Question: For the company in Problem 2, show

For the company in Problem 2, show how the equity accounts will change if:

Problem 2:

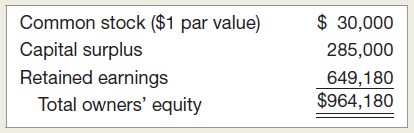

The owners’ equity accounts for Quadrangle International are shown here:

a. Quadrangle declares a four-for-one stock split. How many shares are outstanding now? What is the new par value per share?

b. Quadrangle declares a one-for-five reverse stock split. How many shares are outstanding now? What is the new par value per share?

> Major Instrument, Inc. manufactures two products: missile range instruments and space pressure gauges. During April, 50 range instruments and 300 pressure gauges were produced, and overhead costs of $94,500 were estimated. An analysis of estimated overhe

> The Polishing Department of Harbin Company has the following production and manufacturing cost data for September. Materials are entered at the beginning of the process.Production: Beginning inventory 1,600 units that are 100% complete as to materials an

> Stahl Inc. produces three separate products from a common process costing $100,000. Each of the products can be sold at the split-off point or can be processed further and then sold for a higher price. Shown below are cost and selling price data for a re

> The Green Acres Inn is trying to determine its break-even point. The inn has 50 rooms that it rents at $60 a night. Operating costs are as follows.Salaries ……………………………….6200 per monthUtilities …………………………………1100 per monthDepreciation………………………………..1000 per

> Hank Itzek manufactures and sells homemade wine, and he wants to develop a standard cost per gallon. The following are required for production of a 50-gallon batch.3,000 ounces of grape concentrate at $0.06 per ounce54 pounds of granulated sugar at $0.30

> Refer to Table 12.1 in the text and look at the period from 1973 through 1980:Table 12.1:a. Calculate the average return for Treasury bills and the average annual inflation rate (consumer price index) for this period.b. Calculate the standard deviation o

> Suppose the spot and three-month forward rates for the yen are ¥114.32 and ¥116.03, respectively.a. Is the yen expected to get stronger or weaker?b. What would you estimate is the difference between the inflation rates of the United States and Japan?

> You observe that the inflation rate in the United States is 3.9 percent per year and that T-bills currently yield 5.8 percent annually. What do you estimate the inflation rate to be in:a. Australia, if short-term Australian government securities yield 4

> Suppose the spot and six-month forward rates on the Norwegian krone are Kr 5.15 and Kr 5.22, respectively. The annual risk-free rate in the United States is 3.8 percent, and the annual risk-free rate in Norway is 5.7 percent.a. Is there an arbitrage oppo

> Take a look back at Figure 21.1 to answer the following questions:Figure 21.1:a. If you have $100, how many euros can you get?b. How much is one euro worth?c. If you have 5 million euros, how many dollars do you have?d. Which is worth more, a New Zealand

> Air Spares is a wholesaler that stocks engine components and test equipment for the commercial aircraft industry. A new customer has placed an order for eight high-bypass turbine engines, which increase fuel economy. The variable cost is $1.6 million per

> The Arizona Bay Corporation sells on credit terms of net 30. Its accounts are, on average, 8 days past due. If annual credit sales are $8.4 million, what is the company’s balance sheet amount in accounts receivable?

> Essence of Skunk Fragrances, Ltd., sells 5,600 units of its perfume collection each year at a price per unit of $425. All sales are on credit with terms of 1/10, net 40. The discount is taken by 60 percent of the customers. What is the amount of the comp

> Rise Above This, Inc., has an average collection period of 39 days. Its average daily investment in receivables is $47,500. What are annual credit sales? What is the receivables turnover?

> Skye Flyer, Inc., has weekly credit sales of $19,400, and the average collection period is 34 days. The cost of production is 75 percent of the selling price. What is the average accounts receivable figure?

> Kyoto Joe, Inc., sells earnings forecasts for Japanese securities. Its credit terms are 210, net 30. Based on experience, 65 percent of all customers will take the discount.a. What is the average collection period for Kyoto Joe?b. If Kyoto Joe sells 1,30

> Consider the following information:a. What is the expected return on an equally weighted portfolio of these three stocks?b. What is the variance of a portfolio invested 20 percent each in A and B and 60 percent in C?

> The Sand Surfer Corporation has annual sales of $47 million. The average collection period is 36 days. What is the average investment in accounts receivable as shown on the balance sheet?

> The Techtronic’s store begins each week with 300 phasers in stock. This stock is depleted each week and reordered. If the carrying cost per phaser is $41 per year and the fixed order cost is $95, what is the total carrying cost? What is the restocking co

> Redan Manufacturing uses 2,500 switch assemblies per week and then reorders another 2,500. If the relevant carrying cost per switch assembly is $9, and the fixed order cost is $1,700, is Redan’s inventory policy optimal? Why or why not?

> Devour, Inc., is considering a change in its cash only sales policy. The new terms of sale would be net one month. Based on the following information, determine if Devour should proceed or not. Describe the buildup of receivables in this case. The requir

> You place an order for 400 units of inventory at a unit price of $125. The supplier offers terms of 1/10, net 30.a. How long do you have to pay before the account is overdue? If you take the full period, how much should you remit?b. What is the discount

> No More Pencils, Inc., disburses checks every two weeks that average $93,000 and take seven days to clear. How much interest can the company earn annually if it delays transfer of funds from an interest-bearing account that pays .015 percent per day for

> It takes Cookie Cutter Modular Homes, Inc., about six days to receive and deposit checks from customers. Cookie Cutter’s management is considering a lockbox system to reduce the firm’s collection times. It is expected that the lockbox system will reduce

> Paper Submarine Manufacturing is investigating a lockbox system to reduce its collection time. It has determined the following:The total collection time will be reduced by three days if the lockbox system is adopted.a. What is the PV of adopting the syst

> Your firm has an average receipt size of $108. A bank has approached you concerning a lockbox service that will decrease your total collection time by two days. You typically receive 8,500 checks per day. The daily interest rate is .016 percent. If the b

> Your neighbor goes to the post office once a month and picks up two checks, one for $17,000 and one for $6,000. The larger check takes four days to clear after it is deposited; the smaller one takes five days.a. What is the total float for the month?b. W

> A portfolio is invested 25 percent in Stock G, 55 percent in Stock J, and 20 percent in Stock K. The expected returns on these stocks are 8 percent, 15 percent, and 24 percent, respectively. What is the portfolio’s expected return? How do you interpret y

> Each business day, on average, a company writes checks totaling $14,000 to pay its suppliers. The usual clearing time for the checks is four days. Meanwhile, the company is receiving payments from its customers each day, in the form of checks, totaling $

> No More Books Corporation has an agreement with Floyd Bank whereby the bank handles $4 million in collections a day and requires a $400,000 compensating balance. No More Books is contemplating canceling the agreement and dividing its eastern region so th

> In a typical month, the Jeremy Corporation receives 80 checks totaling $156,000. These are delayed four days on average. What is the average daily float?

> The Torrey Pine Corporation’s purchases from suppliers in a quarter are equal to 75 percent of the next quarter’s forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 20 percent of sales

> Iron Man Products has projected the following sales for the coming year:Sales in the year following this one are projected to be 15 percent greater in each quarter.a. Calculate payments to suppliers assuming that Iron Man places orders during each quarte

> Your firm has an average collection period of 32 days. Current practice is to factor all receivables immediately at a 1.5 percent discount. What is the effective cost of borrowing in this case? Assume that default is extremely unlikely

> Consider the following financial statement information for the Mediate Corporation:Calculate the operating and cash cycles. How do you interpret your answer?

> The Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year:a. Accounts receivable at the beginning of the year are $360. Morning Jolt has a 45-day collection period. Calculate cash collections in each of the f

> Indicate the effect that the following will have on the operating cycle. Use the letter I to indicate an increase, the letter D for a decrease, and the letter N for no change:a. Average receivables goes up.b. Credit repayment times for customers are incr

> Rocco Corp. has a book net worth of $10,380. Long-term debt is $7,500. Net working capital, other than cash, is $2,105. Fixed assets are $15,190. How much cash does the company have? If current liabilities are $1,450, what are current assets?

> Based on the following information, calculate the expected return and standard deviation for the two stocks:,,,

> Below are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount:,,,

> Here are some important fi gures from the budget of Nashville Nougats, Inc., for the second quarter of 2009:The company predicts that 5 percent of its credit sales will never be collected, 35 percent of its sales will be collected in the month of the sal

> The following is the sales budget for Trickle, Inc., for the first quarter of 2009:Credit sales are collected as follows:65 percent in the month of the sale20 percent in the month after the sale15 percent in the second month after the saleThe accounts re

> In the previous problem, suppose the company instead decides on a four-for-one stock split. The firm’s 85-cent per share cash dividend on the new (post-split) shares represents an increase of 10 percent over last year’

> The company with the common equity accounts shown here has declared a 15 percent stock dividend when the market value of its stock is $35 per share. What effects on the equity accounts will the distribution of the stock dividend have?,,,

> The market value balance sheet for Vena Sera Manufacturing is shown here. Vena Sera has declared a 25 percent stock dividend. The stock goes ex dividend tomorrow (the chronology for a stock dividend is similar to that for a cash dividend). There are 12,0

> In the previous problem, suppose Chevelle has announced it is going to repurchase $10,400 worth of stock. What effect will this transaction have on the equity of the firm? How many shares will be outstanding? What will the price per share be after the re

> The balance sheet for Chevelle Corp. is shown here in market value terms. There are 8,000 shares of stock outstanding.The company has declared a dividend of $1.30 per share. The stock goes ex dividend tomorrow. Ignoring any tax effects, what is the stock

> Red Rocks Corporation (RRC) currently has 350,000 shares of stock outstanding that sell for $90 per share. Assuming no market imperfections or tax effects exist, what will the share price be after:a. RRC has a five-for-three stock split?b. RRC has a 15 p

> Based on the following information, calculate the expected return:,,,

> The owners’ equity accounts for Quadrangle International are shown here:a. If Quadrangle stock currently sells for $30 per share and a 10 percent stock dividend is declared, how many new shares will be distributed? Show how the equity a

> So Much, Inc., has declared a $4.60 per share dividend. Suppose capital gains are not taxed, but dividends are taxed at 15 percent. New IRS regulations require that taxes be withheld at the time the dividend is paid. So Much sells for $80.37 per share, a

> ABC Co. and XYZ Co. are identical firms in all respects except for their capital structure. ABC is all equity financed with $600,000 in stock. XYZ uses both stock and perpetual debt; its stock is worth $300,000 and the interest rate on its debt is 8 perc

> Seether, Inc., a prominent consumer products firm, is debating whether to convert its all-equity capital structure to one that is 35 percent debt. Currently, there are 8,000 shares outstanding, and the price per share is $55. EBIT is expected to remain a

> Ignoring taxes in Problem 6, what is the price per share of equity under Plan I? Plan II? What principle is illustrated by your answers?Problem 6:Keenan Corp. is comparing two different capital structures. Plan I would result in 7,000 shares of stock and

> Keenan Corp. is comparing two different capital structures. Plan I would result in 7,000 shares of stock and $160,000 in debt. Plan II would result in 5,000 shares of stock and $240,000 in debt. The interest rate on the debt is 10 percent.a. Ignoring tax

> In Problem 4, use M&M Proposition I to find the price per share of equity under each of the two proposed plans. What is the value of the firm?Problem 4:James Corporation is comparing two different capital structures: an all-equity plan (Plan I) and a lev

> James Corporation is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 160,000 shares of stock outstanding. Under Plan II, there would be 80,000 shares of stock outs

> Suppose the company in Problem 1 has a market to- book ratio of 1.0.Problem 1:Maynard, Inc., has no debt outstanding and a total market value of $250,000. Earnings before interest and taxes, EBIT, are projected to be $28,000 if economic conditions are no

> Repeat parts (a) and (b) in Problem 1 assuming Maynard has a tax rate of 35 percent.Parts (a) and (b) in Problem 1:a. Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. Also calculate the percentage c

> Based on the following information, calculate the expected return:,,,

> In Problem 14, what is the cost of equity after recapitalization? What is the WACC? What are the implications for the firm’s capital structure decision?Problem 14:Frederick & Co. expects its EBIT to be $92,000 every year forever. The firm can borrow at 9

> Frederick & Co. expects its EBIT to be $92,000 every year forever. The firm can borrow at 9 percent. Frederick currently has no debt, and its cost of equity is 15 percent. If the tax rate is 35 percent, what is the value of the firm? What will the value

> Empress Corp. has no debt but can borrow at 8.2 percent. The firm’s WACC is currently 11 percent, and the tax rate is 35 percent.a. What is the company’s cost of equity?b. If the firm converts to 25 percent debt, what will its cost of equity be?c. If the

> Maxwell Industries has a debt–equity ratio of 1.5. Its WACC is 10 percent, and its cost of debt is 7 percent. The corporate tax rate is 35 percent.a. What is the company’s cost of equity capital?b. What is the company’s unlevered cost of equity capital?c

> In the previous question, suppose the corporate tax rate is 35 percent. What is EBIT in this case? What is the WACC? Explain.Previous question:Wood Corp. uses no debt. The weighted average cost of capital is 9 percent. If the current market value of the

> Wood Corp. uses no debt. The weighted average cost of capital is 9 percent. If the current market value of the equity is $23 million and there are no taxes, what is EBIT?

> Maynard, Inc., has no debt outstanding and a total market value of $250,000. Earnings before interest and taxes, EBIT, are projected to be $28,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30 percen

> Left Turn, Inc., has 120,000 shares of stock outstanding. Each share is worth $94, so the company’s market value of equity is $11,280,000. Suppose the firm issues 25,000 new shares at the following prices: $94, $90, and $85. What will the effect be of ea

> The Raven Co. has just gone public. Under a firm commitment agreement, Raven received $18.20 for each of the 10 million shares sold. The initial offering price was $20 per share, and the stock rose to $25.60 per share in the first few minutes of trading.

> In the previous problem, if the SEC fi ling fee and associated administrative expenses of the offering are $900,000, how many shares need to be sold?Previous problem:The Educated Horses Corporation needs to raise $60 million to finance its expansion into

> You have $10,000 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14 percent and Stock Y with an expected return of 10.5 percent. If your goal is to create a portfolio with an expected return of 12.4 percent, how much m

> The Educated Horses Corporation needs to raise $60 million to finance its expansion into new markets. The company will sell new shares of equity via a general cash offering to raise the needed funds. If the offer price is $21 per share and the company’s

> The Woods Co. and the Mickelson Co. have both announced IPOs at $40 per share. One of these is undervalued by $7, and the other is overvalued by $5, but you have no way of knowing which is which. You plan to buy 1,000 shares of each issue. If an issue is

> Red Shoe Co. has concluded that additional equity financing will be needed to expand operations and that the needed funds will be best obtained through a rights offering. It has correctly determined that as a result of the rights offering, the share pric

> The Clifford Corporation has announced a rights offer to raise $40 million for a new journal, the Journal of Financial Excess. This journal will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock c

> Big Time, Inc., is proposing a rights offering. Presently there are 500,000 shares outstanding at $81 each. There will be 60,000 new shares offered at $70 each.a. What is the new market value of the company?b. How many rights are associated with one of t

> Mullineaux Corporation has a target capital structure of 60 percent common stock, 5 percent preferred stock, and 35 percent debt. Its cost of equity is 14 percent, the cost of preferred stock is 6 percent, and the cost of debt is 8 percent. The relevant

> For the firm in Problem 7, suppose the book value of the debt issue is $80 million. In addition, the company has a second debt issue on the market, a zero coupon bond with seven years left to maturity; the book value of this issue is $35 million, and the

> Jiminy’s Cricket Farm issued a 30-year, 8 percent semiannual bond 7 years ago. The bond currently sells for 95 percent of its face value. The company’s tax rate is 35 percent.a. What is the pretax cost of debt?b. What is the after tax cost of debt?c. Whi

> Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 15 years to maturity that is quoted at 107 percent of face value. The issue makes semiannual payments and has an embedded cost of 7 percent annually. What i

> Holdup Bank has an issue of preferred stock with a $6 stated dividend that just sold for $96 per share. What is the bank’s cost of preferred stock?

> You own a portfolio that is 60 percent invested in Stock X, 25 percent in Stock Y, and 15 percent in Stock Z. The expected returns on these three stocks are 9 percent, 17 percent, and 13 percent, respectively. What is the expected return on the portfolio

> Suppose In a Found Ltd. just issued a dividend of $1.43 per share on its common stock. The company paid dividends of $1.05, $1.12, $1.19, and $1.30 per share in the last four years. If the stock currently sells for $45, what is your best estimate of the

> Stock in Country Road Industries has a beta of .85. The market risk premium is 8 percent, and T-bills are currently yielding 5 percent. The company’s most recent dividend was $1.60 per share, and dividends are expected to grow at a 6 percent annual rate

> The Up and Coming Corporation’s common stock has a beta of 1.05. If the risk-free rate is 5.3 percent and the expected return on the market is 12 percent, what is the company’s cost of equity capital?

> Given the following information for even flow Power Co., find the WACC. Assume the company’s tax rate is 35 percent.Debt: 8,000 6.5 percent coupon bonds outstanding, $1,000 par value, 20 years to maturity, selling for 92 percent of par; the bonds make se

> Jungle, Inc., has a target debtequity ratio of 1.05. Its WACC is 9.4 percent, and the tax rate is 35 percent.a. If Jungle’s cost of equity is 14 percent, what is its pretax cost of debt?b. If instead you know that the after tax cost of debt is 6.8 percen

> In Problem 12, suppose the most recent dividend was $4.10 and the dividend growth rate is 6 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. Both bonds make semiannual payments. The

> Filer Manufacturing has 11 million shares of common stock outstanding. The current share price is $68, and the book value per share is $6. Filer Manufacturing also has two bond issues outstanding. The first bond issue has a face value of $70 million, has

> Suppose the returns on long-term corporate bonds and T-bills are normally distributed. Based on the historical record, use the cumulative normal probability table (rounded to the nearest table value) in the appendix of the text to answer the following qu

> You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, fi ll in the rest of the following table:,,,

> Suppose the returns on large-company stocks are normally distributed. Based on the historical record, use the cumulative normal probability table (rounded to the nearest table value) in the appendix of the text to determine the probability that in any gi

> Consider the following information about three stocks:a. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? The variance? The standard deviation?b. If the expected T-bill rate is 3.80 perc

> Look at Table 12.1 and Figure 12.7 in the text. When were T-bill rates at their highest over the period from 1926 through 2007? Why do you think they were so high during this period? What relationship underlies your answer?Table 12.1:Figure 12.7:,,,

> Given the information in Problem 10, what was the average real risk-free rate over this time period? What was the average real risk premium?Problem 10:suppose the average inflation rate over this period was 3.5 percent and the average T-bill rate over th

> For Problem 9, suppose the average inflation rate over this period was 3.5 percent and the average T-bill rate over the period was 4.2 percent.Problem 9:You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five years: 7 pe

> You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five years: 7 percent, - 12 percent, 11 percent, 38 percent, and 14 percent.a. What was the arithmetic average return on Crash-n-Burn’s stock over this five year period?

> Refer to Table 12.1 in the text and look at the period from 1970 through 1975.Table 12.1:a. Calculate the arithmetic average returns for large-company stocks and T-bills over this period.b. Calculate the standard deviation of the returns for large-compan

> Using the following returns, calculate the arithmetic average returns, the variances, and the standard deviations for X and Y.,,,

> Fama’s Llamas has a weighted average cost of capital of 8.9 percent. The company’s cost of equity is 12 percent, and its pretax cost of debt is 7.9 percent. The tax rate is 35 percent. What is the company’s target debt equity ratio?