year. Book income and taxable income before considering this tax deduction are equal to $245,000 (i.e., there are no book-tax differences). Terrell is

> IFRS. Fredrick Wilson Company, an IFRS reporter, determined that one of its finite-life intangible assets is impaired. The asset’s net carrying value on the date of the impairment is $905,000. Fredrick Wilson does not use a separate acc

> How would your answer to BE17-20 change if Year 1 income were equal to $100,000?

> W. Pickett Fence Company incurred a net loss for Year 3. The firm does not have any book-tax differences. We present the results of operations for the first 3 years of the company’s operations: Future tax rates are expected to be 35%.

> Limmox Company has conformity between its taxable income and income before taxes. Limmox Company’s net income after taxes is $195,000, and its tax rate is 35%. What is its taxes payable?

> Errol Toys, Inc. recorded book income of $240,000 in 2016. It does not have any permanent differences, and the only temporary difference relates to a $12,000 warranty expense that it recorded for book purposes. Errol Toys anticipates fulfilling half of t

> Use the same information as in BE17-17, but now assume that Finer Shoes Company is an IFRS reporter. What deferred tax amount should the company record for this temporary difference under IFRS? Data from BE17-17 Finer Shoes Company recorded book income

> Finer Shoes Company recorded book income of $120,000 in 2016. It does not have any permanent differences, and the only temporary difference relates to a $60,000 installment sale that it recorded for book purposes. Finer Shoes anticipates collecting the i

> Use the same information as in BE17-15 but now assume that Maves is an IFRS reporter. What is the journal entry to record the deferred tax asset? Data from BE17-15 Maves, Inc. booked a deferred tax asset of $45,000 resulting from a basis difference in w

> Maves, Inc. booked a deferred tax asset of $45,000 resulting from a basis difference in warranty liabilities. Management has assessed that it is more likely than not that the firm will not realize 30% of the deferred tax asset. Provide the necessary jour

> Wells Junior Apparel Incorporated reported pre-tax book income of $825,000 for the current year. The change in the difference in the basis of plant assets is $210,000, and the book basis is higher than the tax basis. Wells invested in tax-free bonds and

> Using the information for Reflections Mirrors, Ltd. provided in BE17-12, prepare the journal entries required to record the tax provision for Year 2 assuming that Reflections reported income before warranty costs and taxes of $200,000 and incurred actual

> IFRS. Perlu Products, an IFRS reporter, reported an impairment loss of $65,000 for one of its plant assets on December 31, 2018. At December 31, 2019, the asset’s recoverable amount increased by $90,000. The current carrying value is $100,000 less than i

> Reflections Mirrors, Ltd. offers a 3-year warranty on all its products. In Year 1, the company reported income before warranty expense of $620,000 and estimated that warranty repairs would cost the company $150,000 over the 3-year period. Actual repairs

> Bobby James Puppet Company acquired a new plastic molding machine at the beginning of the current year at a cost of $420,000. The asset has a 6-year useful life for financial reporting purposes and is depreciated on a straight-line basis with no residual

> Hondell Industries offers a 3-year basic warranty on all its products. At the beginning of the current year, the estimated warranty liability had a balance of $110,000. Actual repairs cost $35,000, and the company accrued an additional $60,000 for the cu

> Immox Company has conformity between its taxable income and income before taxes. If Immox’s taxes payable are $140,000, and its tax rate is 40%, what is its net income?

> IFRS. Using the information provided in BE16-7, prepare the entries assuming that Turner Tires, Inc. is an IFRS reporter. Turner plans to trade the securities. Prepare the journal entries required on the date of acquisition and at the end of the year. D

> IFRS. Using the information provided in BE16-7, prepare the entries assuming that Turner Tires, Inc. is an IFRS reporter and elects to report these securities at fair value through other comprehensive income. Turner is not holding the investment for trad

> Turner Tires, Inc. acquired 40,000 shares of Fenwick Corporation stock at a price of $35 per share during 2016. This investment does not allow Turner to participate in the decision making of Fenwick, and the company therefore does not have the ability to

> IFRS. Using the information provided in BE16-5, prepare the entry to record the fair value adjustment if Ruban plans to hold the bonds to generate cash flows by selling the bonds. Data from BE16-5: IFRS. Ruban Company, an IFRS reporter, acquired $3,500,

> IFRS. Ruban Company, an IFRS reporter, acquired $3,500,000 face value, 8% bonds on January 1 of the current year when the market rate of interest was 10%. Ruban plans to hold the bonds to generate cash flows by collecting contractual cash flows but could

> IFRS. Gills Products, an IFRS reporter, acquired $2,960,000 face value, 5% bonds on January 1 of the current year when the market rate of interest was 10%. Gills plans to hold the bonds to generate cash flows by collecting contractual cash flows only, an

> IFRS. Tank Top Menswear, Ltd., an IFRS reporter, reported net plant and equipment of $1,600,000. These assets cost $2,500,000 with accumulated depreciation taken to date of $900,000. Based on recently assessed negative evidence, Tank Top’s management con

> Using the information provided in BE16-2, prepare the entry to record the fair value adjustment if Kuban classified this investment as a trading security. Data fromBE16-2: Kuban Company acquired $3,500,000 face value, 8% bonds as an available-for-sale i

> Kuban Company acquired $3,500,000 face value, 8% bonds as an available-for-sale investment on January 1 of the current year when the market rate of interest was 10%. Interest is paid annually each December 31. Kuban purchased the bonds, which mature in 1

> For each debt investment in the following table, compute the impairment loss, if any, and determine whether the loss is reported in net income. Assume that the investor is not expected to sell the investments prior to full recovery of the decline in fair

> IFRS. For each debt investment in BE16-17, compute the impairment loss, if any, and determine whether the loss is reported in net income or other comprehensive income under IFRS. The available-for-sale investments are classified as fair value through oth

> For each debt investment in the following table, compute the impairment loss, if any, and determine whether the loss is reported in net income. All of the investments were purchased in the current year. Assume that the investor is not expected to sell th

> Fill in the blanks in the following statements: a. Level 1: Fair values are determined based on ____________ for identical assets. b. Level 2: Fair values are determined using ____________. Other observable inputs could include ____________ based on si

> Thornwood Consultants, Ltd. adopted the fair value option for a recent acquisition of debt investment securities that were originally classified as held to maturity. Thornwood acquired bonds of Wicker Enterprises at a cost of $1,100,000. The year-end fai

> Aaron Anatole accepted a $250,000, 4-year, non-interest-bearing note receivable upon a sale. The current market rate of interest is 8%. The note is not publicly traded. Prepare the journal entry to record the sale. Ignore cost of goods sold.

> Natale Enterprises, a major real estate developer, recently accepted a $10,000,000, 5-year, 2% note receivable in exchange for products sold. Interest is paid annually. The current market rate of interest is 6%. The note is not publicly traded. Prepare t

> On January 1, Newman acquired a 30% interest in the common shares of MultiGram Entertainment at a cost of $4,295,000. During the year, MultiGram reported a net loss of $630,000 and paid no dividends. At acquisition, MultiGram’s market value equaled the b

> IFRS. Fillepeel Manufacturing, Inc., an IFRS reporter, has only one plant asset used in production. The asset had a cost of $500,000 and was depreciated for 2 full years since the date of acquisition. This accounting resulted in a total accumulated depre

> Almonzo’s Flower Box, Inc. operates a floral delivery service. The company has three delivery trucks. It recently signed a contract to make deliveries for two local florists. The delivery route for one of the florists has been unprofitable. Are the three

> 1. _________ is the method used to support a likely sequence of events at a crime scene by the observation and evaluation of physical evidence and statements made by individuals involved with the incident. 2. Reconstructing the circumstances of a crime

> 11. The believability of _________ accounts, confessions, and informant testimony can all be disputed, maligned, and subjected to severe attack and skepticism in the courtroom. 12. True or False: Physical evidence cannot be used to exclude or exonerate

> If there is a GPS capability on a smartphone, how might the investigator make use of it? Is it useful for correlation? What kind and how would such correlation be accomplished?

> What is the IMSI, where might it reside, and what is it used for? How would the digital forensic investigator use it?

> What are SIMs and SD cards and why does a mobile device need them? Do all mobile devices have one or both of these? If not, what substitutes?

> How are today’s generations of mobile devices different from and the same as personal computers?

> How can law enforcement make use of the locations of cell phone towers?

> Differentiate chain of evidence and chain of custody and give examples of both in the context of an investigation where mobile devices play an important part.

> What precautions should the examiner take when seizing/ analyzing a live, turned-on mobile device?

> You are examining two computers to determine the IP address from which several threatening e-mails were sent. The first computer uses Microsoft Outlook as an e-mail client and the second uses a web-based e-mail client. Where would you probably look first

> What kind of search pattern(s) would investigators be most likely to employ in each of the following situations? a. Two people searching a small area with well-defined boundaries b. Several people searching a large area c. A single person searching a lar

> You are investigating a case in which an accountant is accused of keeping fraudulent books for a firm. Upon examining his computer, you notice that the suspect uses two different accounting programs that are capable of reading the same types of files. Gi

> Criminalist Tom Parauda is investigating the scene of a crime involving a computer. After he arrives, he photographs the overall scene and takes close-up shots of all the connections to the single computer involved, as well as photos of the serial number

> If a file system defines a cluster as six sectors, how many bits of information can be stored on each cluster? Explain your answer.