Question: For each of the following independent cases,

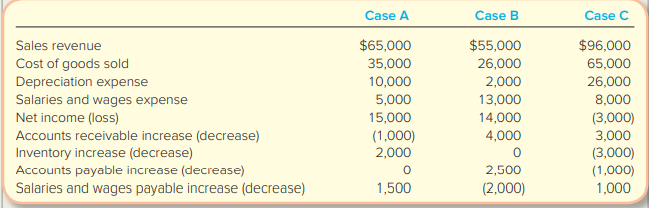

For each of the following independent cases, compute cash flows from operating activities using the direct method. Assume the list below includes all items relevant to operating activities.

> Explain the cost principle.

> Match each definition with its related term or abbreviation by entering the appropriate letter in the space provided.

> The following information was reported in the December 31, 2017, financial statements of National Airways, Inc. (listed alphabetically, amounts in millions). 1. Prepare an income statement for the year ended December 31, 2017. 2. Prepare a statement of

> Items from the 2015 income statement, statement of retained earnings, and balance sheet of Activision Blizzard, Inc., are listed below in alphabetical order. Solve for the missing amounts, and explain whether the company was profitable. TIP: Use Exhibit

> Items from the income statement, statement of retained earnings, and balance sheet are listed below in alphabetical order. For the companies shown in each column, solve for the missing amounts.

> Items from the income statement, statement of retained earnings, and balance sheet are listed below in alphabetical order. For the companies shown in each column, solve for the missing amounts. TIP: Use Exhibit 1.7 to identify relations among

> Stone Culture Corporation was organized on January 1, 2017. For its first two years of operations, it reported the following: On the basis of the data given, prepare a statement of retained earnings for both 2017 (its first year of operations) and 2018.

> Learning which items belong in each category of the statement of cash flows is an important first step in understanding their meaning. Use a letter to mark each item in the following list as a cash flow from Operating, Investing, or Financing activities.

> Learning which items belong in each cash flow statement category is an important first step in understanding their meaning. Use a letter to mark each item in the following list as a cash flow from Operating, Investing, or Financing activities. Put parent

> The following is a list of important abbreviations used in the chapter. These abbreviations also are used widely in business. For each abbreviation, give the full designation. The first one is an example.

> Rock town Corporation bought 600 shares of General Eccentric stock on March 20 at $29 per share. Immediately prior to selling the General Eccentric stock on June 23, Rocktown updated its investment account to report the fair value of $33 per share. Prepa

> Define the following: a. Asset b. Current asset c. Liability d. Current liability e. Common stock f. Retained earnings

> Using the following categories, indicate the effects (direction and amount) of the transactions listed in MD-3. Use + for increase and − for decrease.

> Princeton Company acquired some of the 50,000 outstanding shares of the common stock of Cox Corporation as marketable equity securities. The accounting period for both companies ends December 31. Give the journal entries for each of the following transac

> Using the following categories, indicate the effects (direction and amount) of the transactions listed in MD-1. Use + for increase and − for decrease.

> On January 2, Ubuy.com paid $100,000 to acquire 25 percent (10,000 shares) of the common stock of E-Net Corporation. The accounting period for both companies ends December 31. Give the journal entries for the purchase on January 2 and for each of the fol

> Use the financial calculator app shown in the appendix to answer MC-4. Round to the nearest dollar. MC-4: You plan to retire in 20 years. Use the time value of money tables to calculate whether it is better for you to save $25,000 a year for the last 1

> Use the financial calculator app shown in the appendix to answer MC-3. Round to the nearest dollar. MC-3: As a result of a slowdown in operations, Mercantile Stores is offering to employees who have been terminated a severance package of $100,000 cash,

> Use the financial calculator app shown in the appendix to answer MC-2. Round to the nearest dollar MC-2: Use present value tables to compute the present value of 10 equal payments of $15,000, with an interest rate of 10 percent. Round to the nearest do

> Use the financial calculator app shown in the appendix to answer MC-1. Round to the nearest dollar.

> Use Excel to answer MC-4. Round to the nearest dollar. MC-4: You plan to retire in 20 years. Use the time value of money tables to calculate whether it is better for you to save $25,000 a year for the last 10 years before retirement or $15,000 for each

> Use Excel to answer MC-3. Round to the nearest dollar. MC-3: As a result of a slowdown in operations, Mercantile Stores is offering to employees who have been terminated a severance package of $100,000 cash, another $100,000 to be paid in one year, and

> What information should be included in the heading of each of the four primary financial statements?

> Use Excel to answer MC-2. Round to the nearest dollar. MC-2: Use present value tables to compute the present value of 10 equal payments of $15,000, with an interest rate of 10 percent. Round to the nearest dollar.

> Mystic Laboratories reported total assets of $11,200,000 and noncurrent assets of $1,480,000. The company also reported a current ratio of 1.5. What amount of current liabilities did the company report?

> A manufacturer reported an inventory turnover ratio of 8.6 last year. During the current year, managreement introduced a new inventory control system that was expected to reduce average inventory levels by 25 percent without affecting sales volume. Given

> Given the following data, compute the return on equity ratio for the current year (expressed as a percentage with one decimal place).

> A consumer products company reported a 25 percent increase in sales from last year to this year. Sales last year were $200,000. This year, the company reported Cost of Goods Sold in the amount of $150,000. What was the gross profit percentage this year?

> Your campus computer store reported Sales Revenue of $168,000. The company’s gross profit percentage was 60.0 percent. What amount of Cost of Goods Sold did the company report?

> Refer to the calculations from M13-2. Which of the ratios from Exhibit 13.5 have been included in these calculations? Have these two ratios improved or deteriorated in the current year compared to the previous year? Data from M13-2: Using the following

> Refer to the calculations from M13-1. What are the two most significant year-over-year changes in terms of dollars and in terms of percentages? Give one potential cause of each of these changes. Data from M13-1: Using the following income statements, p

> Refer to M13-1. Perform the calculations needed for vertical analyses. Round percentages to one decimal place. Data from M13-1: Using the following income statements, perform the calculations needed for horizontal analyses. Round percentages to one dec

> For each of the following three accounting choices, indicate the decision that will yield (a) a higher net profit margin and (b) a lower current ratio. If the decision does not affect the ratio, indicate “no effect.” 1. Straight-line versus accelerated

> List the three main types of business activities on the statement of cash flows and give an example of e

> Nevis Corporation operates in an industry where costs are falling. The company is considering changing its inventory method from FIFO to LIFO and wants to determine the impact that the change would have on selected accounting ratios in future years. In g

> Generally speaking, do the following indicate good news or bad news? a. Increase in times interest earned ratio. b. Decrease in days to sell. c. Increase in gross profit percentage. d. Decrease in EPS. e. Increase in fixed asset turnover ratio

> Identify the ratio that is relevant to answering each of the following questions. a. How much net income does the company earn from each dollar of sales? b. Is the company financed primarily by debt or equity? c. How many dollars of sales were generat

> Last year, Big W Company reported earnings per share of $2.50 when its stock was selling for $50.00. If its earnings this year increase by 10 percent and the P/E ratio remains constant, what will be the price of its stock? Explain.

> Using the following income statements, perform the calculations needed for horizontal analyses. Round percentages to one decimal place.

> Which of the following transactions would be considered noncash investing and financing activities?

> Using the data from M12-6, calculate the maximum investing cash inflows that could be reported under IFRS. Using data from M12-7, calculate the maximum financing cash flows that could be reported under IFRS. Data from M12-6: Based on the following inf

> Based on the following information, compute cash flows from financing activities under GAAP.

> Based on the following information, compute cash flows from investing activities under GAAP.

> For the following two independent cases, show the cash flows from operating activities section of the statement of cash flows for year 2 using the indirect method.

> Explain what the separate entity assumption means when it says a business is treated as separate from its owners for accounting purposes.

> For each of the following independent cases, compute cash flows from operating activities. Assume the list below includes all balance sheet accounts related to operating activities.

> Indicate whether each item would be added (+) or subtracted (−) in the computation of cash flows from operating activities using the indirect method.

> The Buckle, Inc., included the following in its statement of cash flows presented using the indirect method. Indicate whether each item is disclosed in the operating activities (O), investing activities (I), or financing activities (F) section of the sta

> Refer to the two cases presented in M12-5, and for each case show the cash flow from operating activities section of the Year 2 statement of cash flows using the direct method. Data from M12-5: For the following two independent cases, show the cash flo

> Prestige Manufacturing Corporation reports the following items in its statement of cash flows presented using the direct method. Indicate whether each item is disclosed in the operating activities (O), investing activities (I), or financing activities (F

> Quantum Dots, Inc., is a nanotechnology company that manufactures “quantum dots,” which are tiny pieces of silicon consisting of 100 or more molecules. Quantum dots can be used to illuminate very small objects, enablin

> Based on the cash flows shown, classify each of the following cases as a growing start-up company (S), a healthy established company (E), or an established company facing financial difficulties (F).

> Sturdy Stone Tools, Inc., announced a 100 percent stock dividend. Determine the impact (increase, decrease, no change) of this dividend on the following: 1. Total assets. 2. Total liabilities. 3. Common stock. 4. Total stockholders’ equity. 5. Marke

> On May 20, the board of directors for Auction.com declared a cash dividend of 50 cents per share payable to stockholders of record on June 14. The dividends are paid on July 14. The company has 500,000 shares of stock outstanding. Closing entries are rec

> The accounting process generates financial reports for both internal and external users. Describe some of the specific groups of internal and external users.

> Net pass Company has 300,000 shares of common stock authorized, 270,000 shares issued, and 100,000 shares of treasury stock. The company’s board of directors declares a dividend of $1 per share of common stock. What is the total amount of the dividend th

> Trans Union Corporation issued 5,000 shares for $50 per share in the current year, and it issued 10,000 shares for $37 per share in the following year. The year after that, the company reacquired 20,000 shares of its own stock for $45 per share. Determin

> Refer to M11-4. Assume the issued stock has no par value. Analyze the accounting equation effects and record the journal entry for the issuance of the no-par value stock at $50. Do the effects on total assets, total liabilities, and total stockholders’ e

> To expand operations, Aragon Consulting issued 1,000 shares of previously unissued common stock with a par value of $1. The price for the stock was $50 per share. Analyze the accounting equation effects and record the journal entry for the stock issuance

> The balance sheet for Crutcher Corporation reported 200,000 shares outstanding, 300,000 shares authorized, and 20,000 shares in treasury stock. Compute the maximum number of new shares that Crutcher could issue

> Face 2 Face Corporation reports 100 outstanding shares, 500 authorized shares, and 50 shares of treasury stock. How many shares are issued?

> To reduce its stock price, Shriver Food Systems, Inc., declared and issued a 100 percent stock dividend. The company has 800,000 shares authorized and 200,000 shares outstanding. The par value of the stock is $1 per share and the market value is $100 per

> On January 2, Daniel Harrison contributed $20,000 to start his business. At the end of the year, the business had generated $30,000 in sales revenues, incurred $18,000 in operating expenses, and distributed $5,000 for Daniel to use to pay some personal e

> Last year, Rec Room Sports reported earnings per share of $8.50 when its stock price was $212.50. This year, its earnings increased by 20 percent. If the P/E ratio remains constant, what is likely to be the price of the stock? Explain.

> From last year to this year, Berry Barn reported that its Net Sales increased from $300,000 to $400,000 and its Gross Profit increased from $90,000 to $130,000. Was the Gross Profit increase caused by (a) an increase in sales volume only, (b) an increase

> Briefly distinguish financial accounting from managerial accounting.

> From last year to this year, Colossal Company’s current ratio increased and its inventory turnover decreased. Does this imply a higher, or lower, risk of obsolete inventory?

> Slow Cellar’s current ratio increased from 1.2 to 1.5. What is one favorable interpretation of this change? What is one unfavorable interpretation of this change?

> Why are some analyses called horizontal and others called vertical?

> What benchmarks are commonly used for interpreting ratios?

> What benchmarks are commonly used for interpreting ratios?

> What is ratio analysis? Why is it useful?

> How is a year-over-year percentage calculated?

> Tec gear is an electronics company in the United States. It uses the LIFO inventory method. You plan to compare its ratios to those of Euro text, but you are concerned because Euro text uses IFRS. What accounting policy difference is certain to exist bet

> Explain where and how discontinued operations are reported on the income statement.

> What is the going-concern assumption? What is a goingconcern problem? What factors can contribute to such a problem?

> Val is opening a hair salon, but she does not know what business form it should take. Tell her about the advantages and disadvantages of operating as a sole proprietorship versus a corporation.

> What is the primary objective of financial reporting?

> What is the primary objective of financial reporting?

> What are the two essential characteristics of useful financial information? What other characteristics enhance the usefulness of financial information?

> Explain whether the following situations, taken independently, would be favorable or unfavorable: (a) increase in gross profit percentage, (b) decrease in inventory turnover ratio, (c) increase in earnings per share, (d) decrease in days to collect, and

> What is the general goal of trend analysis?

> Explain why a $50,000 increase in inventory during the year must be included in computing cash flows from operating activities under both the direct and indirect methods.

> Explain why cash outflows during the period for purchases and salaries are not specifically reported on a statement of cash flows prepared using the indirect method

> Under the indirect method, depreciation expense is added to net income to report cash flows from operating activities. Does depreciation cause an inflow of c

> Describe the types of items used to compute cash flows from operating activities under the two alternative methods of reporting

> What are the typical cash inflows from operating activities? What are the typical cash outflows from operating activities?

> Define accounting.

> What are the major categories of business activities reported on the statement of cash flows? Define each of these activities.

> What are cash equivalents? How are they reported on the statement of cash flows?

> What information does the statement of cash flows report that is not reported on the other required financial statements?

> (Supplement 12A) How is the sale of equipment reported on the statement of cash flows using the indirect method?

> What are noncash investing and financing activities? Give one example. How are noncash investing and financing activities reported on the statement of cash flows?

> What are the typical cash inflows from financing activities? What are the typical cash outflows from financing activities?

> What are the typical cash inflows from investing activities? What are the typical cash outflows from investing activities?

> As a junior analyst, you are evaluating the financial performance of Digilog Corporation. Impressed by this year’s growth in sales (20% increase), receivables (40% increase), and inventories (50% increase), you plan to report a favorable evaluation of th

> Loan covenants require that E-Gadget Corporation (EGC) generate $200,000 cash from operating activities each year. Without intervening during the last month of the current year, EGC will generate only $180,000 cash from operations. What are the pros and

> Compare the purposes of the income statement, the balance sheet, and the statement of cash flows

> In what ways might accounting frauds be similar to cases of academic dishonesty?

> Brothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Inc.) on January 1, 2016. The annual reporting period ends December 31. The trial balance on January 1, 2018, follows (the amounts are rounded to thousands of do