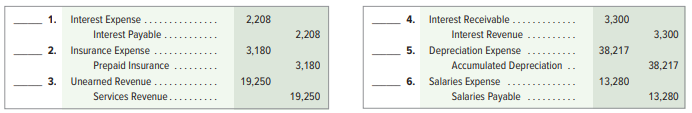

Question: For journal entries 1 through 6, identify

For journal entries 1 through 6, identify the explanation that most closely describes it.

A. To record this period’s depreciation expense. D. To record accrued interest revenue.

B. To record accrued salaries expense. E. To record accrued interest expense.

C. To record this period’s use of a prepaid F. To record the earning of previously unearned expense. Income.

> Stark Company has five employees. Employees paid by the hour earn $10 per hour for the regular 40-hour workweek and $15 per hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but salaried employees are paid monthly on the last

> AA 26-1 Apple invested $10,495 in the current year to expand its manufacturing capacity. Assume that these assets have a 10-year life and generate net cash flows of $3,000 per year, and that Apple requires a 7% return on its investments. (Apple $s in mil

> Riya Co. purchases a machine for $105,000 on January 1, 2021. Straight-line depreciation is taken each year for four years assuming a seven-year life and no salvage value. The machine is sold on July 1, 2025, during its fifth year of service. Prepare ent

> Refer to the information in Exercise 9-14 to complete the following requirements. a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 4.5% of total accounts receivable to estimate uncollectible, instead of the aging o

> Warner Company’s year-end unadjusted trial balance shows accounts receivable of $99,000, allowance for doubtful accounts of $600 (credit), and sales of $140,000. Uncollectible are estimated to be 1% of sales. Prepare the December 31 year-end adjusting en

> Use the following accounts with normal balances to prepare Boscov Company’s classified balance sheet as of December 31

> Using the information in Exercise 8-12, prepare any necessary journal entries that Del Gato Clinic must record as a result of preparing the bank reconciliation.

> Repair a table with the following headings for a monthly bank reconciliation dated September 30. Indicate whether each item should be added to or subtracted from the book or bank balance and whether it should or should not appear on the September 30 reco

> Smith Auto uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize its transactions that should be recorded in the general journal. For those not recorded in the general journal, identify the

> Refer to Exercise 7-7 and for each of the transactions identify the journal in which it would be recorded. Assume the company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal.

> Marx Supply uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Prepare a cash payments journal like the one in Exhibit 7.11. Journalize the following transactions that should be recorded in the cas

> Gomez Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Prepare a purchases journal like the one in Exhibit 7.9. Journalize the following transactions that should be recorded in the purcha

> Your friend, Wendy Geiger, owns a small retail store that sells candies and nuts. Geiger acquires her goods from a few select vendors. She generally makes purchase orders by phone and on credit. Sales are primarily for cash. Geiger keeps her own manual a

> Following is information from Jasper Company for its first month of business. 1. Identify the balances listed in the accounts payable subsidiary ledger. 2. Identify the Accounts Payable balance listed in the general ledger at month’s en

> Refer to Exercise 7-3 and for each of the transactions identify the journal in which it would be recorded. Assume the company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal.

> Ali Co. uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Prepare a cash receipts journal like the one in Exhibit 7.7. Journalize the following transactions that should be recorded in the cash rec

> Refer to Exercise 7-1 and for each of the transactions identify the journal in which it would be recorded. Assume the company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal.

> The following companies are competitors in the same industry and have many of the same suppliers. (a) Calculate days’ payable outstanding for each of the following companies (round to one decimal). (b) Assuming each company has positive

> Following is a cash receipts journal and a partial chart of accounts for a company. For each posting reference a through k, enter (1) an x for an amount not individually posted, (2) a ✓ for individual posting to the customerâ€

> At the end of May, the sales journal of Mountain View appears as follows. Mountain View also recorded an allowance (price reduction) given to Anna Page with the following entry. Required 1. Open an accounts receivable subsidiary ledger that has a T-accou

> Post Pharmacy uses the following journals: sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. The following two transactions were processed. June 5 Post Pharmacy purchased merchandise priced at $14,000, s

> A company that records credit purchases in a purchases journal and records purchases returns in a general journal made the following errors. Enter A, B, or C indicating when each error should be discovered. A. When preparing the schedule of accounts pay

> Finer Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Prepare a sales journal like the one in Exhibit 7.5. Journalize the following transactions that should be recorded in the sales jour

> Refer to Apple’s financial statements in Appendix A. Assume that the owners, sometime during their first five years of business, desire to expand their computer product services to meet business demand regarding computing services. They eventually decide

> Refer to Exercise 5-10 and prepare journal entries to record each of the merchandising transactions assuming that the perpetual inventory system and the net method are used by both the buyer and the seller.

> Refer to Exercise 5-10 and prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system and the gross method are used by both the buyer and the seller.

> Refer to Exercise 5-9 and prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system and the gross method are used by both the buyer and the seller.

> Refer to Exercise 5-3 and prepare journal entries to record each of the merchandising transactions assuming that the buyer uses the periodic inventory system and the gross method.

> Adams Co. reports the following balance sheet accounts as of December 31. Prepare a classified balance sheet.

> Fit-for-Life Foods reports the following income statement accounts for the year ended December 31. Prepare a multiple-step income statement that includes separate categories for net sales; cost of goods sold; selling expenses; general and administrative

> Prepare journal entries for the following merchandising transactions of Powell Company assuming it uses a perpetual inventory system and the gross method. May 1 Powell purchased merchandise with a price of $875 and credit terms of n∕30. 12 Powell returne

> Refer to Exercise 5-6 and prepare journal entries for Macy Co. to record each of the May transactions. Macy is a retailer that uses the gross method and a perpetual inventory system; it purchases these units for resale.

> Analyze each transaction in Exercise 5-6 by indicating its effects on the income statement—specifically, identify the accounts and amounts (including + or −) for each transaction.

> Trey Co. entered into the following two transactions. Trey prepares financial statements annually at December 31. a. Trey rents a building for $2,800 per month beginning December 1. By agreement, Trey paid cash for both December and January rent on Janua

> Assume you are preparing for a class presentation on the accounting for factory overhead. Prepare a set of notes to guide a presentation that addresses the questions below. Required 1. Describe the four-step overhead process. 2. How are applied and act

> Hawk Company used the following information to prepare adjusting entries at its December 31 year-end. Prepare any necessary reversing entries for accounting adjustments a through e assuming that the company uses reversing entries. a. The company earned $

> (a) Calculate the current ratio for each of the following competing companies. (b) Which competitor is in the best position to pay its short-term obligations?

> (a) Use the information in the adjusted trial balance reported in Exercise 4-11 to compute the current ratio for Wilson Trucking. (b) Assuming Spalding (a competitor) has a current ratio of 1.5, which company is better able to pay its short-term obligati

> Use the following selected accounts and amounts with normal balances from Andrea Co. to prepare its classified balance sheet at December 31.

> Using Wilson Trucking Company’s adjusted trial balance from E 4-10, prepare its December 31 closing entries.

> Use the information in the adjusted trial balance reported in Exercise 4-10 to prepare Wilson Trucking Company’s classified balance sheet as of December 31.

> Use the following adjusted trial balance at December 31 of Wilson Trucking Company to prepare the (1) income statement and (2) statement of owner’s equity, for the year ended December 31. The K. Wilson, Capital account balance was $170,

> The following data are taken from the unadjusted trial balance of the Westcott Company at December 31. 1. Use the following information to complete the Adjustments columns of the work sheet. a. Depreciation on equipment, $3 d. Supplies available at Decem

> Ricardo Construction began operations on December 1. In setting up its accounting procedures, the company decided to debit expense accounts when it prepays its expenses and to credit revenue accounts when customers pay for services in advance. Prepare jo

> Use the following information to compute profit margin for each separate company a through e. Which of the five companies is the most profitable according to the profit margin ratio? Interpret the profit margin ratio for company c.

> Write a one-page memorandum to a prospective college student about salary expectations for graduates in business. Compare and contrast the expected salaries for accounting (including different subfields such as public, corporate, tax, audit, and so forth

> Use the adjusted accounts for Stark Company from Exercise 3-16 to prepare the (1) income statement and (2) statement of owner’s equity for the year ended December 31 and (3) balance sheet at December 31. The Stark, Capital account balance was $24,800 on

> Analyze each adjusting entry in Exercise 3-11 by showing its effects on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each transaction or event.

> Determine the missing amounts in each of these four separate situations a through d.

> For each of the following separate situations, determine how much revenue is recognized in December (using accrual basis accounting). a. On December 7, Oklahoma City Thunder sold a $90 ticket to a basketball game to be played in March. b. Tesla sold and

> On March 1, Year 1, a company paid an $18,000 premium on a 36-month insurance policy for coverage beginning on that date. Refer to that policy and fill in the blanks in the following table.

> Analyze each transaction in Exercise 2-9 by showing its effects on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each transaction.

> Open a ledger account for Cash in balance column format. Post general journal entries that impact cash from Exercise 2-9 to the ledger account for Cash, and enter the balance after each posting.

> Prepare general journal entries for the following transactions of Sustain Company. June 1 T. James, owner, invested $11,000 cash in Sustain Company. 2 The company purchased $4,000 of furniture made from reclaimed wood on credit. 3 The company paid $600 c

> Gore Co. bills a client $62,000 for services provided and agrees to accept the following three items in full payment: (1) $10,000 cash, (2) $80,000 of equipment, and (3) $28,000 note payable owed on the equipment. For this transaction, (a) analyze the tr

> Assume that you are Jolie Company’s accountant. Company owner Mary Jolie has reviewed the 2021 financial statements you prepared and questions the $6,000 loss reported on the sale of its investment in Kemper Co. common stock. Jolie acquired 50,000 shares

> For each of the following, (1) identify the account as an asset, liability, equity, revenue, or expense; (2) identify the normal balance of the account; and (3) enter debit or credit to identify the kind of entry that would increase the account balance.

> Identify the item that best completes each of the descriptions below. 1. Chart 2. General ledger 3. Journal 4. Account 5. Source document a. A (n) of accounts is a list of all accounts a company uses, not including account balances. b. The is a record co

> Identify the item that best completes each of the descriptions below. 1. Asset 2. Equity 3. Account 4. Liability 5. Three a. Balance sheet accounts are arranged into general categories. b. The owner’s claim on a company’s assets is called. c. Accounts Pa

> Identify the source document for NDX Company in each of the following accounting processes. a. A customer purchases merchandise with a credit card. NDX uses the electronic sales receipt to record transaction details in its accounting system. b. NDX purch

> a. Compute the debt ratio for each of the three companies. b. Which company has the most financial leverage?

> Compute the missing amount for each of the following separate companies in columns B through E.

> Use the information in Exercise 2-25 to prepare a December 31 balance sheet for Help Today. Hint: The ending C. Camry, Capital account balance as of December 31 is $106,470.

> A company had the following assets and liabilities at the beginning and end of this year. Determine net income or net loss for the business during the year for each of the following separate cases. a. Owner made no investments in the business, and no wit

> Prepare a December 31 trial balance for Jindal Co. using the following information and fill in the missing amount for Equipment (assume all data are correct).

> Use the T-accounts in Exercise 2-19 from Chase Company’s first month of operations to prepare its December 31 trial balance.

> Ellis Island Tropical Tea manufactures and sells tea. Founder Nailah Ellis-Brown stresses the importance of planning and budgeting for business success. Required 1. How can budgeting help Nailah efficiently develop and operate her business? 2. Nailah ho

> Chase Company posted transactions (a through f) in the following T-accounts in December, its first month of operations. Prepare the six journal entries from which the postings were made.

> Use information from Exercise 2-17 to prepare the general journal entries for Belle Co.’s first seven transactions.

> Fill in each of the following T-accounts for Belle Co.’s seven transactions listed here. The T-accounts represent Belle Co.’s general ledger. Code each entry with transaction numbers 1 through 7 (in order) for referenc

> Skull Co. makes snowboards and uses the total cost method in setting product price. Its costs for producing 10,000 units follow. The company targets a 12.5% markup on total cost. 1. Compute the total cost per unit if 10,000 units are produced. 2. Compute

> Lopez Co. is considering replacing one of its old manufacturing machines. The old machine has a book value of $45,000 and a remaining useful life of five years. It can be sold now for $52,000. Variable manufacturing costs are $36,000 per year for this ol

> Marin Company makes several products, including canoes. The company reports a loss from its canoe segment (see below). All its variable costs are avoidable, and $300,000 of its fixed costs are avoidable. (a) Compute the income increase or decrease from e

> Chip Company produces three products, Kin, Ike, and Bix. Each product uses the same direct material. Kin uses 4 pounds of the material, Ike uses 3 pounds of the material, and Bix uses 6 pounds of the material. Selling price per unit and variable costs pe

> Colt Company produces two skateboard models. Machine time per unit for Hero is two hours and for Flip is one hour. The machine’s capacity is 1,600 hours per year. Colt can sell up to 500 units of Hero and 900 units of Flip per year. Sel

> A company must decide between scrapping or reworking units that do not pass inspection. The company has 22,000 defective units that have already cost $132,000 to manufacture. The units can be sold as scrap for $78,000 or reworked for $99,000 and then sol

> Cobe Co. has manufactured 200 partially finished cabinets at a cost of $50,000. These can be sold as is for $60,000. Instead, the cabinets can be stained and fitted with hardware to make finished cabinets. Further processing costs would be $12,000, and t

> Smart Sweets, launched by entrepreneur Tara Bosch as described in this chapter’s opener, makes gummy candy without sugar and from all-natural ingredients. Required 1. Identify at least two fixed costs that do not change regardless of how much candy Tara

> Current year information for Apple and Google follows. Required 1. Compute profit margin for each company. 2. Compute investment turnover for each company. 3. Refer to answers for parts 1 and 2. Which company performed better on investment turnover?

> Gelb Co. currently makes a key part for its main product. Making this part incurs per unit variable costs of $1.20 for direct materials and $0.75 for direct labor. Incremental overhead to make this part is $1.40 per unit. The company can buy the part for

> HH Electric reports the following information. a. Compute the time charge per hour of direct labor. b. Compute the materials markup percentage. c. What price should the company quote for a job requiring four direct labor hours and $580 in materials?

> Pardo Company produces a single product and has capacity to produce 120,000 units per month. Costs to produce its current monthly sales of 80,000 units follow. The normal selling price of the product is $100 per unit. A new customer offers to purchase 20

> Farrow Co. reports the following annual results. The company receives a special offer for 15,000 units at $12 per unit. The additional sales would not affect its normal sales. Variable costs per unit would be the same for the special offer as they are fo

> Rios Co. makes drones and uses the variable cost method in setting product price. Its costs for producing 20,000 units follow. The company targets a profit of $300,000 on this product. 1. Compute the total variable cost and the markup percentage. 2. Comp

> Beto Company pays $2.50 per unit to buy a part for one of the products it manufactures. With excess capacity, the company is considering making the part. Making the part would cost $1.20 per unit for direct materials and $1.00 per unit for direct labor.

> Following is information on two alternative investments. Beachside Resort is considering building a new pool or spa. The company requires a 10% return from its investments. For each investment project, compute, (a) Net present value (b) Profitability in

> Refer to the information in Exercise 26-10. The company instead requires a 12% return on its investments. Compute each project’s: (a) Net present value. (b) Profitability index. Round present value calculations to the nearest dollar and round the profita

> Gonzalez Co. is considering two new projects with the following net cash flows. The company’s required rate of return on investments is 10%. a. Compute payback period for each project. Based on payback period, which project is preferred

> A company is considering a $150,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (a) Compute the net present value of this investment. (b) Should the machinery be purchased?

> Many companies use technology to help them improve processes. One example of such a tool is robotic process automation. Access https://www2.deloitte.com/us/en/pages/operations/articles/a-guide-to-roboticprocess- automation-and-intelligent-automation.htm

> Gomez is considering a $180,000 investment with the following net cash flows. Gomez requires a 10% return on its investments. (a) Compute the net present value of this investment. (b) Should Gomez accept the investment?

> Information for two alternative projects involving machinery investments follows. a. Compute accounting rate of return for each project. b. Based on accounting rate of return, which project is preferred?

> Beyer Company is considering buying an asset for $180,000. It is expected to produce the following net cash flows. Compute the payback period for this investment.

> A shoe manufacturer is evaluating new equipment that would custom fit athletic shoes. The new equipment costs $90,000 and will generate $35,000 in net cash flows for five years. Determine the break-even time for this equipment.

> Quary Co. is considering an investment in machinery with the following information. Compute the investment’s (a) annual income and annual net cash flow and (b) payback period.

> Refer to the information in Exercise 26-12. Create an Excel spreadsheet to compute the internal rate of return for each of the projects.

> Refer to the information in Exercise 26-10. (a) Create an Excel spreadsheet to compute the internal rate of return for each of the projects. (b) Based on internal rate of return, determine whether the company should accept either of the two projects.

> Refer to the information in Exercise 26-17. Create an Excel spreadsheet to compute the internal rate of return for the proposed investment.

> Refer to the information in Exercise 26-2. The company’s required rate of return is 12%. a. Compute the investment’s net present value. b. Using the answer from part a, is the investment’s internal rate of return higher or lower than 12%? Hint: It is not

> Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $228,000 and would yield the following annual net cash flows. a. The company requires a 12% return from its investments. Compute net present values us